Market Overview

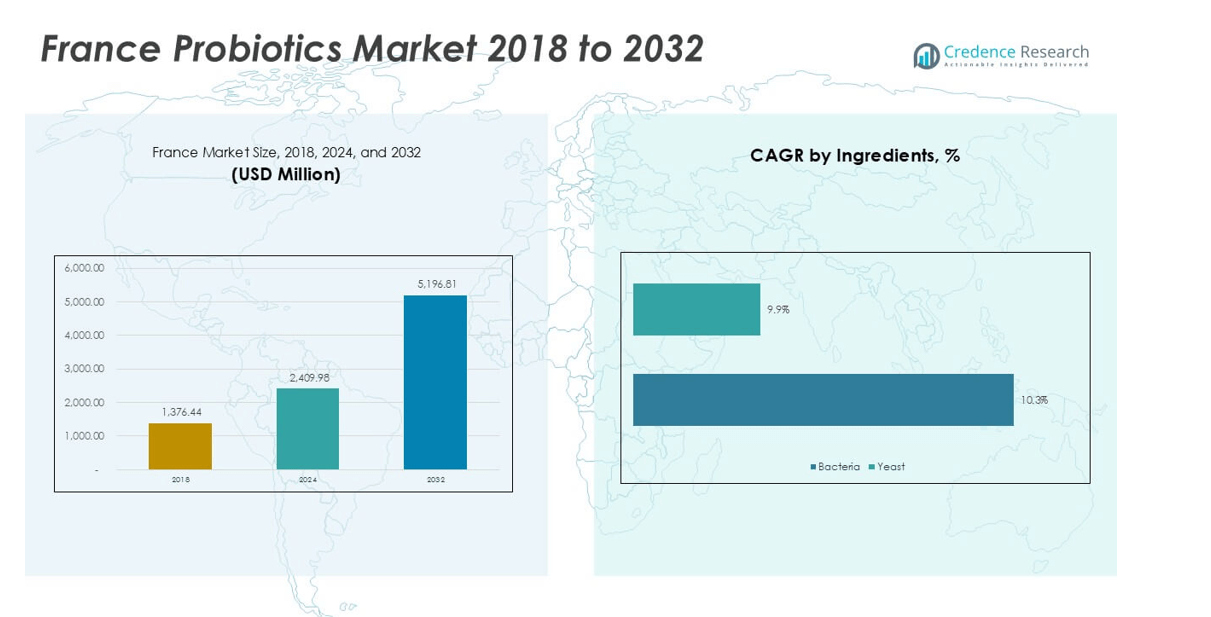

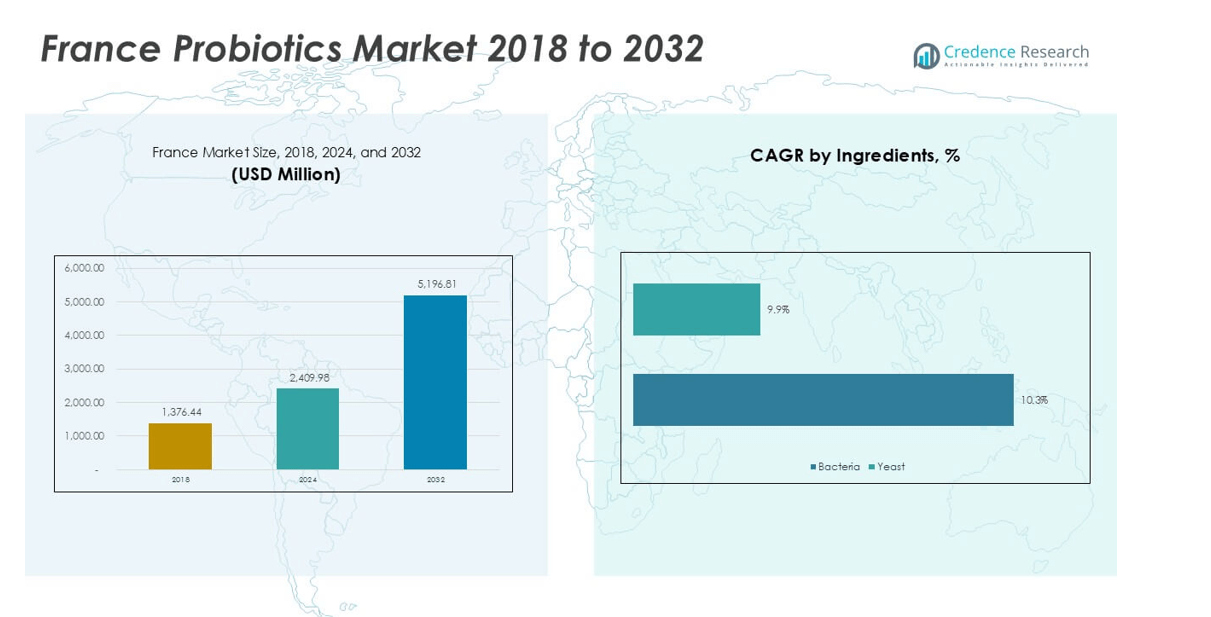

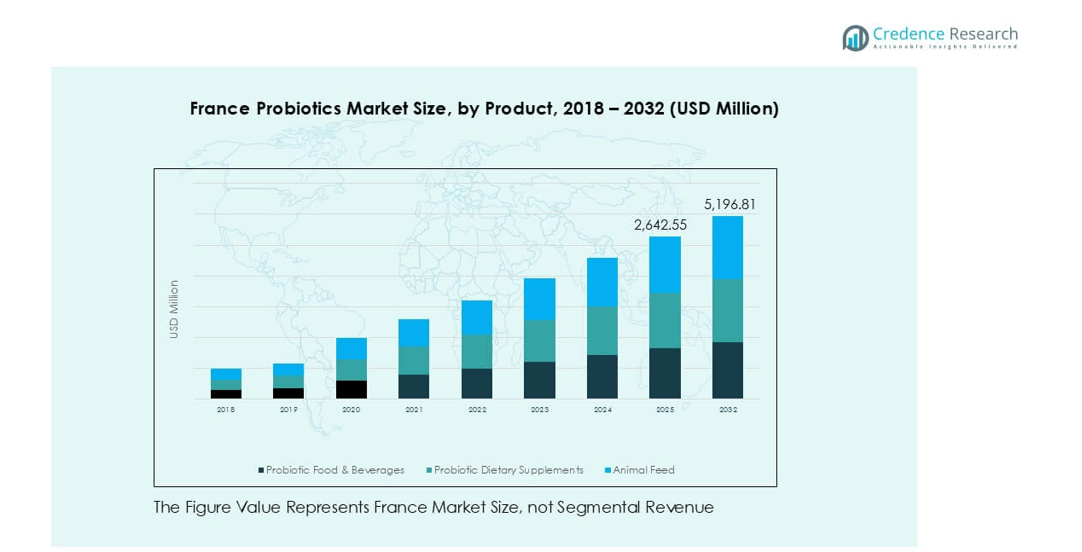

The France Probiotics market size was valued at USD 1,376.44 million in 2018, increasing to USD 2,409.98 million in 2024, and is anticipated to reach USD 5,196.81 million by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Probiotics Market Size 2024 |

USD 2,409.98 million |

| France Probiotics Market , CAGR |

9.9% |

| France Probiotics Market Size 2032 |

USD 5,196.81 million |

The France probiotics market is led by prominent players such as Nestlé S.A., Danone S.A., Yakult Honsha Co., Ltd., Kerry Group, Lallemand Inc., and Arkopharma, alongside specialized firms like Biofarma Srl and D-LAB Nutricosmetics. These companies dominate through extensive product portfolios spanning probiotic dairy, dietary supplements, and functional beverages, supported by strong R&D and clinical validation. Regionally, North France leads the market with a 28% share in 2024, driven by high urban demand for probiotic foods and supplements. South France follows with 22%, supported by lifestyle-driven adoption and a growing elderly population. Central France contributes 20%, benefitting from strong dairy traditions and expanding use in animal feed, while West France holds 18%, driven by infant nutrition. Eastern France accounts for 12%, showing steady growth potential. The combined influence of global leaders and regional innovators, supported by diverse regional consumption patterns, ensures a competitive and expanding probiotics market in France.

Market Insights

- The France probiotics market was valued at USD 2,409.98 million in 2024 and is projected to reach USD 5,196.81 million by 2032, growing at a CAGR of 9.9% during the forecast period.

- Rising demand for digestive and immune health solutions is fueling market growth, with probiotic dairy products and dietary supplements leading consumer preference across France.

- Key trends include the expansion of plant-based and clean-label probiotics, along with technological advancements such as microencapsulation and multi-strain formulations that enhance product stability and effectiveness.

- The market is highly competitive, with global leaders like Nestlé, Danone, Yakult, and Kerry Group competing alongside local players such as Arkopharma and D-LAB Nutricosmetics, all focusing on innovation and expanding product portfolios.

- Regionally, North France holds the largest share at 28%, followed by South France at 22%, Central France at 20%, West France at 18%, and Eastern France at 12%, reflecting diverse consumer adoption patterns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

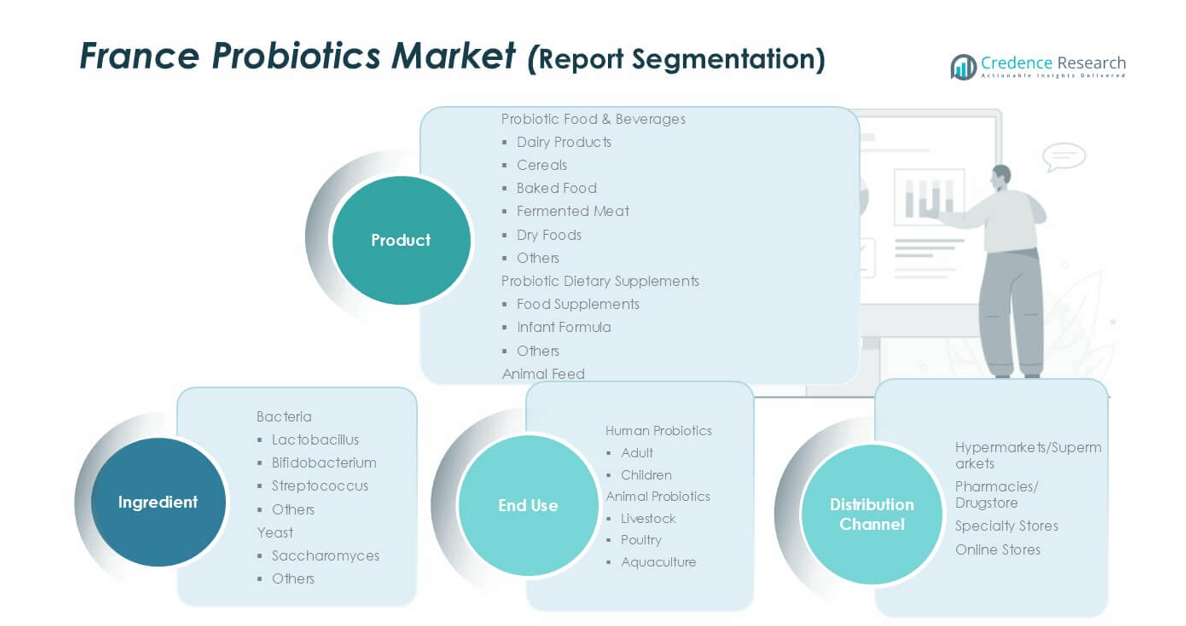

Market Segmentation Analysis:

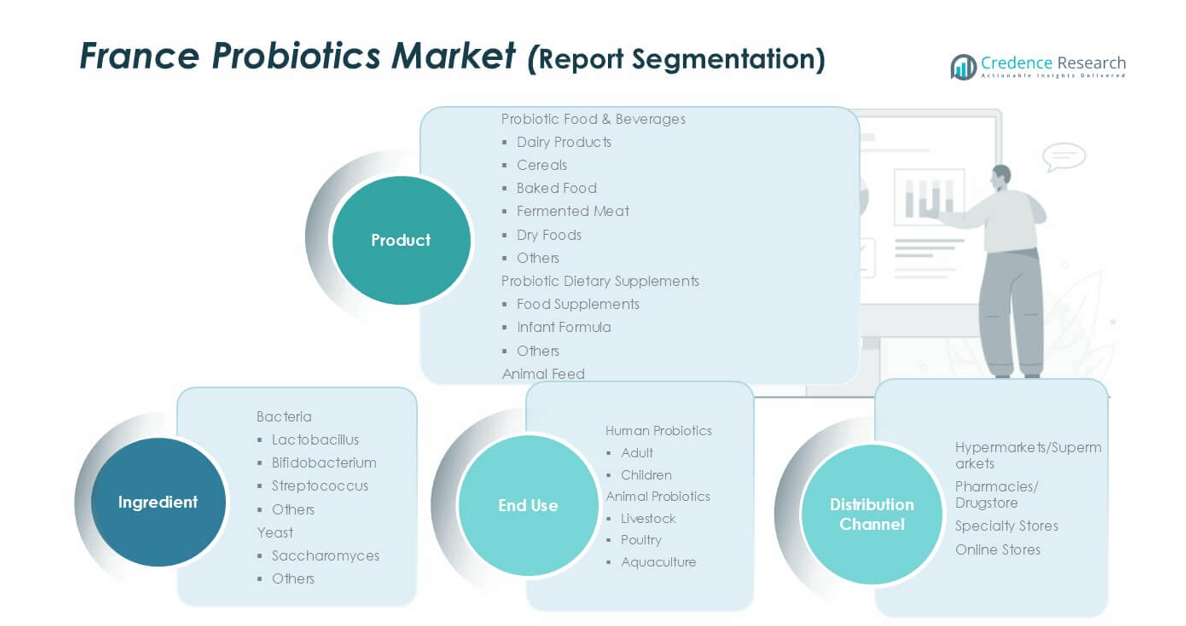

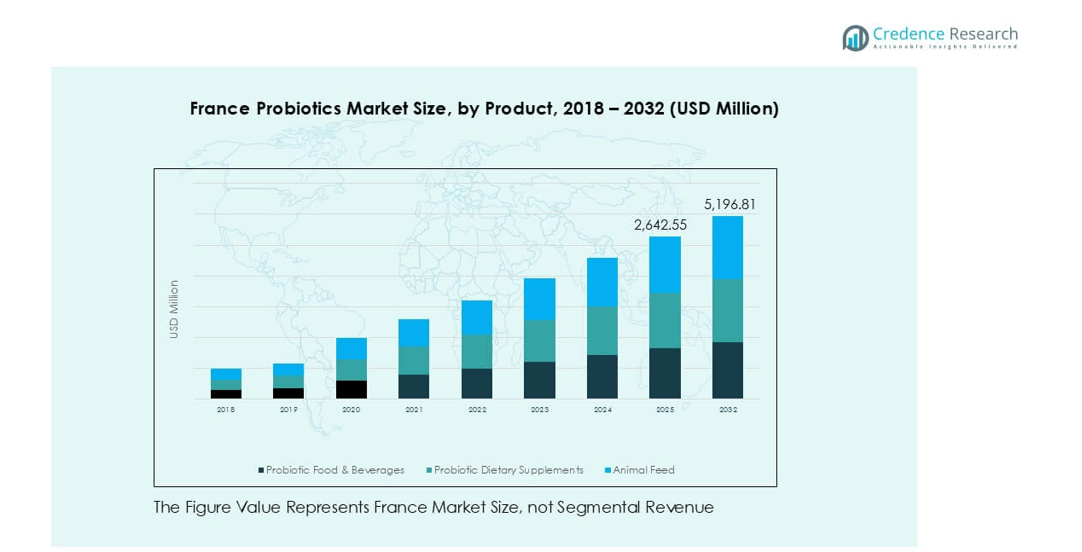

By Product

The France probiotics market by product is dominated by probiotic food and beverages, holding more than 60% share in 2024. Within this category, dairy products, such as yogurts and fermented milk, lead consumption due to high consumer preference for functional and digestive health foods. Cereals, baked food, and fermented meat are gradually expanding adoption with increasing awareness of gut health benefits. Probiotic dietary supplements, including infant formulas and food supplements, show strong growth potential, while the animal feed segment is gaining traction in livestock and poultry health improvement.

- For instance, Danone, headquartered in Paris, sold a significant volume of Activia and Actimel probiotic yogurts and drinks globally in 2022, with France ranking among its strongest markets.

By Ingredient

Bacterial strains dominate the France probiotics market by ingredient, accounting for over 70% share in 2024. Lactobacillus remains the leading sub-segment, driven by its extensive application in dairy products and proven digestive health benefits. Bifidobacterium follows, with strong adoption in infant formula and supplements. Streptococcus is also witnessing increasing use in fermented foods. Yeast-based probiotics, led by Saccharomyces, are expanding their role in dietary supplements and animal feed, supported by their proven resilience and efficiency in gut health management.

- For instance, in 2022, Yakult Honsha globally produced and sold over 40 million probiotic bottles daily, which contain the Lacticaseibacillus paracaseiShirota strain. Yakult’s products are sold in France, and the French probiotic drink market experienced growth that year. However, Yakult’s sales in France represent only a small fraction of its total worldwide production and sales.

By End User

Human probiotics lead the France market, capturing more than 80% share in 2024, with adults representing the largest consumer group. Growing health awareness, demand for preventive healthcare, and lifestyle-driven digestive issues are fueling adoption among adults. Children’s probiotics also show strong uptake, especially in infant formulas and fortified food products. Animal probiotics, though smaller in scale, are rapidly rising in demand, especially in livestock and poultry to improve immunity, growth, and productivity. Aquaculture applications further contribute to expanding adoption in the animal segment.

Key Growth Drivers

Rising Consumer Focus on Digestive and Immune Health

Growing consumer awareness about gut health and its link to overall wellness is a key driver for the France probiotics market. Digestive disorders, lifestyle-related stress, and unhealthy diets are pushing consumers toward functional foods and supplements that support immunity and digestion. Probiotic dairy products, yogurts, and supplements are particularly popular due to their proven benefits in improving gut flora balance. The COVID-19 pandemic further accelerated demand for immunity-boosting products, with probiotics gaining strong visibility. As France’s population continues to age, consumers increasingly prioritize preventive health solutions over reactive treatments. This shift is fueling the integration of probiotics into everyday diets through food, beverages, and supplements. The strong clinical backing of probiotic benefits and the availability of diverse product forms strengthen consumer confidence, making probiotics a mainstream choice for daily nutrition and preventive healthcare in the French market.

- For instance, Danone’s Essential Dairy and Plant-Based division, which includes Activia and Actimel, generated €13.5 billion in global sales value in 2022, as part of the company’s total net sales of over €27.6 billion.

Expansion of Functional Food and Beverage Industry

The strong growth of the functional food and beverage sector in France has created substantial opportunities for probiotics. Dairy remains the backbone of probiotic integration, with yogurts, kefir, and fermented milk products leading consumption. However, new product innovations, such as fortified cereals, baked goods, and beverages, are driving wider adoption among younger and health-conscious consumers. French consumers are willing to pay a premium for products with clear health benefits, supporting the value growth of functional foods enriched with probiotics. Additionally, clean-label preferences are shaping demand for naturally fermented foods and minimally processed probiotic offerings. Manufacturers are investing in innovative formulations to expand beyond traditional dairy, targeting plant-based and vegan alternatives to appeal to changing dietary habits. The blending of probiotics into diverse food matrices ensures convenience and accessibility, aligning with modern lifestyles. This strong integration across food and beverage categories reinforces probiotics as a core growth driver in France.

- For instance, Lactalis is a French dairy leader that innovates with fermented milk products under various brands, such as Lactel, to meet evolving consumer demands for products with perceived health benefits.

Increasing Demand in Infant Nutrition and Elderly Care

The rising demand for probiotics in infant nutrition and elderly healthcare is another major growth factor in France. Infant formula fortified with probiotics is gaining traction, supported by clinical studies highlighting benefits in immunity, gut health, and allergy prevention. Parents are increasingly seeking products that mimic natural microbiota development, ensuring strong adoption in this segment. Meanwhile, the aging French population is more prone to digestive issues, weakened immunity, and chronic health conditions, driving reliance on probiotics for preventive care. Functional supplements and fortified dairy products are particularly favored among elderly consumers for maintaining gastrointestinal balance and reducing health risks. Healthcare professionals are also recommending probiotics more frequently, which boosts trust and adoption rates. This dual demand from infants and seniors creates a wide consumer base, ensuring steady growth in both dietary supplement and functional food categories. As awareness spreads, these specialized segments will remain vital to long-term market expansion.

Key Trend & Opportunity

Shift Toward Plant-Based and Clean-Label Probiotics

One of the key trends in the France probiotics market is the rise of plant-based and clean-label products. As vegan and vegetarian lifestyles expand, consumers are seeking dairy-free probiotic options made from soy, almond, oats, and coconut bases. Clean-label demand is also growing, with consumers preferring natural, organic, and minimally processed formulations without artificial additives. This trend has encouraged innovation in fermented plant-based foods, beverages, and supplements. Companies are actively investing in R&D to ensure stability and viability of probiotic strains in non-dairy matrices, expanding product accessibility. Regulatory frameworks in France further encourage transparency in labeling and health claims, creating trust among buyers. This shift toward sustainable, ethical, and transparent probiotic solutions represents a major growth opportunity for brands, as it aligns with evolving consumer values around wellness, sustainability, and ethical consumption.

- For instance, Danone expanded its Alpro plant-based yogurt line in 2022 with probiotic-enriched almond and oat-based variants, producing more than 130,000 tons of plant-based products across Europe annually, including France.

Technological Advancements in Probiotic Formulations

Advancements in probiotic technology are creating strong opportunities for market growth in France. Innovative encapsulation and microencapsulation technologies are improving the stability, bioavailability, and shelf-life of probiotic strains. This ensures higher effectiveness of probiotics across diverse applications, including dietary supplements, functional beverages, and animal feed. Multi-strain formulations are gaining attention for offering broader health benefits, such as combined digestive, metabolic, and immune support. Personalized nutrition is another emerging trend, with probiotics being tailored to individual microbiome profiles through digital health platforms and DNA-based testing. These innovations not only enhance consumer trust but also allow companies to differentiate their products in a competitive market. As awareness of microbiome science expands, these technological advancements will further elevate consumer confidence and adoption of probiotics, solidifying their role in mainstream healthcare and nutrition in France.

Key Challenge

Regulatory Complexity in Health Claims and Product Approvals

Strict regulatory frameworks governing probiotics in France and the broader EU present a significant challenge. The European Food Safety Authority (EFSA) enforces stringent approval processes for probiotic strains and health claims, requiring extensive scientific evidence. Many probiotic products struggle to obtain approvals for specific health benefits, limiting marketing flexibility for manufacturers. The lack of harmonized definitions of “probiotics” across the EU further adds to confusion and compliance challenges. Companies face high costs in conducting clinical trials and navigating regulatory hurdles, slowing down product launches and innovation. This complexity restricts smaller firms from entering the market and reduces the ability of established players to market probiotic benefits effectively. While regulation ensures consumer safety and product credibility, it creates significant delays and financial barriers, impacting the speed of adoption and growth of probiotic innovations in the French market.

High Product Costs and Competitive Pressure

Another challenge for the France probiotics market is the relatively high cost of probiotic products compared to conventional food and supplements. Advanced manufacturing processes, strain stabilization, and clinical validations increase production expenses, which are often passed on to consumers. While health-conscious buyers are willing to pay premiums, price-sensitive groups may limit their consumption, especially during economic slowdowns. At the same time, rising competition among local and global players has intensified price pressure, forcing companies to balance innovation and affordability. Private-label probiotics are expanding, offering lower-priced alternatives that challenge established brands. The need for continuous R&D, coupled with high compliance costs, further adds to financial strain for manufacturers. This combination of pricing barriers and competitive intensity presents a challenge to sustained profitability, making cost optimization and value-based product positioning essential for long-term success in the France probiotics market.

Regional Analysis

North France

North France accounted for around 28% of the probiotics market share in 2024, supported by strong demand for probiotic dairy products and dietary supplements. The region’s high urbanization and rising health awareness drive consumption of functional foods, particularly yogurts and fermented milk. Pharmacies and retail outlets play a critical role in supplement distribution, enhancing accessibility. Growing adoption among adults for digestive and immune health further strengthens market growth. With rising interest in preventive healthcare and clinical validation of probiotic benefits, North France continues to maintain a significant position in the national market.

West France

West France held nearly 18% share of the probiotics market in 2024, driven largely by increasing adoption in infant nutrition and dietary supplements. Parents are showing a strong preference for probiotic-enriched infant formula, supporting regional demand. The presence of several local dairy producers also contributes to growth, ensuring availability of fortified dairy products. Functional beverages and plant-based probiotic alternatives are gaining traction, especially among younger consumers adopting health-conscious diets. Distribution through supermarkets and specialty health stores adds to market penetration, positioning West France as an expanding hub for probiotic innovation and consumer adoption.

Central France

Central France represented about 20% share of the probiotics market in 2024, benefiting from balanced demand across food, supplements, and animal feed. Strong dairy consumption traditions support probiotic integration into yogurts, cheese, and fermented foods, while dietary supplements continue to expand through pharmacies. The region’s growing elderly population drives demand for preventive health products, boosting adoption of probiotics for digestion and immunity. Additionally, livestock probiotics are increasingly used in farming practices, enhancing animal health and productivity. This combination of human and animal applications underpins steady growth, making Central France an important contributor to the overall market.

South France

South France accounted for around 22% of the probiotics market share in 2024, fueled by lifestyle-driven consumption of functional foods and supplements. The region’s aging population supports strong uptake of probiotics for gut health, immunity, and chronic condition management. Probiotic beverages and fortified dairy products remain key contributors, while the growing wellness culture encourages consumers to adopt preventive healthcare. Pharmacies and online retail channels expand access, with rising consumer trust in clinically proven strains. Demand from both adults and children sustains consistent growth, solidifying South France’s position as a major market within the country.

Eastern France

Eastern France captured approximately 12% share of the probiotics market in 2024, making it the smallest but steadily growing region. Adoption is primarily supported by dietary supplements and functional dairy products. Probiotics in animal feed are also gaining importance in this region, particularly for poultry and livestock sectors, driven by a focus on productivity and disease prevention. Increasing health awareness campaigns and product availability through regional retail chains are encouraging adoption among younger and middle-aged consumers. Though smaller in scale, Eastern France shows promising growth potential as awareness of gut health and preventive care rises.

Market Segmentations:

By Product

- Probiotic Food & Beverages

-

-

- Dairy Products

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Others

- Probiotic Dietary Supplements

-

-

- Food Supplements

- Infant Formula

- Others

By Ingredient

-

-

- Lactobacillus

- Bifidobacterium

- Streptococcus

- Others

By End User

-

-

- Livestock

- Poultry

- Aquaculture

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

By Geography

- North France

- West France

- Central France

- South France

- Eastern France

Competitive Landscape

The competitive landscape of the France probiotics market is characterized by the presence of multinational corporations, regional producers, and emerging niche players. Companies such as Nestlé S.A., Danone S.A., Yakult Honsha Co., Ltd., and Kerry Group dominate the market with extensive product portfolios across probiotic foods, beverages, and dietary supplements. Local players like Arkopharma and D-LAB Nutricosmetics focus on specialized supplements and beauty-from-within concepts, catering to growing consumer demand for targeted health solutions. Biofarma Srl and Lallemand Inc. leverage strong research capabilities to introduce advanced formulations, while DöhlerGroup emphasizes natural ingredient innovation. Competitive differentiation is driven by R&D investments, clinical validation, and brand credibility. Partnerships with healthcare providers, expansion into plant-based formulations, and focus on clean-label positioning are emerging strategies to capture evolving consumer preferences. With intensifying competition, companies are also adopting mergers, acquisitions, and collaborations to strengthen market presence and expand distribution networks in France’s dynamic probiotics sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Biofarma Srl

- DöhlerGroup

- Nestle S.A.

- Danone S.A.

- Yakult Honsha Co., Ltd.

- D-LAB Nutricometics

- Kerry Group

- Lallemand Inc

- Exden

- Probi

- Symprove Ltd.

- Arkopharma

- Other Key Players

Recent Developments

- In October 2024, Probi launched clinically-supported probiotic solution for metabolic health.

- In August 2024, AB-Biotics launched probiotic solutions Gyntima Menopause (complex probiotic made of Lacotobacillus crispatus KABP™ Lactobacillus plantarum KABP™ 051 (CECT 7481), and Lactococcus lactis KABP™ 021 (CECT 7483). It helps to regulate estrogen level by reactivating it through β-glucuronidase (GUS) activity in women suffering from perimenopausal symptoms.

- In August 2024, ZBiotics announced the completion of venture series A (amounting to USD 12 million) in order to support the commercialization of genetically engineered probiotics.

- In February 2024, AB Biotics SA (Netherlands) expands its presence in Asia, partnering with Wonderlab for their globally marketed product, AB-LIFE. The collaboration introduces Shape100, a probiotic blend focusing on cardiometabolic health, to the Chinese market. This strategic move aims to address cholesterol-related concerns through evidence-based solutions.

- In November 2023, Nestlé (Switzerland) launched N3 milk, a breakthrough in nutritional innovation. Incorporating prebiotic fibers and reduced lactose, it enriches gut health and boasts over 15% fewer calories. Tailored for diverse dietary needs, N3 supports bone health, muscle growth, and immunity.

- In April 2022, Symrise, a r producer of cosmetic ingredients, launched SymFerment, a cutting-edge ingredient designed to enhance skin care with its moisturizing and smoothing properties. Developed in collaboration with Probi, a leading manufacturer of probiotics for the healthcare and food industries, SymFerment represents a significant advancement in sustainable cosmetic technology

Report Coverage

The research report offers an in-depth analysis based on Product, Ingredient, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France probiotics market will continue to expand with strong demand for functional foods.

- Dairy-based probiotics will remain dominant, though plant-based alternatives will gain steady traction.

- Dietary supplements will grow rapidly due to rising interest in preventive healthcare.

- Infant nutrition fortified with probiotics will see strong adoption among health-conscious parents.

- Elderly consumers will drive demand for digestive and immune health-focused formulations.

- Technological advancements will improve strain stability and product effectiveness across applications.

- Clean-label and organic probiotics will attract consumers seeking natural wellness solutions.

- Competition will intensify as global leaders and local players expand portfolios.

- Regional consumption will remain led by North and South France with steady nationwide adoption.

- Personalized nutrition solutions will create new opportunities in probiotics through tailored formulations.