Market Overview

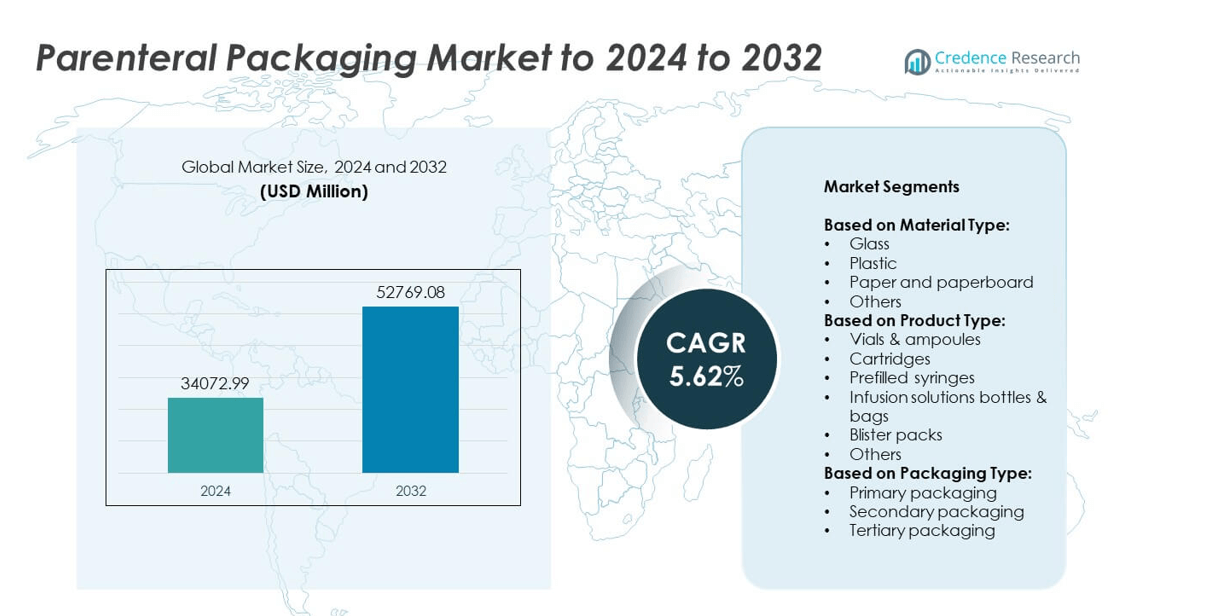

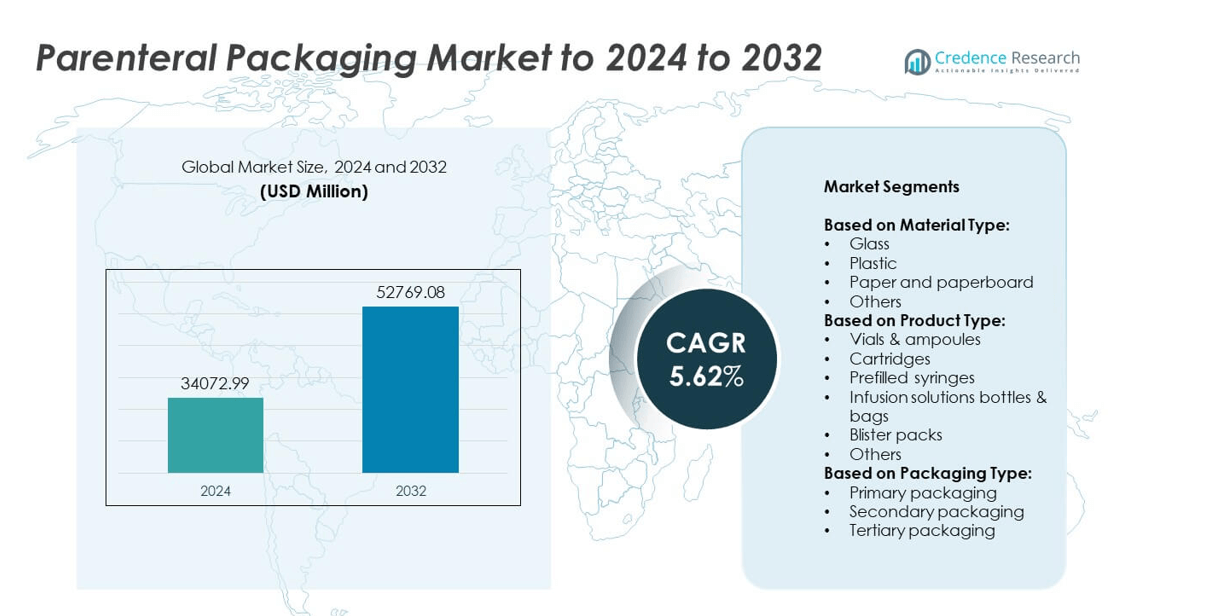

Parenteral Packaging Market size was valued USD 34072.99 Million in 2024 and is anticipated to reach USD 52769.08 Million by 2032, at a CAGR of 5.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Parenteral Packaging Market Size 2024 |

USD 34072.99 Million |

| Parenteral Packaging Market, CAGR |

5.62% |

| Parenteral Packaging Market Size 2032 |

USD 52769.08 Million |

The parenteral packaging market is driven by leading players such as Tekni-Plex, Berry Global, WestRock, Baxter International, Stevanato Group, Catalent, Amcor, ZACROS, AptarGroup, Oliver Healthcare Packaging, West Pharmaceutical Services, Datwyler, SGD Pharma, Nipro, Gerresheimer, Adelphi Group, and Schott. These companies focus on high-quality primary packaging solutions, including glass vials, prefilled syringes, and infusion bags, supported by investments in automation and sterile manufacturing facilities. North America leads the global market with over 36% share in 2024, followed by Europe at around 30%, driven by strong pharmaceutical production and stringent regulatory frameworks, while Asia-Pacific emerges as the fastest-growing region.

Market Insights

- The parenteral packaging market was valued at USD 34072.99 million in 2024 and is projected to reach USD 52769.08 million by 2032, growing at a CAGR of 5.62%.

- Rising demand for biologics, biosimilars, and self-administered therapies drives growth, increasing the need for glass vials, ampoules, and prefilled syringes with high sterility and safety standards.

- Trends include adoption of sustainable materials like COP/COC, automation in packaging production, and smart packaging with RFID tags to improve traceability and reduce contamination risks.

- The market is moderately competitive, with global players focusing on M&A, facility expansion, and technology upgrades to strengthen portfolios and meet regulatory requirements.

- North America leads with over 36% share, Europe follows with around 30%, Asia-Pacific holds 25% and is the fastest-growing region, while Latin America and Middle East & Africa collectively account for nearly 9% share, supported by healthcare infrastructure development and rising injectable drug use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Glass led the parenteral packaging market in 2024, holding over 55% market share. Its superior chemical resistance, ability to maintain drug stability, and compatibility with biologics make it the preferred material. Demand is driven by its use in vials, ampoules, and prefilled syringes for vaccines and injectables. Plastic followed, supported by its lightweight and shatter-resistant properties, making it suitable for infusion bags and cartridges. Paper and paperboard are used mainly for secondary and tertiary packaging, while other materials serve niche applications. Rising biologics production continues to boost demand for glass-based primary packaging solutions globally.

- For instance, SCHOTT Pharma’s Drug Delivery Systems segment generated €114 million in revenues in the third quarter of the fiscal year 2025, which included revenue from glass syringes and other products. The business with prefillable glass syringes grew further during this period, offsetting a lower demand for prefillable polymer syringes.

By Product Type

Vials and ampoules dominated the product type segment, accounting for more than 40% share in 2024. They are widely used for packaging vaccines, oncology drugs, and lyophilized formulations due to their superior sealing and sterility properties. Prefilled syringes are the fastest-growing sub-segment, driven by patient convenience and reduced dosing errors. Cartridges are popular in insulin delivery systems, while infusion bottles and bags serve hospital-based therapies. Blister packs are used mainly for solid parenterals and unit-dose applications. Growth is fueled by the increasing shift toward self-administration and demand for accurate dosing solutions.

- For instance, BD increased U.S. production of its PosiFlush prefilled flush syringes by over 750 million units over the past three years.

By Packaging Type

Primary packaging held the largest share, exceeding 65% of the parenteral packaging market in 2024. It directly contacts the drug, ensuring product safety, sterility, and stability during storage and transport. Rising demand for sterile injectables and biologics is a key driver for this dominance. Secondary packaging provides labeling, protection, and regulatory compliance, while tertiary packaging supports bulk handling and logistics. Growth in primary packaging is further driven by advancements in glass vials, prefilled syringes, and multi-chamber bags designed for complex drug formulations and ready-to-use delivery systems.

Market Overview

Rising demand for biologics and biosimilars

The rising demand for biologics and biosimilars is a key growth driver for the parenteral packaging market. Biologics require sterile, high-quality packaging to maintain efficacy and stability, fueling demand for glass vials, ampoules, and prefilled syringes. Increasing prevalence of chronic diseases such as cancer and diabetes drives the use of injectable therapies, further boosting primary packaging adoption. Manufacturers are investing in advanced production facilities and automation to meet growing requirements for contamination-free solutions, which strengthens the dominance of glass and high-barrier plastic packaging across global pharmaceutical and biotech sectors.

- For instance, Stevanato Group’s new facility in Fishers, Indiana, is approximately 370,000 square feet, and it began ramping up commercial production in late 2024 to serve the U.S. market with “EZ-Fill” syringes and vials.

Preference for self-administration and home healthcare

The growing preference for self-administration and home healthcare is another major driver. Prefilled syringes and cartridges allow patients to administer treatments with precision and safety, reducing hospital visits and overall healthcare costs. This trend is especially strong in insulin therapy, biologics, and vaccines. Pharma companies are adopting innovative drug-device combinations to support patient-centric care, creating steady demand for user-friendly, tamper-evident, and easy-to-handle parenteral packaging formats across regions.

- For instance, Gerresheimer employed approximately 13,600 people (with the inclusion of Bormioli Pharma) by mid-2025

Regulatory compliance and product safety requirements

Regulatory compliance and emphasis on product safety form the third key driver. Stringent guidelines from agencies like the FDA and EMA mandate the use of high-quality packaging to prevent contamination and ensure drug stability. This has pushed manufacturers to adopt advanced sterilization techniques, high-purity glass, and quality inspection systems. Growing investments in serialization and track-and-trace solutions also support secure supply chains, ensuring authenticity and reducing risks of counterfeit medicines entering the market. These regulatory requirements continue to shape innovation in parenteral packaging materials and processes.

Key Trends & Opportunities

Sustainable and eco-friendly packaging solutions

A major trend is the shift toward eco-friendly and sustainable packaging solutions. Pharmaceutical companies are adopting recyclable materials, low-carbon manufacturing, and energy-efficient production methods to align with ESG goals. The development of cyclic olefin polymers (COP) and cyclic olefin copolymers (COC) is gaining attention as they offer lightweight, break-resistant, and high-clarity alternatives to traditional glass, supporting sustainability and reducing transportation costs. This transition opens opportunities for suppliers focused on innovative, compliant, and environmentally friendly packaging options.

- For instance, Tageos had a global annual production capacity of over 9 billion RFID inlays and tags in 2024, including UHF, HF, and NFC, and has since grown its capacity to over 11 billion units, as confirmed by July 2025 company presentations.

Technological advancements and smart packaging

Technological advancements in packaging design are creating new opportunities in the market. Smart packaging with RFID tags and tamper-evident seals helps improve traceability and ensures patient safety. Multi-chamber bags and advanced prefilled systems support complex biologic formulations and combination therapies. Automation in manufacturing is enhancing consistency and reducing contamination risks, enabling large-scale production of sterile packaging solutions. These innovations improve convenience, efficiency, and compliance, offering strong growth potential for companies investing in R&D and digital technologies.

- For instance, Faller Packaging produces billions of items of pharmaceutical secondary packaging annually, with recent capacity expansions in locations like Horsens, Denmark (for 600 million folding cartons per year) and Gebesee, Germany (for up to 650 million folding cartons and 160 million outserts annually), adding to its significant production volumes across its various sites in 2024 and 2025.

Key Challenges

High manufacturing and compliance costs

High manufacturing and compliance costs remain a key challenge for parenteral packaging producers. Meeting stringent quality standards for sterilization, particulate control, and leachables testing requires heavy investment in equipment and technology. Small and mid-sized companies often face difficulties in maintaining cost efficiency while ensuring global regulatory compliance. These costs can limit the adoption of advanced materials or packaging formats, especially in emerging markets where price sensitivity is high, potentially slowing overall market penetration.

Supply chain disruptions and material shortages

Supply chain disruptions and material shortages pose another significant challenge. The demand for pharmaceutical glass surged during global vaccination campaigns, leading to shortages and delays. Dependence on limited suppliers for specialized materials like borosilicate glass or cyclic olefin polymers increases vulnerability. Logistics constraints and geopolitical tensions further affect timely deliveries. Manufacturers must diversify sourcing, enhance inventory management, and invest in localized production to overcome such risks and ensure a stable, continuous supply for critical healthcare packaging needs.

Regional Analysis

North America

North America led the parenteral packaging market in 2024 with over 36% share. Growth is driven by high demand for biologics, vaccines, and injectable therapies across the U.S. and Canada. Strong pharmaceutical manufacturing infrastructure and stringent FDA regulations ensure consistent adoption of high-quality primary packaging materials, particularly glass vials and prefilled syringes. Increasing prevalence of chronic diseases and strong presence of leading pharmaceutical companies boost innovation. The region also benefits from investments in automation and sustainable packaging solutions, supporting large-scale production. Rising demand for patient-friendly packaging formats continues to accelerate growth throughout the forecast period.

Europe

Europe accounted for around 30% of the parenteral packaging market in 2024. The region’s growth is supported by advanced healthcare infrastructure, robust R&D activities, and strict EMA guidelines that drive high-quality packaging adoption. Germany, France, and the U.K. are major contributors, with strong biologics and biosimilars production. The market benefits from government support for local pharmaceutical manufacturing and focus on sustainability initiatives. Increasing demand for prefilled syringes, multi-chamber bags, and traceable packaging solutions drives innovation. Rising preference for patient-centric and eco-friendly packaging formats further enhances growth potential across both Western and Eastern European countries.

Asia-Pacific

Asia-Pacific held nearly 25% share of the parenteral packaging market in 2024 and is the fastest-growing region. Expanding pharmaceutical manufacturing in China, India, and Japan fuels demand for glass vials, ampoules, and infusion bags. Rapid urbanization, increasing healthcare expenditure, and growing prevalence of chronic diseases boost injectable drug consumption. The region is witnessing significant investment in biologics facilities and packaging automation to meet export demand. Favorable government policies and cost advantages encourage global players to expand production capacities in the region. Rising adoption of modern primary packaging solutions continues to create strong growth opportunities.

Latin America

Latin America captured close to 6% share of the parenteral packaging market in 2024. Growth is driven by increasing government initiatives to strengthen local pharmaceutical production in Brazil, Mexico, and Argentina. Demand for cost-effective primary packaging solutions, including glass vials and infusion bags, is rising with the expansion of public health programs. The market benefits from growing vaccine distribution and higher spending on injectable therapies. However, challenges such as limited regulatory harmonization and infrastructure gaps exist. Multinational companies are investing in local partnerships and manufacturing facilities to improve accessibility and meet regional healthcare needs.

Middle East & Africa

The Middle East & Africa region accounted for around 3% of the parenteral packaging market in 2024. Growth is supported by expanding healthcare infrastructure and rising investment in pharmaceutical manufacturing hubs in countries like Saudi Arabia, South Africa, and the UAE. Increasing prevalence of chronic diseases and higher demand for injectable drugs drive adoption of sterile primary packaging. International players are collaborating with regional suppliers to improve access and meet quality standards. Although the market faces pricing pressures and import dependencies, government initiatives to boost local drug production are likely to enhance growth over time.

Market Segmentations:

By Material Type:

- Glass

- Plastic

- Paper and paperboard

- Others

By Product Type:

- Vials & ampoules

- Cartridges

- Prefilled syringes

- Infusion solutions bottles & bags

- Blister packs

- Others

By Packaging Type:

- Primary packaging

- Secondary packaging

- Tertiary packaging

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The parenteral packaging market features major players such as Tekni-Plex, Berry Global, WestRock, Baxter International, Stevanato Group, Catalent, Amcor, ZACROS, AptarGroup, Oliver Healthcare Packaging, West Pharmaceutical Services, Datwyler, SGD Pharma, Nipro, Gerresheimer, Adelphi Group, and Schott. These companies focus on innovation in primary and secondary packaging solutions, driven by the rising demand for biologics, vaccines, and injectable therapies. Strategic investments are being made in advanced manufacturing technologies, cleanroom facilities, and automation to ensure sterility and regulatory compliance. Partnerships with pharmaceutical firms and expansion of production capacities in high-growth regions strengthen global presence. Sustainability initiatives such as recyclable materials, low-carbon production processes, and lightweight designs are being prioritized. Companies are also focusing on digital technologies, including serialization and track-and-trace systems, to improve supply chain security. Mergers, acquisitions, and collaborations remain a key strategy to expand product portfolios and address evolving healthcare packaging requirements worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tekni-Plex

- Berry Global

- WestRock

- Baxter International

- Stevanato Group

- Catalent

- Amcor

- ZACROS

- AptarGroup

- Oliver Healthcare Packaging

- West Pharmaceutical Services

- Datwyler

- SGD Pharma

- Nipro

- Gerresheimer

- Adelphi Group

- Schott

Recent Developments

- In 2025, SCHOTT Pharma company launched its next-generation SCHOTT TOPPAC® infuse polymer syringes. This system includes a tamper-evident cap, an integrated label for traceability, and carton packaging to eliminate blister packs, thereby reducing waste.

- In 2023, Gerresheimer launched cyclic olefin polymer (COP) vials designed to safely fill and store highly sensitive biopharmaceutical ingredients, such as mRNA, used in vaccines.

- In 2023, Stevanato Group continued to leverage its EZ-fill® technology, a platform for providing ready-to-use vials, syringes, and cartridges.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product Type, Packaging Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for biologics and biosimilars.

- Adoption of prefilled syringes and cartridges will increase due to patient self-administration.

- Glass vials will remain dominant, but high-quality plastics will gain more share.

- Automation and robotics in packaging production will reduce contamination risks.

- Sustainable and recyclable materials will see strong investment from manufacturers.

- Smart packaging with RFID and tamper-evident seals will improve drug traceability.

- Asia-Pacific will witness the fastest growth driven by manufacturing expansion and exports.

- Collaborations between pharma companies and packaging firms will accelerate product innovation.

- Stringent regulatory requirements will encourage high-purity materials and advanced sterilization methods.

- Companies will focus on localized production to minimize supply chain disruptions.