Market Overview

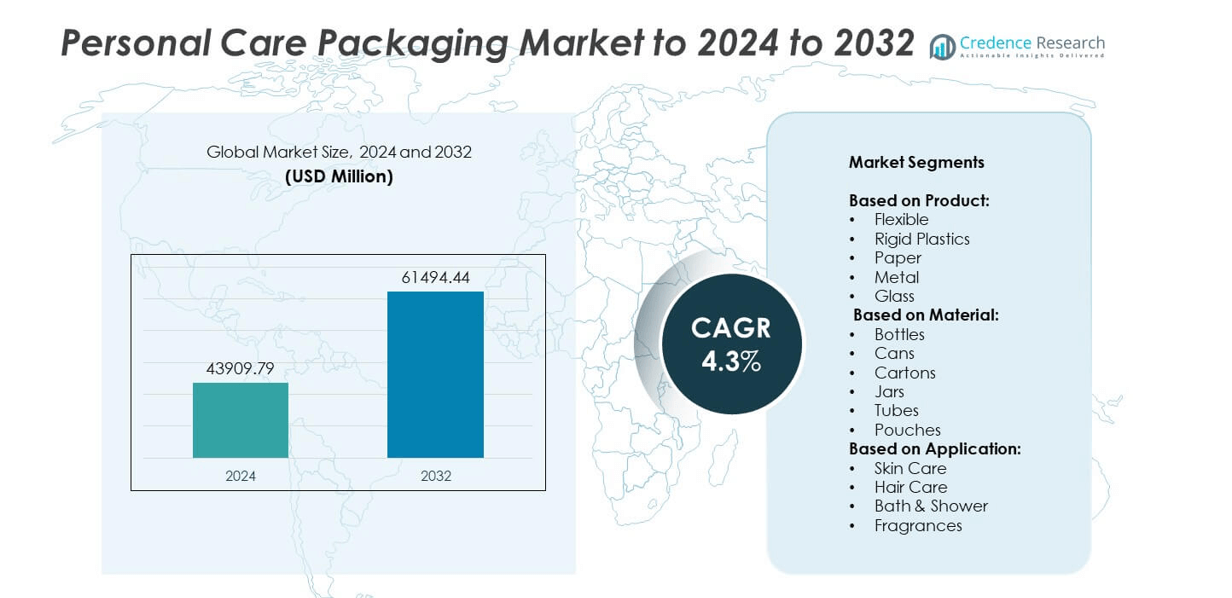

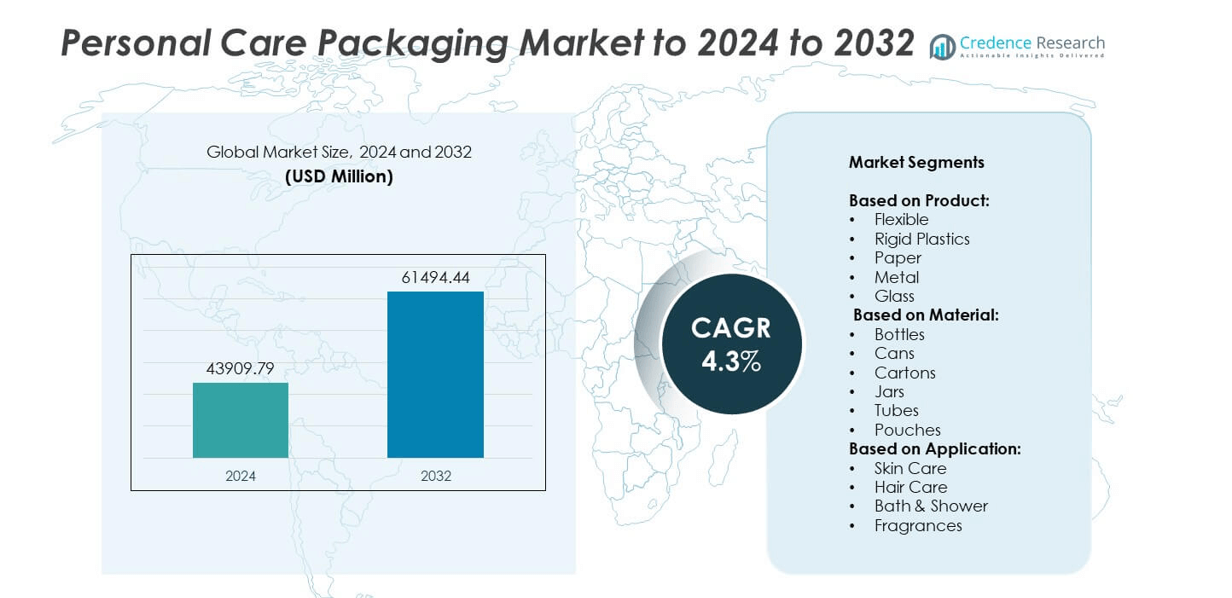

Personal Care Packaging market size was valued USD 43909.79 million in 2024 and is anticipated to reach USD 61494.44 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Personal Care Packaging Market Size 2024 |

USD 43909.79 million |

| Personal Care Packaging Market, CAGR |

4.3% |

| Personal Care Packaging Market Size 2032 |

USD 61494.44 million |

The personal care packaging market is shaped by key players including Aptar, Ardagh Group S.A., ITC, Amcor, WestRock Company, Crown, Berry Global, Albea Group, Sonoco Products Company, Mondi, Ampac Holding, and Amcor plc. These companies focus on sustainable materials, lightweight designs, and innovative formats to meet growing consumer demand and regulatory requirements. Strategic collaborations, capacity expansions, and digital printing technologies are widely adopted to strengthen market position and improve brand engagement. North America leads the market with over 32% share in 2024, supported by high consumption of premium personal care products and early adoption of eco-friendly packaging solutions.

Market Insights

- The personal care packaging market was valued at USD 43909.79 million in 2024 and is projected to reach USD 61494.44 million by 2032, growing at a CAGR of 4.3%.

- Rising demand for sustainable and recyclable packaging materials, along with increased personal grooming awareness, is driving strong market growth across all product categories.

- Flexible packaging holds over 40% share as the dominant segment, while bottles lead material use, supported by the popularity of shampoos, lotions, and body wash products.

- The market is competitive, with players focusing on innovation, lightweight designs, and refillable solutions to gain share, supported by strategic mergers, partnerships, and capacity expansions.

- North America leads with over 32% share, followed by Europe at 28% and Asia Pacific at 26%, with strong growth potential in developing economies due to rising disposable incomes and expanding e-commerce channels boosting packaging demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Flexible packaging led the personal care packaging market in 2024, holding over 40% share due to its lightweight nature, cost-effectiveness, and ability to offer diverse design formats. Its convenience for single-use and travel-size products supports strong demand, particularly in emerging economies. Growth is driven by rising consumer preference for easy-to-use packaging solutions, eco-friendly materials, and reduced transportation costs. Brands are adopting recyclable flexible films to align with sustainability goals. Rigid plastics followed, supported by high durability and suitability for premium product packaging like creams and lotions.

- For instance, Manjushree Technopack has over 275,000 metric tons per annum converting capacity across its plastics preforms, bottles, containers, films, and recycled resins segments.

By Material

Bottles dominated the personal care packaging market with more than 35% share in 2024, supported by their wide use in shampoos, conditioners, lotions, and body washes. Their ability to provide strong barrier protection, easy dispensing, and branding flexibility drives adoption across mass and premium categories. PET and HDPE bottles remain preferred due to recyclability and cost efficiency. Tubes and pouches are also witnessing rapid growth as brands focus on space-saving, lightweight options for e-commerce and sustainable refill packs, meeting growing demand for eco-conscious and convenient packaging.

- For instance, ALPLA has an installed and projected recycling capacity of 290,000 tonnes of recycled PET and 99,000 tonnes of recycled HDPE, bringing its total capacity to 389,000 tonnes of post-consumer recycled material as of mid-2025.

By Application

Skin care accounted for the largest share of the personal care packaging market, holding over 30% share in 2024, driven by rising demand for moisturizers, serums, and sunscreen products. Growth is supported by increasing focus on personal grooming, anti-aging products, and premiumization in urban markets. Packaging innovations like airless pumps and UV-protected bottles enhance product shelf life and consumer appeal. Hair care and bath & shower segments are also expanding steadily, fueled by growth in hygiene awareness and demand for natural and organic formulations.

Market Overview

Rising Demand for Sustainable Packaging

Sustainability is the key growth driver in the personal care packaging market, with consumers favoring eco-friendly materials such as recyclable plastics, paper-based packs, and biodegradable solutions. Brands are investing in closed-loop recycling systems and lightweight packaging to reduce carbon footprint. This shift is supported by stricter regulations like the EU Packaging and Packaging Waste Directive and increasing corporate commitments to achieve net-zero goals. Demand for refillable containers, compostable pouches, and recycled PET bottles is rapidly growing, making sustainability the most influential factor shaping packaging innovations.

- For instance, Amcor operates its Flexibles segment and Rigid Packaging segment in various locations worldwide. In its fiscal year 2024, Amcor reported operating out of 212 locations across 40 countries to produce a range of flexible packaging and rigid plastic containers for markets including food, personal care, and home care.

Growing Personal Grooming and Hygiene Awareness

Increased focus on self-care and hygiene is fueling demand for personal care products, driving packaging consumption. Rising disposable incomes, urbanization, and social media influence are encouraging premium product purchases, which require aesthetically appealing packaging. Categories like skin care, hair care, and bath products are witnessing double-digit growth, supported by rising product launches. Packaging manufacturers are responding with advanced formats like airless pumps, tamper-evident closures, and attractive labeling to cater to this demand. This driver significantly boosts packaging volumes across both mass-market and luxury segments.

- For instance, L’Oréal has expanded its refillable packaging options by a factor of 17 times over the past five years.

Expansion of E-commerce and Direct-to-Consumer Channels

The surge in online beauty and personal care product sales is driving demand for protective and compact packaging formats. E-commerce requires packaging that ensures product safety, tamper resistance, and minimal shipping costs. Companies are adopting lightweight materials, secondary protective packaging, and personalized designs to improve the unboxing experience and enhance brand loyalty. Subscription boxes and sample-size packaging are also gaining traction. This channel expansion is encouraging manufacturers to innovate with durable, sustainable, and space-efficient solutions that balance cost efficiency with visual appeal.

Key Trends & Opportunities

Shift Toward Premium and Smart Packaging

Premiumization in personal care is creating opportunities for high-quality packaging with advanced features. Smart packaging solutions like QR codes, NFC tags, and augmented reality integration are improving brand engagement and traceability. Glass and metal packaging are gaining traction for luxury skin care and fragrances, offering a premium look and superior product protection. Companies are also focusing on visually appealing designs and customization options to strengthen brand identity and attract younger consumers. This trend is reshaping the competitive landscape toward innovative, tech-enabled packaging solutions.

- For instance, Impinj shipped its 100 billionth RAIN RFID tag chip in March 2024, marking a company milestone for total cumulative shipments over its history.

Adoption of Refillable and Reusable Packaging Models

Refillable packaging formats are emerging as a strong opportunity, aligning with sustainability goals and reducing single-use plastic waste. Major brands are launching refill stations, pouch refills, and reusable containers to appeal to environmentally conscious consumers. This model reduces packaging waste while encouraging repeat purchases. Brands like Unilever and L’Oréal are actively piloting refillable product ranges in global markets. Growing consumer acceptance and supportive regulations are likely to accelerate this shift, opening a long-term opportunity for packaging suppliers offering durable and compatible refill systems.

- For instance, The Body Shop installed refill stations in 800 stores worldwide by 2023.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of key raw materials such as PET, HDPE, aluminum, and paperboard pose challenges to packaging manufacturers. Price volatility impacts profit margins and makes cost forecasting difficult. Rising energy costs and supply chain disruptions further add to production expenses. Companies must balance between cost efficiency and maintaining sustainable practices, often leading to margin pressure. Strategic sourcing, adoption of recycled materials, and supplier partnerships are becoming necessary to mitigate risks and ensure business continuity in a competitive market.

Regulatory Compliance and Recycling Infrastructure Gaps

Strict regulations on plastic usage, extended producer responsibility (EPR) policies, and packaging waste management requirements are challenging for market players. Many regions still lack adequate recycling infrastructure, making compliance expensive and complex. Companies must invest in sustainable material development and closed-loop systems to meet evolving standards. Failure to comply may result in penalties and reputational risks. Collaboration with recycling firms and governments is crucial to create efficient collection and recycling systems, ensuring compliance while addressing growing consumer expectations for eco-friendly packaging.

Regional Analysis

North America

North America accounted for over 32% share of the personal care packaging market in 2024, making it the leading region. The market benefits from strong demand for premium skin care, hair care, and fragrance products supported by high disposable incomes and consumer focus on grooming. The presence of major global packaging manufacturers and personal care brands encourages innovation in sustainable and refillable formats. Growth in e-commerce channels has boosted the need for durable and protective packaging solutions. The United States dominates the regional market, supported by advanced production capabilities and early adoption of eco-friendly packaging initiatives.

Europe

Europe captured nearly 28% share of the personal care packaging market in 2024, driven by strict environmental regulations and rising consumer awareness about sustainability. Demand for recyclable and paper-based packaging is high, especially in countries like Germany, France, and the U.K. The premium segment for fragrances and luxury skin care is fueling growth in glass and metal packaging formats. Brands are investing in closed-loop recycling systems and refill programs to meet circular economy goals. Increasing online sales and strong innovation capabilities across the region are further supporting the adoption of modern and visually appealing packaging solutions.

Asia Pacific

Asia Pacific represented around 26% of the personal care packaging market in 2024, driven by a growing middle-class population and rapid urbanization. Rising disposable incomes in China, India, and Southeast Asian countries are boosting demand for affordable and attractive packaging solutions. Flexible packaging formats dominate due to cost efficiency and convenience. Regional manufacturers are adopting recyclable materials and lightweight designs to meet sustainability expectations. The region is witnessing rapid e-commerce growth, pushing demand for compact and protective packaging formats. Expanding domestic production and the presence of both local and global brands are further strengthening market opportunities.

Latin America

Latin America held close to 8% share of the personal care packaging market in 2024, with Brazil and Mexico leading regional consumption. Growth is supported by increasing awareness of personal grooming and the adoption of affordable packaging solutions such as flexible pouches and plastic bottles. Economic recovery and rising disposable incomes are boosting demand across skin care and hair care segments. Packaging suppliers are gradually transitioning toward recyclable and lightweight materials to meet global sustainability standards. Investments in local manufacturing and distribution networks are improving product availability and reducing reliance on imported packaging formats.

Middle East & Africa

Middle East & Africa accounted for nearly 6% share of the personal care packaging market in 2024, with demand supported by the rising popularity of fragrances, cosmetics, and luxury personal care products. The region is experiencing growth in modern retail and e-commerce platforms, increasing the need for attractive and protective packaging. Glass and metal formats are preferred for premium products, while flexible packaging is growing in mass-market segments. Local production capabilities are expanding, supported by investments in sustainable packaging technologies. The market is expected to grow steadily as consumer spending on grooming and beauty products continues to rise.

Market Segmentations:

By Product:

- Flexible

- Rigid Plastics

- Paper

- Metal

- Glass

By Material:

- Bottles

- Cans

- Cartons

- Jars

- Tubes

- Pouches

By Application:

- Skin Care

- Hair Care

- Bath & Shower

- Fragrances

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the personal care packaging market features leading players such as Aptar, Ardagh Group S.A., ITC, Amcor, WestRock Company, Crown, Berry Global, Albea Group, Sonoco Products Company, Mondi, Ampac Holding, and Amcor plc. The market is highly competitive with companies focusing on innovation, sustainable materials, and cost-efficient solutions to gain a competitive edge. Many players are investing in lightweight, recyclable, and refillable packaging formats to meet rising consumer demand for eco-friendly products. Strategic partnerships, mergers, and capacity expansions are common to strengthen regional presence and improve production capabilities. Digital printing technologies and smart packaging solutions are increasingly adopted to enhance brand visibility and consumer engagement. The market also sees a focus on meeting e-commerce requirements through protective and compact designs, ensuring safe product delivery. Sustainability goals and regulatory compliance continue to shape competition, driving investment in advanced material research and closed-loop recycling initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aptar

- Ardagh Group S.A.

- ITC

- WestRock Company

- Crown

- Berry Global

- Albea Group

- Sonoco Products Company

- Mondi

- Ampac Holding

- Amcor plc

Recent Developments

- In 2025, Aptar company introduced full-plastic dispensing systems like the Advance Collection, made entirely from polyolefins (PP and PE), making them compatible with common plastic recycling streams.

- In 2025, Bery Global showcased its expanded Exclusive Stick and Refill range. This product line, which includes new travel-friendly sizes, was developed to meet the growing consumer demand for refillable and convenient packaging for deodorants and skincare products.

- In 2023, Amcor joined a strategic alliance with Mars, Delterra, and Procter & Gamble to invest in a circular plastics economy in developing regions. This upstream initiative aims to improve recycling infrastructure and address plastic pollution

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by rising demand for sustainable packaging solutions.

- Brands will focus on recyclable, biodegradable, and refillable formats to meet consumer expectations.

- E-commerce expansion will drive demand for durable and protective packaging formats.

- Premium packaging designs will gain traction in luxury skin care and fragrance segments.

- Smart packaging with QR codes and digital engagement features will become more common.

- Flexible packaging will remain dominant due to its lightweight and cost-efficient nature.

- Manufacturers will invest in advanced materials to meet global sustainability regulations.

- Emerging markets in Asia Pacific will offer strong growth opportunities for packaging suppliers.

- Collaboration between brands and recyclers will improve circular economy adoption.

- Technological innovations in digital printing and automation will enhance packaging customization.