Market overview

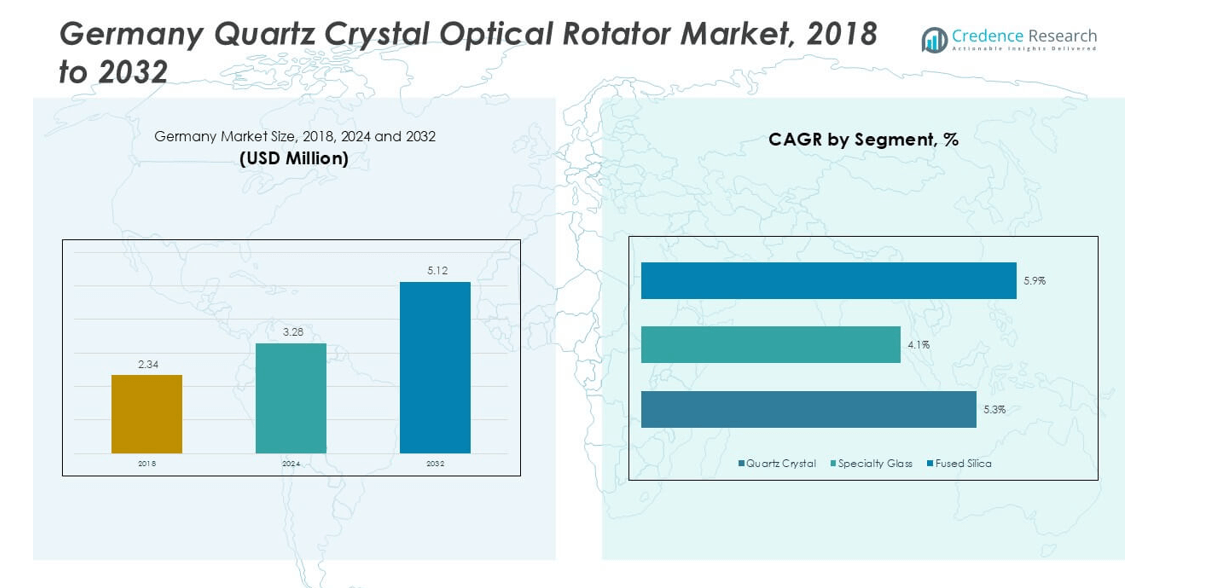

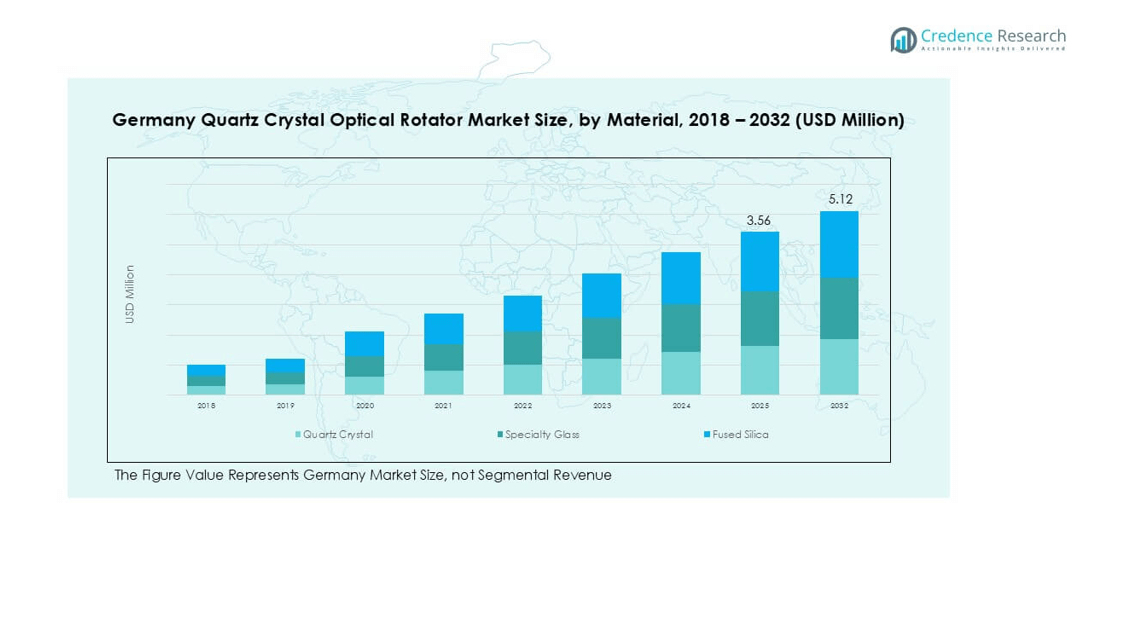

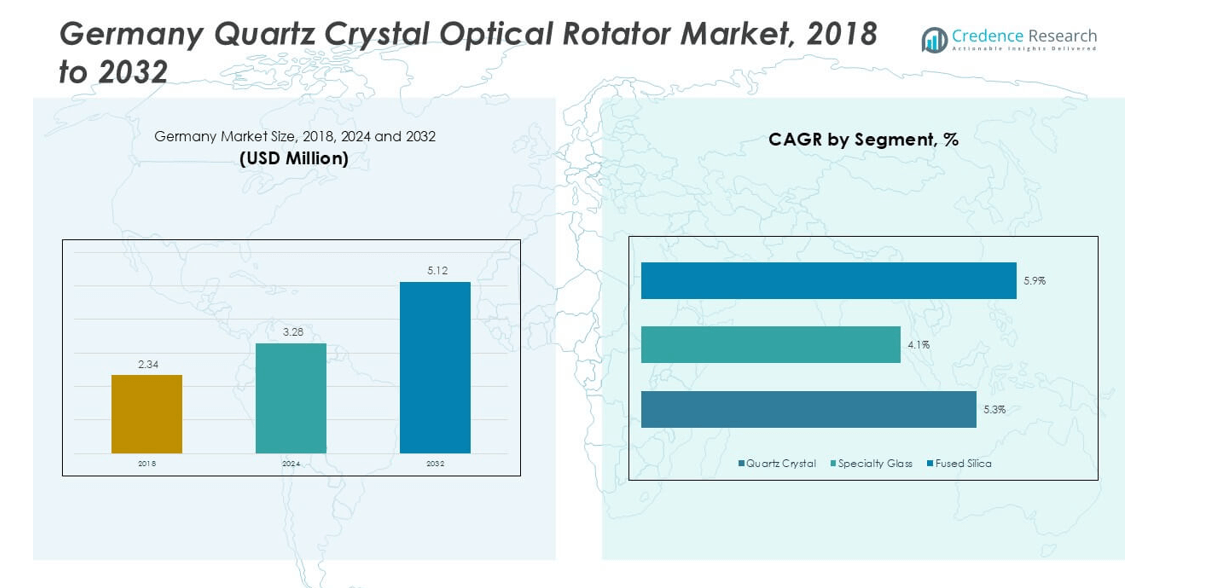

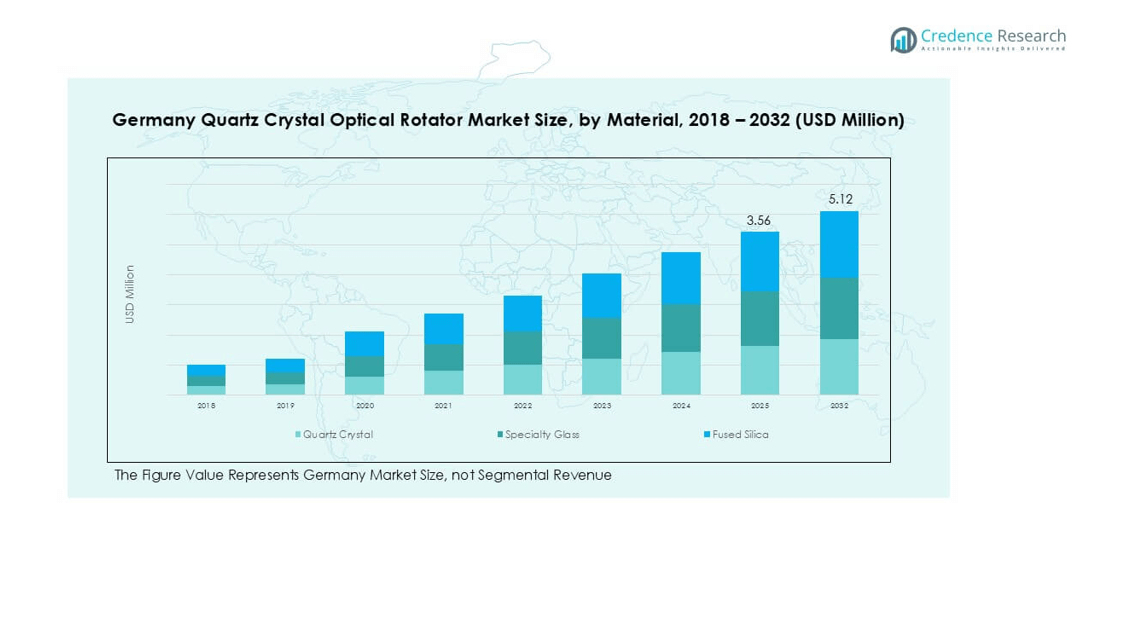

The Germany Quartz Crystal Optical Rotator market size was valued at USD 2.34 million in 2018 and increased to USD 3.28 million in 2024. It is anticipated to reach USD 5.12 million by 2032, growing at a CAGR of 5.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Quartz Crystal Optical Rotator Market Size 2024 |

USD 3.28 million |

| Germany Quartz Crystal Optical Rotator Market, CAGR |

5.31% |

| Germany Quartz Crystal Optical Rotator Market Size 2032 |

USD 5.12 million |

The Germany Quartz Crystal Optical Rotator market is shaped by leading players including Crystal Innovations Ltd, OpticaQuartz Solutions LLC, Optical Engineering Dynamics LLC, Quartz Precision Instruments Inc, SpectraQuartz Corporation, QuartzWave Technologies LLC, Spectral Optics Corp, Visionary Photonics Inc, Optical Quartz Ltd, and Deltronic Crystal Industries. These companies compete through advanced product portfolios, R&D investments, and strategic collaborations across telecommunications, medical imaging, and industrial automation. Regionally, North Germany leads with 32% market share in 2024, supported by strong telecom infrastructure and research activity, while South Germany follows with 28%, driven by medical device manufacturing and automation industries. West Germany accounts for 24% share, benefiting from industrial and commercial hubs, and East Germany holds 16%, with steady growth fueled by research institutions and photonics innovation. This competitive and regionally diverse structure highlights both established dominance and emerging growth opportunities.

Market Insights

- The Germany Quartz Crystal Optical Rotator market was valued at USD 3.28 million in 2024 and is projected to reach USD 5.12 million by 2032, growing at a CAGR of 5.31%.

- Growth is driven by rising demand in telecommunications and medical imaging, where quartz crystal holds over 55% share by material due to its high optical purity and stability.

- Market trends highlight integration with advanced photonic systems and increasing adoption in industrial automation and scientific research, supported by Germany’s Industry 4.0 initiatives.

- Competition is defined by companies such as Crystal Innovations Ltd, OpticaQuartz Solutions LLC, and Quartz Precision Instruments Inc, which focus on innovation, cost efficiency, and strategic partnerships.

- Regionally, North Germany leads with 32% share, followed by South Germany at 28%, West Germany at 24%, and East Germany at 16%, with telecommunications accounting for nearly 40% share by application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The quartz crystal segment dominated the Germany quartz crystal optical rotator market in 2024, accounting for more than 55% share. Its leadership is driven by high optical purity, excellent birefringence, and thermal stability, making it ideal for precision applications in optics and photonics. Specialty glass holds a steady position, supported by its lower cost and adaptability in laboratory research, while fused silica is gaining ground in high-performance laser systems due to its durability and resistance to radiation. The consistent demand for quartz crystal ensures continued leadership throughout the forecast period.

- For instance, PMOptics offers crystalline quartz rotators with a polarization angle tolerance of ±0.1° and parallelism of < 30 arcseconds, optimized for specific laser wavelengths within the 240–2100 nm range.

By Rotation Type

Fixed rotation emerged as the leading segment with over 60% market share in 2024, reflecting strong adoption in standardized optical systems across telecommunications and medical devices. Its reliability and low-maintenance design make it preferred for stable polarization control in high-frequency and long-duration applications. Variable rotation is expanding, driven by scientific research and advanced imaging where flexibility and fine-tuning are required. However, the dominance of fixed rotation is sustained by large-scale integration into telecom networks and diagnostic instruments, where consistent performance and reduced calibration requirements remain critical growth drivers.

- For instance, Edmund Optics offers crystalline quartz rotators (45° or 90°) with parallelism < 10 arcseconds and rotation accuracy < 5 arcminutes.

By Application

Telecommunications led the application segment, contributing nearly 40% share in 2024, supported by widespread deployment of optical rotators in fiber optic communication systems for polarization management. Growing bandwidth demand and 5G expansion across Germany drive continuous adoption. Medical imaging follows, fueled by applications in endoscopy and MRI systems that require precise polarization control for high-resolution imaging. Industrial automation and scientific research collectively enhance demand, particularly in laser-based sensing and spectroscopy. Telecommunications remain the key driver, as network upgrades and optical transmission advancements continue to prioritize quartz crystal-based rotators.

Key Growth Drivers

Rising Adoption in Telecommunications Networks

The expansion of Germany’s high-speed internet and 5G networks significantly drives demand for quartz crystal optical rotators. These devices play a critical role in managing polarization within fiber optic communication systems, ensuring high signal quality and reduced transmission losses. With growing reliance on cloud computing, streaming services, and data-intensive applications, telecom providers are increasing investments in optical infrastructure. Quartz crystal rotators offer stability, accuracy, and efficiency in long-distance data transmission. As Germany pushes digitalization through nationwide broadband expansion programs, the integration of quartz crystal optical rotators in telecom networks remains a strong growth catalyst.

- For instance, with Edmund Optics’ 45° crystalline quartz rotator (25.40 mm diameter, parallelism < 10 arcsec, rotation accuracy < 5 arcmin)

Growing Demand in Medical Imaging Applications

Medical imaging systems, including MRI scanners, endoscopy devices, and optical coherence tomography, require precise polarization control to deliver high-resolution images. Quartz crystal optical rotators provide unmatched birefringence and stability, ensuring accuracy in medical diagnostics. In Germany, where healthcare investment continues to rise, adoption of advanced imaging systems supports the increasing use of optical rotators. The aging population and the prevalence of chronic diseases further fuel demand for reliable imaging technologies. Hospitals and research institutions are adopting these components to enhance diagnostic accuracy, driving steady growth of the medical imaging application segment in the country.

- For instance, Simtrum’s quartz polarization rotator offers parallelism < 10 arcsec and damage threshold > 5 J/cm² (20 ns, 20 Hz).

Expansion of Scientific Research and Industrial Automation

Germany’s strong focus on research and innovation in optics, photonics, and industrial automation is a major driver of market growth. Quartz crystal optical rotators are essential in laboratories for spectroscopy, laser experimentation, and advanced photonic studies. In industrial automation, they support laser alignment, sensing, and precision machining, helping improve productivity and quality in manufacturing. Government funding for research in photonics and Germany’s Industry 4.0 initiatives further accelerate adoption. By providing stability and precision under diverse operating conditions, quartz crystal optical rotators strengthen their role in both academic research and industrial applications, contributing significantly to market expansion.

Key Trends & Opportunities

Integration with Advanced Photonic Systems

A major trend in the market is the growing integration of quartz crystal optical rotators with advanced photonic devices such as laser systems, modulators, and optical isolators. As Germany strengthens its leadership in laser technology and photonics, these rotators provide enhanced control and efficiency across applications. Companies are increasingly embedding optical rotators into compact, multifunctional modules to meet demand for miniaturized systems. This trend creates opportunities for suppliers to collaborate with photonics companies in developing integrated solutions for industrial, defense, and scientific applications. The shift toward compact, high-performance optical components is expected to open new revenue streams.

- For instance, in a modern hybrid integrated circulator, thin films of magneto-optic materials, such as cerium-substituted yttrium iron garnet (Ce:YIG), are bonded onto a waveguide platform (like silicon or indium phosphide) to provide nonreciprocal phase shifts. Within the waveguides, on-chip structures like multimode interferometers (MMIs) or directional couplers act as beam splitters, while integrated polarization converters can perform the function of half-wave plates.

Opportunities in Emerging Medical Technologies

Medical technology innovations are creating significant opportunities for optical rotator manufacturers in Germany. The rising adoption of minimally invasive procedures and advanced diagnostic systems requires enhanced imaging performance. Quartz crystal rotators, with their superior birefringence and thermal stability, ensure accurate polarization control in sensitive medical equipment. Opportunities exist in expanding usage across next-generation endoscopy, robotic surgery visualization, and portable imaging devices. With Germany’s healthcare sector focusing on digital transformation and precision medicine, suppliers of quartz crystal optical rotators can leverage this trend by aligning with medical device manufacturers to deliver tailored, high-precision optical solutions.

Key Challenges

High Manufacturing and Material Costs

The production of quartz crystal optical rotators involves complex fabrication processes that require high precision and advanced equipment. Sourcing high-quality quartz crystals also adds to the cost, making these devices expensive compared to alternative polarization control solutions. This cost barrier limits adoption among small research labs and budget-sensitive industries. Furthermore, the need for customized designs to meet specific application requirements increases development expenses. Manufacturers in Germany face pressure to balance quality with affordability, and the high production cost remains a key challenge that could restrain wider market penetration.

Competition from Alternative Technologies

While quartz crystal optical rotators offer high accuracy, competing technologies such as fiber-based polarization controllers and liquid crystal devices are gaining traction. These alternatives often provide cost advantages, easier integration, or greater flexibility in certain applications. In addition, rapid advancements in photonics and optical communication systems may reduce dependency on traditional quartz crystal solutions. This growing competition challenges market players to continuously innovate and improve performance while keeping costs in check. Without ongoing technological advancements and differentiation, quartz crystal optical rotators risk losing share to emerging alternatives in Germany’s optical components market.

Regional Analysis

North Germany

North Germany accounted for 32% of the market share in 2024, driven by the strong presence of telecommunications hubs and research institutions. The region benefits from advanced infrastructure in Hamburg and Bremen, supporting high-speed internet deployment and optical network expansion. Universities and photonics research centers further increase demand for quartz crystal optical rotators in scientific studies and laboratories. Industrial automation in port logistics and manufacturing also adds to adoption. With government-backed digitalization projects and investments in fiber optic networks, North Germany is expected to maintain steady demand and strengthen its leadership in this market.

South Germany

South Germany held 28% of the market share in 2024, supported by its concentration of medical device manufacturers and industrial automation facilities. Cities like Munich and Stuttgart drive adoption in healthcare imaging systems and automotive automation applications. The region benefits from strong R&D investments in photonics and optics, which fuels higher integration of quartz crystal rotators in advanced scientific research. The medical imaging sector in particular is a major demand driver, as hospitals and diagnostic centers adopt polarization-control technologies. With strong manufacturing and innovation ecosystems, South Germany continues to serve as a growth hotspot.

West Germany

West Germany captured 24% of the market share in 2024, led by widespread use of quartz crystal optical rotators in industrial and telecommunications applications. Düsseldorf, Cologne, and Frankfurt act as commercial hubs, supporting adoption in broadband expansion and enterprise data centers. The automotive and electronics industries in the region also contribute significantly to market growth, where precision optical systems are integrated into automation processes. West Germany’s advanced industrial base and strong logistics network provide opportunities for broader deployment of optical components. With rising investment in telecom infrastructure, the region shows strong potential for long-term growth.

East Germany

East Germany represented 16% of the market share in 2024, emerging as the smallest but steadily growing regional segment. The region’s demand is driven primarily by scientific research institutions and government-backed innovation programs in optics and photonics. Universities in Dresden and Jena play a pivotal role in driving applications of quartz crystal rotators in laser research and spectroscopy. Industrial growth in electronics and precision engineering also supports adoption. Although East Germany lags behind other regions in telecom expansion, increased funding for R&D and technology-driven industries positions the region for higher adoption rates in the coming years.

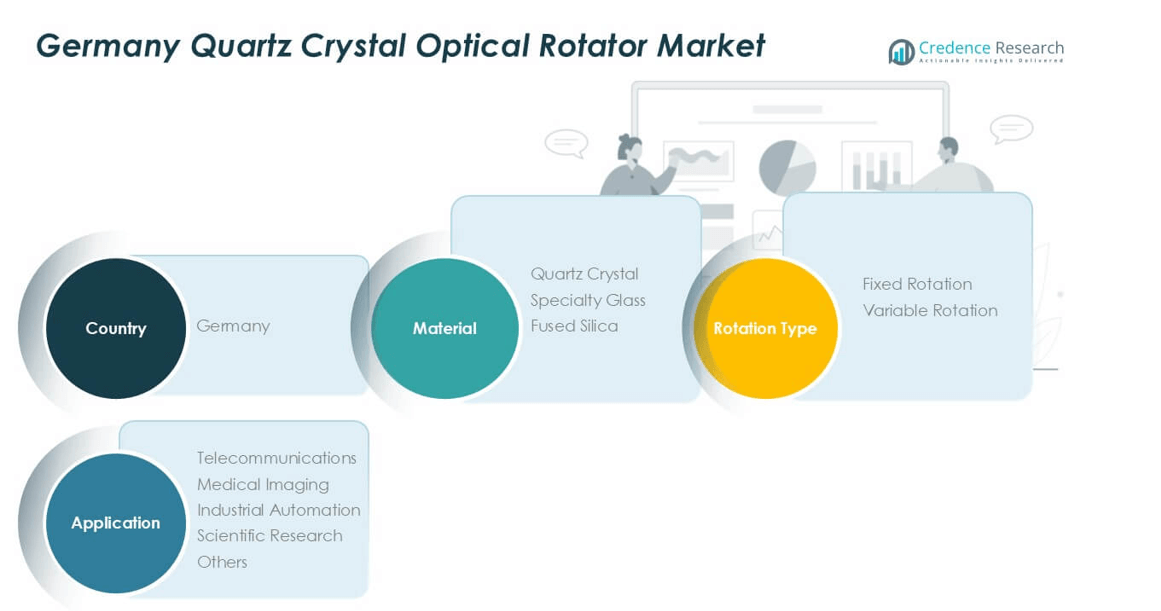

Market Segmentations:

By Material

- Quartz Crystal

- Specialty Glass

- Fused Silica

By Rotation Type

- Fixed Rotation

- Variable Rotation

By Application

- Telecommunications

- Medical Imaging

- Industrial Automation

- Scientific Research

- Others

By Geography

- North Germany

- South Germany

- West Germany

- East Germany

Competitive Landscape

The competitive landscape of the Germany quartz crystal optical rotator market is defined by a mix of established manufacturers and emerging technology players focusing on advanced optical solutions. Companies such as Crystal Innovations Ltd, OpticaQuartz Solutions LLC, and Quartz Precision Instruments Inc lead with strong product portfolios that cater to telecommunications, medical imaging, and scientific research applications. Firms like SpectraQuartz Corporation and QuartzWave Technologies LLC emphasize innovations in fused silica and specialty glass-based rotators, addressing niche industrial automation requirements. Strategic collaborations with research institutions, along with investments in miniaturized and high-efficiency designs, are central to sustaining market leadership. Recent developments highlight increased R&D spending, expansion into integrated photonics, and efforts to reduce manufacturing costs. Market players are also adopting growth strategies such as partnerships with telecom operators and healthcare equipment manufacturers to strengthen distribution networks. Overall, competition is intensifying as companies prioritize innovation, cost optimization, and alignment with Germany’s digitalization and Industry 4.0 initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crystal Innovations Ltd

- OpticaQuartz Solutions LLC

- Optical Engineering Dynamics LLC

- Quartz Precision Instruments Inc

- SpectraQuartz Corporation

- QuartzWave Technologies LLC

- Spectral Optics Corp

- Visionary Photonics Inc

- Optical Quartz Ltd

- Deltronic Crystal Industrie

Recent Developments

- In June 2025, major showcasing of advanced photonics and optical systems occurred at the Laser World of Photonics event, featuring innovations relevant to high-precision optical manipulation

Report Coverage

The research report offers an in-depth analysis based on Material, Rotation Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising adoption in fiber optic networks.

- Medical imaging will remain a strong driver due to demand for precise diagnostic tools.

- Industrial automation will increasingly use rotators in laser alignment and sensing systems.

- Scientific research institutions will continue advancing applications in spectroscopy and photonics.

- Fixed rotation types will dominate, but variable rotation demand will grow in research fields.

- Quartz crystal will retain leadership in materials, while fused silica gains niche adoption.

- Integration into compact and multifunctional photonic systems will accelerate product innovation.

- Competition will intensify as new players focus on cost reduction and miniaturization.

- Regional growth will be strongest in North and South Germany, led by telecom and healthcare.

- Long-term growth will align with Germany’s digitalization and Industry 4.0 strategies.