Market Overview

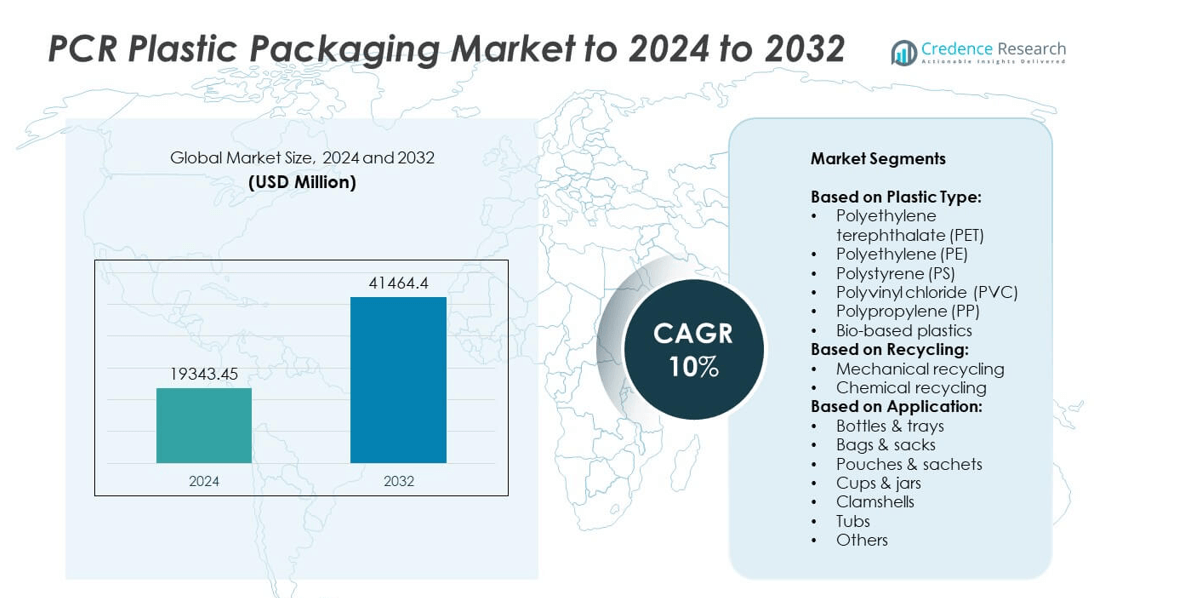

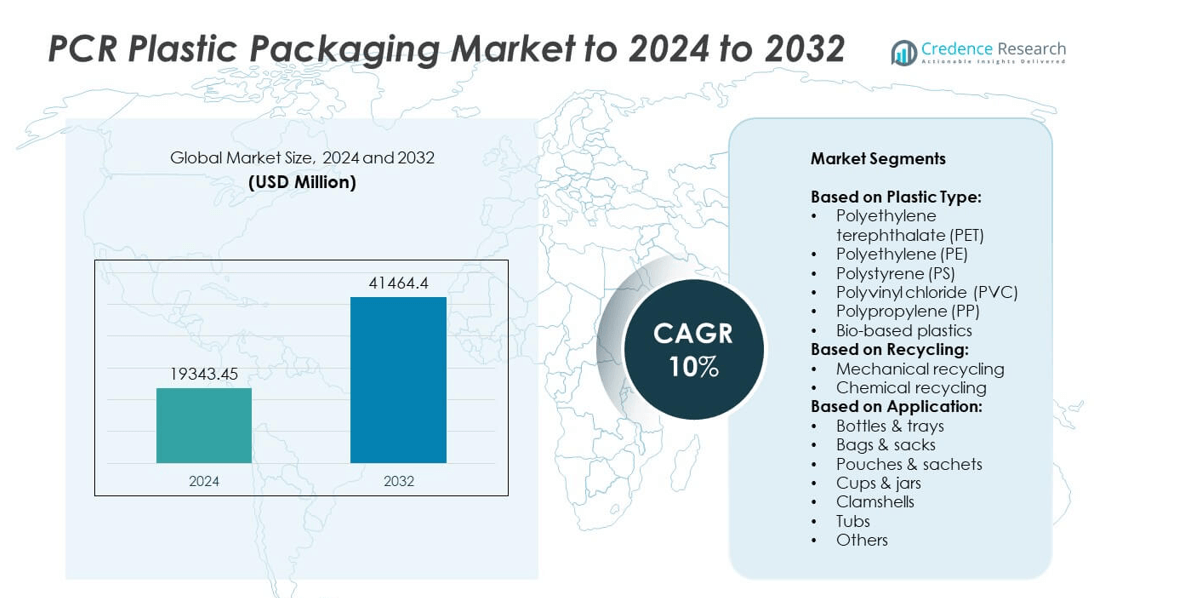

PCR Plastic Packaging Market size was valued USD 19,343.45 Million in 2024 and is anticipated to reach USD 41,464.4 Million by 2032, at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Parenteral Packaging Market Size 2024 |

USD 19,343.45 Million |

| Parenteral Packaging Market, CAGR |

10% |

| Parenteral Packaging Market Size 2032 |

SD 41,464.4 Million |

Key players in the PCR plastic packaging market include Red Pack, Berry Global, Mondi, Dow, Sanle Plastic, Winpak, Cambrian Packaging, 3plastics, Regent Plast, PTT Global Chemical, Evergreen Resources, Proampac, Udinc, Longdapac, Glenroy, and Amcor. These companies focus on expanding PCR production capacity, developing food-grade recycled resins, and strengthening closed-loop recycling systems to meet growing demand from food, beverage, and personal care sectors. Strategic collaborations, acquisitions, and investments in advanced mechanical and chemical recycling technologies are common to enhance supply reliability and meet regulatory targets. Regionally, North America leads the market with around 35% share, supported by robust recycling infrastructure, strong regulatory mandates, and high consumer awareness. Europe follows with about 30% share, driven by strict EU directives and advanced collection systems, while Asia Pacific holds nearly 25% share, emerging as the fastest-growing region due to rising packaged goods demand and increasing government initiatives on plastic waste reduction.

Market Insights

- The PCR plastic packaging market was valued at USD 19,343.45 million in 2024 and is projected to reach USD 41,464.4 million by 2032, growing at a CAGR of 10%.

- Rising demand for sustainable packaging and strict government regulations on recycled content drive strong market growth.

- Key trends include growing adoption of food-grade PCR materials, expansion of chemical recycling capacity, and brand commitments to closed-loop systems.

- The market is competitive with players focusing on capacity expansion, partnerships with recyclers, and innovation in high-performance PCR resins.

- North America leads with 35% share, followed by Europe at 30% and Asia Pacific at 25%; PET is the dominant segment with over 35% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Plastic Type

Polyethylene terephthalate (PET) dominated the PCR plastic packaging market in 2024 with over 35% market share. PET’s high recyclability, strength, and clarity make it the preferred choice for beverage bottles and food packaging. Growing demand from the beverage industry and stringent regulations on single-use plastics drive PET adoption. Polypropylene (PP) and polyethylene (PE) follow, supported by applications in flexible packaging and household products. Bio-based plastics are gaining traction due to increasing sustainability initiatives, but their share remains smaller compared to conventional polymers due to higher production costs and limited large-scale availability.

- For instance, in its 2023 sustainability reporting, Indorama Ventures stated it recycled 324,256 metric tons of post-consumer PET bottles, diverting them from landfills and oceans. The company is a key partner in the recycling industry, and its efforts support various brand owners, including Coca-Cola, but Coca-Cola’s specific target has been adjusted.

By Recycling

Mechanical recycling held the leading share of over 70% in 2024, supported by its cost-effectiveness and mature infrastructure worldwide. This process is widely adopted for PET and HDPE packaging, ensuring compliance with recycled content mandates. Rising demand from food-grade applications and strong collection networks are key drivers for growth. Chemical recycling is gaining interest for mixed and contaminated plastic waste streams, offering a solution to produce near-virgin quality resin. Its share is expected to grow rapidly as chemical recycling plants scale up and technology costs decline over the forecast period.

- For instance, In September 2025, Loop Industries and Ester Industries Ltd. announced a joint venture named Ester Loop Infinite Technologies (ELITe) to build a 70,000 metric ton PET recycling facility in Dahej, Gujarat. Commercial operations are projected to begin by the end of 2027. This “Infinite Loop” facility will utilize Loop Industries’ chemical recycling technology to convert polyester textile waste into virgin-quality PET resin for textile applications.

By Application

Bottles and trays were the dominant application segment, accounting for over 40% market share in 2024. High consumption of PET bottles for beverages, dairy, and personal care products drives this segment’s growth. Rising adoption of recycled content mandates by global brands like Coca-Cola and Nestlé supports demand for PCR-based bottles. Pouches, sachets, and bags are emerging segments, driven by e-commerce and food delivery packaging needs. Cups, jars, and clamshells show steady growth in foodservice packaging, supported by sustainability commitments from quick-service restaurants and regulations targeting virgin plastic use.

Market Overview

Rising Demand for Sustainable Packaging

Sustainability has become the leading driver of PCR plastic packaging adoption. Global brands are pledging to increase recycled content in packaging to meet ESG goals and comply with regulations. Initiatives like the EU Single-Use Plastics Directive and the U.S. Plastics Pact are accelerating demand for PCR materials. This shift is particularly strong in beverage, personal care, and food sectors. The ability of PCR plastics to reduce carbon footprint while maintaining product performance positions them as the preferred material for circular economy-focused packaging solutions worldwide.

- For instance, in 2023, Unilever’s packaging contained 22% recycled plastic globally, according to a report cited in April 2024. This was part of the company’s progress towards a 25% recycled plastic target by 2025.

Government Regulations and Mandates

Stringent government regulations mandating recycled content are a major growth catalyst. Countries in Europe, North America, and parts of Asia are implementing targets for minimum PCR content in plastic packaging. Such mandates encourage investments in recycling infrastructure and technology, ensuring a steady supply of PCR materials. These policies reduce plastic waste in landfills and support resource efficiency. As regulations tighten further, producers and brand owners are compelled to adopt PCR plastics, significantly boosting demand across multiple packaging formats and consumer goods categories.

- For instance, California’s AB 793 mandates that plastic beverage containers subject to the state’s recycling program must contain an annual average of at least 15% postconsumer recycled plastic (PCR) from 2022 to 2024. The minimum content will increase to 25% beginning January 1, 2025, and then to 50% on January 1, 2030.

Advances in Recycling Technology

Innovations in mechanical and chemical recycling are enabling higher-quality PCR plastic production. Improved sorting systems, advanced decontamination technologies, and chemical depolymerization methods now produce food-grade PCR materials that match virgin resin performance. These advances expand the use of PCR in sensitive applications like beverage bottles and medical packaging. The ability to recycle complex, multi-layer plastics further supports market growth. Continued investment in recycling technology is reducing costs, improving supply reliability, and driving higher adoption rates among converters and packaging manufacturers globally.

Key Trends & Opportunities

Shift Toward Food-Grade PCR Plastics

Growing investment in food-grade PCR production is a key market trend. Brand owners increasingly demand high-purity recycled plastics for beverage and food packaging to meet sustainability goals. This has created opportunities for recycling companies to expand FDA and EFSA-compliant PCR capacity. The development of closed-loop systems, where used bottles are recycled back into new bottles, is becoming mainstream. This trend ensures consistent quality, boosts consumer confidence, and drives higher circularity rates in packaging, making food-grade PCR one of the fastest-growing market segments worldwide.

- For instance, Carbios opened a biorecycling demonstration plant in Clermont-Ferrand, France, in September 2021, which features a depolymerization reactor capable of processing 2 tons of PET per cycle.

Expansion of Chemical Recycling

The rising focus on chemical recycling is unlocking opportunities to process hard-to-recycle plastics. This technology converts mixed and contaminated plastic waste into virgin-like monomers, allowing for repeated recycling without quality loss. Chemical recycling supports circularity for materials that cannot be mechanically processed. Several global players are investing in large-scale chemical recycling plants to meet growing brand demand for premium PCR content. As commercialization scales, chemical recycling is expected to complement mechanical processes and significantly increase the availability of high-quality PCR resins in the market.

- For instance, By the end of 2023, ALPLA’s total annual installed and projected output capacity for its recycling companies and collaborations was approximately 266,000 tonnes for rPET and 84,000 tonnes for rHDPE.

Key Challenges

Limited Supply of High-Quality PCR

A major challenge for the market is the limited availability of high-quality, food-grade PCR materials. Inconsistent collection systems, contamination in waste streams, and regional recycling infrastructure gaps affect supply. This supply-demand imbalance leads to price volatility, making it difficult for manufacturers to secure stable volumes. Companies are forced to compete for premium-grade PCR, raising procurement costs. Addressing this challenge requires investment in efficient collection networks, better sorting technologies, and policies that encourage consumer participation in recycling programs.

High Production and Processing Costs

The cost of producing PCR plastics remains higher compared to virgin resins, especially for food-grade applications. Additional processes like washing, decontamination, and quality testing raise production expenses. Energy-intensive chemical recycling technologies also contribute to higher costs. These price differentials can deter smaller converters and brands from adopting PCR packaging. Overcoming this challenge will require scaling up recycling operations, improving process efficiency, and implementing government incentives or subsidies to make PCR materials more economically competitive with virgin plastics.

Regional Analysis

North America

North America held the largest share of the PCR plastic packaging market in 2024, accounting for around 35%. Strong regulatory support for recycled content and corporate sustainability commitments are driving adoption across food, beverage, and personal care industries. Brands are increasing investments in recycled PET and HDPE packaging to meet circular economy targets. The United States dominates regional demand, supported by well-established collection and recycling infrastructure. Canada is witnessing growth driven by extended producer responsibility programs. Rising consumer preference for eco-friendly packaging continues to boost market penetration and accelerate the transition toward high-quality mechanically recycled materials.

Europe

Europe captured close to 30% of the global PCR plastic packaging market share in 2024, driven by strict EU directives promoting recycling and waste reduction. Germany, France, and the UK lead demand, with major FMCG companies integrating PCR content to comply with the Single-Use Plastics Directive. Strong recycling systems and chemical recycling developments support supply growth. The region also witnesses innovations in food-grade rPET production and closed-loop collection programs. Consumer awareness and retailer commitments are accelerating demand for high-quality PCR materials across beverage, household, and cosmetic packaging segments, reinforcing Europe’s leadership in sustainable packaging initiatives.

Asia Pacific

Asia Pacific held approximately 25% share of the PCR plastic packaging market in 2024, with rapid growth driven by expanding recycling infrastructure and rising environmental regulations. China and India are major contributors, supported by government policies targeting plastic waste reduction. The region is witnessing high demand from the food, beverage, and e-commerce sectors due to population growth and urbanization. Japan and South Korea are adopting advanced mechanical and chemical recycling technologies to produce food-grade PCR resins. Investments from global players are boosting local capacity, making Asia Pacific a significant hub for future growth in sustainable packaging solutions.

Latin America

Latin America accounted for nearly 6% of the PCR plastic packaging market share in 2024. Brazil, Mexico, and Argentina are the primary contributors, driven by increasing corporate commitments to reduce virgin plastic usage. Growth is supported by government-led waste management programs and collaborations between brands and recyclers. The region is seeing growing demand for rPET in beverage bottles and flexible packaging. Infrastructure development for collection and sorting remains a focus area to improve recycling rates. Consumer awareness campaigns are helping accelerate adoption, although the market is still in the early stages compared to developed economies.

Middle East & Africa

Middle East & Africa represented about 4% share of the PCR plastic packaging market in 2024, with gradual adoption of recycled materials. South Africa and the UAE are leading markets, supported by circular economy policies and sustainability targets. Demand is increasing from multinational food and beverage brands seeking to align with global sustainability goals. Investments in recycling plants and partnerships with international players are improving local availability of PCR materials. However, challenges such as limited infrastructure and collection networks restrain faster growth, making this region an emerging opportunity for PCR packaging expansion in the coming years.

Market Segmentations:

By Plastic Type:

- Polyethylene terephthalate (PET)

- Polyethylene (PE)

- Polystyrene (PS)

- Polyvinyl chloride (PVC)

- Polypropylene (PP)

- Bio-based plastics

By Recycling:

- Mechanical recycling

- Chemical recycling

By Application:

- Bottles & trays

- Bags & sacks

- Pouches & sachets

- Cups & jars

- Clamshells

- Tubs

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the PCR plastic packaging market include Red Pack, Berry Global, Mondi, Dow, Sanle Plastic, Winpak, Cambrian Packaging, 3plastics, Regent Plast, PTT Global Chemical, Evergreen Resources, Proampac, Udinc, Longdapac, Glenroy, and Amcor. The market is characterized by strong competition as companies focus on expanding PCR production capacity and enhancing recycling technologies. Leading participants invest in food-grade PCR solutions to cater to growing demand from beverage, food, and personal care sectors. Strategic collaborations with recycling firms and brand owners are common to secure stable supply chains and meet regulatory requirements. Companies emphasize lightweight packaging designs, advanced decontamination processes, and closed-loop recycling systems to differentiate their offerings. Geographic expansion, partnerships, and acquisitions are frequent strategies used to strengthen global presence. Continuous innovation in chemical recycling and development of high-performance PCR resins support competitive advantage, enabling companies to address both sustainability targets and consumer expectations efficiently.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Red Pack

- Berry Global

- Mondi

- Dow

- Sanle Plastic

- Winpak

- Cambrian Packaging

- 3plastics

- Regent Plast

- PTT Global Chemical

- Evergreen Resources

- Proampac

- Udinc

- Longdapac

- Glenroy

- Amcor

Recent Developments

- In 2025, Berry Global launched its Bontite Sustane Stretch Film, a new stretch film containing 30% post-consumer recycled (PCR) content, designed for pallet wrapping applications and to be recyclable where PE film collections are established.

- In 2024, Amcor launched a one-liter PET bottle made from 100% PCR content for carbonated soft drinks, becoming the first of its kind on the market.

- In 2024, Dow launched its REVOLOOP Recycled Plastics Resins, including grades with up to 100% PCR content for non-food contact shrink films. The products offer performance comparable to virgin resins.

Report Coverage

The research report offers an in-depth analysis based on Plastic Type, Recycling, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to grow steadily with rising demand for recycled content packaging.

- Food-grade PCR materials will see strong adoption across beverage and dairy packaging applications.

- Mechanical recycling will remain dominant, but chemical recycling capacity will expand rapidly.

- Investments in advanced sorting and decontamination technology will improve PCR quality and availability.

- E-commerce growth will drive demand for PCR-based flexible packaging formats like pouches and mailers.

- Regulations mandating recycled content will push more brands to switch to PCR materials.

- Collaboration between brand owners and recyclers will strengthen closed-loop recycling systems.

- Emerging markets in Asia Pacific will become major growth hubs for PCR packaging adoption.

- Price competitiveness with virgin resins will improve as recycling operations scale up globally.

- Consumer awareness of sustainability will continue to boost preference for PCR-based packaging solutions.