Market Overview

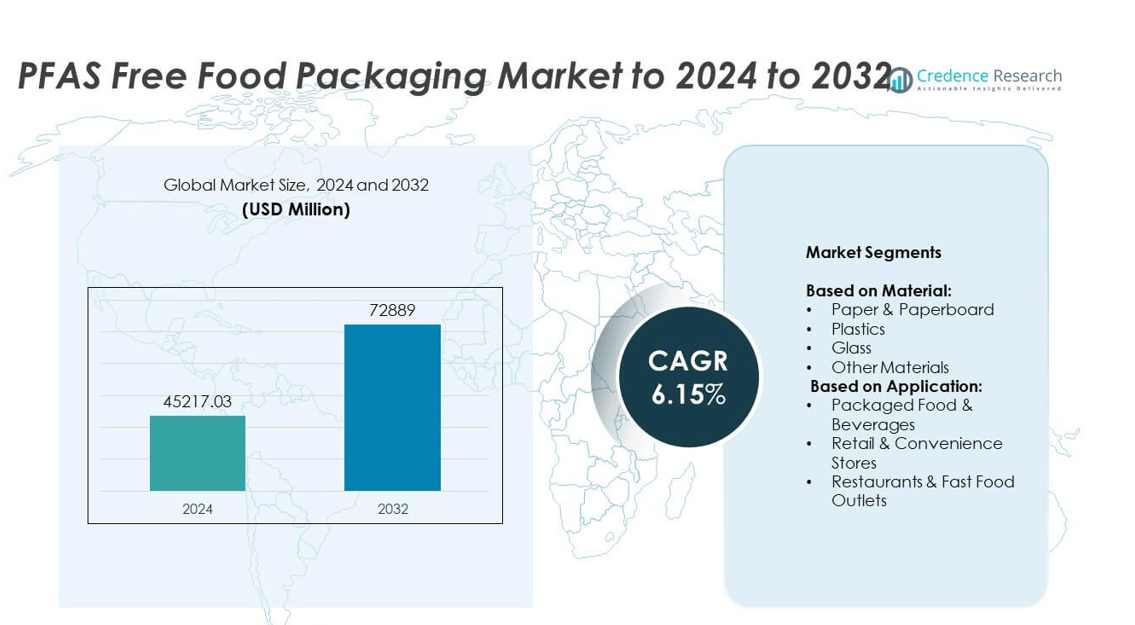

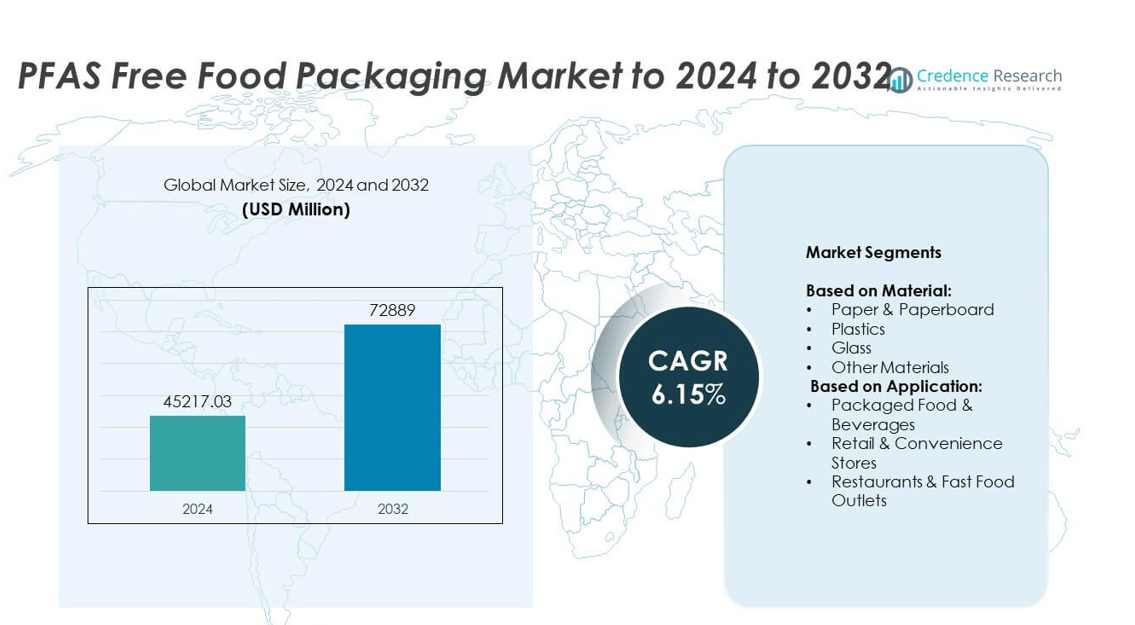

PFAS Free Food Packaging Market size was valued at USD 45,217.03 million in 2024 and is anticipated to reach USD 72,889 million by 2032, at a CAGR of 6.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PFAS Free Food Packaging Market Size 2024 |

USD 45,217.03 million |

| PFAS Free Food Packaging Market, CAGR |

6.15% |

| PFAS Free Food Packaging Market Size 2032 |

USD 72,889 million |

The PFAS free food packaging market is led by key players such as Stora Enso, CarePac, Ahlstrom, delfortgroup AG, MGC, Fox Packaging, Novolex, Detpak, and APP Group, who focus on developing sustainable, PFAS-free solutions to meet regulatory and consumer demand. These companies are investing in advanced paper-based barrier coatings, compostable materials, and recyclable packaging technologies to enhance performance and compliance. North America dominated the market with over 35% share in 2024, driven by strict PFAS bans and rapid adoption by food service providers. Europe followed with nearly 30% share, supported by stringent EU regulations and circular economy initiatives.

Market Insights

- The PFAS free food packaging market was valued at USD 45,217.03 million in 2024 and is projected to reach USD 72,889 million by 2032, growing at a CAGR of 6.15%.

- Growth is driven by global PFAS bans, rising consumer preference for safe packaging, and innovations in PFAS-free barrier coatings that maintain grease and moisture resistance.

- Key trends include adoption of circular economy packaging, expansion of quick-service restaurant and e-commerce packaging, and development of cost-effective recyclable and compostable solutions.

- The market is competitive with major players focusing on R&D, local production capacity expansion, and strategic partnerships with food brands to strengthen market position and ensure compliance.

- North America leads with over 35% share, followed by Europe at nearly 30%, Asia Pacific at 25%, and Latin America and Middle East & Africa contributing 6% and 4% respectively, with paper & paperboard dominating material share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Paper & paperboard dominated the PFAS free food packaging market in 2024, accounting for over 45% of the market share. The dominance is driven by rising demand for sustainable, compostable, and recyclable packaging solutions aligned with PFAS restrictions. Regulatory pressure and consumer preference for eco-friendly materials are accelerating the adoption of paper-based coatings and barrier solutions. Plastics remain significant for their durability and cost-efficiency, while glass is used in premium packaging for beverages. Other materials, including biodegradable polymers, are gaining traction as alternatives to PFAS-treated substrates in niche applications.

- For instance, Amcor’s 2024 Sustainability Report notes that over 94 % of its flexible packaging portfolio by area has a recycle-ready solution, and 95 % of rigid packaging by weight is recyclable in practice and at scale.

By Application

Packaged food & beverages led the market with over 50% share in 2024, driven by rising consumption of ready-to-eat meals, dairy, and frozen food products. Demand is supported by stringent food safety standards and regulations limiting PFAS in direct food contact materials. Retail and convenience stores follow, adopting PFAS-free wraps and containers to meet sustainability commitments. Restaurants and fast-food outlets are increasingly switching to PFAS-free takeaway packaging, driven by consumer awareness and regulatory bans on PFAS-lined food containers in several regions, further boosting market growth.

- For instance, Mamavation tested 81 pieces of fast food and fast casual packaging for PFAS content.

Market Overview

Regulatory Push for PFAS-Free Packaging

Government regulations banning PFAS in food packaging remain the primary growth driver for the market. Countries across North America and Europe are introducing strict limits on PFAS usage, forcing packaging manufacturers to switch to compliant alternatives. This regulatory momentum encourages large-scale investment in PFAS-free coatings and barrier technologies. Brands are rapidly adopting compliant solutions to avoid legal risks and meet consumer expectations, driving strong demand. This driver holds the most significant impact, as compliance remains non-negotiable for companies serving global food and beverage markets.

- For instance, ZeroF project (EU) is developing new PFAS-free coating technologies to replace PFAS in food packaging and textiles. It is a 36-month project started in 2023.

Rising Consumer Demand for Sustainable Packaging

Increasing consumer awareness of health and environmental impacts of PFAS drives the shift toward safer packaging. Shoppers are actively choosing products with labels highlighting PFAS-free and eco-friendly credentials. Brands are responding by introducing sustainable, recyclable, and compostable solutions to strengthen brand loyalty. This consumer-driven shift fuels demand across packaged foods, beverages, and restaurant takeaways. Companies using PFAS-free packaging gain competitive advantage by aligning with sustainability goals and catering to growing environmentally conscious consumer segments.

- For instance, Mondi reported that in 2022, 82 % of its revenue came from packaging and paper products that are reusable, recyclable or compostable.

Technological Advancements in Barrier Coatings

Innovation in PFAS-free barrier technologies is accelerating market adoption across material types. Manufacturers are developing water-based, bio-based, and polymer coatings that replicate PFAS performance in grease and moisture resistance. These advancements enable paperboard and other substrates to meet functional requirements without compromising recyclability. Improved manufacturing processes are also reducing production costs, making PFAS-free solutions more commercially viable. This driver supports large-scale adoption across food categories, helping the market expand beyond regulatory compliance into mainstream packaging solutions.

Key Trends & Opportunities

Shift Toward Circular Economy Packaging

The PFAS-free food packaging market is witnessing a major trend toward circular economy solutions. Companies are investing in packaging designed for recyclability and compostability, supporting closed-loop systems. Partnerships between food brands and packaging producers are rising to create end-of-life solutions that meet local waste infrastructure requirements. This trend opens opportunities for bio-based coatings and recyclable materials, allowing brands to reduce landfill waste. Companies that offer fully recyclable PFAS-free packaging are gaining traction among global retailers seeking to meet sustainability commitments.

- For instance, in its 2024 Sustainability Report (released in March 2025), Berry Global reported that 93% of its fast-moving consumer goods (FMCG) packaging is now either recyclable or has a validated recyclable alternative. The company also increased its total purchases of post-consumer recycled (PCR) resin by 43% year-over-year in 2024. A separate November 2024 report noted that its European flexibles division increased its use of PCR polyethylene (PE) by 36% year-on-year across industrial, consumer, and agricultural film products, incorporating an additional 4,386 metric tons of PCR content.

Growth in Quick-Service and E-Commerce Packaging

The rise of online food delivery and takeout services is creating strong opportunities for PFAS-free packaging adoption. Quick-service restaurants and delivery platforms are shifting to PFAS-free wrappers, boxes, and containers to meet regulatory requirements and improve brand image. Demand is growing for packaging that can handle heat, moisture, and transport stress without PFAS. This trend benefits producers of durable PFAS-free barrier materials, opening lucrative opportunities in the fast-expanding e-commerce food sector and boosting overall market penetration.

- For instance, Restaurant Brands International (owner of Burger King, Popeyes, and Tim Hortons) committed to phasing out intentionally added PFAS in its food packaging globally by the end of 2025. As of 2024, the company had already eliminated intentionally added PFAS from approximately 97% of approved guest packaging volumes globally

Key Challenges

Higher Cost of PFAS-Free Alternatives

One of the major challenges is the higher production cost of PFAS-free coatings compared to traditional PFAS-based solutions. Developing high-performance alternatives requires investment in R&D and advanced coating technology, leading to increased packaging prices. This cost pressure can deter adoption among small and medium food businesses with tight budgets. Price sensitivity in emerging markets further limits penetration, requiring cost optimization strategies from packaging suppliers to make PFAS-free solutions economically viable and competitive at scale.

Performance Limitations in Certain Applications

PFAS-free solutions often face challenges in matching the superior grease, water, and heat resistance of PFAS-based coatings. Some alternative materials struggle with durability in applications involving hot or oily foods. This performance gap may restrict adoption in segments like quick-service restaurants where packaging functionality is critical. Ongoing research is focused on improving barrier performance and maintaining recyclability. Until these limitations are addressed, manufacturers may face slower adoption in demanding use cases, impacting overall market growth potential.

Regional Analysis

North America

North America held the largest share of the PFAS free food packaging market in 2024, accounting for over 35% of the total market. Growth is driven by strict state-level bans on PFAS, including regulations in California, Washington, and New York. The presence of major food and beverage brands and a strong focus on sustainable packaging adoption accelerate market expansion. Demand is further supported by consumer preference for eco-friendly packaging and the rapid shift by quick-service restaurants toward PFAS-free solutions. Manufacturers are heavily investing in developing cost-effective paper-based and compostable solutions to meet growing demand across the region.

Europe

Europe accounted for nearly 30% of the PFAS free food packaging market in 2024, supported by stringent EU chemical regulations and the upcoming restriction on PFAS under REACH. The region’s commitment to circular economy goals is driving the adoption of recyclable and compostable packaging solutions. Demand is strong across retail, food service, and packaged food sectors, with countries like Germany, France, and the UK leading adoption. Industry players are partnering with food brands to supply PFAS-free barrier coatings that meet EU recyclability standards, further strengthening market growth and supporting the transition to a PFAS-free packaging ecosystem.

Asia Pacific

Asia Pacific captured around 25% market share in 2024, with growth fueled by rising packaged food consumption in China, India, and Southeast Asia. Increasing government initiatives to curb hazardous chemicals in food contact materials are encouraging the use of PFAS-free solutions. Rapid urbanization and expansion of quick-service restaurants are driving demand for safe and sustainable packaging. Manufacturers are scaling production capacity and launching affordable PFAS-free solutions to meet the needs of price-sensitive markets. Growing awareness of food safety and sustainability is expected to further accelerate adoption and make Asia Pacific one of the fastest-growing regions.

Latin America

Latin America represented close to 6% of the PFAS free food packaging market share in 2024. Growth is supported by rising health awareness and gradual regulatory action in countries such as Brazil and Mexico. Food service chains and retailers are transitioning to PFAS-free packaging to improve sustainability credentials and meet evolving consumer expectations. Adoption is slower compared to developed regions due to cost concerns, but demand is steadily increasing in urban areas. Investments in local production and collaborations with global packaging companies are expected to make PFAS-free solutions more accessible in the coming years.

Middle East & Africa

The Middle East & Africa region held about 4% of the market share in 2024, with adoption driven by growing food delivery services and modern retail formats. Regulatory activity is still developing, but multinational food and beverage players are introducing PFAS-free packaging to align with global standards. Urban centers such as Dubai, Riyadh, and Johannesburg are leading demand, supported by rising consumer awareness of food safety. Limited local manufacturing capacity poses a challenge, but imports of PFAS-free packaging materials are helping meet demand and gradually promoting wider adoption across the region.

Market Segmentations:

By Material:

- Paper & Paperboard

- Plastics

- Glass

- Other Materials

By Application:

- Packaged Food & Beverages

- Retail & Convenience Stores

- Restaurants & Fast Food Outlets

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The PFAS free food packaging market is highly competitive, with key players including Stora Enso, CarePac, Ahlstrom, delfortgroup AG, MGC, Fox Packaging, Novolex, Detpak, Kroonpak, Solenis, YUTOECO, APP Group, Melodea, Genpak, Guyenne Papier, Farnell Packaging, and CARCCU. The market is characterized by continuous investment in sustainable packaging innovations, particularly in paper-based and bio-based barrier solutions. Companies are focusing on expanding their product portfolios to meet regulatory requirements and consumer demand for PFAS-free options. Strategic partnerships with food service providers and retailers are becoming common to ensure reliable supply chains. Players are investing in R&D to enhance grease, heat, and moisture resistance without compromising recyclability. Regional expansions and local production facilities are helping reduce costs and meet demand in emerging markets. Competitive pricing and differentiation through technology-driven solutions remain critical success factors, as the industry experiences rising adoption across food packaging, retail, and quick-service restaurant applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stora Enso

- CarePac

- Ahlstrom

- delfortgroup AG

- MGC

- Fox Packaging

- Novolex

- Detpak

- Kroonpak

- Solenis

- YUTOECO

- APP Group

- Melodea

- Genpak

- Guyenne Papier

- Farnell Packaging

- CARCCU

Recent Developments

- In 2023, Melodea, a green-tech company, launched VBseal, a new PFAS-free, sustainable barrier coating solution designed to reduce plastic waste in consumer-packaged goods.

- In 2023, Novolex significantly expanded its Vanguard® line, a range of PFAS-free fiber-based food packaging made from sugarcane bagasse.

- In 2023, MGC launched PFAS-free AGELESS, the first oxygen absorber to meet evolving regulatory demands in the smart food packaging market.

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to strict global PFAS bans and regulatory enforcement.

- Demand for paper-based and compostable packaging will continue to dominate across applications.

- Technological innovation in PFAS-free barrier coatings will improve performance and cost efficiency.

- Food brands will increase partnerships with packaging suppliers to ensure compliance and sustainability.

- Quick-service restaurants and delivery platforms will accelerate adoption of PFAS-free packaging.

- Consumer demand for safe and eco-friendly food packaging will remain a major growth driver.

- Asia Pacific will emerge as the fastest-growing region due to urbanization and food service expansion.

- Manufacturers will invest in local production facilities to reduce costs and improve supply chains.

- Retailers will prefer PFAS-free packaging to meet corporate sustainability goals and customer expectations.

- Continuous R&D efforts will focus on developing heat and grease-resistant solutions without compromising recyclability.