Market Overview:

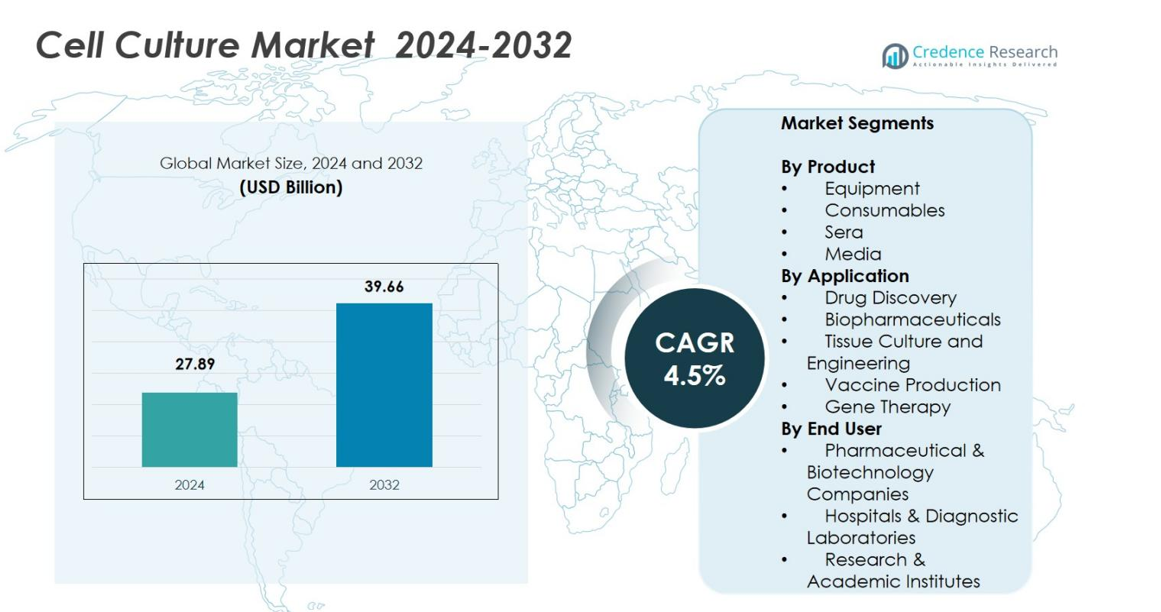

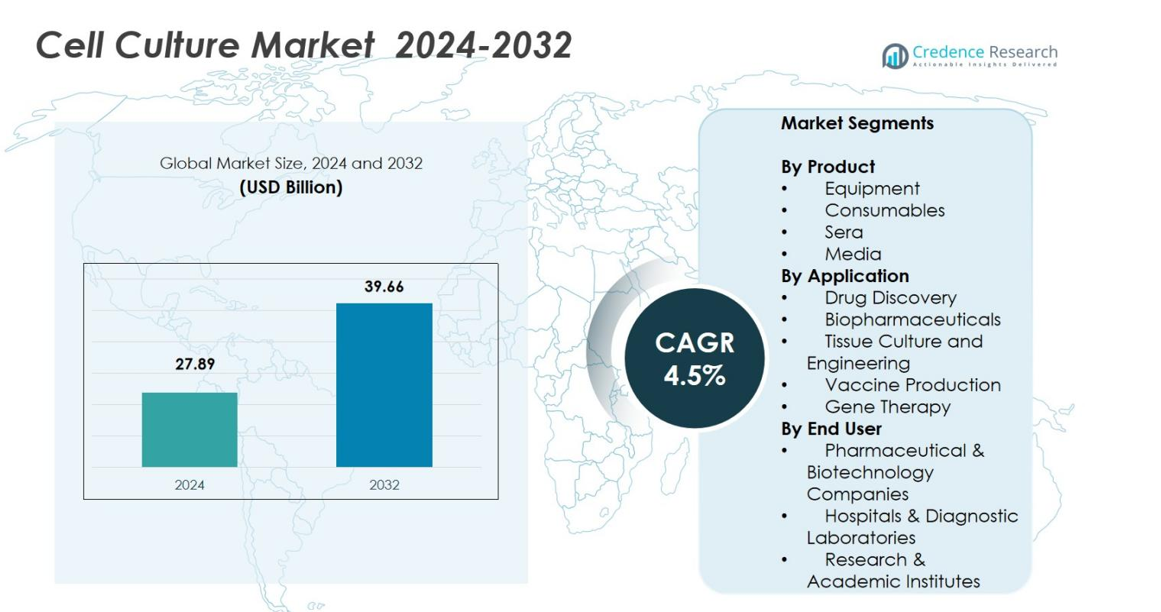

The Cell Culture Market size was valued at USD 27.89 Billion in 2024 and is anticipated to reach USD 39.66 Billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cell Culture Market Size 2024 |

USD 27.89 Billion |

| Cell Culture Market, CAGR |

4.5% |

| Cell Culture Market Size 2032 |

USD 39.66 Billion |

The Cell Culture Market exhibits strong involvement from top players including Thermo Fisher Scientific, Inc., Merck KGaA, Sartorius AG, Corning Incorporated, and Lonza Group, which together command a substantial portion of global demand. The market is anchored largely in North America with an exact share of 36.38% in 2024, thanks to its established pharmaceutical and biotechnology infrastructure, extensive cell-therapy R&D, and broad adoption of advanced cell culture technology. Europe and Asia Pacific follow as other significant regions — Europe benefiting from robust biologics and regenerative medicine research, and Asia Pacific emerging quickly due to rising healthcare investment and expanding biotech manufacturing capabilities.

Market Insights

- The Cell Culture Market size was valued at USD 27.89 Billion in 2024 and is expected to reach USD 39.66 Billion by 2032, growing at a CAGR of 4.5%.

- Increasing demand for biopharmaceuticals and personalized medicine is driving the market, with biopharmaceuticals accounting for the largest share of 34.7% in 2024.

- The shift towards 3D cell culture systems and advancements in gene and stem cell therapies are key trends fueling market growth.

- High cost of advanced cell culture systems and regulatory hurdles for biopharmaceutical production are major restraints.

- North America holds the largest market share of 36.38% in 2024, followed by Europe at 28.5% and Asia Pacific at 22.3%, with the latter region showing the fastest growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The Cell Culture Market is segmented into equipment, consumables, sera, and media. Among these, the consumables segment dominates, holding a substantial market share of 40.3% in 2024. This growth is primarily driven by the increasing demand for cell culture media, sera, and reagents used in the cultivation of various cell types for research and biomanufacturing. Consumables are integral to numerous applications, including drug discovery and vaccine production, further bolstered by the rising focus on personalized medicine and regenerative therapies. The steady demand for consumables in therapeutic production and research continues to fuel market expansion.

- For instance, Corning Incorporated introduced a new line of sterile single-use consumables for cell culture that improved contamination control, enhancing vaccine production efficiency

By Application:

The Cell Culture Market’s application segment includes drug discovery, biopharmaceuticals, tissue culture and engineering, vaccine production, and gene therapy. Biopharmaceuticals hold the largest share of 34.7% in 2024, reflecting the growing demand for monoclonal antibodies, vaccines, and other biologics. This segment is driven by the surge in biologics-based therapies and advancements in cell therapy, necessitating effective cell culture techniques for drug production. Increased investment in biologic drug development, along with regulatory advancements, is expected to further drive the growth of this segment throughout the forecast period.

- For instance, Evonik, awarded the Best Bioprocessing Supplier for its cell culture media ingredients portfolio, which includes peptides and plant-based lipids that support high-yield biopharmaceutical manufacturing.

By End User:

The end-user segment comprises pharmaceutical & biotechnology companies, hospitals & diagnostic laboratories, and research & academic institutes. Pharmaceutical & biotechnology companies dominate with a market share of 49.5% in 2024, fueled by the growing biopharmaceutical production demand and the trend towards biologics. These companies are leveraging advanced cell culture technologies to produce vaccines, gene therapies, and monoclonal antibodies. The rising investments in R&D for drug discovery and the expanding need for biologic products and therapeutics are expected to support the market’s strong growth in this segment, making it the largest contributor.

Key Growth Drivers

Increasing Demand for Biopharmaceuticals

The growing demand for biopharmaceutical products is a key driver for the cell culture market. The rising prevalence of chronic diseases, including cancer, diabetes, and autoimmune disorders, has spurred the need for biologic therapies such as monoclonal antibodies and vaccines. Cell culture plays a crucial role in the production of these biologics, making it indispensable for the biopharmaceutical sector. As the biopharmaceutical industry continues to expand, fueled by technological advancements and increased R&D investment, the demand for cell culture solutions is set to grow substantially during the forecast period.

- For instance, Regeneron Pharmaceuticals reported scaling up production of monoclonal antibodies using advanced mammalian cell culture systems to meet increasing therapy demands for cancer and autoimmune diseases.

Technological Advancements in Cell Culture Techniques

Advancements in cell culture technologies are driving market growth by improving the efficiency and scalability of biomanufacturing processes. Innovations such as 3D cell culture models, automated systems, and lab-on-a-chip technologies are enhancing the ability to culture complex cell types for drug discovery and regenerative medicine. These technologies reduce the time and cost associated with traditional cell culture methods, offering better reproducibility and higher yields. The increased adoption of these cutting-edge solutions is fueling demand, particularly in high-throughput screening and therapeutic production applications.

- For instance, 3D bioprinting allows precise spatial arrangement of cells and biomaterials to recreate tissue architecture, enhancing drug screening and tissue engineering applications.

Rising Focus on Personalized Medicine

Personalized medicine, which tailors treatment to the individual patient’s genetic makeup, is another significant driver for the cell culture market. The growing emphasis on personalized treatments requires sophisticated cell culture models to simulate and predict human responses to drugs. These advancements support the development of targeted therapies and precision medicine, especially for cancer and genetic disorders. As pharmaceutical companies invest more in precision medicine, the need for specialized cell culture techniques that allow for personalized drug testing and production will continue to rise, boosting market growth.

Key Trends & Opportunities

Shift Toward 3D Cell Culture Systems

A major trend in the cell culture market is the shift towards 3D cell culture systems, which offer more accurate modeling of human tissues compared to traditional 2D cell cultures. This technology enables more complex and reliable biological simulations, making it a valuable tool for drug discovery, toxicology testing, and regenerative medicine. As the demand for more physiologically relevant in vitro models increases, 3D cell cultures are expected to gain significant market share, offering opportunities for companies to innovate and expand their product offerings in drug testing and tissue engineering applications.

- For instance, the use of 3D spheroids in the A549 lung cancer cell model revealed significant differences in drug response to the TGF-βR inhibitor A83-01, with effective doses differing by over three orders of magnitude versus 2D cultures.

Expansion of Stem Cell Research

Stem cell research represents a significant opportunity within the cell culture market. As scientists explore the therapeutic potential of stem cells in regenerative medicine and tissue engineering, the need for specialized cell culture techniques continues to rise. Stem cells require carefully controlled environments to maintain their pluripotency and differentiation potential, creating opportunities for advanced cell culture products and services. Increased funding and research activities focused on stem cell therapies will drive demand for robust and scalable cell culture systems, contributing to the market’s expansion.

- For instance, Bio Techno acquired Namocell, a company providing instruments and consumables for gene therapy, highlighting investment in advanced cell culture tools for stem cell research.

Key Challenges

High Cost of Cell Culture Systems

One of the key challenges in the cell culture market is the high cost of advanced cell culture systems and consumables. While technology advancements such as 3D cell cultures and bioreactors provide more precise results, they often require significant capital investment. Small and medium-sized research organizations, especially in emerging economies, may face challenges in adopting these high-end systems. The need for specialized equipment, reagents, and skilled personnel further increases the operational cost, creating a barrier for widespread adoption, particularly in cost-sensitive markets.

Regulatory Hurdles and Compliance Issues

The cell culture market faces regulatory challenges, particularly in the biopharmaceutical sector. Strict regulatory requirements for manufacturing biologics, vaccines, and gene therapies often complicate the approval process. Cell culture systems must meet stringent quality standards to ensure the safety and efficacy of products, which can lead to delays in product development. Navigating the complex regulatory landscape, especially in markets with evolving regulations, remains a significant hurdle for companies looking to introduce new cell culture technologies. These challenges can hinder the speed at which innovations are brought to market.

Regional Analysis

North America

North America commands a leading position in the global cell culture market, holding a market share of 36.38% in 2024. The region benefits from a well-established pharmaceutical and biotechnology infrastructure, strong research and development capabilities, and widespread adoption of advanced cell-culture technologies across academic institutions and industry. High investments in cell-based therapies, biopharmaceutical production, and regenerative medicine drive demand. Regulatory support and mature healthcare systems further strengthen market penetration, making North America the dominant regional market. It is expected to continue holding a significant share throughout the forecast period.

Europe

Europe represents the second major regional market in the global cell culture industry, with a market share of 28.5% in 2024. The region’s share reflects a strong presence of biopharma companies, research institutions, and robust regulatory frameworks supporting biologics, cell therapy, and regenerative medicine. Widespread academic research in cell-based assays and collaborations between biotech firms bolster market demand. As companies invest in innovative culture systems and expand biologic manufacturing capacities, Europe continues to contribute significantly to global market value, supported by growing demand for advanced therapeutics and vaccine production.

Asia Pacific

The Asia Pacific region shows dynamic growth and rising importance in the cell culture market, contributing 22.3% of the global market share in 2024. Driven by increasing investment in biotechnology, expanding healthcare infrastructure, and rising demand for biologics and vaccines, this region has emerged as a key growth frontier. Governments in several countries support R&D funding and regulatory facilitation for cell and gene therapies, fueling market expansion. As more pharmaceutical and contract research organizations adopt cell culture technologies, Asia Pacific’s contribution to global market value is rising steadily, positioning it as a fast-growing regional market.

Latin America

Latin America holds a smaller but growing share of the global cell culture market, contributing 6.5% in 2024. The region’s growth is supported by increasing adoption of cell culture for research, diagnostics, and vaccine production, along with gradual expansion of biotechnology infrastructure. While investment levels remain modest compared to developed regions, rising healthcare demand and emerging biotech initiatives are slowly building capacity. As more players enter the market and regulatory frameworks mature, Latin America is poised for incremental growth over the forecast period, with significant potential for expansion.

Middle East & Africa

The Middle East & Africa region contributes a modest share of 6.1% to the global cell culture market in 2024 but offers rising potential. Growth is driven by emerging interest in biopharmaceutical manufacturing, growing demand for vaccine production, and expanding diagnostic and research capabilities. While limited infrastructure and lower adoption rates continue to pose constraints, increasing public and private sector efforts to develop biotech and life-science capabilities may gradually strengthen market presence. Over time, enhanced regulatory support and infrastructure investments could improve the region’s market contribution, leading to steady growth in the coming years.

Market Segmentations:

By Product

- Equipment

- Consumables

- Sera

- Media

By Application

- Drug Discovery

- Biopharmaceuticals

- Tissue Culture and Engineering

- Vaccine Production

- Gene Therapy

By End User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cell culture market is highly competitive, with several key players driving innovation and market growth. Major companies in the industry include Thermo Fisher Scientific Inc., Lonza Group, Merck KGaA, Sartorius AG, and Corning Incorporated. These companies are focusing on enhancing their product portfolios through strategic acquisitions, partnerships, and technological advancements. Thermo Fisher Scientific and Sartorius AG are leaders in providing a wide range of cell culture products, including media, sera, and reagents, enabling them to cater to diverse applications in drug discovery, biopharmaceutical production, and tissue engineering. Additionally, Lonza and Merck KGaA have strengthened their positions by investing in cell-based therapies and gene therapy applications. Competition within the market is also being fueled by the increasing demand for 3D cell culture systems and the adoption of advanced technologies such as automated cell culture systems. With the growing focus on personalized medicine and biologics, the competitive landscape is expected to intensify, with companies focusing on innovation and regulatory compliance to meet evolving market demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, BD Biosciences introduced the BD FACSDiscover A8 Cell Analyzer, a spectral cell analyzer featuring real-time imaging capabilities. The system combines BD CellView Image Technology and BD SpectralFX Technology, allowing researchers to capture high-resolution images and conduct spectral flow cytometry simultaneously.

- In September 2024, Merck KGaA unveiled the first single-use reactor tailored for the production of antibody-drug conjugates (ADCs).

- In September 2023, Thermo Fisher Scientific launched the Gibco CTS Detachable Dynabeads, an innovative platform featuring an active-release mechanism designed to enhance the clinical and commercial processes of cell therapy manufacturing

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for cell culture products will continue to rise due to the growing focus on biologics and personalized medicine.

- Innovations in 3D cell culture technologies will play a significant role in improving the accuracy and reliability of drug testing and disease modeling.

- Increased investment in gene therapy and stem cell research will drive the adoption of advanced cell culture techniques.

- Regulatory frameworks will evolve to support the production of biologics, opening new opportunities for cell culture technologies.

- The trend towards biopharmaceutical manufacturing and the production of monoclonal antibodies will continue to support market growth.

- Rising healthcare needs in emerging markets will lead to higher demand for cell culture-based diagnostics and therapeutics.

- Strategic partnerships and acquisitions between industry players will fuel the development of new, more efficient cell culture products.

- The shift towards automated and high-throughput cell culture systems will enhance productivity and reduce costs in drug discovery.

- Advancements in single-use technologies and bioreactors will improve scalability and reduce manufacturing costs for biopharmaceuticals.

- As the focus on regenerative medicine grows, the need for specialized cell culture systems for tissue engineering and organ regeneration will increase.