Market Overview

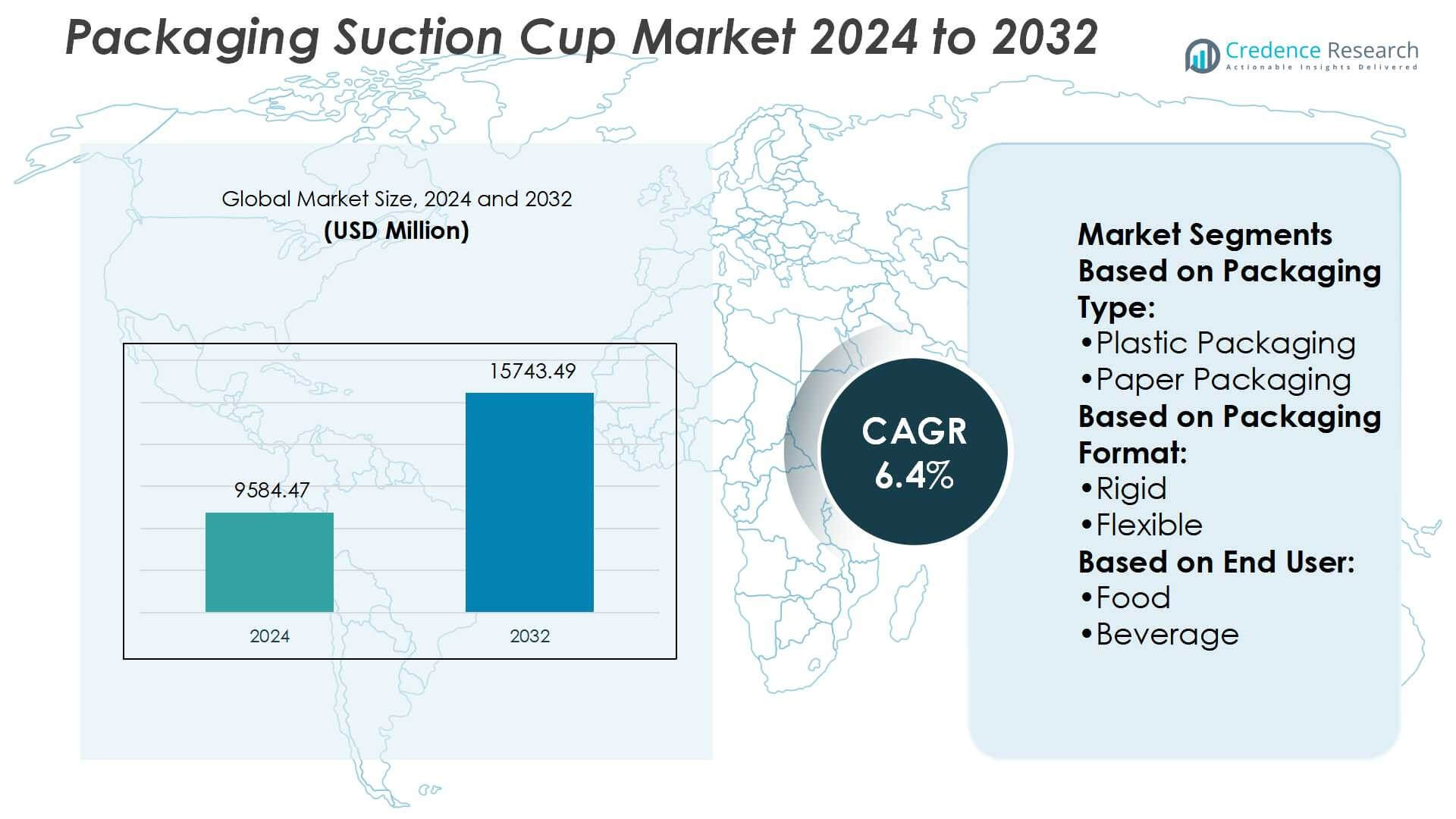

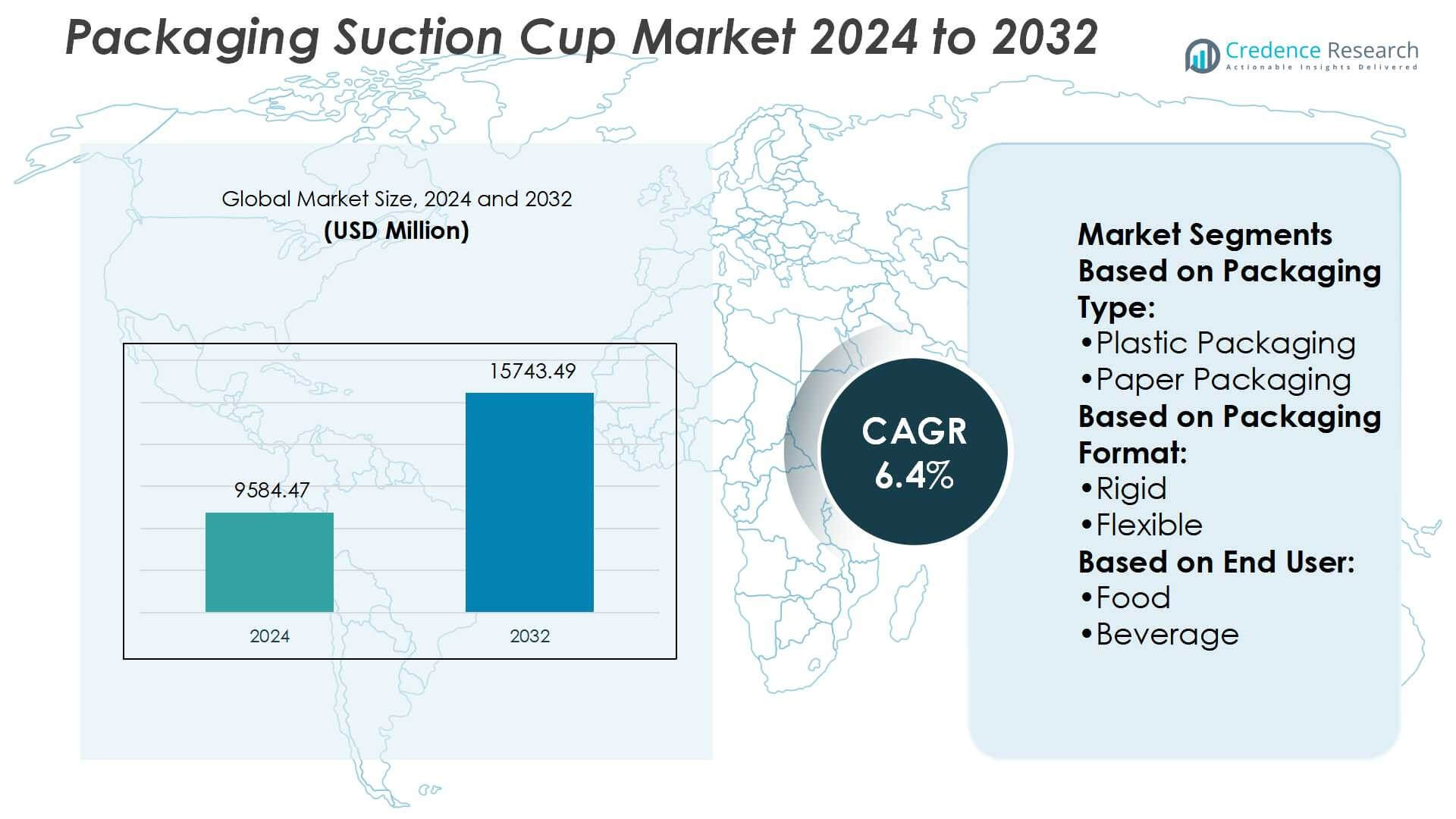

Packaging Suction Cup Market size was valued USD 9584.47 million in 2024 and is anticipated to reach USD 15743.49 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Suction Cup Market Size 2024 |

USD 9584.47 Million |

| Packaging Suction Cup Market, CAGR |

6.4% |

| Packaging Suction Cup Market Size 2032 |

USD 15743.49 Million |

The Packaging Suction Cup Market is dominated by leading players such as O-I Glass, Inc. (U.S.), Smurfit Kappa (Ireland), Amcor Plc (Switzerland), Schütz GmbH & Co. KGaA (Germany), Huhtamaki Inc. (Finland), Ball Corporation (U.S.), Mondi Group (U.K.), International Paper (U.S.), Berry Global Inc. (U.S.), and Sonoco Products Company (U.S.). These companies drive competition through innovation, strategic collaborations, and investments in sustainable materials to meet evolving packaging needs. North America leads the global market, holding 38% of the total share in 2024, supported by strong demand from the e-commerce, food, and beverage industries. The region benefits from advanced manufacturing facilities, rapid adoption of automation, and stringent packaging standards that encourage the use of efficient suction cup technologies. Continuous technological upgrades and a growing focus on recyclable solutions further solidify North America’s leadership position, while Europe and Asia-Pacific follow closely with expanding industrial and consumer applications.

Market Insights

Market Insights

- The Packaging Suction Cup Market was valued at USD 9584.47 million in 2024 and is projected to reach USD 15743.49 million by 2032, registering a CAGR of 6.4%.

- Rising demand from e-commerce, food, and beverage industries is driving market expansion with greater adoption of automated packaging lines.

- Leading players focus on innovation, sustainability, and collaborations to strengthen competitiveness and expand their product portfolios across global markets.

- High production costs and material limitations act as restraints, challenging manufacturers to balance quality, efficiency, and affordability.

- North America holds the largest share at 38% in 2024, driven by advanced facilities and strict packaging standards, while Europe and Asia-Pacific show strong growth; among segments, automated packaging applications account for the largest share, supported by increasing reliance on suction cup technology for speed and efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Packaging Type

Plastic packaging dominates the packaging suction cup market, holding the largest share due to its wide usage in high-volume food, beverage, and pharmaceutical applications. Its lightweight structure, flexibility, and cost-effectiveness make it a preferred choice for manufacturers seeking efficient packaging solutions. Strong demand from ready-to-eat food and single-use products further strengthens its market position. Paper packaging is gaining traction with sustainability initiatives, while container glass and metal cans remain important for premium and long-shelf-life products. Growth in eco-friendly materials may slightly shift shares but plastic retains leadership.

- For instance, O-I Glass, Inc. is a global leader in container glass production, operating 69 manufacturing plants across 19 countries. The company produces billions of glass containers annually.

By Packaging Format

Rigid packaging represents the dominant segment, securing the largest market share with extensive adoption in food, beverage, and pharmaceutical sectors. Suction cups provide reliable grip and handling efficiency for containers, bottles, and jars, making rigid packaging highly compatible. The format ensures product safety, durability, and extended shelf life, key drivers for consumer preference. Flexible packaging, though growing with demand for lightweight and sustainable options, trails behind. Its rising popularity in personal care and e-commerce sectors highlights future potential, but rigid formats remain the largest revenue contributor.

- For instance, Smurfit Kappa invested 40 million to expand its Pruszków, Poland, plant. The investment included a new high-speed corrugator capable of processing 400 meters of paper per minute, which doubled the plant’s production capacity, enabling faster and more durable rigid packaging solutions.

By End-User

The food industry holds the largest share of end-user demand for packaging suction cups, driven by high consumption volumes and strict hygiene requirements. Suction cups support automation in packaging lines, boosting efficiency for packaged meals, snacks, and frozen products. The beverage sector follows closely, supported by bottled water, soft drinks, and alcoholic beverages. Pharmaceuticals and healthcare represent another growing sub-segment due to strict handling standards. Personal care, industrial, and e-commerce sectors contribute steady growth, but the dominance of the food industry remains strong due to consistent global demand.

Key Growth Drivers

Rising Demand for Automated Packaging Solutions

The increasing adoption of automation in manufacturing and packaging lines is a major driver for the packaging suction cup market. Suction cups play a critical role in robotic handling, ensuring efficient movement of bottles, containers, and cartons. Food, beverage, and pharmaceutical companies are integrating automation to reduce labor costs, improve productivity, and maintain hygiene standards. This trend is accelerating the need for reliable suction cups with high precision and durability, directly fueling market growth across industries that prioritize speed, consistency, and safety in packaging operations.

- For instance, Amcor announced its Cali plant transition to 100% renewable energy reduces the plant’s conventional electric energy consumption, decreases its carbon footprint, and aligns with Amcor’s global net-zero emissions goals.

Expansion of Food and Beverage Industry

The global growth of the food and beverage sector is significantly boosting demand for packaging suction cups. Rising consumption of packaged foods, ready-to-eat meals, and bottled beverages has intensified packaging requirements. Suction cups provide fast and safe handling of varied packaging types, including rigid bottles and flexible pouches. Urbanization, shifting dietary preferences, and the expansion of retail channels such as supermarkets and e-commerce further amplify packaging volumes. As food safety and shelf-life preservation remain critical, suction cup adoption continues to grow alongside the rising packaging demand.

- For instance, Mondi rolled out FunctionalBarrier Paper Ultimate, a high-performance barrier paper offering oxygen transmission rate (OTR) below 0.5 cm³/m²·day and water vapour transmission rate (WVTR) below 0.5 g/m²·day.

Sustainability and Eco-Friendly Packaging Shift

The market is gaining momentum from the global push toward sustainable packaging solutions. Manufacturers are shifting from traditional plastics to eco-friendly materials such as biodegradable polymers and recycled paper-based packaging. This transition requires suction cups designed for diverse surface textures and lighter-weight packaging. The ability of suction cups to adapt to evolving materials without compromising efficiency makes them essential in modern packaging lines. Growing regulatory pressures and consumer demand for sustainable practices are driving companies to invest in innovative suction cup designs that support green packaging solutions.

Key Trends & Opportunities

Integration of Smart Manufacturing Technologies

The adoption of smart factories and Industry 4.0 practices presents strong opportunities for the packaging suction cup market. Sensors, IoT-enabled systems, and advanced robotics are being deployed in packaging facilities to enhance efficiency and reduce downtime. Suction cups integrated with smart monitoring systems allow predictive maintenance and ensure consistent performance. This trend opens opportunities for manufacturers to develop advanced suction solutions tailored for high-speed automated lines, especially in food and pharmaceutical sectors where precision and hygiene standards are critical to production quality and regulatory compliance.

- For instance, International Paper launched its “80/20” approach is based on the Pareto principle, focusing company resources and efforts on the 20% of products and customers that generate 80% of the value.

Growth of E-Commerce Packaging Needs

The rapid expansion of e-commerce has created new opportunities for the packaging suction cup market. Online retail requires robust and efficient packaging solutions to handle diverse product categories, from personal care to industrial goods. Suction cups are increasingly used in automated warehouses and fulfillment centers for picking, handling, and packaging operations. Their ability to safely grip items of varied shapes and sizes provides a competitive advantage in high-volume logistics operations. With e-commerce expected to expand globally, demand for suction cups in packaging automation will continue rising.

- For instance, Berry delivered pantry jars made of 100% recycled plastic (excluding lid) for Mars brands (M&M’s, Skittles, Starburst), in sizes 60-, 81-, and 87-ounces, eliminating more than 1,300 metric tons of virgin plastic annually.

Key Challenges

High Maintenance and Replacement Costs

Despite their wide usage, packaging suction cups face challenges related to frequent wear and tear. Continuous high-speed operations in packaging lines lead to surface degradation, reducing efficiency and requiring regular replacements. The costs associated with downtime and maintenance can affect profitability, especially for small and mid-sized packaging firms. This challenge pushes manufacturers to balance operational efficiency with cost management, while also creating demand for durable, long-life suction cup materials that can withstand rigorous industrial environments without frequent failure.

Compatibility with Diverse Packaging Materials

Another challenge lies in the need for suction cups to adapt to an increasing variety of packaging materials. With the shift toward flexible, lightweight, and sustainable materials, suction cups must perform effectively on surfaces that may be porous, uneven, or slippery. Ensuring consistent grip without damaging the packaging is complex, especially in industries like food and healthcare where safety is critical. Manufacturers face pressure to innovate material and design solutions that can accommodate these evolving requirements, making compatibility a persistent technical challenge in the market.

Regional Analysis

North America

North America holds the largest share of the packaging suction cup market, accounting for 34% in 2024. The region benefits from advanced automation adoption in food, beverage, and pharmaceutical packaging industries. Strong regulatory frameworks supporting hygiene and safety standards drive continuous investment in automated packaging lines, where suction cups are essential. The U.S. dominates the regional market, supported by leading packaging manufacturers and robust e-commerce activity. Growth in ready-to-eat meals, healthcare products, and personal care packaging continues to sustain demand. Canada and Mexico also show rising adoption due to expanding food processing and export-oriented packaging industries.

Europe

Europe represents 28% of the global packaging suction cup market, driven by its strong focus on sustainable and eco-friendly packaging solutions. Countries such as Germany, France, and Italy lead adoption due to advanced manufacturing bases and strict EU packaging regulations. The region’s established food and beverage sector and growing pharmaceutical industry fuel steady demand for suction cups in automated production lines. Increasing investment in Industry 4.0 technologies enhances efficiency in packaging operations. Additionally, the rising emphasis on recyclable materials creates opportunities for suction cup manufacturers to develop solutions compatible with diverse and sustainable packaging formats.

Asia-Pacific

Asia-Pacific accounts for 25% of the packaging suction cup market and is projected to register the fastest growth. Rapid urbanization, expanding middle-class populations, and rising consumption of packaged food and beverages drive demand. China leads the region due to large-scale manufacturing and export-focused packaging industries, while India shows strong growth with expanding pharmaceutical and e-commerce sectors. Japan and South Korea contribute through advanced automation and robotics integration in packaging. Increasing investment in modern logistics and packaging infrastructure strengthens the market outlook. The region’s focus on efficiency and scalability supports sustained adoption of suction cups in diverse applications.

Latin America

Latin America captures 7% of the packaging suction cup market, with growth driven by the expansion of the food and beverage industry. Brazil and Mexico dominate the region due to their strong consumer bases and rising demand for packaged goods. The growing pharmaceutical sector and increasing modernization of packaging facilities further boost adoption. However, limited technological infrastructure and higher dependency on imports constrain faster growth. Despite challenges, the shift toward automated packaging and the increasing penetration of e-commerce provide opportunities for suction cup suppliers. Investments in logistics modernization will play a key role in future expansion.

Middle East & Africa

The Middle East & Africa account for 6% of the packaging suction cup market, with gradual growth supported by rising industrial and retail activities. The Gulf countries, particularly the UAE and Saudi Arabia, drive demand through investments in food processing, healthcare, and logistics sectors. Africa shows potential growth, fueled by urbanization and increasing packaged food consumption, though infrastructure gaps remain a challenge. Expansion of e-commerce and retail chains is creating new opportunities for automation in packaging. The region’s focus on diversifying economies beyond oil is further encouraging adoption of modern packaging technologies, including suction cup systems.

Market Segmentations:

By Packaging Type:

- Plastic Packaging

- Paper Packaging

By Packaging Format:

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the Packaging Suction Cup Market players such as O-I Glass, Inc. (U.S.), Smurfit Kappa (Ireland), Amcor Plc (Switzerland), Schütz GmbH & Co. KGaA (Germany), Huhtamaki Inc. (Finland), Ball Corporation (U.S.), Mondi Group (U.K.), International Paper (U.S.), Berry Global Inc. (U.S.), and Sonoco Products Company (U.S.). The competitive landscape of the Packaging Suction Cup Market is characterized by intense rivalry, with companies focusing on innovation, sustainability, and product differentiation to secure a strong position. Market participants are investing in advanced materials and technologies to enhance suction performance, durability, and compatibility with diverse packaging formats. Strategic moves such as mergers, acquisitions, and global expansion are frequently adopted to strengthen distribution networks and broaden product portfolios. Sustainability remains a central theme, with growing emphasis on recyclable and eco-friendly solutions to meet regulatory requirements and shifting consumer preferences. Continuous investment in automation, research, and customized solutions highlights the industry’s effort to cater to dynamic end-user demands while maintaining cost efficiency and scalability. This evolving competitive environment drives innovation and pushes companies to deliver value-added solutions, further intensifying the level of competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- O-I Glass, Inc. (U.S.)

- Smurfit Kappa (Ireland)

- Amcor Plc (Switzerland)

- Schütz GmbH & Co. KGaA (Germany)

- Huhtamaki Inc. (Finland)

- Ball Corporation (U.S.)

- Mondi Group (U.K.)

- International Paper (U.S.)

- Berry Global Inc. (U.S.)

- Sonoco Products Company (U.S.)

Recent Developments

- In May 2025, Futamura and GK Sondermaschinenbau collaborate on a compostable packaging laminate for liquid sachets, using NatureFlex technology and cellulose film for barrier and biofilm seals.

- In March 2025, Green Lab, a leading eco-packaging manufacturer in Southeast Asia, entered the U.S. market, offering FSC-certified, 100% recycled paper bags and eco-friendly food packaging.

- In January 2025, Ardagh Glass Packaging-North America, a division of Ardagh Group, enhanced its 12oz Heritage glass beer bottle range by introducing a new bottle color and an additional closure choice. The two new 12oz (355ml) Heritage bottles come in flint (clear) glass featuring a pry-off cap and amber (brown) glass with a twist-off cap.

- In January 2025, Mauser Packaging Solutions, a worldwide leader in packaging solutions and services throughout the packaging lifecycle, revealed the enhancement of its capabilities at its facility in Haiyan, China. The tactical investment comprises cutting-edge machinery for the production of Intermediate Bulk Containers (IBCs).

- In May 2024, Amcor and AVON both combinedly launch the AmPrima Plus refill pouch for the AVON Little Black Dress classic shower gels in China. The recycle-ready packaging will result in an 83% reduction in carbon footprint, and 88% and 79% reduction in water consumption and renewable energy respectively when it’s recycled.

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Packaging Format, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for efficient handling in packaging operations.

- Sustainability initiatives will drive the use of recyclable and eco-friendly suction cup materials.

- Automation in packaging lines will increase adoption of advanced suction cup technologies.

- Customization for diverse packaging formats will become a key growth driver.

- Investments in R&D will lead to innovations in lightweight and durable suction cup designs.

- Emerging markets will witness strong growth due to expanding industrial packaging needs.

- Regulatory compliance will influence material choices and design improvements.

- Strategic partnerships and acquisitions will strengthen global market presence.

- Demand for high-performance suction cups in e-commerce packaging will accelerate adoption.

- Continuous focus on cost efficiency and operational reliability will shape competition.

Market Insights

Market Insights