Market Overview

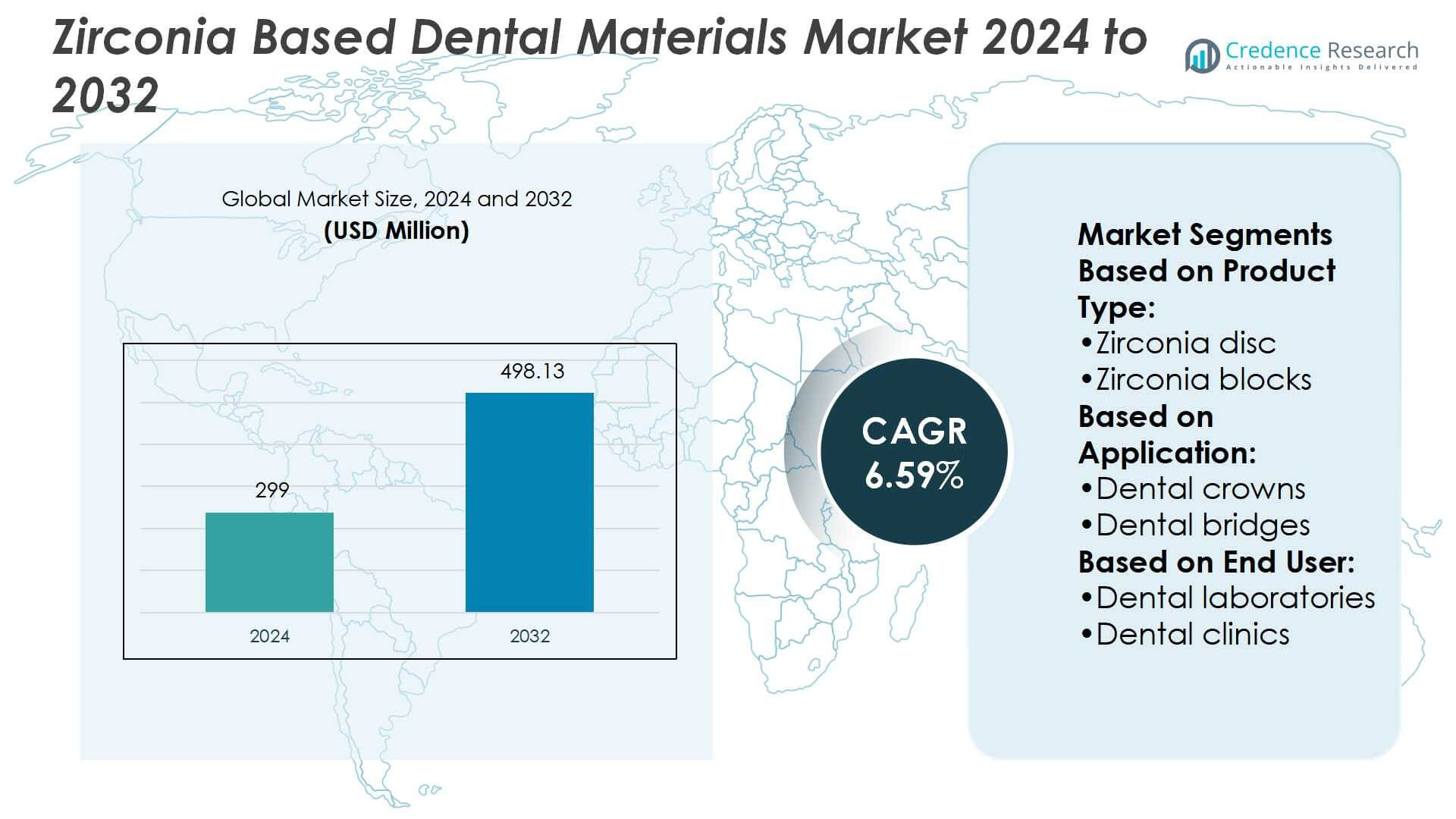

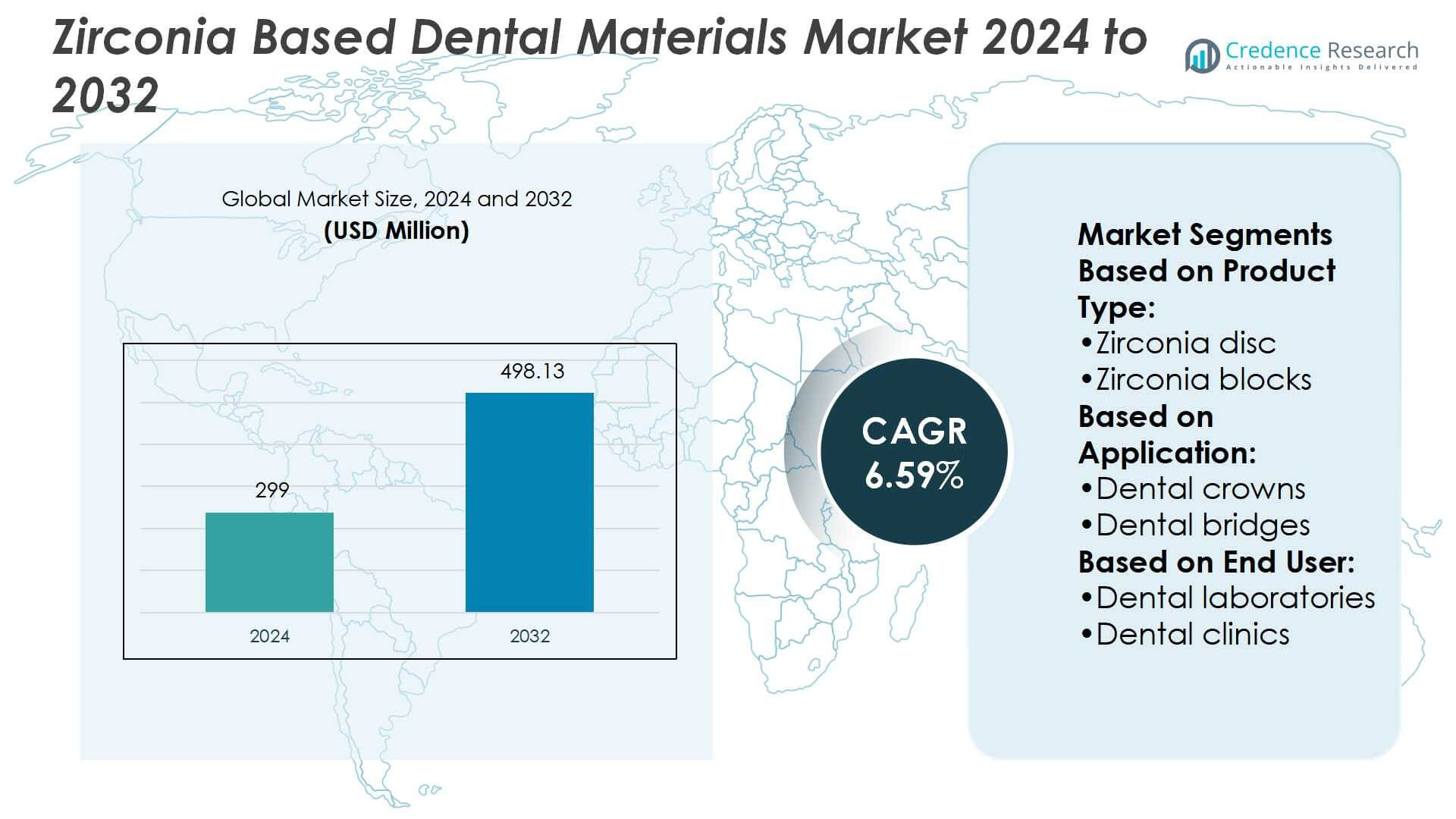

Zirconia Based Dental Materials Market size was valued USD 299 million in 2024 and is anticipated to reach USD 498.13 million by 2032, at a CAGR of 6.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zirconia Based Dental Materials Market Size 2024 |

USD 299 Million |

| Zirconia Based Dental Materials Market, CAGR |

6.59% |

| Zirconia Based Dental Materials Market Size 2032 |

USD 498.13 Million |

The Zirconia Based Dental Materials Market is shaped by key players such as Ivoclar Vivadent, Henry Schein, GC International, Aidite, HUGE Dental, Argen, BandD Dental Technologies, 3M, DENTSPLY SIRONA, and Dental Direkt. These companies compete through product innovation, advanced CAD/CAM integration, and broad distribution networks to meet rising demand for high-performance zirconia restorations. North America leads the market with a 35% share, driven by strong adoption of digital dentistry, advanced dental infrastructure, and high patient expenditure on aesthetic treatments. The region’s dominance, combined with active competition among global and regional suppliers, sets the foundation for sustained market growth.Top of Form

Market Insights

Market Insights

- The Zirconia Based Dental Materials Market was valued at USD 299 million in 2024 and is projected to reach USD 498.13 million by 2032, registering a CAGR of 6.59%.

- Rising demand for aesthetic and durable dental restorations, combined with increasing prevalence of dental disorders, drives steady market growth across key segments such as crowns, which hold the largest application share.

- The market is witnessing strong trends in CAD/CAM adoption, with monolithic zirconia restorations gaining popularity due to enhanced strength, simplified workflows, and improved shade-matching capabilities.

- Competition is intense, with global leaders and regional specialists focusing on product innovation, cost efficiency, and expanded distribution; however, high material and equipment costs remain a key restraint, limiting adoption in smaller clinics.

- North America leads with a 35% share, followed by Europe at 30% and Asia-Pacific at 22%, while dental laboratories dominate end-user demand with nearly 50% of the market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The zirconia disc segment holds the largest share of the Zirconia Based Dental Materials Market, accounting for nearly 55% of revenue. Its dominance is driven by wide adoption in dental crowns and bridges due to superior mechanical strength, high translucency, and ease of milling in CAD/CAM systems. Dental professionals prefer zirconia discs for consistent performance and cost efficiency in large-scale production. Zirconia blocks remain significant but cater more to custom milling for complex restorations. Growing demand for aesthetic, durable, and biocompatible materials sustains the leadership of zirconia discs in this segment.

- For instance, Ivoclar Vivadent’s IPS e.max ZirCAD Prime uses Gradient Technology that combines 3Y-TZP and 5Y-TZP zirconia within a single disc.The dentin area, which is the high-strength portion of the disc, has a flexural strength of up to 1,200 MPa.

By Application

Dental crowns represent the dominant application, contributing to over 40% of the market share. This leadership is supported by the growing preference for zirconia crowns as a superior alternative to porcelain-fused-to-metal crowns, due to their natural appearance, durability, and reduced risk of allergic reactions. Rising cases of dental caries and tooth loss drive the demand for crowns in both developed and emerging economies. Dental bridges and implants follow as strong applications, supported by the rising adoption of zirconia for permanent restorative solutions. Increasing cosmetic dentistry demand further strengthens crowns as the leading application.

- For instance, Ultra-High Translucency (UHT) zirconia typically offers a flexural strength of around 600 MPa. Disks are commonly available in a 98.5 mm diameter and various thicknesses, including 12 mm, 14 mm, 18 mm, and 25 mm, for use in CAD/CAM systems.

By End User

Dental laboratories hold the largest share in the market, representing nearly 50% of the demand. Laboratories remain the primary hub for producing customized zirconia-based restorations through CAD/CAM milling technologies. Their dominance is reinforced by collaborations with clinics and dentists, ensuring high-quality outcomes and bulk processing capabilities. Dental clinics are expanding their share, supported by the rising trend of in-house chairside milling systems, but laboratories continue to lead due to advanced infrastructure and skilled technicians. Academic and research institutes contribute smaller volumes but play a vital role in innovation and testing of new zirconia dental materials.

Key Growth Drivers

Rising Demand for Aesthetic Dentistry

The Zirconia Based Dental Materials Market is expanding as patients increasingly seek natural-looking, durable, and biocompatible dental solutions. Zirconia offers superior translucency and strength, making it a preferred choice for crowns, bridges, and implants. Its ability to mimic natural teeth aligns with the rising demand for cosmetic dentistry across both developed and emerging markets. Growing consumer awareness, combined with higher disposable incomes, supports wider adoption of zirconia restorations. This trend significantly strengthens the market’s long-term growth prospects.

- For instance, Aidite’s 3D Pro Zir multilayer zirconia achieves flexural strength of 1,100 MPa and reaches translucency of 57% in the incisal layer.Its sintered density is ≥ 6.0 g/cm³ and fracture toughness ≥ 5 MPa·m⁰·⁵.

Advancements in CAD/CAM Technology

Growth is strongly supported by innovations in digital dentistry, particularly CAD/CAM systems. Zirconia discs and blocks are optimized for precise milling, enabling faster production and highly accurate dental restorations. Laboratories and clinics benefit from reduced processing times, improved consistency, and cost efficiency. Increasing adoption of chairside milling systems enhances accessibility to customized zirconia restorations for patients. Continuous advancements in CAD/CAM software and material compatibility further encourage dental professionals to rely on zirconia as a dependable restorative material, driving strong market penetration.

- For instance, HUGE Dental’s multilayer zirconia has a flexural strength that ranges from 700 MPa to 1,060 MPa, which varies based on the translucency grade of the material. The NOBILCAM-5X milling machine supports workpiece disks of 98 mm diameter and up to 30 mm thickness.

Growing Prevalence of Dental Disorders

Rising cases of dental caries, periodontal diseases, and tooth loss are key drivers of market expansion. The global burden of oral health issues continues to rise, especially among aging populations and individuals with lifestyle-related dental conditions. Zirconia’s durability, fracture resistance, and compatibility with implants make it suitable for long-term restorative treatments. Increasing preference for permanent dental solutions among patients has led to higher demand for zirconia crowns, bridges, and implants. This growing need for advanced restorative materials strongly accelerates market growth across regions.

Key Trends & Opportunities

Shift Toward Monolithic Zirconia Restorations

A major trend is the increasing adoption of monolithic zirconia restorations, which eliminate the need for porcelain layering. These restorations offer greater strength, simplified workflows, and cost-effectiveness, making them popular among both dental laboratories and clinics. Monolithic zirconia also provides improved aesthetics with advanced shading techniques. The combination of durability and natural appearance positions this material as an attractive solution for crowns, bridges, and implants. Its growing acceptance creates significant opportunities for manufacturers to expand product portfolios.

- For instance, Argen Argen HT+ Multilayer Zirconia Milling Discs deliver flexural strength of 1,250 MPa with translucency of 45%, with availability in seven thicknesses for multilayer discs.

Expansion of In-House Chairside Milling

The rise of in-house chairside milling systems presents new opportunities in the market. Clinics increasingly invest in digital technologies to deliver same-day restorations, reducing dependence on external laboratories. Zirconia discs and blocks are widely used in these systems due to their adaptability and superior outcomes. This trend enhances patient convenience and accelerates adoption of zirconia-based materials. Equipment integration, along with growing patient demand for faster services, positions chairside milling as a transformative growth avenue for market players.

- For instance, Dentsply Sirona’s CEREC Primemill can mill a zirconia crown in about 5 minutes using its Super-Fast Milling Mode. The machine performs both wet and dry milling and grinding, utilizing a 0.5 mm extra-fine bur for detailed occlusal fissures.

Key Challenges

High Material and Equipment Costs

The Zirconia Based Dental Materials Market faces constraints due to the high cost of raw materials, CAD/CAM equipment, and milling systems. These expenses limit adoption, particularly among small clinics and practices in developing markets. While zirconia offers superior properties, affordability remains a challenge for widespread use. Manufacturers and suppliers face pressure to reduce costs while maintaining quality. Price sensitivity in emerging economies continues to hinder faster penetration of zirconia-based restorations compared to traditional alternatives.

Limited Technical Expertise

Another challenge is the shortage of skilled professionals trained in advanced CAD/CAM and digital workflows. Accurate design and milling of zirconia restorations require specialized expertise, which is not uniformly available across all regions. Smaller dental practices often lack the resources and training to integrate zirconia effectively. This gap in technical knowledge delays adoption and restricts the market’s growth potential. Efforts to expand training programs and improve accessibility to digital dentistry are critical to overcoming this barrier.

Regional Analysis

North America

North America holds the largest share of the Zirconia Based Dental Materials Market, accounting for 35%. Strong adoption of CAD/CAM systems, advanced dental technologies, and high awareness of cosmetic dentistry drive growth in this region. The United States leads with a robust network of dental clinics and laboratories, supported by high patient spending on premium restorative solutions. Canada contributes with rising demand for aesthetic restorations and increasing investments in digital dentistry. The region’s dominance is reinforced by the presence of leading manufacturers and a favorable regulatory environment promoting innovation in dental materials.

Europe

Europe accounts for 30% of the Zirconia Based Dental Materials Market, positioning it as the second-largest region. Germany, France, and the United Kingdom are major contributors due to advanced dental infrastructure and a strong emphasis on quality restorative treatments. Growing demand for biocompatible, durable, and natural-looking restorations supports zirconia adoption. Dental laboratories across Europe are early adopters of CAD/CAM workflows, enhancing the use of zirconia discs and blocks. Increasing patient awareness of oral health and expanding insurance coverage for dental procedures further strengthen market performance, keeping Europe a competitive hub for dental material advancements.

Asia-Pacific

Asia-Pacific represents 22% of the Zirconia Based Dental Materials Market, making it a fast-growing region. Countries like China, Japan, and India lead adoption due to rising cases of dental disorders and increased awareness of cosmetic dentistry. Expanding middle-class populations and higher disposable incomes support demand for zirconia-based crowns, bridges, and implants. Dental clinics in the region are rapidly integrating CAD/CAM systems, improving access to digital dentistry. The strong presence of regional manufacturers offering cost-effective zirconia products enhances availability. Asia-Pacific’s growing healthcare expenditure and rising patient preference for permanent restorative solutions are driving significant market expansion.

Latin America

Latin America holds an 8% share of the Zirconia Based Dental Materials Market, with Brazil and Mexico leading growth. The region is witnessing increasing adoption of zirconia restorations due to rising dental tourism, growing awareness of oral health, and improving healthcare infrastructure. Expanding use of CAD/CAM systems in dental laboratories is supporting demand for zirconia discs and blocks. However, high costs of materials and equipment limit broader adoption across smaller clinics. Despite these challenges, rising investments in cosmetic dentistry and increasing patient demand for durable, aesthetic dental solutions continue to drive steady market growth in the region.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the Zirconia Based Dental Materials Market, reflecting its emerging stage of adoption. Growth is concentrated in the Gulf countries, where rising healthcare investments and medical tourism fuel demand for advanced dental solutions. Clinics in the UAE and Saudi Arabia are increasingly integrating CAD/CAM systems to offer high-quality zirconia restorations. However, limited technical expertise and high costs restrict wider penetration in several African markets. Despite these constraints, growing awareness of cosmetic dentistry and expanding dental infrastructure present opportunities for gradual market development in the region.

Market Segmentations:

By Product Type:

- Zirconia disc

- Zirconia blocks

By Application:

- Dental crowns

- Dental bridges

By End User:

- Dental laboratories

- Dental clinics

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Zirconia Based Dental Materials Market is highly competitive, with leading players including Ivoclar Vivadent, Henry Schein, GC International, Aidite, HUGE Dental, Argen, BandD Dental Technologies, 3M, DENTSPLY SIRONA, and Dental Direkt. The Zirconia Based Dental Materials Market is defined by strong competition, driven by innovation and expanding digital dentistry adoption. Companies focus on developing advanced zirconia discs and blocks with higher translucency, strength, and processing efficiency to meet the growing demand for crowns, bridges, and implants. Strategic priorities include integrating materials with CAD/CAM workflows, expanding distribution networks, and addressing the rising need for cost-effective yet premium restorative solutions. Sustainability and biocompatibility are gaining prominence as patients and regulators favor eco-friendly, safe materials. Competitive differentiation is shaped by product quality, pricing strategies, and technological advancements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Iluka has achieved the full year production guidance resulting in a favourable impact on unit cash costs prices within the zircon market. As a preeminent global provider of top-tier zircon, Iluka reaped the rewards of prevailing market dynamics, which witnessed an upward trajectory in zircon prices.

- In July 2025, Zolid Bion blends aesthetics with safety, marking a new era in zirconia-based all-ceramic materials. The material, available for order from June 2023, features a continuous color gradient and enhanced incisal translucency for unmatched naturalness without sacrificing durability.

- In July 2024, Topzir Biotech, a leading manufacturer of dental materials, announced the launch of its innovative 3D zirconia block. This cutting-edge product is set to transform the process of dental restorations, offering a high-strength, durable material suitable for crowns, bridges, and veneers.

- In May 2023, Eramet has launched its initial audit under the Initiative for Responsible Mining Assurance system, highlighting its commitment to sustainable and ethical mining practices in the extraction and processing of zirconium.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for aesthetic and durable dental restorations.

- Growing use of CAD/CAM systems will strengthen adoption of zirconia discs and blocks.

- Monolithic zirconia restorations will gain wider acceptance for strength and simplified workflows.

- Dental laboratories will continue to lead demand, supported by bulk processing capabilities.

- Clinics will increasingly invest in chairside milling systems for same-day restorations.

- Aging populations and higher cases of dental disorders will fuel long-term growth.

- Sustainability and biocompatibility will remain key drivers in material development.

- Emerging markets in Asia-Pacific and Latin America will provide significant growth opportunities.

- Ongoing R&D will enhance translucency, shade matching, and overall performance of zirconia.

- Strategic collaborations and distribution expansions will intensify competition among global and regional players.

Market Insights

Market Insights