Market Overview

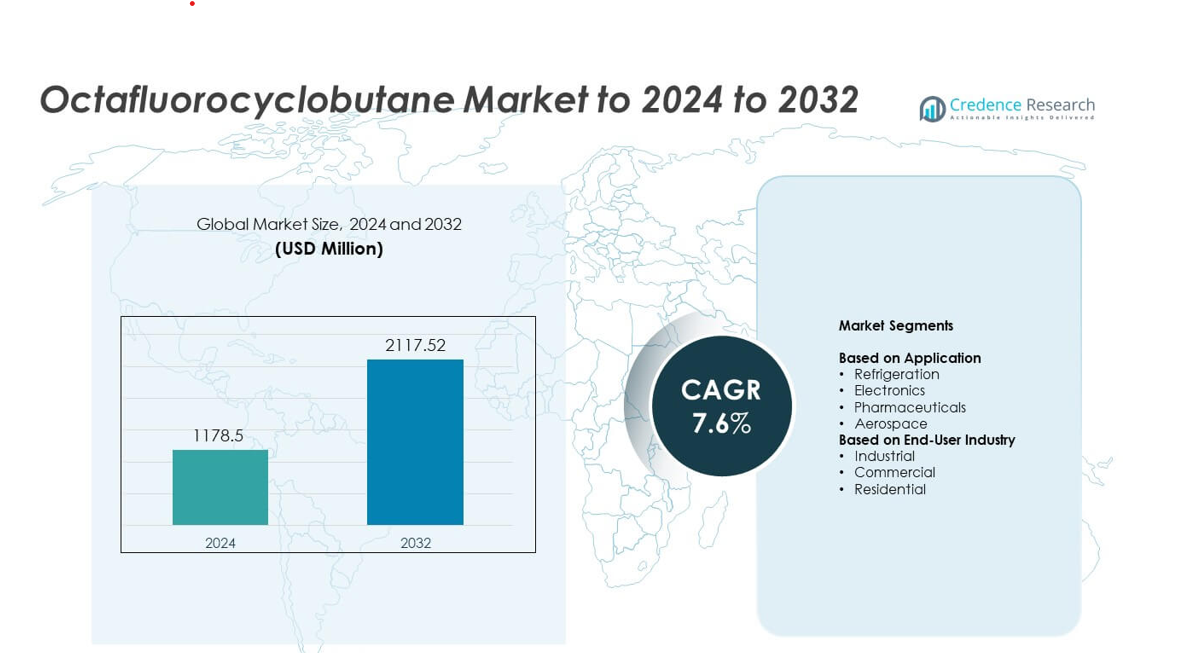

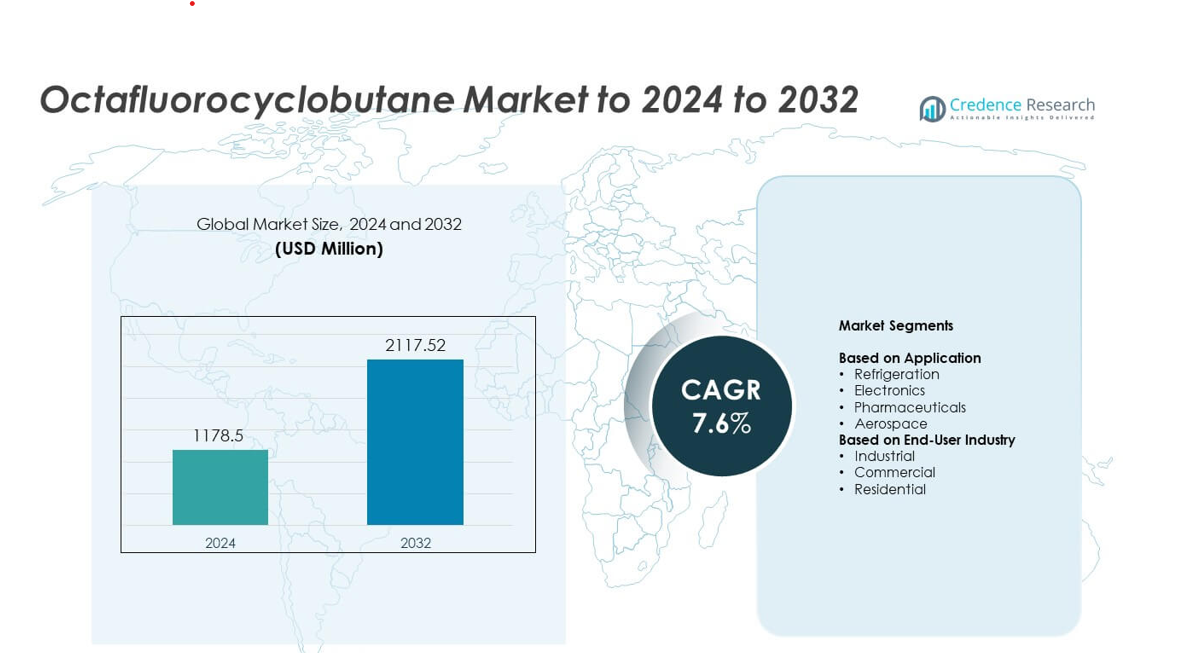

Octafluorocyclobutane Market size was valued at USD 1178.5 million in 2024 and is anticipated to reach USD 2117.52 million by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Octafluorocyclobutane Market Size 2024 |

USD 1178.5 million |

| Octafluorocyclobutane Market, CAGR |

7.6% |

| Octafluorocyclobutane Market Size 2032 |

USD 2117.52 million |

The Octafluorocyclobutane Market is driven by major players such as The Chemours Company, Daikin Industries Ltd., Honeywell International Inc., Solvay S.A., Air Liquide, Linde plc and 3M, each expanding high-purity gas capabilities to meet rising semiconductor and refrigeration demand. North America led the market in 2024 with about 34% share due to strong chip fabrication growth and advanced industrial cooling adoption. Asia Pacific followed closely with nearly 31% share, supported by large-scale wafer manufacturing in major economies. Europe accounted for about 27% share, driven by strict quality standards and steady aerospace and pharmaceutical demand.

Market Insights

- The Octafluorocyclobutane Market was valued at USD 1178.5 million in 2024 and is projected to reach USD 2117.52 million by 2032, growing at a CAGR of 7.6%.

- Growth is driven by strong semiconductor demand, where the application segment of refrigeration led with about 42% share due to rising adoption in cooling and etching processes.

- Market trends highlight expanding high-purity gas use, supported by cleaner plasma processing needs and rapid advancements in chip fabrication technologies across global manufacturing hubs.

- Competition intensifies as major suppliers enhance purification capabilities, expand regional supply networks and strengthen long-term contracts with electronics and refrigeration system manufacturers.

- Regionally, North America held about 34% share, Asia Pacific captured nearly 31%, and Europe accounted for around 27%, while Latin America held 5% and Middle East & Africa about 3%, reflecting strong concentration in advanced manufacturing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Refrigeration held the leading share in 2024 with about 42% of the Octafluorocyclobutane Market. Demand stayed strong because refrigeration systems required stable, non-flammable, and low-toxicity gases for safe cooling performance. Electronics followed as semiconductor firms increased use in plasma etching due to cleaner reactions and tighter process control. Pharmaceuticals and aerospace showed moderate uptake as specialty manufacturers adopted the gas for precision cleaning and controlled-environment processing. Growth across all areas remained supported by rising safety standards and wider adoption of fluorinated gases in advanced manufacturing.

- For instance, Daikin operates more than 100 production bases worldwide to meet a wide range of individual needs and preferences for air-conditioning and refrigeration solutions.

By End-User Industry

Industrial users dominated the Octafluorocyclobutane Market in 2024 with nearly 58% share. Heavy industries and electronics producers relied on the gas for stable performance in etching, cooling, and controlled manufacturing environments. Commercial use expanded as HVAC installers preferred gases with stronger environmental stability and improved safety profiles. Residential adoption grew at a slower pace due to limited use in consumer-level refrigeration and niche cooling applications. Strong industrial automation growth and expanding semiconductor output continued to drive wider adoption across end-user groups.

- For instance, Linde signed 59 new on-site gas contracts in 2024 to build 64 plants.

Key Growth Drivers

Rising Semiconductor Manufacturing Demand

Growing semiconductor output pushed wider adoption of octafluorocyclobutane because chipmakers relied on the gas for stable plasma etching and precise wafer processing. The material supported cleaner reactions and reduced residue, which helped manufacturers improve yield and consistency across advanced nodes. Expanding facilities in Asia and North America increased bulk consumption as companies scaled production of logic chips, memory devices, and advanced display panels. Strong investment in fabrication plants remained a major driver for market growth.

- For instance, TSMC’s manufacturing facilities managed by the company and its subsidiaries produced approximately 12.9 million 12-inch equivalent wafers in 2024 (total wafer shipments).

Expansion of Advanced Cooling and Refrigeration Uses

Refrigeration demand increased as industrial and commercial cooling systems moved toward safer and more efficient gases. Octafluorocyclobutane offered strong thermal stability and a non-flammable profile, which made it suitable for specialized cooling cycles. Growth in cold-chain logistics, data center cooling, and smart building systems further boosted adoption. Rising safety standards and broader equipment modernization programs continued to strengthen its use across refrigeration applications.

- For instance, Trane’s CenTraVac chillers deliver from 200 to over 4,000 tons of cooling capacity.

Growing Adoption in Aerospace and Precision Manufacturing

Aerospace manufacturers increased use of octafluorocyclobutane for surface cleaning, precision assembly, and controlled-environment operations. The gas provided consistent purity and stable performance under strict quality conditions, which supported adoption in high-value fabrication steps. As aircraft production expanded and maintenance procedures modernized, the material gained importance in meeting reliability and contamination-control needs. This shift across advanced manufacturing reinforced long-term demand.

Key Trends & Opportunities

Shift Toward Cleaner Plasma Processing Technologies

The electronics industry continued shifting toward advanced plasma processes that required stable and low-residue gases. Octafluorocyclobutane aligned well with this shift because its chemistry supported tighter etch control and reduced waste generation. Growing demand for high-precision etching in microelectronics and sensor production created new opportunities for suppliers. Increased R&D investments in next-generation plasma tools strengthened prospects for long-term adoption.

- For instance, Lam Research reports having an installed base of approximately 96,000 semiconductor process chambers globally as of fiscal year 2024 (ending June 2024),

Expansion of High-Purity Gas Supply Networks

Producers expanded high-purity gas networks to meet rising quality expectations in pharmaceuticals, aerospace, and semiconductor manufacturing. This trend created opportunities for suppliers delivering ultra-clean grades and advanced packaging solutions. Investments in bulk gas distribution, on-site supply systems, and purification units helped companies capture emerging demand. Growth in global advanced manufacturing hubs continued to boost the opportunity space.

- For instance, Air Liquide will build 3 air separation units and 2 hydrogen plants for semiconductor customers in Germany.

Integration into Sustainable Refrigeration Pathways

Cooling system developers explored alternatives that improved efficiency and supported evolving environmental guidelines. Octafluorocyclobutane found opportunities in niche sustainable refrigeration systems because of its stable performance and low-toxicity profile. Adoption grew in retrofit programs and high-performance industrial cooling applications. Ongoing HVAC technology upgrades opened new pathways for selective market expansion.

Key Challenges

Regulatory Pressure on Fluorinated Gases

Regulators increased scrutiny of fluorinated gases due to global climate targets and evolving emission norms. Octafluorocyclobutane faced pressure from tightening rules that encouraged reductions in high-global-warming-potential materials. Producers needed to adapt through improved containment, recycling, and emission-control measures. Compliance costs and registration requirements added operational complexity for suppliers and end users.

Supply Chain Constraints and High Production Costs

Production of high-purity fluorinated gases required advanced facilities, strict handling systems, and costly raw materials. This structure created supply pressures when demand rose across semiconductor and aerospace sectors. Limited global production capacity increased lead times and pricing volatility. Market players faced challenges in scaling output without compromising purity or safety standards.

Regional Analysis

North America

North America held about 34% share in the Octafluorocyclobutane Market in 2024, supported by strong semiconductor expansion and steady refrigeration system upgrades. Growth in advanced chip fabrication across the United States increased consumption of high-purity gases for plasma etching and precision processing. Data center cooling upgrades and stricter safety norms also pushed demand within industrial and commercial users. Rising aerospace production and wider adoption of controlled-environment applications helped reinforce regional dominance. Stable investment in high-tech manufacturing is expected to keep North America a major consumer through the forecast period.

Europe

Europe accounted for nearly 27% share of the Octafluorocyclobutane Market in 2024, driven by advanced electronics production, strict environmental standards, and adoption of high-purity gases in aerospace and pharmaceutical sectors. The region benefited from established semiconductor clusters in Germany, France, and the Netherlands, which increased the use of fluorinated gases for precision etching. Modernization of cooling systems in commercial buildings and industrial sites added further demand. Expanding clean-manufacturing regulations encouraged better-quality gas supply networks across Europe, supporting steady market growth.

Asia Pacific

Asia Pacific led the growth momentum with about 31% share in 2024, supported by large-scale semiconductor manufacturing in China, South Korea, Japan, and Taiwan. Rapid expansion of wafer fabrication plants increased the need for stable etching gases such as octafluorocyclobutane. Adoption rose in refrigeration, aerospace supply chains, and electronic component assembly due to wider industrialization. Strong investment in advanced manufacturing hubs and continuous capacity additions kept the region a key contributor to global demand. Improving supply networks across major economies supported long-term growth.

Latin America

Latin America held nearly 5% share in the Octafluorocyclobutane Market in 2024, driven by rising industrial refrigeration upgrades and increasing adoption in niche electronics manufacturing. Growth in commercial cold-chain logistics expanded demand for stable and safe cooling gases. Countries such as Mexico and Brazil saw gradual adoption of high-purity materials in aerospace components and precision industrial processes. Limited semiconductor production kept overall consumption moderate, yet ongoing industrial modernization supported a stable outlook.

Middle East & Africa

Middle East & Africa captured around 3% share in 2024, supported by growing industrial cooling needs and rising interest in advanced manufacturing technologies. Adoption increased in commercial refrigeration, oil and gas processing facilities, and emerging aerospace maintenance operations. Supply remained concentrated among select distributors, which kept usage limited compared with larger regions. However, expanding industrial zones in the UAE, Saudi Arabia, and South Africa created new demand for high-purity gases. Steady infrastructure development supported gradual market growth.

Market Segmentations:

By Application

- Refrigeration

- Electronics

- Pharmaceuticals

- Aerospace

By End-User Industry

- Industrial

- Commercial

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Octafluorocyclobutane Market features leading companies such as The Chemours Company, Daikin Industries Ltd., Honeywell International Inc., Solvay S.A., Air Liquide, Linde plc and 3M. The competitive landscape is shaped by firms expanding high-purity gas production, improving distribution systems and strengthening semiconductor supply contracts. Companies focus on advanced purification technologies to meet rising quality requirements in chip fabrication and precision manufacturing. Many players invest in regional capacity expansion to reduce supply-chain risks and improve delivery reliability. Strategic partnerships with electronics manufacturers help secure long-term demand, while ongoing R&D supports innovation in plasma-based applications. Competitors also target refrigeration and aerospace sectors through cleaner, safer and more efficient gas solutions. Sustainability programs, emission-reduction practices and tighter quality control remain central strategies as regulators increase scrutiny of fluorinated gases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Daikin Industries Ltd. advanced its Fusion 25 strategic plan through 2025, investing in fluorochemical production expansions including high-performance materials aligned with Octafluorocyclobutane uses.

- In 2024, Solvay SA2024 Entered an agreement with Cyclic Materials to source recycled rare earth oxides, supporting a sustainable supply chain for various chemical products.

- In December 2022, the 3M Company announced its plan to cease the production of all per- and polyfluoroalkyl substances (PFAS), including substances like Octafluorocyclobutane, by the end of 2025.

Report Coverage

The research report offers an in-depth analysis based on Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as semiconductor fabs expand advanced etching and cleaning processes.

- Refrigeration applications will grow as industries adopt safer and more stable cooling gases.

- Aerospace manufacturing will increase usage due to stricter contamination-control needs.

- High-purity gas production will expand to support tightening quality standards.

- Supply chains will strengthen as producers build more regional purification facilities.

- Environmental regulations will push companies toward controlled handling and recycling systems.

- Commercial buildings will adopt the gas in niche high-performance cooling applications.

- Growth in data centers will boost demand for stable cooling materials.

- Emerging economies will increase consumption as advanced manufacturing capacity expands.

- Technological upgrades in plasma processing will create new opportunities for market adoption.