Market Overview:

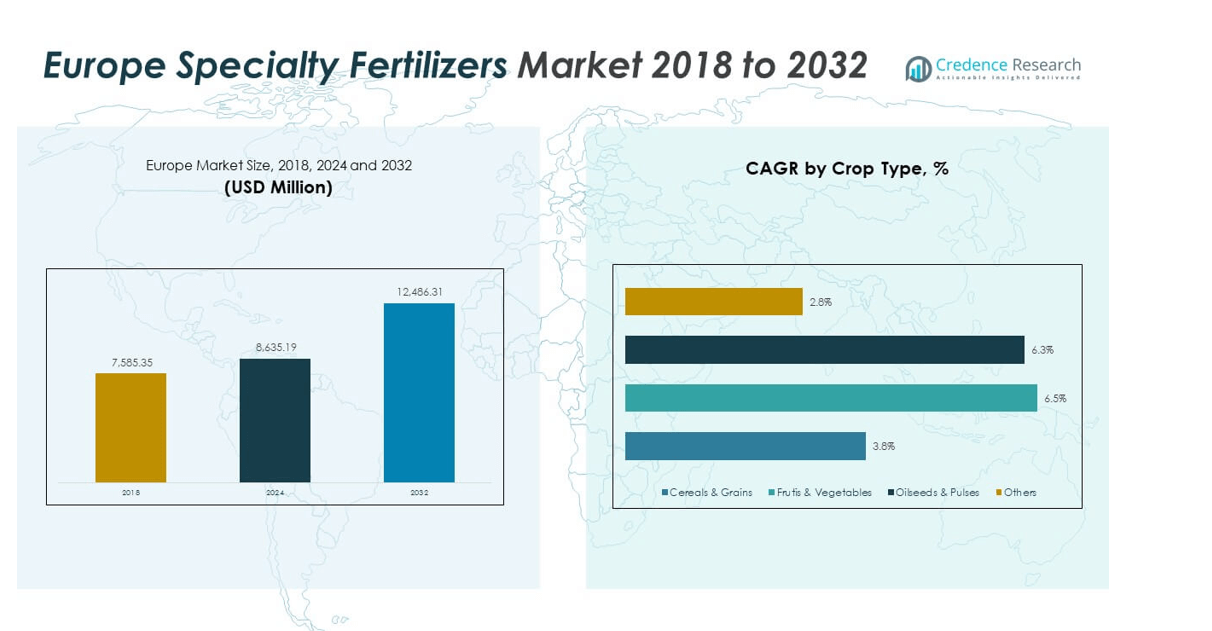

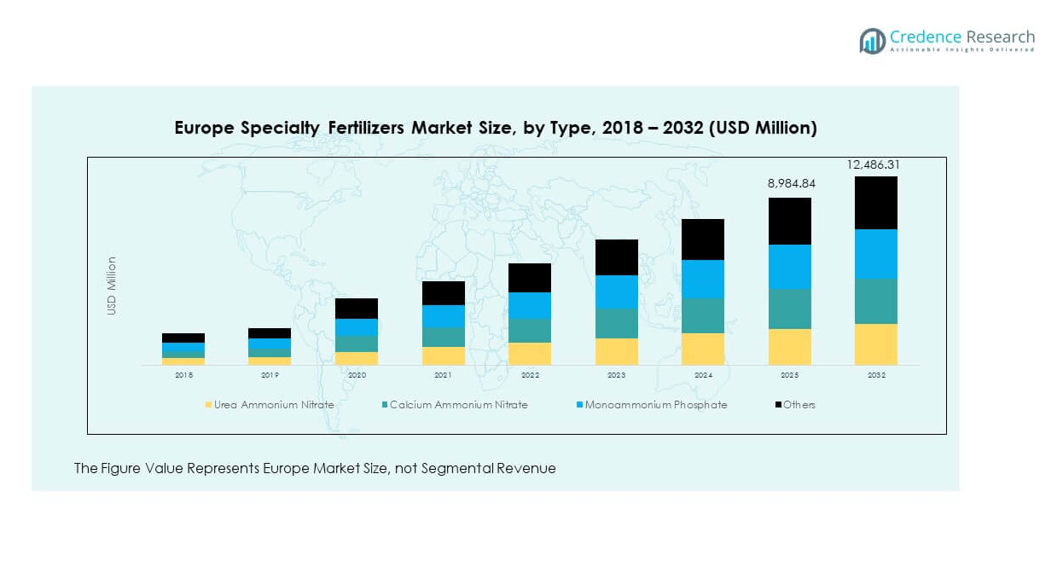

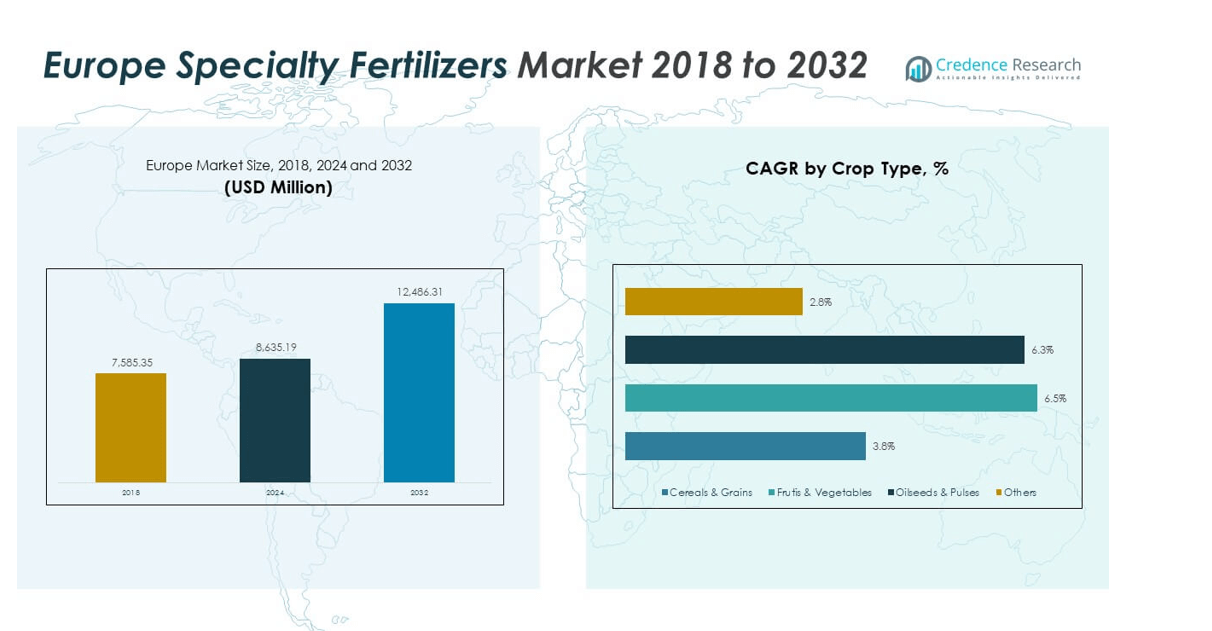

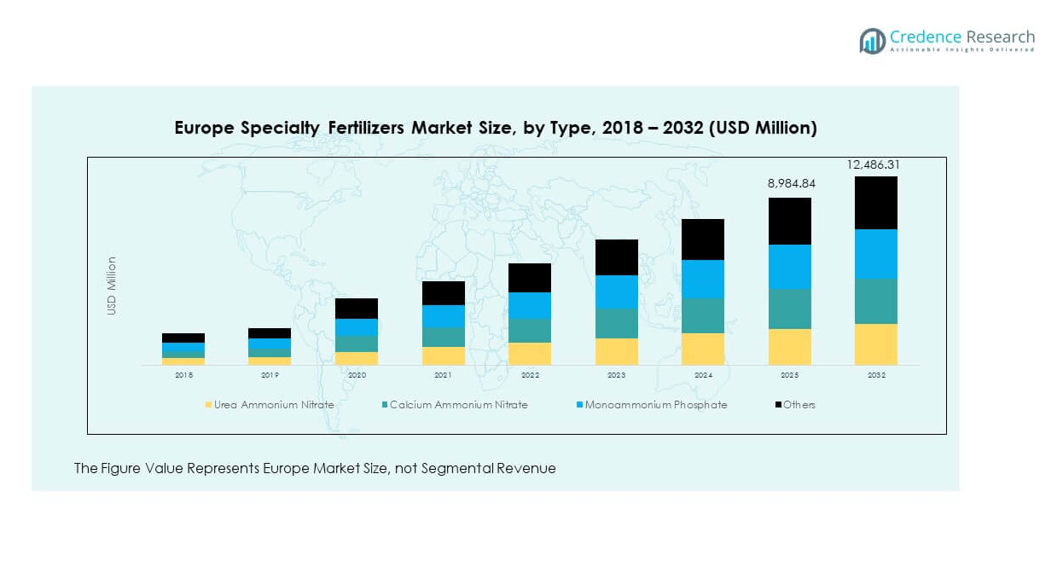

The Europe Specialty Fertilizers Market size was valued at USD 7,585.35 million in 2018 to USD 8,635.19 million in 2024 and is anticipated to reach USD 12,486.31 million by 2032, at a CAGR of 4.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Specialty Fertilizers Market Size 2024 |

USD 8,635.19 million |

| Europe Specialty Fertilizers Market, CAGR |

4.67% |

| Europe Specialty Fertilizers Market Size 2032 |

USD 12,486.31 million |

Growth in the Europe Specialty Fertilizers Market is fueled by increasing adoption of precision agriculture, demand for sustainable farming practices, and stricter EU environmental regulations. Farmers seek products that minimize nutrient loss and enhance soil health while supporting higher yields. Controlled-release, water-soluble, and micronutrient-enriched fertilizers are gaining prominence as they align with both productivity and ecological goals. Consumer demand for high-quality produce and the push for lower emissions further encourage adoption.

Regionally, Western Europe leads the Europe Specialty Fertilizers Market, with strong uptake in Germany, France, and the Netherlands, supported by advanced farming systems and sustainability initiatives. Southern Europe, including Italy and Spain, records notable demand from vineyards, orchards, and horticulture. Eastern Europe emerges as a growth frontier, with modernization of agriculture and government-backed reforms accelerating adoption. Northern Europe maintains steady demand, with focus on compliance and environmentally safe practices. This mix of established and emerging regions underpins the market’s diverse growth landscape.

Market Insights

- The Europe Specialty Fertilizers Market was valued at USD 7,585.35 million in 2018, reached USD 8,635.19 million in 2024, and is forecast to reach USD 12,486.31 million by 2032, growing at a CAGR of 4.67%.

- Western Europe holds 42% share, followed by Southern Europe with 28% and Eastern & Northern Europe together at 30%, driven by strong infrastructure, crop diversity, and sustainability mandates.

- Eastern Europe is the fastest-growing region with 18% share, fueled by modernization programs, subsidies, and rising adoption in cereals and oilseeds.

- Urea Ammonium Nitrate accounts for 26% share of type segments, reflecting its broad use in precision and intensive farming.

- Calcium Ammonium Nitrate contributes 22% share, supporting balanced nutrition across horticultural and field crop cultivation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Precision Farming and Controlled Nutrient Application

Farmers in Europe are shifting toward precision farming techniques that focus on crop-specific nutrient delivery. Controlled-release and water-soluble fertilizers ensure optimal absorption of essential elements by crops. This approach minimizes nutrient losses while improving soil health over time. The Europe Specialty Fertilizers Market benefits from these shifts due to strict EU regulations on nitrate and phosphorus runoff. It supports farmers aiming to comply with sustainability mandates and environmental protection policies. Adoption grows stronger in high-value crop cultivation such as fruits, vegetables, and vineyards. Demand also rises as advanced irrigation systems become integrated into farms. The need for higher yields within limited land drives wider adoption.

Sustainability Goals Driving Reduced Environmental Impact in Fertilizer Application

Sustainability regulations across Europe create a direct push for specialized fertilizers that lower emissions. It enables farmers to align agricultural practices with EU Green Deal objectives. These fertilizers reduce nitrogen leaching and greenhouse gas emissions compared to conventional ones. Governments and policymakers encourage adoption through targeted programs and farm subsidies. The Europe Specialty Fertilizers Market experiences strong support from policy-driven incentives. Demand is fueled by consumer pressure for eco-friendly food production and transparent supply chains. Agribusiness firms also invest in sustainable fertilizer technologies to meet evolving requirements. The market’s expansion reflects the broader focus on climate-resilient farming practices.

Growing Shift Toward High-Value Crops and Quality Yield Optimization

Specialty fertilizers play a critical role in high-value crop production. Horticulture, viticulture, and greenhouse cultivation require targeted nutrient delivery for quality output. It ensures consistent yields with desired crop characteristics across different seasons. Farmers adopt these fertilizers to meet export quality standards and improve profitability. The Europe Specialty Fertilizers Market gains momentum in countries with significant horticulture output. Germany, France, and Italy demonstrate strong demand across vineyards and fresh produce farming. Higher quality output aligns with consumer expectations of premium food products. Investment in research and adoption by commercial farms reinforce this trend.

- For instance, Haifa Group’s Poly-Feed™water-soluble NPK fertilizers, used in greenhouse tomato production across Europe, are formulated for targeted nutrient delivery. Official documentation reports a target yield of 160 MT/ha for tomatoes in greenhouse soil and up to 70 MT/ha for open field cultivation when used under optimal Nutrigation™ protocols, as stated in Haifa’s agronomic recommendations.

Technological Advancement in Smart Fertilizer Application Systems

Integration of digital monitoring and automation accelerates adoption of specialty fertilizers. Smart technologies allow real-time nutrient tracking and controlled fertilizer release. It ensures efficient use of resources while lowering production costs for farmers. Companies develop advanced formulations compatible with precision farming tools and drones. The Europe Specialty Fertilizers Market benefits from strong collaboration between agri-tech firms and fertilizer producers. Farmers are encouraged to embrace technology through government-backed digital farming initiatives. The adoption of IoT-enabled systems makes nutrient management more accurate and traceable. This driver accelerates a modern shift in agriculture across the region.

- For instance, Yara International’snitrate-based mineral fertilizers produced in Europe have a carbon footprint around 50% lower than the majority of non-EU fertilizers, enabled by catalytic processes that cut greenhouse gas emissions during production. This figure is independently verified using the Fertilisers Europe Product Carbon Footprint methodology (as of 2023)

Market Trends

Adoption of Bio-Based Specialty Fertilizers in Organic and Regenerative Farming Practices

Bio-based fertilizers are gaining acceptance due to demand for organic farming solutions. Farmers prefer biodegradable and plant-derived options that restore soil biodiversity. It aligns with EU policies encouraging regenerative farming to protect ecosystems. Companies invest in plant-based formulations targeting environmentally conscious consumers. The Europe Specialty Fertilizers Market sees rising use of biofertilizers across fruits and vegetables. Organic food demand drives consistent adoption across Western European nations. Start-ups also enter the space with innovative microbial fertilizers for specific crops. This trend reshapes the supply chain with greener, sustainable products.

Expansion of Customized Fertilizer Blends for Crop-Specific Solutions

Manufacturers introduce fertilizers tailored to crop types and soil conditions. Customized blends optimize nutrient balance and improve harvest predictability. It reflects a growing shift toward localized solutions instead of one-size-fits-all products. Farmers seek nutrient packages that address region-specific soil deficiencies. The Europe Specialty Fertilizers Market witnesses demand for specialized blends in vineyards and greenhouse crops. Customized products create value by reducing excess fertilizer use. This approach builds trust between suppliers and farmers seeking efficient solutions. It also fosters innovation partnerships with agricultural research institutes.

- For instance, on August 20, 2025, Landhandel Peters inaugurated a new specialty blending plant in Germany that produces crop-specific fertilizer mixtures on demand, including bespoke blends for asparagus and potatoes, enabling local growers to formulate nutrient plans for each field and crop at the site itself.

Increased Integration of Digital Platforms in Fertilizer Management

Digital farming tools integrate with specialty fertilizers to improve efficiency. Smart apps and sensors track soil nutrient levels in real time. It enhances decision-making for fertilizer application with precise recommendations. Agritech firms partner with fertilizer companies to expand digital service portfolios. The Europe Specialty Fertilizers Market benefits from this fusion of technology and inputs. Farmers adopt subscription-based models for continuous nutrient management support. Integration ensures consistency in crop health monitoring and timely interventions. This trend supports the future of smart and data-driven farming.

Growing Role of Circular Economy in Fertilizer Development and Waste Reduction

Circular economy principles reshape fertilizer production and use across Europe. Producers focus on recycling organic waste into nutrient-rich formulations. It supports sustainability targets and addresses raw material dependency challenges. Farmers recognize the cost benefits of recycled fertilizer solutions. The Europe Specialty Fertilizers Market embraces circular models for long-term viability. Innovations include phosphorus recovery from wastewater and compost-based products. These solutions address both environmental concerns and nutrient availability issues. The trend reflects Europe’s ambition to achieve closed-loop agricultural systems.

- For instance, construction began on May 26, 2025, for Germany’s first full-scale phosphorus recovery plant in Schkopau, designed to produce RevoCaP fertilizer using EasyMining’s Ash2Phos process, which recovers over 90% of phosphorus from sewage sludge ash and has been approved for use in organic farming by the European Commission.

Market Challenges Analysis

High Production Costs and Limited Farmer Awareness Restricting Adoption

Production of specialty fertilizers involves advanced technology and higher costs compared to conventional fertilizers. It creates price barriers for small and medium-scale farmers across Eastern Europe. Limited awareness of benefits delays adoption despite proven efficiency advantages. The Europe Specialty Fertilizers Market faces challenges in reaching farmers with limited technical training. Complex formulations also require careful handling and distribution systems. Resistance arises from traditional practices where conventional fertilizers remain the preferred choice. Lower affordability limits penetration beyond commercial farms. This challenge impacts overall market growth momentum.

Regulatory Complexity and Supply Chain Volatility Across Europe

European Union regulations often vary by country, making compliance complex for manufacturers. It raises operational costs and slows cross-border supply chain efficiency. The Europe Specialty Fertilizers Market experiences disruptions due to raw material price volatility. Dependence on imports for essential nutrients like potash heightens vulnerability. Geopolitical issues further affect consistent supply to farmers. Manufacturers struggle to balance compliance costs while maintaining competitive pricing. Delays in approval of innovative fertilizer formulations also limit market expansion. These challenges highlight structural constraints affecting regional stability.

Market Opportunities

Emerging Opportunities in Smart Agriculture Integration Across European Farms

Integration of specialty fertilizers with advanced precision tools creates growth potential. It aligns with Europe’s strong digital farming initiatives. Farmers benefit from cost savings through efficient nutrient use. The Europe Specialty Fertilizers Market gains opportunities by supporting climate-smart agriculture. Partnerships with technology providers enable innovative fertilizer application models. Governments actively promote modernization with subsidies for smart farming. IoT-based fertilizer delivery systems create avenues for growth. This opportunity strengthens competitiveness across the region.

Expansion Potential in Eastern European Agricultural Modernization Efforts

Eastern Europe presents significant opportunities due to its transition toward modern farming. It reflects rising government investments in rural infrastructure and agricultural reforms. Farmers adopt sustainable inputs to increase yields and align with EU standards. The Europe Specialty Fertilizers Market benefits from expanding demand in emerging economies. Multinational players focus on entering these regions with tailored products. Availability of high-value crop cultivation widens fertilizer adoption scope. Companies targeting localized solutions can build long-term customer loyalty. This opportunity highlights strong untapped market potential.

Market Segmentation Analysis

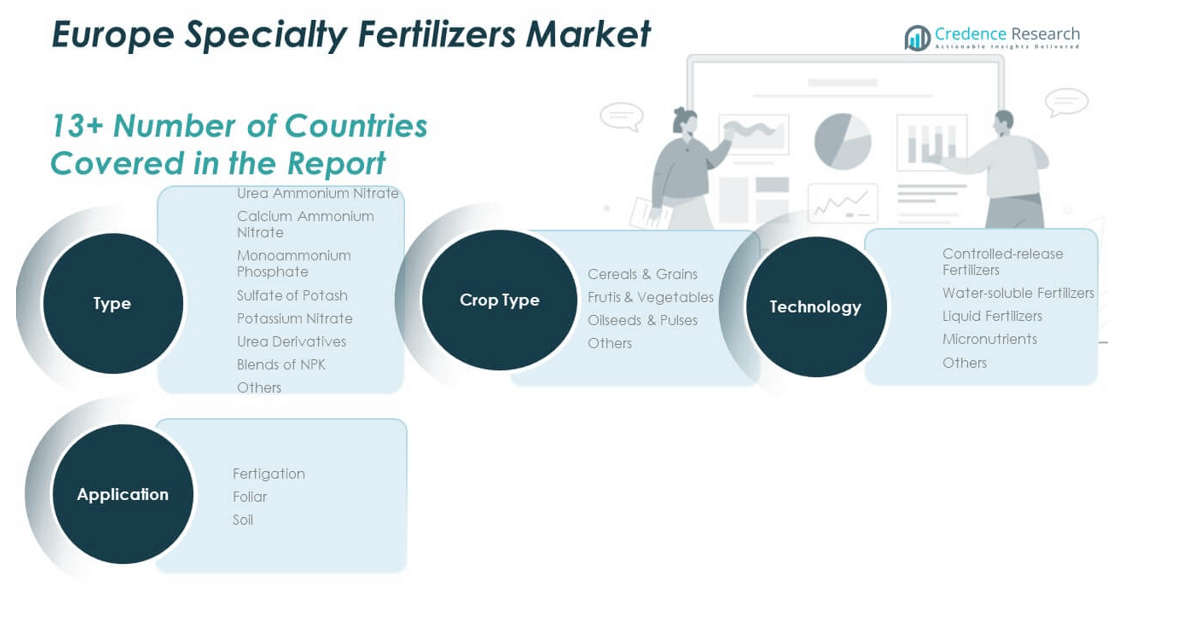

By type, the Europe Specialty Fertilizers Market is led by blends of NPK, urea ammonium nitrate, and potassium nitrate due to their versatility in enhancing crop nutrition and yield quality. Calcium ammonium nitrate and monoammonium phosphate also record strong demand across horticulture and high-value crops, while sulfate of potash supports fruit and vegetable cultivation where potassium is critical. Urea derivatives and other specialized products cater to niche farming requirements and specific soil conditions.

By application, fertigation dominates the market as it supports precise nutrient delivery through irrigation systems, widely used in greenhouse and vineyard farming. Foliar applications gain traction for fast nutrient absorption in high-value crops, while soil-based applications continue to serve traditional farming practices. The Europe Specialty Fertilizers Market benefits from the adaptability of these application methods across diverse crop types. It creates opportunities for suppliers to provide customized solutions aligned with farmer needs.

- For instance, in the 2024 season in Pontelongino, Italy, Haifa Group’s advanced nutrition program for processing tomatoes which included controlled-release and foliar NPK fertilizers—increased yield by 17.6% (from 85 to 100 tons per hectare) over conventional farmer practice in a field demonstration.

By technology, water-soluble fertilizers hold the largest share due to their role in precision agriculture, while controlled-release fertilizers drive sustainable nutrient management. Liquid fertilizers and micronutrients address specific deficiencies, reinforcing balanced crop growth. By crop type, cereals and grains lead in demand due to their extensive cultivation area, while fruits and vegetables record rising consumption because of high-value export markets. Pulses and oilseeds also contribute significantly, supported by growing food security measures and sustainability goals across the region.

- For instance, published controlled field data from Europe showed that ICL Group’s controlled-release fertilizer (CRF, with eco.x coating) reduced nitrogen leaching by up to 59% compared to conventional urea over a 72-day trial period at equivalent application rates

Segmentation

By Type

- Urea Ammonium Nitrate

- Calcium Ammonium Nitrate

- Monoammonium Phosphate

- Sulfate of Potash

- Potassium Nitrate

- Urea Derivatives

- Blends of NPK

- Others

By Application

By Technology

- Controlled-release Fertilizers

- Water-soluble Fertilizers

- Liquid Fertilizers

- Micronutrients

- Others

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Regional Analysis

Western Europe

Western Europe dominates the Europe Specialty Fertilizers Market with a 42% share, supported by advanced farming practices and strict environmental regulations. Countries like Germany, France, and the Netherlands lead adoption through strong investments in precision agriculture and horticulture. The region’s focus on sustainable farming aligns with EU Green Deal objectives, creating steady demand for controlled-release and water-soluble fertilizers. Farmers emphasize efficiency and compliance with nitrate directives, which drives reliance on innovative formulations. High-value crops such as vineyards and greenhouse produce expand fertilizer applications. Strong infrastructure and supportive government subsidies further reinforce the region’s leadership.

Southern Europe

Southern Europe accounts for 28% of the Europe Specialty Fertilizers Market, driven by strong demand from fruit, vegetable, and vineyard cultivation. Countries like Italy and Spain highlight growing reliance on specialty fertilizers for high-value crops that require nutrient precision. The Mediterranean climate supports intensive farming cycles, which increase fertilizer demand. Farmers adopt foliar and fertigation solutions to address soil challenges and maximize yields. Market expansion is supported by investments in irrigation networks and crop diversification. The subregion demonstrates high potential for growth as farmers seek sustainable solutions to address water scarcity and soil nutrient imbalances.

Eastern and Northern Europe

Eastern and Northern Europe together hold 30% share of the Europe Specialty Fertilizers Market, with Eastern Europe emerging as a fast-developing area. Countries such as Poland and Russia see rising adoption through modernization of agriculture and government-backed initiatives. Demand increases with wider use of cereals, grains, and oilseeds requiring efficient nutrient delivery. Northern Europe, including Scandinavia, contributes steadily with a strong emphasis on environmental compliance and sustainable crop production. Both subregions attract multinational fertilizer producers seeking untapped opportunities. Rising awareness, combined with policy support, positions these areas as critical to future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Europe Specialty Fertilizers Market is shaped by global leaders such as Yara International, K+S Aktiengesellschaft, EuroChem Group, ICL Group, Haifa Group, and Nutrien Ltd. These companies maintain strong portfolios across controlled-release, water-soluble, and micronutrient fertilizers. It is marked by continuous product innovations, tailored blends, and expanding partnerships with agritech firms. Firms strengthen their competitiveness through mergers, acquisitions, and regional expansions to capture localized demand. Market leaders focus on sustainability and compliance, aligning with EU environmental goals. Emerging players compete by offering bio-based and cost-effective formulations targeted at niche crop segments. The competitive landscape reflects a balance of established multinational corporations and innovative regional players, with innovation and sustainability defining growth strategies.

Recent Developments

- In July 2025, EuroChem’s Fertiva 03-28/08 launch offered growers an eight-nutrient formulation for continuous nutrient supply and crop yield advances.

- In February 2025, Haifa Group launched the innovative “Haifa Soluble DUO” water-soluble fertilizer in North West Europe, specifically designed to increase calcium input without excess nitrogen or sulphates, catering to sustainable fertigation practices for growers.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Crop Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Precision farming adoption will continue to expand, driving demand for controlled nutrient delivery.

- Bio-based and eco-friendly fertilizers will gain traction, aligned with Europe’s Green Deal targets.

- High-value crops such as horticulture and vineyards will sustain the strongest consumption of specialty fertilizers.

- Technological integration with IoT and smart farming platforms will improve application efficiency.

- Eastern Europe will emerge as a key growth frontier with increasing modernization in agriculture.

- Partnerships between fertilizer producers and agritech firms will create new product and service models.

- Regulatory compliance will shape product development, with emphasis on reducing nitrate leaching.

- Customized blends for crop-specific solutions will strengthen farmer adoption and supplier competitiveness.

- Circular economy initiatives will support production of fertilizers from recycled organic sources.

- Market consolidation will increase as global leaders acquire regional players to secure scale advantages.