Market Overview

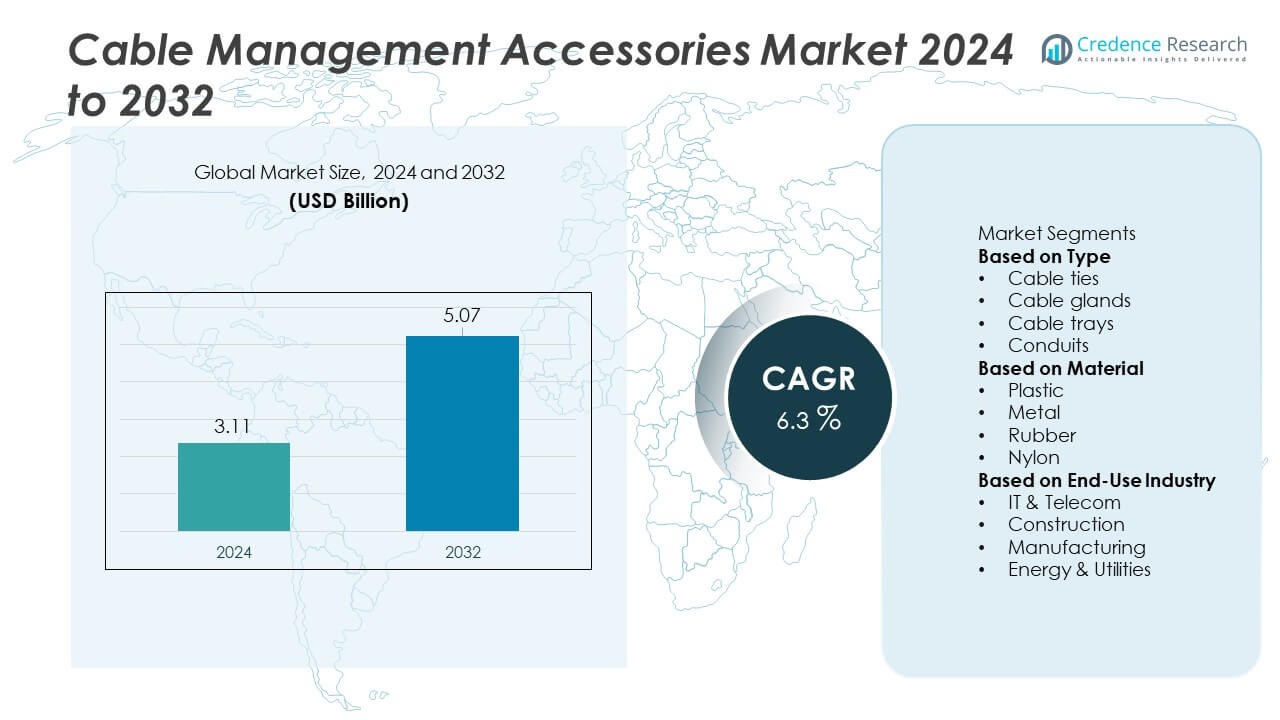

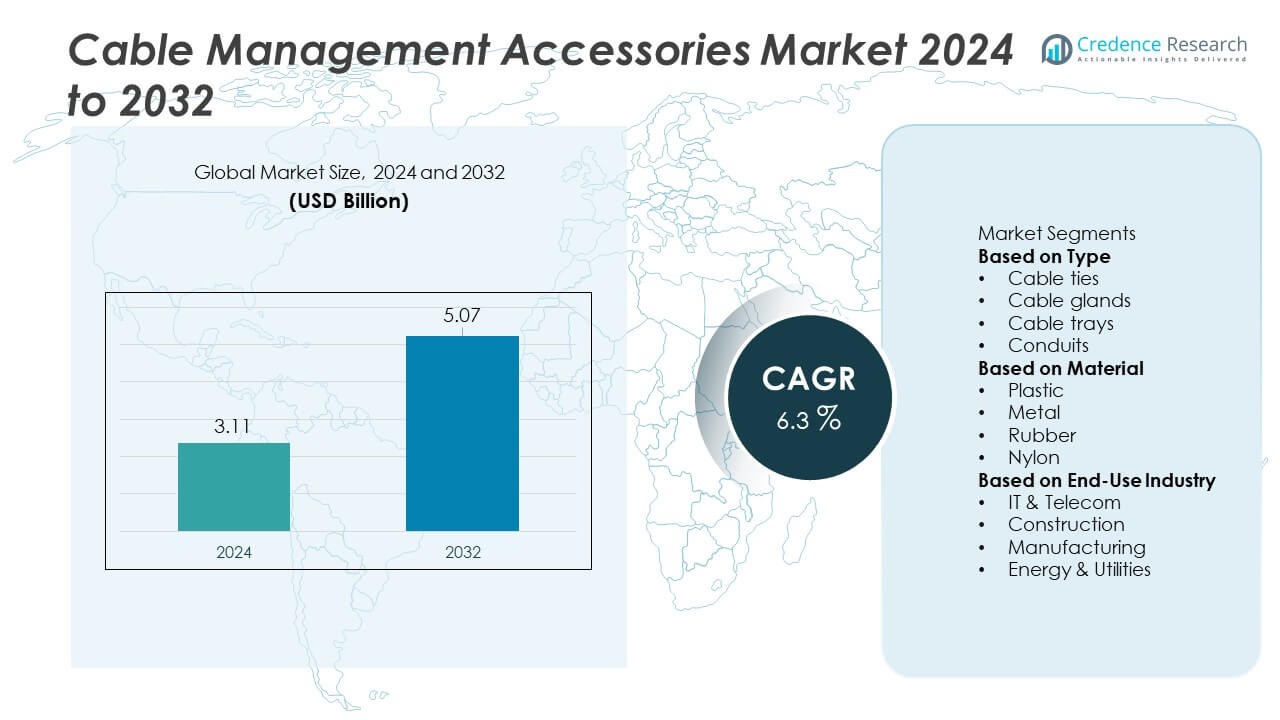

The Cable Management Accessories Market reached USD 3.11 billion in 2024 and is expected to rise to USD 5.07 billion by 2032, registering a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cable Management Accessories Market Size 2024 |

USD 3.11 Billion |

| Cable Management Accessories Market, CAGR |

6.3% |

| Cable Management Accessories Market Size 2032 |

USD 5.07 Billion |

The Cable Management Accessories market includes leading players such as HellermannTyton, Legrand, Schneider Electric, ABB, Panduit, Eaton, TE Connectivity, Niedax Group, Chatsworth Products (CPI), and Thomas & Betts. These companies strengthen their position by developing durable, fire-safe materials, modular installation systems, and solutions tailored for data centers, construction sites, and industrial facilities. North America led the global market with 34% share, supported by strong data center expansion and telecom upgrades. Asia Pacific followed with 30% share, driven by large-scale manufacturing and rapid urban development, while Europe accounted for 28%, supported by strict electrical standards and smart building investments.

Market Insights

Market Insights

- The Cable Management Accessories market reached USD 3.11 billion in 2024 and is expected to rise to USD 5.07 billion by 2032, recording a CAGR of 6.3% during the forecast period.

- Market growth is driven by rising data center expansion, 5G infrastructure development, and increased construction activity, with cable ties leading the type segment with 41% share due to widespread use in telecom and industrial wiring.

- Key trends include growing demand for heat-resistant and halogen-free materials, alongside increasing adoption of modular and easy-installation cable systems across commercial and industrial environments.

- The competitive landscape remains strong, with major manufacturers focusing on durable materials, scalable cable routing solutions, and strategic partnerships to expand presence, while fluctuating raw material costs and lack of standardization act as restraints.

- Regionally, North America led with 34% share, followed by Asia Pacific at 30% and Europe at 28%, supported by data center growth, smart building initiatives, and rising industrial automation across each region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Cable ties held the dominant position with 41% share in 2024, driven by their wide use across telecom networks, electrical installations, and industrial wiring. Their low cost, strong grip strength, and simple installation make them the preferred choice for bundle management in both indoor and outdoor environments. Cable trays followed due to rising demand in large commercial and industrial projects where organized routing and safety are critical. Cable glands gained steady traction in applications requiring sealed and dust-proof cable entry points, while conduits continued expanding with infrastructure upgrades in energy and transportation sectors.

- For instance, Panduit developed stainless-steel cable ties tested to withstand 890 newtons of loop tensile strength, improving durability in harsh industrial zones.

By Material

Plastic emerged as the leading material segment with 46% share in 2024, supported by its flexibility, corrosion resistance, and cost-effectiveness across commercial and residential wiring. Plastic components remain widely adopted in IT setups, construction sites, and light-duty industrial installations due to ease of installation and durable performance. Metal accessories followed because of their strong adoption in heavy-duty environments, including power plants and manufacturing units requiring higher strength and fire resistance. Rubber and nylon materials gained traction in specialized environments where heat, vibration, or chemical exposure demands enhanced material performance.

- For instance, ABB’s polyamide cable fittings achieved a maximum operating temperature of 120°C, offering stable tensile resistance in high-heat electrical rooms.

By End-Use Industry

IT & Telecom accounted for the largest share with 39% in 2024, driven by rapid data center expansion, fiber-optic deployments, and rising cable density in 5G infrastructure. High network reliability needs push operators to invest in advanced cable accessories that reduce clutter and support cooling efficiency. Construction remained a key segment as modern commercial buildings and residential projects continue using structured wiring systems. Manufacturing showed steady adoption with growing automation and equipment connectivity. Energy & utilities also contributed significantly, benefiting from grid modernization and expansion of renewable power installations that require organized and protected cable routing.

Key Growth Driver

Expansion of Data Centers and Telecom Infrastructure

The rapid growth of data centers and telecom networks drives significant demand for cable management accessories. Rising adoption of cloud computing, 5G rollout, and fiber-optic networks increases cable density across server rooms and base stations. Operators rely on efficient cable organization to improve airflow, reduce downtime, and enhance equipment longevity. Cable ties, trays, and conduits support structured deployment in both new and upgraded facilities. As enterprises expand digital infrastructure and edge computing sites multiply, demand for reliable cable management solutions continues to accelerate across global telecom and IT environments.

- For instance, Schneider Electric offers NetShelter SX Advanced Enclosures which are designed to be taller, deeper, and stronger to support increased weight, cabling, and infrastructure requirements for modern high-density applications like AI workloads.

Rising Construction Activities and Smart Building Integration

Global construction growth strengthens demand for cable management accessories across commercial, residential, and industrial projects. Smart buildings, automated security systems, and advanced electrical layouts require organized cable routing to ensure system reliability and safety. Cable trays, conduits, and glands support modern electrical standards and help prevent overheating, wear, and installation risks. Increased adoption of HVAC controls, surveillance systems, and energy-efficient wiring further boosts installations. As nations invest in urban development, smart cities, and infrastructure renewal, cable management solutions become essential to support advanced electrical and communication systems.

- For instance, Legrand deployed its steel cable trays in high-rise smart projects, with specific systems certified to meet stringent IEC 61537 standards for safe working loads across various support spans, ensuring secure routing for critical infrastructure.

Industrial Automation and Equipment Modernization

Manufacturing facilities continue adopting automation, robotics, and sensor-based systems that require structured cable routing for seamless operation. Organized cable pathways reduce maintenance issues, minimize hazards, and improve machine uptime. Heavy-duty cable accessories such as metal trays, reinforced conduits, and high-temperature cable ties support demanding industrial environments. Growth in automotive production, electronics assembly, and process industries further increases cable density around equipment. As factories modernize under Industry 4.0 initiatives, demand for durable and high-performance cable management accessories rises sharply.

Key Trend & Opportunity

Growing Shift Toward Heat-Resistant and Fire-Safe Materials

Industries are increasingly adopting heat-resistant, halogen-free, and fire-safe cable management accessories to meet stricter safety regulations. These materials offer enhanced protection in high-temperature zones such as data centers, power plants, manufacturing lines, and transportation hubs. The trend creates strong opportunities for advanced plastic, metal, and nylon-based products that deliver improved durability and compliance. Growing awareness of workplace safety standards further supports demand for certified cable trays, conduits, and glands. As organizations prioritize risk reduction and equipment integrity, suppliers offering advanced material solutions gain competitive advantage.

- For instance, HellermannTyton introduced its HelaGuard fire-safe non-metallic conduits rated to operate at constant temperatures up to 120°C, providing stable mechanical strength in power distribution rooms.

Rising Demand for Modular and Easy-Installation Systems

Modular cable management systems are gaining traction as organizations seek faster installation and flexible routing options. Tool-less cable trays, adjustable conduits, and snap-fit cable ties reduce installation time and support future upgrades. These systems appeal to data centers, commercial buildings, and telecom sites that frequently modify layouts. The trend creates opportunities for manufacturers offering ergonomic designs, reusable accessories, and integrated labeling solutions. As industries focus on efficiency, modular cable management products become preferred solutions for scalable and maintenance-friendly network setups.

- For instance, Panduit released its Wyr-Grid system that emphasizes speed of deployment through features like snap-on components and bonded splices, which can reduce labor costs by 50% compared to traditional wire basket and ladder rack systems, strengthening deployment speed in edge data racks.

Key Challenge

Fluctuating Raw Material Prices and Supply Chain Disruptions

Volatile prices of key materials such as plastics, metals, and rubber create cost pressures for cable management accessory manufacturers. Supply chain disruptions, shipping delays, and shortages of industrial polymers or steel further affect production timelines. These fluctuations challenge inventory planning and impact profit margins, especially for small and mid-sized producers. Manufacturers face difficulty maintaining stable pricing while ensuring consistent product availability. As global supply chains continue to shift, material volatility remains a major challenge for market stability.

Lack of Standardization Across Diverse End-Use Environments

Different industries follow varied installation standards, making it difficult to create universally compatible cable management solutions. Telecom networks, construction sites, energy plants, and manufacturing lines each require specialized accessories, leading to design complexity and increased production costs. Inconsistent regulatory guidelines across regions further complicate product development. The absence of uniform standards often results in compatibility issues and longer installation cycles. This challenge limits scalability and increases the need for customized solutions, adding pressure on manufacturers to balance flexibility and cost efficiency.

Regional Analysis

North America

North America held 34% share in the Cable Management Accessories market in 2024, supported by rising data center construction, strong telecom infrastructure, and steady industrial automation investments. The region benefits from high adoption of cable trays, conduits, and cable ties across IT facilities, commercial buildings, and energy projects. Growing 5G deployment and the expansion of cloud service providers drive structured wiring installations. Strict electrical safety regulations also boost demand for certified and fire-resistant accessories. The presence of major technology firms and continuous modernization of utility networks further strengthen long-term market growth in North America.

Europe

Europe captured 28% share in 2024, driven by advanced construction standards, robust manufacturing activity, and rising adoption of renewable energy projects that require organized cable routing. Countries such as Germany, France, and the UK invest heavily in smart buildings and industrial automation, increasing the use of cable glands, trays, and conduits. The region’s focus on sustainability encourages the use of halogen-free and recyclable materials. Growth in electric vehicle production and high-tech industries further accelerates demand. Strong regulatory frameworks related to electrical safety and fire-resistant installations reinforce Europe’s position as a key market.

Asia Pacific

Asia Pacific accounted for 30% share in 2024, supported by rapid expansion of IT infrastructure, large-scale manufacturing, and growing construction activities. China, India, Japan, and South Korea lead demand due to increased data center investment and widespread industrial modernization. Telecom operators expanding 5G networks drive high consumption of cable ties and conduits. The region’s booming electronics and automotive sectors rely on structured cable systems for equipment reliability. Urban development, infrastructure upgrades, and rising factory automation continue to position Asia Pacific as the fastest-growing market for cable management accessories.

Latin America

Latin America held 5% share in 2024, driven by steady improvements in telecom networks, construction projects, and industrial facilities. Brazil and Mexico lead adoption due to expanding commercial buildings and modernization of utility infrastructure. Increasing deployment of fiber-optic networks boosts demand for cable ties, trays, and protective conduits. Cost-sensitive sectors favor simple and durable accessories for organized wiring. Although growth is slower due to economic constraints and limited large-scale industrial projects, ongoing digitalization and rising energy investments support consistent market expansion across the region.

Middle East & Africa

The Middle East & Africa region accounted for 3% share in 2024, supported by growing investments in smart cities, large infrastructure projects, and industrial development. Gulf countries invest heavily in data centers, airports, and energy plants, boosting demand for advanced cable management systems. Africa shows gradual adoption as telecom operators upgrade networks and construction activity rises in urban areas. Harsh climatic conditions drive the need for heat-resistant and corrosion-proof accessories. Expanding utility modernization and digital transformation initiatives continue to create long-term opportunities across MEA.

Market Segmentations:

By Type

- Cable ties

- Cable glands

- Cable trays

- Conduits

By Material

- Plastic

- Metal

- Rubber

- Nylon

By End-Use Industry

- IT & Telecom

- Construction

- Manufacturing

- Energy & Utilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cable Management Accessories market is shaped by leading players such as HellermannTyton, Legrand, Schneider Electric, ABB, Panduit, Eaton, TE Connectivity, Niedax Group, Chatsworth Products (CPI), and Thomas & Betts. These companies focus on expanding product portfolios, introducing heat-resistant and halogen-free materials, and enhancing durability to meet rising safety and performance standards. Many vendors invest in modular cable systems, quick-installation solutions, and smart accessories that support efficient routing in data centers and commercial infrastructure. Strategic priorities include strengthening global distribution networks, improving manufacturing capabilities, and adopting sustainable materials. Partnerships with construction firms, telecom operators, and industrial OEMs help improve market penetration. Continuous R&D efforts, competitive pricing, and product certification remain central strategies as companies position themselves to serve growing demand across IT, construction, manufacturing, and utility sectors.

Key Player Analysis

- HellermannTyton

- Legrand

- Schneider Electric

- ABB

- Panduit

- Eaton

- TE Connectivity

- Niedax Group

- Chatsworth Products (CPI)

- Thomas & Betts (A member of ABB Group)

Recent Developments

- In August 2025, ABB released the T&B Liquidtight Systems® cable-entry plates, engineered for high-density applications to help save space, time and cost.

- In November 2024, Legrand launched the “Cablofil Cablobend” series—adaptable cable-tray fittings designed to simplify steel-wire tray installation.

- In January 2024, Legrand UK & Ireland became the first company in the UK to purchase cold-rolled XCarb® recycled and renewably-produced steel from ArcelorMittal for manufacturing cable-management products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cable management accessories will grow with continued data center expansion and higher cable density.

- Smart building adoption will increase the need for advanced cable trays, conduits, and organized routing systems.

- Heat-resistant and fire-safe materials will gain traction as safety regulations become stricter.

- Modular and tool-less installation systems will become more popular for faster setup and future scalability.

- Industrial automation will boost demand for durable metal trays and conduits in harsh environments.

- 5G rollout will drive widespread use of cable ties and glands across telecom infrastructure.

- Renewable energy projects will require robust cable routing solutions to support grid modernization.

- Manufacturers will invest in sustainable and recyclable materials to align with green compliance.

- Growth in EV production and charging infrastructure will increase structured cable routing needs.

- Emerging markets will adopt more cable management solutions as construction and digital infrastructure expand.

Market Insights

Market Insights