Market Overview

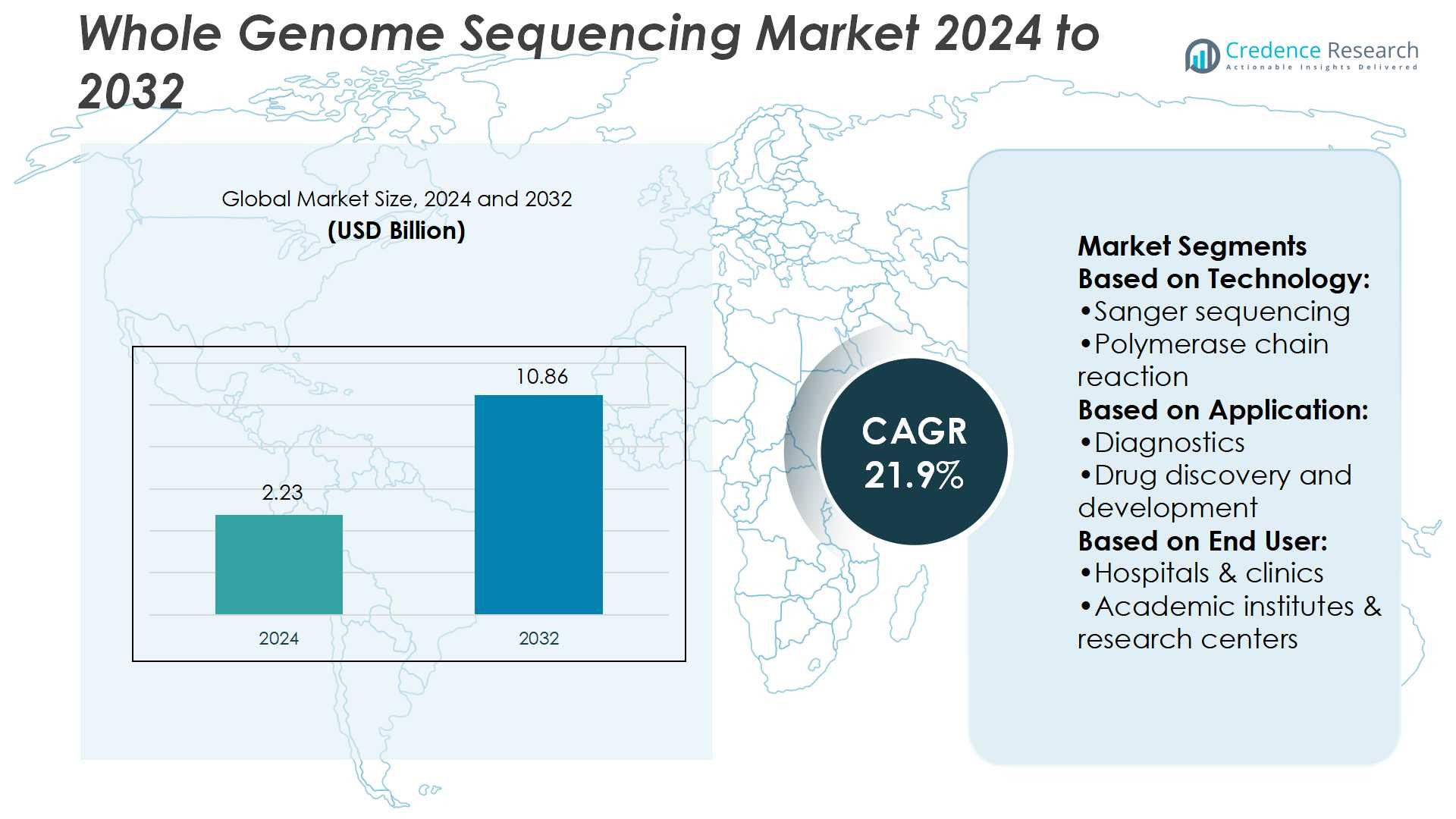

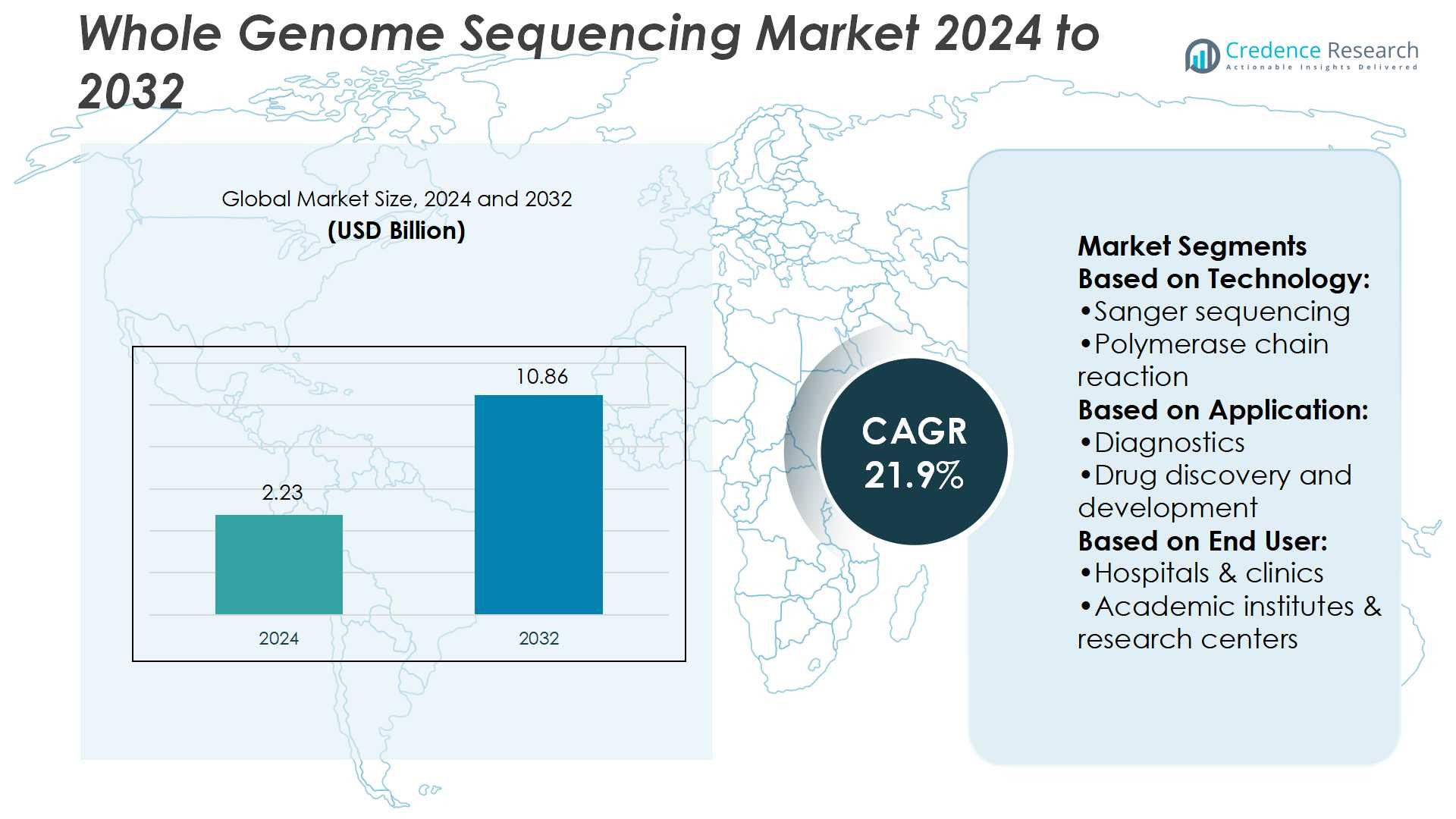

Whole Genome Sequencing Market size was valued USD 2.23 billion in 2024 and is anticipated to reach USD 10.86 billion by 2032, at a CAGR of 21.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Whole Genome Sequencing Market Size 2024 |

USD 2.23 Billion |

| Whole Genome Sequencing Market, CAGR |

21.9% |

| Whole Genome Sequencing Market Size 2032 |

USD 10.86 Billion |

The whole genome sequencing market features strong competition among major players such as Illumina, Inc., Thermo Fisher Scientific, Inc., Danaher Corporation, QIAGEN N.V., Merck KGaA, Eurofins Scientific, Siemens Healthineers, Macrogens, Inc., Bio-Rad Laboratories, Inc., and Agilent Technologies, Inc. These companies focus on advancing sequencing platforms, bioinformatics integration, and service expansion to strengthen global reach. Illumina and Thermo Fisher lead in high-throughput sequencing technologies, while Eurofins and Macrogens specialize in service-based genomics. Strategic investments, collaborations, and acquisitions remain central to market growth. North America emerges as the leading region, holding a 38% market share in 2024, supported by advanced healthcare infrastructure, large-scale genomics initiatives, and early adoption of precision medicine.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The whole genome sequencing market size was USD 2.23 billion in 2024 and is projected to reach USD 10.86 billion by 2032, growing at a CAGR of 21.9% during the forecast period.

- Rising demand for precision medicine and integration of sequencing in oncology and rare disease diagnostics drive strong market growth, supported by declining costs and expanding clinical applications.

- Increasing adoption of AI-driven bioinformatics and cloud-based platforms for genomic data analysis marks a key trend, while large-scale population genomics initiatives enhance long-term opportunities.

- The market is highly competitive, with Illumina, Thermo Fisher, Danaher, QIAGEN, Merck KGaA, Eurofins, Siemens Healthineers, Macrogens, Bio-Rad, and Agilent Technologies focusing on innovation, service expansion, and strategic collaborations.

- North America leads with a 38% market share in 2024, driven by advanced infrastructure and genomics programs, while next-generation sequencing dominates the technology segment, holding the largest share due to its high throughput and efficiency.

Market Segmentation Analysis:

By Technology

Next-generation sequencing (NGS) dominates the whole genome sequencing market with the largest share. Its ability to deliver high-throughput, cost-efficient, and precise genomic data positions it as the leading technology. NGS supports broad clinical and research applications, driving demand from diagnostics to drug discovery. Continuous improvements in sequencing speed, scalability, and analytical tools further strengthen adoption. In contrast, traditional methods such as Sanger sequencing and PCR maintain niche use in validation and targeted analysis, but the efficiency of NGS remains the primary growth driver.

- For instance, QIAGEN N.V. expanded its sequencing solutions with the QIAseq Multimodal Panels, which combine DNA and RNA analysis in a single workflow. These panels provide more than 95% uniformity across target regions.

By Application

Diagnostics holds the largest share in applications, driven by the growing role of genomics in personalized healthcare. Whole genome sequencing enables early detection of genetic disorders, cancer profiling, and infectious disease monitoring. Precision medicine and targeted therapies increasingly rely on genomic insights, which reinforces adoption in diagnostics. While drug discovery and precision medicine also record steady uptake, the demand for timely, accurate, and actionable diagnostic insights ensures this segment’s continued leadership, supported by hospitals and testing centers adopting sequencing for routine clinical use.

- For instance, Eurofins offers a human whole genome sequencing (WGS) service using Illumina NovaSeq 6000 or Xplus with paired-end 2×150 base-pair reads, delivering approximately 90 gigabases raw data per sample for 30× coverage.

By End-user

Hospitals and clinics represent the dominant end-user segment, holding the highest share in the market. Their leadership stems from rising integration of genomic sequencing in patient care, particularly for oncology and rare diseases. Clinical demand for actionable results and growing partnerships with sequencing technology providers drive this segment’s strength. Academic institutes and research centers follow, supported by government funding and collaborations, while pharmaceutical and biotechnology companies leverage sequencing for drug pipelines. However, the consistent clinical demand in hospitals ensures their continued dominance in adoption and utilization.

Key Growth Drivers

Rising Demand for Precision Medicine

The growing emphasis on precision medicine is a major driver of the whole genome sequencing market. Healthcare providers increasingly use sequencing to tailor treatment plans, particularly in oncology and rare genetic disorders. Whole genome sequencing offers insights into gene mutations, treatment response, and disease progression, enabling more effective and individualized therapies. Expanding applications in pharmacogenomics further strengthen its relevance in clinical care. The shift toward patient-centric treatment, combined with falling sequencing costs, ensures rapid adoption across healthcare systems worldwide.

- For instance, Illumina’s Cell-Free DNA Prep with Enrichment workflow can be combined with a custom 79-gene solid tumor panel. This workflow detects somatic mutations down to 0.2% variant allele frequency (VAF) in cfDNA samples.

Expanding Applications in Drug Discovery and Development

Pharmaceutical and biotechnology companies are adopting whole genome sequencing to accelerate drug discovery and development. Sequencing supports identification of novel drug targets, validation of biomarkers, and optimization of clinical trial designs. By enabling comprehensive genetic profiling, it reduces risks in drug pipelines and enhances success rates. Additionally, integration with bioinformatics and artificial intelligence allows faster analysis of large datasets. Growing demand for targeted therapies and biologics reinforces the importance of sequencing in research pipelines, driving strong investments from industry players.

- For instance, Macrogen processes over 300,000 genomes per year across its analytical infrastructure, serving more than 18,000 research institutes in 153 countries, which supports large-scale variant discovery in drug pipelines.

Declining Cost of Sequencing Technologies

The continuous decline in sequencing costs plays a crucial role in market growth. Next-generation sequencing platforms have significantly reduced per-genome costs, making whole genome sequencing more accessible for clinical and research use. Affordable sequencing drives adoption in routine diagnostics, population genomics, and academic research. Manufacturers are also introducing portable and automated platforms that reduce operational expenses. This affordability expands the market beyond high-end laboratories to hospitals and smaller institutions, accelerating adoption across developed and emerging regions. Lower cost barriers ensure long-term market sustainability.

Key Trends & Opportunities

Integration of Artificial Intelligence and Bioinformatics

Artificial intelligence (AI) and advanced bioinformatics tools are transforming the whole genome sequencing market. AI-driven platforms improve speed and accuracy in interpreting large genomic datasets, enabling more precise clinical insights. Integration with cloud computing allows real-time data analysis, facilitating rapid decision-making in diagnostics and research. Companies are investing heavily in AI-based genomic interpretation platforms to enhance scalability. This trend creates opportunities for providers to deliver comprehensive and efficient solutions, addressing the growing complexity of genomic data while strengthening their competitive edge.

- For instance, The ChAS + Franklin system taps into a knowledge base with more than 350,000 shared variant classifications, enabling phenotype matching, literature-supported evidence, and ACMG classification integration.

Expansion of Population Genomics Initiatives

Governments and research organizations are investing in large-scale population genomics projects, creating strong opportunities for the market. These initiatives aim to sequence millions of genomes to understand genetic diversity, disease risks, and drug responses. Such programs provide valuable datasets for pharmaceutical research, personalized medicine, and public health strategies. Countries including the U.S., U.K., and China have launched national sequencing programs, encouraging further adoption. The rise of these initiatives boosts demand for advanced sequencing platforms, data storage, and analytics, opening long-term growth avenues.

- For instance, Agilent’s Avida hybrid-capture technology is designed to capture target molecules using input DNA, typically ranging from 10 ng upwards, and is compatible with both genomic DNA and cell-free DNA.

Key Challenges

Data Storage and Interpretation Complexity

The vast amount of data generated by whole genome sequencing poses a major challenge. Storing, securing, and managing terabytes of genomic data requires advanced infrastructure and high costs. Moreover, interpreting complex datasets demands skilled professionals and robust bioinformatics pipelines, which are often lacking in developing regions. These limitations slow clinical adoption and add to operational challenges for hospitals and laboratories. Without standardized frameworks for data handling, scalability and efficiency remain constrained, creating barriers for widespread implementation in healthcare systems.

Regulatory and Ethical Concerns

Regulatory hurdles and ethical issues present significant challenges in the whole genome sequencing market. Genomic data is highly sensitive, raising privacy concerns related to storage, sharing, and use. Lack of harmonized global regulations complicates international collaborations and commercialization. Additionally, ethical debates regarding patient consent, genetic discrimination, and potential misuse of data continue to grow. These factors create uncertainty for stakeholders, slowing adoption in clinical applications. Addressing these concerns through robust regulatory frameworks and transparent governance will be critical for sustainable market expansion.

Regional Analysis

North America

North America leads the whole genome sequencing market with a 38% share in 2024, supported by advanced healthcare infrastructure and strong adoption in precision medicine. The U.S. drives regional growth with extensive research funding, large-scale genomics initiatives, and integration of sequencing into clinical diagnostics. Favorable reimbursement policies and the presence of major sequencing companies further strengthen market dominance. Canada also contributes with population genomics projects and research collaborations. The region benefits from early adoption of AI and bioinformatics, reinforcing its position as the global hub for genomic innovation and commercialization of sequencing technologies.

Europe

Europe accounts for 29% of the whole genome sequencing market in 2024, driven by strong government funding and population-scale genomics projects. The U.K. leads with its 100,000 Genomes Project and expanding initiatives in rare disease research. Germany and France contribute through rising adoption in hospitals and collaborations with pharmaceutical companies. The European Union’s focus on data protection and ethical frameworks enhances patient confidence, supporting broader adoption. Increasing demand for precision medicine, coupled with a well-established academic research base, positions Europe as a key growth center for whole genome sequencing technologies across healthcare and life sciences.

Asia-Pacific

Asia-Pacific holds a 23% share in the whole genome sequencing market in 2024, with rapid growth driven by China, Japan, and India. Government-backed genomic programs and investments in healthcare modernization fuel adoption. China’s national genomics initiatives and growing sequencing capacity position it as a regional leader. Japan advances integration of sequencing in oncology and precision medicine, while India sees rising uptake in research institutes and clinical diagnostics. Expanding biotechnology hubs, growing healthcare expenditure, and increasing partnerships with global companies make Asia-Pacific the fastest-growing region, creating strong opportunities for sequencing technology providers and service companies.

Latin America

Latin America represents a 6% share in the whole genome sequencing market in 2024, supported by increasing adoption in Brazil, Mexico, and Argentina. Research collaborations, improving healthcare infrastructure, and government-backed genomics initiatives strengthen growth prospects. Brazil leads regional adoption with genomic medicine programs and cancer research projects. However, high costs and limited skilled workforce pose challenges for broader implementation. Growing partnerships with international companies and expanding private healthcare investments are driving sequencing accessibility. The region’s focus on addressing rare diseases and infectious disease surveillance enhances demand for sequencing technologies across both clinical and academic applications.

Middle East & Africa

The Middle East & Africa region holds a 4% share in the whole genome sequencing market in 2024, with growth concentrated in Gulf countries and South Africa. The UAE and Saudi Arabia are investing in national genome programs to advance precision medicine and diversify healthcare systems. South Africa contributes through research on genetic diversity and infectious diseases. Despite limited infrastructure in many parts of the region, international collaborations and rising private healthcare investments support market development. Growing awareness of genomic healthcare benefits and government-backed initiatives are expected to gradually expand sequencing adoption in this region.

Market Segmentations:

By Technology:

- Sanger sequencing

- Polymerase chain reaction

By Application:

- Diagnostics

- Drug discovery and development

By End User:

- Hospitals & clinics

- Academic institutes & research centers

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The whole genome sequencing market is highly competitive, with leading players including QIAGEN N.V., Eurofins Scientific, Illumina, Inc., Macrogens, Inc., Thermo Fisher Scientific, Inc., Merck KGaA, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Siemens Healthineers, and Danaher Corporation. The whole genome sequencing market is characterized by intense competition, rapid technological innovation, and growing strategic collaborations. Companies are investing heavily in next-generation sequencing platforms, bioinformatics tools, and integrated diagnostics to enhance accuracy, speed, and affordability. Continuous advancements in high-throughput sequencing, automation, and cloud-based data analysis are reshaping clinical and research applications. Market participants focus on expanding their global footprint through partnerships, mergers, and acquisitions, while also targeting emerging economies with rising healthcare investments. Increasing demand for precision medicine, drug discovery, and large-scale genomics projects further fuels competition, driving continuous innovation and portfolio diversification across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- QIAGEN N.V.

- Eurofins Scientific

- Illumina, Inc

- Macrogens, Inc

- Thermo Fisher Scientific, Inc

- Merck KGaA

- Agilent Technologies, Inc

- Bio-Rad Laboratories, Inc

- Siemens Healthineers

- Danaher Corporation

Recent Developments

- In May 2025, Twist Bioscience and Ginkgo Bioworks revised their collaboration agreement, transitioning from a four-year contract signed in 2022 to a three-year arrangement. Under the new terms, Ginkgo will continue to prepay annually for Twist’s synthetic DNA products, with no minimum purchase volume required.

- In March 2025, Integrated DNA Technologies (IDT) and Elegen announced a strategic partnership to enhance long DNA synthesis capabilities. Through this collaboration, IDT customers gained early access to Elegen’s ENFINIA Plasmid DNA service, enabling rapid delivery of high-complexity clonal genes ranging from 5 kb to 15 kb.

- In Nov 2024, Ansa biotechnologies sets a new standard in long, complex DNA. A technology pairs with groundbreaking complex DNA synthesis platform. Ansa’s enzymatic idea has eliminated the need for harsh chemicals.

- In June 2024, GenScript Biotech Corporation introduced its FLASH Gene service, an ultra-fast sequence-to-plasmid (S2P) solution designed to expedite gene synthesis. This service delivers gene constructs in four business days, making it the fastest in the industry.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Whole genome sequencing will gain wider adoption in routine clinical diagnostics.

- Precision medicine will remain the strongest driver of sequencing applications.

- Population genomics projects will expand across developed and emerging economies.

- Declining sequencing costs will improve accessibility in hospitals and research centers.

- AI-driven bioinformatics will enhance accuracy and speed of genomic data interpretation.

- Integration with cloud platforms will support real-time analysis and large-scale collaborations.

- Pharmaceutical companies will increase reliance on sequencing for drug discovery pipelines.

- Ethical and regulatory frameworks will evolve to address privacy and consent concerns.

- Emerging markets will invest more in genomics infrastructure and national sequencing programs.

- Strategic collaborations and acquisitions will intensify to strengthen technological capabilities.