Market Overview:

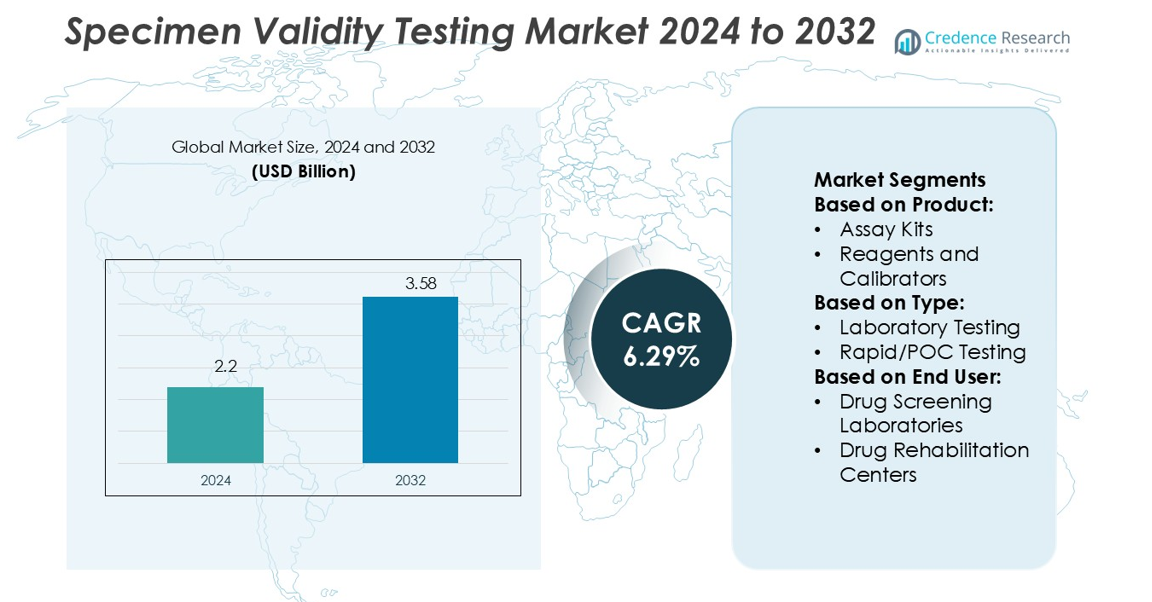

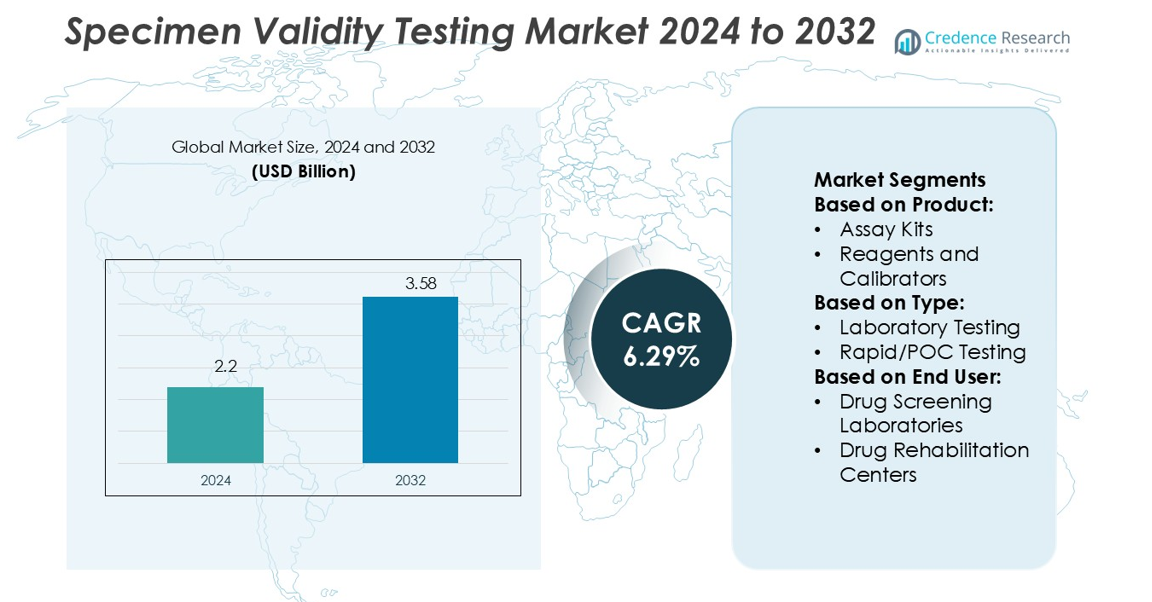

Specimen Validity Testing Market size was valued USD 2.2 billion in 2024 and is anticipated to reach USD 3.58 billion by 2032, at a CAGR of 6.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specimen Validity Testing Market Size 2024 |

USD 2.2 billion |

| Specimen Validity Testing Market, CAGR |

6.29% |

| Specimen Validity Testing Market Size 2032 |

USD 3.58 billion |

The specimen validity testing market is shaped by prominent players such as Abbott Laboratories, Danaher Corporation, LabCorp, ACM Global Laboratories, Express Diagnostics, Premier Biotech, Inc., Alfa Scientific Designs, Inc., Genway Biotech, Inc., American Bio Medica Corporation, and GenomeWeb LLC. These companies strengthen competitiveness through advanced assay kits, rapid testing solutions, and large-scale laboratory networks. They focus on technological innovation, regulatory compliance, and strategic collaborations to expand their reach across healthcare and workplace testing programs. North America leads the global specimen validity testing market with a 41% share, supported by strict regulatory mandates, extensive workplace drug testing adoption, and well-established diagnostic infrastructure. This leadership reinforces the region’s position as the key hub for sustained growth and innovation.

Market Insights

- The Specimen Validity Testing Market size was valued at USD 2.2 billion in 2024 and is projected to reach USD 3.58 billion by 2032, growing at a CAGR of 6.29%.

- Rising workplace drug testing programs and strict regulatory compliance are key drivers boosting adoption of assay kits and laboratory-based testing, which currently holds a 59% share.

- Automation, rapid point-of-care testing, and integration of digital reporting systems are major trends shaping efficiency, accuracy, and accessibility in the market.

- The market faces restraints from high costs of advanced testing systems and concerns over false negatives, which challenge smaller clinics and raise accuracy demands.

- North America leads with a 41% regional share, supported by strong regulations and infrastructure, while Europe holds 28% and Asia Pacific accounts for 21%, reflecting growing adoption across rehabilitation centers, drug screening laboratories, and healthcare facilities worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Assay kits lead the specimen validity testing market with a 46% share, driven by their reliability, ease of use, and strong adoption in both clinical and non-clinical settings. These kits streamline testing procedures and deliver rapid, accurate results, making them essential for drug screening programs. Reagents and calibrators support kit performance, while disposables contribute to recurring revenue streams for suppliers. Services play a role in outsourced testing but remain secondary. The demand for assay kits continues to grow as organizations seek standardized solutions to meet regulatory requirements and ensure sample integrity.

- For instance, Express Diagnostics offers the DrugCheck® Dip Drug Test, which can detect up to 14 drugs and/or adulterants in a single test. The test provides rapid results in 5 minutes, making it suitable for high-volume workplace and clinical testing programs.

By Type

Laboratory testing dominates with a 59% share, supported by its accuracy, advanced technology adoption, and ability to handle high sample volumes. Centralized laboratories rely on validated protocols, offering robust results that comply with industry standards. Rapid or point-of-care (POC) testing is gaining traction due to convenience, but its scope remains limited to field or preliminary screenings. Laboratory testing maintains leadership because regulatory agencies prioritize certified testing environments and advanced instrumentation for sensitive cases. The segment benefits from increasing workplace drug screening programs and mandatory compliance testing across multiple industries.

- For instance, Alfa Scientific Designs offers the Instant-View® Multi-Drug Urine Test Cup, which can screen for up to 14 drug classes and/or adulterants in a single test. The test provides rapid results in minutes and can be configured with built-in adulterant testing to ensure specimen validity.

By End-user

Drug screening laboratories hold a 48% share, making them the leading end-user segment due to large-scale testing contracts with employers, law enforcement agencies, and healthcare institutions. These facilities demand accuracy, efficiency, and validated technologies, which drive continuous investment in automated systems. Drug rehabilitation centers also show steady growth as they rely on specimen validity testing to support patient monitoring and treatment adherence. Pain management centers and other facilities contribute smaller shares but add diversity in demand. The strong dominance of drug screening laboratories reflects the market’s reliance on high-throughput and certified testing services.

Market Overview

Rising Workplace Drug Testing Programs

The growth of workplace drug testing programs drives demand in the specimen validity testing market. Employers across industries increasingly enforce drug-free policies to enhance safety, productivity, and compliance with federal regulations. This trend fuels adoption of advanced validity testing methods to prevent sample tampering and ensure accurate results. Large organizations and transportation firms in particular implement rigorous testing protocols. The consistent expansion of workplace testing initiatives strengthens the role of specimen validity testing as a critical tool in workforce management.

- For instance, The SCIEX QTRAP 4500 LC-MS/MS system is an advanced redesign of the API 4000 platform, featuring a Turbo V ion source and rapid polarity switching. In full-scan MS/MS mode.

Increasing Regulatory Compliance Requirements

Stringent government regulations act as a major driver for the specimen validity testing market. Agencies such as the U.S. Department of Transportation mandate comprehensive drug testing protocols, including validity testing, to ensure compliance. These rules push laboratories and healthcare providers to integrate reliable testing solutions. Regulatory bodies emphasize accuracy and sample integrity, making tamper-detection essential in drug screening. Growing adoption of compliance-driven testing across industries, combined with evolving legal frameworks, directly contributes to market expansion and sustained demand for advanced testing solutions.

- For instance, LabCorp’s SVT panel flags specimens with nitrite levels ≥ 200 mg/mL and those ≥ 500 mg/mL. Its panel checks creatinine, pH, and specific gravity (when creatinine < 20 mg/dL) to detect dilution or substitution.

Technological Advancements in Testing Solutions

Innovations in assay kits, automated analyzers, and point-of-care testing solutions enhance accuracy and efficiency in specimen validity testing. Companies invest heavily in R&D to create faster, user-friendly tools capable of detecting adulterants and substitution with high precision. The integration of digital reporting systems further improves result tracking and compliance management. These advancements reduce operator dependency while meeting the demand for high-throughput capabilities. The availability of technologically advanced kits and instruments ensures laboratories and employers can maintain reliable drug screening practices, reinforcing overall market growth.

Key Trends & Opportunities

Growing Adoption of Rapid and POC Testing

Rapid and point-of-care testing represents a growing trend in the specimen validity testing market. Organizations increasingly favor portable solutions that deliver immediate results in on-site environments, such as rehabilitation centers and field operations. This adoption supports faster decision-making, particularly for initial screenings where quick insights are essential. The development of compact, reliable kits creates opportunities for companies to capture new market segments. Expanding accessibility in remote or resource-limited settings strengthens the case for rapid testing as an emerging growth opportunity.

- For instance, DoseTrac® software helped achieve sustained 100% drug library compliance across its six intensive care units (ICUs) after targeted interventions and staff training.

Integration of Digital and Automated Systems

Automation and digital integration are reshaping specimen validity testing by improving efficiency and reliability. Laboratories increasingly adopt automated analyzers and digital reporting platforms to reduce manual errors and improve workflow. Cloud-based result management and electronic data exchange support compliance tracking and enhance transparency for stakeholders. This trend presents opportunities for manufacturers to expand offerings with integrated solutions that combine hardware, software, and connectivity. As industries demand faster, standardized testing processes, the adoption of automation becomes a key opportunity for sustained growth.

- For instance, CooperSurgical’s PGT-A with PTA (Primary Template‐directed Amplification) uses two analyses (CNV + SNP) to assess embryos. The PGTai platform drives an improvement of over 13% increase in ongoing pregnancy and live birth rates vs standard PGT-A.

Key Challenges

High Cost of Advanced Testing Solutions

The adoption of advanced validity testing technologies faces challenges due to high costs. Assay kits, automated analyzers, and integrated digital platforms often require significant upfront investments, limiting accessibility for smaller clinics or rehabilitation centers. Maintenance and calibration add further expenses, making affordability a concern. While large laboratories can absorb these costs, smaller end-users may struggle, slowing widespread adoption. The financial barrier restricts market penetration in cost-sensitive regions, creating a challenge for companies aiming to expand their customer base globally.

Risk of False Negatives and Accuracy Concerns

Accuracy remains a critical challenge in the specimen validity testing market. Despite advancements, risks of false negatives or undetected adulteration can compromise trust in results. Evolving adulteration methods make detection increasingly complex, requiring constant innovation in testing technology. Laboratories must balance speed with reliability, as rapid tests sometimes trade accuracy for convenience. Inconsistent results erode confidence among employers, regulators, and healthcare providers. Addressing these accuracy concerns is essential for market players to maintain credibility and sustain adoption across diverse end-user segments.

Regional Analysis

North America

North America leads the specimen validity testing market with a 41% share, driven by stringent regulatory mandates and the widespread adoption of workplace drug testing programs. The U.S. Department of Transportation and other agencies enforce strict compliance measures, boosting demand for advanced validity testing solutions. The region benefits from strong investment in laboratory infrastructure and the presence of major diagnostic companies. Canada also contributes steadily with healthcare-driven testing adoption. The market’s growth is reinforced by technological advancements, high awareness levels, and consistent demand from employers and law enforcement agencies across the region.

Europe

Europe holds a 28% share of the specimen validity testing market, supported by structured workplace policies and the adoption of advanced laboratory testing systems. Countries such as Germany, the U.K., and France drive demand through government-backed drug screening programs and private-sector compliance requirements. The growing role of rehabilitation centers and pain management facilities also boosts adoption. Europe emphasizes certified laboratory testing, ensuring accuracy and regulatory adherence. The integration of automated systems across laboratories further accelerates market expansion. Strong healthcare infrastructure and cross-industry drug-free initiatives strengthen the region’s position in the global market.

Asia Pacific

Asia Pacific accounts for a 21% share of the specimen validity testing market, supported by growing industrialization and workplace safety initiatives. Countries such as China, Japan, and India are adopting more structured drug testing frameworks in response to rising substance abuse concerns. Expanding healthcare infrastructure and increasing investment in laboratory facilities enhance adoption. The region also benefits from the rising demand for rapid and cost-effective testing solutions, particularly in resource-limited settings. Government efforts to address public health challenges create opportunities for specimen validity testing, driving strong growth prospects across diverse end-user segments.

Latin America

Latin America represents a 6% share of the specimen validity testing market, driven by gradual adoption of drug testing programs in workplaces and healthcare institutions. Brazil and Mexico lead the regional demand, supported by regulatory reforms and efforts to curb substance abuse. While laboratory-based testing dominates, rapid testing is gaining traction in community and rehabilitation settings. Limited infrastructure in some countries restrains wider adoption, but increasing private sector investment in diagnostics strengthens growth. Rising awareness among employers and government initiatives to standardize drug testing procedures provide a foundation for further market expansion.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the specimen validity testing market, with growth concentrated in the Gulf countries and South Africa. Expanding healthcare investments and workplace safety initiatives support adoption in these markets. While infrastructure challenges remain in certain parts of Africa, increasing partnerships with international diagnostic providers enhance accessibility. Governments and private organizations are gradually adopting drug screening programs, particularly in transportation and public safety sectors. The demand for portable and cost-efficient testing solutions further supports adoption, although the region continues to lag behind developed markets in overall penetration.

Market Segmentations:

By Product:

- Assay Kits

- Reagents and Calibrators

By Type:

- Laboratory Testing

- Rapid/POC Testing

By End User:

- Drug Screening Laboratories

- Drug Rehabilitation Centers

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The specimen validity testing market features strong competition with key players including Express Diagnostics, Premier Biotech, Inc., GenomeWeb LLC., Alfa Scientific Designs, Inc., Abbott Laboratories, Genway Biotech, Inc., Danaher Corporation, LabCorp, ACM Global Laboratories, and American Bio Medica Corporation. The specimen validity testing market is highly competitive, shaped by continuous innovation, regulatory compliance, and evolving customer needs. Companies in this space focus on delivering accurate, efficient, and cost-effective testing solutions to address growing demand from drug screening laboratories, rehabilitation centers, and workplace testing programs. Advanced assay kits, automated analyzers, and rapid testing devices strengthen product portfolios and support diverse applications. Strategic investments in research and development enable the introduction of more reliable and user-friendly solutions. Partnerships with healthcare providers and compliance with stringent regulations further enhance market credibility. Increasing adoption of digital systems, automation, and cloud-based result management also fosters differentiation, positioning companies to capture larger market shares.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, The U.S. Department of Health and Human Services updated Mandatory Guidelines, adding fentanyl and norfentanyl while removing MDMA and MDA, compelling laboratories to adjust validity workflows Federal Register.

- In November 2024, Capitainer launched Capitainer SEP10 collection card which allows users to separate cells from plasma at the site of collection without centrifugation. The product will be available in the U.S., and the European Union.

- In June 2024, Shenzhen Mindray Bio-Medical Electronics Co., Ltd, a key industry player, attended the European Association for Endoscopic Surgery International Congress and revealed its minimally invasive surgical solutions, including a complete range of disposable and reusable surgical instruments.

- In March 2023, Healgen Scientific LLC acquired a New York-based office complex and the 25,000-square-foot factory of American Bio Medica for USD 3 million. This acquisition is expected to drive market growth

Report Coverage

The research report offers an in-depth analysis based on Product, Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with stronger enforcement of workplace drug testing programs.

- Demand for rapid and point-of-care testing will rise in rehabilitation and clinical settings.

- Automation and digital reporting tools will enhance efficiency and reduce human error.

- Regulatory compliance will continue to drive adoption of advanced validity testing methods.

- Integration of AI-based detection systems will improve accuracy against evolving adulteration techniques.

- Laboratory networks will invest in high-throughput systems to manage larger sample volumes.

- Portable and cost-effective kits will gain traction in emerging and resource-limited regions.

- Partnerships between diagnostic firms and healthcare providers will strengthen service reach.

- R&D investment will focus on innovative assay kits with enhanced sensitivity.

- Growing awareness of substance abuse risks will sustain long-term demand for validity testing.