Market Overview

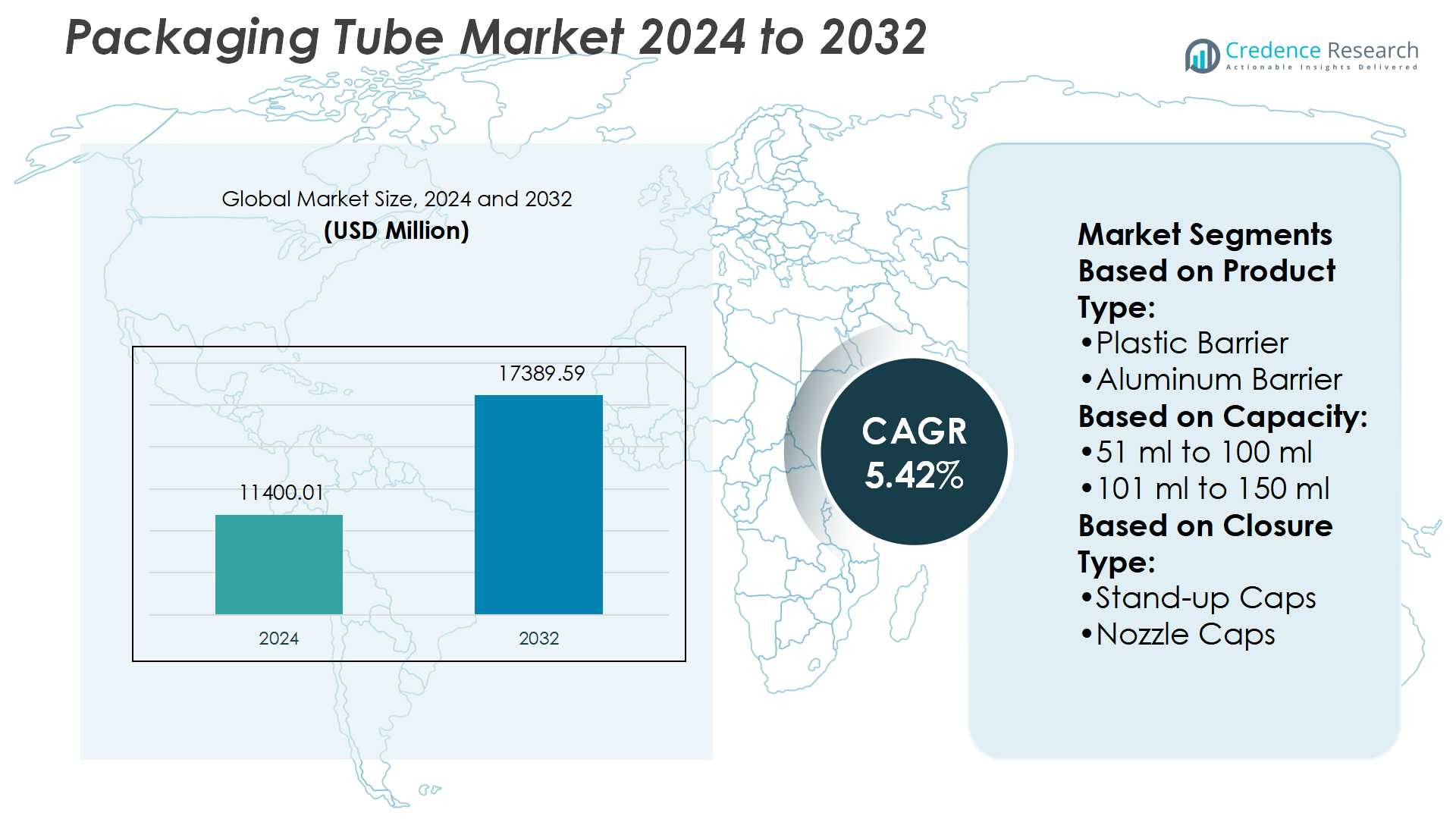

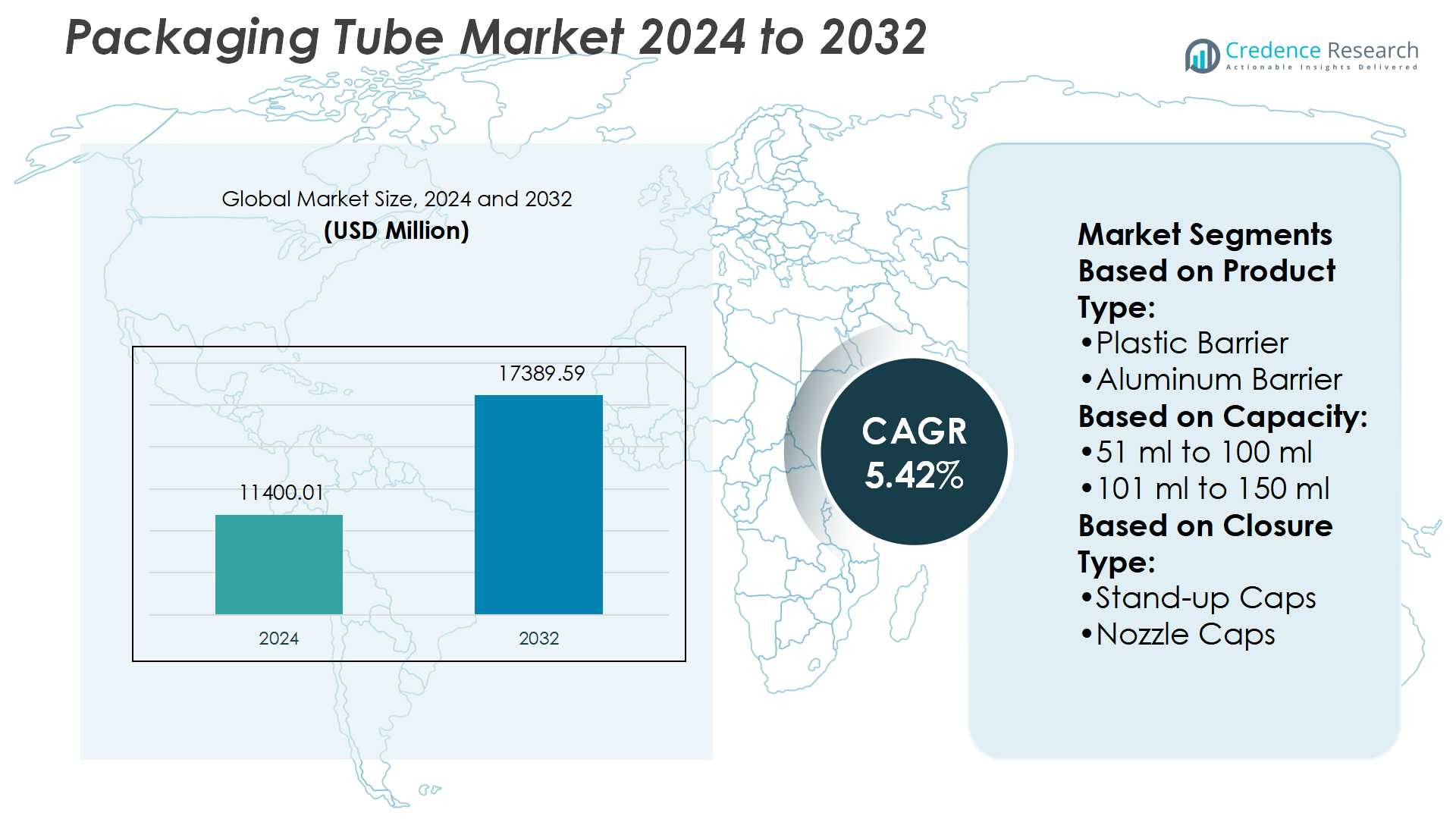

Packaging Tube Market size was valued USD 11400.01 million in 2024 and is anticipated to reach USD 17389.59 million by 2032, at a CAGR of 5.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Tube Market Size 2024 |

USD 11400.01 Million |

| Packaging Tube Market, CAGR |

5.42% |

| Packaging Tube Market Size 2032 |

USD 17389.59 Million |

The packaging tube market features strong competition with top players such as Amcor, Alpla Group, Berry Global, EPL, Albea, Antilla Propack, Evergreen Resources, Aphena Pharma Solutions, HCT Group, and CCL Industries. These companies emphasize innovation in laminated, plastic, and aluminum tube solutions to meet the growing demand from personal care, pharmaceuticals, and food sectors. Strategic investments in sustainable and recyclable materials, along with premium finishes and advanced printing, strengthen their market positioning. Regionally, Asia-Pacific leads the global market with a 34% share, driven by high consumption in cosmetics, pharmaceuticals, and rapid e-commerce growth.

Market Insights

Market Insights

- The packaging tube market size was USD 11400.01 million in 2024 and will reach USD 17389.59 million by 2032, growing at a CAGR of 5.42%.

- Rising demand from personal care and pharmaceutical industries is driving adoption of laminated and plastic barrier tubes due to convenience, hygiene, and portability.

- Sustainability trends are shaping market growth, with companies focusing on recyclable, bio-based, and premium designs to align with consumer preferences and regulatory standards.

- Intense competition among players such as Amcor, Alpla Group, Berry Global, and EPL fosters innovation in printing technologies, closures, and lightweight structures, strengthening their global positions.

- Asia-Pacific leads with a 34% share, supported by high cosmetics and pharmaceutical consumption, while North America and Europe hold significant shares due to premium product demand; the 51 ml to 100 ml capacity segment dominates as the most consumed size across applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Within the product type segment, laminated tubes dominate the market, holding the largest share. Their popularity stems from superior barrier protection, lightweight structure, and cost efficiency compared to aluminum alternatives. Laminated tubes are widely used in cosmetics, personal care, and pharmaceuticals, where aesthetics and product safety are critical. Demand is further supported by customization options, including high-quality printing and designs, which enhance brand appeal. The ongoing shift toward convenient, durable, and recyclable packaging continues to drive laminated tube adoption, making them the preferred choice across diverse end-use sectors.

- For instance, Essel Propack (now EPL Limited) supplies aluminum-barrier laminated (ABL) tubes to major companies like Colgate, Dabur, and Sanofi. With a global annual production of approximately 8 billion total tubes (both ABL and other types) and customizable sizing, including formats between 25-100 ml, the company provides tubes with excellent barrier properties for sensitive products.

By Capacity

The 51 ml to 100 ml capacity segment leads the market with the highest share. This dominance is driven by strong adoption in personal care products such as toothpaste, creams, and lotions, which require portable and user-friendly packaging sizes. These tubes offer a balance between convenience and cost-effectiveness, aligning with consumer demand for travel-friendly formats. Manufacturers focus on this range to cater to daily-use goods, making it the most consumed size category. Growth in e-commerce channels and increased purchases of mid-size packaged products further reinforce this segment’s leadership.

- For instance, Aisa’s Decoseam™ laminate tube production line runs between 100 and 240 tubes per minute while handling diameters from 19 mm to 63.5 mm, delivering decorated cosmetic tubes in the 50-100 ml range with full 360° printing and Synchroflow™ compression heading.

By Closure Type

Flip-top caps represent the dominant closure type in the packaging tube market, securing the largest share. Their popularity is attributed to ease of use, reusability, and secure sealing, which enhances consumer convenience. Flip-top caps are particularly favored in cosmetics, pharmaceuticals, and food packaging due to their ability to prevent leakage and ensure hygiene. Their ergonomic design and compatibility with various tube sizes strengthen their application range. Rising consumer preference for quick-dispensing and one-handed operation solutions continues to fuel growth in this sub-segment, consolidating its market leadership position.

Key Growth Drivers

Rising Demand in Personal Care and Cosmetics

The increasing consumption of skincare, haircare, and cosmetic products is a major driver for the packaging tube market. Tubes provide lightweight, portable, and user-friendly solutions that meet the needs of these industries. Their ability to preserve product integrity and support branding through advanced printing technologies enhances adoption. Growing consumer demand for premium and travel-size cosmetic products further boosts usage. Global brands rely on laminated and plastic barrier tubes to balance cost, aesthetics, and protection, solidifying their dominance in personal care packaging applications.

- For instance, Amcor offers a 1.5-inch laminate tube with a 22 mm threaded neck finish that can be paired with closures offering precise orifice sizes of 3.2 mm, 4.7 mm, and 6.4 mm for controlled dispensing.

Expansion of the Pharmaceutical Industry

Pharmaceutical growth is fueling demand for reliable and hygienic tube packaging formats. Tubes ensure accurate dosage, maintain product stability, and offer tamper-evident features, making them well-suited for ointments, gels, and creams. The industry’s focus on extending product shelf life through barrier protection is accelerating tube adoption. Additionally, regulatory emphasis on safe and convenient packaging supports this trend. With rising healthcare expenditure and the growing demand for OTC products, pharmaceutical companies are increasingly shifting to aluminum and laminated tubes for enhanced reliability.

- For instance, Aphena can manufacture and fill plastic or metal tubes in sizes from 1 gram micro-fills up to 225 grams large fills, using equipment handling items from lotions to heavy ointments, under cGMP-compliant, ISO 13485:2016 & ISO 9001:2015 certification.

Sustainability and Eco-Friendly Packaging Solutions

Growing environmental concerns and regulatory initiatives are pushing manufacturers toward sustainable packaging tubes. Consumers prefer recyclable and biodegradable options, encouraging companies to develop eco-friendly laminated and plastic tube alternatives. The shift toward bio-based plastics and recyclable aluminum tubes is gaining traction across food, cosmetics, and healthcare industries. Brands leverage sustainability as a differentiator, aligning packaging innovations with green commitments. This demand for environmentally responsible solutions is driving product development and positioning eco-friendly packaging as a key growth engine in the global tube market.

Key Trends & Opportunities

Premiumization and Customization in Tube Packaging

Brands are increasingly investing in premium designs and personalization features to strengthen market positioning. Advances in digital printing and decoration technologies allow high-quality graphics and textures that enhance shelf appeal. Customized tube sizes, shapes, and closures are being developed to suit specific product lines, especially in cosmetics and luxury skincare. This trend aligns with rising consumer preference for unique, aesthetic, and functional packaging. The growing importance of brand differentiation and customer experience continues to create opportunities in premiumized tube packaging.

- For instance, EPL’s “Platina™” laminate tubes use an EVOH barrier layer under 5% of total tube weight and have been certified fully recyclable including the shoulder and cap. The “Platina PRO 220” and “Platina PRO 250” product lines are cleared by RecyClass for entry into HDPE recycling streams.

Growth of E-Commerce and Direct-to-Consumer Sales

The rapid rise of e-commerce is transforming packaging tube demand. Online sales require packaging that is durable, lightweight, and easy to ship while maintaining product safety. Tubes meet these requirements, making them popular for personal care, pharmaceuticals, and food sold online. Compact, leak-proof, and travel-friendly packaging enhances consumer convenience in direct-to-consumer models. Manufacturers are optimizing tube structures for better performance in logistics and delivery. With digital retail expanding globally, this trend presents significant growth opportunities for innovative and protective tube packaging formats.

- For instance, Alpla’s “Tether Tube” for a 50 ml capacity weighs only 6 grams and is made entirely of one material, allowing it to be fully recyclable. The tethered closure is integrated in the tube body, permitting fall resistance from 2 metres onto the cap without causing leakage at the tear-off edge.

Adoption of Smart and Functional Features

The integration of smart features, such as QR codes and NFC-enabled packaging, is gaining traction in the tube market. These technologies enhance traceability, product authentication, and consumer engagement. Functional features like airless dispensing and precision nozzles are being adopted in cosmetics and pharmaceuticals to improve hygiene and usability. This trend allows brands to provide interactive experiences while ensuring product quality. The growing convergence of digital technology with packaging solutions is creating new opportunities for innovation and differentiation in tube packaging.

Key Challenges

Fluctuations in Raw Material Prices

Volatility in raw material costs, particularly plastics and aluminum, poses a challenge for manufacturers. Price fluctuations affect production expenses, forcing companies to adjust pricing strategies or absorb higher costs. These pressures can limit profit margins and hinder small and medium-sized producers from maintaining competitiveness. With rising demand for sustainable materials, sourcing recyclable or bio-based alternatives further adds to production complexity. Managing raw material dependency while balancing cost efficiency remains a key challenge in the packaging tube market.

Regulatory Compliance and Environmental Pressure

Stringent regulations on plastic usage and waste management are increasing compliance burdens for tube manufacturers. Governments worldwide are enforcing policies to reduce single-use plastics, driving companies to invest in sustainable alternatives. While necessary, these transitions require significant capital and R&D investment, affecting smaller firms. Failure to comply with environmental standards risks penalties and reputational damage. Balancing sustainability goals with performance, durability, and cost efficiency is a significant challenge, particularly in competitive markets with tight profit margins.

Regional Analysis

North America

North America holds a 32% share of the global packaging tube market, driven by strong demand from personal care, healthcare, and pharmaceutical sectors. The region benefits from high consumer spending on cosmetics and OTC products, which favor convenient and hygienic packaging. Technological advancements in tube manufacturing, coupled with the presence of leading packaging companies, reinforce regional growth. The United States dominates consumption, while Canada contributes through regulatory emphasis on eco-friendly packaging. Increasing adoption of sustainable laminated and plastic barrier tubes further strengthens market expansion across this region.

Europe

Europe accounts for 29% of the global packaging tube market, supported by advanced manufacturing capabilities and strong sustainability policies. Countries such as Germany, France, and the U.K. lead consumption due to high demand in cosmetics, pharmaceuticals, and premium personal care products. The European Union’s strict regulations on plastic waste have accelerated adoption of recyclable and biodegradable tube solutions. Consumers in this region also prefer premiumized and aesthetically designed packaging, driving innovation in customized tube formats. Sustainability commitments by global brands operating in Europe continue to boost market growth and product diversification.

Asia-Pacific

Asia-Pacific dominates the packaging tube market with a 34% share, driven by rapid urbanization, rising disposable incomes, and growing consumption of personal care and pharmaceutical products. China and India are key markets, benefiting from strong domestic demand and expanding manufacturing bases. Affordable laminated and plastic tubes are widely adopted, while increasing awareness of sustainable packaging fuels innovation. The region’s booming e-commerce sector further boosts the need for lightweight and protective tubes. With a large population base and expanding middle class, Asia-Pacific is expected to remain the fastest-growing regional market during the forecast period.

Latin America

Latin America captures 3% of the packaging tube market, with Brazil and Mexico serving as the primary contributors. Rising demand for personal care, beauty, and pharmaceutical products supports tube adoption across the region. Growth in disposable incomes and expanding retail networks enhance packaging consumption, particularly in urban areas. Local manufacturers focus on affordable plastic and laminated tube solutions, while sustainability awareness is gradually increasing. Although the regional share is smaller compared to others, growing investments in cosmetics and healthcare packaging indicate promising opportunities for future market expansion.

Middle East & Africa (MEA)

The Middle East & Africa accounts for 2% of the global packaging tube market, with growth concentrated in the Gulf Cooperation Council (GCC) countries and South Africa. Rising demand for personal care and pharmaceutical products is driving the adoption of convenient tube packaging formats. The region’s cosmetics market, supported by increasing consumer preference for premium products, is further stimulating tube demand. However, limited local manufacturing capabilities and high dependency on imports pose challenges. Despite its modest share, MEA offers long-term opportunities as global players expand distribution networks and sustainable packaging initiatives gain momentum.

Market Segmentations:

By Product Type:

- Plastic Barrier

- Aluminum Barrier

By Capacity:

- 51 ml to 100 ml

- 101 ml to 150 ml

By Closure Type:

- Stand-up Caps

- Nozzle Caps

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The packaging tube market is highly competitive, with key players including Antilla Propack, Evergreen Resources, Amcor, Aphena Pharma Solutions, EPL, Alpla Group, Berry Global, HCT Group, Albea, and CCL Industries. The packaging tube market is characterized by intense competition, driven by innovation, sustainability, and customization. Manufacturers focus on developing advanced laminated, plastic, and aluminum barrier tubes that cater to diverse end-use industries, including personal care, pharmaceuticals, and food packaging. Growing emphasis on eco-friendly solutions, such as recyclable and bio-based materials, is reshaping strategies to align with global sustainability goals. Companies also prioritize premium designs, advanced printing, and functional closures to enhance product appeal and consumer convenience. Expansion into emerging markets, coupled with rising e-commerce demand, is encouraging investments in lightweight and durable packaging formats that ensure product safety and brand differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Albea Tubes launched its Greenleaf production at the Brampton, Ontario plant. This new plastic tube packaging line, which produces recyclable HDPE tubes, assists the oral care, cosmetics, and pharma industries in their shift from aluminum foil to all-plastic laminate tubes and further underscores Albea’s commitment to sustainability.

- In January 2024, Kellanova Europe, in collaboration with Sonoco, redesigned its Pringles tubes by replacing the metal bottom with a recyclable paper-fiber alternative. This change adheres to the 4Evergreen Alliance guidelines and enhances curbside recyclability across Europe.

- In December 2023, Corpack introduced BioD, a sustainable screw cap made from cellulose-based material, designed for tube closures with a 35mm diameter. The industrially compostable cap features wood fibers for a natural appearance and is compatible with injection moulding and thermoforming processes.

- In March 2023, Prep & Smooth Face, a new one-step product from Nair, was introduced to assist customers in eliminating facial hair more quickly. It is also the first facial peel that offers extra skincare advantages

Report Coverage

The research report offers an in-depth analysis based on Product Type, Capacity, Closure Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand in cosmetics and personal care.

- Pharmaceutical applications will expand due to increasing use of ointments, gels, and creams.

- Sustainable and recyclable materials will gain more importance in tube manufacturing.

- Premium and customized tube designs will attract stronger demand from global brands.

- Digital printing and decoration technologies will enhance brand visibility and product appeal.

- E-commerce growth will drive demand for durable, lightweight, and protective tube formats.

- Adoption of smart features like QR codes and NFC will improve traceability and engagement.

- Emerging economies will offer new opportunities through rising consumer spending.

- Regulations on plastic use will accelerate investment in eco-friendly packaging solutions.

- Strategic mergers and partnerships will strengthen global presence and product innovation.

Market Insights

Market Insights