Market Overview:

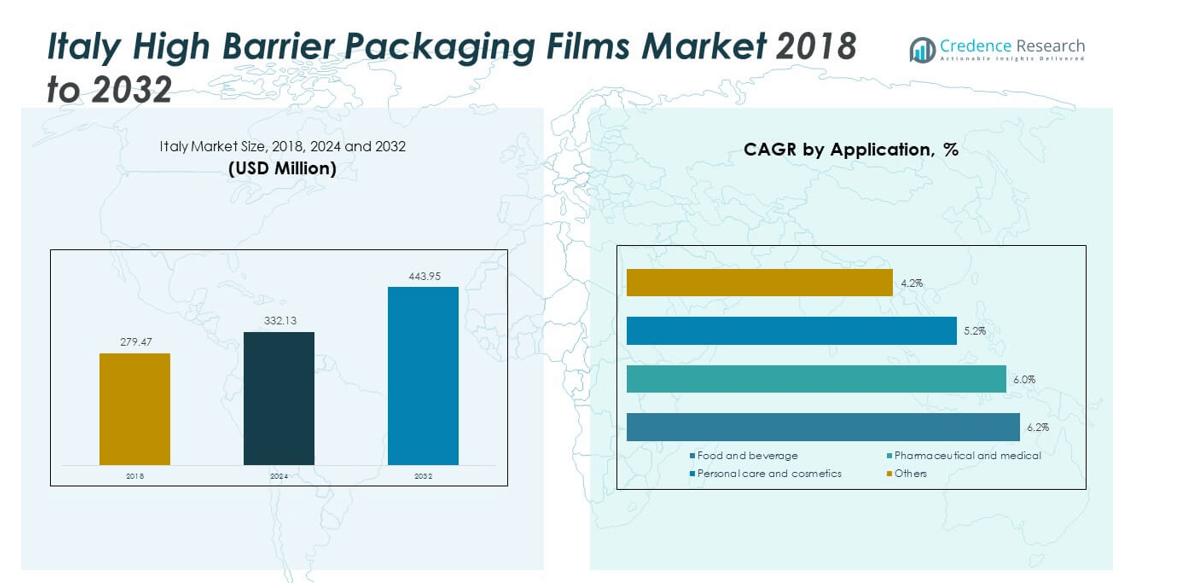

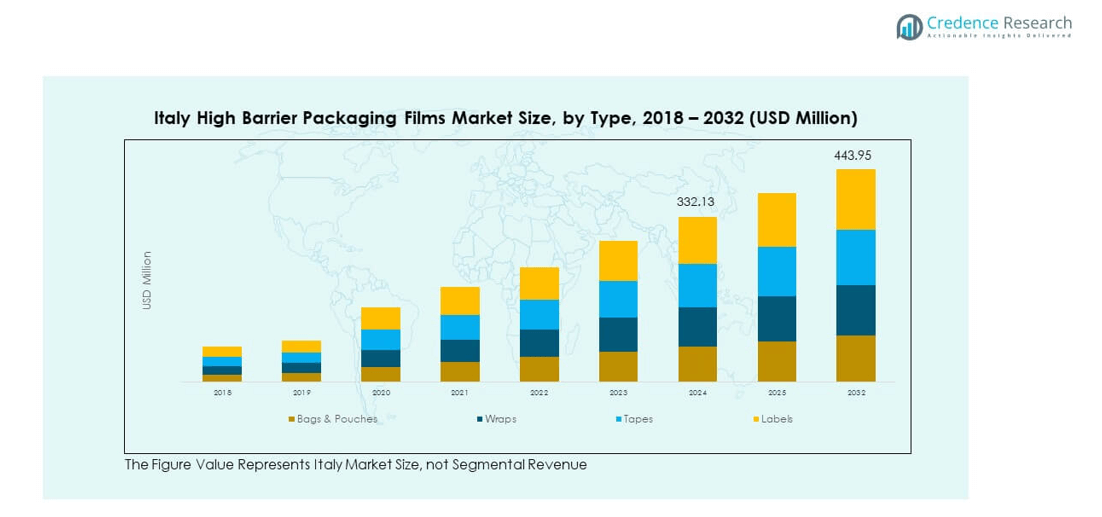

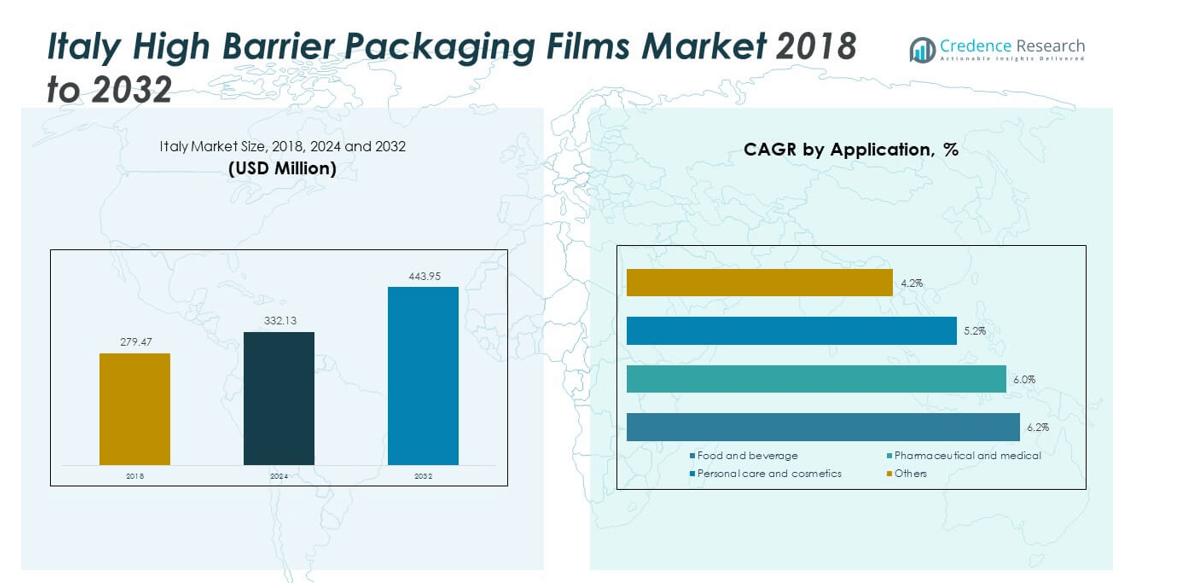

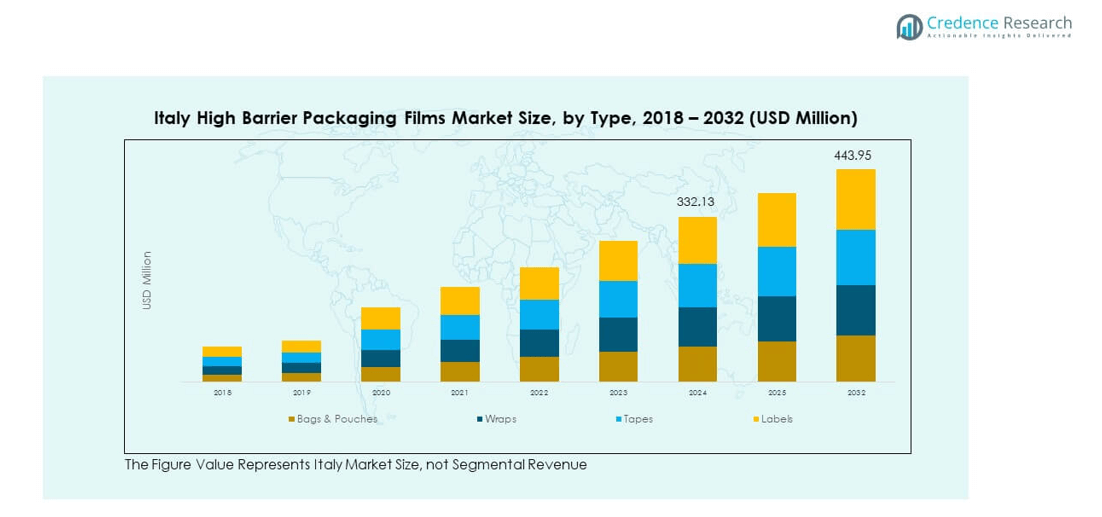

The Italy High Barrier Packaging Films Market size was valued at USD 279.47 million in 2018 to USD 332.13 million in 2024 and is anticipated to reach USD 443.95 million by 2032, at a CAGR of 3.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy High Barrier Packaging Films Market Size 2024 |

USD 332.13 million |

| Italy High Barrier Packaging Films Market , CAGR |

3.69% |

| Italy High Barrier Packaging Films Market Size 2032 |

USD 443.95 million |

The market growth is driven by rising demand from the food and beverage industry, where extended shelf life and product protection are critical. Increased consumer preference for ready-to-eat meals, frozen foods, and packaged snacks supports adoption. Sustainability initiatives further accelerate the use of innovative film structures that reduce waste and enhance recyclability. Manufacturers are investing in advanced barrier technologies, including multi-layer films, to meet evolving industry standards and consumer expectations. Strong demand from healthcare and pharmaceutical packaging also supports expansion.

Within Europe, Italy plays a significant role due to its established food processing and pharmaceutical industries. Western European nations lead adoption due to higher regulatory compliance and strong consumer awareness regarding food safety. Southern Europe, including Italy, shows steady growth, supported by rising consumption of packaged foods and expanding retail networks. Emerging demand from Eastern Europe provides further opportunities, as developing economies shift toward modern packaging practices. This geographic spread creates a balanced growth environment for the Italy High Barrier Packaging Films Market.

Market Insights:

- The Italy High Barrier Packaging Films Market was valued at USD 279.47 million in 2018, reached USD 332.13 million in 2024, and is projected to hit USD 443.95 million by 2032, growing at a CAGR of 3.69%.

- Western Europe held the largest share at 42%, supported by strong food processing and pharmaceutical industries, followed by Southern Europe at 28% driven by retail expansion, and Eastern Europe at 18% due to modernization in packaging.

- The fastest-growing region is Eastern Europe with 18% share, fueled by healthcare demand, regulatory compliance upgrades, and rising adoption of recyclable films.

- Bags and pouches represented the largest product share at 35% in 2024, reflecting their dominance in packaged food and beverage applications.

- Labels accounted for 22% share, while wraps contributed 18%, supported by their roles in branding, convenience, and protective packaging solutions across food and healthcare sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Shelf Life Extension in Food and Beverage Sector

The Italy High Barrier Packaging Films Market experiences strong growth due to rising consumption of packaged foods. Consumers prefer products with extended shelf life that maintain freshness and flavor. Packaging films with advanced oxygen and moisture barrier properties meet these needs effectively. Food manufacturers adopt these materials to reduce spoilage and ensure regulatory compliance. It supports the industry’s efforts to minimize food waste and maintain quality during long distribution cycles. Growth in frozen foods and dairy products further drives adoption. It strengthens the reliance on high barrier films across multiple food categories.

- For instance, Amcor launched its AmPrima recycle-ready film for dairy products in Europe, supporting block cheese and mozzarella packaging with specific barrier properties to extend shelf life and meet both sustainability and performance requirements—certified as recyclable by Cyclos-HTP and designed for integration into existing PE recycling streams.

Increasing Role of Pharmaceuticals and Healthcare Packaging Solutions

Pharmaceutical packaging requirements strongly influence the Italy High Barrier Packaging Films Market. It supports sensitive medicines and healthcare supplies that demand secure, contamination-free storage. Companies invest in multi-layer film technologies to safeguard products against light, air, and chemical exposure. Rising demand for medical-grade films supports compliance with European Union packaging safety standards. Manufacturers focus on tamper-evident and sterile packaging solutions. Expansion of Italy’s pharmaceutical exports reinforces this demand. Healthcare providers prefer packaging films that maintain product efficacy and stability. This factor positions healthcare as a key driver for sustained market adoption.

- For instance, Huhtamaki introduced the Push Tab® blister lid—a first-to-market aluminum-free, mono-material PET lidding for regulated pharmaceutical packaging—engineered to meet the safety requirements of the healthcare sector and proven compatible with existing production lines, thereby improving recyclability without compromising product protection.

Shift Toward Sustainable and Eco-Friendly Packaging Materials

Sustainability strongly influences consumer purchasing patterns across Italy. Brands adopt recyclable and bio-based barrier films to align with environmental regulations. It reflects a clear shift toward reducing plastic waste and supporting circular economy goals. Manufacturers develop innovative film structures that combine high performance with reduced environmental impact. Government policies further strengthen the need for sustainable packaging adoption. Retailers also prioritize eco-friendly solutions to appeal to environmentally conscious consumers. Investments in compostable and biodegradable films enhance competitiveness. These measures make sustainability a core driver of growth.

Rising E-Commerce and Retail Sector Growth Driving Packaging Innovation

The expansion of online retail increases demand for durable and reliable packaging solutions. The Italy High Barrier Packaging Films Market benefits from this shift toward e-commerce shopping. Products require films that protect against mechanical stress, moisture, and handling issues during delivery. Manufacturers develop lightweight, high-strength films to balance protection and cost efficiency. Consumer preference for convenience and attractive product presentation boosts packaging innovation. It creates opportunities for companies to design films with better sealing and aesthetic features. Growth in supermarket chains also reinforces market demand. Together, these factors fuel steady adoption across retail channels.

Market Trends:

Adoption of Advanced Multi-Layer and Nanotechnology-Based Films

The Italy High Barrier Packaging Films Market is witnessing a strong trend toward advanced multi-layer films. Manufacturers integrate nanotechnology to enhance oxygen and moisture resistance while keeping films lightweight. It allows products to retain freshness for longer distribution cycles across food and pharma. The industry focuses on improving mechanical strength without adding excessive material cost. Such innovations support premium packaging requirements across frozen meals, dairy, and ready-to-eat segments. Growth in nanocomposites also enables higher durability in flexible formats. Companies view nanotechnology as a step toward future-ready packaging. This trend reflects a transition toward performance-driven film development.

- For instance, Innovia Films developed Propafilm Strata SL, a mono-filmic high barrier film offering exceptional protection against aroma, mineral oils, and oxygen, even at high humidity, which leads to extended shelf life and reduced food waste—clearly differentiated by its recyclability and suitability for direct food contact.

Expansion of Customized Packaging Solutions for Brand Differentiation

Brands in Italy emphasize customized packaging to create strong shelf appeal. The Italy High Barrier Packaging Films Market supports this trend by offering design flexibility. Companies produce films that allow attractive printing, clear product visibility, and improved aesthetics. It aligns with the demand for branding and marketing differentiation in crowded retail spaces. Flexible customization also addresses varied product needs, from snacks to pharmaceuticals. Growing consumer preference for unique and premium packaging strengthens this trend further. Manufacturers invest in advanced printing technologies to enhance clarity and visual quality. The shift positions customization as a competitive advantage in the market.

- For instance, Schur Flexibles has expanded its sustainable packaging portfolio in Italy by acquiring Termoplast S.r.L., enabling production of 100% recyclable MDO-PE films optimized for superior print quality and custom applications for the food, medical, and pharmaceutical sectors—demonstrating significant investment in advanced processing and customization.

Growing Focus on Functional Packaging with Smart Features

The market shows increasing movement toward smart packaging functions. The Italy High Barrier Packaging Films Market incorporates films with anti-microbial coatings, temperature resistance, and tamper-evidence features. It addresses consumer concerns over safety, hygiene, and authenticity. Rising demand from pharmaceuticals accelerates adoption of intelligent packaging formats. Food producers also invest in films that extend usability while offering resealable functions. Manufacturers seek to add value by combining barrier protection with convenience. Technology integration supports better monitoring of packaged goods during distribution. Functional packaging stands out as an evolving trend shaping long-term adoption.

Rise of Premium Packaging for High-End Consumer Segments

Italian consumers show growing interest in premium product experiences. The Italy High Barrier Packaging Films Market responds with films tailored for luxury food, cosmetics, and specialty goods. High-clarity, glossy finishes and advanced laminations support this premium trend. It appeals strongly to consumers seeking quality assurance and exclusivity in product presentation. Luxury retailers and gourmet brands demand packaging that enhances perceived value. Manufacturers meet this requirement with specialized coatings and advanced barrier layers. The shift contributes to higher margins for packaging producers. Premium packaging adoption highlights the link between lifestyle preferences and packaging innovation.

Market Challenges Analysis:

High Cost of Raw Materials and Manufacturing Complexities

The Italy High Barrier Packaging Films Market faces challenges from fluctuating raw material costs. Polyethylene, polypropylene, and specialty resins often experience price volatility, impacting production margins. It increases operational risks for manufacturers, especially smaller firms with limited capacity. Complex manufacturing processes for multi-layer films also demand high investment in equipment. Compliance with strict EU packaging and safety standards adds to production costs. These factors reduce pricing flexibility and hinder competitive positioning. Global supply chain disruptions further intensify raw material availability issues. Together, these constraints create pressure on profitability across the industry.

Environmental Regulations and Recycling Limitations

Strict environmental regulations pose hurdles for the Italy High Barrier Packaging Films Market. Companies struggle to balance performance with recyclability in multi-layer structures. It becomes difficult to ensure compliance while maintaining product quality and durability. Recycling infrastructure across Italy still faces gaps in processing composite packaging materials. The market also confronts rising consumer scrutiny regarding plastic sustainability. Regulatory shifts toward banning single-use plastics create uncertainty for manufacturers. Companies must invest in R&D to align with circular economy requirements. These challenges demand significant adaptation efforts to remain competitive under tightening environmental standards.

Market Opportunities:

Expansion of Bio-Based and Compostable Film Solutions

The Italy High Barrier Packaging Films Market presents opportunities through development of bio-based and compostable films. Growing consumer preference for eco-friendly packaging drives investment in plant-based raw materials. It aligns with EU circular economy policies and corporate sustainability goals. Companies adopting biodegradable films gain competitive advantage with environmentally conscious consumers. Food and pharmaceutical industries support this shift to reduce waste footprint. Advanced R&D enables production of films that match conventional performance standards. Expanding eco-friendly solutions will strengthen the long-term market outlook.

Integration of Digital Printing and Smart Labeling Technologies

Another opportunity lies in advanced printing and labeling innovations. The Italy High Barrier Packaging Films Market benefits from digital printing that allows personalization and cost efficiency. It supports shorter production runs while meeting branding needs. Smart labeling integration enhances traceability and authenticity verification. Food and pharma producers prefer such features to improve consumer trust. It creates a chance for manufacturers to add functional value beyond barrier protection. Growing adoption of QR codes and tracking features further expands possibilities. This development ensures films meet future-ready packaging requirements.

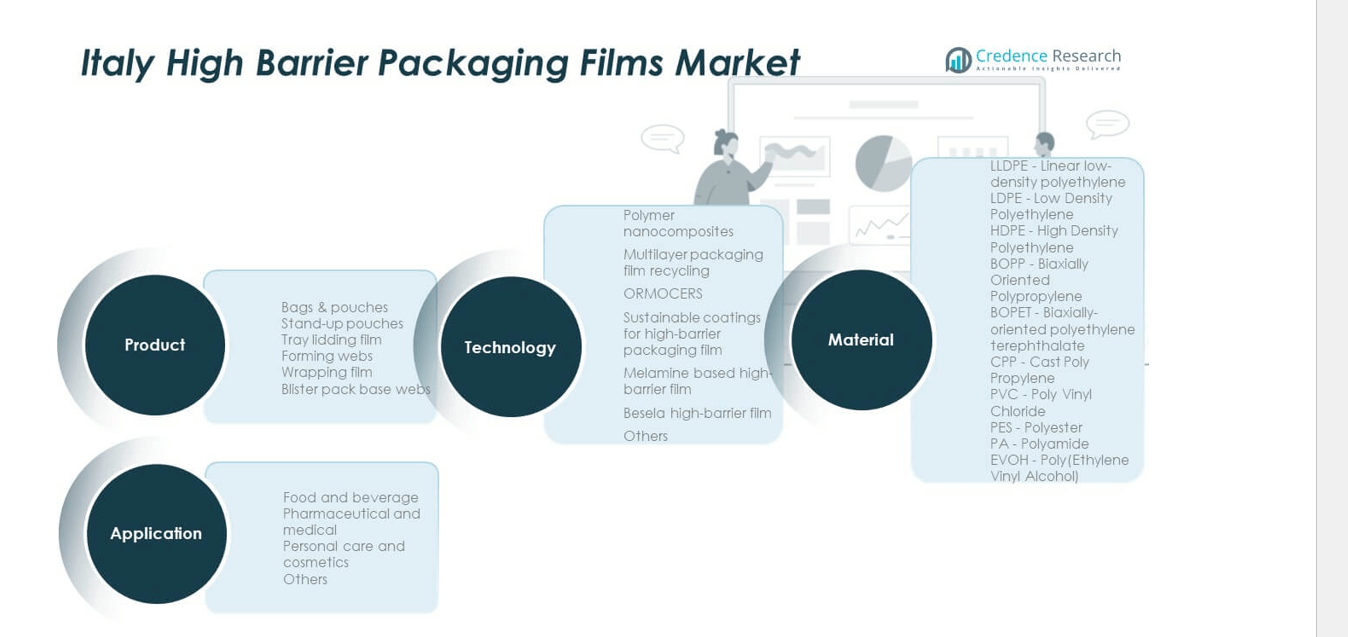

Market Segmentation Analysis:

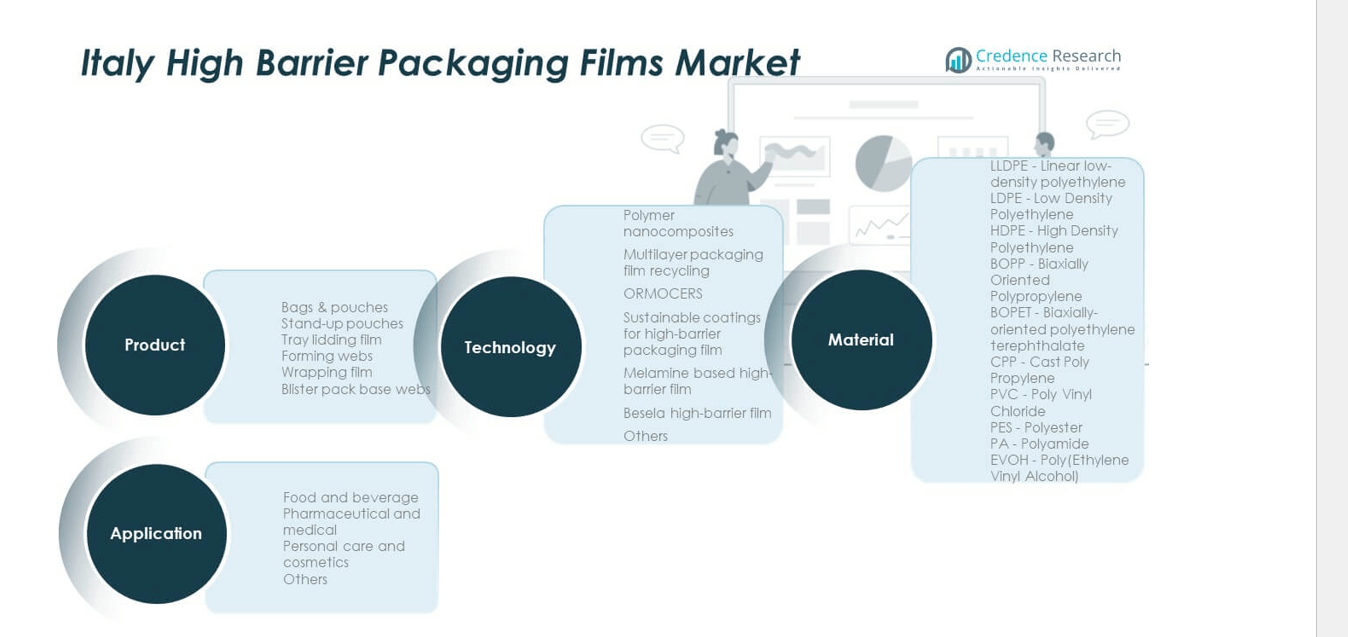

By Product Segment

The Italy High Barrier Packaging Films Market features diverse product categories led by bags and pouches, supported by high demand in food and beverage packaging. Stand-up pouches gain traction for convenience and strong shelf appeal. Tray lidding film and forming webs are preferred in ready meals and meat products. Wrapping films maintain importance in bakery and confectionery packaging. Blister pack base webs remain critical for pharmaceuticals, ensuring secure and protective packaging solutions. It highlights product versatility in meeting varied sector needs.

- For instance, Sealed Air developed the Cryovac Darfresh vacuum skin packaging, which is recognized in Italy for extending the shelf life of fresh meat and seafood, supporting both retail and convenience food markets with innovations in barrier function and packaging design.

By Application Segment

Food and beverage represent the largest application area due to rising consumption of packaged and processed items. The Italy High Barrier Packaging Films Market benefits from growing retail and e-commerce distribution of perishable goods. Pharmaceutical and medical packaging follows, with strict requirements for tamper resistance and sterility. Personal care and cosmetics demand high-quality films that support branding and product safety. Other applications include household goods and niche industrial uses. It demonstrates wide adoption across consumer-driven and specialized markets.

- For instance, Mondi launched the FlexiBag Reinforced range in 2024 for Italy’s food and personal care sectors, offering adjustable medium to high barrier protection against oxygen and moisture; the technology supports a customizable percentage of post-consumer recycled content and delivers practical benefits for e-commerce food and personal care shipments.

By Technology Segment

Technologies such as polymer nanocomposites and ORMOCERS deliver improved performance through superior barrier and strength properties. Sustainable coatings and multilayer packaging film recycling align with environmental priorities and regulatory frameworks. Melamine-based and Besela high-barrier films address specialized product categories requiring advanced resistance. Others include innovations that enhance durability and shelf life. It emphasizes innovation as a major growth lever for the industry.

By Material Segment

Materials like LLDPE, LDPE, and HDPE dominate for flexibility and strength in mainstream applications. BOPP and BOPET lead in high-clarity, durable formats for food packaging. CPP and PVC serve in cost-sensitive and specialty packaging. PES and EVOH gain attention for advanced barrier functions in demanding industries. It illustrates the market’s reliance on diverse materials to balance cost, performance, and sustainability goals.

Segmentation:

By Product Segment

- Bags & Pouches

- Stand-up Pouches

- Tray Lidding Film

- Forming Webs

- Wrapping Film

- Blister Pack Base Webs

By Application Segment

- Food and Beverage

- Pharmaceutical and Medical

- Personal Care and Cosmetics

- Others

By Technology Segment

- Polymer Nanocomposites

- Multilayer Packaging Film Recycling

- ORMOCERS

- Sustainable Coatings for High-Barrier Packaging Film

- Melamine Based High-Barrier Film

- Besela High-Barrier Film

- Others

By Material Segment

- LLDPE – Linear Low-Density Polyethylene

- LDPE – Low Density Polyethylene

- HDPE – High Density Polyethylene

- BOPP – Biaxially Oriented Polypropylene

- BOPET – Biaxially-Oriented Polyethylene Terephthalate

- CPP – Cast Polypropylene

- PVC – Polyvinyl Chloride

- PES – Polyester

- EVOH – Poly(Ethylene Vinyl Alcohol)

Regional Analysis:

Regional Leadership in Western Europe

The Italy High Barrier Packaging Films Market benefits from its position within Western Europe, which commands nearly 42% of the regional share. Strong food processing industries in Italy, France, and Germany drive high adoption of advanced packaging films. Regulatory emphasis on food safety and shelf-life extension further strengthens demand. Italy contributes significantly due to its robust processed food exports and growing pharmaceutical production. It leverages advanced technologies such as multilayer films and sustainable coatings to meet EU standards. This leadership reflects a mature consumer base that prioritizes product safety, quality, and sustainability.

Emerging Growth in Southern and Eastern Europe

Southern Europe, led by Italy and Spain, accounts for about 28% of the regional market share. Expanding retail infrastructure and rising consumption of packaged foods contribute to strong demand. Eastern Europe holds close to 18% of the share, with rapid growth fueled by modernization in packaging practices. Countries in this region invest in recycling technologies to meet European environmental directives. It creates opportunities for high barrier films that align with evolving regulatory and consumer requirements. Growth in healthcare and pharmaceutical applications further supports expansion across emerging economies in this region.

Northern Europe and Export-Driven Demand

Northern Europe represents nearly 12% of the Italy High Barrier Packaging Films Market share. Strong adoption in Scandinavia comes from sustainability-focused packaging choices and high environmental awareness. Companies in this sub-region emphasize bio-based films and advanced recycling systems. Export-driven demand across Europe reinforces Italy’s strategic position as a supplier of innovative packaging solutions. It supports cross-border collaborations and partnerships with global food and healthcare brands. With consistent innovation and strong export orientation, Italy remains a central hub shaping packaging adoption across the broader European landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Limited

- Sealed Air Corporation

- Coveris

- Mondi Group

- Berry Global

- Jindal Films Europe (Treofan)

- Klöckner Pentaplast (kp)

- Schur Flexibles Group

- Huhtamaki

Competitive Analysis:

The Italy High Barrier Packaging Films Market is marked by strong competition among global and regional players. Leading companies such as Amcor, Mondi Group, Sealed Air, Berry Global, and Huhtamaki hold significant positions by offering advanced product portfolios and investing in sustainable solutions. It reflects a landscape where innovation in multilayer technologies and eco-friendly materials drives differentiation. Companies pursue mergers, acquisitions, and partnerships to strengthen their distribution networks and product capabilities. Local players compete by focusing on cost efficiency and regional demand, particularly in food and pharmaceutical packaging. The market rewards firms that balance performance, compliance, and sustainability, creating a competitive environment shaped by both multinational corporations and agile regional producers.

Recent Developments:

- In September 2025, Coveris entered an exclusive partnership with TIPA to deliver home-compostable labels for the fresh produce sector, combining compostable material technology with advanced print processes, which helps retailers and suppliers in Italy and other European markets meet tightening regulatory and sustainability requirements for produce packaging.

- In May 2025, Mondi Group successfully started up its new €200 million recycled containerboard machine in Duino, Italy, expanding its annual production capacity by 420,000 tonnes and supporting long-term sustainable development and resilient supply chains for high barrier packaging solutions in the Italian and broader European market.

- In April 2025, Amcor completed an all-stock combination with Berry Global, enhancing its position as a global leader in consumer and healthcare packaging solutions with new material science and innovation capabilities focused on sustainability and circular economy targets, particularly strengthening its offering throughout Europe, including Italy.

Report Coverage:

The research report offers an in-depth analysis based on product, application, technology, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable barrier films will grow with stricter EU environmental regulations.

- Food and beverage packaging will remain the dominant application segment across Italy.

- Pharmaceutical adoption will expand with higher demand for tamper-proof and sterile films.

- Innovation in nanotechnology-based films will strengthen product durability and barrier efficiency.

- Retail expansion and e-commerce will drive demand for lightweight, protective packaging.

- Bio-based and recyclable films will gain prominence as companies meet green targets.

- Export-driven opportunities will position Italy as a supplier to wider European markets.

- Premium packaging formats will grow in cosmetics and luxury food sectors.

- Regional producers will adopt advanced recycling methods to remain competitive.

- Continued investment in R&D will define market leadership and long-term resilience.