Market Overview

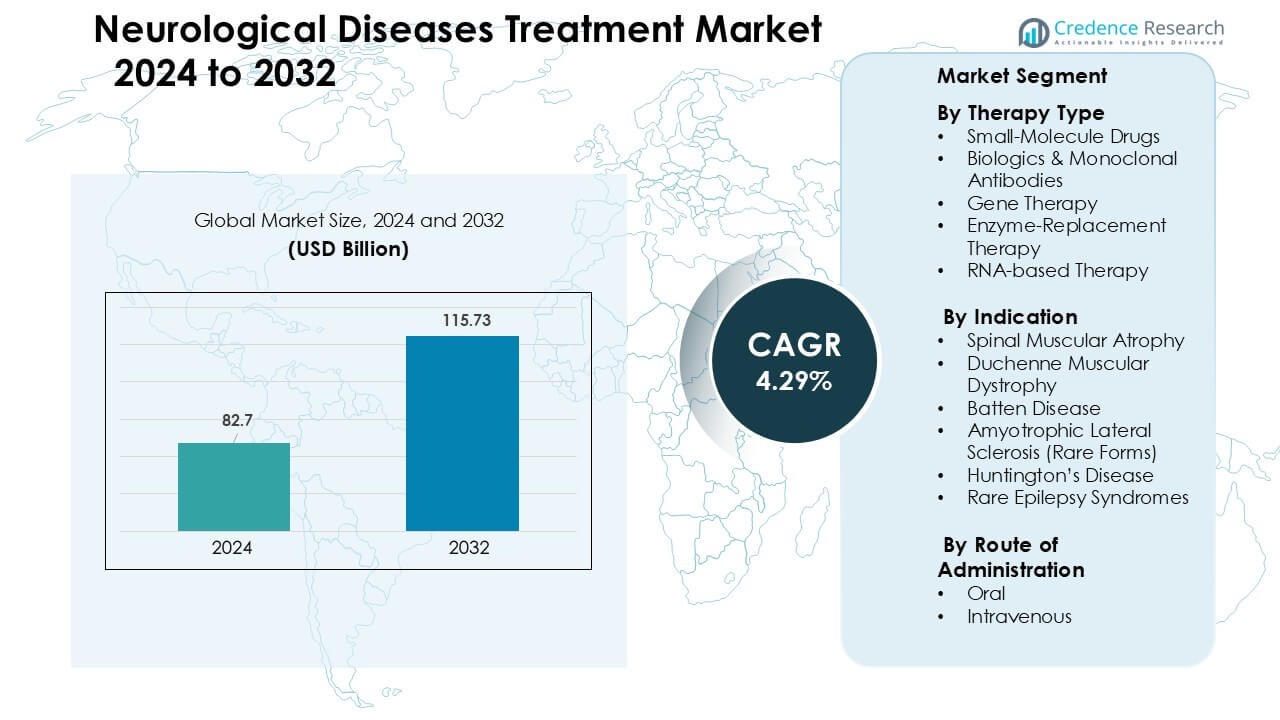

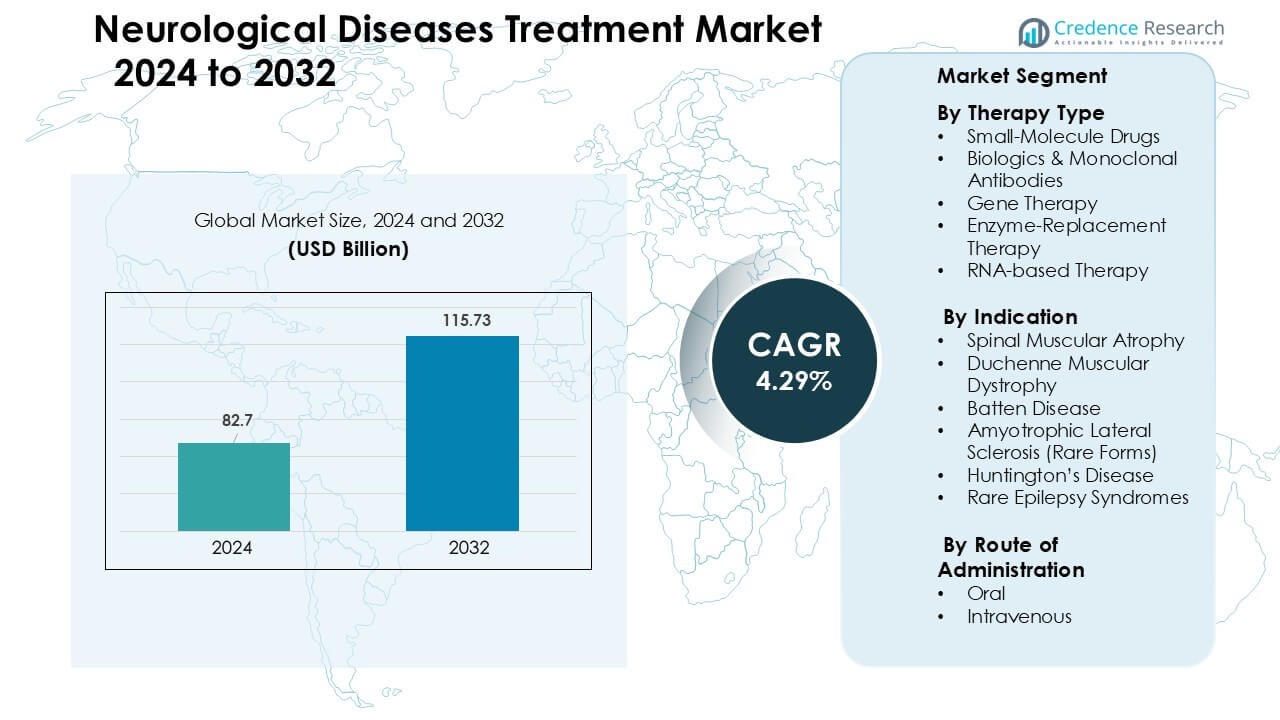

Neurological Diseases Treatment Market was valued at USD 82.7 billion in 2024 and is anticipated to reach USD 115.73 billion by 2032, growing at a CAGR of 4.29 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neurological Diseases Treatment Market Size 2024 |

USD 82.7 Billion |

| Neurological Diseases Treatment Market, CAGR |

4.29 % |

| Neurological Diseases Treatment Market Size 2032 |

USD 115.73 Billion |

Leading players in the neurological diseases treatment market include Biogen, Novartis, Roche, Ionis Pharmaceuticals, Sarepta Therapeutics, PTC Therapeutics, and Bluebird Bio, each advancing strong portfolios in gene therapy, RNA-based drugs, and biologics for SMA, DMD, ALS, Huntington’s disease, and rare epilepsy syndromes. These companies compete through accelerated clinical pipelines, expanded vector manufacturing, and deeper collaboration with global neurology centers. North America led the market with a 38% share in 2024, supported by broad access to advanced therapies, strong reimbursement structures, and high adoption of precision-medicine platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The neurological diseases treatment market reached USD 82.7 billion in 2024 and is projected to hit USD 115.73 billion by 2032, expanding at a CAGR of 4.29% during the forecast period.

- Demand grows due to rising cases of SMA, DMD, ALS, and rare epilepsies, supported by expanding newborn screening, improved diagnostics, and strong adoption of gene and RNA-based therapies.

- Major trends include rapid advancement in precision medicine, increasing approvals of antisense and AAV-based therapies, and wider use of digital biomarkers and remote neurological monitoring.

- Biogen, Novartis, Roche, Ionis Pharmaceuticals, Sarepta Therapeutics, and PTC Therapeutics shape competitive activity through accelerated pipelines, manufacturing expansion, and global research collaborations; restraints include high therapy costs and limited long-term safety data.

- North America led with 38% share, followed by Europe at 31%; Asia Pacific grew fastest at 23%, driven by rising genetic testing, while the oral therapy segment dominated with 55% share in administration preferences

Market Segmentation Analysis:

By Therapy Type

Small-molecule drugs held the dominant share of about 46% in 2024, driven by wide availability, lower development costs, and strong use in chronic neurological disorders. These drugs remain the first-line choice for many conditions because of their predictable pharmacokinetics and easier scaling in manufacturing. Biologics and monoclonal antibodies expanded due to targeted action in neuroinflammation. Gene therapy and RNA-based therapy grew fast as approvals for SMA and DMD increased. Enzyme-replacement therapy stayed limited to a smaller set of rare enzyme-deficiency disorders.

- For instance, Eli Lilly and Novo Nordisk developed xanomeline, a small-molecule muscarinic M₁/M₄ agonist, which has a brain‑to‑plasma ratio of over 10:1, enabling high CNS penetration.

By Indication

Spinal muscular atrophy led the indication segment with nearly 34% share in 2024, supported by strong adoption of gene therapy and antisense drugs in infant and pediatric cases. SMA treatments gained momentum due to clear clinical gains in motor function and high global screening rates. Duchenne muscular dystrophy grew with new exon-skipping approvals. Huntington’s disease and ALS (rare forms) recorded steady uptake, aided by emerging RNA-based pipelines. Batten disease and rare epilepsy syndromes saw niche but rising treatment demand through expanded compassionate-use programs.

- For instance, as of early 2024, 33 countries have newborn screening (NBS) programs for SMA, and in 2023, 1,176 newborns were diagnosed via these screens.

By Route of Administration

The oral route dominated with about 55% share in 2024, backed by strong adherence, ease of long-term therapy, and wide availability of small-molecule neurological drugs. Oral regimens remained the preferred format for chronic neurodegenerative conditions, supporting broader patient access. Intravenous delivery-maintained demand in biologics, gene therapies, and enzyme-replacement therapies, where targeted delivery and controlled dosing are required. Growth in IV treatments came from hospital-based infusion programs and rising approvals of monoclonal antibodies for rare neurological disorders.

Key Growth Drivers

Rising Prevalence of Rare and Degenerative Neurological Disorders

Growing incidence of rare and degenerative neurological disorders drives strong demand for advanced treatment options. Higher diagnosis rates for conditions such as SMA, Huntington’s disease, DMD, and rare epilepsy syndromes push healthcare systems to adopt newer therapeutic classes. Wider newborn screening, improved genetic testing, and increased disease awareness help identify patients earlier, leading to faster treatment uptake. Many countries also expanded reimbursement for high-value neurological medicines, which improved therapy access. Clinical guidelines now favor early intervention for rare neurological diseases, which boosts prescription volume. Strong unmet needs in progressive disorders continue to attract investment from biotech and pharma companies, supporting market expansion across major regions.

- For instance, the global prevalence of Duchenne muscular dystrophy (DMD) is estimated at 4.8 cases per 100,000 males, highlighting both the rarity and the concentrated unmet need in this population.

Advances in Gene, RNA, and Precision Medicine Therapies

Breakthroughs in gene therapy, antisense oligonucleotides, and RNA-based platforms significantly accelerate market growth. These technologies enable targeted intervention at the genetic or molecular level, which improves outcomes in disorders with clear mutations. Multiple regulatory approvals in SMA, DMD, and rare epilepsies validate the commercial potential of precision therapies, encouraging more companies to scale development. Strong funding flows into biotech firms help expand pipelines for rare neurological conditions with no standard treatments. Increased availability of viral vectors, improved delivery systems, and manufacturing innovation also support faster production. These clinical advances raise patient survival rates and deliver long-term functional benefits, making advanced modalities central to future neurological treatment models.

- For instance, Novartis’s gene therapy Zolgensma® (onasemnogene abeparvovec) has now been administered to over 3,700 patients globally, demonstrating sustained SMN protein expression and durable motor benefits in SMA.

Expanding Global Investment and Regulatory Support

Governments and global health agencies now prioritize rare neurological diseases, creating a strong funding and regulatory environment. Incentives such as orphan-drug status, fast-track designations, and accelerated approvals shorten development timelines and reduce commercial risks. Public-private partnerships promote research on neurodegenerative conditions, while academic-industry collaborations expand innovation. Investment firms have increased financing for neurological pipelines as high-value therapies show strong market performance. Reimbursement policies for severe neurological conditions also improved in North America, Europe, and parts of Asia, allowing broader treatment access. This supportive landscape encourages pharma and biotech companies to scale R&D, clinical programs, and manufacturing capacity in neurological therapeutics.

Key Trends & Opportunities

Growing Shift Toward RNA-Based and Gene-Editing Technologies

RNA-based therapies, CRISPR gene editing, and viral-vector delivery systems are emerging as central trends in neurological treatment. Companies explore next-generation platforms that target disease-causing mutations with higher precision and fewer systemic effects. Advancements in AAV vectors and lipid nanoparticles improve delivery to neural tissues, expanding opportunities for previously untreatable conditions. Many firms also invest in modular RNA platforms that reduce development costs and shorten clinical timelines. These innovations enable therapy personalization, offering patients more durable outcomes. The rapid expansion of RNA and editing technologies creates strong commercial opportunities for rare neurological diseases with well-mapped genetic pathways.

- For instance, Intellia Therapeutics has teamed up with Regeneron to use its Nme2Cas9 CRISPR system delivered via Regeneron’s engineered AAV vectors to target neurological and muscular disease genes in vivo.

Rise of Biomarkers, Digital Tools, and Early Diagnosis Technologies

Biomarker-driven diagnostics and digital health tools are transforming the neurological disease landscape. Liquid biopsies, advanced imaging, and genetic assays help detect conditions earlier, improving treatment response rates. Wearables, cognitive-tracking apps, and remote monitoring systems help physicians measure disease progression with more accuracy. These technologies support real-world data generation, which enhances clinical decision-making and accelerates approvals for new therapies. Opportunities are strong for companies integrating AI-based diagnostic platforms with clinical workflows. Improved early detection continues to expand the eligible patient pool for high-value neurological treatments, supporting long-term market growth.

- For instance, BioSerenity’s Neuronaute smart-wearable system, used in neurology, processes data from smart clothing and sensors to identify digital biomarkers the company reports contributing to the diagnosis of 30,000 patients per year.

Expansion of Specialty Care Centers and Infusion-Based Services

Many healthcare systems invest in specialized neurology centers and infusion facilities to manage complex therapies such as monoclonal antibodies, gene therapies, and enzyme-replacement treatments. These centers enable safe administration, better monitoring, and improved patient outcomes. Partnerships between hospitals and biotech companies help create structured care programs for rare neurological diseases. Growing investment in outpatient infusion clinics increases treatment accessibility and reduces hospital burdens. This trend opens opportunities for firms offering infusion-ready formulations, care-coordination services, and long-term follow-up systems for neurological patients.

Key Challenges

High Therapy Costs and Limited Affordability

Many advanced neurological treatments including gene therapy and antisense drugs remain extremely expensive, limiting access for patients worldwide. High manufacturing costs, complex supply chains, and limited production capacity drive prices upward. Reimbursement is inconsistent across regions, creating accessibility gaps and slowing adoption. Patients in low- and middle-income countries face significant affordability barriers, restricting market penetration. Even in developed regions, insurers impose strict eligibility criteria, delaying or preventing treatment initiation. The high economic burden of care challenges healthcare systems and restricts the reach of innovative neurological therapies.

Difficulties in Targeted Delivery and Treatment Durability

Delivering therapies effectively to neural tissues remains a major challenge due to the blood-brain barrier and the complexity of neurological pathways. Many treatments require invasive administration or specialized delivery systems, which limits their widespread adoption. Durable and consistent therapeutic effects are also hard to achieve, especially in progressive disorders with rapid degeneration. Some therapies show reduced long-term efficacy or require repeated administration, increasing patient burden. Safety concerns, particularly with viral vectors and gene-editing tools, also complicate clinical development. These hurdles slow approval timelines and constrain the scalability of innovative neurological treatments.

Regional Analysis

North America

North America held the largest share of about 38% in 2024, supported by strong adoption of advanced neurological therapies, high diagnosis rates, and broad insurance coverage for rare disease treatments. The region benefits from robust R&D output, widespread genetic testing, and early access to gene and RNA-based therapies. Extensive clinical trial activity across the U.S. and Canada strengthens innovation for SMA, DMD, and rare epilepsy syndromes. Growing investment in specialty neurology centers and infusion facilities further expands treatment reach. Favorable regulatory programs, including accelerated approvals, continue to anchor North America’s leading position in this market.

Europe

Europe accounted for nearly 31% market share in 2024, driven by strong adoption of biologics, gene therapies, and advanced diagnostics across major countries. The presence of well-funded rare disease networks and supportive reimbursement frameworks boosts uptake of SMA, DMD, and Huntington’s disease treatments. Expanded newborn screening and earlier intervention programs improve clinical outcomes. Germany, France, and the U.K. lead clinical research, while Nordic nations show high adoption of personalized neurological therapies. Continued investment in neurological research hubs and cross-border treatment pathways positions Europe as a key growth region for innovative neurotherapeutics.

Asia Pacific

Asia Pacific captured about 23% share in 2024, supported by rising diagnosis rates, growing healthcare investment, and improved access to specialty neurological care. Japan, South Korea, China, and Australia drive demand for gene therapy, monoclonal antibodies, and rare disease treatments. Expansion of genomic testing and national rare disease registries increases early detection. Governments in China and India expand reimbursement for severe neurological disorders, supporting wider therapy access. Rapid growth in biotech manufacturing and clinical trial activity strengthens regional capabilities. APAC remains one of the fastest-growing regions due to its large patient base and improving treatment infrastructure.

Latin America

Latin America accounted for nearly 5% market share in 2024, shaped by gradual expansion in genetic testing, improved clinical capacity, and selective reimbursement for high-value neurological therapies. Brazil, Mexico, and Argentina show rising demand for treatments targeting SMA, rare epilepsies, and DMD, supported by better diagnosis and awareness programs. Limited healthcare budgets slow adoption of advanced gene or RNA therapies, but partnerships with global pharmaceutical companies help expand access. Increasing investment in neurology centers and cross-border treatment programs supports slow but steady growth across the region.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024, driven by rising investment in specialized neurology services and improved access to advanced diagnostics in Gulf nations. Countries such as the UAE, Saudi Arabia, and Qatar lead adoption due to strong healthcare spending and early access programs for rare disease therapies. Broader regions in Africa face challenges in affordability, diagnostic gaps, and limited clinical capacity, which restrict market penetration. International collaborations and government-led rare disease initiatives gradually expand treatment availability, supporting moderate long-term growth.

Market Segmentations:

By Therapy Type

- Small-Molecule Drugs

- Biologics & Monoclonal Antibodies

- Gene Therapy

- Enzyme-Replacement Therapy

- RNA-based Therapy

By Indication

- Spinal Muscular Atrophy

- Duchenne Muscular Dystrophy

- Batten Disease

- Amyotrophic Lateral Sclerosis (Rare Forms)

- Huntington’s Disease

- Rare Epilepsy Syndromes

By Route of Administration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Leading companies in the neurological diseases treatment market include Biogen, Novartis, Roche, Ionis Pharmaceuticals, Sarepta Therapeutics, PTC Therapeutics, and Bluebird Bio, each advancing portfolios across gene therapy, RNA-based therapy, and biologics. These firms focus on rare and high-burden disorders such as SMA, DMD, ALS, Huntington’s disease, and rare epilepsies, where unmet clinical needs remain significant. Competition intensifies as companies accelerate clinical pipelines, expand manufacturing for viral vectors and antisense platforms, and secure global regulatory designations. Strategic moves include licensing agreements, biomarker-driven trials, and collaborations with academic neurology centers to support faster innovation. Many players also invest in long-term real-world data programs to strengthen therapy adoption. Growing interest from emerging biotech companies adds competitive pressure, especially in precision medicine segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NIHON KOHDEN CORPORATION.

- Bio-Rad Laboratories, Inc.

- CANON MEDICAL SYSTEMS CORPORATION.

- General Electric Company.

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- FUJIFILM Holdings Corporation.

- Mitsar Co, LTD.

- Siemens AG.

- Koninklijke Philips N.V.

Recent Developments

- In April 2025, NIHON KOHDEN CORPORATION Announced the second-generation Live-View Panel Pro, enabling interactive continuous EEG (cEEG) viewing and improved remote/real-time monitoring for high-risk neurology patients (supports EMU and ICU workflows).

- In March 2025, Canon Medical Systems Corporation (Canon Medical) received U.S. FDA regulatory clearance for major AI enhancements to its Aquilion ONE / INSIGHT Edition CT platform, specifically expanding the availability of the high-resolution PIQE 1024 matrix (Precise IQ Engine deep learning reconstruction) and SilverBeam filter for a wider range of clinical applications.

- In November 2024, NIHON KOHDEN CORPORATION Acquired Ad-Tech Medical Instrument Corporation to strengthen its EEG electrode portfolio and “comprehensive epilepsy care” capabilities, expanding Nihon Kohden’s reach across the epilepsy monitoring / EEG ecosystem.

Report Coverage

The research report offers an in-depth analysis based on Therapy Type, Indication, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Precision medicine will expand as genetic mapping improves treatment targeting.

- Gene therapy and RNA-based platforms will gain wider global approvals.

- Digital biomarkers will support earlier diagnosis and faster clinical decisions.

- Manufacturing capacity for viral vectors will increase to meet demand.

- More countries will adopt newborn screening for rare neurological disorders.

- Oral targeted therapies will grow alongside advanced biologics and gene therapies.

- Partnerships between biotech firms and neurology centers will accelerate innovation.

- Real-world evidence programs will strengthen long-term treatment validation.

- AI-driven diagnostic tools will improve detection of progressive neurological diseases.

- Emerging markets will adopt advanced neurological treatments as infrastructure improves.