Market Overview

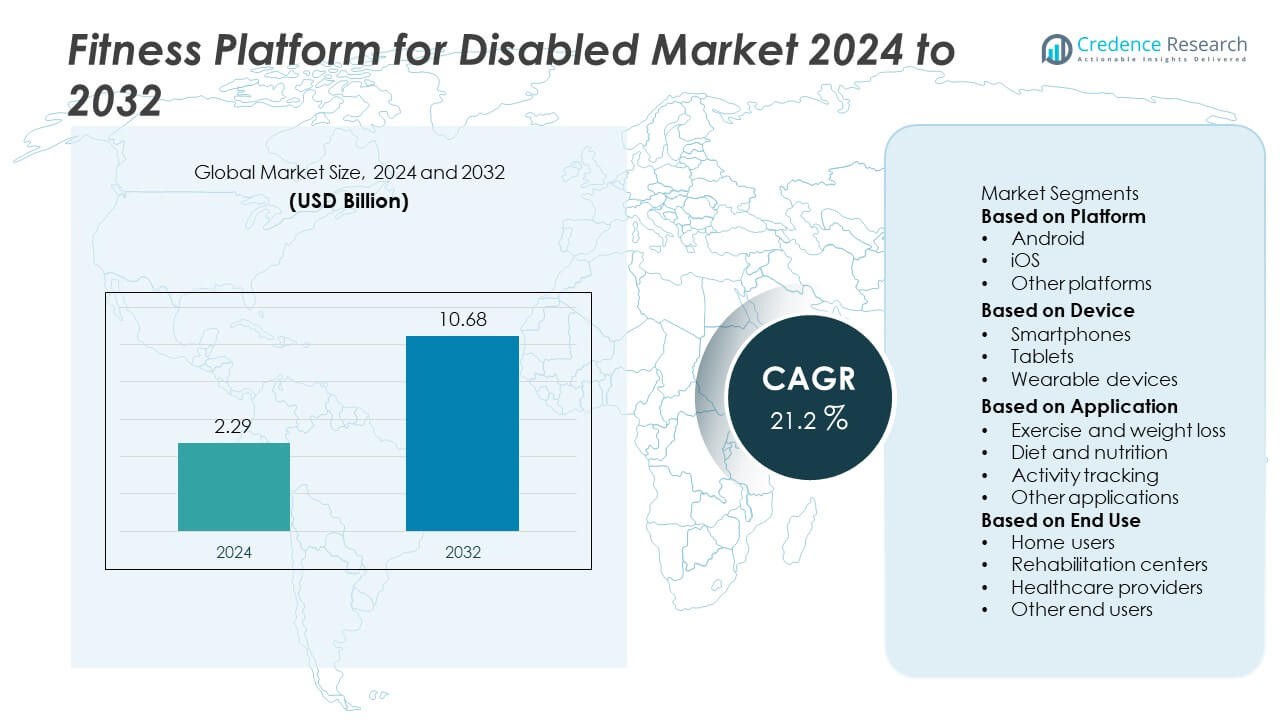

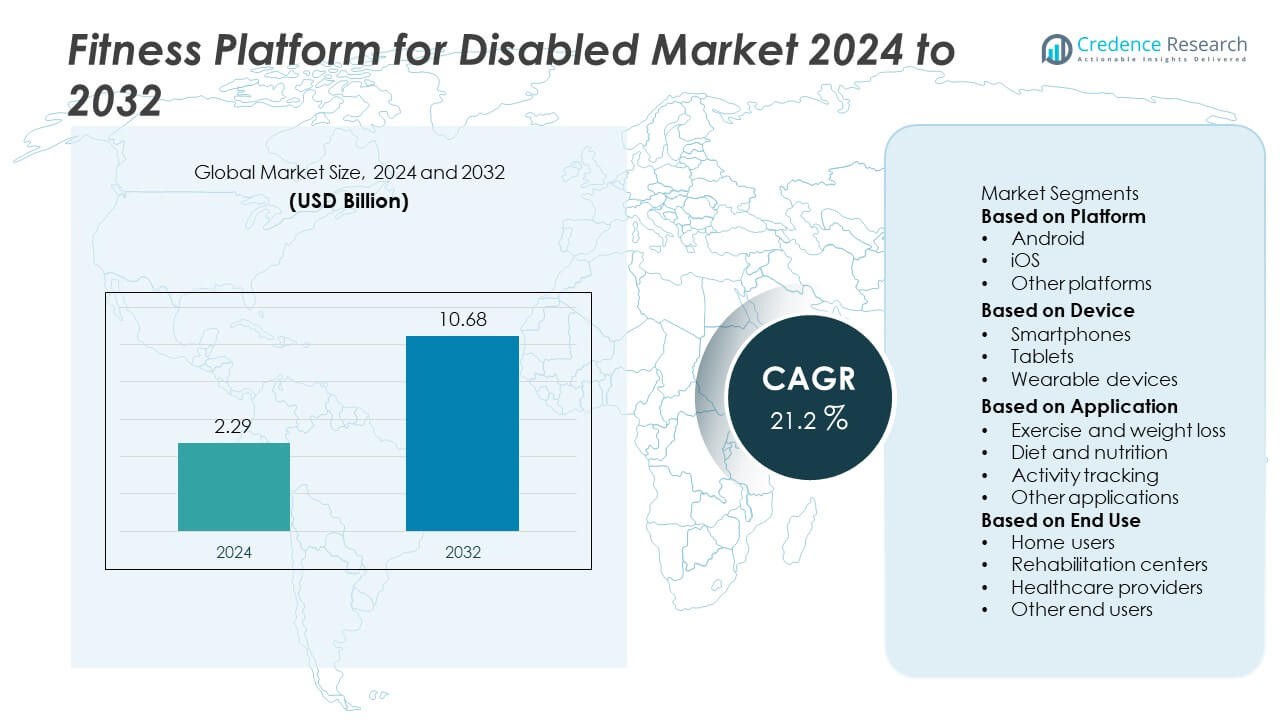

The Fitness Platform for Disabled Market was valued at USD 2.29 billion in 2024 and is projected to reach USD 10.68 billion by 2032, expanding at a CAGR of 21.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fitness Platform for Disabled Market Size 2024 |

USD 2.29 Billion |

| Fitness Platform for Disabled Market, CAGR |

21.2% |

| Fitness Platform for Disabled Market Size 2032 |

USD 10.68 Billion |

The Fitness Platform for Disabled market is led by major players including Fitbit, Move United, FitOn, Evolve21, MyFitnessPal, Chair One Fitness, GOFA International, Let’s Go Fitness, Apple, and Exercise Buddy. These companies drive growth through adaptive workout programs, wearable integration, AI-driven coaching, and partnerships with healthcare providers to improve accessibility. Asia-Pacific emerged as the fastest-growing region with a 30% market share in 2024, supported by rising digital health adoption and government-backed inclusivity programs. North America followed closely with 36% share, driven by advanced healthcare infrastructure and strong adoption of wearable devices, while Europe accounted for 28%, supported by strict accessibility standards and expanding telehealth initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fitness Platform for Disabled market was valued at USD 2.29 billion in 2024 and is expected to reach USD 10.68 billion by 2032, growing at a CAGR of 21.2% during the forecast period.

- Rising demand for accessible health solutions and integration of adaptive technologies drives growth, with smartphones dominating the device segment at 58% share due to their widespread use and accessibility features.

- Market trends highlight the growing role of wearables and AI-driven personalized coaching, while telehealth integration and adaptive fitness programs expand reach for disabled users.

- Key players such as Fitbit, Apple, MyFitnessPal, Move United, and FitOn focus on partnerships, innovation in adaptive platforms, and expansion into high-growth regions, intensifying competition.

- North America led the market with 36% share in 2024, followed by Europe at 28% and Asia-Pacific at 30%, while the exercise and weight loss application segment dominated globally with over 40% share.

Market Segmentation Analysis:

By Platform

Android platforms dominated the market in 2024 with a market share of 52%. Their leadership is attributed to affordability, wider availability of accessible apps, and strong penetration in emerging economies. Open-source flexibility allows developers to create customized solutions tailored to disabled users, enhancing usability. iOS follows closely, preferred in developed regions for its advanced accessibility features and seamless integration across Apple devices. Other platforms, though smaller, serve niche segments with specialized offerings. The broad reach and cost efficiency of Android ensure its continued dominance in this category.

- For instance, MyFitnessPal has been used by over 200 million people worldwide to track their nutrition and fitness goals. The app includes various accessibility features, such as compatibility with wearable devices and custom interface options.

By Device

Smartphones held the largest share of the market in 2024 at around 58%. Their dominance comes from high adoption among disabled individuals for fitness tracking, exercise monitoring, and nutrition management through accessible applications. Smartphones also integrate voice assistance and screen reader technology, improving inclusivity. Wearable devices are rapidly expanding, supported by smartwatches and fitness bands offering real-time health monitoring features tailored for accessibility. Tablets contribute a smaller share but are useful for larger display needs. The portability and multifunctional features of smartphones secure their leading position in the market.

- For instance, Apple Watch unit sales worldwide grew until 2022 and then decreased in 2023. In 2016, Apple introduced accessibility features in watchOS 3 for wheelchair users, which included tracking pushes instead of steps and wheelchair-specific workouts.

By Application

Exercise and weight loss was the dominant application in 2024, capturing over 40% share. The segment is driven by rising awareness of physical wellness and accessible exercise programs designed for disabled users. Platforms offer adaptive workout plans, guided sessions, and progress tracking features that encourage active lifestyles. Activity tracking follows as a strong segment, boosted by wearable integration that monitors heart rate, steps, and mobility patterns. Diet and nutrition platforms are gaining attention with personalized dietary management tools. Exercise-focused solutions remain central, aligning with global efforts to improve inclusivity in health and fitness.

Key Growth Drivers

Growing Adoption of Digital Health Solutions

The increasing adoption of digital health platforms is a major driver for the fitness platform for disabled market. Mobile applications and connected devices provide accessible exercise and wellness programs, bridging gaps in traditional fitness offerings. Healthcare providers and fitness companies are investing in inclusive platforms to address diverse needs, enhancing accessibility and personalization. Rising awareness of preventive healthcare further boosts demand. With mobile penetration growing globally, digital health solutions create a strong foundation for the widespread use of fitness platforms tailored to disabled individuals.

- For instance, as of late 2023, Fitbit had 38.5 million active users and 128 million registered users. The company’s devices, which sold 6.6 million units in 2023, capture a wide variety of health data from its user base. This data, combined with app usage, contributes to its ongoing presence in the digital health market.

Government and NGO Support for Inclusion

Government initiatives and NGO programs promoting inclusivity in healthcare and fitness strongly drive market growth. Many regions are implementing policies that ensure disabled individuals have equal access to fitness and wellness services. Funding support, grants, and accessibility guidelines encourage developers to build inclusive digital solutions. For example, public health campaigns focus on adaptive fitness and rehabilitation, pushing platforms to innovate. These initiatives not only widen adoption but also ensure compliance with accessibility standards, fostering sustainable growth for fitness platforms designed for disabled communities.

- For instance, Move United provides adaptive sports opportunities through its network of over 200 community-based member organizations across the U.S., which includes access to its On Demand virtual fitness classes for disabled participants.

Integration of Wearable and Assistive Technologies

Wearable technology integration plays a vital role in driving this market forward. Smartwatches, fitness bands, and connected devices now offer features like voice commands, haptic feedback, and AI-driven health tracking tailored for disabled users. These innovations enhance real-time monitoring of mobility, heart rate, and activity patterns, providing actionable insights for both users and caregivers. Assistive technologies combined with mobile platforms increase engagement and adoption. The growing preference for personalized and adaptive fitness solutions ensures that wearables and assistive devices remain central to market expansion over the coming years.

Key Trends and Opportunities

Rising Demand for Personalized Fitness Experiences

Personalized fitness experiences are becoming a key trend, with platforms offering adaptive workout programs, customized nutrition guidance, and AI-driven recommendations. Disabled users benefit from tailored solutions that account for mobility limitations, dietary needs, and rehabilitation goals. This personalization improves user engagement, retention, and health outcomes. Companies are increasingly leveraging machine learning to refine offerings, aligning with the global shift toward individualized healthcare. This trend provides significant opportunities for platforms to differentiate and expand their user base while addressing the unique requirements of disabled individuals.

- For instance, GOFA International’s AI-driven adaptive fitness app adjusts routines based on user heart rate and motion data to offer personalized workout plans, including programs tailored for users with disabilities.

Expansion of Telehealth and Remote Wellness Programs

The rise of telehealth and remote wellness solutions opens new opportunities for fitness platforms serving disabled individuals. Virtual coaching, guided exercise sessions, and rehabilitation monitoring allow users to access support without geographical limitations. Integration with video conferencing and AI-enabled tracking enhances the delivery of adaptive fitness programs. This expansion is particularly beneficial in rural and underserved areas where traditional fitness services are limited. The trend toward remote wellness ensures broader accessibility and creates long-term opportunities for digital platforms targeting inclusive healthcare and fitness markets.

- For instance, Chair One Fitness does offer an On Demand streaming service with instructor-led sessions accessible via iOS, Android, and Roku devices.

Key Challenges

High Development and Customization Costs

Developing inclusive fitness platforms requires significant investment in accessibility features, adaptive interfaces, and specialized content. Customization for diverse disabilities demands additional resources, increasing overall costs. Smaller companies face challenges in competing with established players due to high entry barriers. These cost pressures often limit scalability, especially in emerging markets where affordability is a concern. Balancing innovation with cost-efficiency remains a key challenge for developers, potentially slowing down widespread adoption despite growing demand for inclusive fitness solutions worldwide.

Limited Awareness and Digital Divide

Awareness of specialized fitness platforms for disabled individuals remains limited, particularly in low-income and rural regions. The digital divide, including lack of access to smartphones, internet connectivity, and assistive technologies, further constrains adoption. Many potential users remain reliant on traditional rehabilitation services, delaying digital engagement. Additionally, cultural and social barriers in some regions reduce acceptance of fitness solutions for disabled individuals. Overcoming these limitations requires targeted awareness campaigns, subsidies, and partnerships with governments and NGOs to improve digital access and inclusivity.

Regional Analysis

North America

North America held a market share of 36% in 2024, supported by advanced healthcare infrastructure and widespread adoption of digital fitness solutions. Strong accessibility regulations in the United States and Canada encourage the integration of inclusive fitness platforms for disabled individuals. High smartphone penetration and strong wearable device usage further support market growth. Partnerships between healthcare providers, fitness companies, and technology developers accelerate innovation in adaptive fitness programs. The region’s emphasis on preventive healthcare, combined with supportive government initiatives, strengthens adoption and positions North America as a leading market for inclusive digital fitness platforms.

Europe

Europe accounted for a market share of 28% in 2024, driven by strict accessibility standards and a growing emphasis on digital healthcare inclusion. Countries such as Germany, the United Kingdom, and France are leading adopters due to government-backed programs promoting digital wellness for disabled individuals. The rise of telehealth services and rehabilitation-focused fitness platforms enhances regional demand. Increasing focus on sustainability and healthcare equity across the European Union supports long-term growth. Strong collaborations between NGOs and platform providers ensure broader adoption, reinforcing Europe’s role as a significant market for fitness platforms serving disabled populations.

Asia-Pacific

Asia-Pacific emerged as the fastest-growing region with a market share of 30% in 2024, fueled by rapid digitalization, rising healthcare investments, and increasing smartphone adoption across China, India, and Southeast Asia. Governments are prioritizing inclusivity through digital health programs, while growing awareness about fitness among disabled individuals supports adoption. Expansion of telehealth services and affordable Android-based platforms drive wider accessibility. The region also benefits from large-scale investments by technology firms in adaptive fitness applications. Rising urbanization and increasing disposable incomes further accelerate market penetration, positioning Asia-Pacific as a high-potential region for inclusive digital fitness solutions.

Middle East and Africa

The Middle East and Africa region held a market share of 3% in 2024, reflecting growing interest in digital healthcare and wellness accessibility. Countries like the United Arab Emirates and Saudi Arabia are investing in smart healthcare initiatives, which include adaptive digital fitness platforms. Increased focus on disabled-friendly infrastructure and government-backed health campaigns is improving adoption. However, limited internet penetration and affordability issues in parts of Africa constrain growth. Ongoing digital health initiatives and expansion of telehealth platforms are expected to gradually enhance market presence, with long-term potential as infrastructure improves.

Latin America

Latin America captured a market share of 3% in 2024, driven by growing digital fitness adoption in Brazil and Mexico. Rising government support for healthcare inclusion and increasing smartphone penetration are key factors boosting demand. Fitness platforms tailored for disabled individuals are gaining traction through collaborations with NGOs and healthcare providers. However, challenges such as economic instability and limited awareness hinder faster adoption. Despite these barriers, expanding telehealth programs and increasing investment in digital health services create opportunities for gradual growth, positioning Latin America as an emerging market for inclusive fitness platforms.

Market Segmentations:

By Platform

- Android

- iOS

- Other platforms

By Device

- Smartphones

- Tablets

- Wearable devices

By Application

- Exercise and weight loss

- Diet and nutrition

- Activity tracking

- Other applications

By End Use

- Home users

- Rehabilitation centers

- Healthcare providers

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fitness Platform for Disabled market is shaped by key players such as Fitbit, Move United, FitOn, Evolve21, MyFitnessPal, Chair One Fitness, GOFA International, Let’s Go Fitness, Apple, and Exercise Buddy. These companies focus on delivering accessible fitness solutions by integrating adaptive features, personalized workout programs, and advanced digital technologies. Wearable integration, AI-driven coaching, and voice-enabled functionalities are becoming central to enhancing inclusivity for disabled users. Strategic collaborations with healthcare providers, NGOs, and rehabilitation centers are strengthening market presence and expanding user reach. Many players are investing in telehealth integration and adaptive fitness programs tailored for different disabilities, aligning with rising demand for inclusivity in health and wellness. Regional expansion, particularly in Asia-Pacific and North America, remains a priority as companies tap into growing digital health adoption. Intense competition is driving continuous innovation, with differentiation based on accessibility, user engagement, and platform integration across devices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fitbit

- Move United

- FitOn

- Evolve21

- MyFitnessPal

- Chair One Fitness

- GOFA International

- Let’s Go Fitness

- Apple

- Exercise Buddy

Recent Developments

- In February 2025, Fitbit released a firmware update for several models (Charge 6, Inspire 3, Sense 2, Versa 4), introducing new status indicators that display low battery, Bluetooth disconnection, and mode activation.

- In June 2024, Evolve21 was identified among key players in adaptive fitness platforms in global industry reports, recognized for digital solutions supporting people with disabilities.

- In March 2024, FitOn introduced a Senior Fit workout category, designed to support older adults and mobility-impaired individuals with low-impact routines.

- In August 2023, Chair One Fitness launched an On Demand streaming service accessible via iOS, Android, Roku, and web platforms, broadening reach for adaptive workouts.

Report Coverage

The research report offers an in-depth analysis based on Platform, Device, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as demand for inclusive digital fitness platforms continues to grow.

- Smartphones will remain the dominant device, supported by user-friendly accessibility features.

- Wearable devices will gain traction with adaptive tracking for mobility and health monitoring.

- Exercise and weight loss applications will lead adoption, supported by adaptive workout programs.

- Asia-Pacific will show the fastest growth due to rising digital health investments and awareness.

- North America will sustain leadership with advanced healthcare systems and high wearable adoption.

- Europe will benefit from strict accessibility regulations and government-backed digital health programs.

- Telehealth integration will create opportunities for remote coaching and rehabilitation support.

- AI-driven personalization will improve user engagement and drive higher retention in platforms.

- Competition will intensify as companies expand adaptive features and partnerships with healthcare providers.