Market Overview

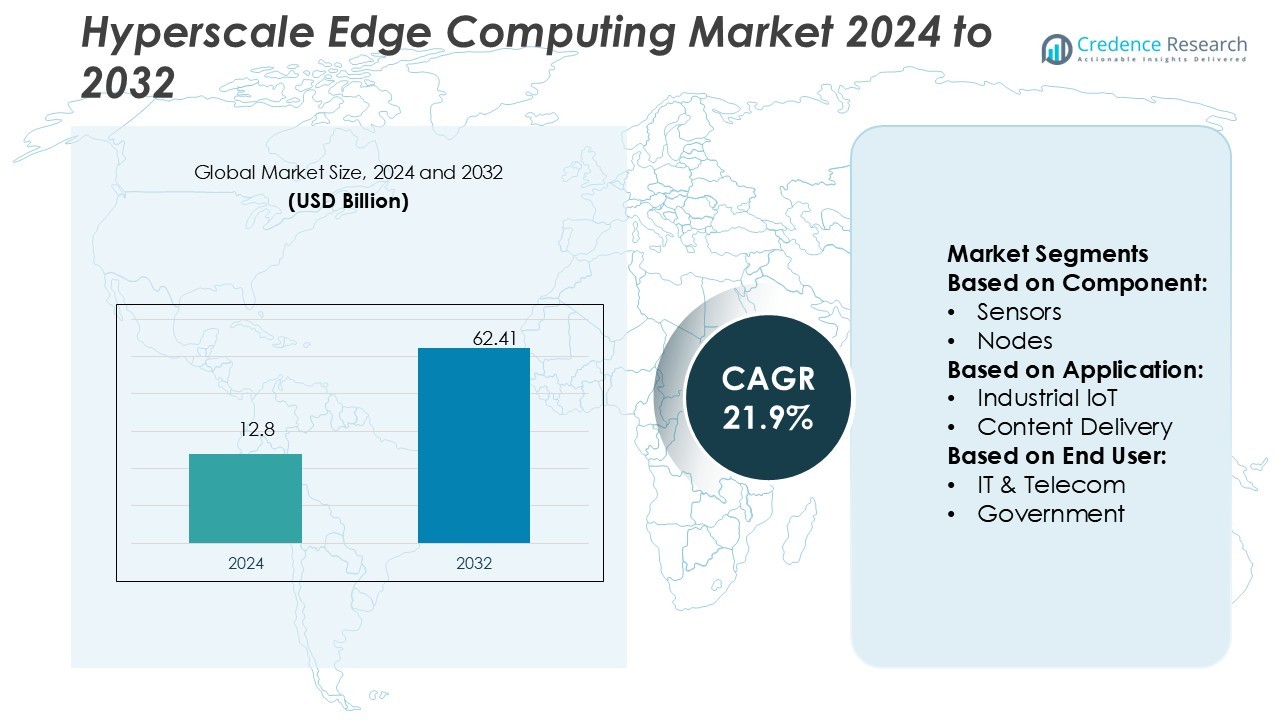

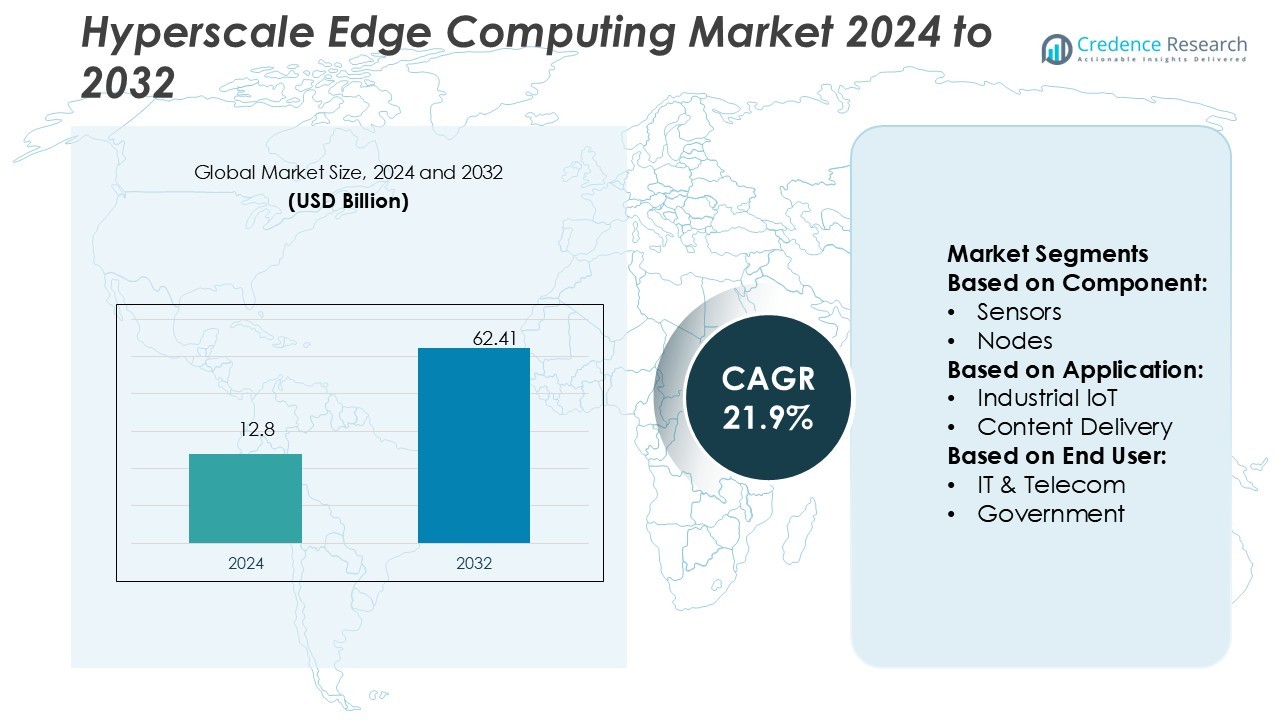

Hyperscale Edge Computing Market size was valued USD 12.8 billion in 2024 and is anticipated to reach USD 62.41 billion by 2032, at a CAGR of 21.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hyperscale Edge Computing Market Size 2024 |

USD 12.8 Billion |

| Hyperscale Edge Computing Market, CAGR |

21.9% |

| Hyperscale Edge Computing Market Size 2032 |

USD 62.41 Billion |

The hyperscale edge computing market is shaped by top players including Cisco Systems, Inc., Huawei Technologies Co., Ltd., Google, LLC, Microsoft Corporation, Dell Technologies Inc., Intel Corporation, Amazon Web Services, Inc., Hewlett Packard Enterprise Company, SAP SE, and IBM Corporation. These companies drive competitiveness through advancements in cloud-edge integration, AI-driven analytics, and 5G-powered infrastructure. North America emerges as the leading region, holding 37% of the global market share, supported by robust digital infrastructure, early adoption of edge technologies, and significant investments from hyperscale cloud providers. The region’s leadership reflects its strong ecosystem and innovation-driven enterprises.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hyperscale Edge Computing Market was valued at USD 12.8 billion in 2024 and is projected to reach USD 62.41 billion by 2032, registering a CAGR of 21.9%.

- Market growth is driven by rising IoT adoption, demand for real-time analytics, and rapid 5G rollouts supporting low-latency edge applications across industries.

- Key trends include integration of AI and machine learning at the edge, expansion of edge-as-a-service models, and increased focus on sustainable and energy-efficient infrastructure.

- The competitive landscape features leading players such as Cisco, Huawei, Google, Microsoft, Dell, Intel, AWS, HPE, SAP, and IBM, with strategies centered on partnerships, cloud-edge integration, and tailored industry solutions.

- North America leads with 37% share due to strong infrastructure and early adoption, while Industrial IoT dominates the application segment with the largest share, reflecting growing demand from manufacturing, utilities, and logistics for localized, real-time data processing.

Market Segmentation Analysis:

By Component

The hardware segment dominates the hyperscale edge computing market, accounting for the largest share, driven by sensors, nodes, and advanced networking equipment. Sensors and nodes are crucial in supporting real-time data capture and processing, enabling faster decision-making at the edge. Demand for hardware continues to rise due to the expansion of IoT devices and industrial automation. Software follows as a vital enabler, integrating workloads with AI and machine learning. Meanwhile, services, including managed and professional services, contribute to growth by ensuring deployment efficiency and ongoing optimization across industries.

- For instance, Cisco launched its UCS X-Series Modular System, which integrates up to 8 compute nodes with two 100G IFMs installed, the chassis delivers an aggregate fabric bandwidth of 1.6 Tbps across the eight compute nodes.environments.

By Application

Industrial IoT leads the application segment with the highest market share, supported by rapid adoption in manufacturing, logistics, and utilities. Its dominance stems from the need for real-time analytics, predictive maintenance, and improved operational efficiency. Content delivery also represents a significant share, benefiting from hyperscale edge computing’s ability to reduce latency and improve streaming quality. AR/VR and remote monitoring are growing at a fast pace, particularly in healthcare and enterprise training. The “others” segment, covering emerging use cases, is expanding as new applications in smart cities and connected vehicles gain traction.

- For instance, Huawei’s 5.5G “extended IoT” solution supports device power consumption as low as 100 µW per device — enabling passive operation without batteries in many cases.

By End-User

The IT & telecom sector holds the dominant share in the end-user segment, fueled by increasing demand for low-latency networks, 5G rollouts, and cloud service expansion. Telecom operators leverage hyperscale edge solutions to enhance bandwidth efficiency and service delivery. Healthcare and BFSI are fast-growing adopters, as they rely on edge infrastructure for secure, real-time processing of sensitive data. Government and utility applications are also expanding with smart infrastructure projects. Retail and manufacturing continue to leverage hyperscale edge solutions to improve customer engagement, inventory management, and production efficiency, driving market diversification across end-user industries.

Key Growth Drivers

Expanding IoT and Connected Devices

The hyperscale edge computing market benefits significantly from the rapid expansion of IoT and connected devices. Enterprises across industries deploy sensors, wearables, and smart equipment that generate massive real-time data streams. Processing this data at the edge reduces latency, supports instant analytics, and enhances operational efficiency. Industrial automation, smart homes, and connected vehicles are strong contributors to this demand. The surge in IoT adoption, combined with the need for decentralized data processing, drives the demand for robust edge computing infrastructure.

- For instance, Google’s Edge TPU (part of the Coral platform) can execute up to 4 trillion operations per second using just 2 W of power. Google’s TPU v6 (Trillium) architecture delivers a 4.7× performance improvement over TPU v5e, with doubled memory bandwidth and capacity in its high-bandwidth memory.

5G Rollouts and Network Advancements

The deployment of 5G networks fuels hyperscale edge computing growth by enabling ultra-low latency and high-speed data transfer. Telecom operators invest heavily in edge infrastructure to support bandwidth-intensive applications such as AR/VR, gaming, and content streaming. 5G enhances scalability and allows enterprises to integrate edge computing into mission-critical systems, including autonomous vehicles and healthcare monitoring. The synergy between 5G and hyperscale edge computing creates strong opportunities for enterprises to deliver seamless, real-time digital experiences, positioning network advancements as a major growth catalyst.

- For instance, Microsoft’s Azure Private 5G Core can achieve a 25 Gbps user plane throughput per site when deployed on an Azure Stack Edge device. Microsoft’s Edge Video Services (EVS), used in collaboration with Azure Video Analyzer and the Rocket platform, delivers an order-of-magnitude improvement in video analytics throughput per CPU core at edge nodes.

Rising Demand for Real-Time Analytics

Enterprises increasingly require real-time analytics to support decision-making and maintain competitiveness in dynamic markets. Hyperscale edge computing enables localized data processing, eliminating delays caused by reliance on centralized data centers. This capability is vital for sectors such as manufacturing, finance, and healthcare, where immediate insights can prevent costly downtime or enhance patient care. The growing focus on predictive maintenance, fraud detection, and customer experience management further boosts the adoption of hyperscale edge solutions. As industries prioritize instant data-driven insights, real-time analytics emerges as a critical growth driver.

Key Trends & Opportunities

Integration of AI and Machine Learning

AI and machine learning are being increasingly integrated into hyperscale edge computing systems, enhancing capabilities in automation, security, and data analysis. By processing AI models locally, organizations reduce dependency on central servers and achieve faster outcomes. Industries such as healthcare, retail, and manufacturing benefit from advanced use cases like anomaly detection, personalized recommendations, and autonomous operations. This integration represents a major opportunity for providers to deliver differentiated solutions that combine scalable infrastructure with intelligent edge processing, fueling innovation across applications.

- For instance, Dell’s NativeEdge platform now includes over 55 pre-built blueprints that automate AI deployment across edge sites, enabling VM migration and failover across clustered endpoints.

Growth in Edge-as-a-Service Models

The rise of edge-as-a-service (EaaS) creates new opportunities in the hyperscale edge computing market. Enterprises prefer flexible, subscription-based models that reduce upfront costs while ensuring scalability. EaaS allows businesses to adopt edge infrastructure without heavy capital investments, appealing particularly to small and medium enterprises. Cloud providers and telecom operators increasingly collaborate to offer bundled edge services, accelerating adoption across industries. This trend opens avenues for ecosystem partnerships and enhances accessibility, allowing organizations of all sizes to harness the benefits of edge computing efficiently.

- For instance, Intel’s internal benchmarking for its AI Edge Systems shows that an Intel Core Ultra processor on an edge device can deliver up to 2.3× higher end-to-end video analytics pipeline performance compared to a competing edge AI setup.

Key Challenges

High Deployment and Infrastructure Costs

Despite its potential, hyperscale edge computing faces the challenge of high deployment and infrastructure costs. Building distributed networks of edge data centers requires significant investments in hardware, connectivity, and skilled personnel. Smaller enterprises often struggle to justify such capital-intensive commitments, limiting adoption in price-sensitive markets. Additionally, ongoing maintenance and upgrades add to operational expenses. This cost barrier slows down widespread adoption, particularly in emerging economies, and remains a key challenge for stakeholders aiming to expand market reach.

Security and Data Privacy Concerns

The decentralized nature of hyperscale edge computing increases vulnerability to cyber threats and data breaches. Processing data closer to the source creates multiple entry points, complicating security management. Industries like healthcare, BFSI, and government face heightened risks due to sensitive data exposure. Ensuring compliance with strict regulations such as GDPR and HIPAA further adds complexity. Organizations must adopt advanced encryption, intrusion detection, and monitoring tools to mitigate these risks. Addressing security and privacy concerns remains critical to building trust and accelerating adoption across industries.

Regional Analysis

North America

North America holds the largest share of the hyperscale edge computing market, accounting for 37% in 2024. The region’s leadership is driven by early adoption of edge infrastructure, strong 5G rollouts, and the presence of major hyperscale cloud providers. The United States leads demand due to its advanced IT ecosystem, high investment in AI-driven applications, and strong industrial IoT deployment across manufacturing, healthcare, and retail. Canada also contributes significantly, focusing on smart cities and digital healthcare. Continuous investment in autonomous systems and cloud-edge integration strengthens North America’s position as the market leader.

Europe

Europe represents 28% of the hyperscale edge computing market, supported by strong digital infrastructure initiatives and regulatory backing for data sovereignty. Countries such as Germany, the UK, and France lead adoption, particularly in manufacturing, automotive, and BFSI. The European Union’s focus on secure data localization and sustainable IT drives investment in regional edge facilities. Expanding 5G deployments enhance the market’s scalability for applications in AR/VR and remote monitoring. Enterprises prioritize localized computing to comply with GDPR, making Europe a vital hub for secure, resilient, and regulatory-driven hyperscale edge computing growth.

Asia-Pacific

Asia-Pacific captures 25% of the hyperscale edge computing market, with the highest growth potential due to rapid industrialization and digital transformation. China, Japan, South Korea, and India are key markets, driven by massive IoT adoption, smart city initiatives, and expanding 5G infrastructure. Content delivery, e-commerce, and gaming further accelerate demand for low-latency edge computing. Regional governments actively support investments in AI and cloud-edge integration, enhancing adoption across industries. With a large population base and expanding digital economy, Asia-Pacific is expected to witness the fastest CAGR, strengthening its role as a growth epicenter.

Middle East & Africa

The Middle East & Africa account for 6% of the hyperscale edge computing market, with growth fueled by investments in smart infrastructure and oil & gas digitalization. Countries like the UAE and Saudi Arabia lead adoption, focusing on smart city projects and government digitalization strategies. Edge computing supports energy management, remote monitoring, and industrial automation in resource-driven economies. Africa’s market remains nascent but shows potential with rising connectivity and fintech applications. Strategic partnerships between global cloud providers and regional telecom operators are enhancing capabilities, positioning the region as an emerging growth frontier.

Latin America

Latin America holds a 4% share in the hyperscale edge computing market, with Brazil and Mexico emerging as leading adopters. Growth is driven by rising demand for content delivery, e-commerce, and digital banking solutions. Telecom operators are expanding 5G coverage, enabling enterprises to adopt edge solutions for improved customer experience and operational efficiency. Brazil leads with strong industrial and retail adoption, while Mexico benefits from proximity to North America and cross-border digital trade. Despite infrastructure challenges, increasing cloud investments and digital transformation initiatives are expected to boost regional adoption over the forecast period.

Market Segmentations:

By Component:

By Application:

- Industrial IoT

- Content Delivery

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hyperscale edge computing market features key players such as Cisco Systems, Inc., Huawei Technologies Co., Ltd., Google, LLC, Microsoft Corporation, Dell Technologies Inc., Intel Corporation, Amazon Web Services, Inc., Hewlett Packard Enterprise Company, SAP SE, and IBM Corporation. The competitive landscape of the hyperscale edge computing market is defined by rapid innovation, strategic partnerships, and growing investments in advanced technologies. Companies are focusing on integrating edge solutions with cloud platforms to enable faster data processing, reduced latency, and improved scalability. The market is witnessing strong activity in areas such as AI-driven analytics, IoT integration, and 5G-powered edge deployments. Providers are also emphasizing sustainable infrastructure, with data centers designed for energy efficiency and resilience. Competition intensifies as firms differentiate through tailored solutions for industries including healthcare, BFSI, manufacturing, and retail, creating a dynamic and evolving ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Google, LLC

- Microsoft Corporation

- Dell Technologies Inc.

- Intel Corporation

- Amazon Web Services, Inc.

- Hewlett Packard Enterprise Company

- SAP SE

- IBM Corporation

Recent Developments

- In January 2025, Amazon Web Services (AWS) announced the launch of new hyperscale data center campuses in Thailand and Saudi Arabia, strengthening its infrastructure footprint in emerging digital economies. The facilities are designed with high-density AI workloads in mind and powered by 100% renewable energy, reinforcing AWS leadership in sustainable hyperscale cloud solutions.

- In October 2024, Huawei Technologies unveiled a new generation of prefabricated modular hyperscale data centers at the digital power forum in Dubai. The modular design enables rapid deployment across remote and high-temperature environments, targeting cloud service providers and telecom operators expanding in the Middle East and Africa.

- In February 2024, At MWC Barcelona, ADLINK revealed 5G and industrial edge computing. Moreover, partners and customers of ADLINK, including AgrandTech, SageRAN, and Askey, would be representing several 5G network solutions built on the MECS series of ADLINK Edge Server.

- In January 2024, EQT Infrastructure announced a collaboration with EdgeConneX to progress data centers for hyperscale customers globally. This new alliance would build numerous megawatts of new data center capability to aid future cloud, artificial intelligence, and other precarious digital infrastructure necessities.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with the growing adoption of IoT and connected devices.

- 5G rollouts will accelerate the demand for low-latency edge solutions.

- Real-time analytics will become central to enterprise decision-making.

- AI and machine learning integration will drive intelligent edge capabilities.

- Edge-as-a-service models will gain momentum among small and medium enterprises.

- Sustainable and energy-efficient edge infrastructure will attract higher investments.

- Security and privacy solutions will evolve to address decentralized risks.

- Industry-specific use cases in healthcare, BFSI, and manufacturing will strengthen adoption.

- Partnerships between telecom operators and cloud providers will shape market growth.

- Emerging economies will present new opportunities with rising digital transformation initiatives.