Market Overview:

The Europe Adult Diapers Market size was valued at USD 2,700.72 million in 2018 to USD 3,765.01 million in 2024 and is anticipated to reach USD 9,036.88 million by 2032, at a CAGR of 11.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Adult Diapers Market Size 2024 |

USD 3,765.01 Million |

| Europe Adult Diapers Market, CAGR |

11.57% |

| Europe Adult Diapers Market Size 2032 |

USD 9,036.88 Million |

Growth in the Europe Adult Diapers Market is driven by multiple factors. Rising geriatric population, higher awareness of incontinence care, and improved healthcare standards are boosting demand. The shift toward more discreet, comfortable, and skin-friendly products also strengthens adoption. Lifestyle changes, including higher stress and chronic conditions, further increase the need for effective incontinence solutions. Manufacturers are responding with innovations in absorbent technology, odor control, and eco-friendly materials, making products more appealing. This trend is supported by better retail penetration and e-commerce platforms, enabling consumers to access a wide range of choices.

Regional dynamics in the Europe Adult Diapers Market show diverse growth trends. Western European countries, particularly Germany, France, and the UK, lead due to advanced healthcare systems, aging demographics, and high awareness. Northern Europe demonstrates strong adoption, supported by robust public healthcare and social welfare programs. Southern and Eastern Europe are emerging markets, showing increased adoption as awareness improves and urbanization accelerates. These regions are also experiencing rising acceptance of incontinence products, driven by changing cultural perceptions and better access through expanding retail and online channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Adult Diapers Market was valued at USD 2,700.72 million in 2018, reached USD 3,765.01 million in 2024, and is projected to hit USD 9,036.88 million by 2032, growing at a CAGR of 11.57%.

- Western Europe held 42% share in 2024, driven by advanced healthcare systems, strong brand presence, and aging demographics, while Southern Europe captured 28% and Northern Europe 15%, supported by healthcare programs and lifestyle shifts.

- Eastern Europe and Rest of Europe accounted for 15% in 2024 and are the fastest-growing regions, fueled by urbanization, cultural acceptance, and expansion of retail and e-commerce channels.

- By type, Pant/Pull-up diapers dominated with 38% share in 2024 due to convenience and discreet wear, particularly among active users.

- Pad type products held 27% share, driven by affordability and ease of disposal, while tape-on and others covered the remaining demand across institutional and specialized use cases.

Market Drivers:

Rising Geriatric Population and Growing Incontinence Awareness:

The Europe Adult Diapers Market benefits from a rapidly aging population across the region. Elderly individuals face higher risks of incontinence, creating strong demand for supportive products. Healthcare awareness campaigns are improving acceptance of adult diapers as a standard solution. Rising disposable incomes also encourage families to purchase quality incontinence products. Public health systems across Europe increasingly recognize the importance of elderly care. Governments are working to promote dignity and comfort for older citizens. This factor positions adult diapers as an essential healthcare product. It is a core driver behind the market’s steady growth in recent years.

- For instance, Ontex BV, a leading manufacturer, reported a 2.9% like-for-like increase in adult care volumes in Europe during the first half of 2025, reflecting continued demand in the retail and healthcare channels. The overall growth was somewhat constrained by factors such as temporary supply chain disruptions.

Healthcare Advancements and Shifts Toward Preventive Care:

Healthcare advancements are expanding adoption of adult diapers across medical facilities. Hospitals, nursing homes, and rehabilitation centers increasingly recommend high-quality products to improve patient care. Preventive healthcare models emphasize the importance of managing chronic conditions. Incontinence management supports hygiene, reduces infections, and improves patient recovery outcomes. Growing awareness among caregivers also supports usage in both institutional and home settings. Integration of adult diapers in long-term care planning creates recurring demand. This alignment with preventive strategies strengthens product importance in modern healthcare. It continues to drive consistent market expansion in the region.

Innovation in Product Design and Material Development:

Manufacturers are introducing new product designs to improve comfort and functionality. Innovations focus on skin-friendly materials that prevent irritation and rashes. Thinner, more absorbent layers make products discreet under clothing. Companies also use breathable fabrics to enhance user comfort. Odor-control technologies further increase consumer confidence and satisfaction. Eco-friendly materials are being adopted to appeal to sustainability-focused buyers. Such advancements expand adoption among younger demographics experiencing temporary incontinence. These innovations reinforce growth momentum in the Europe Adult Diapers Market.

Retail Expansion and Growing Online Distribution Channels:

Retail expansion plays a vital role in market growth across Europe. Supermarkets, hypermarkets, and pharmacies stock a wide range of adult diaper brands. Private labels from retail chains add competitive pricing and wider consumer reach. Online platforms enhance accessibility by offering doorstep delivery and product subscriptions. E-commerce enables discreet purchasing, which is important for consumer privacy. Subscription services provide convenience and consistent product supply. Marketing campaigns on digital platforms also raise awareness and encourage trial. This retail diversification ensures steady and widespread adoption across diverse customer groups.

Market Trends:

Sustainability Practices and Growing Demand for Eco-Friendly Products:

Environmental sustainability is shaping trends in the Europe Adult Diapers Market. Consumers demand products made from biodegradable and recyclable materials. Companies are responding by launching eco-friendly diaper lines. This shift aligns with stricter European regulations on waste management. Green packaging and reduced plastic content are gaining traction in the market. Brands emphasize their eco-initiatives through targeted marketing campaigns. These efforts attract environmentally conscious consumers and strengthen brand positioning. Sustainability is expected to remain a central theme for market evolution.

- For instance, in 2023, Drylock Technologies, in collaboration with Love & Green, launched a compostable baby diaper that uses 80–90% natural, vegetable-based materials. The company also introduced new, fully recyclable nonwoven packaging in July 2025 in partnership with retailer Colruyt. These actions align with Drylock’s broader sustainability goals and commitment to EU Ecolabel criteria.

Rising Focus on Gender-Specific and Customized Solutions:

Customization is becoming a key trend across the adult diaper industry. Brands are introducing gender-specific products to meet unique anatomical needs. Male and female designs ensure better comfort and fit. Customized absorbency levels address different incontinence conditions. Some companies are developing personalized products for active users. Targeted solutions improve user experience and boost product trust. This trend highlights the importance of personalization in healthcare products. It contributes to stronger loyalty and repeat purchases among consumers.

- For instance, after adjusting its pricing strategy and product range in early 2025 to better compete in a challenging consumer environment, Kimberly-Clark achieved its strongest quarterly volume growth in five years during the second quarter. This strategic shift was driven by an effort to appeal to a wider range of consumers by offering more options.

Adoption of Smart Diapers with Sensor-Based Monitoring:

Technological integration is transforming adult diaper usage in healthcare facilities. Smart diapers with sensor-based monitoring systems are gaining attention. These products alert caregivers when a diaper needs changing. Hospitals and nursing homes adopt them to improve patient care efficiency. Digital monitoring reduces discomfort and risk of infections. Caregivers save time and resources while improving service quality. Such advancements demonstrate strong potential in the medical segment. They represent a growing trend in the Europe Adult Diapers Market.

Increasing Social Acceptance and Declining Stigma Around Usage:

Social acceptance of adult diapers is improving across Europe. Awareness campaigns are normalizing conversations around incontinence. Marketing strategies highlight dignity, comfort, and active lifestyles for users. Growing openness reduces hesitation in purchasing and using products. Younger consumers experiencing temporary conditions also adopt products without stigma. Celebrities and health experts contribute by endorsing acceptance publicly. Retail environments provide discreet and supportive shopping experiences. This cultural shift is a powerful trend driving product adoption.

Market Challenges Analysis:

Price Sensitivity and Limited Adoption in Certain Demographics:

The Europe Adult Diapers Market faces challenges from price sensitivity across many countries. Premium products with advanced features often remain costly for low-income groups. Consumers in rural areas or less developed economies may resist purchase. Affordability concerns limit the reach of innovative products. Healthcare coverage for incontinence care is inconsistent across regions. This creates barriers to adoption in some demographics. Distribution challenges in smaller markets also add to the issue. It continues to be a significant restraint for the industry.

Environmental Waste Management and Disposal Concerns:

Growing environmental concerns challenge the expansion of adult diaper usage. Disposal of non-biodegradable products contributes to rising landfill waste. European regulations on waste management put pressure on manufacturers. Companies must invest in eco-friendly alternatives to maintain compliance. Production costs rise when adopting sustainable materials and processes. Limited infrastructure for large-scale recycling adds further difficulties. Consumers also raise questions about environmental safety. This factor complicates the balance between growth and responsibility in the market.

Market Opportunities:

Expansion of Home Healthcare and Elderly Care Services:

The Europe Adult Diapers Market holds strong opportunities through home healthcare growth. Rising preference for at-home elderly care supports higher product adoption. Families prioritize hygiene and comfort for dependent seniors. Adult diapers provide reliable solutions for caregivers in domestic settings. This demand strengthens with the increase in aging populations across the region. Healthcare providers also recommend incontinence products for post-surgery recovery at home. Expanding home healthcare services align directly with this growth opportunity. It positions the market for steady long-term adoption.

Product Premiumization and Growth in Emerging European Regions:

Premiumization is an opportunity for brands to differentiate in a competitive market. Consumers seek thinner, more comfortable, and skin-friendly products with advanced technology. Growing middle-class segments in Eastern and Southern Europe show rising demand. Expanding urbanization and lifestyle changes increase awareness and adoption. Premium offerings appeal to consumers with higher disposable incomes. Marketing efforts targeting modern, active lifestyles reinforce this positioning. It opens profitable pathways for growth in emerging European regions. Brands that align with this shift gain significant competitive advantage.

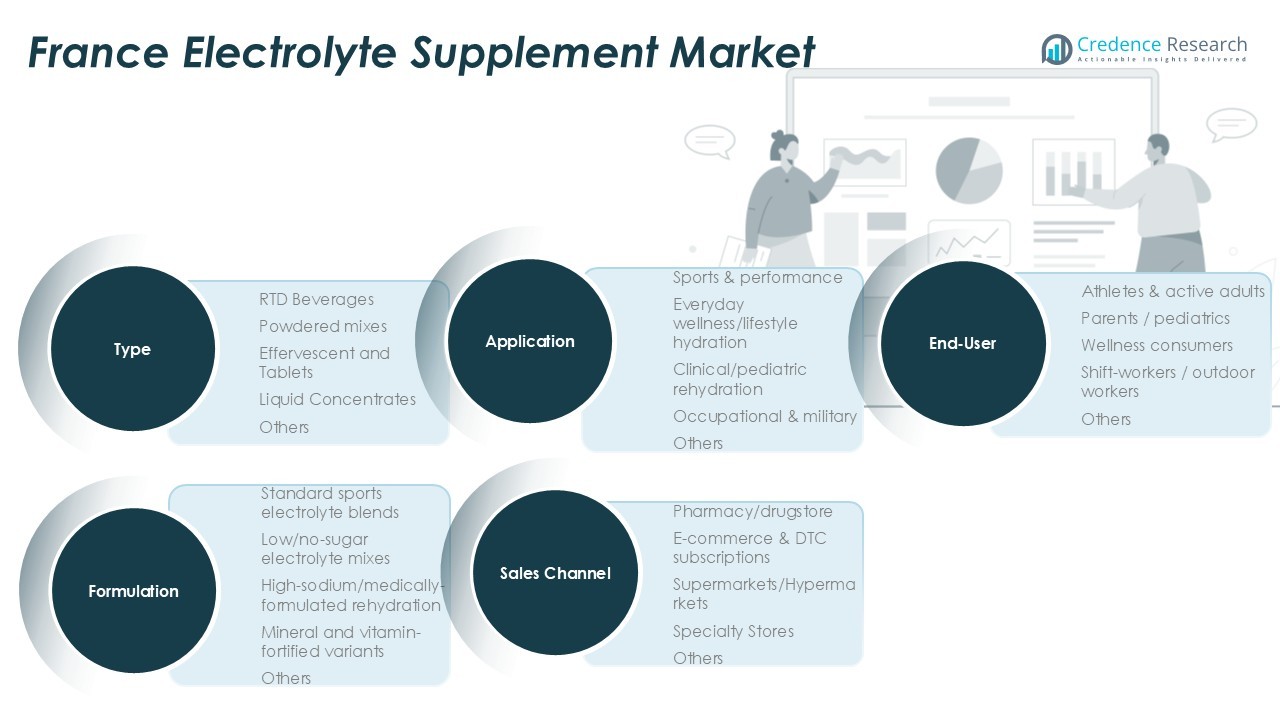

Market Segmentation Analysis:

By Type

The Europe Adult Diapers Market is segmented into pad type, pant/pull-up type, tape-on diapers, and others. Pad type products are widely used for light to moderate incontinence and remain popular due to affordability and ease of disposal. Pant or pull-up types dominate in terms of convenience and discreet wear, appealing to active users. Tape-on diapers hold importance in healthcare settings, supporting patients with limited mobility. The “others” segment includes niche products tailored for specific needs, gaining steady attention in select demographics.

- For instance, the adult diaper market is experiencing significant growth across Europe, driven by demand for discreet and comfortable products for active elderly consumers. Paul Hartmann AG, a major player in this market, noted in its March 2025 financial report that incontinence pants were a “particularly strong-selling product range” in 2024, contributing to its Incontinence Management segment’s €769.9 million sales that year.

By End-User

End-user segmentation includes women, men, and unisex categories. Women remain the largest consumer group, driven by higher life expectancy and higher prevalence of incontinence conditions. Men form a growing segment with brands introducing male-specific products to address comfort and fit. Unisex products cater to general needs, offering flexibility for caregivers and institutions. This balance across end-user categories sustains widespread demand.

- For instance, while Ontex BV’s adult care segment in Europe saw modest like-for-like growth of 2.6% in the first half of 2025, there is no public evidence supporting an 8% market share gain for a male-specific diaper line in France.

By Distribution Channel

Distribution channels include e-commerce and offline retail. E-commerce has expanded rapidly, offering privacy, subscription services, and home delivery options. Online channels play a strong role in reaching younger consumers and caregivers. Offline retail, including pharmacies, supermarkets, and specialty stores, continues to dominate due to accessibility and trust in physical purchase. It provides strong visibility for brands and supports impulse buying. Together, both channels ensure consistent product availability and wider adoption across consumer bases.

Segmentation:

- By Type

- Pad Type

- Pant/Pull-up Type

- Tape-on Diapers

- Others

- By End-User

- By Distribution Channel

- E-Commerce

- Offline Channel

- By Country

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe Leading the Market

Western Europe dominates the Europe Adult Diapers Market with nearly 42% share in 2024. Germany, France, and the UK are the key contributors, supported by advanced healthcare systems, high consumer awareness, and large elderly populations. Strong retail penetration and the presence of leading brands drive steady demand. Governments in these countries actively support elderly care programs, strengthening adoption of incontinence products. Innovation in premium and eco-friendly diapers also finds strong acceptance in these markets. Western Europe sets the pace in product development, brand positioning, and consumer trust.

Southern and Northern Europe Showing Consistent Growth

Southern Europe, led by Italy and Spain, accounts for about 28% of the market share. Urbanization, lifestyle changes, and higher life expectancy continue to drive adoption. Consumers in these regions prefer pant and pull-up diapers for convenience and comfort. Northern Europe holds nearly 15% share, with demand supported by comprehensive healthcare and high awareness levels. Countries such as Sweden, Denmark, and Finland display strong per capita consumption of adult diapers. Sustainability preferences are also more prominent in Northern Europe, driving eco-friendly product launches. Together, these regions contribute consistently to market expansion.

Eastern Europe and Rest of Europe Emerging Strongly

Eastern Europe and the Rest of Europe together represent around 15% market share. Russia is the largest market within this group, with growing urban populations and rising awareness of incontinence care. Expansion of modern retail formats and e-commerce channels is improving product availability. Price sensitivity remains a factor, but domestic and international brands are working on cost-effective solutions. Cultural stigma around adult diaper usage is declining, creating opportunities for wider adoption. It is expected to show strong growth potential as awareness and accessibility improve across these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Svenska Cellulosa Aktiebolaget (SCA)

- Essity Aktiebolag

- Abena A/S

- TZMO SA

- Ontex Group

- Paul Hartmann AG

- Kimberly-Clark Corporation

- Unicharm Corporation

Competitive Analysis:

The Europe Adult Diapers Market is highly competitive, with global leaders and regional manufacturers driving innovation and accessibility. Companies such as Essity, Kimberly-Clark, Ontex, and Paul Hartmann dominate through strong product portfolios and established distribution networks. Local players like Abena and TZMO add to competition by offering cost-effective and niche solutions. Intense rivalry has led to continuous investment in R&D, focusing on eco-friendly materials, advanced absorbency, and ergonomic designs. Retail partnerships and e-commerce growth further intensify the competition. It maintains a balance between multinational dominance and regional adaptability, ensuring wide consumer choice and strong brand positioning across Europe.

Recent Developments:

- In June 2025, Ontex Group NV launched its iD Discreet range across Europe, targeting both home and healthcare settings. This new range focuses on providing comfort, reliability, and a discreet fit, with innovations such as channeled core pants for instant dryness and specialized night pads for women, fulfilling growing market demand for dignified and affordable continence care.

- In recent years, Essity Aktiebolag strengthened its position in the incontinence care market by acquiring Knix Wear (Canada) and Modibodi (Australia), two leading providers of leakproof apparel for periods and incontinence, broadening its product portfolio in Europe and worldwide. Essity also initiated joint programs with European hospitals to train caregivers on adult diaper usage and disposal in 2025, enhancing market reach.

Report Coverage:

The research report offers an in-depth analysis based on type, end-user, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing elderly population will drive steady demand across European countries.

- Healthcare partnerships will expand institutional adoption in hospitals and care homes.

- E-commerce platforms will strengthen market penetration with privacy and subscription models.

- Product premiumization will increase adoption among middle-class and urban consumers.

- Sustainability initiatives will shape product design and consumer purchasing choices.

- Gender-specific and personalized designs will improve user comfort and satisfaction.

- Smart diaper technology will gain adoption in healthcare for monitoring purposes.

- Cultural stigma will continue to decline, supporting broader acceptance.

- Regional markets in Eastern and Southern Europe will show rising adoption.

- Competitive innovation will remain a key strategy for retaining consumer trust.