Market Overview:

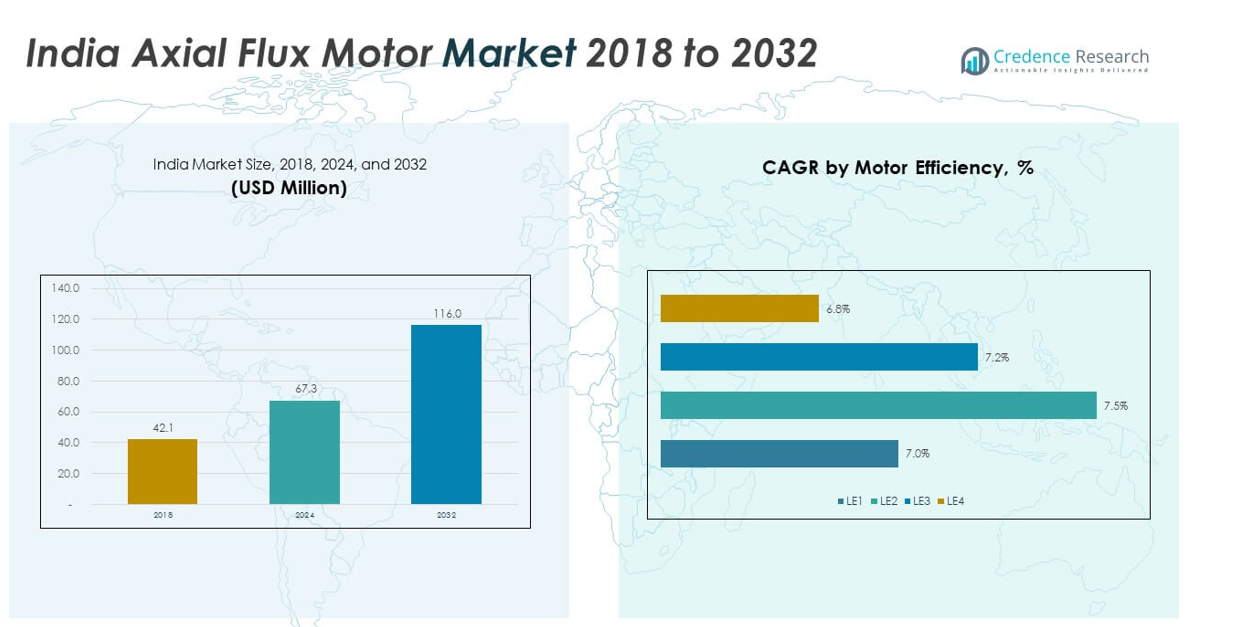

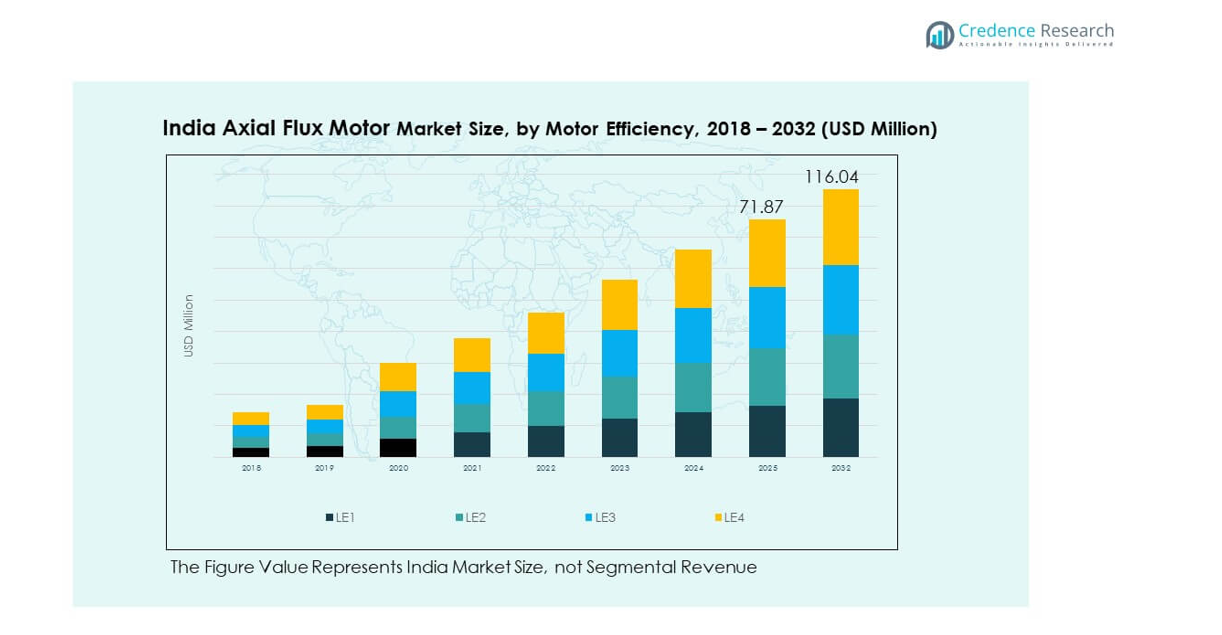

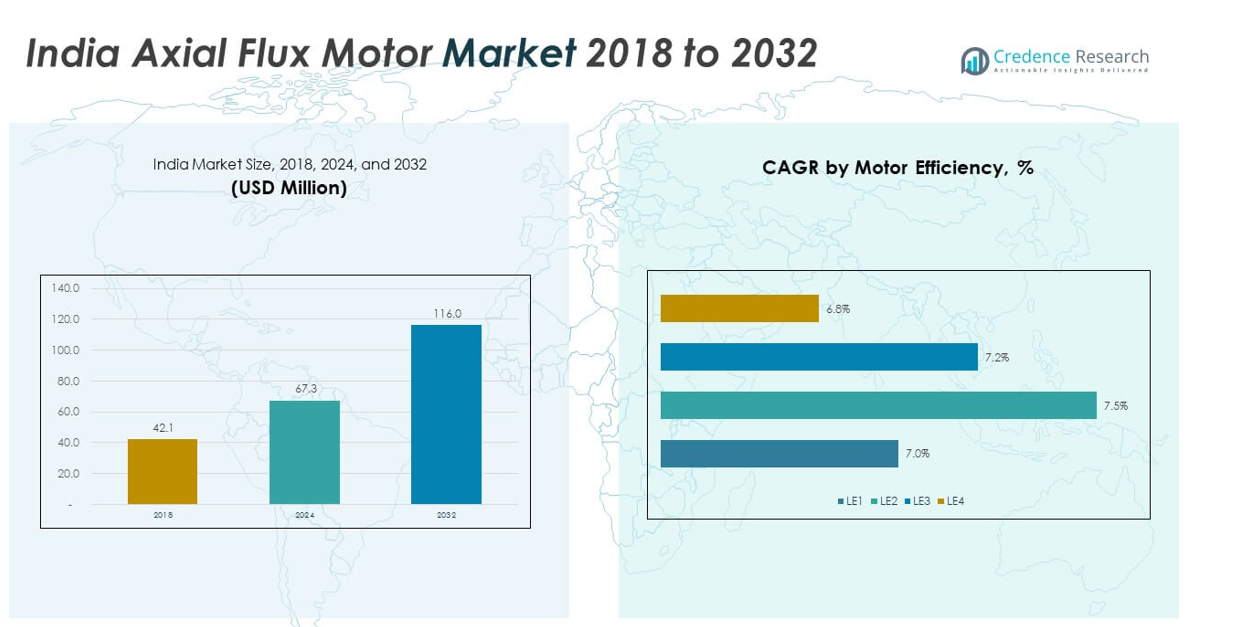

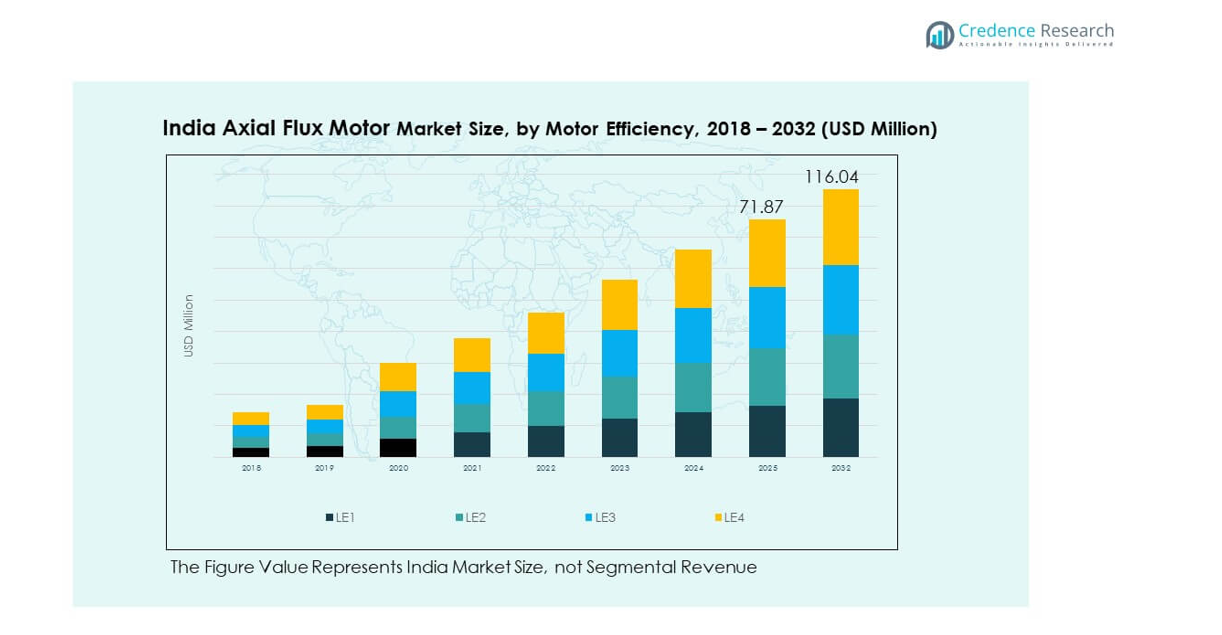

The India Axial Flux Motor Market size was valued at USD 42.07 million in 2018, reached USD 67.30 million in 2024, and is anticipated to reach USD 116.04 million by 2032, at a CAGR of 7.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Axial Flux Motor Market Size 2024 |

USD 67.30 million |

| India Axial Flux Motor Market, CAGR |

7.08% |

| India Axial Flux Motor Market Size 2032 |

USD 116.04 million |

The market is driven by rising adoption of electric vehicles, renewable energy systems, and industrial automation in India. Axial flux motors are gaining attention due to their higher efficiency, compact design, and superior torque density compared to conventional motors. Government incentives supporting electric mobility, combined with growing demand for energy-efficient equipment, are fueling investments. In addition, increasing R&D activities by startups and manufacturers in the EV supply chain are strengthening domestic production capabilities, making these motors more accessible and affordable for wider applications.

Geographically, India is witnessing notable growth across key regions such as Western and Southern states, where automotive hubs and renewable energy projects are concentrated. Northern India is emerging with growing investments in EV infrastructure and industrial manufacturing. Eastern regions are gradually entering the market with support from government-driven initiatives aimed at strengthening green mobility and localized production. Together, these regional dynamics are shaping India into an important market for axial flux motors, supported by a mix of industrial demand, energy transition, and evolving transportation needs.

Market Insights:

- The India Axial Flux Motor Market was valued at USD 42.07 million in 2018, reached USD 67.30 million in 2024, and is projected to reach USD 116.04 million by 2032, growing at a CAGR of 7.08%.

- Western and Southern India led with 46% share in 2024 due to strong automotive clusters and renewable energy projects, while Northern India followed with 32% share supported by EV adoption and infrastructure growth.

- Eastern and Central India accounted for 22% share in 2024, but this region is the fastest-growing, driven by industrial projects, renewable energy, and rising EV adoption in Tier-II and Tier-III cities.

- By motor efficiency, LE3 accounted for the largest share of the India Axial Flux Motor Market in 2024, reflecting its balance of cost and performance for automotive and industrial applications.

- LE4 represented the fastest-growing segment with rising demand from aerospace and premium EV applications, supported by its superior efficiency and power density.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Electric Mobility Supported by Government Incentives

The India Axial Flux Motor Market benefits strongly from the rapid growth of electric mobility. Central and state governments are offering subsidies and tax benefits to promote EV adoption. These incentives reduce the cost burden for both manufacturers and consumers. Automakers are also investing in axial flux motor technology to improve vehicle efficiency. Its compact size and high torque output make it attractive for next-generation EVs. Localized supply chain development further strengthens market growth. The combination of policies and industrial investments creates a sustainable demand base.

- For instance, Mahindra Electric launched its new Treo Plus model, which utilizes an axial flux motor delivering a peak power of 8 kW and a torque of 42 Nm, enhancing acceleration by 12% compared to previous models.

Increasing Demand for Energy-Efficient Solutions Across Industries

Industrial sectors in India are increasingly focusing on energy efficiency to reduce operational costs. Axial flux motors deliver higher efficiency than traditional radial flux motors. Their lightweight design and superior performance support manufacturing, robotics, and automation. The India Axial Flux Motor Market gains traction as industries seek sustainable equipment. Businesses adopt these motors to meet stricter efficiency standards and reduce emissions. It also offers long-term cost savings by lowering power consumption. The emphasis on sustainability across industries makes these motors highly relevant. Companies investing in automation find them particularly beneficial for precise operations.

Growth in Renewable Energy Projects Boosting Demand for Compact Motors

India is witnessing large-scale investments in renewable energy generation. Solar and wind projects require reliable and compact motor systems for energy conversion. Axial flux motors suit this requirement due to their high power density. The India Axial Flux Motor Market benefits from integration in distributed energy systems. It enables greater efficiency in renewable energy infrastructure. Developers prioritize motors with lower weight and better durability. It also aligns with the national target to increase renewable energy capacity. With ongoing project expansion, demand for axial flux motors grows steadily.

Technological Advancements and R&D Activities Driving Domestic Manufacturing

Research and development initiatives are expanding the potential applications of axial flux motors. Indian startups and manufacturers are innovating to create cost-effective solutions. Their efforts improve efficiency, reduce manufacturing costs, and expand scalability. The India Axial Flux Motor Market benefits from these innovations. Domestic production reduces dependency on imports and enhances supply chain stability. It also supports the Make in India initiative and industrial self-reliance. Companies develop customized motors tailored to specific end-use industries. These efforts strengthen India’s position as a competitive manufacturing hub for advanced motors.

Market Trends:

Integration of Axial Flux Motors in Two-Wheeler and Three-Wheeler EV Segment

Two-wheelers and three-wheelers dominate India’s urban mobility landscape. Automakers are incorporating axial flux motors into these vehicle categories. The India Axial Flux Motor Market benefits from rising demand in these segments. Motors provide compact design, high torque, and improved energy efficiency. It ensures better driving range for budget-sensitive consumers. The trend aligns with the push for affordable EV solutions in India. Startups and established brands are focusing heavily on this integration. This growing application highlights a critical trend in the mobility ecosystem.

- For instance, at its ‘Sankalp 2025’ event in August 2025, Ola Electric showcased a new two-wheeler motor that uses ferrite technology instead of rare-earth magnets. The company also highlighted that its future Gen 4 platform will be 15% more energy efficient than the previous generation.

Emergence of Collaborative Partnerships Between OEMs and Component Suppliers

The market is seeing strong collaboration between automakers and component suppliers. Partnerships aim to co-develop axial flux motors tailored for Indian conditions. The India Axial Flux Motor Market grows as supply chain integration strengthens. It improves cost efficiency and ensures faster technology adoption. It also fosters trust among stakeholders and reduces dependency on imports. OEMs benefit from localized production, which reduces lead times. Component suppliers gain opportunities to innovate in design and materials. This cooperative trend builds resilience across the industry.

- For instance, in August 2023, the Indian electric truck OEM Tresa Motors unveiled its in-house-developed axial flux motor for electric commercial vehicle The company, which builds trucks in the medium-to-heavy electric vehicle segment, has also secured pre-orders for its vehicles. While axial flux motor technology can offer benefits like improved efficiency and a higher torque-to-weight ratio.

Application in Aerospace and Defense for Lightweight Efficiency

Beyond automotive, axial flux motors are entering aerospace and defense applications. The India Axial Flux Motor Market expands as these industries adopt lightweight solutions. Motors provide high torque-to-weight ratios, critical for drones and defense systems. Their compactness allows integration into advanced mobility systems. It supports the military’s interest in efficient and durable technologies. Aerospace startups are also exploring axial flux motor integration. This trend shows the market diversifying into specialized high-value sectors. The expansion into aerospace and defense strengthens its long-term outlook.

Focus on Digital Manufacturing and Advanced Motor Testing Techniques

Indian manufacturers are investing in advanced design tools and digital manufacturing. This enables improved axial flux motor development at scale. The India Axial Flux Motor Market evolves through modern prototyping and testing practices. Simulations and digital twins enhance product reliability before launch. It reduces production risks and lowers development costs. Companies also adopt automated testing for higher accuracy. The focus on precision ensures compliance with strict industry standards. Such trends highlight the industry’s progression toward digital transformation.

Market Challenges Analysis:

High Initial Cost and Limited Consumer Awareness Slowing Adoption

The India Axial Flux Motor Market faces challenges due to its higher initial cost. Consumers often hesitate to adopt advanced motors when cheaper alternatives exist. Limited awareness among end-users about long-term efficiency benefits creates resistance. It affects penetration in mass-market applications such as two-wheelers and industrial machinery. Manufacturers struggle to balance affordability with advanced design features. This gap in consumer understanding remains a significant hurdle. Efforts to promote awareness and highlight savings over time are critical. Until then, adoption rates may remain uneven across industries.

Supply Chain Constraints and Dependency on Imported Components

Another challenge is supply chain limitations and reliance on imports for specialized parts. The India Axial Flux Motor Market depends on precision materials and advanced manufacturing. Local suppliers are still developing the capacity to meet demand. It increases costs and creates delays in large-scale production. Uncertainty in global supply chains adds further risk. Domestic initiatives like Make in India aim to reduce this reliance. However, progress remains gradual and requires heavy investment. Until supply chains strengthen, market scalability will face limitations.

Market Opportunities:

Expansion of Charging Infrastructure Creating New Growth Prospects

The rollout of nationwide EV charging networks supports broader motor adoption. The India Axial Flux Motor Market benefits from this ecosystem development. Motors perform optimally when supported by reliable charging solutions. It ensures efficiency and performance in long-distance travel. Infrastructure expansion encourages more consumers to adopt EVs. Growing adoption drives motor demand across segments. Opportunities are significant for both startups and established manufacturers. This alignment strengthens the industry’s growth trajectory.

Customization of Motors for Niche Applications in Industrial and Robotics Sectors

Industrial automation and robotics present new demand avenues for compact motors. The India Axial Flux Motor Market can expand through customized solutions. Motors offer high precision and performance for automated systems. It creates opportunities in logistics, warehousing, and smart manufacturing. Specialized designs meet industry-specific needs efficiently. Companies that innovate in this space gain a competitive edge. Opportunities also extend to healthcare equipment requiring compact motors. This diversification supports long-term market resilience.

Market Segmentation Analysis:

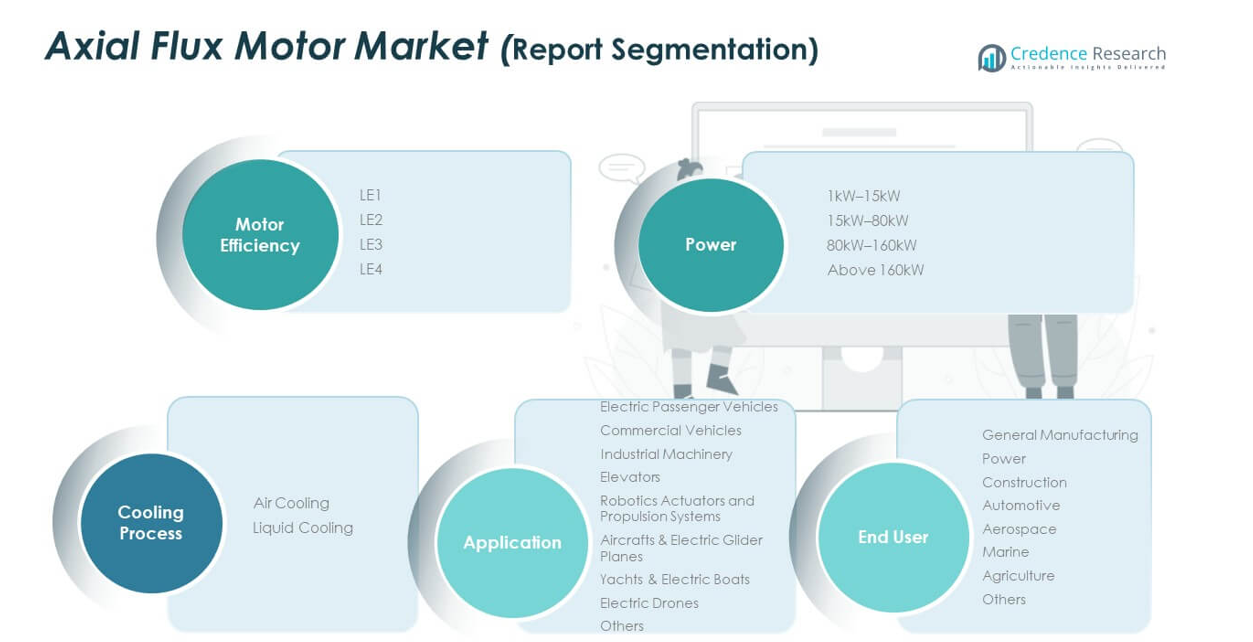

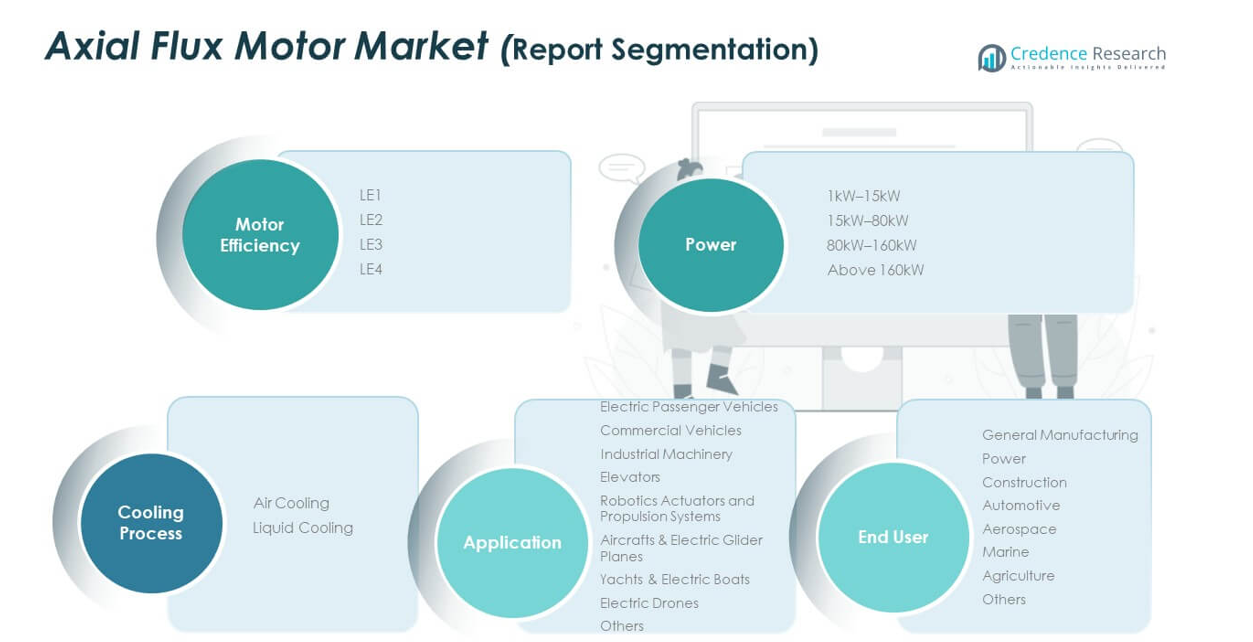

By Motor Efficiency

The India Axial Flux Motor Market is segmented into LE1, LE2, LE3, and LE4 categories. LE1 and LE2 segments attract adoption in cost-sensitive applications due to affordability. LE3 and LE4 motors deliver higher efficiency and durability, supporting industrial and advanced automotive uses. Demand is strong for LE3 and LE4 in premium EVs and aerospace. It reflects the market’s shift toward high-performance and energy-efficient systems. Manufacturers focus on advancing higher efficiency classes to meet stringent energy regulations.

- For instance, In February 2025, TVS Motor Company announced the launch of the 2025 TVS Ronin, an updated edition of its retro-style motorcycle.

By Power

Power segmentation includes 1kW–15kW, 15kW–80kW, 80kW–160kW, and above 160kW. Motors in the 1kW–15kW range dominate electric two-wheelers and drones. The 15kW–80kW segment supports electric passenger vehicles and light commercial fleets. Larger power categories above 80kW address heavy commercial vehicles, marine, and aerospace. It showcases versatility across transport and industrial sectors. Market players are aligning production with rising demand for mid and high-power categories.

By Application

Applications span electric passenger vehicles, commercial vehicles, industrial machinery, elevators, robotics, aircraft, boats, drones, and others. EV adoption leads demand, particularly in passenger and light commercial vehicles. Robotics actuators and drones are emerging areas with strong growth. It highlights the broad penetration of axial flux motors across industries.

By End User Type

End users include general manufacturing, power, construction, automotive, aerospace, marine, agriculture, and others. Automotive remains dominant due to rapid EV deployment. Aerospace and marine represent growing demand for compact and lightweight motors. It reinforces the market’s alignment with mobility and sustainability goals.

By Cooling Process

Cooling processes include air cooling and liquid cooling. Air cooling suits smaller power segments and cost-driven applications. Liquid cooling dominates in high-power EVs, aerospace, and marine systems. It ensures stable performance under demanding operations.

Segmentation:

By Motor Efficiency

By Power

- 1kW–15kW

- 15kW–80kW

- 80kW–160kW

- Above 160kW

By Application

- Electric Passenger Vehicles

- Commercial Vehicles

- Industrial Machinery

- Elevators

- Robotics Actuators and Propulsion Systems

- Aircrafts & Electric Glider Planes

- Yachts & Electric Boats

- Electric Drones

- Others

By End User Type

- General Manufacturing

- Power

- Construction

- Automotive

- Aerospace

- Marine

- Agriculture

- Others

By Cooling Process

- Air Cooling

- Liquid Cooling

Regional Analysis:

Western and Southern India – Established Automotive and Energy Hubs

The India Axial Flux Motor Market is strongly concentrated in Western and Southern India, accounting for nearly 46% of the market share in 2024. States such as Maharashtra, Karnataka, and Tamil Nadu lead due to advanced automotive clusters and strong EV adoption. It is supported by the presence of key OEMs, suppliers, and manufacturing infrastructure. Renewable energy projects in Southern states also drive demand for compact, high-efficiency motors. Western India benefits from industrial automation and rising adoption in passenger EVs. Together, these regions provide a stable base for innovation and large-scale deployment of axial flux motors.

Northern India – Growing Demand Through Infrastructure and EV Adoption

Northern India holds around 32% of the market share and is emerging as a high-growth region. Delhi NCR, Haryana, and Uttar Pradesh are central to this expansion due to strong policy support and EV adoption programs. It is driven by infrastructure projects, rising demand for electric mobility, and rapid industrialization. The region also witnesses early adoption in commercial vehicles and industrial applications. Strong government initiatives and charging infrastructure deployment are reinforcing demand. Manufacturers and startups are targeting Northern states to scale up production and supply chains.

Eastern and Central India – Emerging Potential with Gradual Adoption

Eastern and Central India together represent nearly 22% of the market share in 2024. These regions are at an early stage but show strong potential through government-backed industrial and energy projects. It is influenced by growth in renewable energy initiatives and gradual adoption of EVs in Tier-II and Tier-III cities. States like Odisha and West Bengal focus on industrial use cases and localized manufacturing. Central India benefits from agriculture-driven demand and adoption of motors in machinery and construction. Though smaller in share, these markets are becoming strategic focus areas for expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Yasa Limited

- Agni Motors

- Torus Robotics

- Kisimach Energy Solutions Pvt. Ltd

- Tresa Motors

- Evolito Ltd

- Sintercom

- Other Key Players

Competitive Analysis:

The India Axial Flux Motor Market is moderately fragmented with a mix of domestic startups and global players. Companies such as Yasa Limited, Tresa Motors, Agni Motors, and Evolito Ltd focus on efficiency-driven designs and EV applications. It is shaped by partnerships between OEMs and component suppliers that accelerate localized production. Competitive differentiation arises from motor efficiency, power density, and customization for niche applications. Established players emphasize technological advancements, while emerging firms target cost competitiveness. The market is witnessing intensified competition driven by demand for electric mobility and industrial automation.

Recent Developments:

- In June 2025, Evolito announced a strategic collaboration with VÆRIDION to develop an advanced electric propulsion system for the Microliner aircraft, integrating Evolito’s high-performance axial-flux motors and controllers. This partnership, revealed at the Paris Air Show, supports innovation in electric aviation and builds upon Evolito’s expertise in lightweight, high-efficiency motor technologies for eVTOL and aerospace applications.

- In May 2025, YASA Limited inaugurated a fully upgraded manufacturing facility in Yarnton, near Oxford, backed by a £12 million investment to boost annual output of axial flux motors beyond 25,000 units. This new super-factory now integrates all production processes under one roof, significantly enhancing both automation and product quality for their advanced electric-drive motors.

- n January 2025, Torus Robotics unveiled India’s first production-ready SMC-based axial flux motors, delivering an industry-leading 98% efficiency and featuring a 91% coil fill factor. Developed in Chennai and backed by partnerships with organizations like Höganäs India and SINE IIT Bombay, these motors are engineered to compete globally and were announced in collaboration with key government and industry stakeholders.

Report Coverage:

The research report offers an in-depth analysis based on motor efficiency, power, application, end-user, and cooling process segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising EV adoption will accelerate demand for compact and efficient axial flux motors.

- Government incentives and supportive policies will continue driving investments in domestic production.

- Technological advancements in high-efficiency designs will expand applications across sectors.

- Collaborations between OEMs and startups will strengthen innovation and cost optimization.

- Aerospace and marine applications will emerge as high-value growth avenues.

- Robotics and automation demand will contribute to steady adoption in industrial sectors.

- Expansion of renewable energy projects will create new deployment opportunities.

- Local supply chain development will reduce dependency on imported components.

- Digital manufacturing and testing methods will improve scalability and reliability.

- Regional adoption will deepen, with Western and Southern India leading expansion.