Market Overview

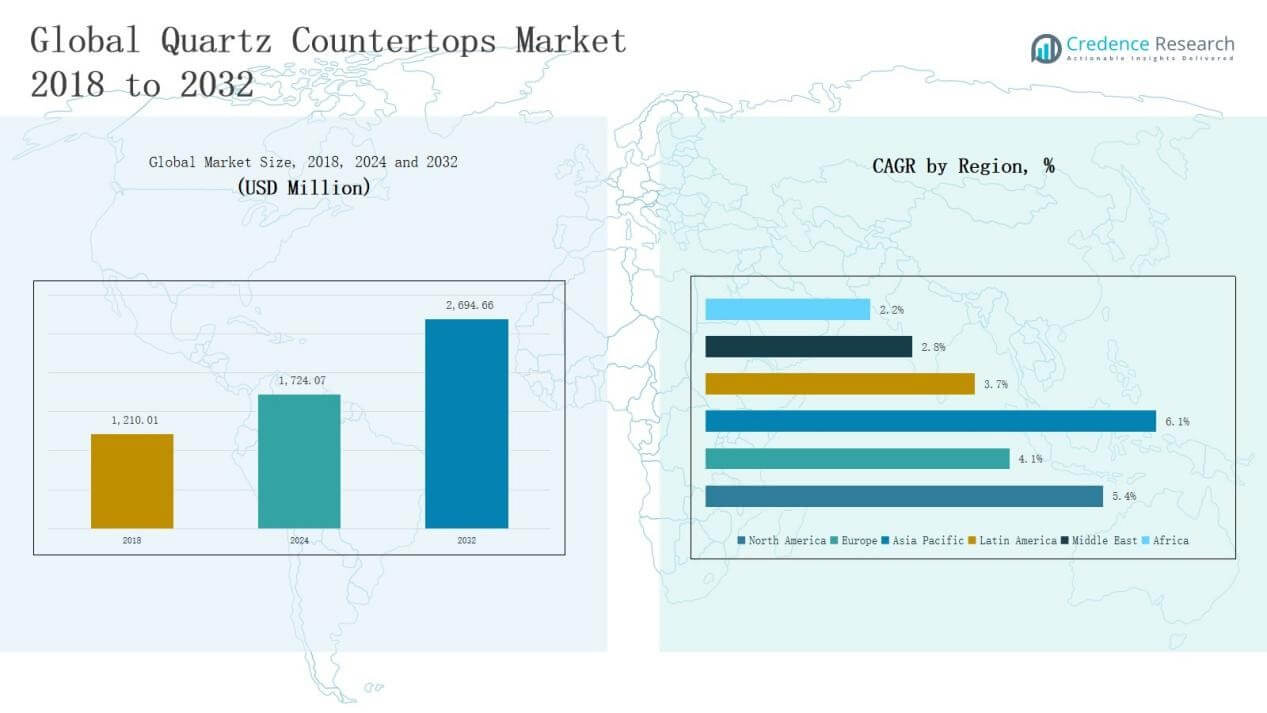

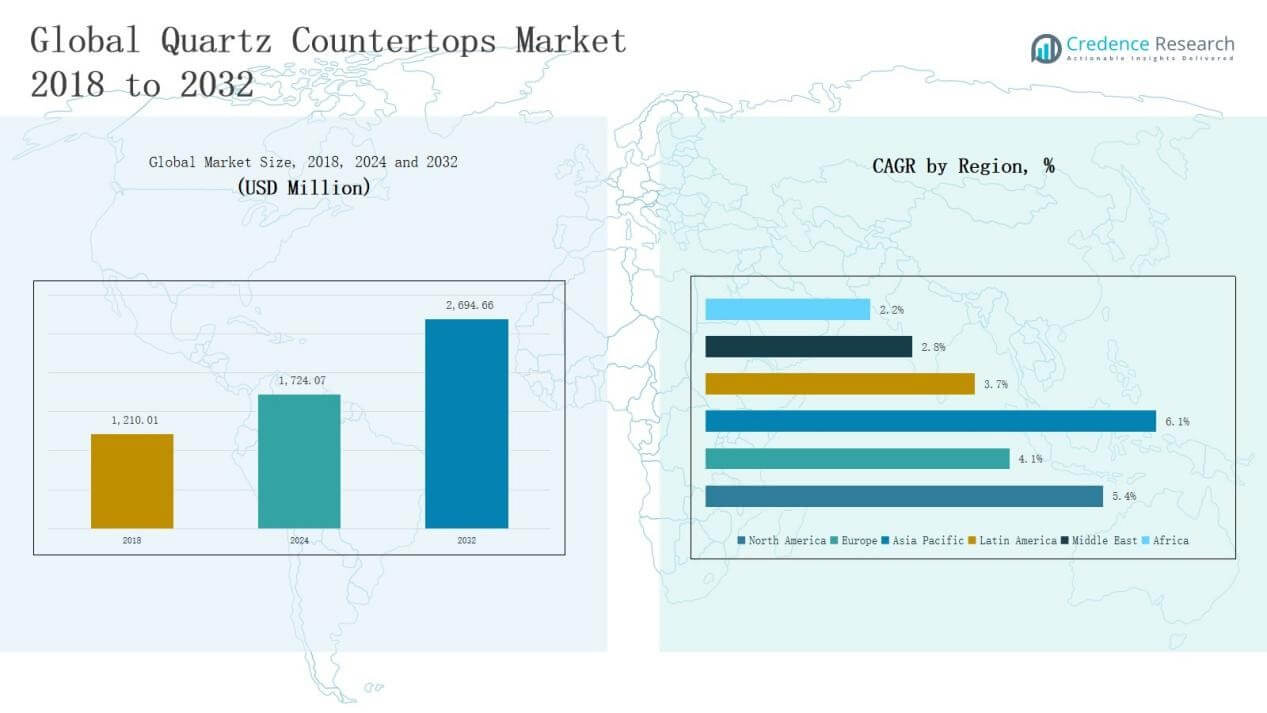

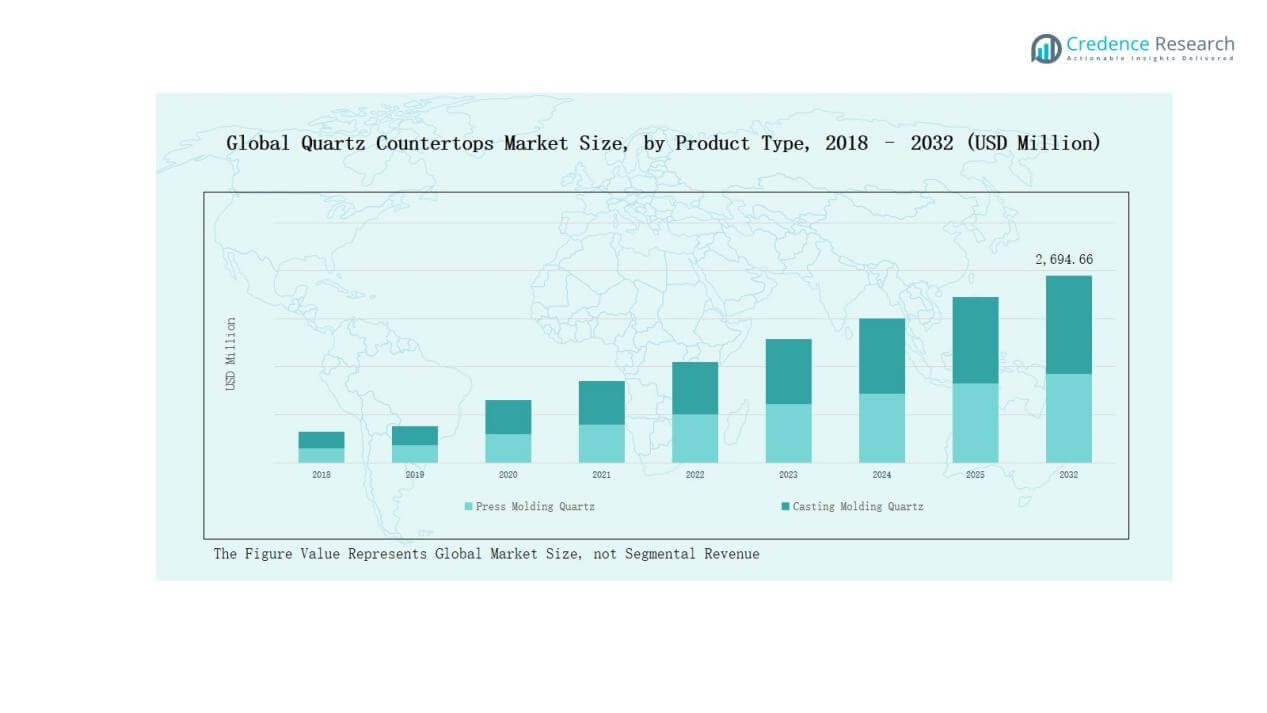

Quartz Countertops Market size was valued at USD 1,210.01 million in 2018, reached USD 1,724.07 million in 2024, and is anticipated to reach USD 2,694.66 million by 2032, at a CAGR of 5.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quartz Countertops Market Size 2024 |

USD 1,724.07 Million |

| Quartz Countertops Market, CAGR |

5.34% |

| Quartz Countertops Market Size 2032 |

USD 2,694.66 Million |

The Quartz Countertops Market is shaped by strong competition among global players such as Caesarstone Ltd., Cosentino Group (Silestone), Cambria Company LLC, Hanwha L&C (HanStone Quartz), LG Hausys, Dupont (Corian Quartz), Vicostone, Compac, Santa Margherita S.p.A., and Quartz Master. These companies focus on product innovation, premium finishes, and expanding distribution to strengthen their market position. In 2024, Asia Pacific emerged as the leading region with 45.3% market share, driven by rapid urbanization, large-scale construction, and rising consumer demand for durable and stylish countertop surfaces.

Market Insights

Market Insights

- Quartz Countertops Market grew from USD 1,210.01 million in 2018 to USD 1,724.07 million in 2024 and will reach USD 2,694.66 million by 2032 at a 34% CAGR.

- Major players include Caesarstone Ltd., Cosentino Group, Cambria Company LLC, Hanwha L&C, LG Hausys, Dupont, Vicostone, Compac, Santa Margherita S.p.A., and Quartz Master, focusing on innovation and premium finishes.

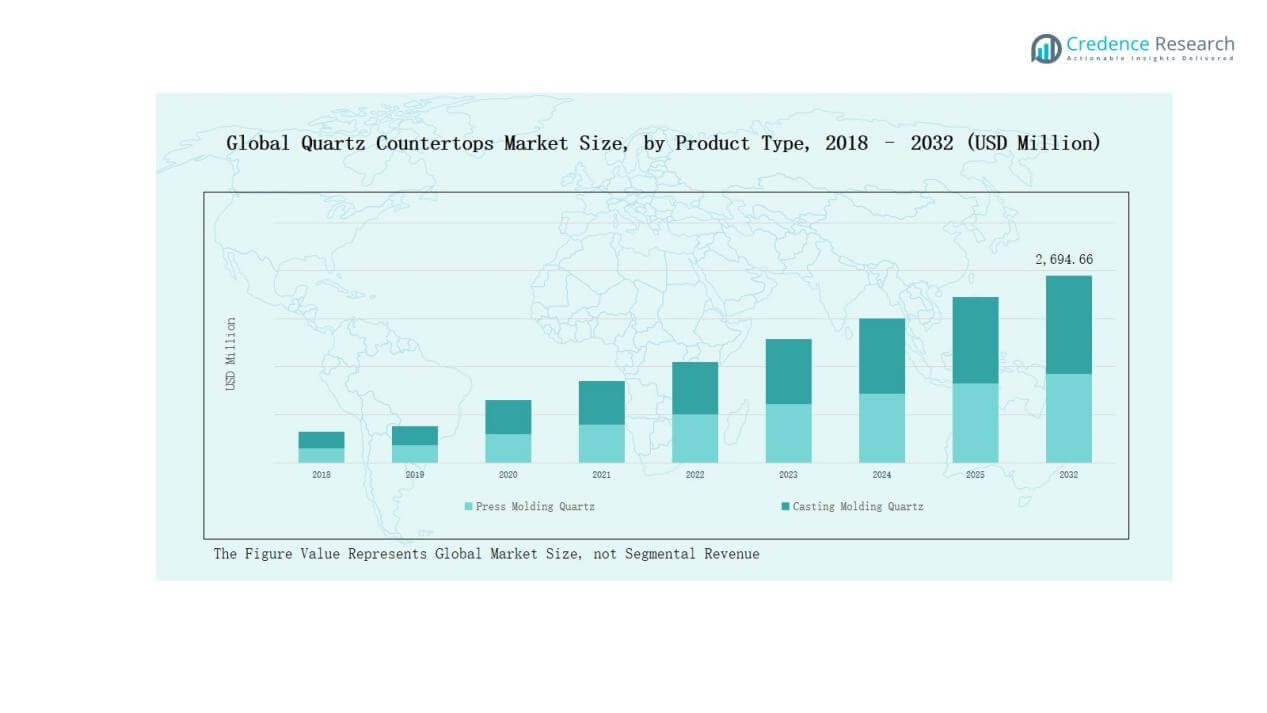

- Press molding quartz dominated with 61% share in 2024, favored for its durability, cost-effectiveness, and uniform finish, while casting molding quartz gained traction in luxury applications.

- The residential segment led with 67% share in 2024, followed by commercial at 24% and others at 9%, supported by growing adoption in healthcare, laboratories, and institutions.

- Asia Pacific led with 45.3% share in 2024, followed by North America at 2% and Europe at 18.1%, reflecting strong growth in urbanization and construction activity across key regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Press molding quartz dominated the Quartz Countertops Market with nearly 61% share in 2024, driven by its durability, uniform finish, and suitability for large-scale installations in kitchens and bathrooms. Its cost-effectiveness and ease of production make it the preferred choice for both residential and commercial applications. Casting molding quartz, while holding a smaller share, is steadily gaining traction due to its ability to deliver design flexibility and unique patterns, appealing to luxury housing and premium interior projects.

For instance, Cambria introduced designs such as Brittanicca Gold and Mersey through casting methods, offering artistic veining and unique textures that appeal to high-end, luxury interiors.

By Application

The residential segment led the market with about 67% share in 2024, supported by rising housing projects, remodeling activities, and consumer preference for stylish, low-maintenance surfaces. Quartz countertops’ resistance to scratches and stains drives household adoption. The commercial segment followed with 24% share, fueled by usage in hospitality, retail, and office spaces, while the others category accounted for 9% share, with growing adoption in laboratories, healthcare facilities, and educational institutions due to hygiene and durability benefits.

For instance, Caesarstone introduced its Pebbles Collection, designed for residential kitchens and bathrooms, emphasizing stain resistance and aesthetic appeal.

Key Growth Drivers

Rising Residential Renovation and Remodeling Activities

Increasing home renovation projects, particularly in urban and suburban areas, drive strong demand for quartz countertops. Consumers prefer quartz over natural stone due to its durability, stain resistance, and stylish finishes suitable for kitchens and bathrooms. Growing disposable incomes and shifting lifestyle preferences support this trend. Rising adoption in DIY projects and online sales channels further expands access. The ability of quartz to combine functionality with premium aesthetics positions it as a dominant choice in residential remodeling.

For instance, Caesarstone introduced its Porcelain Collection with high-heat resistance and innovative designs to cater to luxury kitchen renovations.

Expanding Commercial Infrastructure Development

Rapid growth in hospitality, retail, and corporate infrastructure is creating opportunities for quartz countertop installations. Hotels, restaurants, and office spaces increasingly use quartz for reception areas, food service counters, and high-traffic interiors due to its resilience and easy maintenance. The material’s wide color range and customizable finishes enable alignment with branding and design needs. Global tourism growth and retail expansion accelerate this adoption. Strong demand from emerging economies also supports market growth, making commercial infrastructure development a major driver.

For instance, Marriott International has integrated quartz countertops into several hotel renovation projects to enhance durability and aesthetic appeal in public areas.

Advancements in Manufacturing and Design Technology

Ongoing innovations in quartz countertop production are enabling greater design flexibility, efficiency, and sustainability. Digital design technologies allow manufacturers to produce marble-look and customized surfaces that meet diverse consumer preferences. Eco-friendly practices, such as recycling waste materials and reducing energy consumption, strengthen the product’s appeal to environmentally conscious buyers. Improved casting and pressing techniques also enhance durability and finish. These technological advancements lower production costs while improving quality, helping manufacturers expand market reach and capture new customer bases.

Key Trends & Opportunities

Key Trends & Opportunities

Growing Preference for Eco-Friendly and Sustainable Surfaces

Consumers are increasingly demanding eco-friendly quartz countertops that use recycled materials and low-emission resins. Manufacturers are adopting green certifications and promoting sustainable production practices to appeal to environmentally conscious buyers. Rising awareness of indoor air quality and sustainable building trends further supports this shift. Governments and industry bodies are also encouraging eco-certified materials in residential and commercial construction. This trend positions sustainable quartz surfaces as a significant growth opportunity for companies seeking to strengthen competitive advantage.

For instance, Cosentino’s Silestone Sunlit Days collection uses HybriQ technology combining quartz with recycled glass to reduce crystalline silica by up to 90%, also partnering with marine conservation groups for sustainability.

Rising Demand for Customization and Premium Finishes

Quartz countertops are gaining popularity for their ability to replicate luxury surfaces such as marble while offering superior durability. Demand for customized colors, textures, and edge profiles is growing in both residential and commercial markets. Premium finishes appeal strongly to homeowners seeking modern aesthetics and businesses aiming to align interiors with brand identity. Advancements in digital design and molding technologies support this demand. This trend creates opportunities for manufacturers to differentiate products and expand portfolios with unique, high-value offerings.

For instance, Cambria launched six new quartz designs in 2022 with signature edging and bold veining patterns to address premium interior requirements.

Key Challenges

High Production Costs Compared to Alternatives

Quartz countertops often involve higher production costs compared to alternatives like laminates or ceramic tiles. The expenses related to advanced manufacturing processes, imported raw materials, and resins limit affordability in price-sensitive markets. This cost barrier may slow adoption in developing regions, where budget-friendly solutions remain dominant. Manufacturers face pressure to reduce costs while maintaining quality, making it challenging to balance profitability with competitive pricing. Addressing affordability is critical to capturing untapped growth potential in emerging economies.

Competition from Natural and Alternative Surfaces

The Quartz Countertops Market faces strong competition from natural stones such as granite and marble, along with cost-effective substitutes like solid surfaces and laminates. While quartz offers durability and design flexibility, traditional stones appeal to consumers valuing authenticity and natural aesthetics. Price-sensitive buyers may opt for cheaper materials with acceptable performance. This competitive pressure requires manufacturers to emphasize quartz’s advantages, including low maintenance and consistent quality, while also investing in marketing strategies to overcome resistance from traditional preferences.

Environmental Concerns and Regulatory Compliance

Quartz production involves energy-intensive processes and the use of resins that raise environmental concerns. Stricter government regulations on emissions, waste management, and chemical usage are increasing compliance costs for manufacturers. Companies must adapt by adopting eco-friendly materials and sustainable practices, which can require significant investment. Non-compliance risks damaging brand reputation and limiting market access in regions with strict environmental standards. Balancing growth with sustainability remains a key challenge as global demand for environmentally responsible products intensifies.

Regional Analysis

North America

North America held a strong position in the Quartz Countertops Market, generating USD 346.21 million in 2018, rising to USD 485.48 million in 2024, and projected to reach USD 762.02 million by 2032 at a CAGR of 5.4%. The region accounted for about 28.6% of global revenue in 2018, 28.2% in 2024, and is expected to hold 28.3% in 2032. Growth is supported by widespread remodeling activities, premium product adoption, and advanced distribution networks across the U.S., Canada, and Mexico.

Europe

Europe reached USD 231.39 million in 2018, expanding to USD 312.07 million in 2024, and forecasted at USD 444.64 million by 2032, with a CAGR of 4.1%. It represented 19.1% of the global market in 2018, 18.1% in 2024, and will likely account for 16.5% by 2032, reflecting moderate growth. Strong demand comes from residential renovation and commercial projects across the UK, France, Germany, Italy, and Spain, though competition from natural stones and price-sensitive consumers slows expansion.

Asia Pacific

Asia Pacific dominated the Quartz Countertops Market, valued at USD 529.19 million in 2018, increasing to USD 781.83 million in 2024, and expected to reach USD 1,296.46 million by 2032 at the highest CAGR of 6.1%. The region captured 43.7% of global share in 2018, 45.3% in 2024, and will grow further to 48.1% in 2032. Growth is driven by rising urbanization, strong construction activity, and increasing consumer preference for stylish, durable countertops in China, India, Japan, and Southeast Asia.

Latin America

Latin America recorded USD 54.60 million in 2018, moving to USD 76.78 million in 2024, and projected at USD 105.57 million by 2032, at a CAGR of 3.7%. It accounted for 4.5% of global revenue in 2018, 4.5% in 2024, and will slightly decline to 3.9% by 2032. Brazil and Argentina lead adoption, supported by growth in residential and commercial construction. However, economic fluctuations and preference for lower-cost alternatives limit broader expansion across the region.

Middle East

The Middle East market generated USD 30.53 million in 2018, reaching USD 39.36 million in 2024, and anticipated at USD 50.73 million by 2032, growing at a CAGR of 2.8%. Its share represented 2.5% in 2018, 2.3% in 2024, and will decline to 1.9% in 2032. Growth is supported by demand from luxury housing, hospitality projects, and retail spaces in GCC countries, Turkey, and Israel, though limited manufacturing capacity and high import reliance constrain faster market penetration.

Africa

Africa stood at USD 18.08 million in 2018, increasing to USD 28.55 million in 2024, and is expected to reach USD 35.25 million by 2032, at a CAGR of 2.2%. Its share was 1.5% in 2018, 1.7% in 2024, and will decline to 1.3% in 2032. Demand is primarily driven by urban development in South Africa and Egypt, where premium countertops are slowly gaining popularity. However, high cost, limited awareness, and affordability issues remain key restraints for widespread adoption across the continent.

Market Segmentations:

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Molding Quartz

By Application

- Residential

- Commercial

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Quartz Countertops Market is highly competitive, with global and regional players focusing on product innovation, design variety, and distribution expansion to strengthen their market presence. Leading companies such as Caesarstone Ltd., Cosentino Group (Silestone), Cambria Company LLC, Hanwha L&C (HanStone Quartz), LG Hausys, Dupont (Corian Quartz), Vicostone, Compac, Santa Margherita S.p.A., and Quartz Master dominate the industry with wide portfolios and premium offerings. These players compete by introducing marble-look and customized quartz surfaces, leveraging advanced digital design and eco-friendly production methods. Strong regional networks, strategic partnerships with distributors, and investments in sustainability enhance competitiveness. While established brands target premium segments, local manufacturers focus on affordability to capture demand in emerging economies. Intense rivalry encourages continuous improvement in durability, finish, and customization. Consolidation through mergers and acquisitions also shapes the landscape, enabling companies to expand geographical reach and strengthen supply chains in the global Quartz Countertops Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Caesarstone Ltd.

- Cosentino Group (Silestone)

- Hanwha L&C (HanStone Quartz)

- Cambria Company LLC

- LG Hausys

- Compac

- Dupont (Corian Quartz)

- Vicostone

- Santa Margherita S.p.A.

- Quartz Master

Recent Developments

- In July 2025, Caesarstone launched Caesarstone ICON, a crystalline-silica-free surface made with ~80% recycled material.

- In July 2025, Vicostone introduced 10 new quartz colors for its Fall 2025 collection.

- In February 2025, LX Hausys unveiled new VIATERA quartz colors and technologies for the year.

- In August 2025, Wilsonart rolled out new Quartz and Solid Surface collections featuring bold colorways.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz countertops will rise due to increasing residential remodeling projects.

- Commercial adoption will expand in hotels, restaurants, and office spaces.

- Eco-friendly and recycled quartz surfaces will gain stronger market traction.

- Customization in colors, patterns, and edge profiles will drive premium demand.

- Technological advances in digital design will support innovation in product finishes.

- Emerging economies will offer growth opportunities through urbanization and housing expansion.

- Competition with natural stones and low-cost alternatives will remain a challenge.

- Sustainability certifications and green building standards will influence consumer choices.

- Distribution through online platforms and specialty stores will continue to strengthen.

- Strategic partnerships and acquisitions will shape the global competitive landscape.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: