Market Overview:

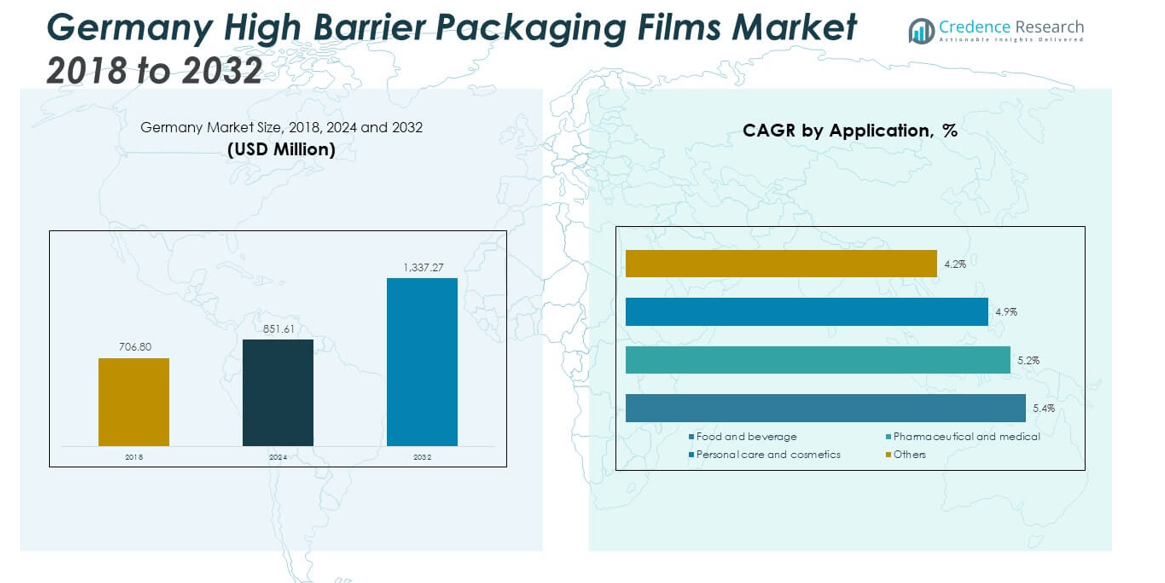

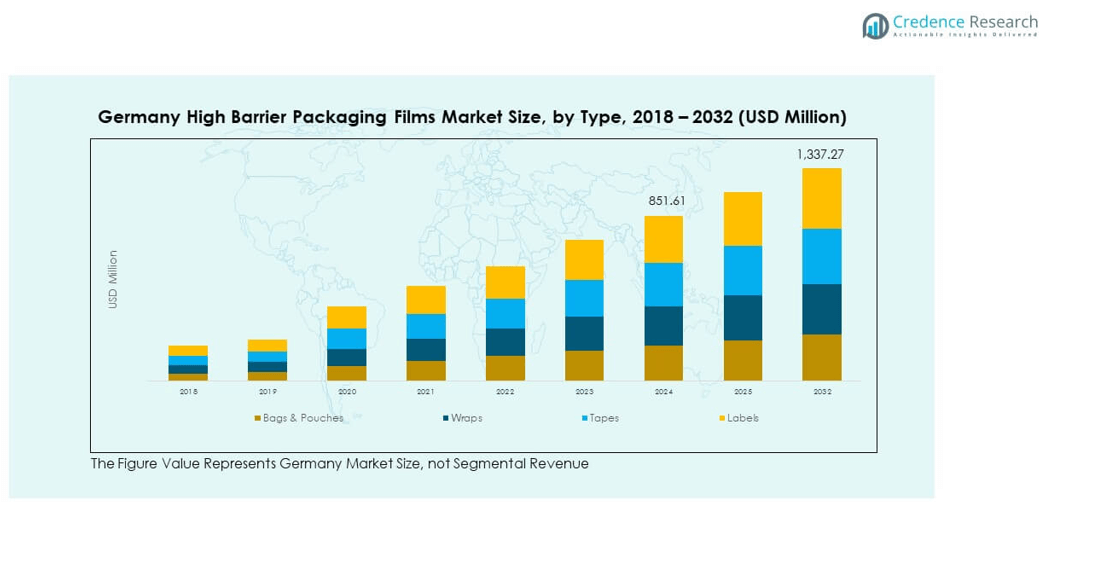

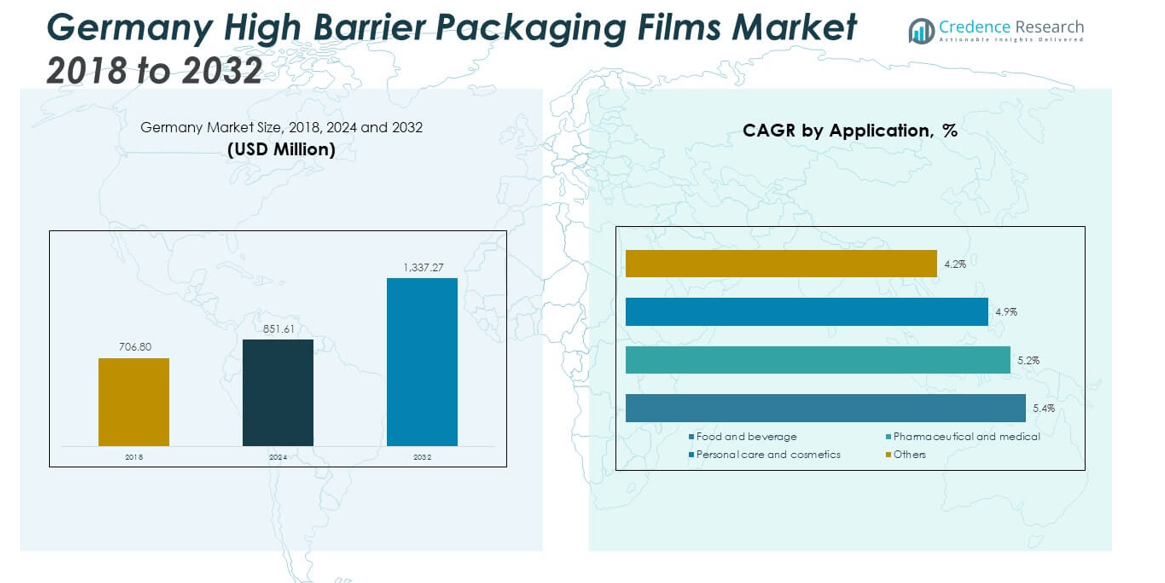

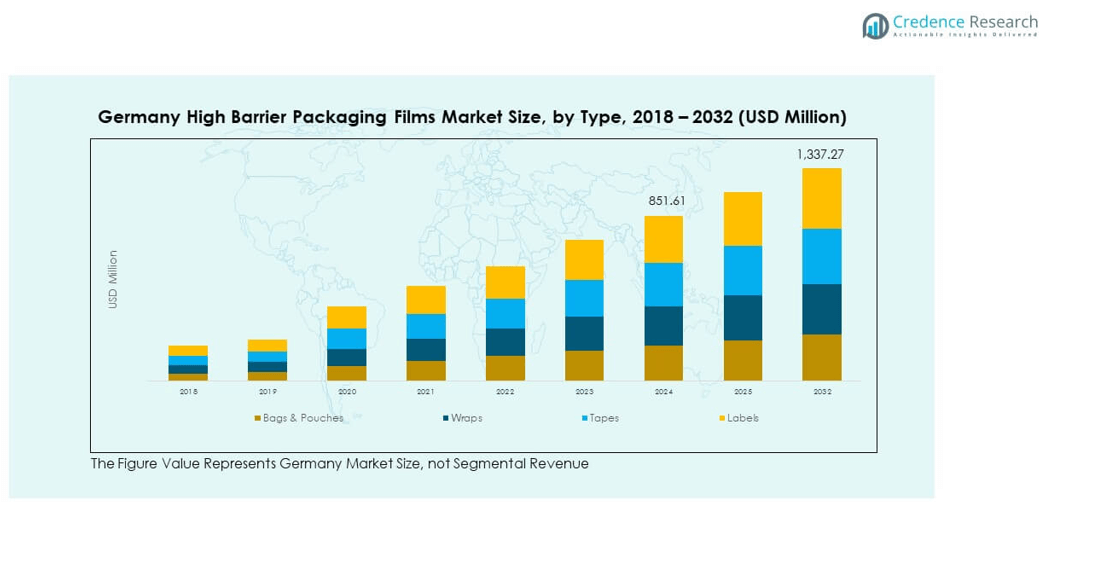

The Germany High Barrier Packaging Films Market size was valued at USD 706.80 million in 2018, reached USD 851.61 million in 2024, and is anticipated to reach USD 1,337.27 million by 2032, at a CAGR of 5.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany High Barrier Packaging Films Market Size 2024 |

USD 851.61 million |

| Germany High Barrier Packaging Films Market, CAGR |

5.80% |

| Germany High Barrier Packaging Films Market Size 2032 |

USD 1,337.27million |

Growth in this market is driven by increasing demand for extended shelf life packaging, rising consumer preference for ready-to-eat meals, and stricter regulations on food safety. The need for effective protection against oxygen, moisture, and UV exposure is fueling adoption. Manufacturers are focusing on innovation in multi-layer films, recyclable materials, and lightweight designs to meet sustainability goals. E-commerce growth also drives the use of high barrier packaging to ensure product integrity during transportation and storage.

Regionally, Western Europe dominates the Germany High Barrier Packaging Films Market, supported by strong food processing, pharmaceutical, and retail sectors. Germany plays a leading role due to its advanced packaging industry and emphasis on sustainable solutions. Emerging demand is noted in Eastern European countries, where urbanization and modern retail expansion are fueling packaging upgrades. Northern Europe is also adopting advanced barrier films, driven by regulatory pressure on waste reduction and strong consumer awareness of eco-friendly packaging.

Market Insights:

- The Germany High Barrier Packaging Films Market was valued at USD 706.80 million in 2018, reached USD 851.61 million in 2024, and is projected to hit USD 1,337.27 million by 2032, growing at a CAGR of 5.80%.

- Western and Southern Germany together hold 55% share, supported by strong food, pharmaceutical, and retail sectors, along with advanced R&D and packaging infrastructure.

- Northern Germany accounts for 25% of the market share, led by seafood exports, retail expansion, and strong trade networks.

- Eastern Germany holds 20% share and stands as the fastest-growing region, fueled by food processing, healthcare packaging demand, and expanding logistics.

- In product distribution, bags & pouches lead with nearly 34% share, followed by labels at around 28%, while wraps account for about 21% and tapes represent nearly 17% of the Germany High Barrier Packaging Films Market in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Preference for Packaged and Processed Foods

The Germany High Barrier Packaging Films Market benefits from strong consumer demand for packaged and processed foods. Urban lifestyles and fast-paced routines encourage people to opt for convenient food formats. This shift increases reliance on packaging that extends freshness and preserves quality. High barrier films are widely chosen to protect food against oxygen, moisture, and microbial activity. Growth in the retail and e-commerce sectors further strengthens the use of such films. Food producers adopt innovative designs to meet safety standards and customer expectations. It is driven by the need to maintain flavor and texture in perishable products. Rising population density in urban areas creates sustained demand for packaging with longer shelf life.

- For instance, SÜDPACK’s Multipeel® High barrier films are equipped with advanced resealing technology that contributes significantly to extending the shelf life of packaged meats and sausages, with reliable protection confirmed even under high mechanical stress and reduced need for extra packaging material.

Growing Adoption in Pharmaceutical and Healthcare Sectors

Pharmaceutical and healthcare sectors support rapid growth in the Germany High Barrier Packaging Films Market. Drug manufacturers require protective films that safeguard products from contamination and degradation. These films provide strong resistance against environmental elements, supporting drug stability. Demand rises due to stringent regulations and rising exports of German pharmaceutical goods. Hospitals and clinics also drive usage of sterile packaging for medical devices. It is widely used to prevent exposure to oxygen, UV light, and humidity. German packaging firms focus on high-precision solutions tailored to critical healthcare needs. Increasing reliance on advanced medication packaging supports long-term expansion of this sector.

- For instance, SCHOTT Pharma’s TOPPAC® polymer cartridges deliver functional performance comparable to glass while minimizing protein adsorption and extractables, providing a reliable sterile barrier for sensitive biologics and emergency drugs as confirmed in recent product and compatibility tests.

Advancements in Film Technology and Multi-Layer Structures

Innovation in film structures is a major driver shaping the Germany High Barrier Packaging Films Market. Multi-layer technologies deliver improved strength, flexibility, and durability. Manufacturers invest heavily in research to design recyclable and bio-based solutions. These efforts align with sustainability goals while meeting strict regulatory norms. It benefits from growing interest in smart and eco-friendly packaging options. Films with enhanced sealing properties help maintain freshness across long supply chains. Industries prefer lightweight yet durable packaging to reduce transportation costs. Continuous development of barrier coatings improves product integrity and long-term reliability.

E-Commerce Growth and Distribution Chain Expansion

Expansion of e-commerce strongly supports the Germany High Barrier Packaging Films Market. Online food delivery and retail services demand packaging that ensures safety during transit. High barrier films protect items against moisture, oxygen, and temperature fluctuations. It has become critical for companies delivering perishable and delicate items. Demand for flexible packaging formats rises with the popularity of direct-to-consumer sales. Logistics networks rely on durable materials to reduce spoilage rates and product returns. German companies invest in packaging designs suitable for long-distance and global shipments. Consumer trust increases when high-quality packaging ensures secure delivery and product freshness.

Market Trends:

Shift Toward Sustainable and Recyclable Packaging Materials

The Germany High Barrier Packaging Films Market is experiencing a strong shift toward sustainability. Consumers demand packaging that reduces environmental impact while maintaining high performance. Manufacturers develop recyclable and compostable films to address regulatory pressures. It has encouraged collaborations across the packaging value chain to introduce eco-friendly alternatives. Corporate sustainability goals also shape purchasing preferences across retail and manufacturing sectors. Suppliers invest in advanced bio-polymers and lightweight barrier films. Demand for renewable resources in packaging is expected to remain strong. Regulatory policies in Europe continue to accelerate innovation in green packaging solutions.

- For instance, BASF’s ecovio® film is certified compostable in accordance with the European EN 13432 standard and delivers compostability verified in industrial settings, with bio-based content ranging from 70% to 80% depending on application.

Integration of Smart Packaging Features and Functional Additives

Smart packaging trends are reshaping the Germany High Barrier Packaging Films Market. Producers are integrating indicators and additives that enhance product monitoring. Temperature-sensitive films help track cold chain logistics in food and pharmaceuticals. It improves transparency for consumers and retailers by offering quality assurance. Anti-fog and antimicrobial coatings add extra functionality to packaging products. These advanced films reduce waste while ensuring freshness during storage and distribution. Manufacturers view smart packaging as a premium segment that differentiates brands. Rising interest in active and intelligent films creates opportunities for advanced product offerings.

- For instance, recent studies demonstrate that printed moisture sensors, integrated with hemicellulose-based barrier coatings, enable smart food packaging to reliably detect and display humidity changes in the relative humidity range of 20% to 80%, using impedance-based measurement with high air barrier properties confirmed in calibration tests at 23°C.

Expansion of Customized Packaging Solutions for Diverse Applications

Customization is a growing trend within the Germany High Barrier Packaging Films Market. Food, beverage, and healthcare sectors demand films tailored to specific requirements. Manufacturers offer flexibility in thickness, printability, and barrier properties. It enables companies to align packaging with branding and consumer appeal. Growth in premium product categories fuels demand for advanced finishes and designs. Customized packaging also supports niche sectors like organic and specialty foods. Local companies experiment with creative solutions to gain competitive advantages. Brand differentiation through packaging has become a central strategy in highly competitive markets.

Adoption of High-Performance Materials for Extended Shelf Life

Extended shelf life remains a key trend in the Germany High Barrier Packaging Films Market. Producers seek high-performance films that ensure longer product usability. Advanced laminates and coatings strengthen protection against oxygen and UV rays. It supports manufacturers in reducing food waste and enhancing consumer confidence. Innovations in nanotechnology coatings are gaining traction to improve durability. Retailers push for packaging that withstands long storage and distribution cycles. The use of high-performance barrier layers is expanding across multiple applications. German packaging firms emphasize research to create films that balance performance and cost efficiency.

Market Challenges Analysis:

High Costs of Production and Raw Material Volatility

The Germany High Barrier Packaging Films Market faces challenges due to high production costs and raw material volatility. Complex multi-layer structures increase manufacturing expenses compared to conventional films. Dependence on petrochemical-based inputs exposes manufacturers to price fluctuations. It creates difficulties in maintaining competitive pricing, especially for small firms. Energy costs in Germany further raise production expenses across packaging operations. Currency fluctuations impact import costs for raw materials sourced globally. These challenges reduce profit margins and limit affordability in emerging segments. Companies seek alternative bio-based inputs, but such options remain expensive at scale.

Stringent Regulatory Compliance and Recycling Infrastructure Gaps

Strict European Union regulations create compliance challenges for the Germany High Barrier Packaging Films Market. Companies must adhere to demanding environmental and safety requirements. Recycling infrastructure in some regions is still underdeveloped for complex multi-layer packaging. It limits the recyclability of high barrier films despite rising eco-friendly initiatives. Pressure from policymakers drives firms to redesign packaging for easier processing. Meeting circular economy goals requires significant investments in material innovation. Consumer awareness of sustainability intensifies scrutiny on non-recyclable packaging formats. The industry struggles to balance performance requirements with evolving environmental expectations.

Market Opportunities:

Growing Demand for Bio-Based and Eco-Friendly Packaging Solutions

The Germany High Barrier Packaging Films Market presents opportunities through bio-based and eco-friendly solutions. Rising environmental awareness among consumers drives adoption of recyclable and compostable films. It supports growth in premium product categories where sustainability is a core selling point. Companies investing in innovative materials secure stronger positions with regulatory and customer support. Bio-based films also provide new pathways for product differentiation.

Expansion Across Export-Oriented Food and Pharmaceutical Sectors

Export growth creates further opportunities for the Germany High Barrier Packaging Films Market. German food and pharmaceutical products require advanced packaging to maintain quality during long transit. It strengthens the role of high barrier films in safeguarding product safety globally. Expanding exports to Asia and North America boosts demand for durable, high-performance solutions. The opportunity lies in aligning packaging innovation with international trade growth.

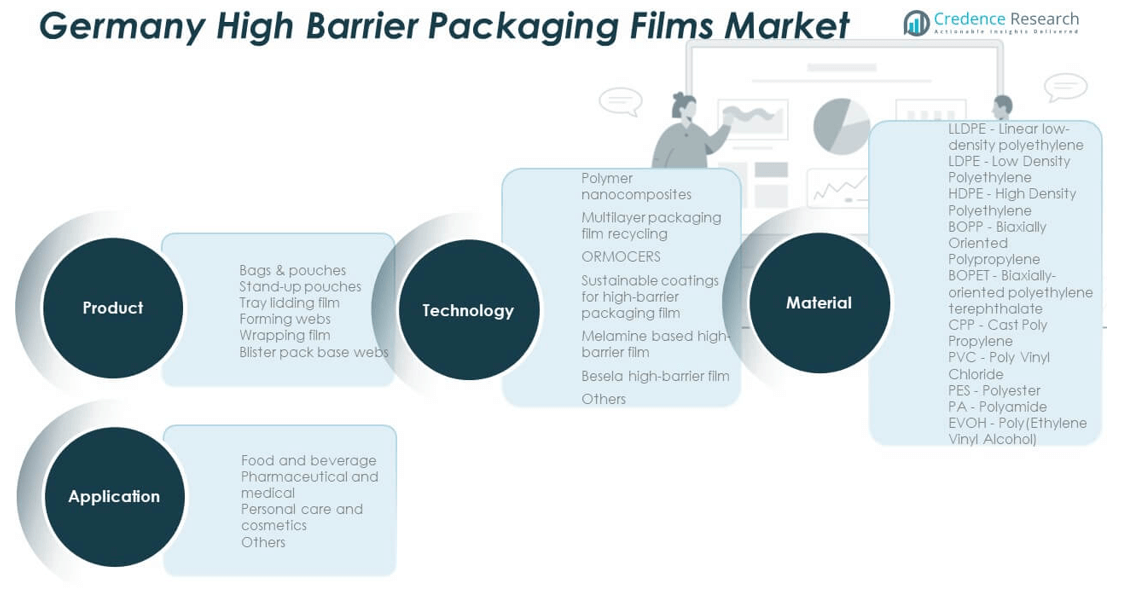

Market Segmentation Analysis:

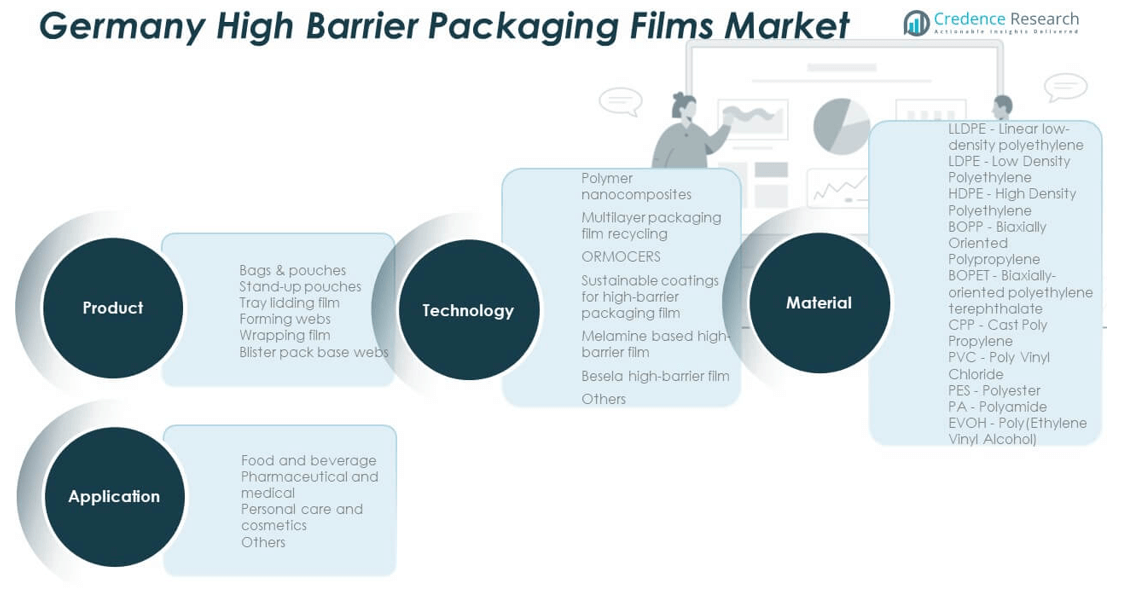

By Product Segment

The Germany High Barrier Packaging Films Market shows strong adoption across bags and pouches, stand-up pouches, tray lidding films, forming webs, wrapping films, and blister pack base webs. Bags and pouches dominate due to their versatility and convenience in food and beverage applications. Stand-up pouches are gaining traction in retail packaging for their lightweight and branding advantages. Tray lidding films and forming webs see rising demand from meat, dairy, and ready-meal categories. Wrapping films and blister pack base webs remain essential for pharmaceuticals and personal care products where product protection is critical.

- For instance, Amcor’s latest Easy Peel Lidding high-barrier film for modified atmosphere packaging and vacuum applications realizes a total gauge of just 50µm, achieves up to 23% more material per reel compared with standard lidding films, and supports 14% cradle-to-gate carbon footprint reduction for meat packaging in EMEA.

By Application Segment

Food and beverage remain the largest application area in the Germany High Barrier Packaging Films Market, supported by rising demand for extended shelf life solutions. Pharmaceuticals and medical packaging drive strong growth, requiring films that ensure sterility and product safety. Personal care and cosmetics sectors increasingly adopt high barrier films to preserve product integrity and appeal. Other applications, including household and industrial goods, contribute steadily to market expansion.

- For instance, Gerresheimer’s Duma® container range for pharmaceuticals and personal care comes with child-resistant caps and is specifically designed for direct-to-door delivery, enabling flat, mailable packaging formats that reduce contamination risk and simplify distribution for millions of units annually.

By Technology Segment

Innovation defines this segment, with polymer nanocomposites and sustainable coatings gaining significant attention. The Germany High Barrier Packaging Films Market leverages multilayer packaging film recycling to address environmental mandates. ORMOCERS, melamine-based films, and Besela high-barrier film technologies improve performance and product safety. Companies invest in advanced barrier solutions to reduce waste and enhance recyclability.

By Material Segment

Materials such as LLDPE, LDPE, and HDPE continue to hold substantial shares in the Germany High Barrier Packaging Films Market due to cost efficiency and versatility. BOPP and BOPET dominate flexible packaging formats for food and consumer goods. CPP and PVC support specialty applications, while PES and EVOH offer superior barrier properties. It reflects the industry’s need for diverse materials balancing performance, cost, and sustainability goals.Bottom of For

Segmentation:

By Product Segment

- Bags & Pouches

- Stand-up Pouches

- Tray Lidding Film

- Forming Webs

- Wrapping Film

- Blister Pack Base Webs

By Application Segment

- Food and Beverage

- Pharmaceutical and Medical

- Personal Care and Cosmetics

- Others

By Technology Segment

- Polymer Nanocomposites

- Multilayer Packaging Film Recycling

- ORMOCERS

- Sustainable Coatings for High-Barrier Packaging Film

- Melamine-Based High-Barrier Film

- Besela High-Barrier Film

- Others

By Material Segment

- LLDPE – Linear Low-Density Polyethylene

- LDPE – Low-Density Polyethylene

- HDPE – High-Density Polyethylene

- BOPP – Biaxially Oriented Polypropylene

- BOPET – Biaxially-Oriented Polyethylene Terephthalate

- CPP – Cast Polypropylene

- PVC – Polyvinyl Chloride

- PES – Polyester

- EVOH – Poly(Ethylene Vinyl Alcohol)

Regional Analysis:

Western and Southern Germany – Dominant Regional Hubs

The Germany High Barrier Packaging Films Market is strongly concentrated in Western and Southern Germany, together accounting for nearly 55% of the total market share in 2024. Western Germany benefits from its well-established food and beverage sector, supported by advanced packaging infrastructure and export-oriented industries. Southern Germany leverages its pharmaceutical and medical manufacturing strength, creating consistent demand for sterile and high-performance packaging films. It also benefits from strong retail and logistics networks that require durable packaging solutions. Regional players invest heavily in R&D facilities to support material innovation and sustainability initiatives. The concentration of multinational packaging firms further strengthens growth across these hubs.

Northern Germany – Expanding Role in Food Exports and Retail

Northern Germany contributes around 25% of the Germany High Barrier Packaging Films Market in 2024, supported by its focus on processed food and seafood exports. Its ports and trade infrastructure enable strong packaging demand for global distribution. Retail growth and consumer preference for ready-to-eat meals accelerate usage of high barrier packaging across this region. It has also seen increasing adoption of eco-friendly packaging materials, aligning with European sustainability mandates. Innovation in multilayer films tailored for export markets boosts its regional competitiveness. Local manufacturers in this region emphasize lightweight designs to reduce logistics costs and meet international standards.

Eastern Germany – Emerging Manufacturing and Industrial Growth

Eastern Germany holds nearly 20% of the Germany High Barrier Packaging Films Market in 2024, marking it as an emerging growth region. Industrial expansion and rising investments in modern food processing facilities are driving higher adoption of barrier films. Pharmaceutical packaging also shows steady progress, supported by regional initiatives in healthcare manufacturing. It benefits from improving supply chains and infrastructure that connect producers to national and European markets. Local companies are focusing on cost-efficient packaging solutions to compete with established Western and Southern players. Growing awareness of recyclable and sustainable packaging drives investments in newer material technologies in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Limited

- Sealed Air Corporation

- Coveris

- Mondi Group

- Berry Global

- Taghleef Industries

- Jindal Films Europe (Treofan)

- Klöckner Pentaplast (kp)

- Schur Flexibles Group

- Huhtamaki

- Südpack Verpackungen GmbH & Co. KG

Competitive Analysis:

The Germany High Barrier Packaging Films Market is characterized by intense competition among global and regional players. Leading companies such as Amcor, Sealed Air, Mondi, Berry Global, and Südpack Verpackungen GmbH & Co. KG invest heavily in sustainable film technologies and recyclable solutions. It has witnessed steady advancements in multi-layer structures, lightweight materials, and eco-friendly coatings to meet regulatory and consumer expectations. Firms compete through product innovation, mergers, acquisitions, and regional expansion strategies. German manufacturers strengthen their positions by focusing on niche applications like pharmaceuticals and premium foods. Competitive pressure drives continuous investment in R&D to deliver high-performance barrier properties. Strategic partnerships with food and healthcare industries further enhance market positioning.

Recent Developments:

- In February 2024, Sealed Air Corporation expanded its portfolio of multilayer vacuum barrier films for fresh meat and cheese packaging in Europe, addressing the increasing consumer demand for longer shelf life and enhanced food safety in retail and e-commerce distribution channels.

- In June 2025, Mondi Group launched its re/cycle PaperPlus Bag Advanced, a sustainable, high-barrier paper bag designed to protect humidity-sensitive products; this product uses a high-performance barrier film while reducing plastic content, supporting circular economy goals and receiving recognition at the 2025 EUROSAC Grand Prix.

Report Coverage:

The research report offers an in-depth analysis based on product, application, technology, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable and recyclable films will drive innovation across all product categories.

- Growth in food exports will increase adoption of advanced high barrier packaging solutions.

- Pharmaceutical applications will expand, supported by strict safety regulations and exports.

- Smart packaging features, including antimicrobial and anti-fog films, will gain wider use.

- Customized packaging designs will create differentiation in competitive consumer markets.

- E-commerce growth will strengthen demand for durable, lightweight packaging formats.

- Advancements in multilayer structures will improve product shelf life and reduce waste.

- Investments in bio-based materials will reshape the competitive landscape by 2032.

- Regional expansion in Eastern Germany will support manufacturing diversification.

- Strategic partnerships between packaging companies and food producers will intensify.