Market Overview

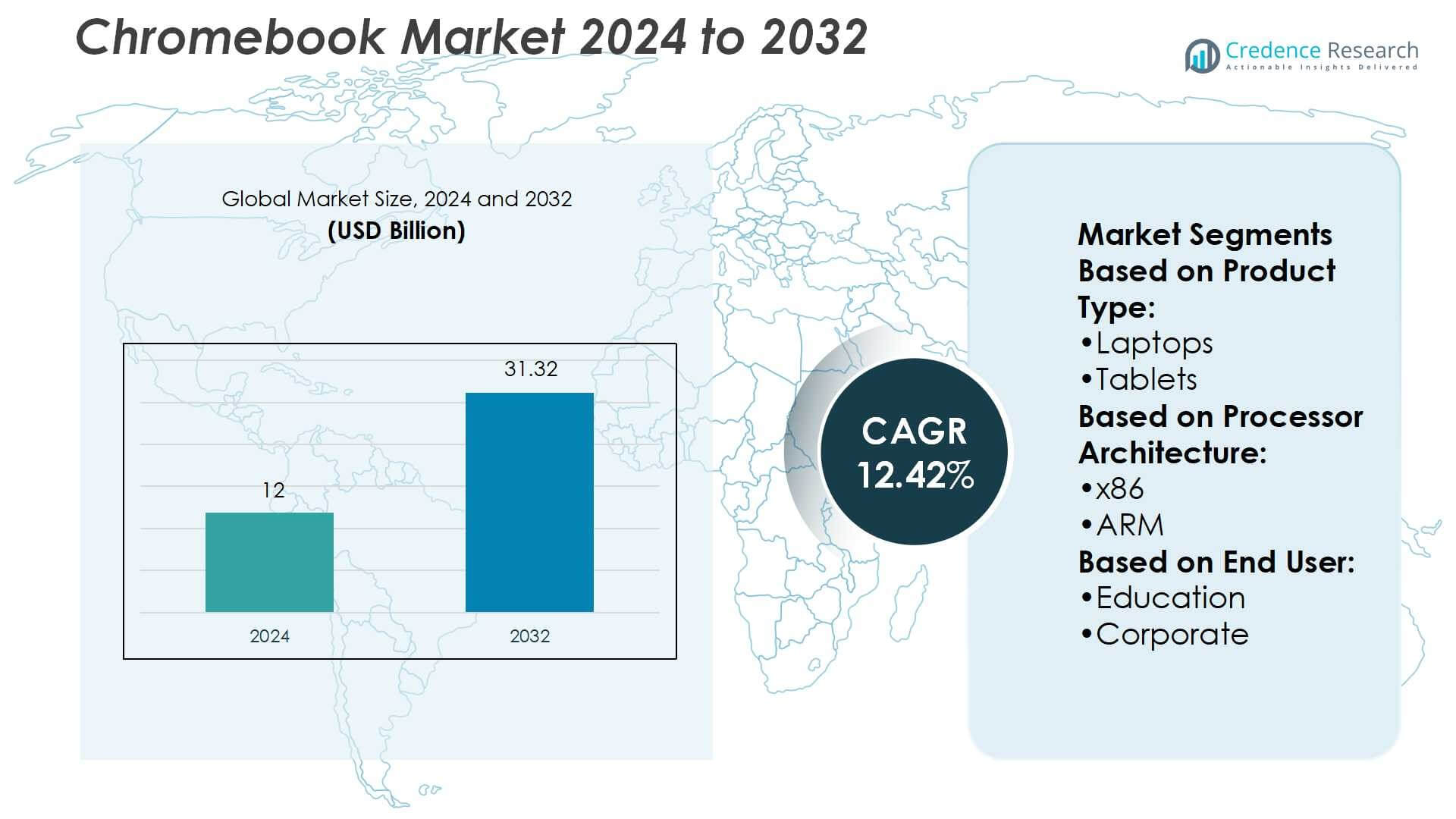

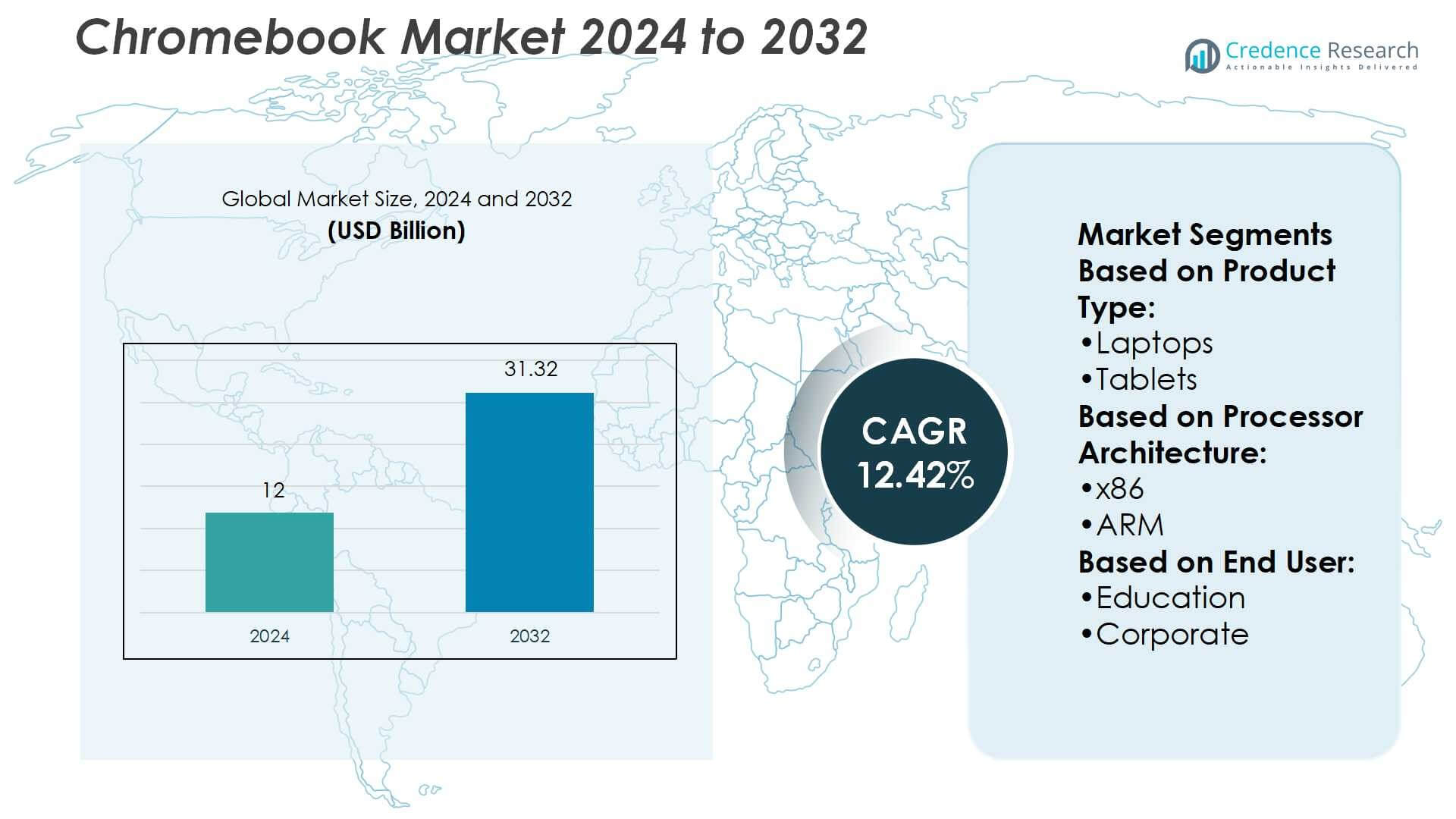

Chromebook Market size was valued USD 12 billion in 2024 and is anticipated to reach USD 31.32 billion by 2032, at a CAGR of 12.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chromebook Market Size 2024 |

USD 12 Billion |

| Chromebook Market, CAGR |

12.42% |

| Chromebook Market Size 2032 |

USD 31.32 Billion |

The Chromebook Market features strong competition among top players such as HP Inc., Dell Technologies, Lenovo Group, Acer Inc., Samsung Electronics, and ASUS. These companies focus on product innovation, affordability, and integration with cloud-based platforms to strengthen their market positions. Education remains the primary growth driver, prompting vendors to form strategic partnerships with schools and governments for bulk deployments. Among regions, North America leads the global Chromebook Market with a 38% share, supported by large-scale adoption in the U.S. education sector and rising demand from enterprises embracing hybrid work environments.

Market Insights

- The Chromebook Market was valued at USD 12 billion in 2024 and is projected to reach USD 31.32 billion by 2032, registering a CAGR of 12.42%.

- Education is the dominant driver, holding over 55% share, supported by bulk purchases and digital learning initiatives worldwide.

- Market trends highlight rising adoption of ARM-based Chromebooks for energy efficiency and the growing demand for hybrid learning and work solutions.

- Competitive dynamics involve HP Inc., Dell Technologies, Lenovo Group, Acer Inc., Samsung Electronics, and ASUS focusing on product innovation, affordability, and cloud integration.

- North America leads the global market with a 38% share, fueled by strong adoption in the U.S. education sector, while Asia-Pacific accounts for 28% share driven by rapid digitalization and growing student enrollments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the Chromebook Market, laptops dominate the product type segment with nearly 65% share. Their strong adoption stems from affordability, robust battery life, and compatibility with cloud-based applications. Education institutions, in particular, prefer laptops due to their ease of deployment and ability to support collaborative learning environments. Tablets and convertibles/2-in-1 devices are growing segments, driven by flexibility and mobility needs, but laptops remain the leading choice. Their cost-effectiveness and scalability continue to drive adoption across both developed and emerging economies, reinforcing their leading market position.

- For instance, Dell’s Chromebook 3110 2-in-1 weighs 1.42 kg and offers up to 12 hours battery life under typical workloads, making it easy to carry and use throughout a school day. Tablets and convertibles/2-in-1 devices are growing segments, driven by flexibility and mobility needs, but laptops remain the leading choice.

By Processor Architecture

x86-based Chromebooks lead the market with close to 70% share, supported by Intel’s strong processor ecosystem and compatibility with productivity software. The architecture delivers higher performance for multitasking and enterprise-grade applications, which strengthens adoption in education and corporate sectors. ARM-based Chromebooks are expanding in share, fueled by their energy efficiency and cost advantages. They are gaining momentum in consumer segments focused on mobility and longer battery life. Despite this, x86 processors maintain dominance due to established OEM partnerships, consistent performance benchmarks, and integration with widely used enterprise applications.

- For instance, Singtel’s Paragon platform spans 428 points of presence in 362 cities, enabling enterprise services like edge compute and network slicing across its footprint.

By End-User

Education is the dominant end-user segment, accounting for over 55% of the Chromebook Market share. The preference is driven by large-scale government-backed digital learning initiatives and school modernization programs. Chromebooks provide a secure, low-maintenance, and budget-friendly solution, making them highly attractive for academic institutions. The corporate and consumer segments are witnessing steady growth as businesses adopt cloud-first strategies and consumers value lightweight devices. However, education continues to lead due to bulk purchasing programs, strong integration with learning management systems, and rising demand for affordable digital education tools worldwide.

Key Growth Drivers

Key Growth Drivers

Rising Demand in Education Sector

The Chromebook Market is significantly driven by rising adoption in the education sector. Governments and institutions are promoting digital learning, fueling bulk purchases of cost-effective Chromebooks. Their ease of management, fast boot times, and integration with cloud-based tools make them ideal for classroom environments. With strong compatibility with Google Workspace for Education and secure remote updates, schools are increasingly investing in these devices. Growing focus on e-learning and hybrid teaching models further supports demand, making education the most influential growth driver.

- For instance, EchoStar’s subsidiary Hughesnet donated 1,000 STEM education kits to students across America via its National 4-H partnership. Schools receiving kits could engage hands-on learning in science & tech fields.

Growing Corporate Adoption of Cloud-Based Solutions

Businesses adopting cloud-first strategies are boosting Chromebook adoption across corporate environments. Chromebooks offer seamless integration with cloud platforms, enabling remote collaboration and secure data access. Enterprises benefit from lower total cost of ownership, as Chromebooks require minimal IT maintenance and support. Strong performance in web-based applications and virtual desktops is expanding their use for enterprise mobility. Rising demand for secure and lightweight devices in hybrid workplaces reinforces corporate uptake, making this a major driver for long-term market growth.

- For instance, SpaceX launched 134 missions with its Falcon family of rockets. These missions delivered approximately 1,500 metric tonnes of payload to orbit, demonstrating a highly repeatable infrastructure build-out.

Cost-Effectiveness and Long Battery Life

Affordability and extended battery performance are critical growth drivers in the Chromebook Market. These devices deliver value by offering lower upfront costs compared to traditional laptops. Long-lasting battery capacity ensures high productivity for both students and professionals without frequent charging. Cost efficiency also appeals to large-scale deployments in education and government sectors. Combined with durability and automatic updates, Chromebooks reduce operational costs and downtime, strengthening their appeal. This balance of affordability and functionality drives widespread adoption across global end-user segments.

Key Trends & Opportunities

Shift Toward Hybrid Learning and Work Models

Hybrid learning in education and hybrid work in enterprises are creating strong opportunities for Chromebook adoption. Institutions and companies need affordable devices that support video conferencing, cloud-based collaboration, and remote management. Chromebooks meet these requirements with lightweight design, strong security features, and easy scalability. The rise of remote classrooms and distributed teams highlights the demand for cost-effective and portable solutions. This trend ensures steady growth as both students and professionals rely on flexible, cloud-enabled devices to meet their productivity needs.

- For instance, The Suape Port network, which operates in the 3.5 GHz band, effectively demonstrates the use of private 5G to support mission-critical enterprise applications, including automation, safety, and efficiency.

Emergence of ARM-Powered Chromebooks

The growing interest in ARM-based processors presents a strong opportunity for the Chromebook Market. ARM-powered devices deliver energy efficiency, extended battery life, and competitive pricing compared to x86 models. This architecture is gaining traction among consumers seeking lightweight, mobile-first computing. With chipmakers investing in higher-performance ARM designs, Chromebooks are expanding into mainstream usage. This trend aligns with sustainability goals and consumer demand for portable devices. The rise of ARM adoption also enhances vendor competition, fostering product diversity and innovation.

- For instance, The ViaSat-2 satellite has throughput of about 300 Gbit/s at design, though due to anomalies in two Ka-band antennae actual throughput dropped to around 260 Gbit/s.

Key Challenges

Competition from Traditional Laptops and Tablets

The Chromebook Market faces strong competition from traditional laptops and tablets that offer broader software compatibility and higher processing power. While Chromebooks are effective for web-based and educational applications, many users prefer Windows or macOS for advanced tasks. Tablets with detachable keyboards also provide similar mobility with wider app ecosystems. This competitive pressure limits Chromebook adoption in some consumer and enterprise segments. To sustain growth, manufacturers must enhance performance, expand offline capabilities, and differentiate offerings against established computing devices.

Dependence on Internet Connectivity

A major challenge for Chromebooks is their dependence on stable internet connections for optimal functionality. Although offline features have improved, many productivity tools and applications still rely heavily on cloud access. In regions with poor connectivity, this limits their usability and appeal. Students and professionals in remote areas may struggle to maximize the device’s potential, slowing adoption rates. Vendors must continue developing robust offline capabilities and partner with connectivity providers to address this barrier. Overcoming this issue is crucial for wider global expansion.

Regional Analysis

North America

North America holds a dominant position in the Chromebook Market with a 38% share. Strong adoption in the education sector, driven by government-funded digital learning initiatives, supports this lead. The U.S. remains the largest contributor, as school districts prefer bulk purchases for cost efficiency and simplified IT management. Corporate adoption is also rising, fueled by hybrid work trends and the demand for secure cloud-based devices. Technology partnerships between Chromebook manufacturers and educational institutions further strengthen growth. Continuous innovation from leading OEMs sustains the region’s leadership in both education and enterprise usage.

Europe

Europe accounts for 25% of the global Chromebook Market share, supported by increasing integration of digital learning tools across schools and universities. The United Kingdom, Germany, and France lead adoption, driven by government initiatives to modernize classrooms and promote remote education. Demand for secure, low-maintenance devices supports Chromebook penetration in corporate environments as well. The region also benefits from growing emphasis on cost-effective IT infrastructure in public institutions. Rising awareness of sustainability and energy efficiency aligns with Chromebook features, making them attractive to environmentally conscious buyers in both education and enterprise sectors.

Asia-Pacific

Asia-Pacific captures 28% of the Chromebook Market, driven by large-scale adoption in education across countries such as India, Japan, and South Korea. The region benefits from strong government support for digital education programs and rising student enrollments in online learning. Growing demand for affordable devices fuels expansion in emerging economies, while advanced markets emphasize hybrid learning and workplace mobility. Chromebooks’ cost efficiency, lightweight design, and integration with cloud platforms strengthen adoption across both education and corporate sectors. Rising internet penetration and rapid digitalization initiatives ensure continued momentum, positioning Asia-Pacific as a high-growth region in the forecast period.

Latin America

Latin America represents 5% of the Chromebook Market share, with growth largely concentrated in education sectors of Brazil, Mexico, and Argentina. Government-backed programs to expand digital access in schools are key drivers of adoption. Cost-effectiveness and simplified IT management make Chromebooks suitable for large-scale deployments in resource-constrained institutions. However, limited internet connectivity in rural areas poses a barrier to broader market penetration. Despite challenges, increasing investment in digital infrastructure and growing consumer interest in affordable cloud-enabled devices are expected to support steady growth, with education continuing as the dominant application segment across the region.

Middle East & Africa

The Middle East & Africa holds 4% of the Chromebook Market share, with adoption at an early stage compared to other regions. Demand is primarily concentrated in government and public sector programs aimed at improving digital access in education. Countries like the UAE and South Africa are emerging hotspots due to rising investments in e-learning platforms and infrastructure. Affordability and durability of Chromebooks make them appealing in budget-sensitive markets, but limited connectivity and reliance on traditional devices hinder wider adoption. As internet penetration expands, the region presents opportunities for gradual growth in both education and enterprise segments.

Market Segmentations:

By Product Type:

By Processor Architecture:

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Chromebook Market players such as Freedomsat, Hughes Network Systems LLC, Singtel, EchoStar Corporation, SpaceX, Embratel, Viasat Inc., Telesat, Starlink, and Speedcast. The Chromebook Market is highly competitive, shaped by strong participation from global OEMs, software providers, and cloud service companies. Manufacturers focus on product innovation, expanding device performance, and enhancing battery efficiency to meet evolving user demands. Education remains the largest revenue-generating segment, encouraging vendors to form partnerships with schools and government bodies for bulk deployments. At the same time, rising adoption in corporate and consumer segments pushes companies to introduce models with improved processing power and offline capabilities. Competitive strategies include aggressive pricing, sustainability-focused designs, and integration with cloud-based ecosystems to strengthen market presence worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Freedomsat

- Hughes Network Systems LLC

- Singtel

- EchoStar Corporation

- SpaceX

- Embratel

- Viasat Inc.

- Telesat

- Starlink

- Speedcast

Recent Developments

- In April 2025, Amazon’s Project Kuiper successfully launched its KA-01 mission, deploying 27 LEO satellites as part of a 3,200-satellite constellation plan. This marks the beginning of full-scale operations, with service expected to begin later this year, enhancing global broadband coverage and competition.

- In March 2025, Jio Platforms and Bharti Airtel partnered with SpaceX’s Starlink to launch satellite internet services in India. This collaboration addresses challenges in spectrum allocation and aims to provide high-speed connectivity to rural regions where traditional networks face limitations.

- In November 2024, BSNL, in collaboration with Viasat, launched India’s first satellite-to-device service using L-band geostationary satellites. This two-way communication system enables connectivity in remote areas without cellular or Wi-Fi. It supports emergency calls, messaging, and digital payments, advancing India’s non-terrestrial network capabilities.

- In January 2024, Singtel collaborates with Starlink to boost maritime digital solutions, integrating AI, 5G, and edge computing for improved safety and efficiency. Starlink’s LEO broadband service enhances connectivity, enabling real-time data analysis and cost reduction.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Processing Architecture, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The education sector will remain the leading driver of Chromebook demand worldwide.

- Corporate adoption will expand as businesses prioritize cloud-first strategies and hybrid work models.

- ARM-based Chromebooks will gain share due to energy efficiency and competitive pricing.

- Enhanced offline features will increase device appeal in regions with limited internet access.

- Government-backed digital learning initiatives will support large-scale deployments in developing economies.

- Sustainability-focused designs will strengthen Chromebook adoption among environmentally conscious buyers.

- Partnerships between OEMs and cloud service providers will improve integration and performance.

- Rising consumer preference for affordable, lightweight devices will fuel steady market penetration.

- Connectivity improvements from satellite and 5G networks will expand Chromebook usability in remote areas.

- Continuous innovations in battery life and processing power will drive long-term market growth.

Key Growth Drivers

Key Growth Drivers