Market Overview

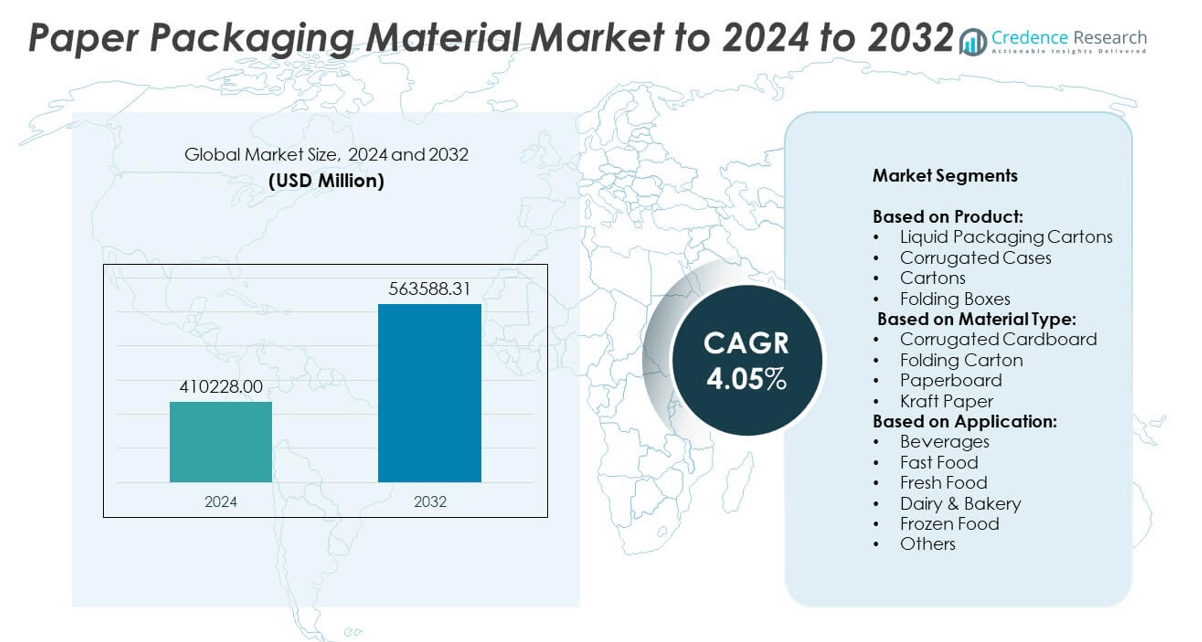

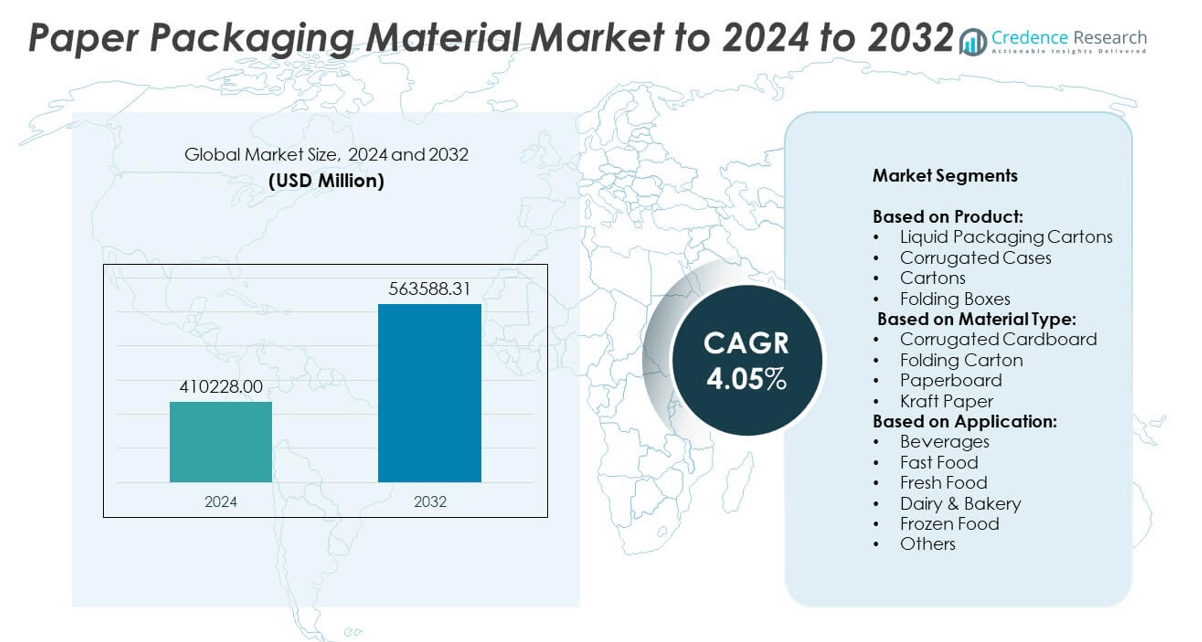

Paper Packaging Material Market size was valued at USD 410,228.00 million in 2024 and is anticipated to reach USD 563,588.31 million by 2032, at a CAGR of 4.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paper Packaging Material MarketbSize 2024 |

USD 410,228.00 million |

| Paper Packaging Material Market, CAGR |

4.05% |

| Paper Packaging Material Market Size 2032 |

USD 563,588.31 million |

The paper packaging material market is led by major players including Mondi Group Plc, WestRock Company, DS Smith PLC, Smurfit Kappa, Georgia-Pacific Corporation, Billerud, Stora Enso Oyj, Hood Packaging Corporation, Napco National, and Rengo Co. Ltd. These companies focus on developing sustainable, recyclable, and lightweight paper solutions to meet rising regulatory and consumer demands. Asia-Pacific holds the dominant position with approximately 38% market share in 2024, driven by rapid urbanization, e-commerce growth, and increasing consumption of packaged food and beverages in China and India. North America and Europe follow, supported by strong regulations favoring eco-friendly packaging and investments in recycling infrastructure.

Market Insights

- The paper packaging material market was valued at USD 410,228.00 million in 2024 and is projected to reach USD 563,588.31 million by 2032, growing at a CAGR of 4.05% from 2025 to 2032.

- Rising demand for sustainable and recyclable packaging, along with regulatory bans on single-use plastics, is driving market growth across food, beverage, and e-commerce sectors.

- Trends include innovation in lightweight paperboard, moisture-resistant coatings, and digital printing, enabling cost efficiency, better protection, and enhanced branding opportunities.

- The market is moderately consolidated, with players focusing on capacity expansions, product innovation, and strategic partnerships to strengthen their competitive positions globally.

- Asia-Pacific leads with 38% share in 2024, followed by North America at 30% and Europe at 28%, while corrugated cases dominate the product segment with over 40% share due to their strength and cost-effectiveness in shipping and logistics applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Corrugated cases dominated the market in 2024, holding over 40% share due to their superior strength and suitability for shipping applications. They are widely used for e-commerce packaging, electronics, and industrial goods, supported by the global rise in online retail. Their lightweight nature reduces logistics costs, and their recyclability aligns with sustainability goals. Liquid packaging cartons and folding boxes are also witnessing demand growth, driven by rising consumption of packaged beverages and personal care products. Continuous improvements in print quality and moisture resistance are boosting adoption across end-use industries.

- For instance, PCA (Packaging Corporation of America) produced 1,310,000 tons of containerboard in Q4 2024.

By Material Type

Corrugated cardboard led the segment in 2024 with more than 45% market share. Its durability and ability to protect goods during transportation make it the preferred choice for shipping and logistics. The growing e-commerce sector and emphasis on cost-effective, eco-friendly solutions further accelerate demand. Folding carton and paperboard materials are gaining traction in food and cosmetics packaging, offering high-quality printability and design flexibility. Kraft paper is expanding in popularity for single-use bags and wraps, driven by regulatory bans on plastic packaging and rising consumer preference for biodegradable solutions.

- For instance, Klingele Paper & Packaging Group produces corrugated raw paper with an annual capacity of over 800,000 tons across its mills. This includes the Weener mill (270,000 tons per year), the Blue Paper joint venture in Strasbourg (which has a capacity of around 440,000 tons), and the kraftliner mill in Nova Campina, Brazil (160,000 tons).

By Application

Beverages accounted for the largest share, exceeding 35% of the market in 2024. Rising consumption of packaged water, soft drinks, and dairy products continues to drive demand for liquid packaging cartons and paper-based bottles. Fresh food and dairy & bakery follow as key segments, supported by the growth of organized retail and consumer preference for eco-friendly, hygienic packaging. Fast-food chains increasingly adopt paper wraps and boxes to replace plastics, while frozen food packaging benefits from innovations in moisture-resistant coatings. The shift toward sustainable packaging remains a key driver across all applications.

Market Overview

Sustainability and Recyclability

Sustainability and recyclability remain the key growth driver for the paper packaging material market. Rising consumer awareness and government regulations banning single-use plastics are accelerating the adoption of paper-based solutions. Brands are shifting to biodegradable and recyclable packaging to meet ESG goals and appeal to eco-conscious consumers. Paper packaging’s ability to reduce carbon footprint and support circular economy initiatives further boosts demand. This shift is most visible in food, beverages, and e-commerce sectors where companies are under pressure to reduce plastic usage and meet regulatory compliance targets.

- For instance, Billerud AB reported SEK 43.453 billion in revenue in 2024.

E-commerce and Retail Expansion

The growth of e-commerce and retail is another major driver propelling market expansion. The surge in online shopping has fueled demand for corrugated boxes, folding cartons, and lightweight paperboard packaging. Retailers prioritize packaging that ensures product protection, cost efficiency, and brand visibility during shipping. Advances in digital printing allow companies to customize packaging for marketing purposes, enhancing customer engagement. Strong demand from FMCG and electronics sectors is pushing manufacturers to increase production capacity and invest in automated paper packaging solutions.

- For instance, Smurfit WestRock manufactured 204.4 billion square feet of corrugated packaging in 2024.

Rising Packaged Food and Beverage Demand

Rising demand for packaged food and beverages significantly contributes to market growth. Urbanization, busy lifestyles, and rising disposable incomes have boosted consumption of ready-to-eat meals, beverages, and dairy products. Paper packaging is preferred for its ability to preserve product freshness while remaining eco-friendly. Food brands are investing in innovative paper-based solutions, including liquid packaging cartons and grease-resistant wraps. The trend toward sustainable food packaging aligns with consumer expectations for hygiene and convenience, ensuring steady demand for paper materials across foodservice outlets, supermarkets, and quick-service restaurant chains.

Key Trends and Opportunities

Lightweighting and Innovation

Lightweighting and innovation in paper packaging is a key trend transforming the market. Manufacturers are developing thinner yet stronger paperboard and corrugated materials to reduce resource use without compromising durability. This trend lowers logistics costs, improves sustainability performance, and meets stricter packaging waste directives. Opportunities exist for companies innovating with water-based coatings, barrier papers, and smart packaging with QR codes for tracking and consumer engagement. Such solutions not only enhance shelf appeal but also align with circular economy targets, creating a competitive edge for early adopters.

- For instance, Packaging Corporation of America sold 60.5 billion square feet of corrugated products in 2023.

Digital Printing and Customization

The growing adoption of digital printing technology is another major opportunity for the market. Digital printing enables cost-effective short runs, mass customization, and rapid design changes, meeting the needs of e-commerce and FMCG brands. This trend is reshaping brand marketing, allowing personalized campaigns and seasonal packaging launches. Startups and SMEs particularly benefit from low setup costs and quick turnaround times. The opportunity for suppliers lies in offering high-speed, high-resolution printing solutions compatible with paper materials, further driving premiumization and brand differentiation in a competitive retail landscape.

- For instance, International Paper collected, consumed, and marketed 7 million tons of recovered fiber in 2024.

Key Challenges

Raw Material Price Volatility

Fluctuating raw material prices represent a key challenge for the paper packaging material market. Price volatility of wood pulp and recovered paper directly affects production costs and profitability for manufacturers. Global supply chain disruptions and increasing demand for raw materials in other industries often intensify price swings. These fluctuations make long-term planning difficult for packaging converters and can lead to higher prices for end-users. Companies are exploring alternative fibers and improved recycling technologies to reduce dependence on virgin raw materials and mitigate cost-related risks.

Competition from Plastics

Competition from plastic and flexible packaging solutions poses another challenge. Plastic alternatives often provide superior moisture barriers, longer shelf life, and lower costs, making them attractive to manufacturers with limited budgets. Despite regulatory restrictions, plastic continues to dominate in certain food and pharmaceutical applications. Paper packaging producers must invest in advanced coatings, lamination, and material innovation to match the performance of plastic. Overcoming these technical barriers while remaining cost-competitive is essential for paper packaging to capture a greater share of the overall packaging market.

Regional Analysis

North America

North America accounted for around 30% of the paper packaging material market share in 2024, driven by strong demand from the food, beverage, and e-commerce sectors. The United States leads the region with widespread adoption of corrugated boxes and folding cartons for retail and logistics applications. Stringent regulations encouraging sustainable packaging and corporate commitments to reduce plastic use are fueling market expansion. Growth in quick-service restaurants and packaged food consumption also contributes to rising demand. Ongoing innovation in lightweight, recyclable paperboard and investments in recycling infrastructure support steady market growth across the region.

Europe

Europe captured nearly 28% of the global market share in 2024, supported by strict EU directives promoting circular economy practices and reducing plastic waste. Countries such as Germany, France, and the U.K. are major contributors, with strong adoption in food, beverage, and personal care sectors. Rising consumer preference for eco-friendly packaging drives demand for folding cartons and kraft paper solutions. Regional producers focus on developing advanced barrier coatings to replace plastic laminates. Growth in online retail and cross-border shipping continues to boost corrugated packaging demand, ensuring steady market expansion across Western and Eastern European markets.

Asia-Pacific

Asia-Pacific dominated the market with approximately 38% share in 2024, led by China, India, and Japan. Rapid urbanization, rising disposable incomes, and growth in retail infrastructure are driving high demand for paper-based packaging in food, beverages, and e-commerce sectors. Corrugated cases and folding cartons see strong adoption for bulk and last-mile delivery needs. Government initiatives promoting sustainable packaging and bans on certain single-use plastics accelerate market penetration. Local manufacturers are expanding capacity to meet rising domestic demand, while technological improvements in paper production enhance product quality and cost efficiency, supporting future market growth in the region.

Latin America

Latin America held about 8% share of the market in 2024, driven by increasing consumption of packaged food and beverages and expanding retail networks. Brazil and Mexico are key contributors, with growing use of corrugated boxes and folding cartons for FMCG and industrial goods packaging. The shift toward sustainable packaging alternatives is creating opportunities for regional paper manufacturers. Economic recovery and rising middle-class population are fueling demand for convenience food and e-commerce deliveries. Investment in local paper production and recycling facilities is expected to reduce reliance on imports and strengthen supply chain efficiency across the region.

Middle East & Africa

The Middle East & Africa region accounted for nearly 6% of global market share in 2024, supported by growth in packaged food, beverages, and pharmaceuticals. GCC countries drive demand through rising retail activity and urban development projects, while South Africa represents a key hub for paper packaging production. Increasing awareness of sustainable packaging and government-led waste management programs are encouraging paper-based alternatives. Expansion of quick-service restaurants and modern trade outlets boosts the need for folding cartons and takeaway paper packaging. Manufacturers are focusing on cost-effective, durable solutions suitable for diverse climatic and distribution conditions in the region.

Market Segmentations:

By Product:

- Liquid Packaging Cartons

- Corrugated Cases

- Cartons

- Folding Boxes

By Material Type:

- Corrugated Cardboard

- Folding Carton

- Paperboard

- Kraft Paper

By Application:

- Beverages

- Fast Food

- Fresh Food

- Dairy & Bakery

- Frozen Food

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the paper packaging material market features prominent players such as Mondi Group Plc (U.K.), Napco National (Saudi Arabia), WestRock Company (U.S.), Billerud (Sweden), Georgia-Pacific Corporation (U.S.), Smurfit Kappa (Ireland), DS Smith PLC (U.K.), Rengo Co. Ltd. (Japan), Hood Packaging Corporation (U.S.), and Stora Enso Oyj (Finland). The market is moderately consolidated, with these companies focusing on capacity expansions, mergers, and acquisitions to strengthen their global presence. Leading players invest in sustainable packaging solutions, including recyclable and biodegradable materials, to meet regulatory requirements and growing consumer demand for eco-friendly products. Innovation in lightweight and high-strength paperboard, advanced barrier coatings, and digital printing technologies is a major area of competition. Companies are also expanding their geographic footprint through partnerships and joint ventures to tap into emerging markets in Asia-Pacific and Latin America. The emphasis on circular economy principles and closed-loop recycling is driving long-term strategic investments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mondi Group Plc (U.K.)

- Napco National (Saudi Arabia)

- WestRock Company (U.S.)

- Billerud (Sweden)

- Georgia-Pacific Corporation (U.S.)

- Smurfit Kappa (Ireland)

- DS Smith PLC (U.K.)

- Rengo Co. Ltd. (Japan)

- Hood Packaging Corporation (U.S.)

- Stora Enso Oyj (Finland)

Recent Developments

- In 2025, Mondi ramps up FunctionalBarrier Paper Ultimate to meet growing demand for sustainable high-barrier paper-based packaging

- In 2023, Smurfit Kappa launched its Better Planet Packaging portfolio, featuring a wide range of recyclable and renewable paper-based solutions designed to replace plastic packaging across various sectors, including food, e-commerce, and industrial applications.

- In 2023, DS Smith partnered with Minerva S.A. to launch DS Smith Tape Back for e-commerce in 2025, introducing the smart, sustainable solution to the Greek market to simplify returns and reduce waste by utilizing two integrated adhesive strips for secure resealing.

Report Coverage

The research report offers an in-depth analysis based on Product, Material Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by rising demand for sustainable packaging solutions.

- E-commerce expansion will continue driving the need for corrugated boxes and lightweight paperboard.

- Innovation in barrier coatings will improve moisture and grease resistance, replacing more plastic packaging.

- Digital printing will enable greater customization and faster turnaround for brands.

- Recycling infrastructure investments will strengthen the circular economy and support supply security.

- Growth in packaged food and beverage consumption will remain a key demand driver.

- Emerging markets in Asia-Pacific and Latin America will witness the fastest adoption rates.

- Regulatory pressure will push manufacturers to increase production of recyclable and biodegradable materials.

- Automation and smart manufacturing will enhance cost efficiency and scalability for producers.

- Partnerships and mergers will shape the competitive landscape, expanding global market reach.