Market Overview

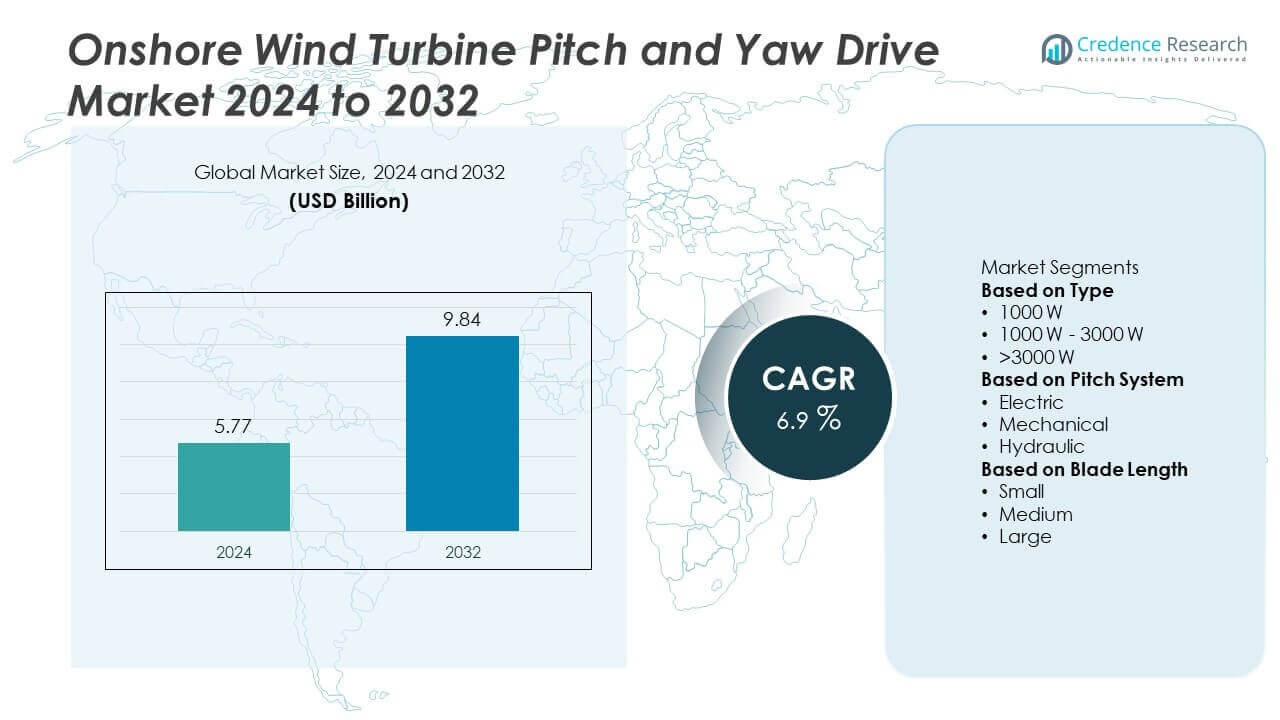

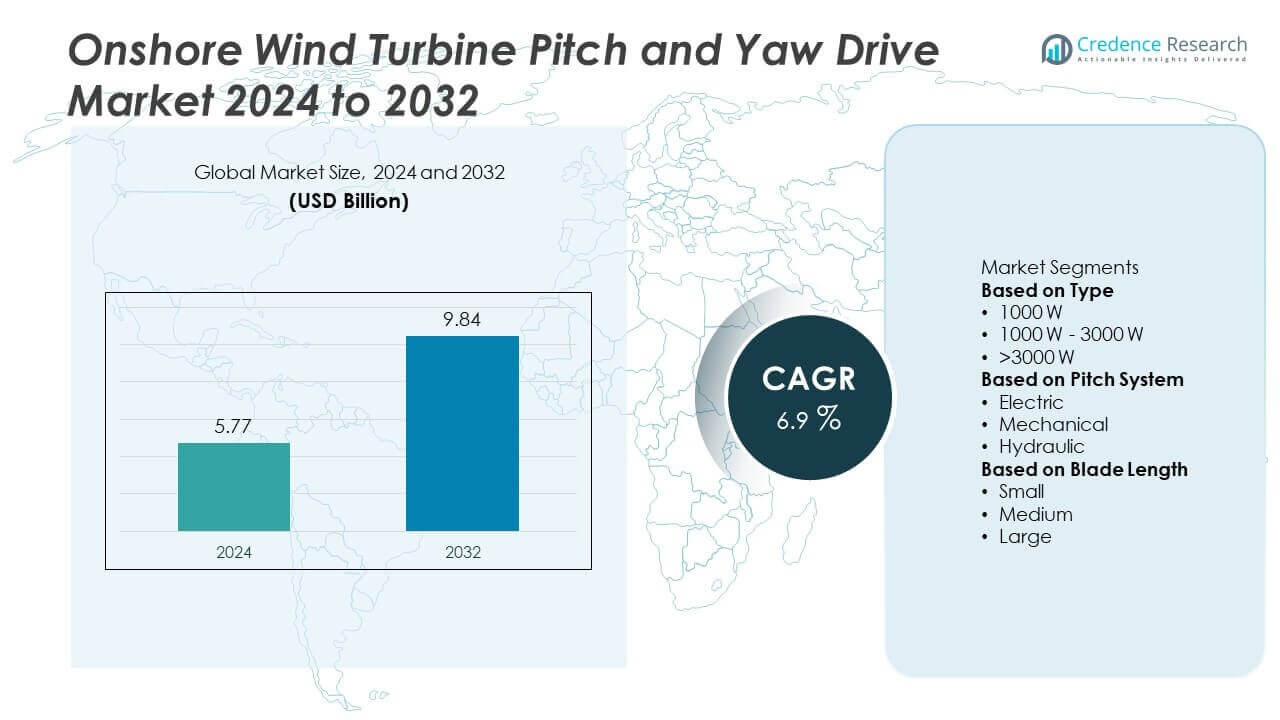

The global Onshore Wind Turbine Pitch and Yaw Drive Market was valued at USD 5.77 billion in 2024. It is projected to reach USD 9.84 billion by 2032, expanding at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Onshore Wind Turbine Pitch and Yaw Drive Market Size 2024 |

USD 5.77 Billion |

| Onshore Wind Turbine Pitch and Yaw Drive Market, CAGR |

6.9% |

| Onshore Wind Turbine Pitch and Yaw Drive Market Size 2032 |

USD 9.84 Billion |

The onshore wind turbine pitch and yaw drive market is shaped by leading players such as Nabtesco Corporation, Comer Industries, Nanjing High Speed Gear Manufacturing Co., Ltd, Liebherr, Dana SAC UK, Nidec Conversion, Bosch Rexroth AG, Bonfiglioli S.p.A, KEBA, and ABM Greiffenberger. These companies drive market growth through innovation in high-torque drive solutions, digital integration, and durable systems tailored for larger turbines. North America led the market in 2024 with 32% share, supported by strong renewable policies and large-scale projects. Europe followed with 29%, driven by EU decarbonization goals, while Asia-Pacific held 27%, emerging as the fastest-growing region with rapid wind farm expansions in China and India.

Market Insights

Market Insights

- The global onshore wind turbine pitch and yaw drive market was valued at USD 5.77 billion in 2024 and is projected to reach USD 9.84 billion by 2032, growing at a CAGR of 6.9%.

- Market growth is driven by rising installations of medium-capacity turbines, with the 1000 W–3000 W type holding 48% share in 2024, supported by efficiency and widespread use in onshore wind farms.

- Key trends include the dominance of electric pitch systems with 52% share, offering high precision, low maintenance, and integration with digital monitoring, along with growing adoption of large blades, which held 57% share.

- Leading companies such as Nabtesco Corporation, Comer Industries, Bosch Rexroth AG, Bonfiglioli S.p.A, and Liebherr focus on innovation, durability, and regional expansion, while challenges include high maintenance costs and supply chain constraints.

- Regionally, North America led with 32% share in 2024, followed by Europe at 29% and Asia-Pacific at 27%, while Latin America and Middle East & Africa collectively contributed 12%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In 2024, the 1000 W – 3000 W segment held the dominant share of 48% in the onshore wind turbine pitch and yaw drive market. This range is widely adopted in medium-capacity wind turbines, which are most commonly deployed in onshore wind farms due to their balance of efficiency and cost-effectiveness. These drives offer reliable torque and power management to optimize blade positioning and maximize energy output. The <1000 W category is mainly used in small turbines, while >3000 W drives serve large-scale projects, but their adoption remains limited to select high-capacity installations.

- For instance, Bonfiglioli S.p.A. offers various pitch drives within its 700TW series for wind turbines, with models like the 709 TW featuring a nominal torque of 60,000 Nm. The complete 700TW series spans a torque range of 16,000 to 260,000 Nm

By Pitch System

The electric pitch system dominated the market in 2024 with a 52% share, driven by its high efficiency, precision control, and reduced maintenance needs compared to hydraulic and mechanical systems. Electric systems enable better monitoring and integration with smart turbine controls, supporting the growing demand for advanced wind farm automation. Hydraulic systems, although still significant in heavy-duty applications, are gradually losing share due to higher maintenance costs and oil leakage concerns. Mechanical systems represent a smaller portion of the market, used primarily in older or low-capacity turbine models.

- For instance, KEBA’s PitchOne Size 1+ was released in 2024 with a 25–30% increase in power density over previous versions. This expanded product line is designed for larger turbine applications, including those rated above 4 MW, to provide efficient and reliable blade control. The higher power density allows for more precise adjustments of the blade pitch, which helps maximize energy yield and reduce stress on the turbine.

By Blade Length

In 2024, large blade turbines accounted for 57% of the market share, reflecting the industry’s shift toward higher capacity turbines with longer blades for improved energy capture. Larger blades require robust pitch and yaw drives to handle greater aerodynamic loads, making this segment critical for modern onshore wind farms. Medium blade lengths held a notable share, primarily supporting mid-range turbine installations, while small blades remained limited to localized or small-scale projects. The trend toward larger turbines for efficiency and cost optimization continues to drive growth in the large blade length segment.

Key Growth Drivers

Rising Global Demand for Renewable Energy

The onshore wind turbine pitch and yaw drive market is growing due to increasing investments in renewable energy. Governments worldwide are setting ambitious targets to reduce carbon emissions, which is driving large-scale wind power projects. Onshore wind remains one of the most cost-effective renewable sources, creating sustained demand for reliable pitch and yaw drive systems. These components ensure optimal blade orientation, improving energy output and turbine efficiency. As countries expand their wind energy capacity, demand for advanced drive systems continues to accelerate.

- For instance, Nanjing High Speed Gear Manufacturing Co., Ltd. reported delivering more than 720,000 yaw and pitch gearboxes cumulatively by 2024, with production capacity scaled to 120,000 units annually to meet rising demand in onshore projects.

Technological Advancements in Wind Turbines

Advances in turbine design are driving demand for high-performance pitch and yaw drive systems. Modern turbines feature larger rotor blades and higher capacity ratings, requiring more precise and durable control mechanisms. Electric pitch systems are gaining traction as they provide improved reliability, reduced maintenance, and seamless integration with digital monitoring. Continuous R&D in drive efficiency, safety features, and predictive maintenance technologies strengthens their adoption. These innovations enable operators to maximize energy yield while reducing operational risks, making them a key growth driver for the market.

- For instance, Bosch Rexroth AG developed a modular hydraulic pitch drive capable of handling rotor diameters up to 170 meters, with integrated condition monitoring sensors transmitting real-time load data at 100 Hz frequency to enhance predictive maintenance.

Expansion of Onshore Wind Projects in Emerging Markets

Emerging economies are rapidly adopting wind energy as part of their energy transition strategies. Countries in Asia-Pacific, Latin America, and parts of Africa are investing heavily in utility-scale onshore wind farms due to rising energy demand and supportive policies. This expansion is fueling demand for efficient pitch and yaw drives that ensure reliable turbine operation under diverse climatic conditions. Local manufacturing initiatives and lower installation costs further boost market penetration. The growth of these projects provides significant opportunities for global and regional suppliers of advanced drive technologies.

Key Trends & Opportunities

Shift Toward Larger Turbines with Longer Blades

The market is experiencing a clear trend toward larger turbines with blade lengths exceeding traditional designs. These longer blades capture more wind energy, improving overall efficiency and reducing the levelized cost of electricity (LCOE). As a result, demand for stronger and more durable pitch and yaw drive systems has increased. This trend creates opportunities for manufacturers to innovate in high-torque drive solutions capable of managing heavier loads. The move toward large-scale turbines, especially in Europe and Asia-Pacific, highlights a long-term growth pathway.

- For instance, Liebherr developed a segmented slewing bearing of 23.4 meters in 2024 for a heavy-duty offshore crane, built by GustoMSC and installed on a wind turbine installation vessel. This crane is used to handle large components, such as turbine blades, during the construction of offshore wind farms.

Adoption of Digital Monitoring and Predictive Maintenance

The integration of digital monitoring technologies is transforming the pitch and yaw drive market. Operators are increasingly using IoT-enabled sensors and predictive analytics to track performance, detect faults, and schedule maintenance proactively. This reduces downtime and enhances turbine efficiency, creating opportunities for suppliers to develop smart drive systems. The adoption of advanced monitoring solutions also aligns with broader industry goals of reducing operating costs and extending equipment lifespan. This trend is expected to strengthen as wind farms scale up and demand for automation increases.

- For instance, Bosch Rexroth AG integrates condition monitoring solutions, such as its CytroConnect system, with its hydraulic pitch drives to enable predictive maintenance and early fault detection for multi-MW wind turbines.

Key Challenges

High Maintenance Costs and Reliability Issues

Pitch and yaw drive systems face challenges related to wear and tear from continuous operation under high stress. Failures in these systems can lead to costly downtime and reduced energy output. Hydraulic systems, in particular, require frequent maintenance due to oil leakage risks. Even with advancements in electric drives, reliability issues in extreme weather remain a concern. These high maintenance requirements increase operating costs, making it difficult for developers in price-sensitive markets to achieve competitive returns on investment.

Supply Chain Constraints and Rising Material Costs

The market faces challenges from global supply chain disruptions and fluctuating raw material prices. Manufacturing pitch and yaw drives requires high-quality components such as gears, bearings, and electronic controls, which are sensitive to steel and rare-earth material costs. Delays in procurement and transportation can impact project timelines, particularly in emerging markets with weaker infrastructure. Rising input costs put pressure on manufacturers to balance pricing competitiveness while maintaining quality standards. These supply chain issues continue to pose a barrier to scaling up production efficiently.

Regional Analysis

North America

North America held 32% of the onshore wind turbine pitch and yaw drive market in 2024, driven by large-scale installations across the United States and Canada. Supportive policies such as tax credits, renewable energy targets, and grid modernization initiatives continue to accelerate wind farm deployment. Demand for high-capacity turbines with advanced pitch and yaw drives is rising, as operators focus on maximizing efficiency and reducing downtime. Strong investments from independent power producers and utilities further strengthen the region’s position. The growing trend toward repowering older turbines with modern systems also contributes to sustained market growth.

Europe

Europe accounted for 29% of the onshore wind turbine pitch and yaw drive market in 2024, led by Germany, Spain, and the UK. The region benefits from strict renewable energy mandates and long-term carbon neutrality goals under the EU Green Deal. Deployment of larger turbines with longer blades is fueling the need for high-torque pitch and yaw drive systems. Established wind energy infrastructure, coupled with strong manufacturer presence, supports steady adoption. Repowering projects to upgrade older turbines also boost demand. The region’s commitment to decarbonization ensures continuous growth in advanced drive technologies over the forecast period.

Asia-Pacific

Asia-Pacific captured 27% of the onshore wind turbine pitch and yaw drive market in 2024 and is the fastest-growing regional market. China and India dominate installations, supported by ambitious renewable energy targets and rising electricity demand. Countries like Japan, South Korea, and Australia are also expanding capacity, driving significant demand for high-performance pitch and yaw drives. The trend toward larger turbines and local manufacturing incentives further supports growth. Rapid infrastructure development and government subsidies for clean energy accelerate adoption, positioning Asia-Pacific as a critical hub for both manufacturing and deployment of advanced drive systems.

Latin America

Latin America represented 7% of the onshore wind turbine pitch and yaw drive market in 2024, with Brazil and Mexico leading the region’s growth. Supportive government policies and attractive auction mechanisms for renewable energy projects are boosting investment in wind farms. The adoption of mid-capacity turbines with reliable pitch and yaw systems is rising, particularly in areas with strong wind resources. Although challenges such as financing constraints and grid integration remain, increasing private sector involvement is improving project feasibility. The region’s expanding energy demand and focus on sustainability are expected to drive further adoption over the forecast period.

Middle East & Africa

The Middle East & Africa accounted for 5% of the onshore wind turbine pitch and yaw drive market in 2024, with South Africa, Saudi Arabia, and Egypt leading regional developments. Government-backed renewable energy programs, coupled with rising electricity demand, are driving wind farm installations. The focus is primarily on utility-scale projects, requiring durable pitch and yaw drive systems to withstand harsh environmental conditions. While the market is still in its early stages compared to other regions, growing investments in clean energy diversification support steady adoption. Strategic collaborations with global manufacturers are expected to accelerate regional growth.

Market Segmentations:

By Type

- 1000 W

- 1000 W – 3000 W

- >3000 W

By Pitch System

- Electric

- Mechanical

- Hydraulic

By Blade Length

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the onshore wind turbine pitch and yaw drive market includes key players such as Nabtesco Corporation, Comer Industries, Nanjing High Speed Gear Manufacturing Co., Ltd, Liebherr, Dana SAC UK, Nidec Conversion, Bosch Rexroth AG, Bonfiglioli S.p.A, KEBA, and ABM Greiffenberger. These companies maintain their market position through strong product portfolios, technological advancements, and global supply networks. Leading manufacturers focus on producing high-torque, durable, and efficient drive systems to support the industry’s shift toward larger turbines with longer blades. Strategic collaborations with turbine OEMs, as well as investments in digital monitoring and predictive maintenance technologies, enhance competitiveness. Regional expansion, particularly in Asia-Pacific and Latin America, further supports growth strategies. The market is witnessing increasing competition as both established players and regional suppliers emphasize cost efficiency and compliance with global renewable energy standards. This dynamic is expected to accelerate innovation and further strengthen product differentiation over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nabtesco Corporation

- Comer Industries

- Nanjing High Speed Gear Manufacturing Co., Ltd

- Liebherr

- Dana SAC UK

- Nidec Conversion

- Bosch Rexroth AG

- Bonfiglioli S.p.A

- KEBA

- ABM Greiffenberger

Recent Developments

- In June 2025, Nabtesco Corporation relaunched its wind CMFS site, adding service and diagnostics content for turbine condition monitoring.

- In 2025, Dana SAC UK (Dana Off-Highway) highlighted Brevini gearbox advances at Bauma 2025, including new Brevini S270 planetary gearbox introductions.

- In 2025, Nanjing High Speed Gear (NGC) said yaw and pitch gearbox demand is projected to reach 120,000 units in 2025

- In August 2024, Liebherr announced a 23.4-meter segmented slewing bearing for offshore wind installation cranes, supporting turbine erection operations.

Report Coverage

The research report offers an in-depth analysis based on Type, Pitch System, Blade Length and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as governments strengthen renewable energy targets worldwide.

- Larger turbines with longer blades will increase demand for high-torque drive systems.

- Electric pitch systems will gain preference due to efficiency and low maintenance needs.

- Digital monitoring and predictive maintenance will become standard in drive solutions.

- Asia-Pacific will record the fastest growth with large-scale projects in China and India.

- North America and Europe will sustain strong demand through repowering and new installations.

- Manufacturers will invest in durable materials to enhance system reliability and lifespan.

- Supply chain optimization will remain crucial to manage rising material costs.

- Strategic collaborations with turbine OEMs will drive product innovation and market share.

- Emerging regions like Latin America and Middle East & Africa will offer new growth opportunities.

Market Insights

Market Insights