| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Retail Pharmacy Market Size 2024 |

USD 380,566.14 Million |

| Europe Retail Pharmacy Market, CAGR |

3.19% |

| Europe Retail Pharmacy Market Size 2032 |

USD 489,130.36 Million |

Market Overview

The Europe Retail Pharmacy Market is projected to grow from USD 380,566.14 million in 2024 to an estimated USD 489,130.36 million by 2032, with a compound annual growth rate (CAGR) of 3.19% from 2025 to 2032. This steady expansion reflects the sector’s resilience and adaptation to evolving consumer needs and healthcare trends across the continent.

Key drivers of this growth include the increasing prevalence of chronic diseases, the aging population, and the rising demand for over-the-counter (OTC) medications. Additionally, the integration of digital services and e-commerce platforms has enhanced accessibility and convenience for consumers, further fueling market expansion.

Geographically, the market is influenced by varying regulatory environments and healthcare infrastructures across European countries. Major players such as Boots, McKesson Europe, and Phoenix Pharmahandel lead the market, with Boots particularly prominent in the UK. The competitive landscape is characterized by both established chains and emerging e-pharmacies, reflecting a dynamic and evolving retail pharmacy sector in Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Retail Pharmacy Market is projected to grow from USD 380,566.14 million in 2024 to USD 489,130.36 million by 2032, with a CAGR of 3.19% from 2025 to 2032.

- The Global Retail Pharmacy Market is expected to grow from USD 14,45,920.00 million in 2024 to USD 19,65,958.05 million by 2032, at a CAGR of 3.92% from 2025 to 2032.

- Key drivers of market growth include the increasing prevalence of chronic diseases, an aging population, and the rising demand for over-the-counter (OTC) medications.

- The integration of digital services, e-commerce platforms, and online pharmacies has enhanced accessibility, providing convenience and contributing to market expansion.

- Regulatory challenges and varying healthcare infrastructures across different European countries may slow down market growth, particularly in regions with less advanced healthcare systems.

- Western Europe remains the largest market segment, with countries like Germany, the UK, and France leading the demand for both prescription drugs and OTC medications.

- The growing trend of digital health solutions, including telemedicine and e-pharmacies, is reshaping the retail pharmacy landscape, offering new opportunities for growth.

- Emerging markets in Eastern and Southern Europe are experiencing steady growth, with rising consumer demand for medications and healthcare services, particularly through digital platforms.

Report Scope

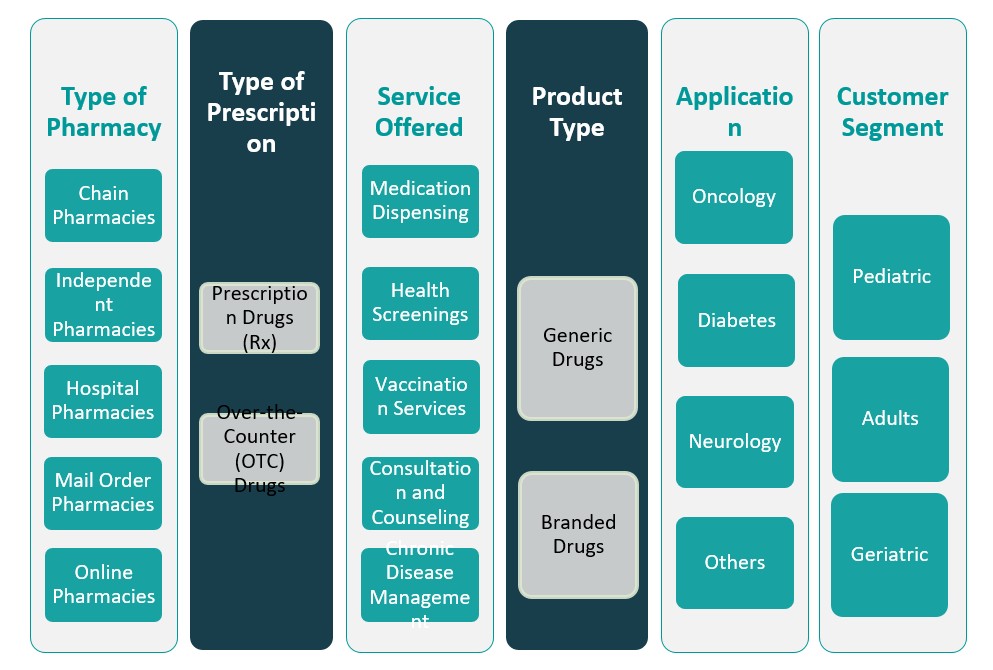

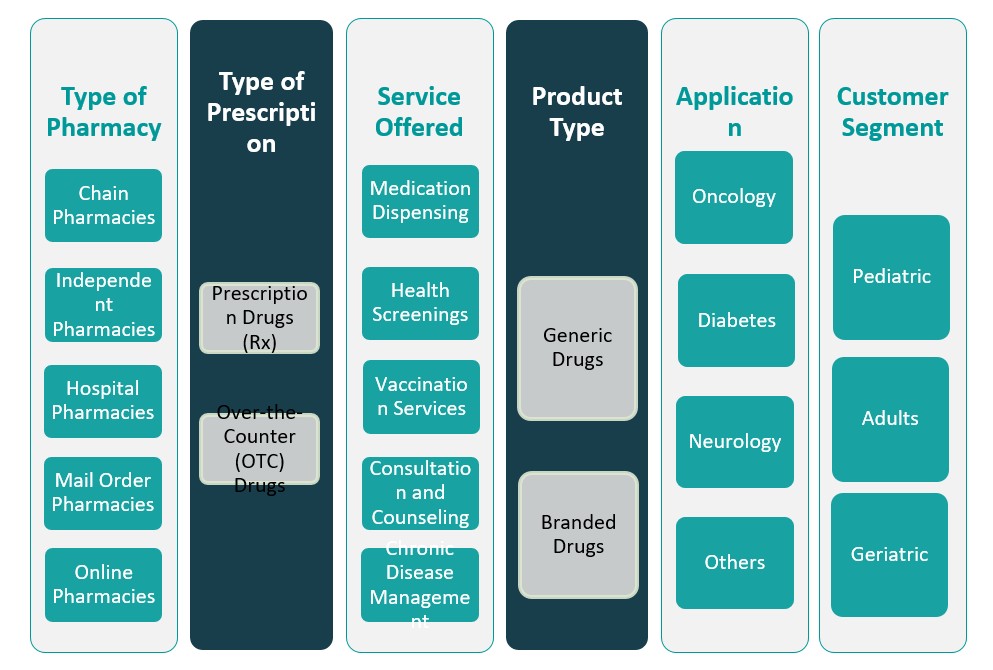

This report segments the Europe Retail Pharmacy Market as follows:

Market Drivers

Technological Advancements and E-commerce Integration

The adoption of digital health technologies and the integration of e-commerce platforms are transforming the Europe retail pharmacy market. Over the past few years, pharmacies have increasingly incorporated online services, enabling consumers to purchase medications, health products, and prescription refills from the comfort of their homes. E-pharmacies and digital platforms have made access to medications and healthcare information more convenient and efficient, improving overall consumer experience. Additionally, technological advancements have allowed pharmacies to enhance their service offerings, with many now providing services such as online consultations, personalized medication management, and health tracking apps. The growth of mobile health apps, telemedicine services, and digital prescriptions is increasingly appealing to tech-savvy European consumers who value convenience and immediate access to healthcare products and services. The ongoing digitalization of the pharmacy industry is expected to drive further market growth, particularly as the consumer demand for seamless, online healthcare services continues to rise.

Shift Towards Preventive Healthcare and Self-care

There is a growing emphasis on preventive healthcare and self-care across Europe, driven by increased awareness of the importance of early intervention and disease prevention. Consumers are becoming more proactive about their health and wellness, seeking information and products to prevent illnesses rather than just treat them. This shift is being fueled by public health campaigns, access to health information through digital platforms, and increased availability of preventive medications and supplements in retail pharmacies. For example, over-the-counter vitamins, dietary supplements, and lifestyle-related health products are becoming increasingly popular among consumers in Europe. Retail pharmacies have adapted by expanding their product ranges to include preventive care products, such as supplements, wellness kits, and home diagnostic tools, in addition to traditional medications. This trend towards self-care and preventive healthcare is expected to continue, further strengthening the retail pharmacy market’s growth as pharmacies align their services and offerings with consumer desires for better health management.

Aging Population and Increasing Healthcare Needs

The aging population in Europe is a significant driver of growth in the retail pharmacy market. As of 2023, over 95 million individuals in Europe were aged 65 and older, with Germany and Italy hosting the largest numbers of elderly citizens. This demographic group often faces chronic conditions such as diabetes, hypertension, and arthritis, which require ongoing management through medication and health consultations. A key example includes the increasing need for treatments targeting conditions like cardiovascular diseases and arthritis, which are prevalent among this age group. Retail pharmacies have addressed this by offering medication dispensing, chronic disease management services, and preventive healthcare solutions tailored to meet the needs of aging individuals.

Growth of Chronic Diseases and Health Conditions

The increasing prevalence of chronic diseases such as diabetes, heart disease, and respiratory conditions is another primary driver for the Europe retail pharmacy market. According to the European Chronic Disease Alliance, millions of people across the region require daily or weekly medication regimens to manage their health. For instance, diabetes management often necessitates regular glucose monitoring and insulin therapy, while respiratory conditions require asthma inhalers and nebulizers. Retail pharmacies are expanding their services to support these needs, offering blood pressure monitoring programs, vaccinations, and more accessible health consultations. The integration of digital tools such as telemedicine platforms has further enhanced their role in helping patients manage chronic conditions effectively.

Market Trends

Rise of Personalized and Tailored Health Services

Personalized and tailored health services are becoming an important trend in the Europe Retail Pharmacy Market. Consumers are increasingly seeking healthcare solutions that are individualized to their specific needs, prompting pharmacies to offer more customized services. This trend is reflected in the growing popularity of personalized medication management, where pharmacists provide tailored advice on drug regimens based on a patient’s health history, genetics, and lifestyle. Additionally, many pharmacies are offering personalized wellness consultations and health assessments, often integrating technology such as health monitoring devices and mobile apps. This trend is driven by consumers’ desire for more tailored healthcare experiences, as well as the growing recognition that individualized care can lead to better health outcomes. Furthermore, some pharmacies are providing specialized services, such as vaccination clinics, smoking cessation programs, and chronic disease management, all of which are personalized to the patient’s needs. The shift towards personalized healthcare is a major trend that is reshaping the role of retail pharmacies in Europe, offering more value-added services that go beyond traditional product dispensing.

Emphasis on Sustainability and Eco-friendly Practices

Sustainability is a rising trend within the Europe Retail Pharmacy Market, with more pharmacies incorporating eco-friendly practices into their operations. Consumers are becoming increasingly aware of the environmental impact of their purchases, and as a result, they are seeking retailers who prioritize sustainability. Retail pharmacies are responding to this demand by implementing a range of environmentally friendly initiatives, including the reduction of plastic packaging, the promotion of eco-friendly health products, and the use of recyclable or biodegradable materials. Some pharmacies are also offering refill stations for certain health and beauty products, allowing customers to reduce waste and minimize their carbon footprint. Furthermore, the adoption of sustainable practices extends to energy-efficient operations, waste management systems, and even promoting the use of plant-based and natural products. In line with growing consumer awareness about climate change and sustainability, pharmacies are aligning themselves with eco-conscious values, reinforcing their commitment to both health and the environment. This trend is expected to gain momentum, as both consumers and pharmacies become more focused on sustainability in the coming years.

Expansion of Online Pharmacies and Digital Platforms

One of the most significant current trends in the Europe Retail Pharmacy Market is the rapid growth of online pharmacies and the integration of digital platforms. For instance, during the COVID-19 pandemic, e-pharmacies in Europe reported a surge in demand, with some platforms experiencing a 150% increase in online prescription orders. E-pharmacies are now offering services such as home delivery, online prescription refills, and telemedicine consultations, which have significantly transformed the way patients interact with pharmacies. This digital shift is accelerated by the growing acceptance of telehealth services, driven by both the pandemic and the increasing digitalization of healthcare. Online pharmacies not only meet the needs of a tech-savvy consumer base but also enable pharmacies to expand their customer reach beyond geographical limitations. Furthermore, many traditional brick-and-mortar pharmacies are adopting hybrid models, offering both in-store services and e-commerce options to cater to diverse customer preferences. This trend toward digitalization is set to continue growing, with more pharmacies expected to invest in e-commerce platforms and mobile apps to enhance the customer experience and streamline operations.

Increase in Health and Wellness Offerings

Retail pharmacies across Europe are increasingly expanding their offerings to cater to the growing consumer demand for health and wellness products. For example, sales of vitamins and supplements in European pharmacies have grown by approximately 20% over the past year. Beyond prescription medications, many pharmacies are broadening their product lines to include personal care products, fitness aids, and organic or natural remedies. This expansion reflects the shifting consumer preference towards a more holistic approach to health, emphasizing prevention and overall well-being rather than just treating illnesses. Retail pharmacies are tapping into this trend by providing products that support immune health, weight management, stress relief, and mental well-being, addressing concerns that go beyond the traditional scope of pharmacy services. Pharmacies are also focusing on offering personalized health advice and customized wellness plans to meet the diverse needs of consumers. With the increasing popularity of self-care and preventive healthcare, pharmacies are positioning themselves as comprehensive health hubs, catering not only to patients seeking medications but also to those who wish to maintain a healthy lifestyle.

Market Challenges

Regulatory Compliance and Policy Changes

One of the significant challenges facing the Europe Retail Pharmacy Market is the complexity of regulatory compliance. Pharmacy operations in Europe are subject to a wide array of laws and regulations, which vary across countries within the region. These regulations govern the sale of pharmaceuticals, including pricing, advertising, and the dispensing of medications. Additionally, pharmacies must comply with stringent standards related to product safety, health data privacy, and controlled substances. As regulations evolve, retail pharmacies must continuously adapt to new rules, which can be both time-consuming and costly. The challenge is particularly pronounced in countries with differing regulatory frameworks, which adds a layer of complexity for pharmacies operating across borders or in multiple jurisdictions. The European Union’s evolving pharmaceutical laws and directives, as well as local government policies, impact various aspects of pharmacy operations, including reimbursement policies, pricing transparency, and drug approval processes. For instance, the implementation of the General Data Protection Regulation (GDPR) in 2018 required pharmacies to overhaul their data management systems to ensure compliance, leading to significant operational costs. Furthermore, the introduction of new regulations concerning e-pharmacy services, data protection, and the sale of over-the-counter medications online presents challenges in terms of compliance and operational adjustments. Retail pharmacies are thus required to constantly monitor and adapt to regulatory changes, which can incur significant compliance costs and affect business strategy.

Intense Competition and Margin Pressure

Intense competition within the European retail pharmacy market is another major challenge. With numerous players operating in the market, both traditional brick-and-mortar stores and online pharmacies, the competitive landscape has become highly fragmented. Established pharmacy chains, such as Boots and Walgreens, face competition from local independent pharmacies as well as growing e-pharmacy platforms that offer convenience and lower prices. The rise of online pharmacies, particularly following the COVID-19 pandemic, has further intensified the pressure on traditional retail pharmacies to innovate and offer more value to consumers. This heightened competition, combined with price sensitivity among consumers, has led to significant margin pressure for many pharmacy retailers. Consumers are increasingly comparing prices across both physical stores and e-pharmacies, demanding lower costs for medications and healthcare products. As a result, pharmacies must find ways to optimize operational efficiencies, reduce costs, and differentiate their offerings without compromising quality or service. This has led to a growing emphasis on providing added services, such as personalized health consultations, wellness programs, and home delivery options, in an effort to maintain customer loyalty and justify higher prices. Additionally, the increasing use of generics and the growing trend of consumers opting for self-care products over prescription medications further squeezes profit margins for pharmacies. As the competitive landscape continues to evolve, pharmacies must adapt quickly to stay relevant and maintain profitability.

Market Opportunities

Growth of E-commerce and Digital Health Solutions

The increasing demand for e-commerce and digital health solutions presents a significant opportunity for the Europe Retail Pharmacy Market. As consumer preferences shift towards online shopping for convenience, pharmacies have the chance to expand their digital presence. E-pharmacies, offering home delivery of medications, over-the-counter products, and personalized health services, are gaining traction among tech-savvy consumers. By adopting e-commerce platforms and integrating digital tools like telemedicine consultations, virtual health assessments, and mobile health apps, retail pharmacies can attract a broader customer base. This trend is particularly beneficial in reaching rural or underserved areas where access to physical pharmacies may be limited. Moreover, the integration of artificial intelligence (AI) and machine learning into pharmacy operations offers opportunities to enhance the customer experience, such as through personalized recommendations, real-time inventory management, and automated prescriptions. The growing trend of digital health is further supported by the EU’s digital health initiatives, which encourage innovation in healthcare delivery. Retail pharmacies that embrace these digital advancements can not only cater to changing consumer preferences but also streamline operations, reduce overhead costs, and improve customer satisfaction.

Expansion into Preventive Healthcare and Wellness Products

The rising consumer interest in preventive healthcare and wellness products offers a prime opportunity for retail pharmacies in Europe. As consumers become more health-conscious and proactive about maintaining their well-being, pharmacies have the chance to diversify their product offerings beyond traditional pharmaceuticals. By expanding into the wellness segment, including vitamins, supplements, fitness aids, and organic health products, pharmacies can tap into a growing market. Additionally, pharmacies can offer personalized wellness services, such as dietary consultations, weight management programs, and stress relief therapies, further positioning themselves as holistic health hubs. This trend aligns with the broader shift toward self-care and preventive healthcare, with consumers increasingly seeking products and services that promote long-term health and disease prevention. Retail pharmacies that capitalize on this trend can drive revenue growth while strengthening their role in overall health management, thereby enhancing customer loyalty and capturing a broader market segment.

Market Segmentation Analysis

By Type of Pharmacy

The retail pharmacy market in Europe is dominated by chain pharmacies, which have extensive networks and benefit from economies of scale, leading to a larger market share. Chain pharmacies are able to offer a wide range of services and products at competitive prices, which appeals to a broad consumer base. Independent pharmacies, on the other hand, cater to a more localized market, offering personalized services and building strong customer relationships. Hospital pharmacies serve a critical function within healthcare institutions, providing medications and pharmaceutical services to hospitalized patients. Mail order pharmacies are gaining traction due to their convenience and ability to serve patients remotely, while online pharmacies have seen rapid growth, driven by the increasing demand for e-commerce, offering home delivery and digital consultations. Each type of pharmacy plays a distinct role in the overall market, contributing to its diversity.

By Type of Prescription

The retail pharmacy market is split between prescription drugs (Rx) and over-the-counter (OTC) drugs. Prescription drugs represent a significant share of the market, as they are essential for managing chronic conditions and acute illnesses. The demand for these drugs is influenced by factors such as the aging population and the prevalence of chronic diseases. OTC drugs, which are available without a prescription, cater to a broader customer base and cover a wide range of products including pain relievers, cold medications, and dietary supplements. OTC drugs are increasingly favored due to the convenience of purchasing them without needing a doctor’s prescription.

Segments

Based on Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

Based on Type of prescription

- Prescription Drugs (Rx)

- Over-the-Counter (OTC) Drugs

Based on Service offered

- Medication Dispensing

- Health Screenings

- Vaccination Services

- Consultation and Counseling

- Chronic Disease Management

Based on Product Type

- Generic Drugs

- Branded Drugs

Based on Application

- Oncology

- Diabetes

- Neurology

- Others

Based on Customer

- Paediatric

- Adults

- Geriatric

Based on Region

- Western Europe

- Southern Europe

- Eastern Europe

- Northern Europe

- Central Europe

Regional Analysis

Western Europe (60%)

Western Europe holds the largest share of the Europe Retail Pharmacy Market, accounting for approximately 60% of the total market share. Key countries such as Germany, France, the UK, and the Netherlands dominate this region. These countries benefit from well-established healthcare systems, high healthcare spending, and a large consumer base with a high demand for both prescription and over-the-counter (OTC) drugs. The adoption of digital health technologies, such as e-pharmacies and online consultation services, has further accelerated market growth in this region. The growing elderly population in countries like Germany and France, combined with high rates of chronic diseases, contributes to a robust demand for pharmaceutical products and services. Western Europe also leads in regulatory advancements and healthcare innovations, making it a key region for both pharmaceutical companies and retail pharmacies.

Southern Europe (15%)

Southern Europe represents approximately 15% of the Europe Retail Pharmacy Market. Countries such as Italy, Spain, and Greece are the primary contributors to this region’s market share. The market is growing steadily due to a rising middle class, increasing health awareness, and the growing adoption of pharmacy-based health services. However, Southern European countries face challenges such as economic instability, which can affect consumer spending on non-essential medications and services. Despite this, retail pharmacies are capitalizing on the demand for preventive healthcare products, over-the-counter drugs, and personalized health services. The trend toward digital health solutions is also gaining momentum in this region, contributing to market growth.

Key players

- CVS Health

- Boots Walgreens

- Cigna

- Walmart

- Kroger

Competitive Analysis

The Europe Retail Pharmacy Market is highly competitive, with several key players dominating the landscape. CVS Health, a global leader in healthcare services and retail pharmacy, offers a vast product portfolio and extensive pharmacy services, strengthening its position in both the U.S. and Europe. Boots Walgreens, a prominent European pharmacy chain, benefits from its widespread presence across multiple countries and its strong brand recognition. Cigna, a major health insurance company, is making strides in the retail pharmacy space by integrating pharmacy benefits with its healthcare services, offering additional convenience to customers. Walmart and Kroger, known for their large retail operations, are increasingly expanding their pharmacy services to include wellness products, health consultations, and e-commerce options. These companies focus on offering competitive pricing, expanding service offerings, and embracing digital health solutions to maintain their market share and cater to evolving consumer demands.

Recent Developments

- As of March 31, 2024, Apollo Pharmacy operated 6,030 stores across approximately 1,200 cities and towns in 22 states and 5 union territories. The company continues to expand its digital healthcare platform, offering services like online medicine delivery and virtual doctor consultations.

- In October 2024, Caring Pharmacy Retail Management Sdn Bhd, a 75%-owned unit of 7-Eleven Malaysia Holdings Bhd, announced acquisitions of equity interest and business assets in several pharmaceutical outlets for a combined cash consideration of RM48.86 million.

- In June 2024, the Australian Competition and Consumer Commission (ACCC) expressed concerns that the proposed acquisition of Chemist Warehouse by Sigma Healthcare could substantially lessen competition in pharmacy retailing, potentially leading to higher prices and reduced service quality.

- In January 2025, Watsons Philippines ended 2024 with 1,166 stores, expanding its community pharmacy format. The company opened more than 50 stores outside of Metro Manila.

Market Concentration and Characteristics

The Europe Retail Pharmacy Market is moderately concentrated, with a few dominant players holding significant market shares, while numerous regional and independent pharmacies also contribute to the overall market dynamics. Large pharmacy chains, such as CVS Health, Boots Walgreens, and Walmart, dominate the market, benefiting from their extensive networks, brand recognition, and economies of scale. These players offer a wide range of products and services, including prescription medications, over-the-counter (OTC) drugs, and wellness products, along with growing e-commerce capabilities. However, independent pharmacies and smaller regional players remain competitive by offering personalized services, fostering strong local customer relationships, and focusing on niche healthcare needs. Additionally, the market is characterized by a trend towards digitalization, with a growing number of pharmacies integrating e-pharmacy platforms and telemedicine services to enhance customer convenience and expand their reach. This combination of large chains and independent players creates a dynamic, competitive environment where service differentiation and customer experience are key factors in maintaining market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmacy, Type of prescription, Service offered, Product Type, Application, Customer and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The integration of e-pharmacy platforms and digital health services will continue to grow, offering greater accessibility for consumers. Online pharmacies will play an increasingly critical role in shaping the market, driven by the demand for convenience and remote healthcare services.

- Preventive healthcare products and services will experience significant growth as consumers focus more on health management. Pharmacies will expand their wellness offerings, such as dietary supplements, health screenings, and personalized health consultations.

- The aging population in Europe will continue to drive the demand for chronic disease management and age-related medications. Retail pharmacies will need to adapt their services to meet the healthcare needs of the elderly, offering specialized products and care.

- As chronic conditions such as diabetes, cardiovascular diseases, and respiratory issues rise, pharmacies will increasingly offer chronic disease management services. This will include medication management, health monitoring, and personalized consultations for better disease control.

- The rise of telehealth and remote consultations will influence pharmacy services, allowing consumers to access healthcare advice and prescriptions digitally. Pharmacies will integrate these services to enhance customer convenience and improve healthcare access.

- As the market evolves, stricter regulations regarding the sale of pharmaceuticals, e-commerce practices, and data protection will be implemented. Retail pharmacies will need to navigate these regulations to ensure compliance and minimize operational disruptions.

- Retail pharmacies will diversify their product offerings to include more health and wellness products, from supplements to home healthcare devices. This diversification will help pharmacies tap into the growing self-care market and broaden their revenue streams.

- Strategic partnerships, mergers, and acquisitions will increase as players seek to expand market share and enhance service offerings. Large pharmacy chains will collaborate with technology firms and healthcare providers to offer integrated health solutions.

- Sustainability efforts will become increasingly important, with pharmacies focusing on reducing waste, using eco-friendly packaging, and promoting environmentally friendly products. Consumer demand for sustainable practices will drive pharmacies to implement greener solutions.

- As e-pharmacies gain traction, traditional brick-and-mortar pharmacies will face intensified competition. To stay competitive, physical pharmacies will invest in digital capabilities, offering integrated services that combine both in-store and online experiences for consumers.