Market Overview:

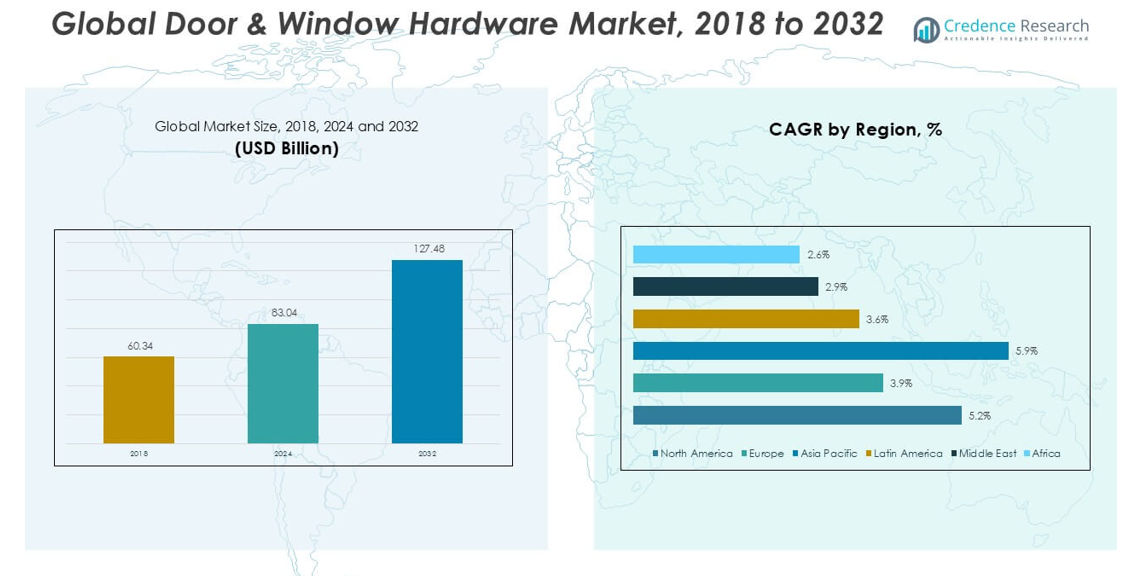

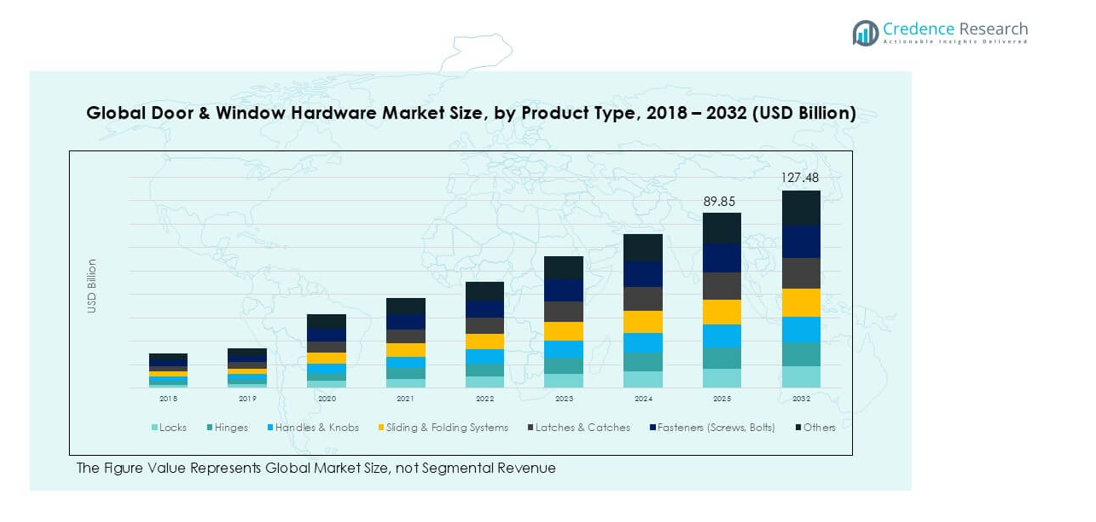

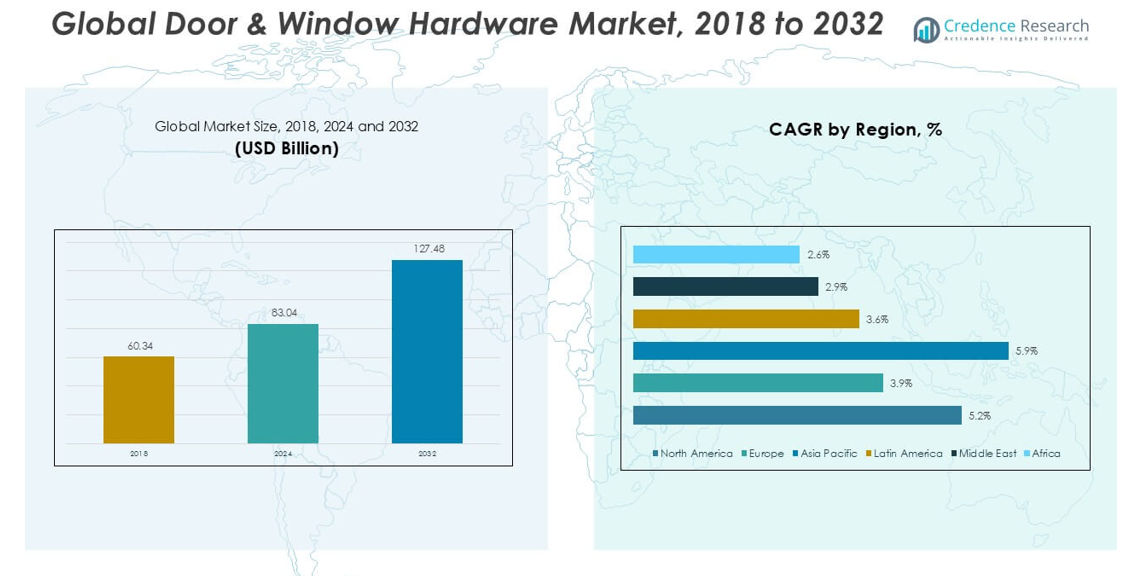

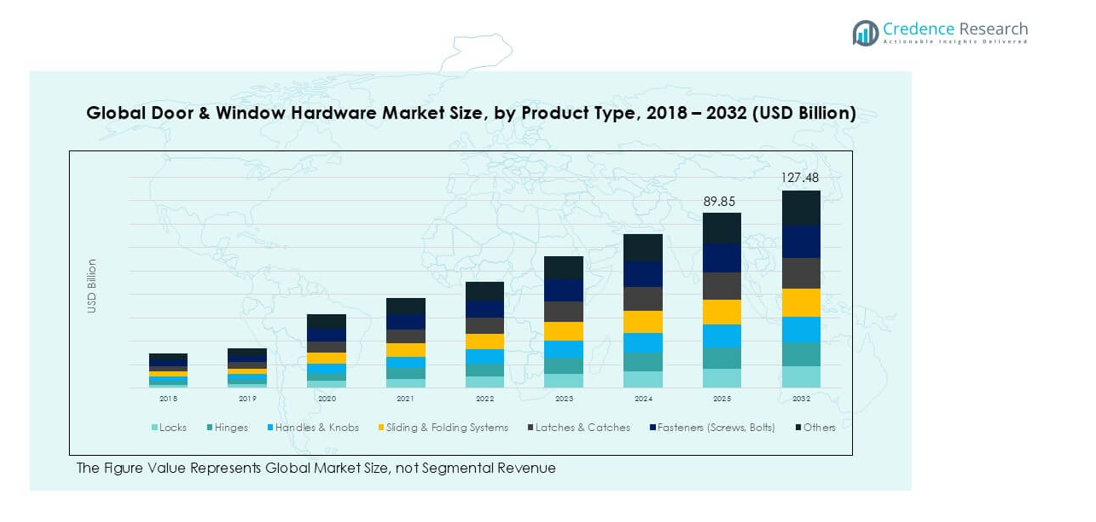

Global Door & Window Hardware market size was valued at USD 60.34 billion in 2018, growing to USD 83.04 billion in 2024, and is anticipated to reach USD 127.48 billion by 2032, at a CAGR of 5.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Door & Window Hardware Market Size 2024 |

USD 83.04 billion |

| Door & Window Hardware Market, CAGR |

5.12% |

| Door & Window Hardware Market Size 2032 |

USD 127.48 billion |

The global door and window hardware market is led by major players such as ASSA ABLOY, Allegion PLC, Dormakaba, Stanley Black & Decker, Schüco International KG, Roto Frank AG, Spectrum Brands Holdings, Andersen Corporation, Pella Corporation, and Masonite International. These companies maintain leadership through wide product portfolios, strong brand recognition, and continuous innovation in smart locking systems, sustainable materials, and high-performance hardware. Asia Pacific dominates the market with 44.2% share in 2024, driven by rapid urbanization and large-scale construction projects. North America follows with 27.8%, supported by advanced renovation activities and adoption of digital hardware, while Europe holds 18.6%, benefiting from stringent safety and sustainability standards. This regional concentration underscores the combined influence of technological innovation and construction growth on market leadership

.Market Insights

- The global door and window hardware market was

- valued at USD 83.04 billion in 2024 and is projected to reach USD 127.48 billion by 2032, expanding at a CAGR of 5.12% during the forecast period.

- Growth is driven by rising urbanization, smart city projects, and increasing demand for advanced security solutions, particularly smart locks and automated systems across residential and commercial buildings.

- Key trends include the adoption of IoT-enabled hardware, sustainability-focused materials such as aluminum and stainless steel, and growing demand in emerging economies where housing projects are expanding rapidly.

- The market is highly competitive with major players including ASSA ABLOY, Allegion PLC, Dormakaba, Stanley Black & Decker, and Schüco International KG, competing on innovation, product quality, and global distribution.

- Regionally, Asia Pacific holds 44.2% share, followed by North America at 27.8% and Europe at 18.6%, while by product, locks lead with over 30% share due to strong adoption in security-focused applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Locks held the largest share of the global door and window hardware market in 2024, accounting for over 30% of total revenue. Their dominance is driven by rising demand for advanced security systems across residential and commercial properties. The growth of smart locks with biometric and IoT integration further strengthens this position. Hinges and handles & knobs follow closely, supported by increasing construction and renovation activities. Sliding and folding systems are gaining traction in urban housing projects, while latches, catches, and fasteners maintain steady demand in industrial and utility settings.

- For instance, in 2023, Assa Abloy continued to invest in and expand its offerings of electromechanical and connected access solutions globally. However, the company’s Yale smart residential lock business in the United States and Canada was sold to Fortune Brands Innovations in June 2023.

By Material

Metal-based hardware, particularly aluminum, stainless steel, and brass, dominated the material segment with a market share of more than 55% in 2024. Metals are preferred for their durability, strength, and aesthetic appeal in both premium and mass-market applications. Stainless steel continues to gain traction due to corrosion resistance and long lifecycle, especially in coastal and industrial environments. Aluminum’s lightweight properties support demand in modern architectural projects. Plastic hardware is expanding in low-cost housing projects, while wood remains niche for decorative applications. Other materials cater to specific functional or regional requirements.

- For instance, Dormakaba partners with various hotel chains to provide stainless steel hardware and access solutions across Asia-Pacific, including a recent joint venture in China to serve the growing local hospitality market.

By Application

The residential segment led the global market in 2024, capturing over 50% of total revenue. Growth is driven by rising urbanization, increased housing construction, and renovation projects worldwide. The shift toward smart homes has also accelerated demand for advanced door and window hardware, including digital locks and modern handles. Commercial applications, including offices, retail, and hospitality projects, follow with strong adoption of high-performance hardware to meet durability and safety standards. Industrial applications account for a smaller but stable share, largely supported by heavy-duty locking and fastening systems in manufacturing and warehousing facilities.

Market Overview

Rising Urbanization and Infrastructure Development

The rapid pace of urbanization and large-scale infrastructure development projects worldwide is a major growth driver for the door and window hardware market. Expanding residential construction, coupled with rising investments in smart cities and commercial complexes, has significantly increased demand for durable and innovative hardware solutions. Emerging economies in Asia-Pacific, including China and India, are leading contributors due to strong government-backed housing initiatives and industrial growth. At the same time, developed regions such as North America and Europe continue to upgrade existing infrastructure, particularly through renovation and remodeling projects, further boosting product adoption. Hardware components such as locks, handles, and hinges are increasingly integrated into new designs that prioritize security, sustainability, and energy efficiency. This trend ensures continued expansion as urban population growth and housing demand remain strong drivers for market development.

- For instance, Godrej & Boyce is a plausible supplier for India’s affordable housing sector, potentially including Pradhan Mantri Awas Yojana (PMAY) projects.

Growing Adoption of Smart and Digital Hardware Solutions

The adoption of smart door and window hardware is reshaping the competitive landscape of the market. Rising consumer preference for digital locks, biometric access systems, and IoT-enabled hardware solutions is driving innovation across product categories. These technologies are particularly favored in residential and commercial buildings for their enhanced convenience, real-time monitoring, and advanced security features. For instance, smart locks integrated with mobile applications are gaining traction among tech-savvy consumers. Commercial sectors such as offices and retail outlets also demand automated sliding and folding systems to support modern designs and safety compliance. The combination of rising disposable income, growing awareness about smart home solutions, and increased affordability of connected devices further supports this shift. Manufacturers are responding with product portfolios that blend functionality with design appeal, aligning with the global trend toward digitization and intelligent building solutions.

- For instance, Allegion’s Schlage brand saw continued strong consumer adoption of its connected access systems, including the Encode Smart WiFi Deadbolt, contributing to the company’s overall electronic and software solutions growth in 2023.

Rising Emphasis on Security and Safety Standards

Security concerns in residential, commercial, and industrial spaces have become a critical factor fueling demand for advanced door and window hardware. With rising incidents of thefts and unauthorized access, consumers and businesses are investing in high-quality locking systems, reinforced hinges, and durable fasteners. Regulatory bodies across regions have also established stringent safety standards, encouraging the use of certified and tested hardware components. The commercial sector, including banks, retail chains, and hospitality establishments, places strong emphasis on access control systems and heavy-duty locks. Industrial users rely on specialized latches, bolts, and reinforced hardware for warehouse and factory safety. This heightened focus on compliance with fire safety and building codes further drives innovation in materials, such as stainless steel and aluminum, which offer both strength and corrosion resistance. As a result, safety and security remain central to shaping purchasing decisions across global end-users.

Key Trends & Opportunities

Expansion of Sustainable and Eco-Friendly Materials

Sustainability is emerging as a key trend and opportunity in the door and window hardware market. Increasing environmental regulations and consumer awareness are encouraging manufacturers to adopt recyclable metals, energy-efficient production methods, and eco-friendly finishes. Aluminum and stainless steel are gaining traction for their long life cycles and recyclability, while low-VOC coatings and water-based treatments are being adopted to meet green building certifications such as LEED. The rise of sustainable construction practices globally offers hardware manufacturers opportunities to position themselves as environmentally responsible suppliers. In addition, wood-based and hybrid material innovations are finding niche applications in premium residential projects, appealing to eco-conscious homeowners. Companies investing in sustainable material innovation can capture growing demand from architects, builders, and consumers focused on reducing environmental impact, thereby gaining a competitive edge in markets where regulatory compliance and green certification are becoming standard requirements.

- For instance, according to its 2023 Sustainability Report, ASSA ABLOY reduced its absolute Scope 1 & 2 carbon emissions by 23% compared to its 2019 baseline. The company is actively working to incorporate more recycled materials into its products and is committed to reducing its environmental impact globally.

Rising Demand in Emerging Economies

Emerging economies present a strong opportunity for the global door and window hardware market due to rapid industrialization, urban housing demand, and government initiatives supporting affordable housing projects. Countries such as India, Brazil, and Indonesia are witnessing increased construction spending, driving higher consumption of basic and advanced hardware solutions. With middle-class populations growing, there is a greater demand for both functional and aesthetic hardware, including modern handles, digital locks, and sliding systems. Affordable housing programs are accelerating hardware adoption at the lower cost segment, while urban high-rise projects stimulate demand for premium solutions. Foreign direct investments in real estate and infrastructure are further supporting local market expansion. Manufacturers entering these markets through strategic partnerships and localized production can gain long-term growth opportunities, particularly by offering cost-efficient solutions tailored to regional construction practices and budget requirements.

Key Challenges

Price Volatility of Raw Materials

Fluctuating prices of raw materials such as aluminum, stainless steel, and brass pose a significant challenge for the door and window hardware market. These metals are core inputs for the production of locks, hinges, and handles, and any sudden rise in prices directly impacts manufacturing costs and profit margins. Frequent price instability, often driven by global supply chain disruptions or trade restrictions, creates uncertainty for manufacturers trying to maintain consistent pricing. Smaller players face greater pressure, as they lack the scale to absorb cost fluctuations compared to multinational companies. Additionally, volatile raw material prices often lead to delayed project completion in the construction industry, indirectly affecting hardware demand. Companies are attempting to mitigate this risk by diversifying supply chains, entering long-term contracts, and developing alternative materials. However, raw material cost volatility remains an ongoing challenge that constrains growth and competitive pricing strategies.

Intense Competition and Market Fragmentation

The global door and window hardware market is highly competitive and fragmented, with the presence of numerous regional and international players. Leading manufacturers focus on innovation, smart product offerings, and design differentiation, while smaller regional players compete aggressively on pricing. This dynamic exerts significant pricing pressure, particularly in cost-sensitive markets such as Asia-Pacific and Latin America. Fragmentation also creates challenges in maintaining consistent quality and adherence to international safety standards, as low-cost alternatives often lack certifications. For global players, sustaining profitability requires constant investment in product development, marketing, and distribution expansion. The rise of e-commerce channels has further intensified competition by enabling direct access for smaller brands to reach consumers. While consolidation opportunities exist, the fragmented landscape continues to create hurdles for achieving long-term market dominance, making differentiation and brand positioning essential for survival.

Regional Analysis

North America

North America accounted for nearly 27.8% share of the global market in 2024, valued at USD 23.08 billion, up from USD 17.04 billion in 2018. The region is projected to reach USD 35.58 billion by 2032, growing at a CAGR of 5.2%. Growth is supported by advanced construction projects, strong adoption of smart locks, and higher investments in residential remodeling. The U.S. dominates regional demand with a focus on security innovations and premium hardware, while Canada contributes through increasing urban housing. Strong replacement and renovation activity sustain North America’s leadership position in the market.

Europe

Europe held around 18.6% market share in 2024, valued at USD 15.45 billion, compared to USD 11.84 billion in 2018. The region is expected to reach USD 21.67 billion by 2032, expanding at a CAGR of 3.9%. Growth is driven by strict building safety regulations, energy-efficient construction, and widespread renovation of historical and residential buildings. Western Europe leads demand with advanced architectural designs, while Eastern Europe adds momentum with rising infrastructure projects. Demand for sustainable, certified, and corrosion-resistant materials such as stainless steel and aluminum supports steady expansion across both residential and commercial end-user segments.

Asia Pacific

Asia Pacific dominated the global market with over 44.2% share in 2024, valued at USD 36.73 billion, up from USD 25.72 billion in 2018. The market is projected to reach USD 59.92 billion by 2032, registering the fastest CAGR of 5.9%. Regional growth is fueled by rapid urbanization, large-scale housing demand, and government-backed infrastructure projects in China, India, and Southeast Asia. Expanding middle-class populations are also boosting demand for both basic and premium hardware. Manufacturers increasingly focus on cost-effective production and localized supply chains, making Asia Pacific the largest and most dynamic contributor to global hardware demand.

Latin America

Latin America represented about 4.8% market share in 2024, valued at USD 3.97 billion, up from USD 2.92 billion in 2018. The market is forecast to reach USD 5.40 billion by 2032, growing at a CAGR of 3.6%. Rising residential construction in Brazil and Mexico, along with growing urban infrastructure investments, supports hardware adoption across the region. Demand is particularly strong for cost-effective locks, hinges, and handles, catering to mid-income households. While premium hardware adoption remains limited, increasing foreign investments in commercial projects are opening opportunities for advanced solutions. Steady growth is expected despite economic fluctuations.

Middle East

The Middle East accounted for nearly 2.6% market share in 2024, valued at USD 2.14 billion, compared to USD 1.70 billion in 2018. It is expected to reach USD 2.78 billion by 2032, expanding at a CAGR of 2.9%. Growth is concentrated in the Gulf countries, particularly Saudi Arabia and the UAE, driven by large-scale commercial projects, hospitality developments, and urban housing expansion. Demand for modern, durable hardware is strong in luxury real estate projects, while economic diversification programs further boost construction. However, reliance on oil-based economies and fluctuating investments limit the pace of expansion in smaller markets.

Africa

Africa held the smallest share at around 2.0% in 2024, valued at USD 1.67 billion, up from USD 1.12 billion in 2018. The market is anticipated to reach USD 2.12 billion by 2032, growing at a CAGR of 2.6%. Growth is primarily driven by ongoing residential housing programs, rising urbanization, and small-scale commercial developments in countries such as South Africa, Nigeria, and Kenya. Demand remains concentrated on affordable and basic hardware solutions, as cost sensitivity dominates consumer purchasing decisions. Limited adoption of premium products and slower infrastructure investments restrain faster growth, though gradual improvement in construction supports steady progress.

Market Segmentations:

By Product Type

- Locks

- Hinges

- Handles & Knobs

- Sliding & Folding Systems

- Latches & Catches

- Fasteners (Screws, Bolts)

- Others

By Material

- Metal (Aluminium, Stainless Steel, Brass)

- Plastic

- Wood

- Others

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The global door and window hardware market is highly competitive, featuring a mix of multinational corporations and regional players striving to strengthen their market presence. Leading companies such as ASSA ABLOY, Allegion PLC, Dormakaba, Stanley Black & Decker, and Schüco International KG dominate through extensive product portfolios, advanced technology integration, and wide distribution networks. These firms focus on innovation, particularly in smart locks, automated sliding systems, and sustainable materials, to capture growing demand across residential and commercial sectors. Regional players like Roto Frank AG, Pella Corporation, and Masonite International emphasize cost-effective solutions and localized designs to meet diverse customer needs. Mergers, acquisitions, and partnerships remain key strategies to expand global reach and enhance manufacturing capabilities. The industry also witnesses rising competition from mid-tier firms introducing niche products, while strong brand reputation and adherence to safety standards continue to define competitive advantage in this fragmented yet steadily growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ASSA ABLOY

- Allegion PLC

- Andersen Corporation

- Dormakaba

- Schüco International KG

- Stanley Black & Decker

- Roto Frank AG

- Spectrum Brands Holdings

- Pella Corporation

- Masonite International

Recent Developments

- In January 2025 ASSA ABLOY has acquired 3millID and Third Millennium, two companies specializing in physical access control readers and credentials. 3millID is based in the US, while Third Millennium is based in the UK. The acquisition is expected to strengthen ASSA ABLOY’s position in the physical access control industry and expand its technology portfolio.

- In December 2024, ASSA ABLOY has successfully acquired Norshield Security Products, a US-based manufacturer specializing in high-security openings and enclosures. This acquisition aligns with ASSA ABLOY’s strategy to enhance its offerings in mature markets by integrating complementary products into its existing portfolio.

- In December 2024, ASSA ABLOY has acquired Premier Steel Doors and Frames, a US manufacturer specializing in hollow metal doors and frames, as well as metal building door systems and aluminum windows. This acquisition, announced on marks a strategic move for ASSA ABLOY to enhance its product offerings and strengthen its market presence, particularly in the southern United States.

- In May 2024, YKK AP Inc. and Kandenko Co., Ltd. formed a commercial alliance to enhance Building Integrated Photovoltaics (BIPV). This cooperation seeks to integrate renewable energy solutions into commercial building windows and walls, with a focus on carbon neutrality. The agreement will include demonstration testing with perovskite solar cells and other technologies.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand from residential and commercial construction.

- Smart locks and IoT-enabled systems will see wider adoption across developed and emerging regions.

- Sustainability will shape product development with recyclable metals and eco-friendly coatings gaining traction.

- Asia Pacific will remain the dominant regional market due to urbanization and large housing projects.

- North America will grow with renovation activities and high adoption of digital hardware solutions.

- Europe will focus on energy-efficient and safety-compliant hardware supported by strict regulations.

- Industrial applications will increasingly demand durable, heavy-duty locks, latches, and fasteners.

- Companies will strengthen competitive positioning through mergers, acquisitions, and product innovation.

- E-commerce platforms will play a larger role in distribution, expanding reach for global and regional players.

- Rising middle-class populations in emerging economies will fuel growth in both affordable and premium product segments.