Market Overview:

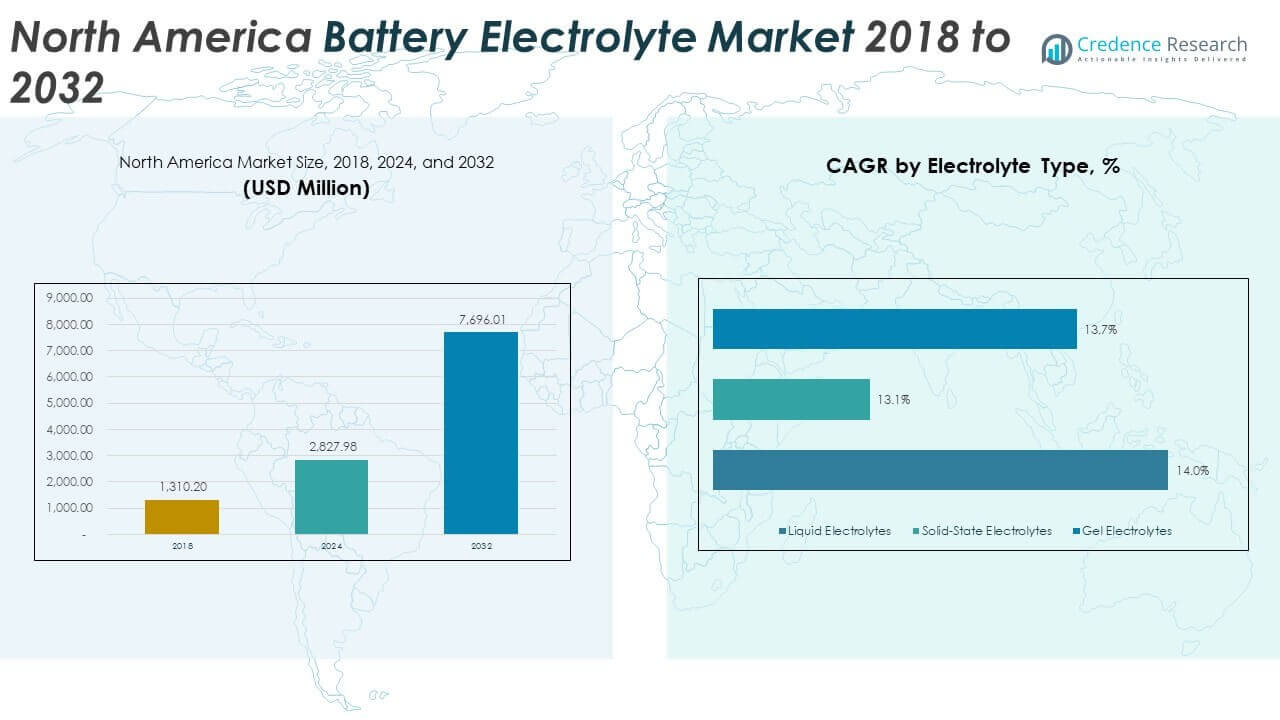

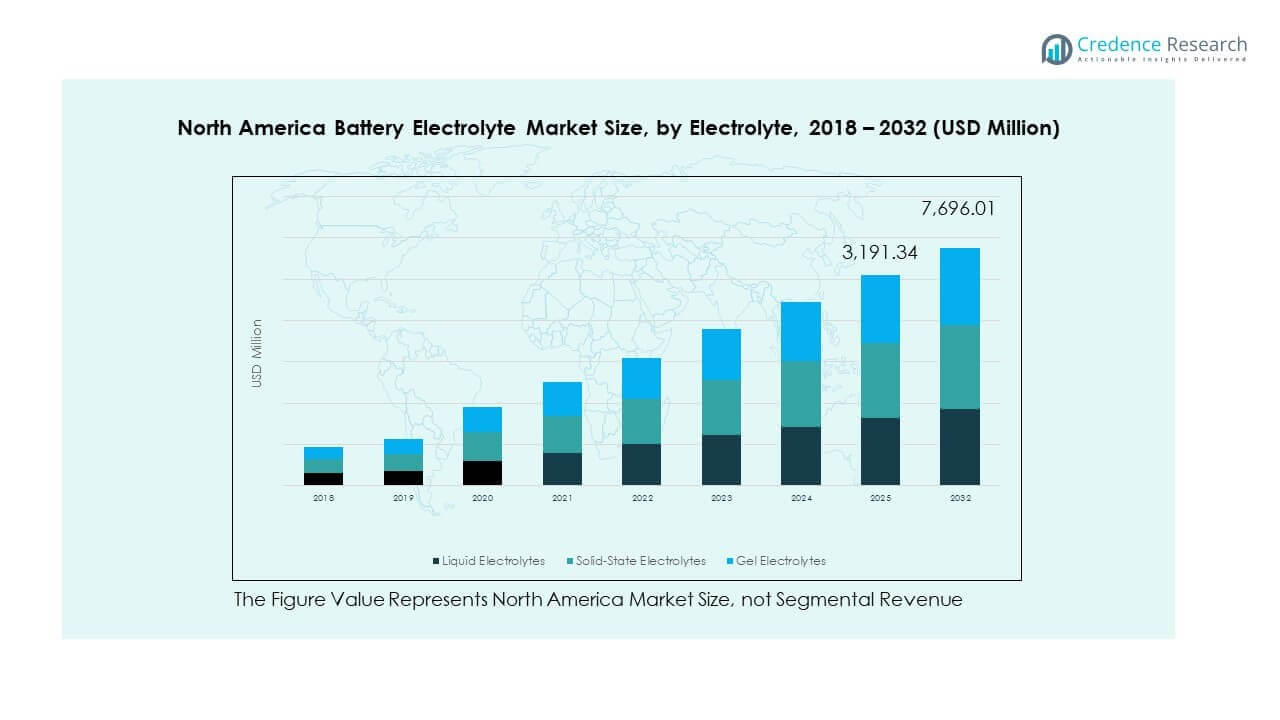

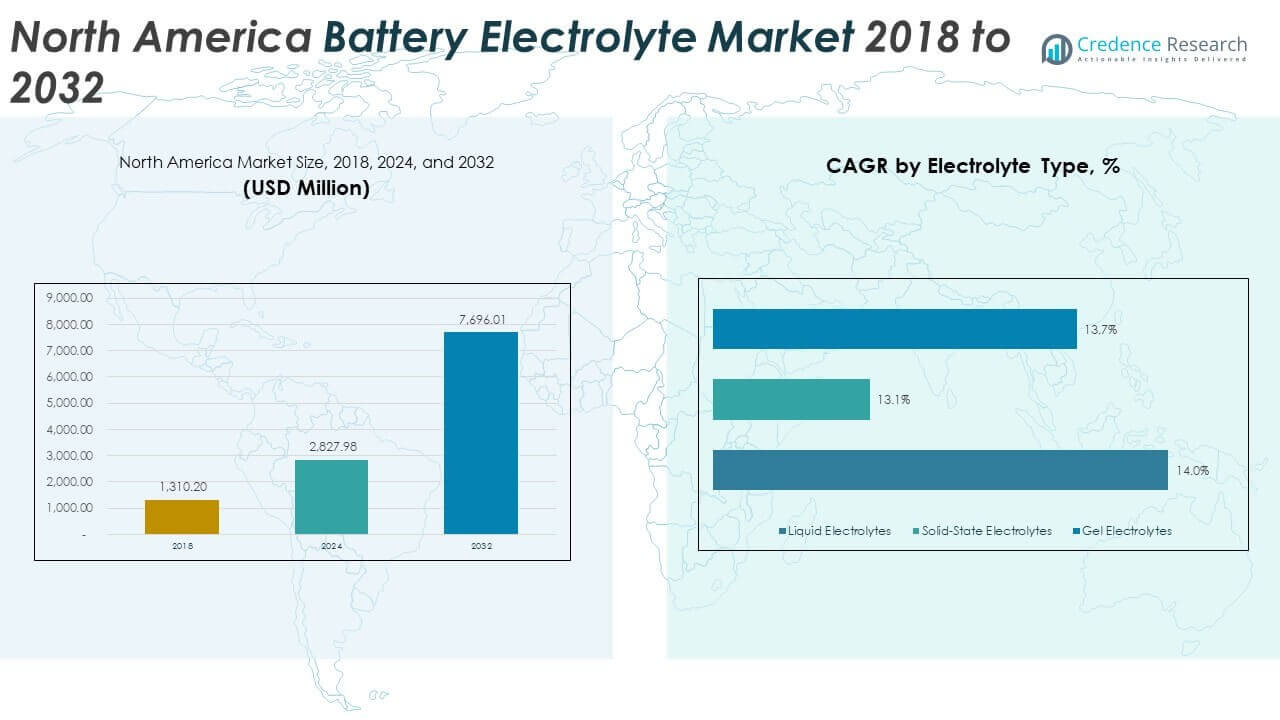

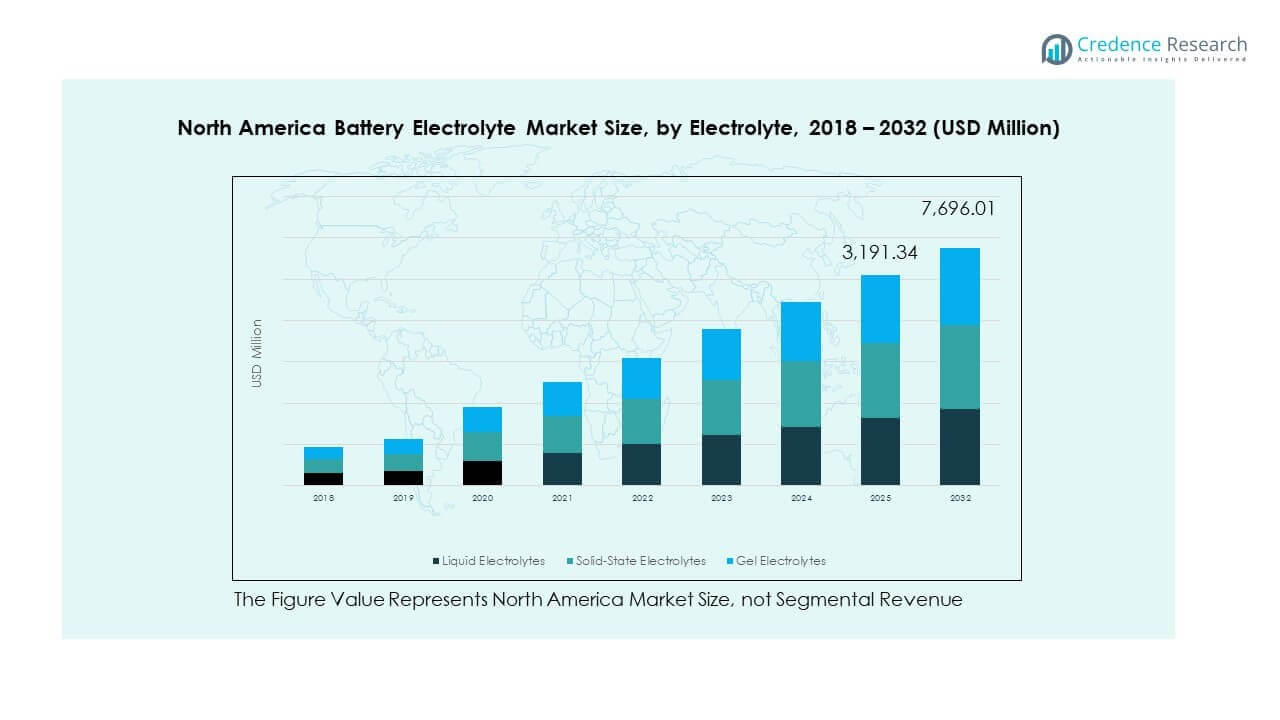

The North America Battery Electrolyte Market size was valued at USD 1,310.20 million in 2018 to USD 2,827.98 million in 2024 and is anticipated to reach USD 7,696.01 million by 2032, at a CAGR of 13.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Battery Electrolyte Market Size 2024 |

USD 2,827.98 Million |

| North America Battery Electrolyte Market, CAGR |

13.33% |

| North America Battery Electrolyte Market Size 2032 |

USD 7,696.01 Million |

The market expands rapidly due to the rising adoption of electric vehicles, large-scale renewable energy storage projects, and increasing demand for consumer electronics. Government incentives and emission regulations are pushing automakers to transition toward advanced battery technologies. Investments in solid-state and gel-based electrolytes are improving safety, lifespan, and energy efficiency, while industrial electrification and grid storage projects continue to add momentum. The shift toward sustainable energy systems further reinforces electrolyte demand across multiple end-use industries.

Geographically, the United States leads the market, supported by strong EV adoption, large-scale renewable projects, and advanced R&D ecosystems. Canada demonstrates steady growth with increasing investments in energy storage and clean energy transition programs. Mexico is emerging as a significant hub, benefiting from growing automotive manufacturing and regional supply chain integration. Together, these countries highlight a balanced regional outlook, with mature markets driving innovation and emerging economies creating new demand avenues for battery electrolytes.

Market Insights:

Market Insights:

- The North America Battery Electrolyte Market was valued at USD 1,310.20 million in 2018, reached USD 2,827.98 million in 2024, and is expected to hit USD 7,696.01 million by 2032, growing at a CAGR of 13.33% during the forecast period.

- The United States led with 65% share in 2024, supported by strong EV adoption, renewable projects, and advanced R&D. Canada held 20%, driven by clean energy investments, while Mexico accounted for 15%, benefiting from manufacturing expansion.

- The fastest-growing region is Mexico, supported by rising EV assembly plants, integrated supply chains, and competitive production costs that attract global investments.

- By electrolyte type, liquid electrolytes accounted for around 45% of market share in 2024, sustaining dominance due to wide use in lithium-ion and lead acid batteries.

- Solid-state electrolytes held about 35%, reflecting rapid adoption in EV and energy storage applications, while gel electrolytes secured the remaining share through niche consumer and industrial demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Electric Vehicles and Increasing Demand for Sustainable Mobility Solutions

The growing shift toward sustainable transportation strongly drives demand for advanced battery electrolytes. Governments across North America enforce emission regulations and provide incentives for EV adoption. Automakers accelerate battery development to align with stricter policies. The North America Battery Electrolyte Market benefits as lithium-ion batteries dominate EV production. Investments in fast-charging infrastructure further reinforce growth potential. It responds with research into safer and more efficient electrolytes. Consumer preference for cleaner mobility strengthens this momentum. Industry collaborations ensure a steady supply chain for large-scale deployment.

- For instance, in November 2020, General Motors announced its second-generation Ultium batteries were projected to deliver twice the energy density of the first-generation packs by mid-decade. GM is also developing other battery technologies, like LMR prismatic cells, which were announced in May 2025.

Expansion of Renewable Energy Projects and Growing Need for Grid Storage Systems

The increasing focus on renewable energy integration raises the demand for efficient storage. Solar and wind projects require scalable battery solutions for balancing supply and demand. Grid operators adopt energy storage systems to stabilize frequency and improve reliability. The North America Battery Electrolyte Market gains momentum as advanced electrolytes enhance performance and safety. Governments support this shift through clean energy targets and funding for storage technologies. It positions battery electrolytes as critical enablers of energy transition. Utilities invest in long-duration storage, boosting opportunities for flow batteries. This driver ensures long-term resilience for the market.

- For instance, in November 2020, General Motors announced its second-generation Ultium batteries were projected to deliver twice the energy density of the first-generation packs by mid-decade. GM is also developing other battery technologies, like LMR prismatic cells, which were announced in May 2025.

Advancements in Solid-State and Gel Electrolytes for Safety and Efficiency Improvements

Technological innovation plays a central role in shaping market expansion. Solid-state electrolytes attract significant attention due to higher energy density and safety benefits. Gel-based variants gain demand in consumer devices where stability and performance matter. The North America Battery Electrolyte Market adapts as manufacturers shift from conventional solutions to next-generation materials. It opens pathways for higher adoption in both automotive and stationary storage sectors. Research funding from public and private institutions accelerates product development. Partnerships with automakers and electronics companies strengthen commercialization prospects. This advancement ensures continued competitiveness for the region.

Government Policies, Industrial Electrification, and Strengthening of Regional Manufacturing Capacity

Supportive regulatory frameworks and industrial electrification amplify market potential. Governments introduce incentives for local production of battery components. Manufacturing hubs expand capacity to meet domestic and export demand. The North America Battery Electrolyte Market benefits from localized supply chains that reduce import dependency. It aligns with national strategies focused on energy independence and clean technology leadership. Industrial sectors adopt electrification to reduce carbon footprints, boosting demand for reliable electrolytes. Strategic alliances with chemical companies strengthen innovation pipelines. This driver reinforces the region’s leadership role in the global battery industry.

Market Trends:

Integration of Advanced Electrolyte Additives to Enhance Battery Performance and Lifecycle

The growing need for durable and high-performing batteries drives innovation in electrolyte additives. Manufacturers introduce specialized compounds that improve thermal stability, ion conductivity, and safety. These additives extend the overall lifespan of lithium-ion and other batteries. The North America Battery Electrolyte Market reflects this trend as companies adopt advanced formulations to meet automotive and energy storage demands. It strengthens efficiency across diverse applications such as EVs and renewable storage. Research centers collaborate with suppliers to accelerate additive innovation. Consumer electronics also benefit from improved performance consistency. This trend highlights the region’s focus on premium solutions for future-ready applications.

- For instance, in June 2024, BASF, in collaboration with NGK Insulators, released an advanced container-type sodium-sulfur (NAS) battery, called the NAS MODEL L24, for stationary storage projects. The improved technology incorporated into this battery allows customers to save approximately 20% on long-term project costs over the battery’s lifetime.

Digitalization and AI Integration in Battery Development and Testing Processes

The adoption of digital technologies transforms the way battery electrolytes are developed and optimized. Artificial intelligence and machine learning models help predict electrolyte behavior under various conditions. This reduces testing timelines and accelerates product innovation. The North America Battery Electrolyte Market embraces digital tools to enhance R&D productivity. It allows manufacturers to design safer and more efficient electrolyte chemistries with greater accuracy. Partnerships between technology firms and chemical producers increase. Universities and labs integrate AI-driven models into experimental processes. This trend ensures that development cycles remain cost-effective and competitive.

- For instance, in January 2024, Microsoft partnered with the U.S. Pacific Northwest National Laboratory (PNNL) to use AI and high-performance cloud computing to discover a new solid electrolyte material, which took less than nine months from discovery to a working prototype.

Shift Toward Localized Supply Chains and Regional Gigafactory Investments

Governments and industry stakeholders prioritize local manufacturing of battery components. Regional gigafactories expand production to reduce reliance on imports and improve supply security. The North America Battery Electrolyte Market benefits as companies invest in domestic electrolyte plants. It enhances regional resilience and strengthens alignment with clean energy policies. Automakers secure contracts with local suppliers for stable procurement. Chemical companies form joint ventures to scale production near demand centers. Workforce development programs support the industry’s labor needs. This trend underscores regional self-sufficiency and global competitiveness.

Focus on Sustainability and Development of Eco-Friendly Electrolyte Materials

Environmental regulations push the industry to adopt greener materials and reduce chemical hazards. Manufacturers explore bio-based and recyclable electrolytes that align with sustainability goals. The North America Battery Electrolyte Market experiences strong momentum as eco-friendly alternatives gain traction. It supports corporate ESG commitments and regulatory compliance. Investors favor companies prioritizing low-carbon processes and safe materials. Research initiatives target eliminating toxic solvents and reducing lifecycle emissions. Consumer awareness also drives interest in sustainable technologies. This trend cements the importance of environmental stewardship in long-term market strategies.

Market Challenges Analysis:

Market Challenges Analysis:

High Production Costs, Raw Material Volatility, and Supply Chain Constraints

The cost of producing advanced electrolytes remains a significant barrier for companies. Price volatility of raw materials such as lithium salts, solvents, and specialty additives directly impacts profitability. The North America Battery Electrolyte Market faces supply chain risks linked to global sourcing of critical chemicals. It creates uncertainty for manufacturers balancing production scale with competitive pricing. Transportation disruptions and geopolitical pressures further increase risks of delays and shortages. Companies struggle to maintain cost stability while meeting growing demand from automotive and storage sectors. Investments in recycling and localized sourcing provide partial relief but remain limited. This challenge emphasizes the importance of securing resilient supply networks.

Stringent Safety Standards, Regulatory Compliance, and Slow Transition to Next-Generation Technologies

Electrolytes are highly sensitive to safety regulations due to flammability and environmental risks. Companies must comply with strict standards for storage, transport, and product performance. The North America Battery Electrolyte Market often faces delays in commercialization due to regulatory approvals. It slows the adoption of new chemistries like solid-state or bio-based electrolytes. Testing, certification, and compliance increase costs and lengthen timelines. Customers in automotive and energy storage sectors demand proven safety, adding further pressure on suppliers. Smaller firms face challenges competing against established players with compliance infrastructure. This barrier highlights the need for balancing innovation with regulatory frameworks.

Market Opportunities:

Expansion of Electric Vehicle Ecosystem and Rising Investment in Battery Manufacturing Infrastructure

The rapid expansion of the EV ecosystem creates significant opportunities for electrolyte suppliers. Automakers invest in new battery production facilities, and regional gigafactories increase capacity. The North America Battery Electrolyte Market benefits from strong policy incentives that support clean mobility adoption. It enables electrolyte producers to form long-term supply contracts with OEMs. Investments in localized production reduce dependency on imports and strengthen supply resilience. Collaborations between automakers and chemical companies accelerate the commercialization of advanced electrolyte technologies. Growing demand for lightweight, safe, and high-capacity batteries boosts innovation. This opportunity ensures a stable growth pipeline across both automotive and industrial sectors.

Development of Next-Generation Electrolytes for Energy Storage and Renewable Integration

Energy storage demand grows as renewable adoption accelerates across the region. Grid operators and utilities require high-performance electrolytes for flow batteries and solid-state systems. The North America Battery Electrolyte Market positions itself as a key enabler of this transition. It creates space for companies to introduce new formulations focused on stability and efficiency. Funding from government initiatives and private investors strengthens research pipelines. Consumer electronics and industrial applications also benefit from safer and longer-lasting electrolytes. Companies entering this space can gain a competitive edge by addressing unmet technical needs. This opportunity highlights the alignment between innovation and sustainability goals.

Market Segmentation Analysis:

By Electrolyte Type

Liquid electrolytes dominate due to established use in lithium-ion and lead acid batteries. Solid-state electrolytes gain momentum with demand for safer, higher-density storage solutions. Gel electrolytes find application in portable devices and specialized systems where stability is critical. The North America Battery Electrolyte Market reflects this shift toward advanced chemistries as manufacturers prioritize performance and safety improvements. It continues to adapt as R&D funding supports next-generation formulations.

- For instance, in June 2024, QuantumScape produced solid-state electrolyte prototypes achieving energy densities exceeding 800 Wh/L in test cells.

By Battery Type

Lithium-ion batteries hold the largest share, supported by electric vehicle adoption and consumer electronics demand. Lead acid batteries maintain steady relevance in backup power and industrial applications. Flow batteries capture interest from grid-scale storage projects, aligning with renewable energy integration. Other battery types serve niche industrial and defense requirements. This segment illustrates the broad diversification of electrolyte applications across industries.

By Application

Automotive represents the leading application, with EV production driving strong demand for advanced electrolytes. Consumer electronics sustain consistent growth through smartphones, laptops, and wearables. Energy storage emerges as a high-potential sector, driven by renewable integration and grid modernization. Other applications, including industrial and specialty uses, provide steady niche opportunities. The North America Battery Electrolyte Market captures growth across all applications, reflecting a balanced mix of mature and emerging demand drivers.

Segmentation:

Segmentation:

By Electrolyte Type

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel Electrolytes

By Battery Type

- Lithium-ion

- Lead Acid

- Flow Battery

- Others

By Application

- Automotive

- Consumer Electronics

- Energy Storage

- Others

By Geography / Country

Regional Analysis:

United States Leading the Regional Market

The United States dominates the North America Battery Electrolyte Market with a share of nearly 65% in 2024. Strong electric vehicle adoption, large-scale renewable projects, and a mature consumer electronics sector support this leadership. Automakers and battery producers invest in gigafactories, ensuring stable demand for advanced electrolytes. It benefits from robust R&D ecosystems and government incentives promoting clean energy transition. Collaborations between technology firms and chemical suppliers accelerate development of solid-state and gel-based variants. The U.S. continues to act as the anchor market, shaping both regional supply and innovation trends.

Canada’s Expanding Role in Energy Storage and Clean Technology

Canada accounts for about 20% of the regional share in 2024, driven by increasing investments in energy storage and renewable power integration. Provincial policies emphasize sustainable energy, creating strong opportunities for battery electrolyte adoption. Local initiatives promote EV usage, boosting demand for lithium-ion electrolytes. The North America Battery Electrolyte Market in Canada also benefits from partnerships between universities and chemical companies that focus on safety and efficiency improvements. It positions itself as a regional hub for clean technology, supported by federal commitments to carbon neutrality. Canada demonstrates steady progress as both a consumer and innovator.

Mexico’s Emerging Position as a Manufacturing Hub

Mexico holds nearly 15% of the regional share in 2024, reflecting its growing importance in automotive and industrial manufacturing. The expansion of EV assembly plants and supplier networks supports rising demand for electrolytes. It gains momentum through integration into North American supply chains that link production with U.S. and Canadian markets. Mexico’s lower production costs attract foreign investment into battery component manufacturing. Regional trade agreements further strengthen its role as a strategic hub. The North America Battery Electrolyte Market in Mexico continues to expand, balancing cost efficiency with rising demand for advanced energy storage solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- East Penn Manufacturing

- 3M

- Targray Industries Inc

- NOHMs Technologies Inc

- NEI Corporation

- Advanced Electrolyte Technologies, LLC

- Solvay SA

- UNICOM Engineering, Inc

- Capchem

- Koura

Competitive Analysis:

The North America Battery Electrolyte Market is characterized by strong competition between global chemical majors and regional innovators. Companies focus on expanding production capacity, advancing solid-state technologies, and building long-term partnerships with automotive OEMs. Leading players such as Mitsubishi Chemical America, East Penn Manufacturing, and 3M emphasize R&D investments to enhance product safety and efficiency. It remains competitive due to the presence of both established multinationals and specialized electrolyte suppliers. Strategic acquisitions, regional expansions, and new product launches are central to securing market share. Collaboration with gigafactories and renewable energy projects further strengthens positioning. This competitive landscape highlights a mix of technology leadership, cost competitiveness, and sustainable manufacturing strategies.

Recent Developments:

- In March 2025, East Penn Manufacturing launched the new Deka Ready Power product family at the ProMat 2025 show in Chicago. This product line offers maintenance-free batteries for Motive Power applications, including Lithium and Gel technologies, designed for heavy-duty environments with features like welded busbars, active cooling for thermal management, and battery discharge indicators for safety. This launch targets improved performance and reduced downtime in material handling operations.

Report Coverage:

The research report offers an in-depth analysis based on electrolyte type, battery type, and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- EV adoption will remain the strongest driver of electrolyte demand in the region.

- Solid-state electrolyte commercialization will accelerate with support from research and pilot projects.

- Localized supply chains will strengthen as governments promote domestic manufacturing.

- Energy storage projects will boost demand for flow battery electrolytes.

- Consumer electronics will sustain consistent growth in liquid electrolyte usage.

- Safety-focused innovations will dominate product development strategies.

- Partnerships between automakers and chemical companies will expand further.

- Regulatory frameworks will continue to shape product design and compliance standards.

- Investments in recycling and circular economy models will gain importance.

- The North America Battery Electrolyte Market will expand through a balance of mature and emerging applications.

Market Insights:

Market Insights: Market Challenges Analysis:

Market Challenges Analysis: Segmentation:

Segmentation: