Market Overview

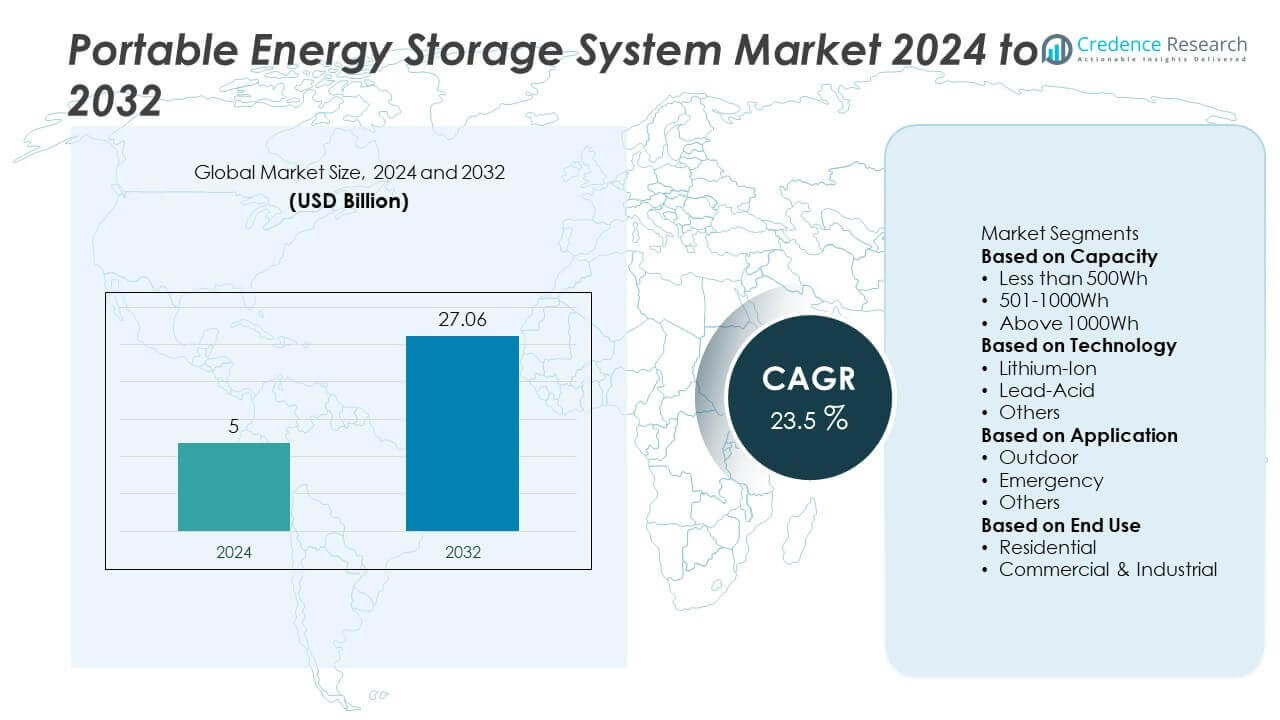

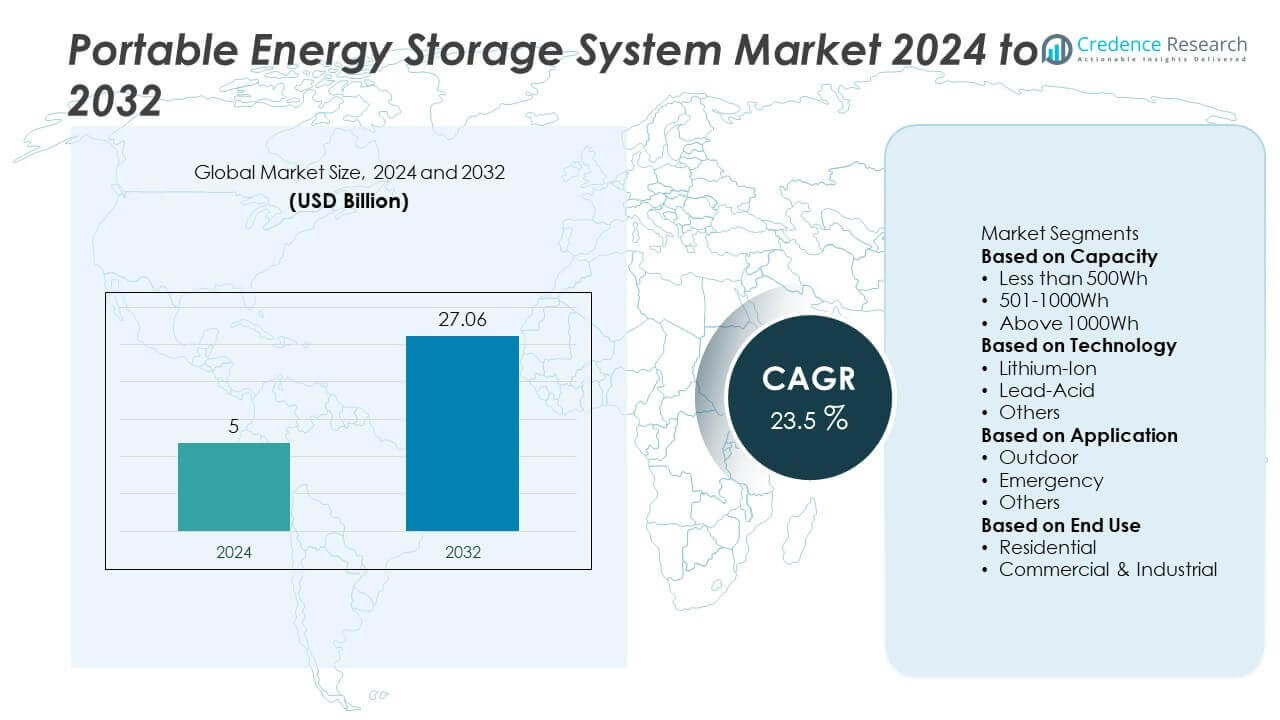

The Portable Energy Storage System Market was valued at USD 5 billion in 2024. It is projected to reach USD 27.06 billion by 2032, expanding at a CAGR of 23.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Energy Storage System Market Size 2024 |

USD 5 Billion |

| Portable Energy Storage System Market, CAGR |

23.5% |

| Portable Energy Storage System Market Size 2032 |

USD 27.06 Billion |

The portable energy storage system market is led by prominent players such as Jackery Technology, Chint Global, Goal Zero, Jntech Renewable Energy, Bluetti Power, ATGepower, AceOn Group, Anker Innovations, Jiangsu Senji New Energy Technology, and EcoFlow. These companies drive competition through advanced lithium-ion solutions, solar integration, and smart connectivity features tailored for outdoor, residential, and emergency applications. North America emerged as the leading region in 2024 with 35% share, supported by high consumer adoption and strong retail networks. Europe followed with 28% share, driven by eco-friendly policies and recreational demand, while Asia-Pacific held 25% share, positioning itself as the fastest-growing market with strong manufacturing and rising consumer spending.

Market Insights

Market Insights

- The portable energy storage system market was valued at USD 5 billion in 2024 and is projected to reach USD 27.06 billion by 2032, growing at a CAGR of 23.5%.

- Growing demand for reliable backup power and increasing outdoor recreational activities drive adoption, with the 501–1000Wh segment holding over 45% share due to its balance of portability and capacity.

- Key trends include integration with solar panels, development of smart connected systems, and rising investments in advanced lithium-ion technologies, which captured over 70% share in 2024.

- The competitive landscape features players such as Jackery Technology, EcoFlow, Bluetti Power, Goal Zero, Anker Innovations, and others focusing on lithium-based innovation, modular systems, and retail expansion across global markets.

- North America led with 35% share, followed by Europe at 28% and Asia-Pacific at 25%, while Latin America and Middle East & Africa together contributed the remaining 12%, highlighting growth opportunities in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

In 2024, the 501–1000Wh segment held the dominant share of over 45% in the portable energy storage system market. Its leadership stems from wide adoption in residential backup, outdoor activities, and small commercial setups, where mid-range capacity balances portability with reliable runtime. Consumers prefer these units for charging electronics, powering small appliances, and handling short outages. The above 1000Wh category, while smaller with around 30% share, is gaining traction in industrial and heavy-duty outdoor use, whereas the less than 500Wh units cater to personal electronics but remain niche.

- For instance, Jackery launched its Explorer 500 v2 in September 2025 with a 512Wh capacity, supporting up to 6,000 full charge cycles, and capable of recharging to 100% in 1.3 hours using AC input.

By Technology

The Lithium-ion segment accounted for more than 70% share of the market in 2024, establishing itself as the clear leader. Superior energy density, faster charging, and longer lifecycle drive its dominance across both consumer and industrial applications. Companies are investing in safer lithium variants, such as lithium iron phosphate, which further expand adoption. The lead-acid segment, with nearly 20% share, remains relevant in cost-sensitive and emergency applications. Other chemistries, while contributing under 10%, play roles in specialized use cases but lack scalability compared to lithium-based storage.

- For instance, EcoFlow introduced its DELTA Pro Ultra in January 2025, a lithium iron phosphate system with a single-unit capacity of 6,000Wh and scalability up to 90,000Wh, delivering 7,200W continuous AC output for residential and commercial backup.

By Application

The outdoor application segment led the market with over 50% share in 2024, driven by strong demand from camping, recreational activities, and mobile workstations. Growing adoption of off-grid living and portable power for electric tools further boosts its appeal. The emergency use segment, holding about 35% share, benefits from rising household backup needs during power outages and increasing disaster preparedness programs. Other applications, accounting for the remaining 15%, include niche deployments such as event power support and temporary installations, highlighting steady but secondary growth compared to mainstream outdoor use.

Key Growth Drivers

Rising Demand for Backup Power

Frequent power outages and increasing grid instability have accelerated demand for portable energy storage systems. Consumers seek reliable backup solutions for residential, commercial, and outdoor use, making mid-capacity systems particularly attractive. The adoption is strongest in regions with aging power infrastructure and high outage frequency. Government-led disaster preparedness programs and rising awareness of energy resilience further support adoption. As users prioritize portability, efficiency, and quick deployment, the role of compact storage systems in ensuring continuity has become a primary growth driver for the market.

- For instance, Bluetti Power’s AC200MAX portable system offers a 2,048Wh LiFePO₄ battery with 3,500+ life cycles, expandable up to 8,192Wh, and delivers 2,200W AC output to support critical backup needs during outages.

Expansion of Outdoor and Recreational Activities

The growing popularity of camping, off-grid living, and outdoor recreational activities significantly boosts portable storage adoption. Consumers rely on portable systems to power appliances, gadgets, and tools in remote locations without grid access. Rising sales of RVs, boats, and mobile workstations amplify this demand across developed and emerging markets. Mid to high-capacity lithium-ion solutions dominate due to their longer runtime and compact design. This lifestyle-driven demand, coupled with increasing disposable income, makes outdoor applications a core contributor to overall market growth during the forecast period.

- For instance, Goal Zero’s Yeti 1000X portable power station provides 983Wh capacity with a 1,500W AC inverter, supporting up to 2,400W surge loads, enabling users to power refrigerators, CPAP machines.

Technological Advancements in Lithium-Ion Batteries

The market benefits greatly from innovations in lithium-ion chemistry, particularly lithium iron phosphate (LFP). These advancements provide higher energy density, faster charging times, and improved safety profiles. Longer lifecycle and reduced maintenance make lithium-ion the preferred technology over traditional lead-acid. Ongoing investments by leading companies in smart features, modular designs, and integration with renewable energy sources add further appeal. With lithium-ion holding over 70% share, continuous advancements are central to sustaining market leadership and broadening the customer base across residential, commercial, and outdoor power applications.

Key Trends & Opportunities

Integration with Renewable Energy Sources

Portable energy storage systems are increasingly integrated with solar panels, enabling users to harness clean energy in remote or off-grid areas. This trend aligns with global decarbonization efforts and consumer interest in sustainable living. Compact solar-plus-storage kits are gaining traction in both developed and emerging markets, offering energy independence and cost savings. The opportunity is particularly strong in regions with abundant solar resources, where off-grid households, outdoor users, and small businesses can achieve self-sufficiency. This integration enhances portability while addressing the need for eco-friendly power solutions.

- For instance, Anker Innovations introduced its Solix F2000 system with a 2,048Wh LiFePO4 battery paired with multiple solar panels for a maximum solar input of 1000W, a configuration that is capable of recharging fully in about 2.5 hours of direct, ideal sunlight.

Emergence of Smart and Connected Systems

Manufacturers are embedding smart features such as Bluetooth monitoring, mobile apps, and IoT connectivity into portable systems. These capabilities allow real-time performance tracking, predictive maintenance, and energy optimization. Consumers value the convenience of monitoring charge levels, usage patterns, and system health remotely. This trend opens opportunities for subscription-based services and value-added features, enhancing customer engagement. As connected devices become standard in households and workplaces, smart portable storage systems position themselves as premium solutions, particularly for tech-savvy users seeking both functionality and advanced digital integration.

- For instance, Goal Zero’s Yeti 3000X integrates with the Yeti App 3.0 via Wi-Fi and Bluetooth, allowing remote monitoring of its 3,032Wh lithium battery, real-time tracking of input/output wattage, and control of AC and DC ports from a smartphone.

Key Challenges

High Initial Costs of Advanced Systems

Despite falling battery prices, advanced lithium-ion-based portable storage systems remain expensive compared to conventional alternatives. The upfront cost often deters price-sensitive consumers in emerging markets, where lead-acid or low-capacity devices still find preference. High-end units with smart features and solar integration further increase costs, limiting mass adoption. This challenge is particularly relevant in regions with limited purchasing power, where affordability remains critical. Balancing performance and cost through innovations and subsidies will be essential for accelerating global adoption of advanced portable energy storage systems.

Limited Energy Density in Compact Designs

While portability is a core strength, compact designs often limit energy density and runtime. Consumers seeking long-duration backup for heavy-duty equipment or household appliances may find existing models insufficient. Frequent recharging or dependence on supplementary sources reduces convenience and limits widespread usage. This challenge particularly affects industrial and emergency applications, where longer runtimes are critical. Addressing this limitation through advanced chemistries, modular systems, and hybrid solutions will be necessary for manufacturers to expand application scope and meet evolving customer needs effectively.

Regional Analysis

North America

North America held the largest share of the portable energy storage system market in 2024 with over 35% share. The region’s dominance is driven by high consumer awareness, advanced energy infrastructure, and rising adoption of backup power for residential and commercial purposes. The United States leads demand with strong recreational activity trends, while Canada shows increasing reliance on emergency backup solutions. The presence of leading manufacturers and high disposable income further fuel market penetration. Growth is also supported by government programs promoting renewable integration and consumer preference for sustainable, smart, and portable energy solutions.

Europe

Europe accounted for nearly 28% share of the global market in 2024, supported by strict environmental regulations and consumer adoption of eco-friendly energy technologies. Countries such as Germany, the UK, and France are at the forefront, driven by strong camping and outdoor activity culture and robust preparedness programs for power outages. The European Union’s push toward decarbonization accelerates integration of portable systems with renewable sources, particularly solar. Rising demand for compact, efficient, and low-emission storage systems strengthens the region’s position. Strong retail distribution and a mature e-commerce market also enhance accessibility and consumer uptake.

Asia-Pacific

Asia-Pacific captured 25% share of the portable energy storage system market in 2024, emerging as the fastest-growing region. China and Japan dominate production and consumption, leveraging strong manufacturing capabilities and growing urban demand for backup solutions. India and Southeast Asian nations are experiencing surging adoption, fueled by frequent power outages and expanding outdoor leisure activities. Rising disposable incomes and increased focus on off-grid renewable integration enhance opportunities. Favorable government policies and investments in lithium-ion technology drive further market expansion. The region’s diverse consumer base ensures rapid scaling across residential, commercial, and outdoor energy storage applications.

Latin America

Latin America represented 7% share of the market in 2024, with Brazil and Mexico leading regional adoption. Rising concerns about unreliable grid supply, particularly in rural and semi-urban areas, increase reliance on portable energy storage. The popularity of outdoor recreational activities and tourism further drives sales. The region also shows growing interest in solar-plus-storage solutions, especially in off-grid communities. While adoption is slower compared to developed markets due to higher upfront costs, government initiatives promoting renewable access and the rising affordability of lithium-ion systems support steady growth prospects across Latin America.

Middle East & Africa

The Middle East & Africa held 5% share of the portable energy storage system market in 2024. Market growth is primarily driven by off-grid demand in African nations, where portable systems support households and small businesses with unreliable grid access. In the Middle East, the rising use of portable systems for outdoor and recreational activities adds momentum. Increasing adoption of solar-powered solutions, supported by abundant solar resources, provides significant opportunities. However, limited consumer affordability and infrastructure challenges restrict wider penetration. Continued government efforts to expand renewable integration and energy access are expected to foster regional demand.

Market Segmentations:

By Capacity

- Less than 500Wh

- 501-1000Wh

- Above 1000Wh

By Technology

- Lithium-Ion

- Lead-Acid

- Others

By Application

By End Use

- Residential

- Commercial & Industrial

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the portable energy storage system market is shaped by key players including Jackery Technology, Chint Global, Goal Zero, Jntech Renewable Energy, Bluetti Power, ATGepower, AceOn Group, Anker Innovations, Jiangsu Senji New Energy Technology, and EcoFlow. These companies compete through technological advancements, strong brand positioning, and broad product portfolios covering various capacity ranges. Lithium-ion based solutions dominate offerings, with leaders focusing on compact designs, rapid charging, and solar integration to capture outdoor and emergency demand. Strategic partnerships with retailers and e-commerce platforms expand their global footprint, while investments in smart connectivity and eco-friendly chemistries strengthen differentiation. Price competitiveness remains critical, especially in emerging markets, where affordability drives adoption. Many players are also diversifying into modular and hybrid storage systems, addressing both residential backup and off-grid applications. Continuous innovation and geographic expansion remain central strategies, enabling these companies to consolidate market share in a rapidly growing industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jackery Technology

- Chint Global

- Goal Zero

- Jntech Renewable Energy

- Bluetti Power

- ATGepower

- AceOn Group

- Anker Innovations

- Jiangsu Senji New Energy Technology

- EcoFlow

Recent Developments

- In 2025, EcoFlow debuted OASIS, its AI-powered energy management system, at CES, enabling real-time energy optimization across devices.

- In 2025, Jackery Technology launched the Explorer 500 v2 at IFA, offering 512 Wh capacity, up to 6,000 charge cycles, and full AC charging in 80 minutes.

- In 2025, EcoFlow unveiled its Stream series balcony PV + battery system, enabling plug-and-play solar coordination with its distributed battery units.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Technology, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with strong demand for backup power solutions.

- Lithium-ion technology will continue to dominate due to efficiency and durability advantages.

- Integration with renewable energy, especially solar, will drive widespread adoption.

- Smart connectivity and app-based monitoring will become standard features in products.

- Outdoor and recreational applications will remain a primary growth segment worldwide.

- Emergency preparedness programs will strengthen demand in residential and commercial sectors.

- Emerging markets will witness faster adoption supported by government energy initiatives.

- Modular and hybrid storage designs will gain popularity for flexible usage.

- Competition will intensify as global and regional players expand product portfolios.

- Sustainability goals and eco-friendly policies will accelerate long-term market penetration.

Market Insights

Market Insights