Market Overview

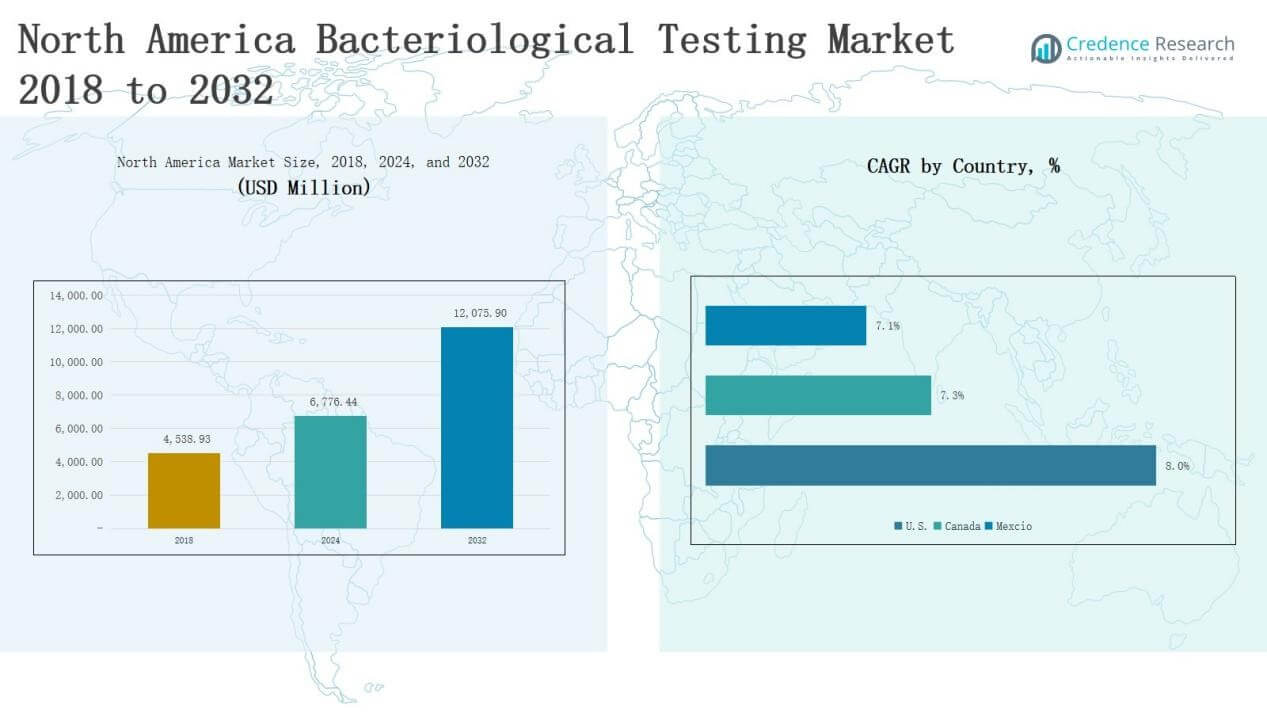

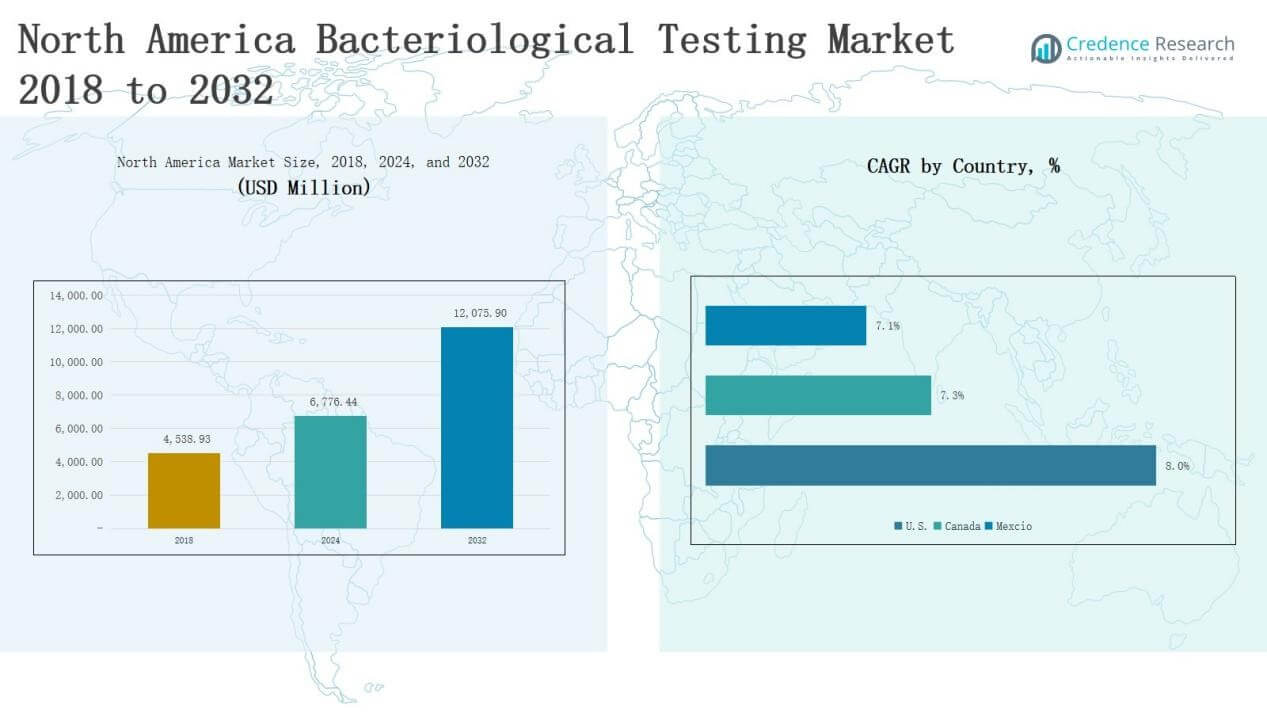

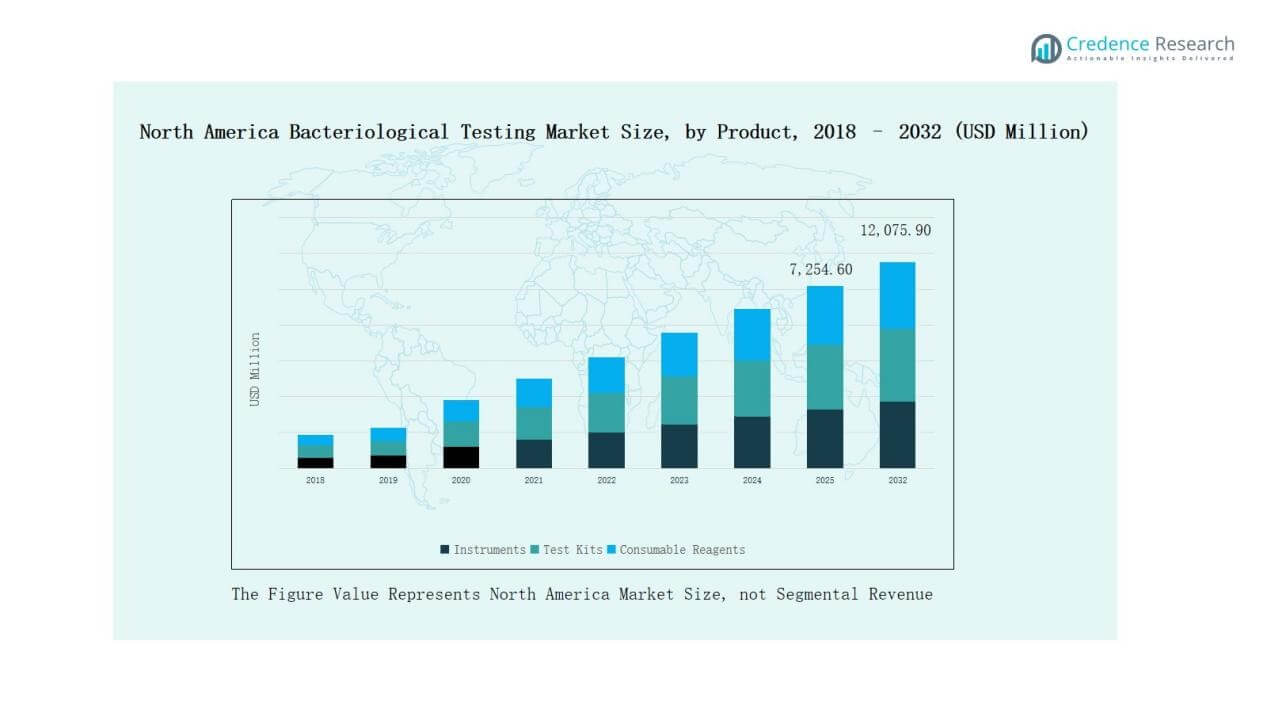

The North America Bacteriological Testing Market size was valued at USD 4,538.93 million in 2018, reaching USD 6,776.44 million in 2024, and is anticipated to grow to USD 12,075.90 million by 2032, at a CAGR of 7.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Bacteriological Testing Market Size 2024 |

USD 6,776.44 Million |

| North America Bacteriological Testing Market, CAGR |

7.43% |

| North America Bacteriological Testing Market Size 2032 |

USD 12,075.90 Million |

The North America Bacteriological Testing Market is led by global and regional players offering diverse solutions across instruments, kits, and reagents. Key companies include Thermo Fisher Scientific Inc., Eurofins, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Merck KGaA, Neogen Corporation, Intertek, Hardy Diagnostics, BioMerieux, Symbio Labs, Alfa Chemistry, and Vimta Labs. These companies strengthen their presence through advanced technologies, compliance-driven services, and strategic partnerships. The U.S. emerges as the leading region, holding 68% of the market share in 2024, supported by stringent food safety regulations, robust healthcare infrastructure, and strong demand from pharmaceutical and biotechnology sectors.

Market Insights

Market Insights

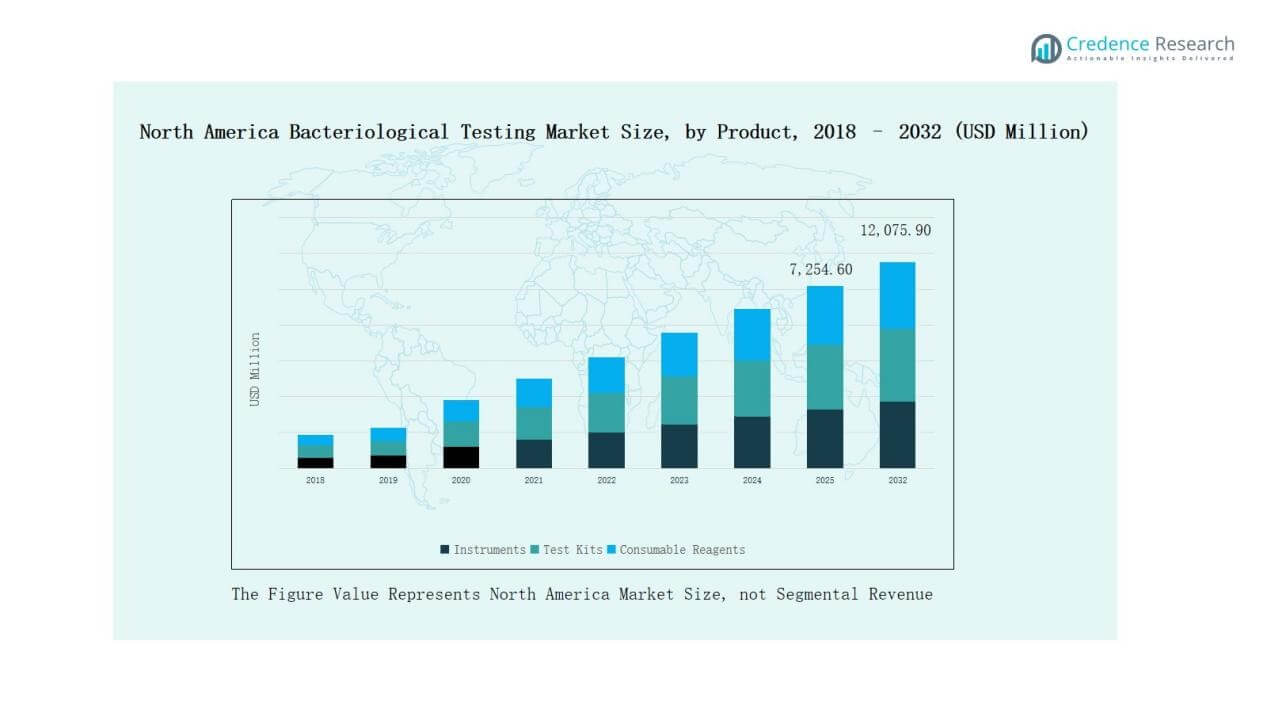

- The North America Bacteriological Testing Market was USD 4,538.93 million in 2018, reached USD 6,776.44 million in 2024, and is projected at USD 12,075.90 million by 2032, growing at 7.43%.

- Instruments dominate the product segment with a 42% share in 2024, supported by advanced laboratory infrastructure and automation, while test kits hold 34% and consumable reagents 24%.

- Salmonella leads the bacteria segment with 28% share in 2024, followed by Coliform at 22% and Listeria at 18%, reflecting strong food safety testing requirements.

- Rapid technology accounts for 61% share in 2024, driven by demand for fast and accurate results, while traditional methods retain 39% due to cost-effectiveness and reliability.

- The U.S. holds 68% of the regional share in 2024, followed by Canada at 20% and Mexico at 12%, reflecting strong regulatory support and industrial demand across all three markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

Instruments hold the dominant position in the North America Bacteriological Testing Market with a 42% share in 2024. Their adoption is driven by advanced laboratory infrastructure, automation capabilities, and demand for accurate, large-scale testing. Test kits account for 34% as rapid solutions gain traction among food producers and smaller labs requiring quick results. Consumable reagents represent 24%, supported by recurring demand for routine testing in pharmaceuticals and water analysis. Instruments remain the key growth driver due to high sensitivity and long-term reliability.

For instance, Thermo Fisher Scientific launched the SureTect E. coli O157:H7 PCR Assay for food safety labs, enhancing rapid detection workflows with validated AOAC certification.

By Bacteria

Salmonella leads the market with a 28% share in 2024, reflecting its strong association with foodborne outbreaks and regulatory testing mandates. Coliform follows with 22% as it serves as a primary indicator of water and food contamination. Listeria represents 18%, supported by rising recalls in dairy and ready-to-eat products. Legionella accounts for 12%, driven by testing needs in water systems. Campylobacter holds 10%, while other bacteria collectively represent 10%. Salmonella testing continues to dominate due to stringent compliance standards across the food industry.

For instance, the European Centre for Disease Prevention and Control (ECDC) reported 10,723 cases of Legionnaires’ disease in 29 countries across Europe, reinforcing the regulatory emphasis on Legionella testing in water systems

By Technology

Rapid technology dominates with a 61% share in 2024, reflecting the industry’s shift toward faster and more efficient detection methods. Demand is fueled by the need to minimize turnaround time in food processing, pharmaceuticals, and water utilities. Rapid kits and automated analyzers enable accurate results within hours, supporting real-time quality control. Traditional methods retain 39% of the market, driven by their cost-effectiveness and established reliability in certain sectors. Rapid technology leads growth as industries prioritize speed and precision in safety testing.

Key Growth Drivers

Rising Food Safety Concerns

Growing awareness of foodborne diseases in North America drives the demand for bacteriological testing. Regulatory bodies such as the FDA and USDA enforce strict quality standards across the food and beverage industry. Frequent product recalls and consumer health concerns further highlight the need for advanced detection methods. Food manufacturers increasingly adopt bacteriological testing instruments, kits, and reagents to ensure compliance and safeguard brand reputation. This strong emphasis on public health continues to expand testing applications across the food supply chain.

For innstance, the USDA’s Food Safety and Inspection Service recalled over 16,000 pounds of ground beef produced by Cargill Meat Solutions due to possible E. coli O157:H7 contamination.

Expanding Pharmaceutical and Healthcare Applications

The pharmaceutical sector’s reliance on sterility testing fuels market growth. Drug manufacturers require stringent microbial testing during production and packaging to prevent contamination risks. Rising demand for biologics, vaccines, and sterile injectables further strengthens adoption. Healthcare facilities, diagnostic labs, and biotechnology companies increasingly invest in advanced rapid testing technologies for efficiency and accuracy. The growing focus on patient safety and the rising prevalence of hospital-acquired infections contribute significantly to the market’s expansion in this region.

For instance, Charles River Laboratories expanded its Accugenix® microbial identification and strain typing services to support sterility assurance programs for global pharmaceutical clients.

Technological Advancements in Testing Methods

Advancements in rapid bacteriological testing methods create strong growth opportunities in North America. Traditional testing methods are gradually being replaced by automated, high-throughput systems and portable kits. These technologies deliver faster results, reduce manual errors, and enhance laboratory efficiency. Integration of molecular techniques such as PCR and next-generation sequencing provides higher sensitivity and specificity. Continuous R&D investment from major players and collaborations with regulatory agencies strengthen innovation pipelines, ensuring greater adoption of modern solutions across industries.

Key Trends & Opportunities

Key Trends & Opportunities

Shift Toward Rapid Testing Solutions

A notable trend is the growing shift from traditional culture-based methods to rapid bacteriological testing. Companies seek solutions that reduce turnaround time while maintaining high accuracy. Rapid kits and automated analyzers offer results within hours, enabling faster decision-making for food producers, pharmaceutical firms, and water testing agencies. This trend enhances supply chain safety, reduces operational delays, and aligns with stringent regulatory requirements. Rising adoption in smaller labs and decentralized facilities creates new market opportunities.

For instance, bioMérieux launched the GENE-UP ENVIROPRO assay, enabling simultaneous detection of Salmonella and Listeria in food industry environmental samples within 22 hours.

Growing Demand for Customized Test Kits

An emerging opportunity lies in customized bacteriological test kits tailored to specific industry needs. Food and beverage companies, pharmaceutical firms, and water utilities increasingly request specialized solutions for targeted pathogens. Manufacturers respond by developing user-friendly, portable kits with high sensitivity and cost efficiency. Personalized testing products also cater to small-scale facilities that require focused, affordable solutions. This trend supports broader adoption across varied end-user groups, enhancing market penetration and strengthening growth prospects in North America.

For instance, Thermo Fisher Scientific introduced the SureTect Salmonella Species PCR Assay for rapid detection of Salmonella in food samples, designed to meet the needs of food processors requiring precise pathogen identification.

Key Challenges

High Cost of Advanced Testing Systems

One major challenge is the high cost associated with advanced bacteriological testing instruments and technologies. Smaller laboratories and mid-sized enterprises often struggle to invest in automated systems and molecular testing tools. While these solutions offer accuracy and speed, budget constraints limit adoption in developing regions of North America. The need for frequent calibration, maintenance, and specialized reagents further adds to overall expenses. This cost barrier hampers wider accessibility, particularly among cost-sensitive end users.

Complexity of Regulatory Compliance

Strict and evolving regulatory standards in North America present significant challenges for testing companies. Agencies such as the FDA, EPA, and USDA enforce complex guidelines across food, water, and pharmaceutical applications. Meeting these compliance requirements often demands frequent updates to testing protocols and heavy investment in certification processes. Smaller service providers may face resource limitations in adapting quickly to new rules. Delays in regulatory approval can also restrict timely product launches, slowing down market growth potential.

Shortage of Skilled Laboratory Professionals

A persistent shortage of skilled microbiologists and laboratory technicians poses challenges for the bacteriological testing market. Advanced technologies require expertise in handling automated systems, molecular diagnostics, and data interpretation. Limited availability of trained professionals leads to operational inefficiencies, longer turnaround times, and underutilization of high-end instruments. Training new staff involves significant time and financial resources for organizations. This talent gap remains a pressing obstacle, especially for smaller labs seeking to expand their testing capacity.

Regional Analysis

U.S.

The U.S. dominates the North America Bacteriological Testing Market with a 68% share in 2024. Strong demand arises from its well-developed food and beverage industry, which faces strict safety regulations under agencies like the FDA and USDA. The country also leads in pharmaceutical and biotechnology research, driving significant adoption of advanced testing methods. Key players such as Thermo Fisher Scientific and Bio-Rad Laboratories strengthen the market with innovative rapid test solutions. Rising consumer awareness of foodborne illnesses further accelerates demand. It remains the largest contributor to revenue growth across the region.

Canada

Canada accounts for 20% of the North America Bacteriological Testing Market in 2024. Its strong food export industry drives continuous investment in bacteriological testing to meet both domestic and international standards. Government regulations supporting clean water and safe food production strengthen market adoption. Pharmaceutical and healthcare sectors also rely heavily on microbial testing to ensure quality compliance. Major companies collaborate with laboratories to introduce cost-effective kits and reagents. It maintains steady growth supported by rising focus on public health and safety.

Mexico

Mexico represents 12% of the North America Bacteriological Testing Market in 2024. Expanding food processing industries and rising urban population drive increasing demand for safety testing. Government initiatives to improve water quality also enhance the adoption of bacteriological testing technologies. International companies expand their presence in Mexico, offering rapid kits and consumables to local manufacturers. Pharmaceutical and cosmetic industries further contribute to testing demand through regulatory compliance needs. It is expected to grow steadily, supported by industrial development and rising export requirements.

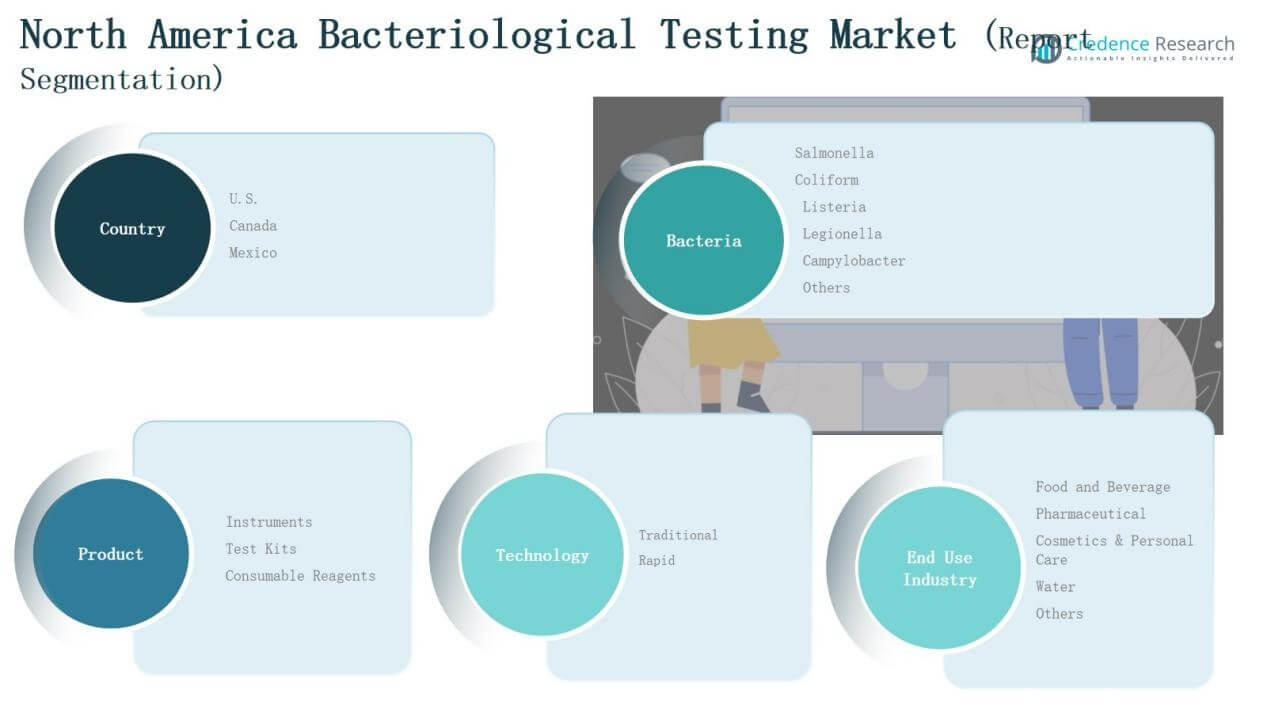

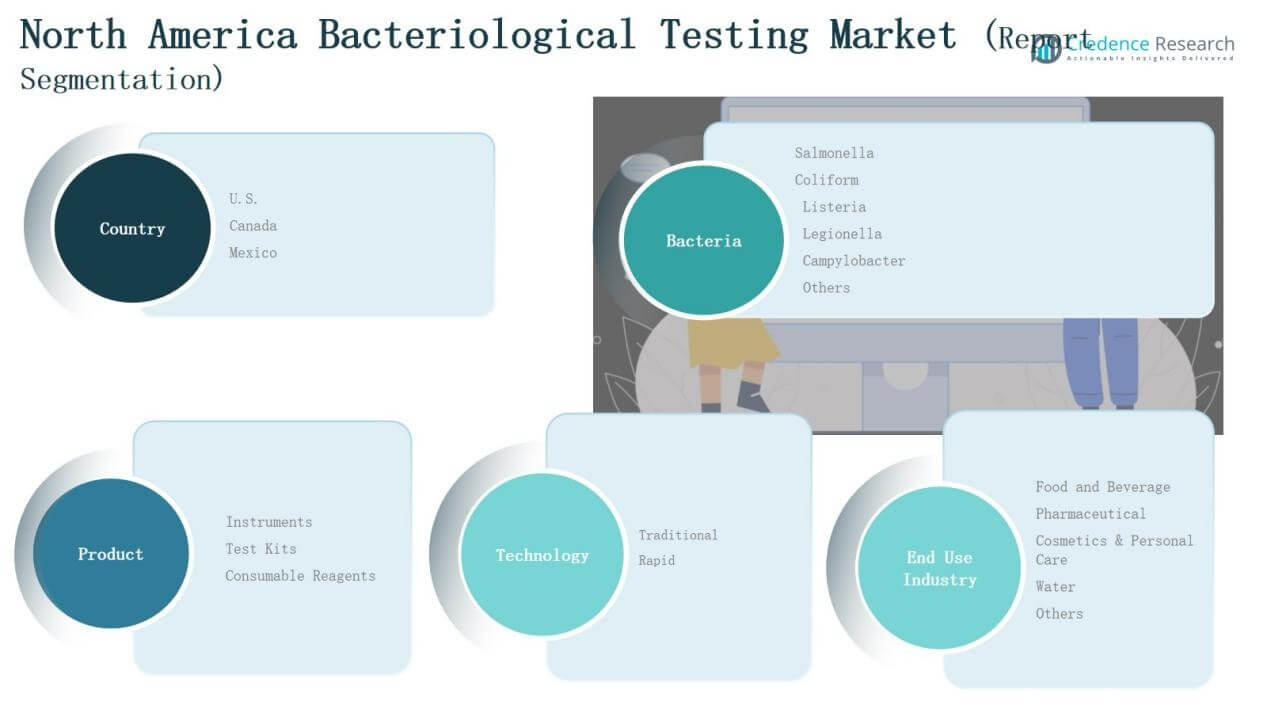

Market Segmentations:

Market Segmentations:

By Product

- Instruments

- Test Kits

- Consumable Reagents

By Bacteria

- Salmonella

- Coliform

- Listeria

- Legionella

- Campylobacter

- Others

By Technology

By End User

- Food and Beverage

- Pharmaceutical

- Cosmetics & Personal Care

- Water

- Others

By Region

Competitive Landscape

The North America Bacteriological Testing Market is highly competitive, shaped by the presence of global leaders and regional specialists offering diverse testing solutions. Major players such as Thermo Fisher Scientific Inc., Eurofins, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Merck KGaA, and Neogen Corporation dominate through advanced instruments, rapid test kits, and consumable reagents. These companies focus on automation, molecular testing, and user-friendly solutions to meet the region’s stringent regulatory requirements across food, pharmaceuticals, and water industries. Intertek, Hardy Diagnostics, and BioMerieux strengthen their positions by providing compliance-driven services and expanding laboratory networks. Smaller players, including Symbio Labs, Alfa Chemistry, and Vimta Labs, contribute by delivering cost-effective solutions catering to niche applications. Continuous innovation, strategic collaborations, and acquisitions remain central strategies for market expansion. Intense competition pushes companies to prioritize faster turnaround times, high sensitivity testing, and scalable solutions, making technological leadership and regulatory expertise critical success factors in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Hardy Diagnostics

- Thermo Fisher Scientific Inc.

- Eurofins

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Intertek

- Merck KGaA

- Neogen Corporation

- Vimta Labs

- BioMerieux

- Symbio Labs

- Alfa Chemistry

- Other Key Players

Recent Developments

- In January 2025, Cormica expanded its U.S. presence by acquiring Focus Laboratories, a microbiological testing firm.

- In May 2024, Rapid Micro Biosystems launched the Growth Direct® Rapid Sterility System, enabling detection in about 12 hours.

- In May 2024, the Growth Direct® System by Rapid Micro Biosystems was introduced to meet USP <71> harmonized sterility testing standards.

- In April 2025, Biotia announced a collaboration with Mayo Clinic to advance microbial identification for infectious disease diagnostics.

Report Coverage

The research report offers an in-depth analysis based on Product, Bacteria, Technology, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rapid testing technologies will continue to rise across food and pharmaceutical industries.

- Automation and AI integration will improve accuracy and reduce turnaround time in testing.

- Regulatory agencies will enforce stricter compliance, driving consistent investments in testing infrastructure.

- Growth in processed food exports will boost bacteriological testing requirements across the supply chain.

- Customized test kits tailored to specific pathogens will gain higher adoption among end users.

- Water quality monitoring programs will expand, increasing testing demand in municipal and industrial sectors.

- Healthcare facilities will strengthen microbial surveillance to reduce hospital-acquired infections.

- Partnerships between global leaders and local labs will widen access to advanced technologies.

- Rising awareness of public health safety will fuel adoption in small and medium laboratories.

- Technological innovation in portable and user-friendly testing devices will drive market penetration.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: