Market Overview

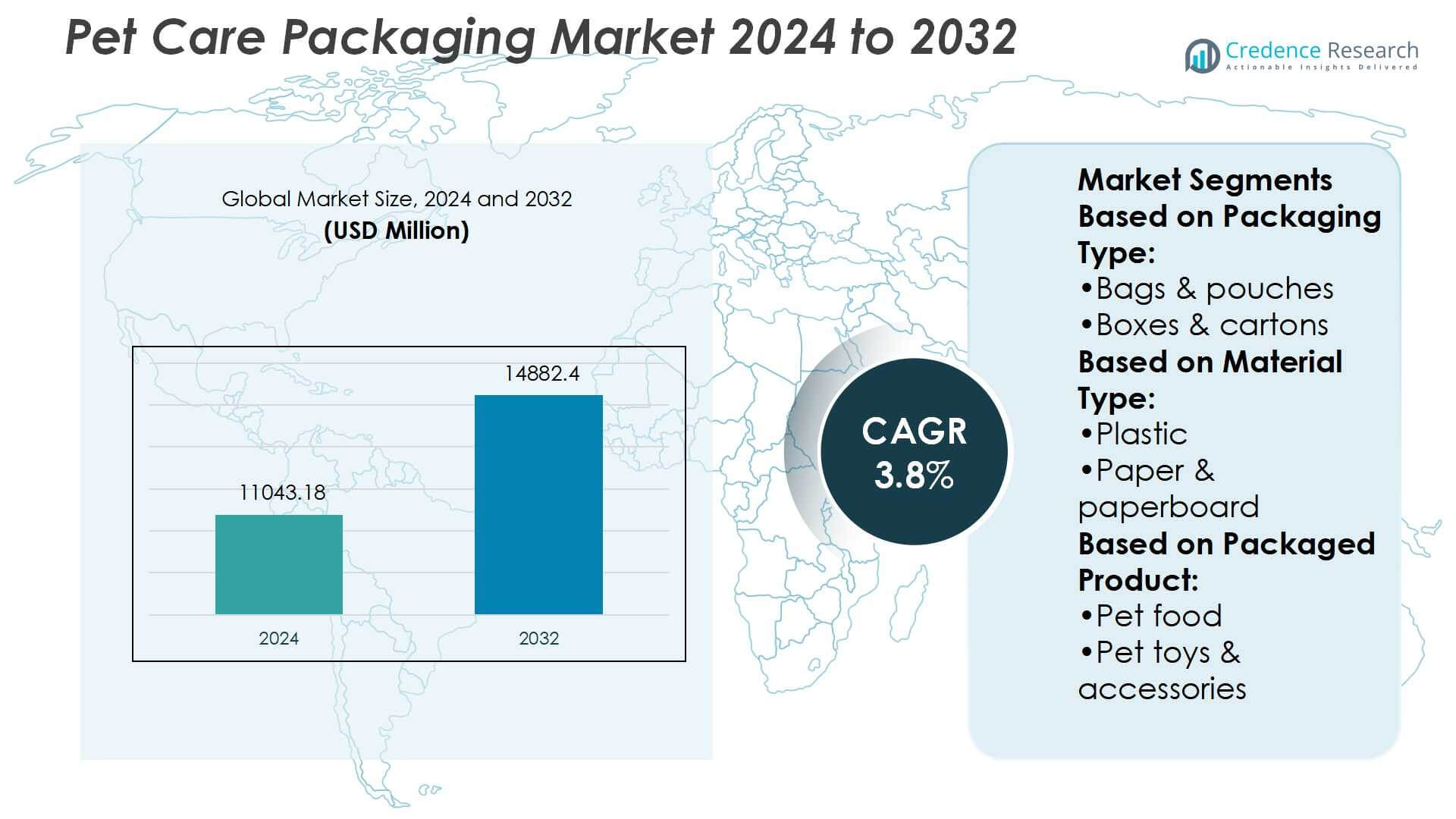

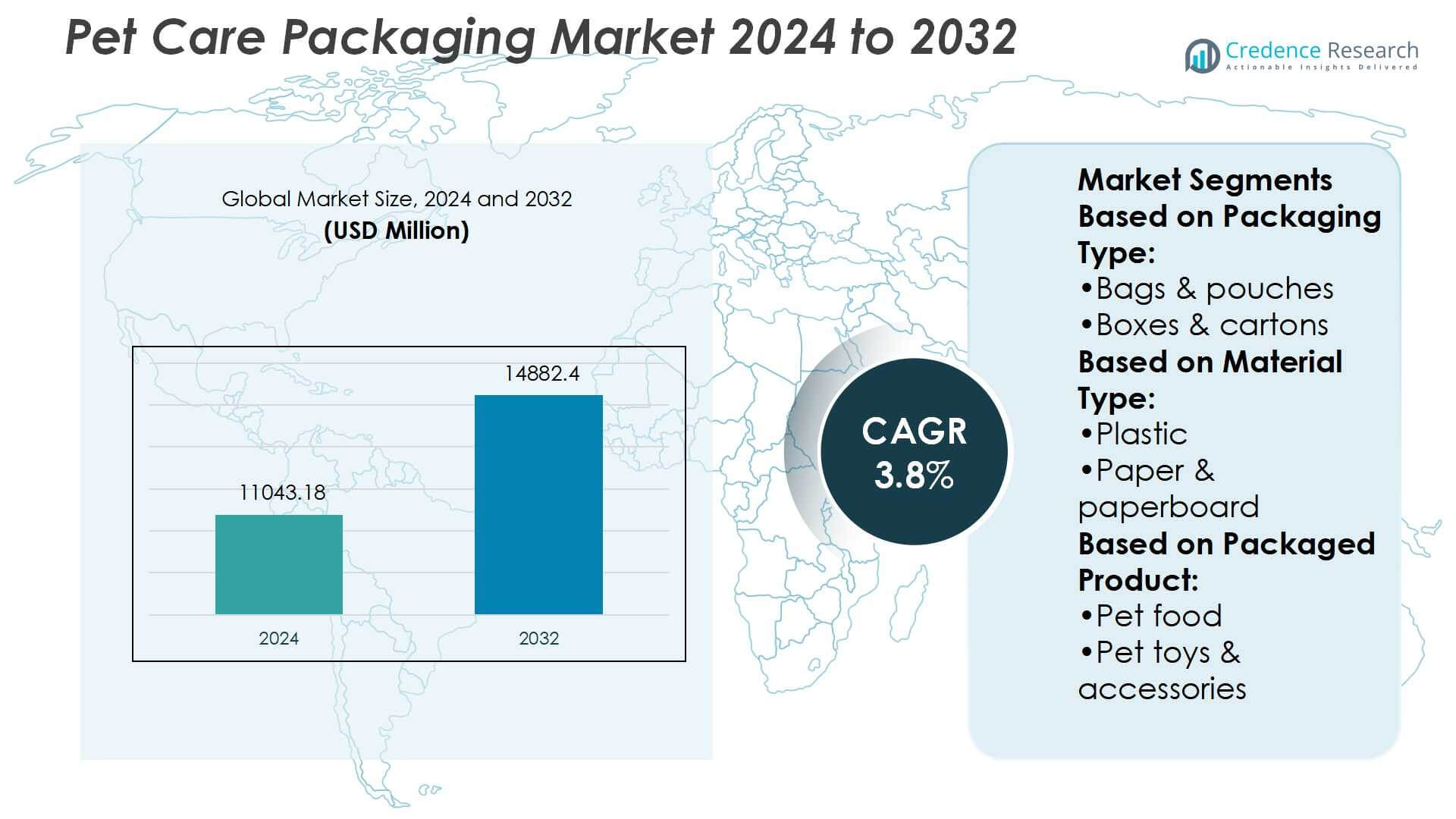

Pet Care Packaging Market size was valued USD 11043.18 million in 2024 and is anticipated to reach USD 14882.4 million by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pet Care Packaging Market Size 2024 |

USD 11043.18 Million |

| Pet Care Packaging Market, CAGR |

3.8% |

| Pet Care Packaging Market Size 2032 |

USD 14882.4 Million |

The pet care packaging market is highly competitive, with top players including Amcor, Berry Global, Mondi, Huhtamaki, DS Smith, Constantia Flexibles, Coveris, Graphic Packaging, NNZ Group, and ATID Packaging. These companies focus on innovation, sustainability, and customized packaging solutions to strengthen their market presence. Flexible packaging formats such as pouches and resealable bags remain central to their product portfolios, while sustainable paperboard and recyclable plastics are gaining momentum due to regulatory and consumer demand. Regionally, North America leads the market with a 37% share, driven by high pet ownership rates, premium product demand, and the strong presence of global packaging manufacturers.

Market Insights

- The Pet Care Packaging Market was valued at USD 11043.18 million in 2024 and is expected to reach USD 14882.4 million by 2032, growing at a CAGR of 3.8%.

- Rising pet humanization and growing demand for premium pet food drive the need for innovative packaging formats, with bags and pouches holding the largest segment share due to convenience and resealable features.

- Sustainable and recyclable packaging solutions are a key trend, with paperboard and eco-friendly plastics gaining momentum as regulations on single-use plastics tighten across major markets.

- The market is highly competitive, with companies like Amcor, Berry Global, Mondi, and Huhtamaki focusing on product differentiation, material innovation, and customized packaging to maintain leadership in both global and regional markets.

- North America leads with a 37% share, supported by high pet ownership and premium product demand, while Europe and Asia-Pacific show strong growth driven by sustainability initiatives and rising disposable incomes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Packaging Type

Bags and pouches dominate the pet care packaging market with a market share of 38%. Their lightweight nature, resealable features, and cost-effectiveness make them highly suitable for dry pet food and treats. Growing consumer preference for convenience and portion control drives adoption. Flexible formats also support branding with high-quality graphics and barrier protection. In contrast, bottles and jars are expanding in grooming products, while cans and containers serve wet food. However, bags and pouches remain the most preferred due to sustainability initiatives and recyclable material options.

- For instance, Huhtamaki launched fiber-based egg cartons made from 100% recycled materials in North America.The company also developed a home-compostable paper-based coffee capsule under its blueloop™ technology.

By Material Type

Plastic holds the largest share of 55% in material use for pet care packaging. Its versatility, durability, and ability to provide airtight sealing ensure product safety and extended shelf life. Plastic’s adaptability across bottles, pouches, and containers strengthens its dominance. However, rising demand for eco-friendly packaging is accelerating the adoption of paper and paperboard, particularly for secondary packaging and small pet accessory packs. Metal maintains a niche role in premium canned pet food. The increasing regulatory push toward recyclable plastics further enhances innovation in this dominant segment.

- For instance, DS Smith replaced over 1.2 billion pieces of plastic from supermarket shelf items with fibre-based alternatives (fruit & vegetable punnets, shrink wrap etc.).

By Packaged Product

Pet food packaging accounts for the largest segment, commanding 62% of the overall market share. Strong global demand for dry, wet, and specialty food products drives its dominance. Packaging innovations such as resealable pouches, single-serve sachets, and portion-control packs align with consumer convenience trends. Premiumization in pet food also increases demand for high-barrier films and cartons. Grooming and hygiene products are growing sub-segments, supported by rising pet humanization and health awareness. Nonetheless, pet food packaging remains the largest contributor, supported by continuous innovation and brand differentiation strategies.

Key Growth Drivers

Rising Pet Humanization

The growing trend of pet humanization is a major driver for the pet care packaging market. Pet owners increasingly view pets as family members, fueling demand for premium food, grooming, and healthcare products. This shift pushes packaging innovation toward premium designs, convenience features, and enhanced product safety. Brands are investing in resealable, portion-controlled, and travel-friendly formats to meet consumer expectations. As spending on pet well-being rises globally, packaging companies benefit from greater volumes and premium pricing opportunities across both food and non-food pet categories.

- For instance, Berry Global rolled out pantry jars for Mars’s M&M’S®, SKITTLES®, and STARBURST® brands made with 100% recycled plastic (excluding lids). This change eliminates over 1,300 metric tons of virgin plastic annually.

Expansion of Pet Food Industry

The rapid growth of the pet food industry strongly supports packaging market expansion. Dry food, wet food, and specialty diets require advanced packaging solutions to ensure freshness, shelf stability, and convenience. High demand for resealable bags, pouches, and single-serve formats reflects consumer focus on portion control and waste reduction. Global brands are investing in high-barrier materials to preserve nutrition and flavor. With pet food accounting for the largest share of pet care packaging, this segment’s continuous innovation acts as a central driver for market growth.

- For instance, Mondi launched FunctionalBarrier Paper Ultimate, a paper-based barrier paper that delivers an oxygen transmission rate (OTR) below 0.5 cm³/m²·d and a water vapour transmission rate (WVTR) below 0.5 g/m²·d.

Sustainability and Eco-Friendly Packaging

Sustainability initiatives are driving strong adoption of eco-friendly packaging solutions. Consumers increasingly demand recyclable, biodegradable, and compostable materials, prompting companies to reduce plastic use and introduce alternatives like paperboard and bioplastics. Packaging players are developing lightweight designs that minimize material usage without compromising safety. Regulatory pressure on single-use plastics also accelerates sustainable innovation across the supply chain. This driver is shaping both product development and brand differentiation, with companies adopting greener solutions to align with consumer values and comply with global environmental standards.

Key Trends & Opportunities

Premium and Customized Packaging

Premium packaging is emerging as a key trend as consumers seek high-quality, aesthetically appealing pet products. Customization opportunities, including personalized labels, portion packs, and specialty designs, enhance brand loyalty and consumer engagement. Packaging formats that emphasize transparency, resealability, and convenience are growing in demand. Brands that integrate premium features can command higher margins while appealing to the increasing number of urban pet owners. This trend also opens opportunities for packaging players to collaborate with pet food and grooming product brands to deliver value-added solutions.

- For instance, Amcor now offers recycle-ready solutions for 94% of its flexible packaging portfolio (by area).Rigid packaging from Amcor is 95% recyclable in practice and at scale across its operations.

E-Commerce-Driven Packaging Demand

The rapid growth of e-commerce in pet care is creating strong opportunities for specialized packaging. Online channels require packaging that is durable, lightweight, and protective during shipping. Easy-to-store and compact designs also appeal to online shoppers. Companies are optimizing packaging for direct-to-consumer deliveries by focusing on convenience and reducing shipping costs. This trend is fostering demand for corrugated cartons, flexible pouches, and protective secondary packaging. With digital sales channels continuing to expand globally, e-commerce-specific packaging represents a growing revenue stream for packaging manufacturers.

- For instance, EcoPeelCover, Constantia reduced aluminium thickness by 25% and lowered the coating layer weight by 50% relative to its previous standard lids, while still achieving sealing temperature tolerance up to 230 °C.

Innovation in Functional Packaging

Functional packaging innovations are reshaping the pet care market, with features like resealable zippers, easy-pour spouts, and odor-control systems gaining traction. Advanced barrier films are being adopted to maintain product freshness and extend shelf life. Functional packaging also supports portion control, waste reduction, and better storage, which align with consumer convenience needs. Packaging manufacturers investing in these innovations gain a competitive edge by enhancing the overall customer experience. This trend highlights opportunities to blend technology with packaging for stronger market positioning.

Key Challenges

Rising Raw Material Costs

The pet care packaging market faces challenges due to volatile raw material prices. Plastics, paperboard, and metal costs fluctuate with global supply chains, affecting production expenses for packaging manufacturers. These cost pressures limit profit margins and may result in higher end-product prices, impacting consumer affordability. Companies are working to mitigate risks by adopting lightweight designs, increasing material efficiency, and investing in alternative sources. Despite these strategies, unpredictable cost surges remain a persistent challenge for packaging firms operating in competitive pet care markets.

Regulatory Compliance and Sustainability Pressure

Increasing regulatory focus on environmental sustainability presents another significant challenge. Governments worldwide are enforcing stricter regulations on single-use plastics and mandating recyclable or biodegradable packaging solutions. While these policies encourage innovation, they also raise compliance costs for manufacturers. Companies must invest in new technologies, materials, and certifications to align with these standards. Smaller firms may struggle with the financial burden of compliance, creating entry barriers. Meeting evolving regulatory requirements while maintaining cost efficiency continues to be a balancing act for market players.

Regional Analysis

North America

North America holds the largest share of the pet care packaging market at 37% in 2024. Strong pet ownership rates, particularly in the U.S., drive consistent demand for premium food and grooming packaging. High consumer spending on pets and a preference for convenience-oriented formats such as resealable pouches and single-serve packs support growth. Sustainability initiatives are also reshaping packaging trends, with companies investing in recyclable and biodegradable materials. The presence of leading packaging manufacturers and pet food brands strengthens the region’s dominance, making North America a key hub for innovation and product development in the global market.

Europe

Europe accounts for 29% of the global pet care packaging market in 2024. The region’s demand is shaped by strict sustainability regulations and consumer preference for eco-friendly materials. Paperboard and recyclable plastics see strong adoption, particularly in Western European countries. Premium packaging is gaining traction due to rising pet humanization and the popularity of organic and specialty food. E-commerce growth across the region also fuels demand for protective and lightweight packaging solutions. With supportive regulatory frameworks and high consumer awareness, Europe remains a leader in driving innovation toward sustainable packaging solutions for the pet care sector.

Asia-Pacific

Asia-Pacific represents 23% of the pet care packaging market and is the fastest-growing region. Rising urbanization and increasing pet ownership in countries like China, India, and Japan are fueling demand for packaged food and grooming products. Consumers prefer cost-effective yet durable packaging formats such as flexible films, pouches, and cartons. E-commerce expansion is also creating new opportunities for protective and portable packaging designs. Growing awareness of pet health and premium food options is driving interest in advanced packaging. As disposable incomes rise, Asia-Pacific is expected to significantly expand its market share during the forecast period.

Latin America

Latin America holds 7% of the global pet care packaging market in 2024. The region’s growth is supported by increasing pet adoption and a rising middle-class population in countries such as Brazil, Mexico, and Argentina. Flexible packaging formats like pouches dominate due to their affordability and convenience. Economic constraints limit premium packaging adoption, but demand is increasing for cost-effective packaging that ensures product safety and freshness. Regional players are gradually shifting toward sustainable materials, though adoption remains slower compared to developed markets. With growing e-commerce channels, the region is emerging as a key growth opportunity for packaging providers.

Middle East & Africa

The Middle East & Africa region accounts for 4% of the pet care packaging market. Market growth is gradual, supported by increasing urbanization, rising pet ownership, and expanding retail channels. Countries like South Africa, UAE, and Saudi Arabia are witnessing higher demand for packaged pet food and accessories. Flexible and low-cost packaging formats dominate, while premium packaging remains limited to niche segments. Sustainability adoption is still at an early stage but is gaining traction with international brands entering the market. Although currently a smaller market, the region presents long-term growth potential driven by changing consumer lifestyles.

Market Segmentations:

By Packaging Type:

- Bags & pouches

- Boxes & cartons

By Material Type:

- Plastic

- Paper & paperboard

By Packaged Product:

- Pet food

- Pet toys & accessories

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the pet care packaging market is shaped by key players such as Huhtamaki, DS Smith, ATID Packaging, Berry Global, Mondi, NNZ Group, Graphic Packaging, Amcor, Constantia Flexibles, and Coveris. The competitive landscape of the pet care packaging market is defined by continuous innovation, sustainability initiatives, and strategic partnerships. Companies are focusing on developing eco-friendly materials such as recyclable plastics, biodegradable films, and paperboard alternatives to meet regulatory requirements and consumer demand for green solutions. Advancements in flexible packaging, resealable closures, and lightweight designs are enhancing convenience and functionality, particularly in pet food and grooming products. E-commerce growth is further shaping packaging needs, with durable, protective, and cost-efficient formats gaining traction. Intense competition drives firms to invest in research, expand regional presence, and differentiate through premium and customized packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huhtamaki

- DS Smith

- ATID Packaging

- Berry Global

- Mondi

- NNZ Group

- Graphic Packaging

- Amcor

- Constantia Flexibles

- Coveris

Recent Developments

- In July 2024, Mondi launched additions to the company’s sustainable pre-made plastic bags portfolio. The new line, FlexiBag Reinforced, is recyclable packaging, mono-polyethylene-based with enhanced properties such as sealability, stiffness and puncture-resistance.

- In May 2024, ALPLA, a plastic packaging manufacturer, announced the introduction of a new wine container that is recyclable and composed of PET (polyethylene terephthalate). With possible cost reductions of up to 30%, this packaging method reduces carbon footprints by up to 50%.

- In April 2024, ProMach launched its Pet Care Solutions group, aimed at providing specialized processing and packaging solutions tailored for the pet care industry. This new division is designed to address the challenges faced by pet food manufacturers, including the production and packaging of wet foods, kibble, and treats.

- In January 2024, Coca-Cola India and Reliance Retail, the retail division of India-based conglomerate Reliance Industries Limited (RIL), have introduced a new program for collecting and recycling polyethylene terephthalate (PET). In January 2024, Coca-Cola India and Reliance Retail, the retail division of India-based conglomerate Reliance Industries Limited (RIL), have introduced a new program for collecting and recycling polyethylene terephthalate (PET).

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Material Type, Packaged Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for sustainable and recyclable packaging materials.

- Flexible packaging formats will continue to dominate due to convenience and cost efficiency.

- Premium packaging designs will gain traction with growing pet humanization trends.

- E-commerce expansion will increase the need for durable and protective packaging solutions.

- Smart and functional packaging with resealable and portion-control features will see higher adoption.

- Paperboard and biodegradable alternatives will grow as regulatory pressures on plastics intensify.

- Customization and branding opportunities will expand to strengthen consumer engagement.

- Emerging markets will contribute significantly as pet ownership and disposable incomes rise.

- Partnerships between packaging firms and pet food brands will enhance innovation pipelines.

- Technology-driven packaging solutions will evolve to ensure freshness, safety, and extended shelf life.