Market Overview

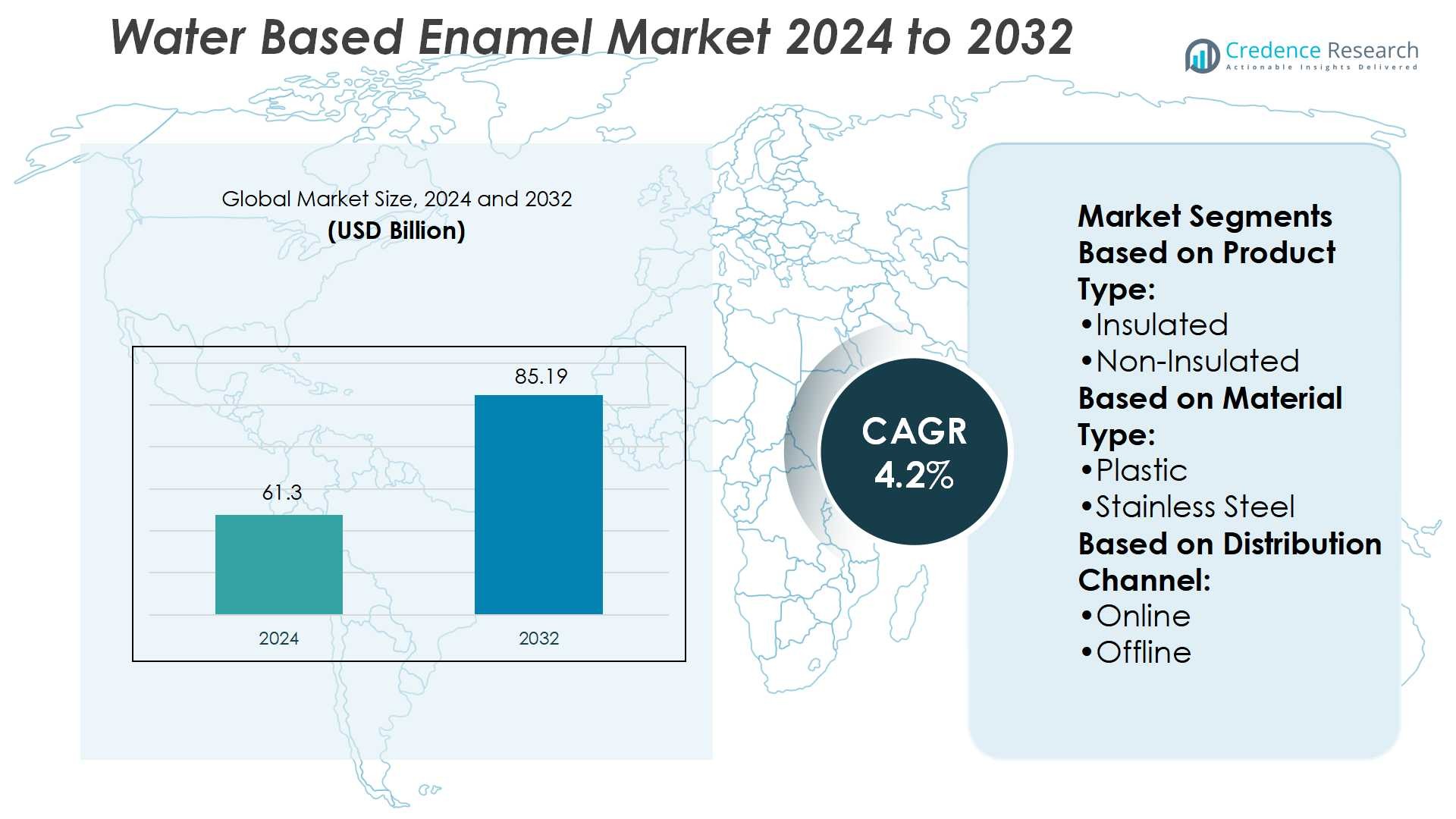

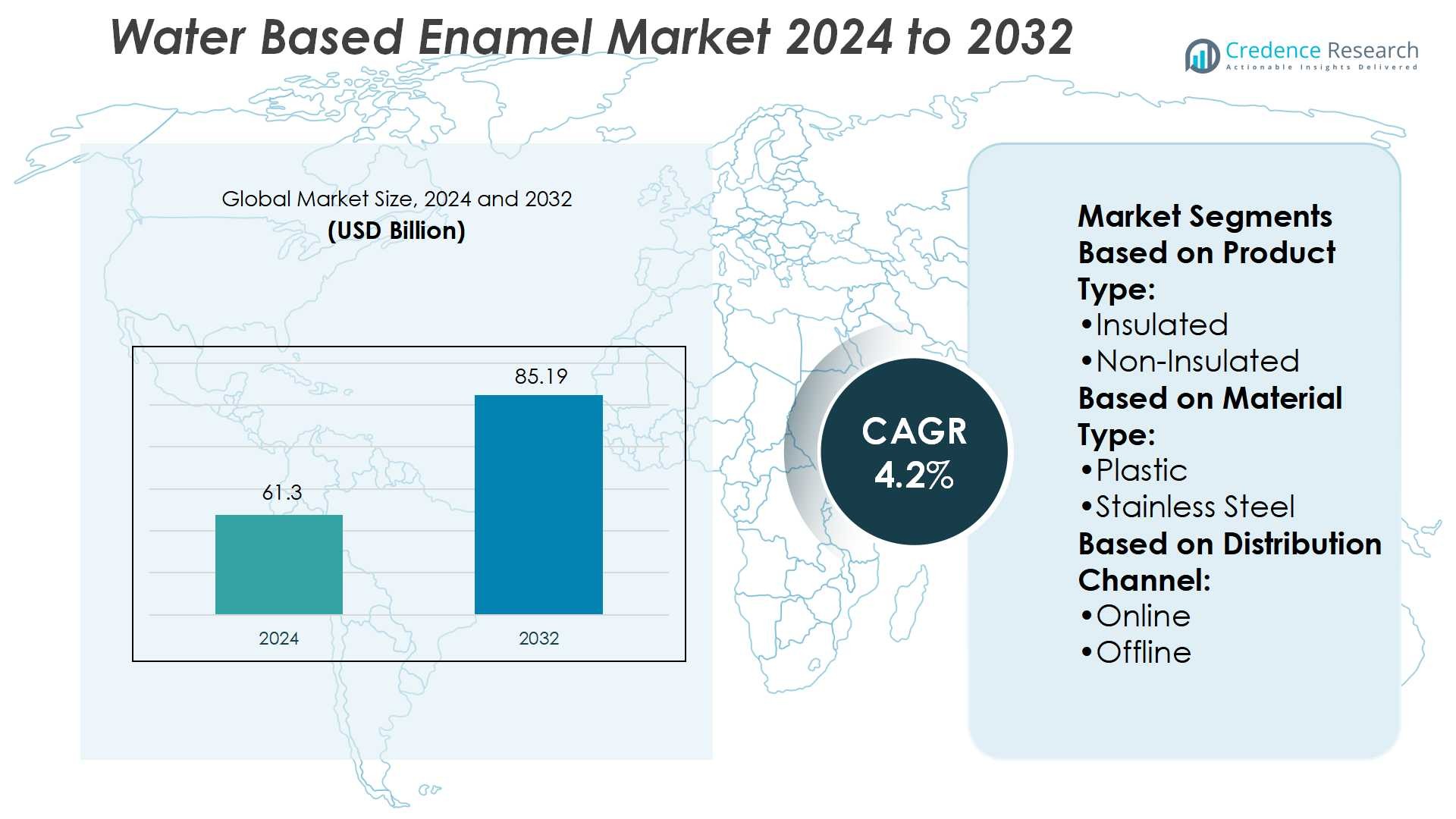

Water Based Enamel Market size was valued USD 61.3 billion in 2024 and is anticipated to reach USD 85.19 billion by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Based Enamel Market Size 2024 |

USD 61.3 Billion |

| Water Based Enamel Market, CAGR |

4.2% |

| Water Based Enamel Market Size 2032 |

USD 85.19 Billion |

The water-based enamel market is shaped by prominent players such as Franklin International, BASF SE, AkzoNobel N.V., Asian Paints, Sherwin-Williams, Nippon Paint, Dutch Boy Paint (Sherwin-Williams), Huber Group, The Dow Chemical Company (Dow Inc.), and Dulux. These companies drive growth through innovation, sustainability initiatives, and expanded product portfolios catering to both industrial and consumer needs. Advanced R&D investments focus on improving durability, eco-friendly performance, and premium finishes, strengthening their global reach. Regionally, Asia-Pacific leads the market with a 34% share, driven by rapid industrialization, large-scale infrastructure projects, and rising consumer demand for sustainable decorative and protective coatings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Water Based Enamel Market size was USD 61.3 billion in 2024 and is projected to reach USD 85.19 billion by 2032, growing at a CAGR of 4.2%.

- Rising demand for eco-friendly, low-VOC coatings across construction, automotive, and industrial applications is driving sustained market growth.

- Innovation in resin technologies, premium finishes, and consumer-oriented products highlight market trends, with leading players investing heavily in R&D for durability and sustainability.

- Higher production costs compared to solvent-based alternatives and performance limitations in extreme environments remain key restraints for wider adoption.

- Asia-Pacific leads with a 34% share, supported by industrialization and infrastructure projects, while North America holds 32% and Europe 28%; insulated product types dominate with over 40% share, and stainless steel materials lead with 38%.

Market Segmentation Analysis:

By Product Type

In the water-based enamel market, insulated water bottles hold the dominant share, accounting for over 40% of sales. Consumers prefer insulated bottles for their ability to maintain temperature for extended periods, making them popular among working professionals, fitness enthusiasts, and travelers. Non-insulated and infuser bottles follow, catering to casual users seeking lightweight or health-oriented options. The demand for insulated variants is driven by rising health awareness, increasing outdoor activities, and the premiumization trend in hydration products, which emphasizes durability, convenience, and eco-friendly designs.

- For instance, BASF’s Joncryl 2990 self-crosslinking acrylic emulsion achieves a solids content of about 47.0%, has a Brookfield viscosity under 400 centipoise, and enables VOC levels down to 50 grams per litre while maintaining strong resistance to hot-tire pickup and chemical exposure.

By Material Type

Stainless steel leads the water-based enamel market by material, holding a 38% share. Its durability, resistance to corrosion, and eco-friendly appeal strengthen its adoption across premium and mid-range segments. Consumers increasingly avoid single-use plastics, boosting demand for sustainable stainless steel options. Plastic continues to serve price-sensitive consumers but faces challenges from regulatory restrictions and changing preferences. Glass water bottles maintain niche demand for health-conscious buyers due to their purity and chemical-free composition. Stainless steel’s balance of functionality and sustainability ensures its market leadership.

- For instance, Sherwin-Williams’ Waterbased Industrial Enamel, identified by the B53-300 series code. The technical data sheet for the B53-300 series specifies a recommended dry film thickness of 1.5–3.0 mils, which corresponds to 40–75 microns.

By Distribution Channel

Offline channels dominate the water-based enamel market with a 60% share, supported by strong retail presence across supermarkets, specialty stores, and sporting outlets. Physical outlets allow consumers to evaluate quality, size, and brand credibility before purchasing. However, online channels are growing at the fastest rate due to convenience, wider product availability, and attractive discount strategies. E-commerce platforms such as Amazon and brand-specific websites expand customer reach globally. Offline channels remain dominant, but the rapid digital shift positions online sales as a key driver for future market expansion.

Key Growth Drivers

Rising Demand for Eco-Friendly Coatings

The water-based enamel market is driven by the global shift toward sustainable and low-VOC solutions. Stringent environmental regulations are compelling industries to replace solvent-based products with water-based alternatives. Consumers and manufacturers are increasingly focused on reducing carbon footprints, which strengthens adoption across construction, automotive, and industrial applications. The eco-friendly profile of water-based enamels, combined with superior durability and finish quality, positions them as a preferred choice. This rising demand enhances long-term market prospects, especially in regions with strong environmental compliance policies.

- For instance, Nippon Paint’s Hydro enamel has a solid volume (volume solids) in the range of 38-42%, requires a dry film thickness of 35-40 microns, achieves theoretical coverage of 13 m² per litre at 30 microns, and reports VOC emissions under 1 g/L.

Expanding Construction and Infrastructure Projects

Rapid urbanization and large-scale infrastructure investments are fueling the use of water-based enamels in residential, commercial, and industrial projects. These coatings provide weather resistance, aesthetic appeal, and protection for surfaces like wood, metal, and concrete. Governments in emerging economies continue to invest heavily in housing and public infrastructure, which directly supports demand growth. The versatility of water-based enamels across interior and exterior applications enhances their market appeal. Their ease of application and faster drying times further attract construction professionals and DIY consumers alike.

- For instance, Dow’s Maincote™ Acrylic Resins technology enables formulating waterborne metal coatings with VOC levels below 25 g/L. Some Maincote™ resins feature ambient temperature self-crosslinking for reliable curing in low-temperature conditions.

Advancements in Product Performance

Continuous research and development in water-based enamel formulations have improved properties such as adhesion, abrasion resistance, and gloss retention. Manufacturers are leveraging nanotechnology and hybrid resin systems to enhance durability while maintaining eco-friendly attributes. These advancements allow water-based enamels to compete with solvent-based products in demanding applications such as automotive refinishing and industrial coatings. Improved shelf life and compatibility with various substrates expand usage across multiple industries. As performance barriers diminish, innovation in formulations becomes a critical driver for wider market adoption and premium product positioning.

Key Trends & Opportunities

Growth of DIY and Home Improvement Activities

The rising trend of do-it-yourself (DIY) projects is creating new opportunities for the water-based enamel market. Consumers increasingly invest in home renovation, furniture refurbishment, and decorative applications. Water-based enamels offer advantages such as easy application, low odor, and faster drying times, which suit household users. E-commerce platforms further strengthen access to diverse product ranges. This trend aligns with growing lifestyle-driven spending, making the DIY segment a promising contributor to market expansion and brand diversification strategies in the retail space.

- For instance, Dulux’s Aquanamel Gloss coating has a solids by volume of about 35.4%, a dry film thickness of 19 microns per coat when applied wet at 53 microns, is touch-dry after 30 minutes, and allows recoat after 2 hours.

Digitalization and E-Commerce Expansion

E-commerce has emerged as a significant growth avenue, reshaping distribution strategies in the water-based enamel market. Online platforms provide wider accessibility, price transparency, and promotional opportunities that attract both consumers and businesses. Manufacturers increasingly leverage direct-to-consumer sales models, supported by digital marketing and online brand visibility. Global players are also investing in digital tools to enhance customer experience through virtual product demos and color simulation applications. This digital shift creates long-term opportunities to expand market reach, especially in emerging regions with rising online adoption.

- For instance, Evercoat UROFILL 2.1 Acrylic Urethane Primer Surfacer use a mixing ratio of 4 parts primer to 1 part activator (2230), sprays with a 1.6-1.8 fluid nozzle, builds a dry film thickness of 1.5-2.0 mils per coat, and achieves coverage of 673 square feet per U.S. gallon at 1 mil dry film thickness.

Premiumization and Customization Demand

The market is witnessing a growing shift toward premium water-based enamels offering superior finish, durability, and eco-certifications. Consumers and businesses seek customized solutions tailored to specific applications, from industrial machinery to decorative furniture. This premiumization trend is supported by rising disposable incomes and growing awareness of long-term performance benefits. Manufacturers respond by launching specialized formulations with unique properties, such as anti-microbial coatings or UV resistance. These tailored products strengthen customer loyalty while opening new revenue streams in niche markets.

Key Challenges

Higher Production Costs Compared to Solvent-Based Products

One of the primary challenges in the water-based enamel market is the higher cost of production. Advanced formulations require specialized raw materials and R&D investments, which increase product prices compared to traditional solvent-based options. In price-sensitive regions, this cost disparity limits adoption and pushes consumers toward cheaper alternatives. Manufacturers face pressure to balance eco-friendly features with affordability to remain competitive. Without cost optimization strategies, penetration in emerging markets may remain restricted, slowing down broader acceptance of water-based enamels.

Performance Limitations in Extreme Environments

Despite improvements, water-based enamels still face performance challenges in certain extreme conditions. Applications involving high humidity, heavy abrasion, or intense chemical exposure sometimes favor solvent-based coatings. Industrial users may hesitate to fully transition due to concerns over durability and long-term resistance. These limitations create barriers in heavy-duty industries such as oil and gas or marine. To overcome this, continuous innovation and technology integration remain crucial. Addressing these performance gaps will determine how effectively water-based enamels can replace solvent-based counterparts in specialized sectors.

Regional Analysis

North America

North America holds a 32% share of the water-based enamel market, driven by stringent environmental regulations and strong demand from construction and automotive sectors. The U.S. leads the region, supported by rising adoption of eco-friendly coatings and government policies limiting VOC emissions. Renovation and DIY activities further accelerate product use in residential and commercial spaces. Canada contributes with growing infrastructure projects and green building initiatives. Leading manufacturers expand product portfolios with sustainable solutions, reinforcing market growth. High consumer preference for low-odor and durable finishes sustains the region’s competitive advantage in global adoption.

Europe

Europe accounts for 28% of the water-based enamel market, supported by strict environmental laws and a mature construction industry. Countries such as Germany, France, and the UK dominate usage due to strong automotive production and infrastructure modernization. EU directives favor low-VOC coatings, driving the shift from solvent-based to water-based formulations. Demand also rises in decorative and industrial applications, particularly in sustainable building projects. Growing emphasis on energy-efficient and eco-friendly materials strengthens the market position. Innovation in premium and customized enamel products continues to create new growth opportunities for European manufacturers.

Asia-Pacific

Asia-Pacific leads the global water-based enamel market with a 34% share, fueled by rapid industrialization and urbanization. China dominates regional demand with large-scale infrastructure projects, expanding automotive manufacturing, and rising consumer preference for sustainable coatings. India and Southeast Asian nations show strong growth potential due to booming construction activity and government investments in smart cities. Affordable pricing strategies and increased local manufacturing further enhance market penetration. Rising middle-class income and adoption of DIY projects support consumer applications. With expanding production capacities, Asia-Pacific remains the fastest-growing and most influential region for long-term market expansion.

Latin America

Latin America represents a 4% share of the water-based enamel market, with Brazil and Mexico leading regional adoption. Economic development and gradual infrastructure investments drive demand for eco-friendly coatings across residential and commercial construction. Brazil shows strong uptake due to its large consumer base and preference for sustainable products in urban centers. Mexico benefits from its automotive and manufacturing industries, which increasingly rely on low-VOC coatings. Limited awareness and cost barriers restrict wider adoption in smaller markets. However, e-commerce growth and local production expansion provide opportunities to strengthen regional market presence.

Middle East & Africa

The Middle East & Africa account for 2% of the water-based enamel market, driven by infrastructure development and rising consumer awareness. Gulf countries, including the UAE and Saudi Arabia, dominate with large-scale construction projects and strong demand for decorative finishes in residential and commercial spaces. South Africa and Nigeria show potential with increasing urbanization and rising middle-class populations. However, cost sensitivity and limited awareness of eco-friendly products pose challenges. Strategic partnerships with local distributors and government-backed green building initiatives provide future opportunities to expand the regional market footprint.

Market Segmentations:

By Product Type:

By Material Type:

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the water-based enamel market features key players including Franklin International, BASF SE, AkzoNobel N.V., Asian Paints, Sherwin-Williams, Nippon Paint, Dutch Boy Paint (Sherwin-Williams), Huber Group, The Dow Chemical Company (Dow Inc.), and Dulux. The competitive landscape of the water-based enamel market is defined by continuous innovation, sustainability initiatives, and strategic expansion. Companies are focusing on developing advanced formulations that deliver superior durability, faster drying times, and reduced environmental impact. The demand for eco-friendly, low-VOC products is reshaping portfolios, with manufacturers investing in R&D to meet regulatory standards and consumer expectations. Expanding distribution networks, both online and offline, enhances market reach and accessibility. Strategic partnerships and acquisitions strengthen regional footprints, while premiumization trends drive the launch of high-performance and customized solutions. This competitive environment fosters constant innovation and market differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Franklin International

- BASF SE

- AkzoNobel N.V.

- Asian Paints

- Sherwin-Williams

- Nippon Paint

- Dutch Boy Paint (Sherwin-Williams)

- Huber Group

- The Dow Chemical Company (Dow Inc.)

- Dulux

Recent Developments

- In December 2024, Shalimar Paints introduced the ‘Mela range’ of paints that combined affordability with durability. The company also launched the ‘Smart Bharat 2-in-1 Paint’ during an event in Thailand.

- In November 2024, Henkel Corporation partnered with Celanese Corporation to produce water-based adhesives from captured CO2 emissions. This collaboration opens new opportunities for customers in the packaging and consumer goods sectors, allowing them to increase the renewable content of their products by incorporating CO2 emissions into the production process.

- In February 2024, Kumar Mangalam Birla, Chairman of the Aditya Birla Group, launched the new decorative paint brand, Birla Opus, to achieve INR 10,000 crore in gross revenue within three years of full-scale operations.

- In April 2023, Nalgene revealed that it has switched its reusable bottle production process to Eastman’s Tritan Renew, a certified 50% recycled material using the mass balance technique of determination.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing adoption of eco-friendly coatings.

- Demand will rise from construction and infrastructure projects across developed and emerging economies.

- Advancements in resin technologies will enhance durability and performance of water-based enamels.

- Growth in automotive and industrial applications will strengthen market penetration.

- DIY and home improvement trends will boost sales in retail and e-commerce channels.

- Regulatory support for low-VOC products will accelerate the shift from solvent-based alternatives.

- Premium and customized enamel formulations will gain stronger consumer preference.

- Emerging economies in Asia-Pacific and Latin America will offer high growth opportunities.

- Strategic mergers and acquisitions will shape competitive positioning and market expansion.

- Digital sales platforms and virtual color simulation tools will drive consumer engagement.