Market Overview:

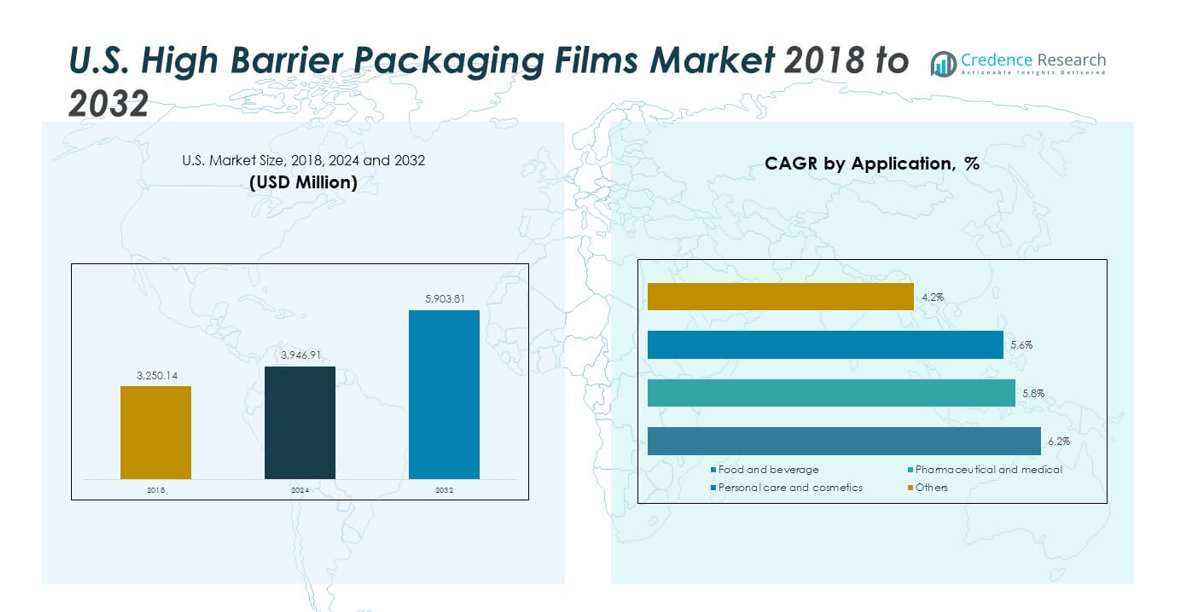

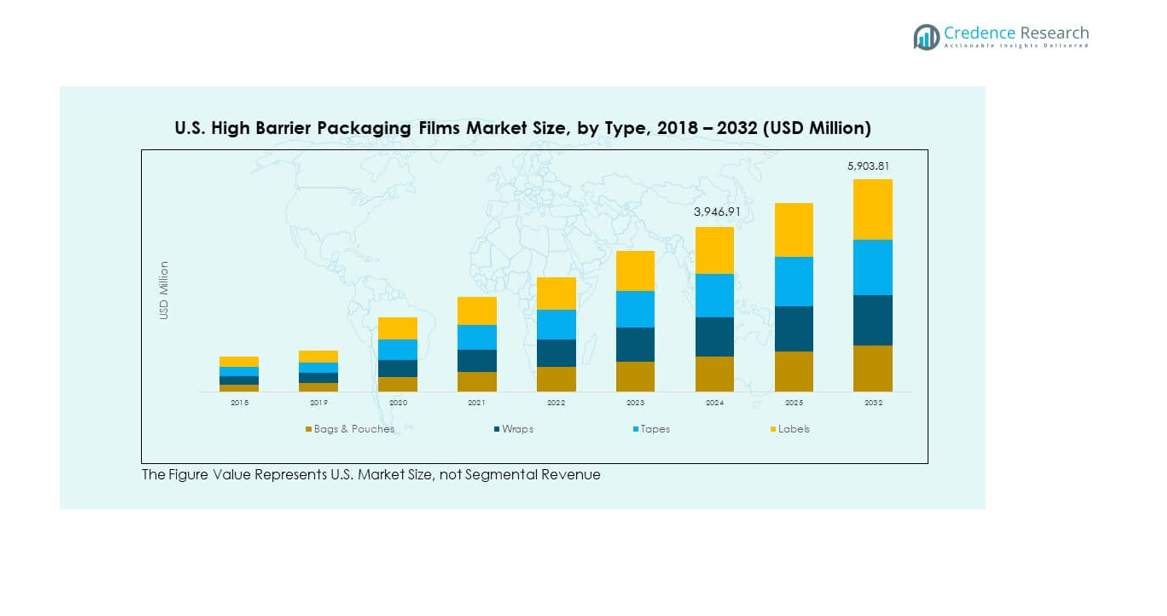

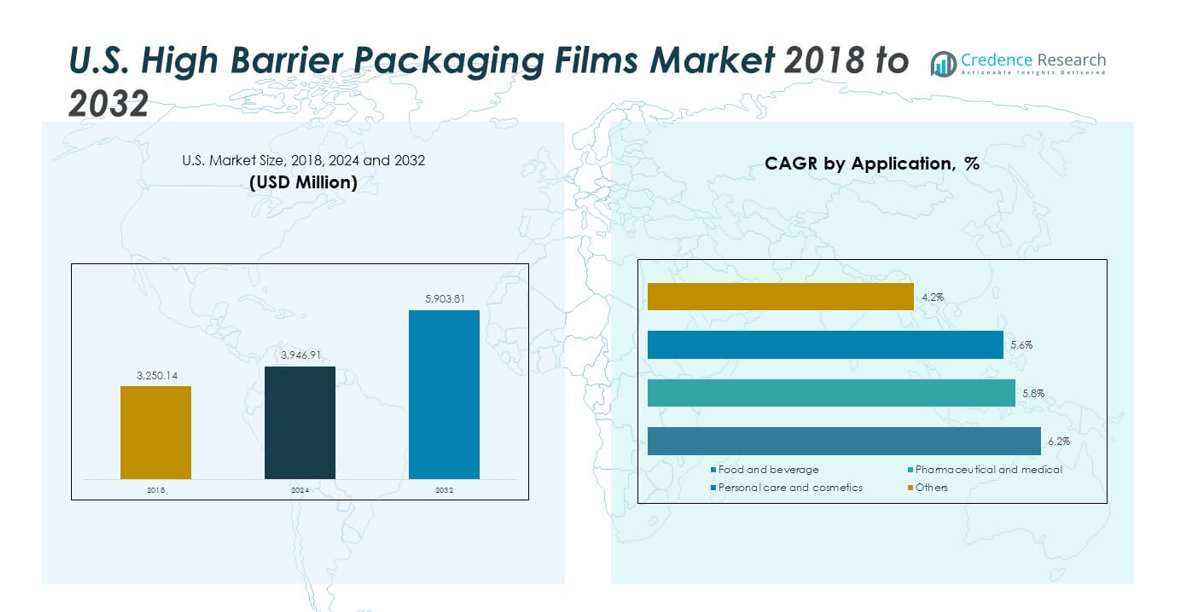

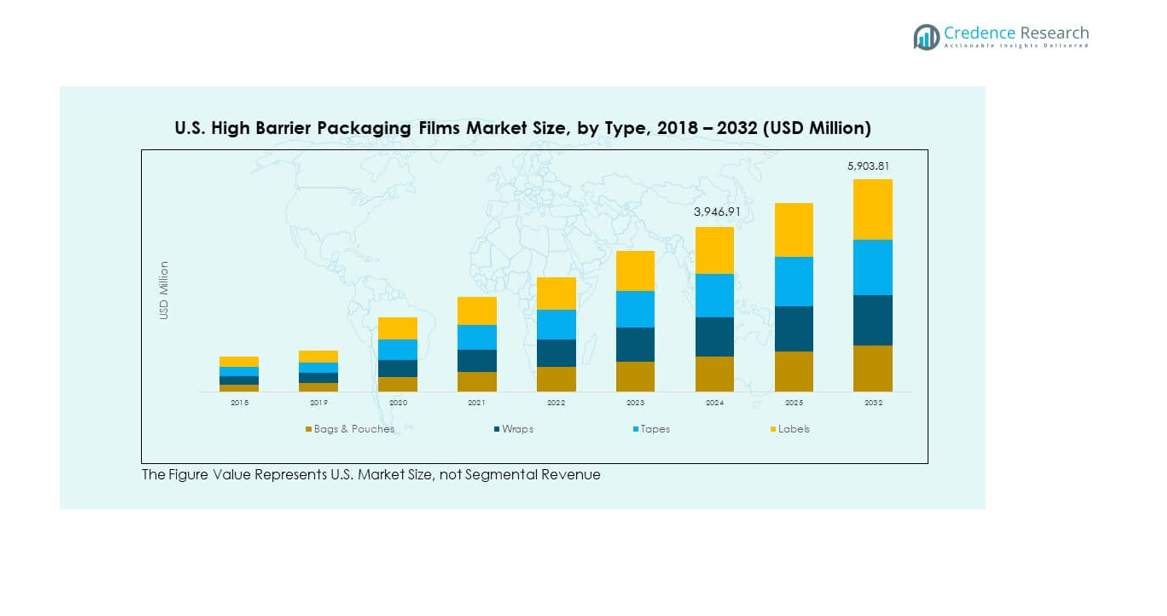

The U.S. High Barrier Packaging Films Market size was valued at USD 3,250.14 million in 2018, reached USD 3,946.91 million in 2024, and is anticipated to reach USD 5,903.81 million by 2032, at a CAGR of 5.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. High Barrier Packaging Films Market Size 2024 |

USD 3,946.91 million |

| U.S. High Barrier Packaging Films Market, CAGR |

5.16% |

| U.S. High Barrier Packaging Films Market Size 2032 |

USD 5,903.81 million |

The market is expanding due to rising demand for extended shelf-life packaging across food, beverages, and pharmaceuticals. Growing consumer preference for convenient, ready-to-eat products is driving innovation in barrier properties. Companies are investing in multilayer films and eco-friendly solutions to balance performance with sustainability. Increasing regulatory pressure on plastic waste is also encouraging adoption of recyclable and bio-based alternatives. The market benefits from strong R&D activity that enhances material strength, clarity, and resistance, making high barrier packaging a vital choice for manufacturers aiming to preserve quality and reduce food waste.

Geographically, the U.S. leads this market due to its strong food processing and pharmaceutical sectors, which demand advanced packaging solutions. Emerging adoption is visible in Canada and Mexico, where rising packaged food consumption and improving retail infrastructure support growth. The U.S. also benefits from a robust regulatory framework that promotes innovation in sustainable materials. Mexico is showing promise as urbanization and expanding consumer markets drive packaged product demand, while Canada emphasizes sustainable packaging practices, making the North American region diverse in adoption dynamics.

Market Insights:

- The U.S. High Barrier Packaging Films Market size was valued at USD 3,250.14 million in 2018, reached USD 3,946.91 million in 2024, and is projected to reach USD 5,903.81 million by 2032, growing at a CAGR of 5.16%.

- The Midwest accounted for 29% of the U.S. High Barrier Packaging Films Market in 2024, supported by food processing and distribution strength. The South held 27%, driven by retail expansion and urbanization, while the Northeast held 24%, led by healthcare and pharmaceutical packaging demand.

- The West contributed 20% in 2024 and remains the fastest-growing region, driven by California’s food and beverage industry, strong sustainability focus, and rising e-commerce activity.

- Bags and pouches represented the largest product share at around 38% in 2024, reflecting their versatility, extended shelf-life performance, and dominance in food packaging.

- Stand-up pouches accounted for nearly 25% share, emerging as a high-growth segment due to strong retail appeal, portability, and eco-friendly lightweight design.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Longer Shelf-Life in Food and Beverage Packaging

The U.S. High Barrier Packaging Films Market is driven by the growing need to extend the shelf-life of perishable products in food and beverage industries. Manufacturers are increasingly using multilayer films that provide superior resistance to oxygen, moisture, and light. These films help in reducing spoilage and maintaining nutritional quality, which strengthens consumer trust. Demand for ready-to-eat meals and processed foods is reinforcing adoption across supermarkets and convenience stores. The market benefits from consumer lifestyles that prioritize convenience and time efficiency. It is strongly influenced by food safety regulations that encourage advanced packaging solutions. Companies are also leveraging innovation to create recyclable options that align with sustainability goals. This balance between performance and environmental responsibility enhances the overall demand.

- For instance, in June 2024, Amcor launched its AmPrima® PE Plus recycle-ready film technology, enabling vacuum-sealed food pouches with oxygen transmission rates below 0.1 cc/m²/day, extending shelf-life for sensitive products by up to 60% compared to conventional packs.

Strong Growth in Pharmaceutical and Healthcare Packaging

Healthcare and pharmaceutical industries are major drivers for the U.S. High Barrier Packaging Films Market due to their strict quality and safety requirements. It is widely used to protect sensitive drugs from moisture, oxygen, and contaminants. Rising demand for blister packaging in tablets, capsules, and sterile products supports market expansion. The increasing aging population in the U.S. fuels higher consumption of medicines, boosting demand for secure packaging. Hospitals and pharmacies prioritize packaging films that ensure product integrity during long storage and transport. The growing trend of personalized medicine requires specialized high barrier solutions. Manufacturers are investing in advanced materials that meet regulatory compliance while offering strong protective functions. These trends position pharmaceutical and healthcare packaging as a strong contributor to future growth.

- For instance, in April 2024, Schott Pharma launched Fiolax® Pro glass tubing for prefilled syringes, which demonstrated a reduction of extractables by 50% when compared to conventional pharmaceutical glass, meeting USP <1663> test limits for leachables and improving drug safety in long-term storage.

Increasing Consumer Preference for Sustainable Packaging Solutions

Sustainability is an important driver for the U.S. High Barrier Packaging Films Market as consumer awareness of environmental issues grows. Retailers and food producers are demanding eco-friendly packaging that reduces reliance on single-use plastics. Companies are adopting recyclable and biodegradable high barrier films to meet both customer expectations and regulatory requirements. It is also stimulating investments in material science to develop films with lower carbon footprints. Brands use sustainable packaging as a marketing advantage, appealing to eco-conscious consumers. The movement toward green procurement in large retailers amplifies this demand. Growth in circular economy initiatives further strengthens adoption across industries. This strong shift toward environmentally responsible packaging solutions fuels significant momentum for the market.

Technological Advancements in Multilayer and Flexible Film Design

Advanced technology adoption is significantly boosting the U.S. High Barrier Packaging Films Market. Innovations in multilayer film design improve barrier performance while maintaining clarity and flexibility. It supports wider applications across dairy, meat, snacks, and pharmaceutical products. Companies are developing thinner films with higher strength to reduce material usage without compromising protection. These technological advancements lower production costs and enhance scalability. Growing use of nanotechnology and coatings further improves moisture and oxygen resistance. Flexible designs allow for easy customization, which benefits brand differentiation and consumer appeal. Technology-driven product development ensures manufacturers stay competitive while meeting industry standards. This strong focus on innovation continues to drive growth across multiple applications.

Market Trends:

Rising Adoption of Flexible and Lightweight Packaging Formats

The U.S. High Barrier Packaging Films Market is witnessing strong adoption of flexible and lightweight packaging solutions. Consumers are shifting preferences toward portable formats like pouches and sachets that offer convenience and ease of use. It is encouraging food, beverage, and healthcare companies to redesign traditional packaging with modern alternatives. Lightweight films reduce transportation costs and improve supply chain efficiency. Growing e-commerce activity further supports flexible packaging due to its durability during shipping. Retailers prefer lightweight packaging that enhances shelf visibility and extends product life. The push toward resource-efficient solutions aligns with both cost control and sustainability goals. This trend continues to reshape product development strategies across industries.

- For instance, Berry Global and Printpack partnered to launch the Preserve™ PE PCR recyclable pouch, which uses Berry’s Entour™ sealant film technology. This initiative, announced in 2022, was created to address growing demand for more sustainable packaging. In a separate achievement reported in 2024, Berry announced its Omni Xtra+ film, a PVC cling film replacement that offers a weight reduction of over 25%.

Integration of Smart and Functional Packaging Features

Smart packaging technologies are gaining traction in the U.S. High Barrier Packaging Films Market. It includes integration of QR codes, freshness indicators, and anti-counterfeit features. Companies are investing in films that improve consumer engagement and ensure product safety. Smart films help monitor food freshness, which reduces waste and enhances consumer confidence. Growth in digital shopping is amplifying the use of traceable packaging formats. Healthcare packaging is adopting functional features to prevent tampering and safeguard patient safety. These innovations provide brands with a strong competitive advantage. The ability to merge barrier strength with intelligent packaging features positions the market for advanced adoption.

Growing Use of Bio-Based and Recyclable Film Materials

Sustainability-driven innovations are reshaping the U.S. High Barrier Packaging Films Market through bio-based and recyclable materials. It is supporting the demand for eco-friendly solutions across food, pharmaceutical, and personal care packaging. Research efforts focus on creating films from renewable resources like plant-based polymers. Recyclable high barrier films are increasingly entering retail channels to reduce environmental impact. Companies are also collaborating with recycling organizations to improve collection systems. Consumer demand for low-waste packaging motivates investments in greener technologies. The trend is aligned with U.S. regulatory actions pushing for reduced plastic waste. These shifts highlight sustainability as a core factor shaping the future of packaging films.

Expansion of Packaging Demand in E-Commerce and Online Retail

E-commerce expansion is creating new opportunities for the U.S. High Barrier Packaging Films Market. It requires packaging that can withstand shipping, protect products, and remain visually appealing. Films with enhanced strength and durability are in demand across groceries, cosmetics, and healthcare deliveries. The rise of direct-to-consumer channels is driving packaging innovations tailored for online retail. Flexible barrier films reduce breakage and ensure freshness during transit. Consumer expectations for fast and safe deliveries amplify the need for reliable packaging formats. It also enables brands to enhance unboxing experiences that improve customer loyalty. The growth of e-commerce continues to act as a major trend influencing packaging film design.\

Market Challenges Analysis:

High Production Costs and Recycling Complexities

The U.S. High Barrier Packaging Films Market faces significant challenges from high production costs and recycling difficulties. Advanced multilayer film designs require specialized raw materials and complex manufacturing processes. It often results in higher prices that limit adoption among small manufacturers and low-margin product categories. Recycling multilayer films remains a major challenge due to separation of materials. Limited recycling infrastructure in many regions further complicates collection and processing. Regulatory pressure to reduce single-use plastics intensifies these challenges, requiring heavy investment in alternative solutions. Companies are forced to balance cost efficiency with sustainability goals. This tradeoff slows broader adoption and creates barriers for rapid market expansion.

Competition from Alternative Packaging Solutions

Competition from alternative packaging materials poses another challenge for the U.S. High Barrier Packaging Films Market. Paper-based and aluminum packaging solutions are gaining momentum as eco-friendly substitutes. It creates pressure on film manufacturers to innovate continuously and differentiate products. Some industries, such as beverages, still prefer rigid alternatives for durability and consumer familiarity. Volatility in raw material prices also undermines cost competitiveness of films. Shifts in consumer perception favoring biodegradable or compostable packaging reduce reliance on traditional barrier films. Companies are adapting by investing in hybrid packaging formats to counter competition. This challenge requires ongoing innovation to maintain market relevance in a changing landscape.

Market Opportunities:

Expansion in Ready-to-Eat and Convenience Food Packaging:

The U.S. High Barrier Packaging Films Market has strong opportunities in the rapidly expanding ready-to-eat and convenience food segment. Rising urban lifestyles and increased demand for on-the-go consumption drive need for advanced barrier films. It enables longer shelf-life and supports distribution across diverse retail formats. Growth in meal kits and frozen foods further supports adoption of high-performance packaging. Retailers are partnering with film producers to launch customized solutions for food safety. Consumer willingness to pay for freshness and convenience fuels steady demand. Companies can capture this growth by aligning packaging design with evolving consumer habits. The opportunity remains strong across both premium and mass-market food categories.

Adoption of Eco-Friendly Innovations in Packaging Films:

Sustainable packaging innovations present a significant opportunity for the U.S. High Barrier Packaging Films Market. It encourages adoption of recyclable, compostable, and bio-based barrier films. Consumer awareness and retailer policies amplify the demand for environmentally responsible packaging. Government regulations are further supporting innovation through incentives and stricter waste rules. Film manufacturers that pioneer sustainable solutions can strengthen brand reputation and gain a competitive edge. The trend supports growth across sectors including food, pharmaceuticals, and personal care. Opportunities also extend to partnerships with recycling organizations for closed-loop systems. This direction ensures alignment with future market expectations and regulatory standards.

Market Segmentation Analysis:

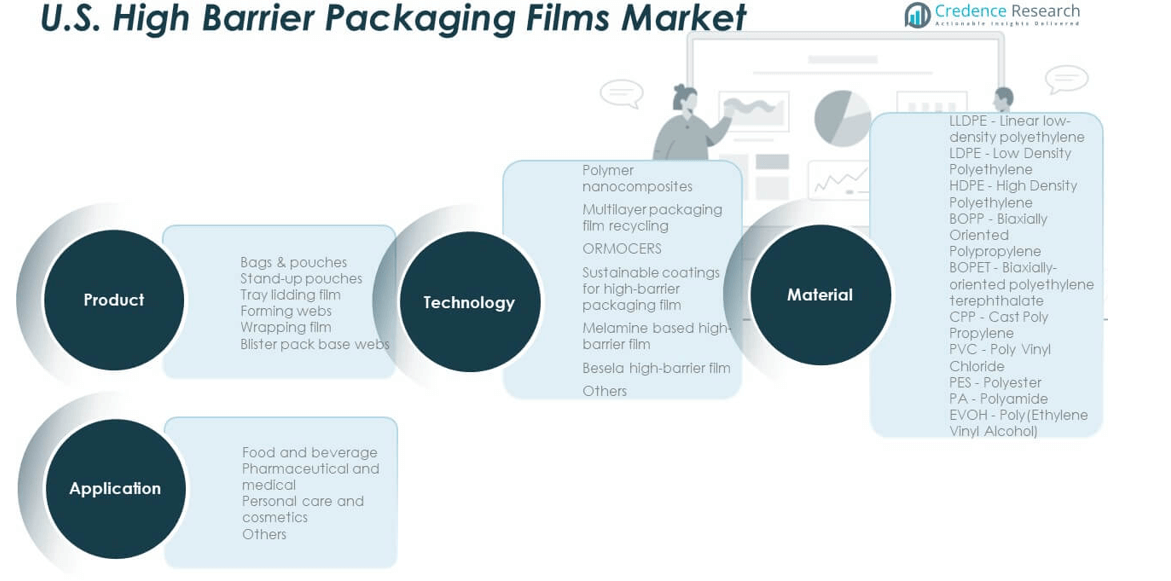

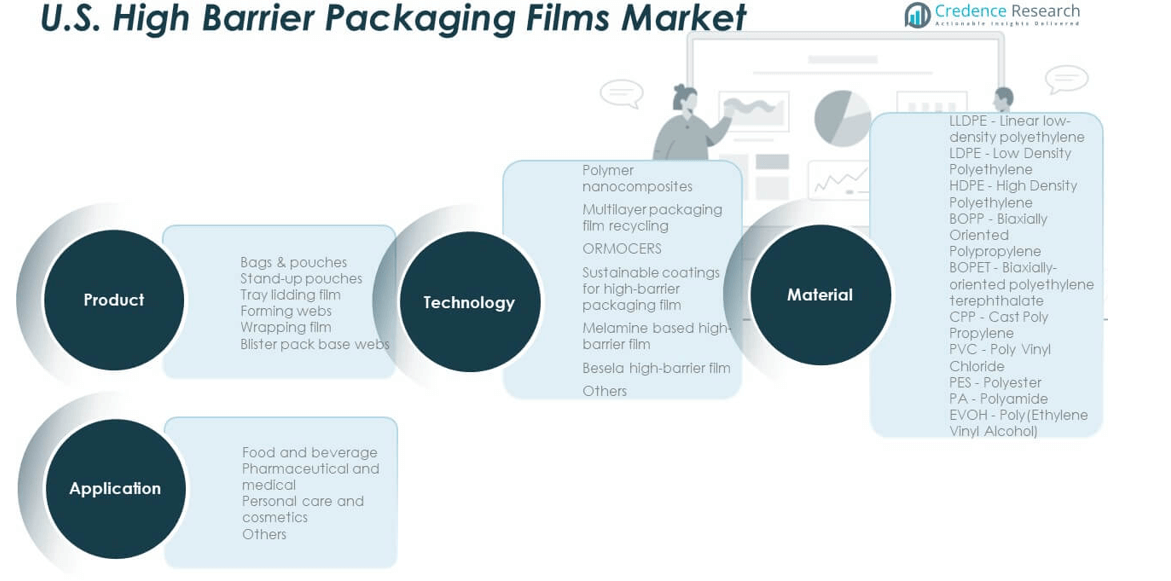

By Product

The U.S. High Barrier Packaging Films Market demonstrates strong demand across bags and pouches due to their versatility and dominance in food packaging. Stand-up pouches are gaining traction in retail environments for their shelf appeal and lightweight nature. Tray lidding films support dairy, meat, and ready-meal applications where sealing strength is critical. Forming webs are preferred in vacuum and modified atmosphere packaging for fresh produce and proteins. Wrapping films maintain visibility and protection for bakery and confectionery goods. Blister pack base webs remain vital in pharmaceuticals where product integrity is paramount.

- For instance, in May 2024, Sealed Air Corporation released Cryovac® Darfresh® vacuum skin packaging, increasing shelf visibility by 30% and achieving a 98.5% sealing rate for fresh and processed meats in U.S. retail outlets.

By Application

Food and beverage packaging leads the market due to rising demand for extended shelf-life and convenience. Pharmaceutical and medical applications follow closely, driven by the need for secure, contamination-free packaging formats. Personal care and cosmetics packaging adopts barrier films to protect formulations and enhance branding appeal. Other uses, including industrial and household products, provide additional growth potential.

- For instance, in September 2025, AptarGroup supplied its Irresistibleairless packaging to French brand Sisley for the launch of a new preservative-free face cream. This packaging features a patented barrier system that protects the formula from contamination.

By Technology

Polymer nanocomposites are increasingly used to enhance mechanical strength and barrier performance. Multilayer packaging film recycling is gaining importance under sustainability mandates. ORMOCERS and sustainable coatings offer advanced alternatives to traditional materials. Melamine-based and Besela high-barrier films cater to niche applications requiring premium performance. The segment highlights both innovation and eco-friendly adoption.

By Material

LLDPE and LDPE dominate due to cost efficiency and adaptability across applications. HDPE is valued for strength, while BOPP and BOPET ensure durability and clarity. CPP and PVC serve niche packaging needs, though environmental concerns limit PVC use. PES and EVOH are favored for superior barrier properties, especially in food and healthcare packaging.

Segmentation:

- By Product

- Bags & Pouches

- Stand-up Pouches

- Tray Lidding Film

- Forming Webs

- Wrapping Film

- Blister Pack Base Webs

- By Application

- Food and Beverage

- Pharmaceutical and Medical

- Personal Care and Cosmetics

- Others

- By Technology

- Polymer Nanocomposites

- Multilayer Packaging Film Recycling

- ORMOCERS

- Sustainable Coatings for High-Barrier Packaging Film

- Melamine-Based High-Barrier Film

- Besela High-Barrier Film

- Others

- By Material

- LLDPE – Linear Low-Density Polyethylene

- LDPE – Low-Density Polyethylene

- HDPE – High-Density Polyethylene

- BOPP – Biaxially Oriented Polypropylene

- BOPET – Biaxially-Oriented Polyethylene Terephthalate

- CPP – Cast Polypropylene

- PVC – Polyvinyl Chloride

- PES – Polyester

- EVOH – Poly(Ethylene Vinyl Alcohol)

Regional Analysis:

Northeast Market Share and Dynamics

The U.S. High Barrier Packaging Films Market in the Northeast holds about 24% share in 2024. Strong demand comes from packaged food, dairy, and pharmaceutical industries concentrated in states such as New York, Pennsylvania, and Massachusetts. It is supported by a robust healthcare sector that requires secure and contamination-free packaging. Urban lifestyles and dense retail networks also boost the use of ready-to-eat and convenience packaging formats. Sustainability regulations in states like New York accelerate adoption of recyclable and eco-friendly films. The region’s advanced R&D facilities encourage innovation in material science and film technology. This makes the Northeast a stable yet innovation-driven hub within the U.S.

Midwest and South Regional Contributions

The Midwest accounts for nearly 29% of the U.S. High Barrier Packaging Films Market, driven by its strong food processing and agricultural industries. States like Illinois and Ohio act as distribution centers, ensuring steady demand for packaging that extends product shelf-life. The South contributes around 27% of the market, fueled by growing urbanization and retail infrastructure across Texas, Florida, and Georgia. It is witnessing rising adoption of flexible packaging formats for beverages, meat, and personal care products. The South also benefits from cost-efficient manufacturing and proximity to logistics networks. Together, the Midwest and South reinforce market growth by serving both domestic and export-driven industries.

West Region Growth Prospects

The West region represents close to 20% of the U.S. High Barrier Packaging Films Market. Demand is anchored by California’s large food and beverage sector, which prioritizes packaging that balances product safety with sustainability. The presence of a strong pharmaceutical base in states like California and Arizona further drives adoption. It is also influenced by eco-conscious consumer preferences that encourage the use of recyclable barrier films. The rise of e-commerce and online grocery platforms across the West boosts demand for durable and flexible packaging formats. Technology-driven companies in the region are investing in innovative coatings and sustainable materials. This positions the West as a rapidly evolving and future-focused segment of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Limited

- Sealed Air Corporation (Cryovac)

- Winpak Ltd.

- ProAmpac

- Glenroy, Inc.

- Printpack

- Toray Plastics (America)

- Mitsubishi Chemical / Toray

- Taghleef Industries

- Jindal Films

- Cosmo Films

Competitive Analysis:

The U.S. High Barrier Packaging Films Market is highly competitive, with both global and domestic players shaping its landscape. It features companies focusing on innovation, sustainability, and product differentiation to maintain leadership. Leading firms such as Amcor, Sealed Air Corporation, and Winpak emphasize advanced barrier technologies to meet evolving consumer and regulatory demands. It remains marked by strong rivalry in flexible packaging formats, particularly pouches and lidding films. Mid-sized firms such as Glenroy, Printpack, and ProAmpac strengthen the competitive field through regional expansions and strategic collaborations. Price competitiveness, material innovation, and sustainability commitments drive market positioning. The emphasis on R&D ensures continuous evolution in performance and environmental compliance, securing growth momentum.

Recent Developments:

- In September 2025, Amcor entered a strategic partnership with Burt’s to develop crisps packaging that incorporates 55% post-consumer recycled content, reinforcing its commitment to circular packaging solutions and ESG targets.

- On September 9, 2025, the CRYOVAC® brand from Sealed Air celebrated the installation of its 4,000th rotary vacuum packaging system, marking a major milestone in food packaging innovation and process efficiency.

- On September 23, 2025, Winpak Ltd. received approval of its near-term science-based greenhouse gas reduction targets from the Science Based Targets initiative (SBTi), demonstrating verified progress in meeting specific sustainability goals by 2030.

- In early September 2025, ProAmpac signed an agreement to acquire PAC Worldwide, a move that will expand its presence in flexible packaging and bolster its sustainable packaging solutions with a strengthened North American footprint.

- In May 2025, Printpack partnered with KIND to launch a curbside recyclable paper bar wrapper, offering a new verified recyclable packaging option for consumer snack bars.

Report Coverage:

The research report offers an in-depth analysis based on product, application, technology, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer demand for convenient and flexible packaging will reinforce adoption.

- Pharmaceutical and healthcare applications will expand, requiring advanced protective solutions.

- Sustainability-focused films will become a critical growth area for manufacturers.

- Investment in recyclable and compostable materials will accelerate across production lines.

- Smart packaging technologies will gain importance to enhance safety and traceability.

- E-commerce expansion will drive durable, lightweight packaging formats.

- Regional production hubs will strengthen supply chains and reduce logistics costs.

- Technological innovation in coatings and nanocomposites will boost performance.

- Competition will intensify as mid-sized firms adopt aggressive expansion strategies.

- Regulatory frameworks will continue to shape material choices and innovation.