Market Overview:

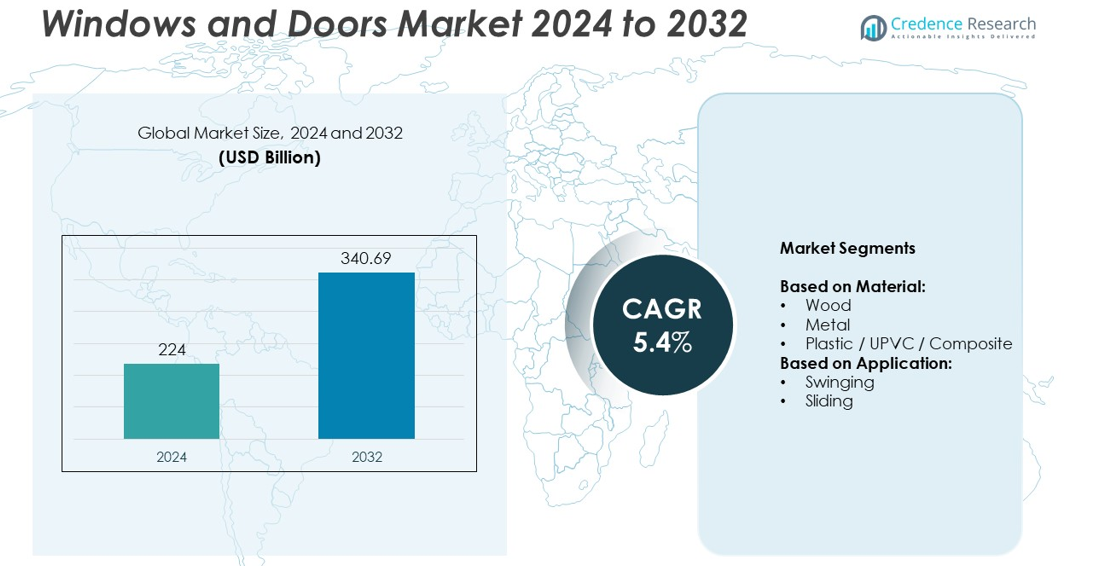

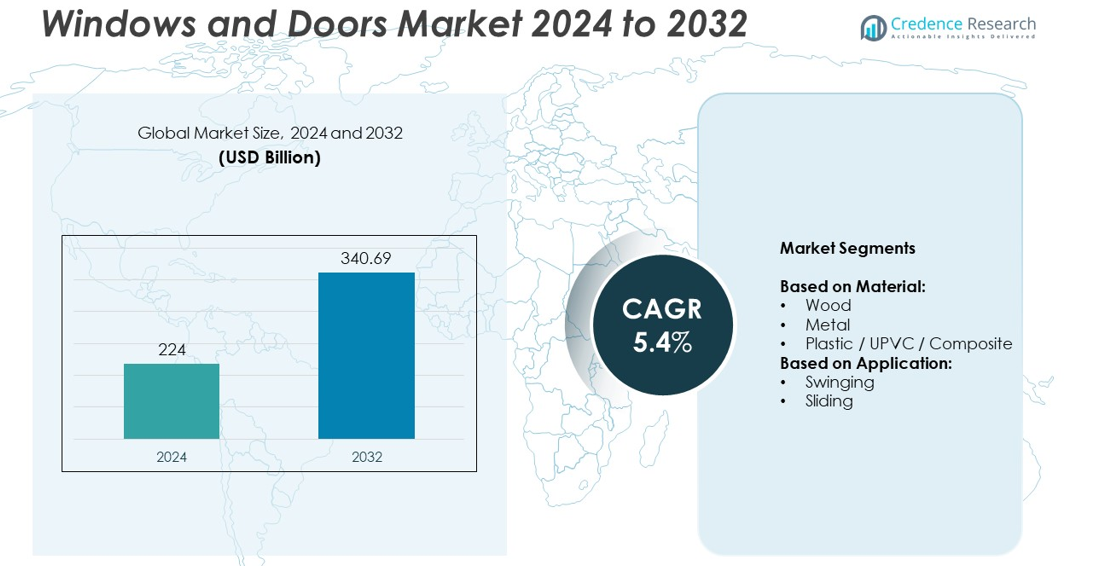

Windows and Doors market size was valued USD 224 Billion in 2024 and is anticipated to reach USD 340.69 Billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Windows and Doors Market Size 2024 |

USD 224 Billion |

| Windows and Doors Market, CAGR |

5.4% |

| Windows and Doors Market Size 2032 |

USD 340.69 Billion |

Key players in the windows and doors market include Jeld-Wen Holding Inc., Weru GmbH, Pella Corporation, YKK, Andersen Corporation, Masonite, Atrium Corporation, Masco, Ply Gem, and PGT. These companies compete by focusing on product innovation, energy-efficient solutions, and expanding global distribution networks. They invest in advanced glazing technologies, sustainable materials, and smart home integration to meet regulatory standards and consumer preferences. North America led the market with over 35% share in 2024, driven by strong residential construction and renovation activities. Europe followed with nearly 30% share, supported by stringent energy-efficiency regulations and renovation programs.

Market Insights

- The windows and doors market was valued at USD 224 Billion in 2024 and is projected to reach USD 340.69 Billion by 2032, growing at a CAGR of 5.4%.

- Rising urbanization, housing construction, and government incentives for green buildings are major drivers boosting demand.

- Trends include the adoption of energy-efficient triple-glazed products, thermally broken aluminum profiles, and smart automated doors and windows.

- The market is competitive with players focusing on product innovation, sustainable materials, and strategic mergers to expand their presence.

- North America leads with over 35% share, followed by Europe with nearly 30%, while metal windows and doors dominate material segments with more than 45% share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Metal windows and doors dominated the market in 2024, accounting for over 45% of the total share. Their strength, durability, and resistance to warping or cracking make them highly preferred in residential and commercial buildings. Aluminum frames, a key metal sub-segment, are popular for their corrosion resistance and sleek design, especially in urban and coastal regions. Rising adoption of thermally broken aluminum profiles supports energy efficiency and compliance with green building standards. Growth in smart cities and infrastructure development continues to drive demand for metal products, keeping them the leading choice among all material types.

- For instance, Asia Aluminum Group (AAG), based in Guangdong, China, was once a very large aluminum extrusion and fabrication group with an annual production capacity exceeding 600,000 metric tons.

By Application

Swinging windows and doors held the largest share, exceeding 60% in 2024, driven by their wide use in residential and commercial spaces. Their simple operation, cost-effectiveness, and compatibility with various designs make them a preferred solution. Demand is supported by rising home renovations, increased construction of single-family homes, and energy-efficient hinged door designs. Weather-sealed swinging doors also improve insulation and lower energy costs, appealing to eco-conscious buyers. The sliding segment grows steadily, favored in urban apartments for space-saving benefits, but swinging systems remain dominant due to their broader application and replacement demand.

- For instance, Since its founding in 1935, the Hörmann Group has delivered more than 20 million doors worldwide, a number higher than the 15 million cited. The company is Europe’s leading door supplier and manufactures products for both residential and commercial properties, including a variety of hinged (swinging) doors.

Market Overview

Rising Urbanization and Housing Development

Rapid urbanization drives demand for residential and commercial spaces, boosting the need for windows and doors. Growing populations in emerging economies lead to increased housing construction and infrastructure projects. Smart city initiatives and government-backed affordable housing programs further accelerate installations. The market benefits from a shift toward modern, energy-efficient structures that require advanced materials and glazing solutions. This is the key growth driver shaping overall market expansion and influencing product innovations, particularly in metal and energy-efficient door and window solutions.

- For instance, Western Extrusions issues an environmental product declaration for 1 metric ton of thermally improved aluminum extrusion products (painted and anodized), providing transparency for builders and regulators.

Focus on Energy Efficiency and Sustainability

Energy efficiency regulations and green building standards are fueling demand for insulated windows and thermally efficient doors. Consumers prefer double- and triple-glazed windows that reduce energy loss and help lower utility bills. Builders and contractors integrate eco-friendly materials and low-emission coatings to comply with LEED certifications and regional mandates. Manufacturers are also investing in recyclable materials and energy-saving solutions, aligning with global sustainability goals. This shift creates a long-term growth path and enhances adoption across residential, commercial, and institutional projects worldwide.

- For instance, Since its founding in 1996, Wellste has been exporting aluminum profiles and now produces custom windows and doors for a wide range of projects, including small renovations. The company states a minimum order quantity (MOQ) as low as 6 square meters for some window products.

Home Renovation and Remodeling Activities

Rising disposable incomes and lifestyle upgrades drive demand for home renovation and remodeling, especially in developed markets. Consumers are replacing old windows and doors with modern designs that offer better aesthetics, insulation, and security. Government incentives and tax credits for energy-efficient upgrades encourage homeowners to invest in advanced solutions. The trend supports a steady replacement cycle, contributing significantly to market growth. Manufacturers leverage this demand with customizable, ready-to-install products designed for faster installation and reduced labor costs.

Key Trends & Opportunities

Integration of Smart and Automated Solutions

The market is witnessing growth in smart windows and automated doors equipped with IoT and sensor technology. These systems offer features such as remote locking, light control, and energy management through connected devices. Builders integrate such solutions into smart homes and commercial facilities to improve convenience and security. Rising adoption of AI-driven building automation creates opportunities for manufacturers offering digitally enabled products. This is a key trend and opportunity expected to redefine competition and product differentiation in coming years.

- For instance, View, Inc. manufactures smart electrochromic glass panels that can vary tint up to 99% visible light blockage via app or building management systems.

Growth of uPVC and Composite Materials

uPVC and composite windows and doors are gaining traction due to their affordability, low maintenance, and resistance to moisture and termites. They offer better thermal efficiency and are available in various finishes that mimic wood or metal, appealing to cost-sensitive consumers. Their increasing adoption in mid-range housing projects creates growth opportunities, particularly in Asia-Pacific and Latin America. Manufacturers focusing on recyclable uPVC and composite materials benefit from sustainability-driven purchasing decisions and the growing preference for long-lasting, lightweight solutions.

- For instance, ETEM S.A. was founded in Greece in 1971. For many years, it operated two production facilities: one in Greece and one in Bulgaria, with a combined annual capacity exceeding 40,000 metric tons for aluminum profiles. However, in April 2023, ETEM completed a merger with COSMOS Aluminum S.A.. The new, merged company now operates with a combined production capacity exceeding 70,000 metric tons of aluminum profiles and has continued to develop ETEM’s architectural systems brand, particularly in the Balkans and Ukraine.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in prices of key raw materials such as aluminum, steel, and PVC pose a significant challenge. Rising input costs directly impact manufacturing margins and final product prices, limiting affordability for end-users. Frequent price changes make long-term contracts difficult and affect project budgeting for construction companies. This is a key challenge that pushes manufacturers to explore cost optimization strategies and diversify their supplier base to manage risks.

High Installation and Maintenance Costs

Premium windows and doors with advanced glazing or smart features come with higher installation and maintenance costs. This increases the total cost of ownership and can deter adoption, especially in price-sensitive markets. Skilled labor shortages in some regions further raise installation expenses and project delays. Addressing this challenge requires manufacturers to offer modular designs and faster installation systems that reduce labor dependency and overall costs.

Regional Analysis

North America

North America held over 35% of the windows and doors market share in 2024, driven by robust residential construction and renovation activities. The U.S. leads the region with strong demand for energy-efficient and impact-resistant windows supported by federal tax credits and stringent building codes. Rising investments in commercial infrastructure, including offices and healthcare facilities, further boost demand. Canada contributes with growth in urban housing and adoption of triple-glazed products for energy conservation in cold climates. Key players focus on premium and smart solutions to meet consumer preferences for durability, security, and advanced insulation performance.

Europe

Europe accounted for nearly 30% of the market share in 2024, supported by strict energy efficiency regulations such as the EU Green Deal. Countries like Germany, the UK, and France witness strong demand for triple-glazed windows and thermally broken frames in residential and commercial sectors. Renovation programs under EU funding encourage replacement of older installations with sustainable products. Demand for wood-framed windows remains high in Northern Europe due to aesthetic preferences and thermal insulation. Manufacturers increasingly adopt recyclable materials and low-emission coatings to comply with environmental norms and attract eco-conscious consumers in mature markets.

Asia-Pacific

Asia-Pacific captured over 25% of the global market share in 2024, with China and India driving growth through large-scale urbanization and housing projects. Rising disposable incomes and rapid infrastructure development fuel adoption of modern metal and uPVC frames. Government initiatives for smart cities and green buildings support demand for energy-efficient solutions. Japan and South Korea contribute with innovations in smart and automated systems, catering to tech-savvy consumers. The region presents lucrative opportunities for manufacturers as construction activity surges, particularly in affordable housing and commercial spaces, boosting volume sales across multiple material and application segments.

Latin America

Latin America represented around 6% of the market share in 2024, led by Brazil and Mexico with increasing residential construction and government-backed housing programs. The growing middle-class population supports demand for affordable uPVC and composite windows. Rising investments in commercial spaces and hospitality infrastructure also create opportunities for market expansion. However, economic fluctuations and high import dependency for raw materials can affect growth rates. Local players focus on cost-effective solutions to compete with international brands, while demand for energy-efficient and weather-resistant products gradually increases in regions prone to extreme weather conditions.

Middle East & Africa

Middle East and Africa accounted for nearly 4% of the market share in 2024, driven by infrastructure development in GCC nations and urbanization in African economies. Demand is supported by large-scale commercial projects, including hotels, malls, and office complexes. Aluminum and metal frames dominate due to their durability in hot climates and low maintenance needs. South Africa and Nigeria see growing adoption of uPVC windows in residential projects. Increasing focus on sustainable building practices and energy efficiency creates opportunities for advanced glazing solutions, although market growth is moderated by economic instability in parts of the region.

Market Segmentations:

By Material:

- Wood

- Metal

- Plastic / UPVC / Composite

By Application:

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

Key players in the windows and doors market include Jeld-Wen Holding Inc. (U.S.), Weru GmbH (Germany), Pella Corporation (U.S.), YKK (Japan), Andersen Corporation (U.S.), Masonite (U.S.), Atrium Corporation (U.S.), Masco (U.S.), Ply Gem (U.S.), and PGT (U.S.). The market is highly competitive, with companies focusing on innovation, product differentiation, and expanding their distribution networks. Manufacturers invest heavily in energy-efficient solutions, sustainable materials, and advanced glazing technologies to meet regulatory requirements and rising consumer demand. Strategic initiatives such as mergers, acquisitions, and partnerships strengthen market presence and enhance global reach. Digitalization, smart home integration, and customized product offerings are emerging as key areas of focus. Leading players also emphasize operational efficiency and cost optimization to remain competitive, while catering to both mass-market and premium segments through diversified product portfolios and tailored solutions for residential, commercial, and institutional construction projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jeld-Wen Holding Inc. (U.S.)

- Weru GmbH (Germany)

- Pella Corporation (U.S.)

- YKK (Japan)

- Andersen Corporation (U.S.)

- Masonite (U.S.)

- Atrium Corporation (U.S.)

- Masco (U.S.)

- Ply Gem (U.S.)

- PGT (U.S.)

Recent Developments

- In 2025, JELD-WEN Holding Inc. (U.S.), expanded its Cradle to Cradle certification across Europe, adding several exterior doors and frames across five countries.

- In 2025, Andersen Corporation (U.S.), published its “2025 Home and Design Trends” report spotlighting sustainability, adaptability, and bold design revivals.

- In 2025, Pella Corporation,acquired Weather Shield to accelerate its growth in the premium window and door market, expanding its product range of architectural wood and aluminum solutions.

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily driven by urbanization and rising housing construction.

- Energy-efficient and sustainable windows and doors will see strong demand across regions.

- Smart and automated solutions will gain wider adoption in residential and commercial spaces.

- uPVC and composite materials will expand due to low maintenance and durability benefits.

- Renovation and remodeling activities will continue to fuel replacement demand worldwide.

- Asia-Pacific will remain the fastest-growing region supported by infrastructure development.

- Manufacturers will invest more in recyclable materials and eco-friendly production processes.

- Premium and customizable designs will gain traction among high-end consumers.

- Strategic partnerships and acquisitions will shape competition and global market presence.

- Digital sales channels and online customization tools will become major growth enablers.