Market Overview

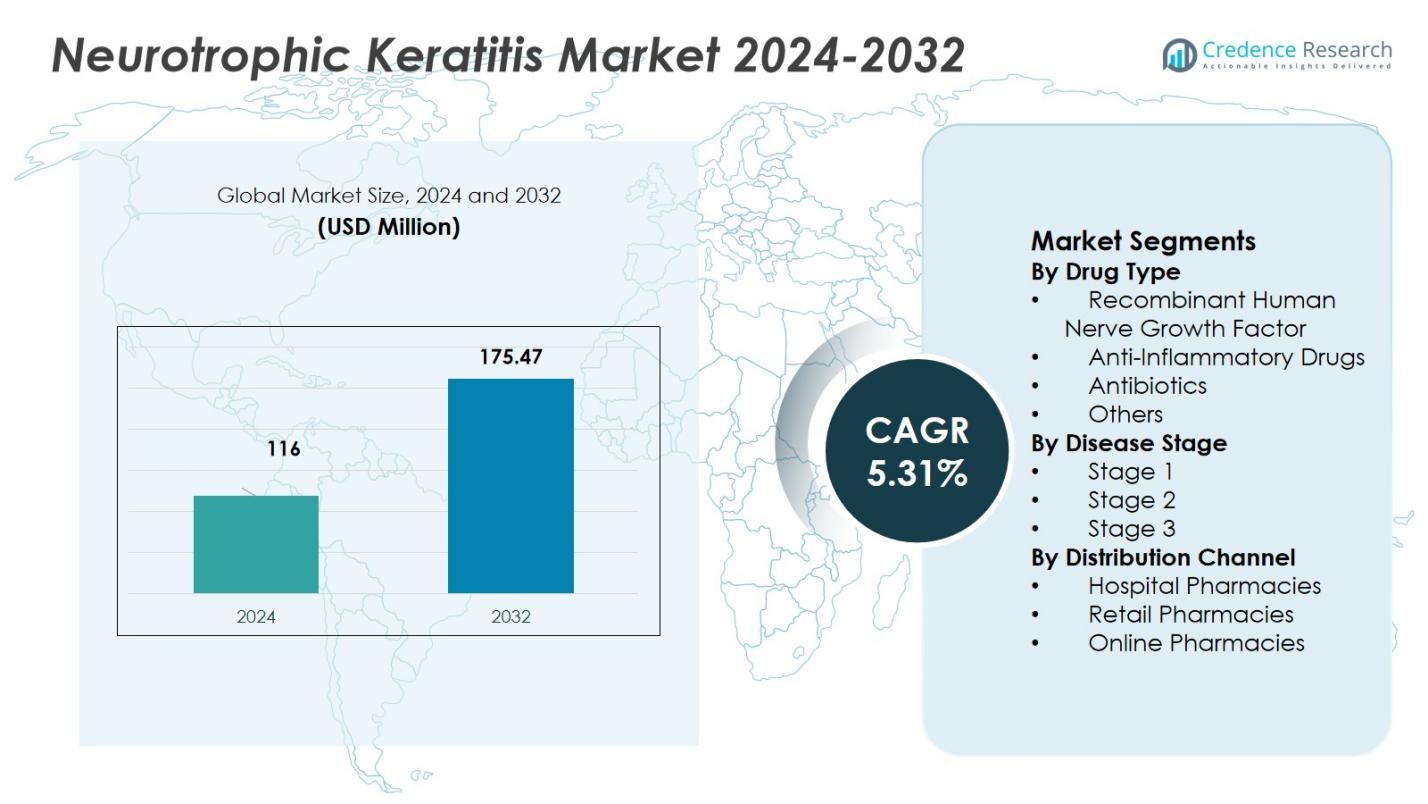

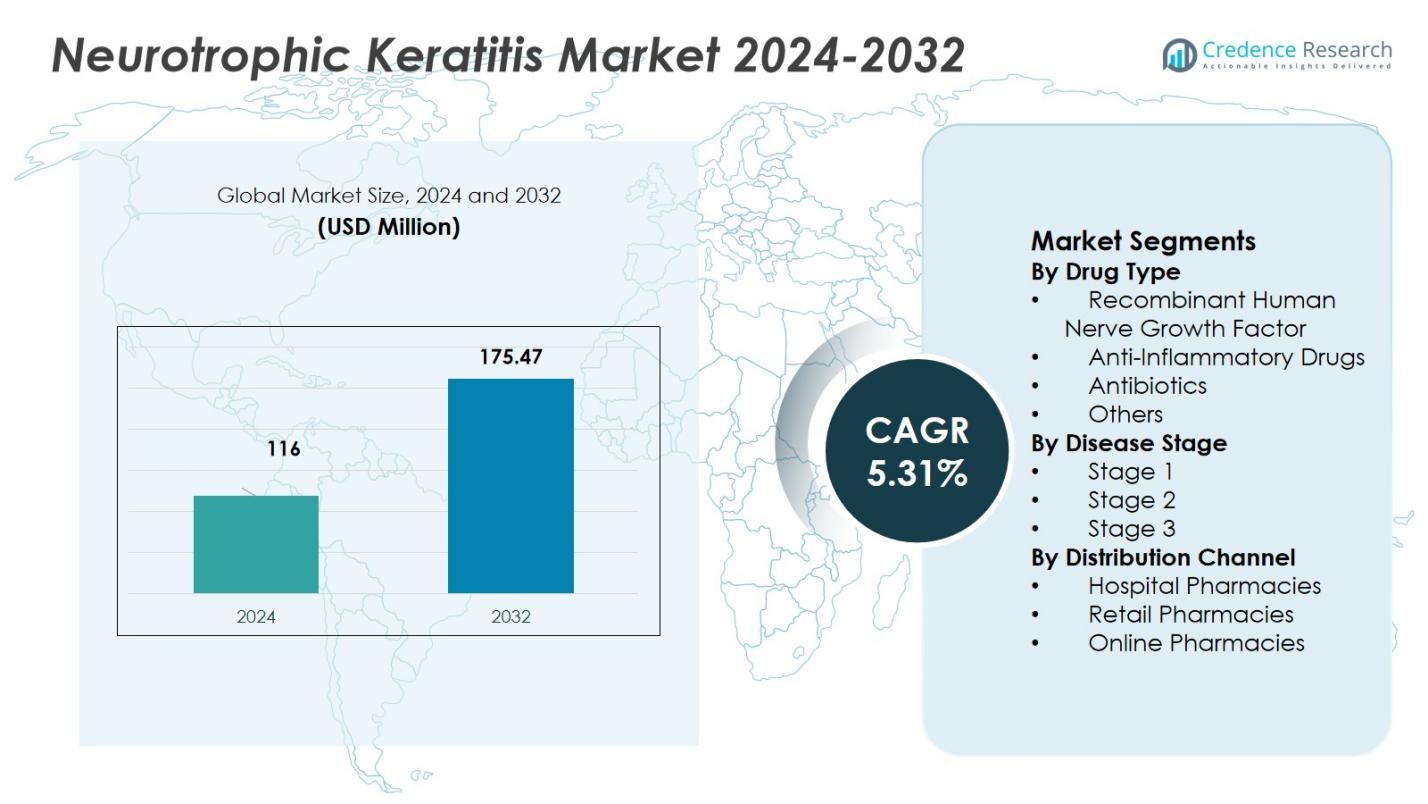

The Neurotrophic Keratitis Market size was valued at USD 116 million in 2024 and is anticipated to reach USD 175.47 million by 2032, at a CAGR of 5.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neurotrophic Keratitis Market Size 2024 |

USD 116 Billion |

| Neurotrophic Keratitis Market, CAGR |

5.31% |

| Neurotrophic Keratitis Market Size 2032 |

USD 175.47 Billion |

Neurotrophic Keratitis Market demonstrates significant presence of leading companies such as Johnson & Johnson Vision, Bausch + Lomb, RegeneRx Biopharmaceuticals, Allergan (AbbVie), CONTACARE Ophthalmics, OHTO Pharmaceutical Co., Ltd., Pfizer, Neuroptika, Dompé Farmaceutici, and Novartis AG. The market shows regional concentration with North America capturing 39.9% share in 2024 and remaining the dominant region, supported by strong healthcare infrastructure, advanced regulatory approvals, and high adoption of biologic therapies. Europe follows with 30.2% share, benefiting from robust public‑health systems and high awareness of rare ocular disorders. Asia Pacific, at 15.4%, emerges as a fast‑growing region driven by rising incidence of risk factors, expanding ophthalmic care access, and increasing investments in eye‑care services. Combined, these regions represent the core geographic strongholds for neurotrophic keratitis treatment demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Neurotrophic Keratitis Market was valued at USD 116 million in 2024 and is expected to reach USD 175.47 million by 2032, growing at a CAGR of 5.31% during the forecast period.

- The market is driven by the increasing prevalence of underlying conditions such as diabetes, viral infections, and trauma, which lead to a rise in the incidence of Neurotrophic Keratitis.

- Key trends include the growing adoption of biologic therapies, particularly recombinant human nerve growth factors, and advancements in regenerative medicine, which improve treatment efficacy and patient outcomes.

- The market faces challenges such as the high cost of advanced therapies, which limits their accessibility in emerging regions, and the relatively low patient volume of this rare disease.

- North America holds the largest market share of 39.9%, followed by Europe at 30.2%, with Asia Pacific being the fastest-growing region, contributing 15.4% to the global market in 2024.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Drug Type

In the drug‑type segment, Recombinant Human Nerve Growth Factor dominates with a 45.0% market share in 2024. The strong share reflects an increasing shift toward biologic therapies that directly target corneal healing pathways. Key drivers include growing clinical evidence of faster corneal nerve regeneration, rising physician preference for novel biologics over older treatments, and favorable reimbursement policies supporting advanced therapies. This sub‑segment also benefits from higher pricing levels compared to traditional drugs, which amplifies its revenue impact relative to volume.

- For instance, Alomone Labs produces recombinant human NGF alongside native mouse variants like NGF 2.5S (>95% purity, up to 1000 µg sizes). Their in-house manufacturing ensures stable supply for research into nerve cell survival and function.

By Disease Stage

Within the disease‑stage segmentation, Stage 3 Neurotrophic Keratitis holds the largest share at 50.0%, capturing half of the market in 2024. This dominance stems from the critical need for effective intervention in advanced cases, where corneal ulceration or perforation risk is highest. Drivers include increased diagnosis rates of late‑stage disease, more aggressive treatment protocols in tertiary care centers, and the willingness of payers to cover premium therapies for severe cases. Consequently, demand for high-efficacy treatments spikes at Stage 3, underpinning the sub‑segment’s leadership.

- For instance, Dompé’s Oxervate (cenegermin) is the only FDA-approved prescription eye drop for treating Stage 3 Neurotrophic Keratitis, promoting corneal nerve regeneration and epithelial healing through recombinant human nerve growth factor.

By Distribution Channel

In terms of distribution channels, Hospital Pharmacies lead with a 60.0% share of the Neurotrophic Keratitis treatment market in 2024. This reflects the tendency for advanced therapies especially biologics and compounded formulations to be dispensed and administered within hospital settings. Drivers include the requirement for cold‑chain storage, need for physician supervision during initial dosing, and the high volume of referrals from ophthalmology clinics to hospitals. Moreover, limited availability of specialized treatments in retail or online pharmacies reinforces hospitals as the primary procurement and distribution hub.

Key Growth Drivers

Increasing Prevalence of Underlying Risk Conditions

Growing incidence of systemic and ocular conditions notably diabetes mellitus, viral infections (e.g., herpes simplex and herpes zoster), and corneal nerve trauma from surgery or contact-lens misuse has driven rising cases of Neurotrophic Keratitis (NK). As more patients experience corneal nerve damage, demand for effective NK therapies escalates. This trend expands the addressable patient pool and pushes healthcare providers to adopt specialized treatments, boosting overall market growth.

- For instance,Dompé Farmaceutici reported positive real-world data showing improved corneal healing in patients using their nerve growth factor–based therapy.

Emergence of Innovative Biologic and Regenerative Therapies

Advancements in biologic and regenerative medicine particularly therapies based on nerve growth factors and wound-healing agents have transformed NK treatment. These novel therapies target the underlying nerve-damage pathology rather than only managing symptoms, improving clinical outcomes and patient quality of life. As regulatory approvals and clinical evidence accumulate, adoption of these advanced treatments increases, reinforcing market expansion.

- For instance, Dompé Pharmaceuticals developed Cenegermin (Oxervate®), the first FDA- and EMA-approved recombinant nerve growth factor (rhNGF) eye drop treatment for NK, shown to improve corneal nerve density and visual acuity through multiple clinical trials involving over 200 patients.

Growing Clinical Awareness and Improved Diagnostics

Enhanced understanding of NK among ophthalmologists and broader awareness among patients have improved early detection and proper diagnosis. Improvements in diagnostic protocols including sensitivity testing and clinical staging enable timely intervention before severe corneal damage occurs. As a result, rates of diagnosed and treated cases increase, creating greater demand for approved therapies and expanding the overall market.

Key Trends & Opportunities

Rising R&D and Pipeline Expansion for Novel Therapies

Pharmaceutical companies and biotech firms are intensifying research into new therapeutic options for NK, including next-generation growth-factor formulations, regenerative agents, and innovative delivery systems. This trend creates opportunities for development of more effective, safer, and patient-friendly treatments, which can potentially improve access and adherence especially in markets where current options are limited or expensive.

- For instance, Gamida Cell employs a proprietary nicotinamide (NAM) cell expansion platform to enhance NK cell potency, function, and persistence, with positive Phase 1 clinical data for GDA-201 and planned Phase 1/2 studies for cryopreserved versions targeting hematologic malignancies.

Increased Emphasis on Early Diagnosis and Preventive Ophthalmic Care

Healthcare providers and public-health stakeholders are placing greater emphasis on early ophthalmic screening – especially among high-risk populations (e.g., diabetics, post-corneal surgery patients, recurrent herpes keratitis sufferers). This focus on preventive eye care raises detection rates of subclinical or early-stage NK, enabling earlier intervention. As a result, demand for accessible therapies and maintenance treatments increases, widening market reach.

- For instance, BRIM Biotechnology received FDA orphan drug designation for BRM424, a novel regenerative therapy aimed at stimulating corneal limbal stem cells to accelerate healing in NK patients.

Key Challenges

High Treatment Costs and Limited Accessibility in Emerging Markets

Many advanced NK therapies, such as recombinant nerve growth factor drops, autologous serum eye-drops, and biologic wound-healing agents, are expensive, significantly limiting their affordability and widespread adoption, particularly in low- and middle-income regions. These high-cost treatments create a significant barrier to access, restricting their penetration into large patient pools and hindering their adoption in underserved markets. As a result, only a small percentage of patients benefit from these advanced therapies, which may dampen overall market growth. Furthermore, the disparity in access to these treatments exacerbates the treatment gap, especially in countries with limited healthcare budgets or inadequate insurance coverage.

Rare Disease Status and Low Patient Volume Hamper Market Scale-up

As a rare disease, NK affects a relatively small population globally (prevalence < 5 per 10,000 in some regions), which significantly constrains the potential patient base. This small volume makes it less attractive for some pharmaceutical companies to invest heavily in large-scale production or aggressive outreach, slowing the pace of new treatment introductions and limiting broader market expansion. The limited market potential in terms of patient numbers further discourages large investments in clinical trials and distribution networks, resulting in slower adoption of new therapies. Additionally, the low awareness among both healthcare providers and patients contributes to the underdiagnosis and under-treatment of the disease, further restricting the market’s growth opportunities.

Regional Analysis

North America

In 2024, North America accounted for 39.9% of the global Neurotrophic Keratitis market. This dominance reflects the region’s advanced healthcare infrastructure, high healthcare expenditure, and rapid adoption of novel ophthalmic therapies. A robust pipeline of innovative treatments, including biologics and recombinant therapies, supports strong demand. Additionally, high disease awareness, widespread diagnostic capabilities, and reimbursement coverage for advanced treatments further reinforce North America’s leading position in the market. These factors are expected to sustain North America’s market leadership throughout the forecast period.

Europe

Europe holds a significant share of 30.2% in the Neurotrophic Keratitis market, supported by strong public health systems, rising awareness of rare ocular disorders, and increasing adoption of advanced therapies. European countries benefit from well-established healthcare frameworks, patient access programs, and regulatory support that facilitate early diagnosis and treatment of NK. These factors combine to sustain a substantial share of the market, with Europe positioned as a key region for growth in the coming years.

Asia Pacific

Asia Pacific represents the fastest‑growing regional market for Neurotrophic Keratitis, accounting for 15.4% of the global market in 2024. This growth is driven by the rising prevalence of diabetes and other risk factors, improving healthcare infrastructure, and growing ophthalmic care awareness across populous countries such as China, India, Japan, and South Korea. The expanding base of potential patients, combined with increasing investments in eye-care services and greater access to novel therapies, positions APAC as a major growth engine for the global NK market.

Latin America

Latin America holds a market share of 6.7% in the global Neurotrophic Keratitis market. The region’s growth is supported by gradual improvements in medical infrastructure, rising awareness of eye disorders, and increasing availability of ophthalmic treatments. However, budget constraints and limited access to advanced therapies in some countries temper market penetration. Latin America thus represents a developing but opportunistic region for NK treatment expansion, with significant potential for growth as healthcare access improves.

Middle East & Africa

Middle East & Africa holds a relatively small share of 7.8% in the global Neurotrophic Keratitis market, owing to varied healthcare infrastructure, limited access to advanced ophthalmic therapeutics, and lower overall disease diagnosis rates in some areas. Nonetheless, growing interest in improving eye-care services, rising public-health initiatives, and increasing adoption of modern therapies in urban centers provide opportunities for gradual expansion. As awareness and access improve, MEA could capture a larger portion of demand for NK treatments over the forecast period.

Market Segmentations:

By Drug Type

- Recombinant Human Nerve Growth Factor

- Anti-Inflammatory Drugs

- Antibiotics

- Others

By Disease Stage

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global Neurotrophic Keratitis (NK) market is led by key players such as Johnson & Johnson Vision, Bausch + Lomb, RegeneRx Biopharmaceuticals, Allergan (AbbVie), CONTACARE Ophthalmics, OHTO Pharmaceutical Co., Ltd., Pfizer, Inc., Neuroptika, Dompé Farmaceutici, and Novartis AG. The market is moderately concentrated, with major pharmaceutical companies dominating due to their established ophthalmic portfolios and global distribution networks. Dompé Farmaceutici stands out with its first‑in‑class recombinant human nerve growth factor, Cenegermin, which has reshaped NK treatment by focusing on nerve regeneration rather than symptom management. Meanwhile, companies like Bausch + Lomb, Allergan, and Pfizer capitalize on their extensive market presence, offering a broad range of treatments. Niche players, including RegeneRx and CONTACARE, differentiate by focusing on specialized therapies or specific regional markets. Overall, competition hinges on innovation, regulatory approvals, and the ability to penetrate emerging markets with affordable, effective treatments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Novartis AG

- CONTACARE Ophthalmics

- Neuroptika

- Bausch + Lomb

- Allergan (AbbVie)

- OHTO Pharmaceutical Co., Ltd.

- Pfizer, Inc.

- RegeneRx Biopharmaceuticals

- Dompé Farmaceutici

- Johnson & Johnson Vision

Recent Developments

- In July 2025, Krystal Biotech announced that it had dosed the first patient in the Phase 1/2 “EMERALD‑1” trial of its investigational gene‑therapy eye drop KB801 for treatment of Neurotrophic Keratitis.

- In October 2025, the U.S. Food and Drug Administration (FDA) granted a platform‑technology designation to the HSV‑1 viral vector underlying KB801, potentially streamlining further development and regulatory review of this NK gene‑therapy candidate.

- In 2025, real‑world data for Cenegermin (rhNGF eye‑drop) demonstrated efficacy in promoting corneal epithelial healing and nerve regeneration in patients with Neurotrophic Keratitis across disease stages.

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Disease Stage, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of biologic and regenerative therapies such as nerve-growth factor treatments will drive significant demand growth in the Neurotrophic Keratitis market.

- Expanded awareness among ophthalmologists and improved diagnostic techniques for rare ocular disorders will lead to earlier detection and treatment of Neurotrophic Keratitis, enlarging the addressable patient pool.

- Regulatory incentives and orphan-drug designations will accelerate the development and approval of novel therapies, encouraging more companies to invest in R&D for NK treatments.

- Growing prevalence of underlying risk factors such as diabetes, corneal surgeries, and contact-lens related complications will raise incidence rates, boosting demand for effective NK management.

- Expansion of healthcare infrastructure and improved access to ophthalmic care in emerging and developing regions will open new markets and increase regional penetration of NK therapies.

- Broader reimbursement coverage and inclusion of NK treatments under insurance schemes in high-income countries will improve patient affordability and uptake of advanced therapies.

- Pipeline diversification including newer drug formulations, alternative delivery methods, and potential surgical adjuncts will offer clinicians more treatment options and attract a larger patient base.

- Increasing collaborations between pharmaceutical companies and research institutes will accelerate clinical trials and bring next-generation NK treatments to market.

- Rising geriatric population globally a demographic more susceptible to ocular surface diseases will contribute to a steady increase in NK cases, thereby sustaining long-term market growth.

- Growing physician and patient education about rare eye diseases will reduce under-diagnosis and under-treatment, enabling more consistent detection and management of Neurotrophic Keratitis worldwide.

Market Segmentation Analysis:

Market Segmentation Analysis: