Market Overview:

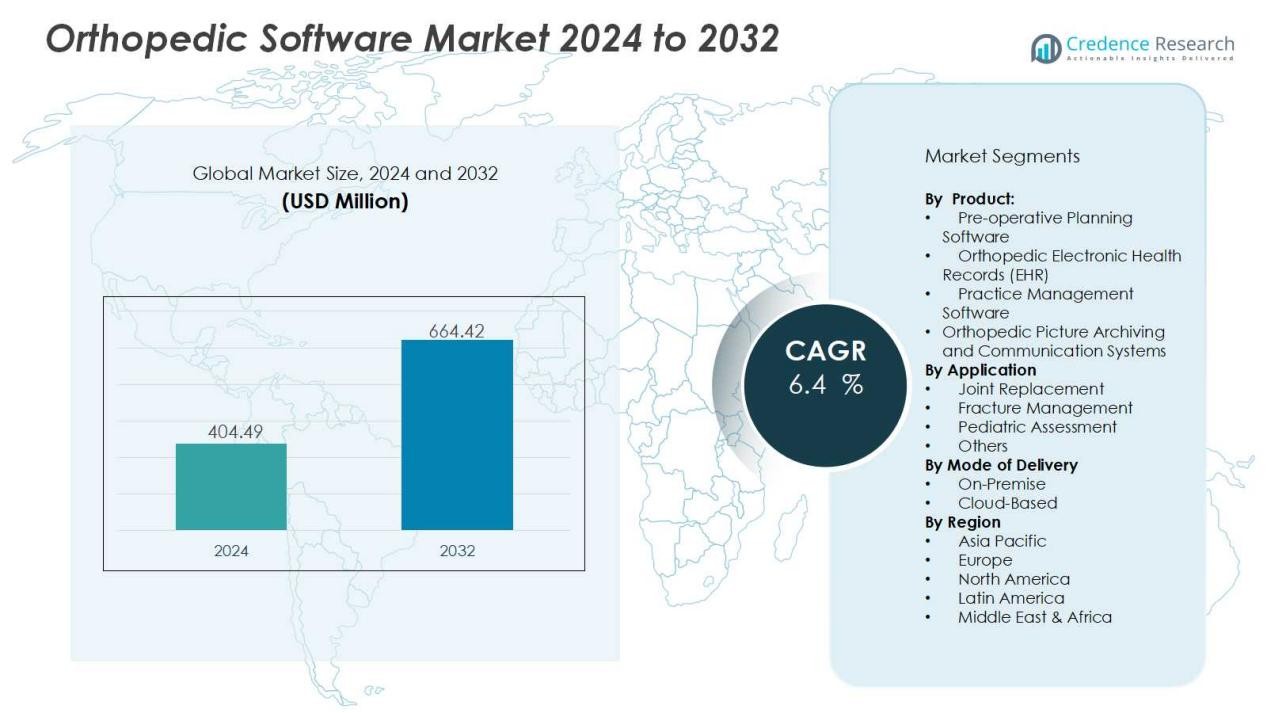

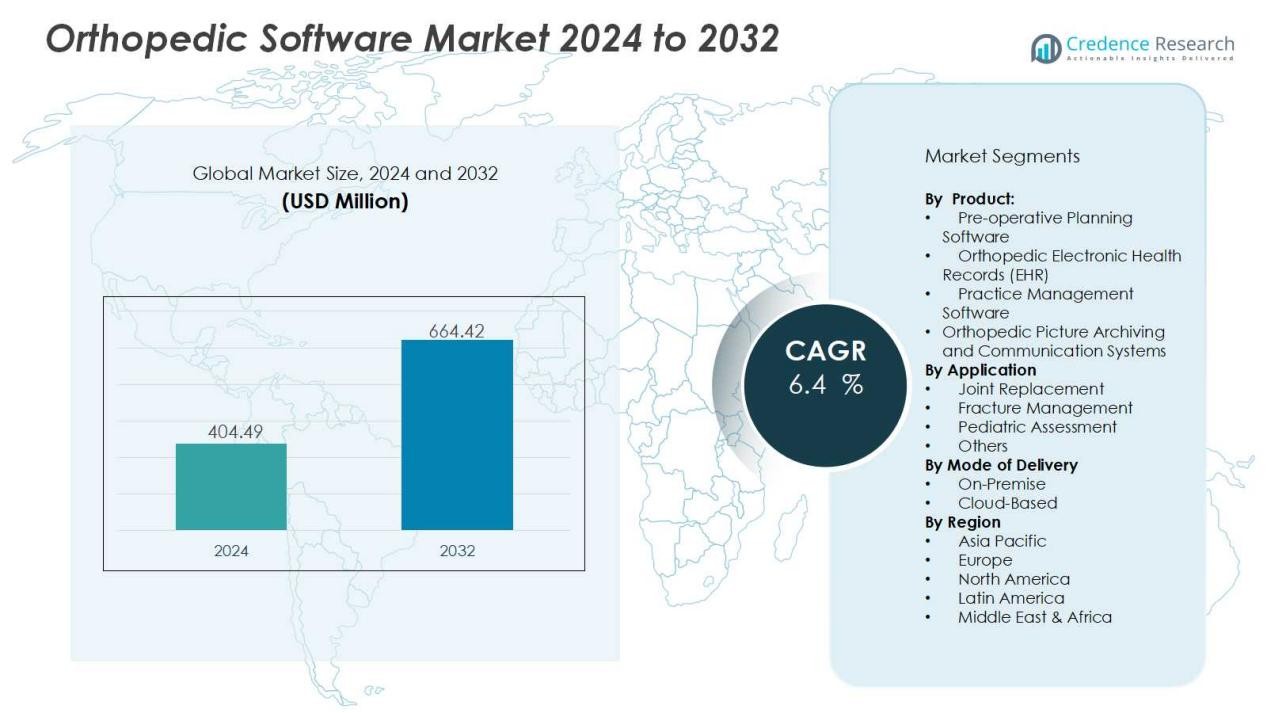

The orthopedic software market size was valued at USD 404.49 million in 2024 and is anticipated to reach USD 664.42 million by 2032, at a CAGR of 6.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Software Market Size 2024 |

USD 404.49 Million |

| Orthopedic Software Market, CAGR |

6.4 % |

| Orthopedic Software Market Size 2032 |

USD 664.42 Million |

Key market drivers include the rising prevalence of musculoskeletal disorders, increased orthopedic surgeries, and the adoption of electronic health records (EHR). Hospitals and clinics are prioritizing digital platforms that improve accuracy in diagnosis, streamline surgical planning, and reduce administrative burdens. Growing use of 3D imaging, AI-driven analytics, and cloud-based platforms also enhances efficiency and supports better patient outcomes.

Regionally, North America dominates the orthopedic software market due to advanced healthcare infrastructure, high orthopedic procedure volumes, and strong technology adoption. Europe follows closely, driven by aging demographics and investments in digital healthcare systems. Asia Pacific is projected to witness the fastest growth, fueled by healthcare digitization in countries like China and India, rising disposable incomes, and expanding access to orthopedic care. Latin America and the Middle East & Africa present emerging opportunities, supported by improving healthcare infrastructure and growing focus on technology-enabled medical solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The orthopedic software market was valued at USD 404.49 million in 2024 and is projected to reach USD 664.42 million by 2032, growing at a CAGR of 6.4%.

- Rising prevalence of musculoskeletal disorders and aging populations drive demand for advanced orthopedic interventions and digital planning tools.

- Hospitals and clinics are adopting digital platforms that integrate electronic health records, imaging data, and surgical planning modules.

- Advancements in AI-driven analytics, 3D imaging, and virtual surgical planning tools are improving surgical precision and patient recovery.

- High implementation costs and limited IT infrastructure in developing regions remain significant barriers for widespread adoption.

- North America held 42% share in 2024, supported by advanced healthcare infrastructure, strong technology adoption, and favorable reimbursement policies.

- Asia Pacific secured 20% share in 2024 and is the fastest-growing region, driven by healthcare digitization, rising incomes, and expanding hospital infrastructure.

Market Drivers:

Rising Burden of Musculoskeletal Disorders:

The orthopedic software market is driven by the increasing prevalence of musculoskeletal disorders and related conditions. An aging population faces higher risks of arthritis, osteoporosis, and bone injuries, creating greater demand for orthopedic interventions. It supports surgeons and healthcare providers by offering accurate diagnostic and treatment planning tools. The growing number of trauma and sports injuries further reinforces the need for advanced digital orthopedic solutions.

- For Instance, Globus Medical, Inc. launched its TENSOR™ Suture Button System, a suture-based product that advances orthopedic trauma care. The system received 510(k) clearance from the U.S. Food and Drug Administration earlier in 2024.

Growing Adoption of Digital Healthcare Platforms:

Healthcare systems are rapidly integrating digital platforms that streamline clinical workflows and reduce manual errors. The orthopedic software market benefits from hospitals and clinics deploying solutions that link electronic health records, imaging data, and surgical planning modules. It helps providers deliver more efficient, patient-centered care while improving treatment outcomes. Rising investments in healthcare IT infrastructure across developed and developing regions strengthen this adoption.

- For instance, in October 2024, Altera Digital Health Inc. announced the general availability of Paragon Denali, an EHR system built on Microsoft Azure, enhancing data accessibility and minimizing client downtime by leveraging containerized cloud services for rural and community hospitals.

Advancements in Imaging and Surgical Planning Tools:

The development of AI-driven analytics, 3D imaging, and virtual surgical planning tools is expanding orthopedic care capabilities. The orthopedic software market gains momentum from solutions that improve pre-operative visualization and intraoperative accuracy. It allows surgeons to personalize treatments and reduce complications, improving patient recovery rates. These innovations also align with the broader trend of precision medicine and minimally invasive procedures.

Increasing Focus on Cost Efficiency and Workflow Optimization:

Healthcare providers are under pressure to manage costs while delivering quality care. The orthopedic software market addresses this by offering platforms that optimize scheduling, resource allocation, and patient data management. It enhances productivity by minimizing administrative tasks and enabling better coordination across teams. This focus on efficiency appeals to hospitals, clinics, and specialty centers seeking long-term operational improvements.

Market Trends:

Integration of Advanced Technologies and Cloud-Based Solutions:

The orthopedic software market is witnessing strong adoption of AI, machine learning, and 3D imaging to improve diagnostic precision and surgical planning. It enables healthcare providers to personalize treatment strategies and achieve better clinical outcomes. Cloud-based platforms are gaining popularity because they support real-time access, data sharing, and collaboration across departments. Mobile applications that allow patients to engage with their treatment plans also strengthen this trend. Growing reliance on digital twin technology and simulation tools is enhancing pre-surgical visualization and reducing risks. These innovations align with the demand for minimally invasive procedures and precision-driven orthopedic care.

- For instance, RSIP Vision’s XPlan.ai provides AI-based 3D bone modeling from X-ray images with sub-millimeter accuracy, enabling precise pre-surgical planning without the need for CT scans, as clinically validated in 2024.

Growing Focus on Interoperability and Patient-Centered Care:

Hospitals and clinics are prioritizing interoperable systems that seamlessly integrate with electronic health records and imaging tools. The orthopedic software market benefits from platforms designed to streamline data flow and reduce inefficiencies in care delivery. It also reflects a shift toward patient-centered models where software supports remote monitoring and post-surgical rehabilitation. Adoption of telehealth-enabled orthopedic platforms is expanding in response to increased digital healthcare usage. Rising awareness of value-based healthcare encourages providers to invest in tools that measure outcomes and track recovery. This focus on connectivity and patient engagement is shaping future demand across global markets.

- For Instance, ModMed EMA is a leading orthopedic software platform that offers various features to improve practice efficiency and patient outcomes.

Market Challenges Analysis:

High Implementation Costs and Limited IT Infrastructure:

The orthopedic software market faces challenges due to the high cost of deployment and maintenance. Smaller hospitals and clinics often struggle to invest in advanced digital solutions because of budget constraints. It also requires continuous upgrades, training, and technical support, which increase long-term expenses. Limited IT infrastructure in emerging economies further restricts adoption, slowing growth opportunities. The gap between advanced healthcare systems and underfunded facilities highlights a key barrier for widespread penetration.

Data Security Concerns and Regulatory Compliance:

Healthcare providers remain cautious about adopting orthopedic software due to rising concerns over data security and privacy. The orthopedic software market must comply with strict regulations such as HIPAA in the U.S. and GDPR in Europe. It requires robust cybersecurity measures to prevent breaches and ensure patient trust. Complex regulatory environments across different regions create further challenges for global vendors. Integration with legacy systems without compromising compliance also adds to the difficulty. These factors slow adoption despite the benefits of digital transformation in orthopedic care.

Market Opportunities:

Expansion of Digital Healthcare and Telemedicine Integration:

The orthopedic software market presents strong opportunities through the rising adoption of digital healthcare and telemedicine. It supports remote consultations, post-surgical monitoring, and rehabilitation programs that improve patient engagement. Growing acceptance of virtual care platforms creates demand for software solutions that integrate seamlessly with telehealth services. Providers can expand access to orthopedic expertise in rural and underserved regions, strengthening market potential. Rising patient preference for convenient and technology-enabled care models further drives this growth. Investments in connected healthcare ecosystems enhance the role of orthopedic software in modern clinical practice.

Growing Role of AI, Analytics, and Personalized Care:

Artificial intelligence and predictive analytics are opening new opportunities for the orthopedic software market. It enables advanced decision support, personalized surgical planning, and outcome forecasting for improved treatment accuracy. Increasing use of wearable devices and connected sensors provides real-time patient data that enhances software functionality. Demand for precision medicine encourages solutions that adapt to individual patient profiles. Vendors focusing on AI-driven insights and data integration stand to gain a competitive edge. Expanding applications in minimally invasive and robotic surgeries also broaden future opportunities across global markets.

Market Segmentation Analysis:

By Product:

The orthopedic software market is segmented into pre-operative planning software, orthopedic EHR, practice management software, and orthopedic PACS. Pre-operative planning software holds a strong position due to its ability to enhance surgical accuracy and improve patient outcomes. It supports surgeons with 3D visualization and customized implant designs, which reduces risks during complex procedures. Orthopedic EHR and practice management software are gaining traction for their role in streamlining workflows and improving record-keeping efficiency. Orthopedic PACS further strengthens imaging integration, making diagnostic and surgical planning processes more effective.

- For instance, Orthofix’s OrthoNext™ software 2.1 release introduced AI-powered automatic marker identification on X-rays and 3D frame visualization, which has enabled surgeons to plan hexapod fixator cases with enhanced precision, improving workflow efficiency by approximately 30% in clinical settings as reported in 2025.

By Application:

The orthopedic software market by application includes joint replacement, fracture management, pediatric assessment, and others. Joint replacement dominates because of the rising number of hip and knee replacement surgeries worldwide. It is supported by aging populations and increasing incidences of osteoarthritis. Fracture management is also expanding steadily as trauma cases and sports-related injuries continue to grow. Pediatric assessment software is gaining attention for early detection and treatment of developmental bone conditions. Broader applications in rehabilitation and post-surgical monitoring also contribute to segment growth.

- For instance, OhioHealth’s orthopedic surgery teams in Ohio have completed over 3,000 robotic-assisted joint replacement surgeries using the Stryker Mako system, achieving millimeter-level surgical precision that enhances implant longevity and patient recovery.

By Mode of Delivery:

The orthopedic software market by mode of delivery is categorized into on-premise and cloud-based solutions. On-premise platforms remain relevant due to strong data control and security benefits. It continues to attract large hospitals with advanced IT infrastructure. Cloud-based solutions are expanding rapidly because they provide scalability, cost efficiency, and remote accessibility. Growing demand for real-time collaboration across care teams strengthens this trend. Cloud deployment is expected to become the dominant delivery model over the coming years.

Segmentations:

By Product:

- Pre-operative Planning Software

- Orthopedic Electronic Health Records (EHR)

- Practice Management Software

- Orthopedic Picture Archiving and Communication Systems (PACS)

By Application:

- Joint Replacement

- Fracture Management

- Pediatric Assessment

- Others

By Mode of Delivery:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America held 42% market share in 2024, making it the largest regional market. The orthopedic software market in this region benefits from advanced healthcare infrastructure and strong investments in digital transformation. It is supported by high surgical volumes, early adoption of AI-driven platforms, and the presence of leading technology providers. Favorable reimbursement policies and the widespread use of electronic health records also strengthen growth. Rising demand for precision medicine and minimally invasive orthopedic procedures further drives adoption. Continuous focus on healthcare IT innovation keeps North America at the forefront of global expansion.

Europe:

Europe accounted for 30% market share in 2024, ranking as the second-largest regional market. The orthopedic software market in this region gains momentum from an expanding elderly population that increases orthopedic care demand. It benefits from government-backed digital health initiatives and strict clinical standards supporting software adoption. Strong focus on interoperability across healthcare systems drives wider implementation of integrated solutions. Leading research institutions and medical device companies contribute to technological advancements in surgical planning tools. Rising healthcare spending across Western and Central Europe sustains steady regional growth.

Asia Pacific:

Asia Pacific secured 20% market share in 2024, positioning it as the fastest-growing regional market. The orthopedic software market here is driven by rising healthcare digitization in countries like China, India, and Japan. It benefits from increasing surgical volumes, expanding hospital infrastructure, and growing patient awareness of digital care. Governments are investing heavily in healthcare IT systems to improve accessibility and efficiency. Strong economic growth and rising disposable incomes encourage private healthcare providers to adopt advanced solutions. Expanding applications in telehealth and medical imaging further support rapid adoption across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- IBM

- GreenWay Health LLC

- Brainlab AG

- CureMD Healthcare

- Medstrat

- NextGen Healthcare LLC

- DrChrono, Inc

- Materialise

- Allscripts Healthcare, LLC

- athenahealth

Competitive Analysis:

The orthopedic software market is highly competitive with global and regional players focusing on innovation and digital integration. Key companies include IBM, GreenWay Health LLC, Brainlab AG, CureMD Healthcare, Medstrat, NextGen Healthcare LLC, DrChrono, Inc, and Materialise, each strengthening their market positions through product development and partnerships. It emphasizes advanced features such as AI-driven analytics, 3D imaging, and cloud-enabled solutions to improve surgical planning and patient management. Vendors actively expand interoperability with electronic health records and integrate mobile applications to enhance accessibility. Competition also centers on pricing strategies, scalability, and compliance with healthcare regulations. The market shows growing consolidation as established players seek to expand portfolios and emerging companies introduce specialized platforms. It continues to evolve with rising investments in telehealth and personalized orthopedic care, creating opportunities for differentiation among leading providers.

Recent Developments:

- In July 2025, IBM launched the Power11 processor, enhancing productivity and AI transformation with features like quantum-safe protection and ransomware detection.

- In May 2025, IBM showcased advancements in AI at Think 2025, including upgrades to the Watsonx data platform and new AI tools for enterprises.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, Mode of Delivery, Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The orthopedic software market will expand with stronger integration of AI and predictive analytics.

- It will witness higher adoption of cloud-based platforms that enhance collaboration and remote access.

- Growing demand for telemedicine-linked orthopedic solutions will strengthen digital care models.

- It will benefit from the rising focus on precision medicine and personalized treatment pathways.

- Vendors will invest in interoperability to ensure seamless data exchange across healthcare systems.

- It will gain momentum from wearable integration, enabling real-time monitoring and recovery tracking.

- The market will see increased use of 3D imaging and surgical simulation tools for planning.

- It will face ongoing pressure to meet cybersecurity and regulatory compliance requirements.

- Global expansion will continue in emerging markets supported by healthcare infrastructure improvements.

- It will evolve toward value-based healthcare, emphasizing measurable outcomes and patient-centered care delivery.