Market overview

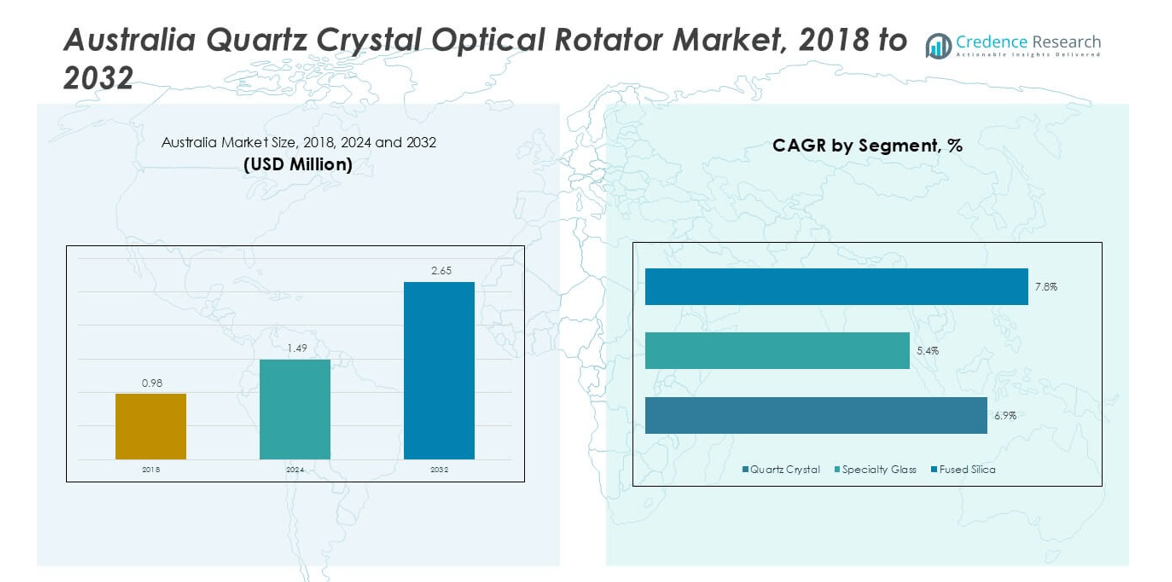

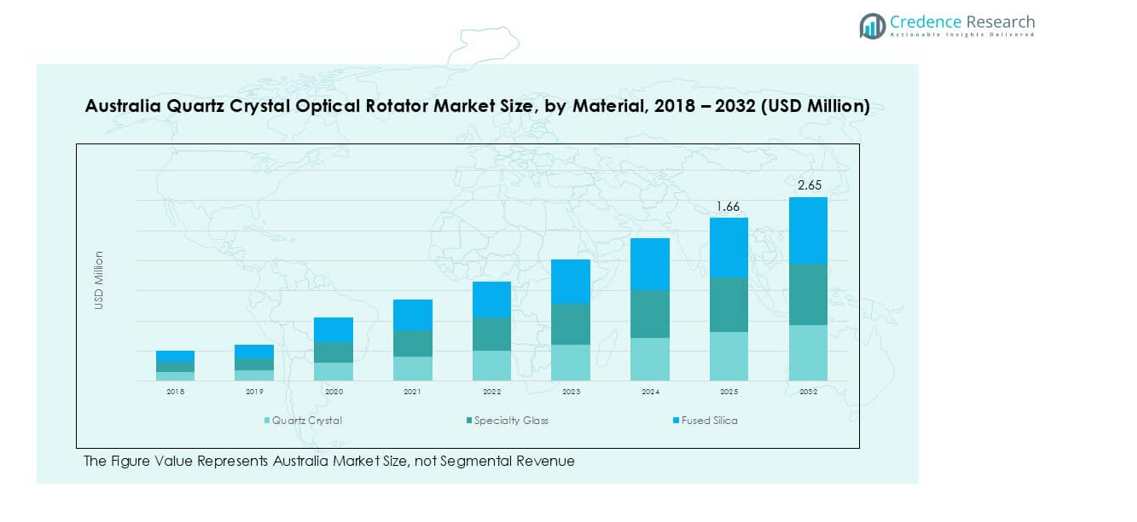

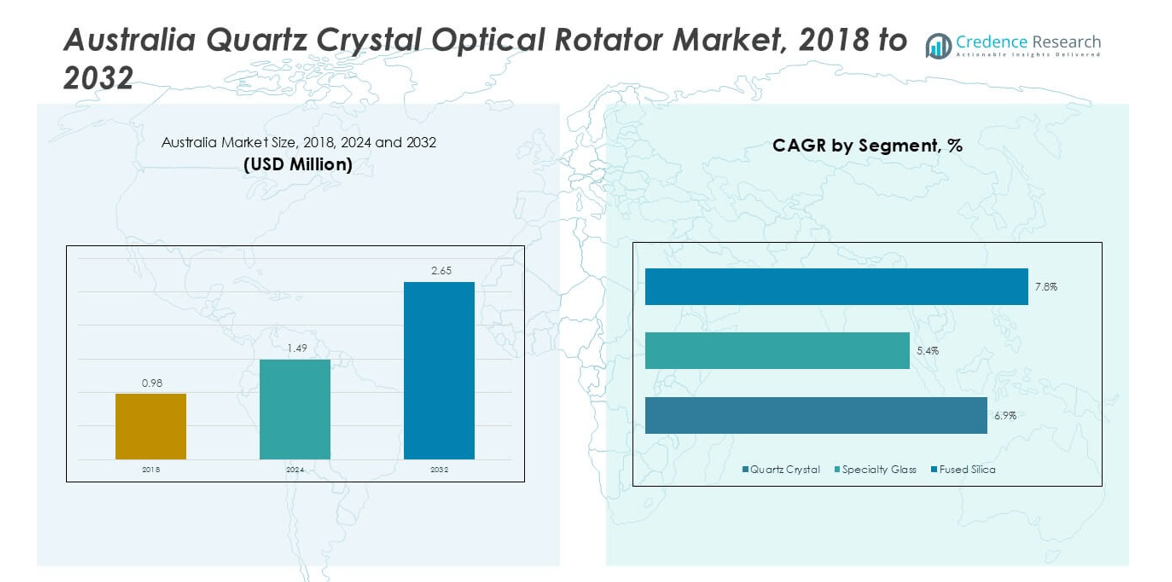

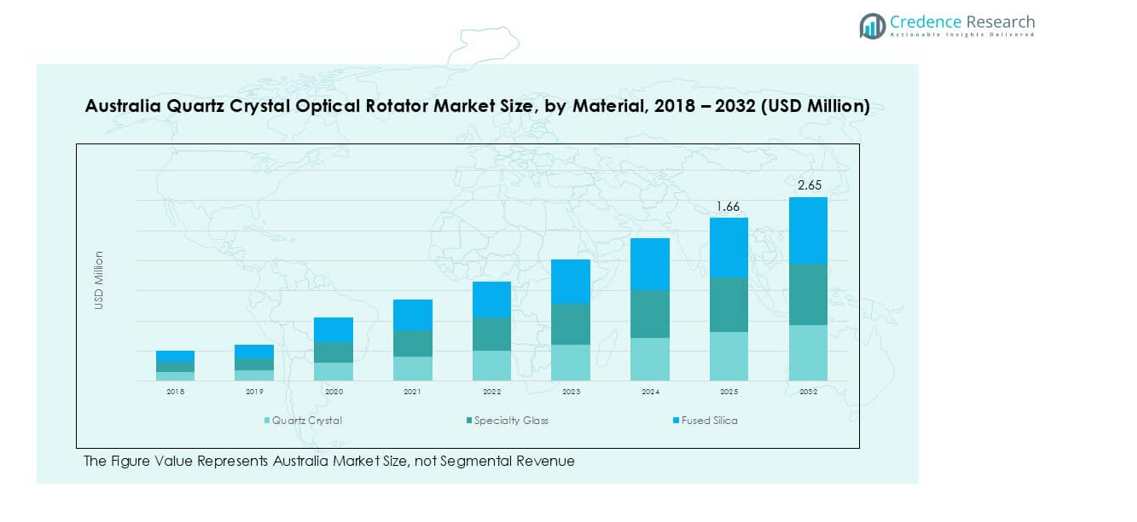

The Australia Quartz Crystal Optical Rotator market size was valued at USD 0.98 million in 2018 and increased to USD 1.49 million in 2024. It is anticipated to reach USD 2.65 million by 2032, growing at a CAGR of 6.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Quartz Crystal Optical Rotator Market Size 2024 |

USD 1.49 million |

| Australia Quartz Crystal Optical Rotator Market, CAGR |

6.90% |

| Australia Quartz Crystal Optical Rotator Market Size 2032 |

USD 2.65 million |

The Australia Quartz Crystal Optical Rotator market is led by key players including Crystal Innovations Ltd, Crystal Dynamics Inc, Optical Engineering Dynamics LLC, OpticaQuartz Solutions LLC, Quartz Precision Instruments Inc, CrystalPro Technologies LLC, CrystalOptics Group Inc, Advanced Photonics Corporation, SpectraQuartz Corporation, and LuminaOptics Inc. These companies strengthen their market positions through advanced product development, collaborations with telecom providers, and investments in photonics research. Regionally, New South Wales leads with a 32% market share in 2024, driven by strong telecommunications infrastructure and research institutions. Victoria follows with 27% share, supported by its growing biomedical sector and industrial automation projects. Queensland, Western Australia, and South Australia together contribute the remaining share, highlighting steady demand from research, healthcare, and niche industrial applications. This regional concentration ensures that eastern states remain the core hubs for growth in the Australian market.

Market Insights

- The Australia Quartz Crystal Optical Rotator market was valued at USD 1.49 million in 2024 and is projected to reach USD 2.65 million by 2032, growing at a CAGR of 6.90%.

- Growth is driven by rising demand in telecommunications, where quartz crystal materials dominate with over 55% share, supported by stable performance and wide adoption in high-speed networks.

- Market trends highlight the shift toward variable rotation devices, gaining traction in medical imaging and research, alongside opportunities in photonics integration for defense and quantum technologies.

- The competitive landscape features leading players such as Crystal Innovations Ltd, Crystal Dynamics Inc, OpticaQuartz Solutions LLC, and SpectraQuartz Corporation, focusing on R&D, product precision, and niche application development.

- Regionally, New South Wales leads with 32% share, followed by Victoria at 27%, while Queensland holds 18%, Western Australia 14%, and South Australia with others collectively contribute 9%, reflecting strong eastern dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In 2024, the quartz crystal segment held the dominant share of the Australia Quartz Crystal Optical Rotator market, accounting for over 55% of total revenue. Its leadership is supported by high optical purity, stable performance, and widespread use in precision applications. Quartz crystals are the preferred material for advanced rotators used in telecommunications and medical devices, as they deliver consistent polarization rotation. Specialty glass and fused silica also serve niche applications, offering flexibility and resistance to thermal changes, but quartz remains the most commercially viable driver of growth in this segment.

- For instance, OptiSource offers synthetic single crystal quartz rotators with parallelism ≤ 1 arc second and transmitted wavefront distortion of λ/10 @ 632.8 nm.

By Rotation Type

The fixed rotation segment captured the largest market share in 2024, contributing around 60% of total demand. Fixed rotation devices dominate due to their stable optical properties and broad adoption in cost-sensitive sectors such as industrial automation and research laboratories. Their straightforward design and long operational life make them the standard choice for routine polarization control. Variable rotation devices, while gaining traction, are used mainly in advanced medical imaging and scientific research that require flexible adjustments, but their higher cost limits widespread adoption compared to fixed types.

- For instance, Edmund Optics’ 45° crystalline quartz polarization rotator (12 mm thickness mount) achieves a damage threshold > 10 J/cm² (10 ns pulses) at 1064 nm.

By Application

Telecommunications emerged as the dominant application in 2024, holding nearly 40% of the Australian market share. Growth is driven by the rapid expansion of high-speed fiber optic networks and demand for improved signal transmission quality. Quartz crystal optical rotators are increasingly used to enhance polarization management in optical communication systems, supporting efficient data transfer. Medical imaging follows as a significant growth area, fueled by rising adoption of advanced diagnostic equipment, while industrial automation and scientific research expand steadily. The “others” category, including defense and aerospace, contributes smaller yet specialized demand.

Key Growth Drivers

Expansion of Fiber Optic Telecommunications

The rapid expansion of Australia’s fiber optic infrastructure is a primary driver of the quartz crystal optical rotator market. Increasing demand for high-speed internet, 5G rollouts, and data-intensive applications requires advanced optical components to ensure polarization stability and signal quality. Quartz crystal rotators are critical in minimizing signal distortion and enhancing transmission efficiency across long distances. With the Australian government investing in broadband expansion and private operators upgrading networks, the adoption of high-performance optical devices is accelerating. This growth underpins consistent demand from telecom operators, driving the largest application share in the market.

- For instance, PMOptics’ quartz rotator offers polarization angle rotation tolerance ± 0.1° and parallelism < 30 arc seconds across 240–2100 nm.

Rising Use in Medical Imaging

The medical imaging sector is another major driver, fueled by increasing reliance on advanced diagnostic tools in Australia’s healthcare system. Quartz crystal optical rotators are integrated into imaging equipment such as MRI systems and laser-based diagnostic tools, where precise polarization control is essential. The rise in chronic diseases and aging populations has intensified demand for accurate, high-resolution imaging technologies. Hospitals and diagnostic centers are investing in next-generation optical devices to improve detection accuracy and patient outcomes. This trend positions medical imaging as a high-value growth area, complementing strong adoption in telecommunications.

- For instance, Thorlabs’ Z-cut quartz rotator (diameter 25.4 mm) delivers parallelism ≤ 0.5 arcseconds, surface flatness λ/10 @ 633 nm, and rotation accuracy ±0.5°.

Growth of Industrial Automation and Research Applications

Industrial automation and scientific research sectors are steadily driving adoption of quartz crystal optical rotators. In automated manufacturing and robotics, these devices enable precise optical control for laser-based inspection and measurement systems. Research institutions and universities in Australia also integrate optical rotators into experiments requiring polarization analysis and light modulation. Supportive government funding for advanced R&D projects and emphasis on Industry 4.0 adoption have accelerated deployment. The versatility of quartz crystal rotators in supporting both practical industrial uses and cutting-edge scientific studies ensures steady demand, creating a balanced growth opportunity across diverse user segments.

Key Trends & Opportunities

Shift Toward Variable Rotation Devices

A major trend shaping the market is the growing adoption of variable rotation devices. While fixed rotators dominate, variable types are increasingly sought in applications that demand flexibility, such as medical imaging and research. These devices allow adjustable polarization control, enhancing accuracy and customization in advanced optical systems. Although higher costs limit adoption, technological advancements are gradually improving affordability. This creates an opportunity for manufacturers to innovate in cost-efficient designs, positioning variable devices as a future growth segment in specialized applications where precision and adaptability are essential.

For instance, Thorlabs’ liquid-crystal polarization rotators can continuously rotate the polarization from −90° to +90°, maintain an extinction ratio > 1000:1, and handle laser pulses up to 1.0 J/cm² (532 nm, 10 Hz, 8 ns).

Integration with Emerging Photonics Technologies

Opportunities are also emerging through integration with next-generation photonics technologies. As Australia strengthens its photonics research and advanced manufacturing base, optical rotators are being incorporated into lasers, sensors, and quantum optics platforms. The rise of photonic chips and optical computing further expands the scope for quartz crystal rotators. This integration not only strengthens application in traditional sectors but also opens new possibilities in aerospace, defense, and advanced communication systems. Companies investing in R&D for photonics-enabled solutions stand to capture significant value from this technological convergence.

Key Challenges

High Production Costs

One of the primary challenges for the Australian quartz crystal optical rotator market is high production costs. Manufacturing precision optical devices involves advanced material processing, cutting, and alignment technologies, which raise overall costs. Quartz crystal sourcing and fabrication demand specialized expertise, limiting large-scale cost reduction opportunities. High upfront costs restrict adoption among smaller research labs and cost-sensitive industrial applications, concentrating demand in larger institutions. Unless production efficiencies and material innovations reduce costs, affordability will remain a barrier to broader market penetration.

Competition from Alternative Materials and Technologies

Another challenge is the growing competition from alternative materials and optical technologies. Specialty glass and fused silica, while less dominant, are being optimized for better performance in certain conditions, such as high-temperature or low-cost applications. Additionally, technological advancements in polarization control methods, such as liquid crystal devices or integrated photonic solutions, could reduce reliance on quartz rotators. As these alternatives evolve, quartz crystal devices face pricing and performance pressures. Manufacturers must differentiate through precision, reliability, and application-specific benefits to sustain their competitive edge in a market with rising material and technology substitutions.

Regional Analysis

New South Wales

New South Wales dominated the Australia quartz crystal optical rotator market in 2024, holding 32% market share. The state benefits from its strong base in telecommunications infrastructure and leading research universities driving demand for advanced photonics applications. Sydney’s position as a technology hub further strengthens adoption in both telecom and medical imaging. Growing healthcare investments and industrial automation projects also support higher usage of optical rotators. With strong government support for innovation, New South Wales continues to lead market expansion and remains the primary center for R&D and commercialization of advanced optical technologies.

Victoria

Victoria accounted for 27% market share in 2024, emerging as the second-largest region in the quartz crystal optical rotator market. The state’s concentration of biomedical research centers and hospitals has driven adoption of optical devices in medical imaging applications. Melbourne’s growing role in advanced manufacturing and automation technologies further supports demand from industrial sectors. Research institutions in Victoria are increasingly focusing on photonics, creating opportunities for specialized optical components. With both healthcare and industrial applications expanding, Victoria represents a key growth market, complementing New South Wales’ dominance while showing strong momentum in applied technology deployment.

Queensland

Queensland held 18% market share of the Australia quartz crystal optical rotator market in 2024, supported by demand from industrial automation and scientific research. The state has a growing research ecosystem, with universities integrating advanced optical components into photonics and quantum technology programs. Expanding fiber optic networks in Brisbane and other urban centers further enhance adoption in telecommunications. The state’s growing aerospace and defense activities also open opportunities for specialized optical applications. With increasing investments in research and advanced technologies, Queensland is steadily strengthening its presence, though it trails behind New South Wales and Victoria in overall market size.

Western Australia

Western Australia contributed 14% market share to the national quartz crystal optical rotator market in 2024. The region’s demand is largely driven by scientific research and industrial automation in mining operations. Universities in Perth are also investing in photonics research, integrating optical components for precision studies. While telecommunications and healthcare demand is smaller compared to eastern states, the industrial sector’s need for optical control systems supports steady adoption. Government funding toward research innovation and digital transformation in resource industries is expected to maintain market relevance. Western Australia remains a niche but important region in the overall market.

South Australia and Others

South Australia, along with smaller regions including Tasmania and the Northern Territory, collectively accounted for 9% market share in 2024. Demand is concentrated in research institutions, defense applications, and limited industrial use. South Australia’s growing defense and aerospace sector provides opportunities for optical rotators in specialized systems. While overall adoption remains smaller compared to larger states, initiatives in photonics research and niche applications ensure steady though limited growth. These regions act as supplementary markets, supporting national demand through targeted applications rather than broad-scale adoption, but contribute to the overall technological diversity of the Australian market.

Market Segmentations:

By Material

- Quartz Crystal

- Specialty Glass

- Fused Silica

By Rotation Type

- Fixed Rotation

- Variable Rotation

By Application

- Telecommunications

- Medical Imaging

- Industrial Automation

- Scientific Research

- Others

By Geography

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia and Others

Competitive Landscape

The competitive landscape of the Australia Quartz Crystal Optical Rotator market is characterized by the presence of leading players such as Crystal Innovations Ltd, Crystal Dynamics Inc, Optical Engineering Dynamics LLC, OpticaQuartz Solutions LLC, Quartz Precision Instruments Inc, CrystalPro Technologies LLC, CrystalOptics Group Inc, Advanced Photonics Corporation, SpectraQuartz Corporation, and LuminaOptics Inc. These companies compete through advanced product portfolios, strong R&D capabilities, and strategic collaborations with research institutions and telecom providers. Market leaders focus on precision engineering and innovations in variable rotation devices to serve specialized applications in telecommunications, medical imaging, and scientific research. Smaller firms emphasize niche applications and customized solutions, particularly for industrial automation and defense projects. Competitive intensity is heightened by ongoing technological advancements in photonics and increasing demand for high-quality optical components across diverse sectors. Players are also pursuing partnerships and geographic expansion strategies to strengthen their presence in a growing but highly specialized Australian market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crystal Innovations Ltd

- Crystal Dynamics Inc

- Optical Engineering Dynamics LLC

- OpticaQuartz Solutions LLC

- Quartz Precision Instruments Inc

- CrystalPro Technologies LLC

- CrystalOptics Group Inc

- Advanced Photonics Corporation

- SpectraQuartz Corporation

- LuminaOptics Inc

Recent Developments

- In June 2025, major showcasing of advanced photonics and optical systems occurred at the Laser World of Photonics event, featuring innovations relevant to high-precision optical manipulation.

Report Coverage

The research report offers an in-depth analysis based on Material, Rotation Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand from fiber optic telecommunications.

- Medical imaging adoption will rise as healthcare invests in advanced diagnostic equipment.

- Industrial automation will continue driving usage in precision optical systems.

- Variable rotation devices will gain more traction in research and medical applications.

- Photonics integration will create new opportunities in defense and quantum technologies.

- Research institutions will strengthen demand through advanced optical experiments and studies.

- Competition will intensify as players innovate in cost-efficient and high-precision devices.

- Regional growth will remain highest in New South Wales and Victoria.

- Emerging applications in aerospace and scientific research will broaden market scope.

- Long-term growth will depend on reducing production costs and improving accessibility.