Market Overview

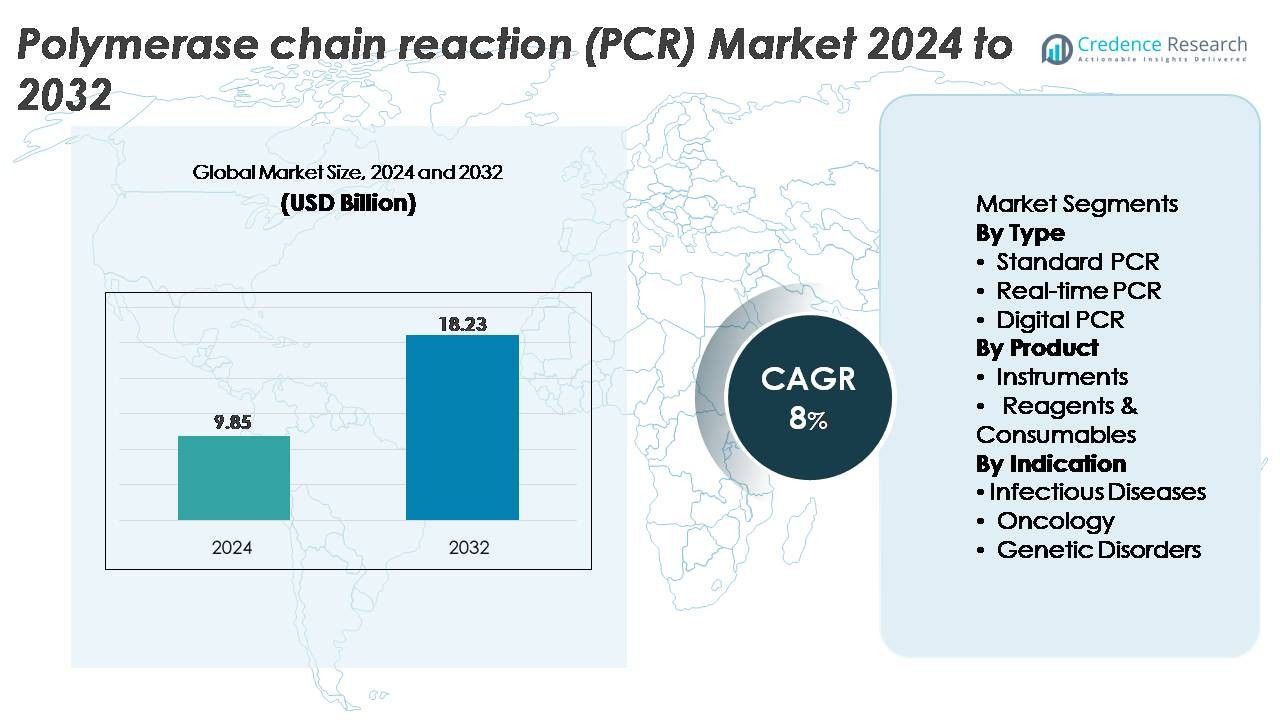

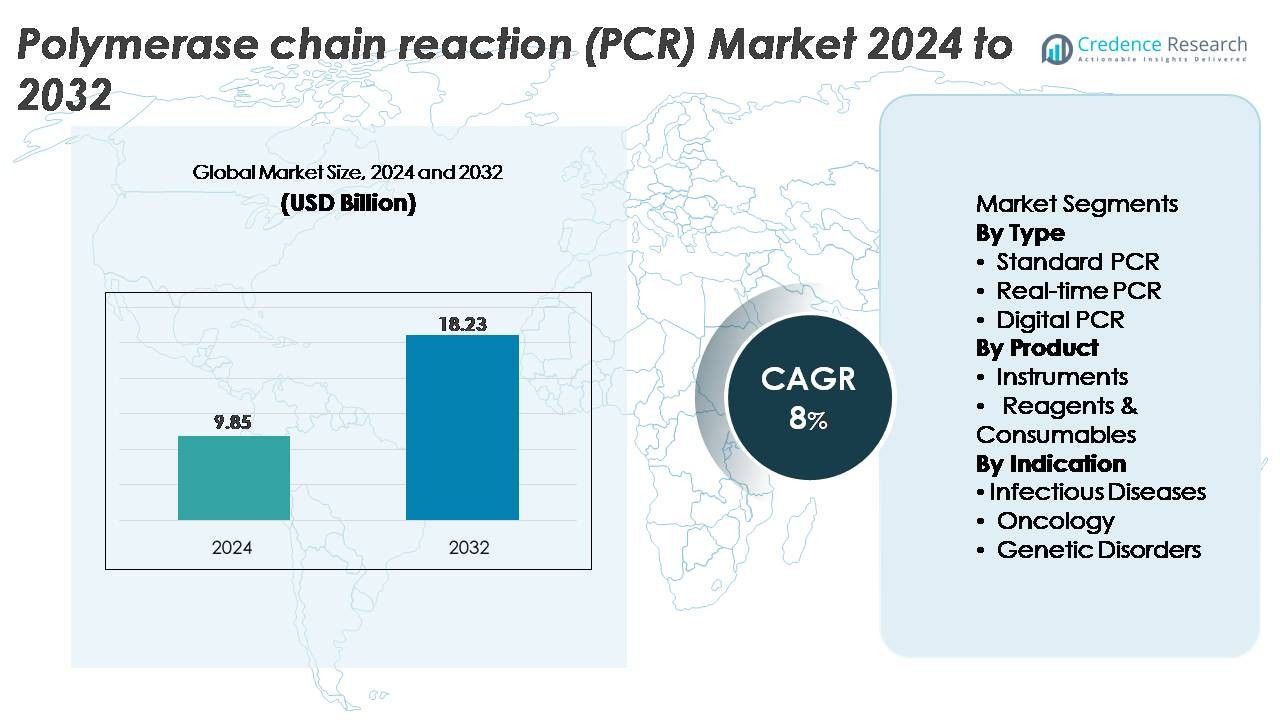

The polymerase chain reaction (PCR) market was valued at USD 9.85 billion in 2024 and is projected to reach USD 18.23 billion by 2032, expanding at a CAGR of 8% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polymerase Chain Reaction (PCR) Market Size 2024 |

USD 9.85 Billion |

| Polymerase Chain Reaction (PCR) Market, CAGR |

8% |

| Polymerase Chain Reaction (PCR) Market Size 2032 |

USD 18.23 Billion |

The Polymerase Chain Reaction (PCR) market is dominated by globally established diagnostics and life science companies that continue to advance instrument performance, workflow automation, and reagent quality. Key players including Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, QIAGEN, Bio-Rad Laboratories, Abbott, Agilent Technologies, BD, Eppendorf AG, and Sysmex Inostics focus on expanding real-time and digital PCR capabilities to strengthen their competitive positions. These companies benefit from extensive distribution networks and strong portfolios spanning instruments, consumables, and software solutions. North America leads the market with approximately 41% share, supported by high diagnostic testing volume, strong R&D investments, and widespread adoption of advanced molecular technologies across clinical and research laboratories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The polymerase chain reaction (PCR) market reached USD 9.85 billion in 2024 and is projected to grow to USD 18.23 billion by 2032, registering a CAGR of 8% over the forecast period.

- Growing demand for molecular diagnostics particularly in infectious disease testing, oncology screening, and genetic analysis continues to drive adoption, with real-time PCR holding the largest segment share due to its speed and quantification accuracy.

- Key trends include rapid expansion of automation, rising use of digital PCR for ultra-sensitive detection, and broader applications in precision medicine, biopharmaceutical quality control, and genomics research.

- Competitive intensity remains strong as leading players enhance instrument throughput, reagent performance, and integrated workflows, while high equipment costs and technical complexity act as restraints for smaller laboratories.

- Regionally, North America leads with ~41% market share, followed by Europe at ~28% and Asia Pacific at ~26%, while Latin America and the Middle East & Africa collectively account for the remaining share, reflecting developing molecular diagnostic infrastructure.

Market Segmentation Analysis:

By Type:

Real-time PCR (qPCR) remains the dominant sub-segment, accounting for the largest market share due to its high sensitivity, rapid quantification capability, and broad clinical adoption. Its ability to deliver precise amplification data in real time makes it the preferred method across diagnostic laboratories, particularly for infectious disease detection, oncology profiling, and genetic analysis. Standard PCR continues to serve routine applications in research and academic settings, while digital PCR is gaining traction for ultra-sensitive detection, although its higher cost and specialized workflow limit widespread adoption compared to qPCR.

- For instance, Thermo Fisher’s QuantStudio™ 7 Pro Real-Time PCR System enables detection of as few as 1–10 target copies per reaction and supports 384-well high-throughput runs, allowing laboratories to process large volumes of qPCR assays with exceptional reproducibility.

By Product:

Reagents & consumables hold the dominant market share, driven by their recurring usage across high-volume diagnostic workflows, research protocols, and clinical validation assays. Continuous demand for high-purity enzymes, master mixes, probes, and amplification buffers ensures stable revenue growth for manufacturers. Instruments also contribute significantly, supported by technological advancements such as automated thermal cyclers, multiplexing platforms, and integrated workflows for real-time and digital PCR. However, their non-recurring nature results in a slower replacement cycle, positioning consumables as the primary revenue-generating segment in the PCR ecosystem.

- For instance, QIAGEN’s QuantiTect® PCR kit portfolio supports reactions with low picogram DNA inputs, and its HotStarTaq® DNA Polymerase delivers reliable performance and high specificity, underscoring the essential role of high-precision reagents in PCR-based applications.

By Indication:

Infectious diseases represent the leading sub-segment with the highest market share, driven by the widespread deployment of PCR testing for viral, bacterial, and parasitic pathogens. The segment’s dominance is strengthened by the continued need for high-accuracy diagnostics in hospital laboratories, public health programs, and surveillance systems. Oncology applications are expanding as PCR supports mutation detection, tumor profiling, and minimal residual disease assessment, while genetic disorders segment benefits from increasing adoption of PCR-based carrier screening and newborn testing. Despite this growth, infectious disease diagnostics remain the core driver of PCR utilization globally.

Key Growth Drivers

Rising Global Burden of Infectious and Chronic Diseases

The increasing prevalence of infectious diseases such as influenza, HIV, tuberculosis, and emerging viral threats continues to drive the adoption of PCR-based diagnostic testing. As healthcare systems prioritize early detection and rapid intervention, PCR’s unmatched sensitivity and specificity position it as a frontline diagnostic modality. Chronic diseases such as cancer also contribute to rising demand as PCR enables mutation detection, tumor profiling, and monitoring of therapeutic response. Growing investment in public health surveillance programs, antimicrobial resistance monitoring, and outbreak preparedness further accelerates PCR deployment across centralized laboratories and point-of-care environments. Additionally, developing regions are expanding diagnostic infrastructure, fueling broader PCR penetration. Together, these dynamics reinforce the sustained need for high-accuracy nucleic acid testing.

· For instance, Abbott’s m2000 RealTime System supports 96-sample batch runs and fully automated extraction-to-amplification workflows, enabling molecular labs to process multiple infectious-disease assays per shift with consistent sensitivity and reduced hands-on time.

Advancements in PCR Technologies and Automation

Continuous innovation in PCR instrumentation and chemistry is significantly boosting market expansion. Modern platforms now offer faster cycling times, improved multiplexing, integrated sample-to-answer workflows, and enhanced quantitative accuracy. Automation is becoming a major driver as laboratories adopt high-throughput real-time PCR systems capable of processing hundreds to thousands of samples daily with minimal manual intervention. Digital PCR (dPCR) advancements, including improved microfluidics and partitioning accuracy, support ultra-sensitive detection required in oncology, cell and gene therapy development, and infectious disease research. These enhancements reduce labor requirements, minimize error rates, and improve turnaround times, making PCR more accessible across clinical, research, and industrial applications.

- For instance, Bio-Rad’s QX200 Droplet Digital PCR System generates up to 20,000 droplets per sample and quantifies targets with a resolution as low as 0.1 copies/µL, supporting highly sensitive mutation and copy number detection.

Expanding Applications in Precision Medicine and Genetic Testing

PCR is playing an increasingly pivotal role in precision medicine, supporting personalized therapeutic decisions and early disease detection. The method enables highly targeted biomarker analysis, copy number variation detection, hereditary disease screening, and pharmacogenomic profiling. In oncology, PCR supports minimal residual disease assessment and companion diagnostic development, aligning with the growing shift toward individualized treatment pathways. Newborn screening, reproductive genetics, and carrier testing also benefit from improved PCR accuracy and workflow efficiency. As healthcare providers adopt molecular testing protocols and governments invest in nationwide genomic initiatives, PCR platforms continue to experience expanded utilization across medical specialties and preventive health programs.

Key Trends & Opportunities

Integration of PCR with Digital Health, AI, and Automation

A significant trend shaping the PCR landscape is the integration of digital technologies such as AI-driven analysis, cloud-based data management, and remote connectivity for instrument monitoring. AI algorithms are increasingly supporting automated result interpretation, error reduction, and workflow optimization. This enhances reporting accuracy for large clinical laboratories and decentralized testing networks. Cloud platforms enable real-time data sharing for epidemiological surveillance, strengthening public health response capabilities. Automated liquid-handling systems and robotics further streamline pre-analytics and post-analytics processes, opening opportunities for fully automated PCR labs. Together, these advancements expand operational efficiency while enabling PCR systems to serve emerging applications in digital diagnostics.

· For instance, Roche’s cobas® 6800/8800 systems integrate with the Roche Flow cloud suite for remote run monitoring, automated alert handling, and centralized workflow control. The cobas® 6800 platform delivers up to 96 results per hour with minimal hands-on time, supporting high-volume automated PCR operations.

Growing Demand for Point-of-Care and Portable PCR Systems

Interest in decentralized molecular testing continues to rise, creating opportunities for compact, rapid, and user-friendly PCR platforms. Portable real-time PCR devices enable on-site diagnostics in clinics, emergency settings, remote locations, agricultural testing, and environmental surveillance. These systems reduce reliance on centralized labs while significantly shortening turnaround times. Advances in microfluidics, battery-powered operation, and integrated sample preparation are enabling high performance in compact devices. Governments and private organizations are increasingly investing in field-deployable molecular diagnostics for outbreak response, food safety monitoring, and border screening. The trend toward miniaturization and mobility will expand PCR adoption across non-traditional testing environments.

· For instance, Thermo Fisher’s Accula™ System performs true point-of-care PCR using a fully integrated cartridge that delivers sample-to-result outputs in about 30 minutes. Abbott’s ID NOW™ platform uses isothermal amplification technology and provides positive results in as little as 5 minutes, supporting rapid molecular testing in decentralized settings.

Expansion of PCR in Biopharmaceutical Manufacturing and Quality Control

PCR is becoming essential in biopharmaceutical workflows, including cell line authentication, viral contamination testing, residual DNA quantification, and gene therapy vector characterization. As biologics, biosimilars, and advanced therapies scale globally, manufacturers increasingly deploy PCR for stringent quality assurance. Opportunities are emerging with the growth of mRNA therapeutics, which require precise nucleic acid quantification and impurity analysis. The need for rapid lot release testing and compliance with regulatory quality standards further supports increased PCR utilization. This trend enables suppliers to expand specialized reagent lines and compliant instrumentation tailored to industrial QC environments.

Key Challenges

High Cost of Advanced PCR Instruments and Operational Expenses

Despite its broad adoption, the high capital cost of advanced PCR systems especially real-time PCR and digital PCR remains a significant barrier for smaller laboratories, academic institutions, and facilities in developing regions. Operational expenses such as reagent procurement, consumable usage, specialized maintenance, and trained personnel requirements add to the financial burden. Digital PCR, while offering superior sensitivity, involves particularly high system and partitioning consumable costs. These economic constraints limit the pace of technology upgrades and inhibit adoption of high-throughput or ultra-sensitive platforms, widening the gap between well-funded and resource-limited healthcare settings.

Technical Limitations and Risk of Contamination or False Results

PCR workflows require precise handling, controlled environments, and rigorous quality assurance to prevent contamination or false-positive results. Even minor issues such as reagent degradation, pipetting errors, or cross-contamination can compromise accuracy. Highly sensitive assays magnify the impact of such errors, particularly in low-copy-number detection scenarios. PCR also faces limitations in multiplexing capacity compared to next-generation sequencing and may struggle with complex genomic variations. These technical constraints necessitate continuous training, strict laboratory protocols, and validation measures. Such complexities can hinder scalability, especially in decentralized or low-resource testing settings where expertise and infrastructure may be limited.

Regional Analysis

North America

North America holds the largest share of the PCR market at approximately 41%, supported by advanced healthcare infrastructure, strong diagnostic testing capabilities, and high adoption of molecular technologies across hospitals, research centers, and public health laboratories. The region benefits from continuous investment in biotechnology, widespread use of real-time PCR in infectious disease monitoring, and growing application in oncology and genetic testing. Strong regulatory support and ongoing R&D funding further reinforce the region’s leadership, driving consistent demand for high-performance instruments, consumables, and automated PCR platforms across clinical and academic environments.

Europe

Europe accounts for around 28% of the global market, driven by well-established molecular diagnostic networks, stringent quality standards, and strong adoption of PCR in infectious disease surveillance, oncology diagnostics, and genetic screening programs. Countries such as Germany, the U.K., and France remain central hubs for biomedical research, supporting high utilization of real-time and digital PCR technologies. Expanding precision medicine initiatives, government-supported screening programs, and growing investments in laboratory automation contribute to stable market growth. Europe’s diverse research ecosystem and clinical demand reinforce its position as the second-largest regional contributor.

Asia Pacific

Asia Pacific captures roughly 26% of the PCR market and represents the fastest-growing region, supported by rapid healthcare expansion, rising diagnostic testing rates, and increased awareness of molecular technologies. China, Japan, South Korea, and India lead adoption due to large patient populations, rising infectious disease burdens, and strong investments in biotechnology and genomics. Government-driven disease surveillance programs and expansion of public and private diagnostic laboratories further accelerate PCR uptake. Increasing affordability of PCR instruments and consumables and growth in academic research drive APAC’s trajectory toward becoming a global molecular diagnostics hub.

Latin America

Latin America holds an estimated 3% share of the global PCR market, characterized by growing adoption in infectious disease testing, maternal health screening, and public health laboratories. Countries such as Brazil, Mexico, and Argentina show increasing demand as healthcare systems strengthen molecular diagnostic capabilities. Expansion of private diagnostic networks and wider availability of PCR reagents and instruments support adoption, although budget constraints and uneven access to advanced technologies limit penetration. Continued investments in laboratory infrastructure, along with rising awareness of early disease detection, are gradually improving the region’s molecular diagnostics landscape.

Middle East & Africa

The Middle East & Africa region accounts for approximately 2% of the PCR market, with adoption concentrated in countries with better-developed healthcare systems such as the UAE, Saudi Arabia, and South Africa. Demand is primarily driven by infectious disease screening, public health surveillance, and growing investment in hospital laboratory modernization. Despite rising awareness, limited reimbursement coverage and disparities in diagnostic infrastructure slow broader uptake. International partnerships, government-led healthcare expansion programs, and increasing private-sector laboratory investments continue to support steady growth, positioning MEA as a developing but increasingly important market for PCR technologies.

Market Segmentations:

By Type

- Standard PCR

- Real-time PCR

- Digital PCR

By Product

- Instruments

- Reagents & Consumables

By Indication

- Infectious Diseases

- Oncology

- Genetic Disorders

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Polymerase Chain Reaction (PCR) market is characterized by the strong presence of global diagnostics and life science companies that continue to expand their technological capabilities and product portfolios. Leading players focus on innovations in real-time and digital PCR platforms, developing faster, more sensitive, and automation-ready systems to meet growing clinical and research demands. Companies increasingly invest in integrated workflows combining sample preparation, amplification, and data analysis to enhance user efficiency and reduce turnaround times. Strategic partnerships, acquisitions, and geographic expansion remain central to strengthening market positioning, particularly in high-growth regions such as Asia Pacific. Vendors also prioritize high-quality reagents and consumables, which represent a recurring revenue stream and critical performance component across PCR workflows. Competitive differentiation is further driven by AI-enabled software tools, multiplexing capabilities, and expanded applications in oncology, infectious disease diagnostics, and genetic testing. Overall, the market remains dynamic, innovation-focused, and driven by continuous technological advancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sysmex Inostics (Hyogo, Japan)

- Agilent Technologies, Inc. (California, U.S.)

- BD (New Jersey, U.S.)

- Eppendorf AG (Hamburg, Germany)

- Abbott (Illinois, U.S.)

- Thermo Fisher Scientific Inc. (Massachusetts, U.S.)

- Bio-Rad Laboratories, Inc. (California, U.S.)

- QIAGEN (Hilden, Germany)

- F. Hoffmann-La Roche Ltd (Basel, Switzerland)

Recent Developments

- In July 2025, Bio-Rad Laboratories expanded its digital PCR portfolio by launching new platforms including the QX Continuum™ ddPCR system and the QX700™ series. This expansion followed the company’s acquisition of digital PCR developer Stilla Technologies and broadened its droplet digital PCR offerings for research and diagnostic workflows.

- In January 2025, QIAGEN announced enhancements to its QIAcuity Digital PCR system, doubling the number of targets analyzable per sample and entered a partnership with GENCURIX, Inc. to develop oncology assays for the QIAcuityDx platform’s clinical diagnostic use

Report Coverage

The research report offers an in-depth analysis based on Type, product, Indication and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- PCR adoption will continue to expand as healthcare systems prioritize rapid and accurate molecular diagnostics.

- Real-time PCR will retain dominance, while digital PCR gains momentum in ultra-sensitive applications.

- Automation and integrated sample-to-answer systems will streamline workflows and reduce labor dependency.

- AI-enabled data interpretation will improve result accuracy and support high-throughput laboratory operations.

- Point-of-care and portable PCR devices will see increased deployment in decentralized and remote settings.

- PCR will play a larger role in precision medicine, particularly in oncology and genetic profiling.

- Biopharmaceutical manufacturing will increasingly rely on PCR for quality control and contamination monitoring.

- Demand for multiplex assays will rise as labs seek to detect multiple pathogens in a single run.

- Reagent and consumable innovation will accelerate to support faster cycling times and higher sensitivity.

- Emerging markets will experience stronger adoption as diagnostic infrastructure and molecular testing capacity expand.