Market Overview

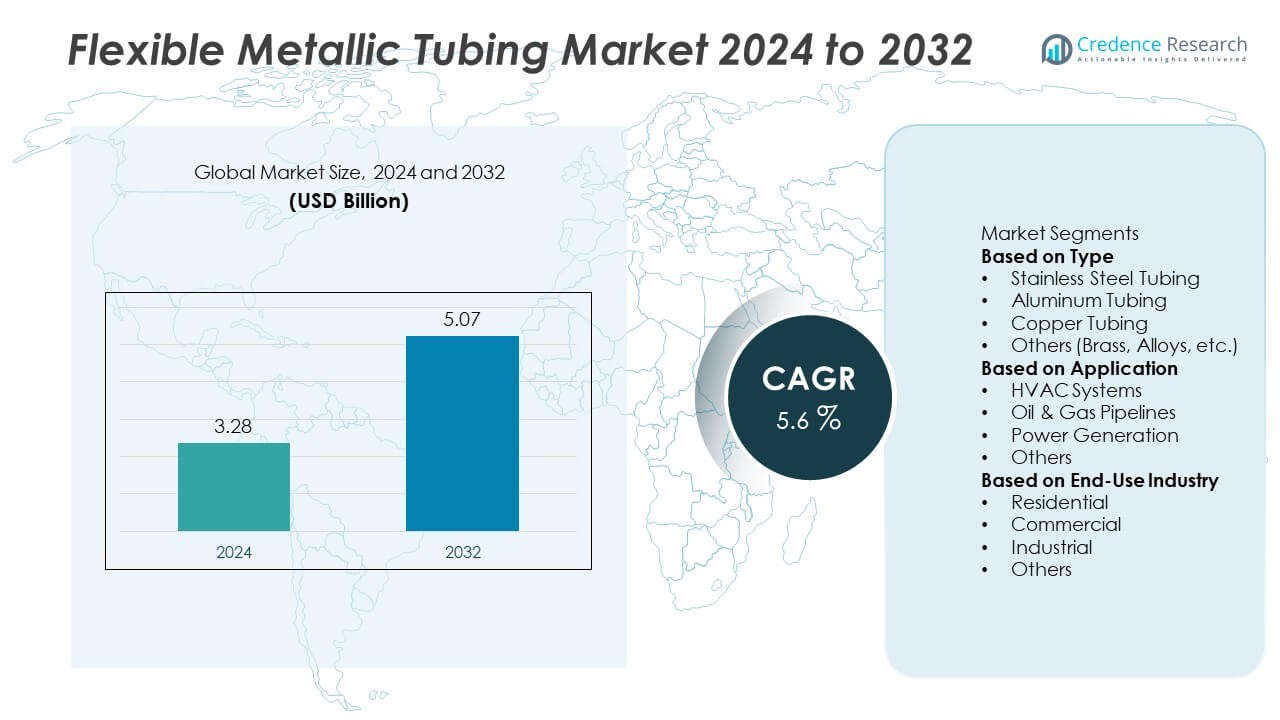

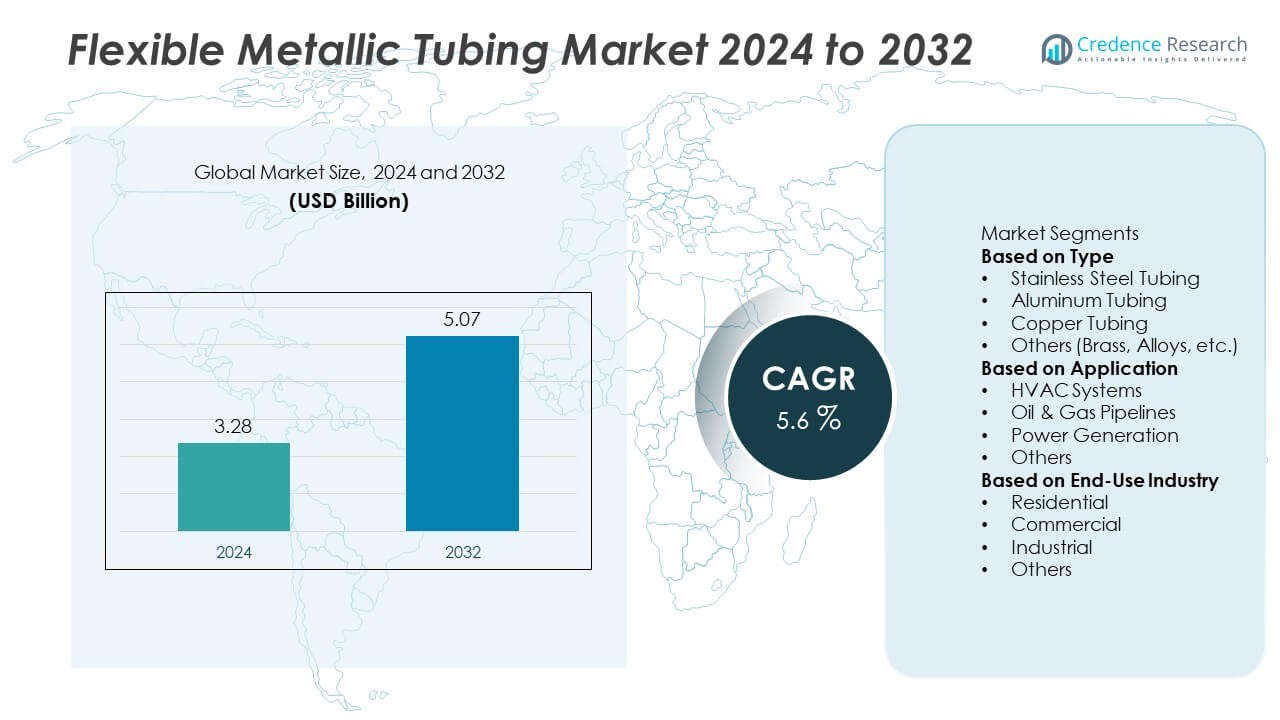

The Flexible Metallic Tubing market was valued at USD 3.28 billion in 2024 and is projected to reach USD 5.07 billion by 2032, expanding at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible Metallic Tubing Market Size 2024 |

USD 3.28 Billion |

| Flexible Metallic Tubing Market, CAGR |

5.6% |

| Flexible Metallic Tubing Market Size 2032 |

USD 5.07 Billion |

The top players in the flexible metallic tubing market include Parker Hannifin Corporation, OmegaFlex Inc., Metraflex Company, Smiths Group plc, Aerosun Corporation, Unisource Manufacturing Inc., Penflex Corporation, Witzenmann GmbH, Zotefoams plc, and Hose Master LLC. These companies focus on advanced tubing solutions that meet the performance needs of industries such as oil and gas, power generation, HVAC, and construction. Regionally, North America led the market with a 34% share in 2024, supported by strong adoption in industrial and energy sectors. Europe followed with a 28% share, driven by sustainability-focused construction and automotive industries, while Asia-Pacific held 27% share, reflecting rapid urbanization and infrastructure growth. Latin America and the Middle East & Africa accounted for 6% and 5% shares, respectively, representing emerging but steadily expanding markets. This regional distribution highlights the dominance of developed economies while underscoring Asia-Pacific’s rising influence in global demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The flexible metallic tubing market was valued at USD 3.28 billion in 2024 and is projected to reach USD 5.07 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

- Growth is driven by rising demand from oil and gas pipelines, HVAC systems, and power generation sectors, with oil and gas applications holding 38% share in 2024 due to extensive use in transportation and refinery operations.

- Market trends highlight a shift toward stainless steel tubing, which dominated with 44% share in 2024, supported by its durability, corrosion resistance, and wide use in industrial applications.

- Competitive landscape includes Parker Hannifin Corporation, OmegaFlex Inc., Smiths Group plc, Witzenmann GmbH, and Hose Master LLC, with companies focusing on innovation, expansion in emerging markets, and strengthening distribution networks.

- Regionally, North America led with 34% share in 2024, followed by Europe at 28% and Asia-Pacific at 27%, while Latin America and the Middle East & Africa accounted for 6% and 5%, respectively.

Market Segmentation Analysis:

By Type

In 2024, stainless steel tubing dominated the flexible metallic tubing market with a 44% share, driven by its superior durability, corrosion resistance, and adaptability in demanding environments. Its use across oil and gas, construction, and HVAC systems strengthens demand, particularly where high-pressure and temperature resistance are essential. Copper tubing followed, benefiting from its reliability in plumbing and HVAC applications, while aluminum tubing gained traction for lightweight installations in aerospace and automotive. Other types, including brass and specialty alloys, support niche markets. Stainless steel remains the leading type, supported by expanding industrial and infrastructure applications.

- For instance, Parker Hannifin manufactures cold-worked stainless steel tubing rated up to 20,000 psi. This specialized tubing is utilized in high-pressure oil and gas systems, as well as industrial automation applications. The company provides a range of these products through its Autoclave Engineers division.

By Application

Oil and gas pipelines accounted for the largest application segment in 2024, holding a 37% share, as safety and efficiency standards drive high adoption of flexible metallic tubing in upstream, midstream, and downstream operations. Its ability to withstand pressure, temperature fluctuations, and chemical exposure makes it indispensable in energy transport. HVAC systems followed closely, supported by rising urbanization and building projects demanding flexible piping for heating and cooling. Power generation applications also contributed steadily, using tubing for steam and fluid transfer. Oil and gas continues to lead due to its critical role in energy infrastructure.

- For instance, OmegaFlex Inc. supplies its DoubleTrac® flexible metallic piping system for the safe transfer of petroleum products, with its use documented in retail gas station repiping and new construction. The system is noted for its zero-permeation design and continuous leak monitoring capabilities, which enhance safety.

By End-Use Industry

The industrial sector led the market in 2024 with a 42% share, driven by extensive use of flexible metallic tubing in manufacturing, refineries, and power plants. Its flexibility, thermal stability, and resistance to wear support heavy-duty operations, making it the preferred choice in industrial settings. Commercial applications followed, supported by large-scale construction projects and HVAC installations in offices, malls, and hospitals. Residential adoption is growing steadily, with demand for plumbing and gas distribution solutions. Other sectors, including utilities and public infrastructure, also contributed. Industrial applications remain dominant, supported by modernization and expansion of global industrial facilities.

Key Growth Drivers

Rising Demand in Oil and Gas Industry

The oil and gas sector strongly drives the flexible metallic tubing market, as these products are essential for handling extreme temperatures, high pressures, and corrosive environments. Their flexibility and strength make them ideal for upstream exploration, midstream transport, and downstream refining processes. Increasing global energy demand, coupled with pipeline expansion projects in Asia-Pacific and the Middle East, fuels growth. With emphasis on safety and efficiency, oil and gas operators continue to prioritize flexible metallic tubing for critical operations, reinforcing its market leadership.

- For instance, Penflex manufactures corrugated hoses for LNG projects, with each hose tested for cryogenic service down to –196 °C to ensure safe hydrocarbon transport.

Expansion of HVAC and Construction Sectors

The HVAC and construction industries significantly boost demand for flexible metallic tubing due to rising urbanization, infrastructure development, and commercial construction projects. Flexible tubing ensures ease of installation, adaptability in tight spaces, and long-term durability in heating and cooling systems. Growing energy efficiency regulations also encourage the use of advanced metallic tubing in building applications. The surge in large-scale construction projects in North America, Asia-Pacific, and Europe continues to support demand, positioning HVAC and construction as major growth contributors to the market.

- For instance, Metraflex manufactures flexible metal connectors, such as the Metraloop, for HVAC systems to absorb thermal expansion and seismic movement. The amount of movement they can absorb varies based on the product, and certain models like the VRF Metraloop are designed for specific conditions.

Industrial Modernization and Automation

Ongoing industrial modernization and the adoption of advanced automation systems enhance demand for flexible metallic tubing in manufacturing, power generation, and chemical industries. Tubing is used extensively for fluid transfer, protective cable housing, and mechanical systems requiring durability and flexibility. Increasing investments in industrial upgrades and smart factories further accelerate adoption, particularly in Asia-Pacific and North America. As industries prioritize safety, efficiency, and reliability, the integration of flexible metallic tubing in automated processes ensures strong, long-term demand across global industrial applications.

Key Trends & Opportunities

Adoption of Lightweight and Sustainable Materials

Manufacturers are increasingly exploring lightweight alloys and eco-friendly materials in flexible metallic tubing to reduce weight and environmental impact. Aluminum and hybrid alloys are gaining traction in automotive, aerospace, and renewable energy applications. This trend aligns with global sustainability initiatives, where industries seek materials that balance performance with reduced carbon footprint. Companies focusing on recyclable and energy-efficient tubing solutions are well-positioned to capture future opportunities.

- For instance, the Smiths Group’s Flex-Tek division provides high-and low-pressure tubing and ducting for fluid conveyance in aerospace applications, such as in aircraft fuel and hydraulic systems, and has manufacturing roots that include precision tube assemblies for jet engines.

Technological Advancements in Tubing Design

Innovations in tubing design, including improved corrosion resistance, higher flexibility, and longer service life, are creating new opportunities in high-performance industries. Advanced coating technologies and hybrid composite-metallic designs are extending usage in harsh environments like offshore drilling and chemical processing. These advancements not only enhance safety and efficiency but also open up applications in new sectors such as renewable energy and smart infrastructure projects.

- For instance, Hose Master LLC manufactures corrugated metal hoses suitable for refineries, and offers some models, such as those with T321 and T316 construction, that are specifically designed for high flexibility to improve installation in compact layouts.

Key Challenges

High Material and Installation Costs

One of the main challenges for the flexible metallic tubing market is its relatively high cost compared to non-metallic alternatives. Stainless steel and specialty alloys increase production expenses, while installation often requires skilled labor and specialized equipment. This limits adoption in cost-sensitive markets, particularly in residential and small-scale applications. The high upfront investment remains a restraint despite the long-term durability of metallic tubing.

Competition from Non-Metallic Alternatives

Non-metallic tubing, such as plastic and composite options, presents a significant challenge due to lower costs, ease of installation, and lightweight properties. These alternatives are gaining popularity in residential plumbing, basic HVAC, and certain industrial applications where extreme conditions are not present. While metallic tubing offers superior strength and resistance, competition from cheaper non-metallic substitutes threatens to limit growth, especially in emerging markets with cost-sensitive buyers.

Regional Analysis

North America

North America held a 34% share of the flexible metallic tubing market in 2024, driven by strong demand in HVAC, oil and gas, and industrial applications. The United States led adoption, supported by infrastructure upgrades, advanced construction projects, and high safety standards across energy pipelines. Canada also contributed significantly with growth in power generation and residential construction sectors. Rising emphasis on energy efficiency and durable building materials continues to boost adoption. Strict regulatory frameworks and investments in modern industrial systems ensure North America maintains its leadership in the global market for flexible metallic tubing.

Europe

Europe accounted for a 28% share of the flexible metallic tubing market in 2024, supported by well-established industrial bases in Germany, France, and the UK. Demand is primarily driven by construction, automotive, and renewable energy projects that require high-performance tubing solutions. The region’s strong focus on sustainability has accelerated adoption of recyclable and lightweight metallic tubing, particularly aluminum and stainless steel types. Regulatory compliance with EU standards further drives usage across HVAC and energy systems. Ongoing urban development projects and modernization of industrial infrastructure reinforce Europe’s position as a mature and innovation-driven market.

Asia-Pacific

Asia-Pacific captured a 27% share of the flexible metallic tubing market in 2024, emerging as the fastest-growing region. China, India, and Japan drive demand due to rapid industrialization, urbanization, and large-scale infrastructure projects. Rising investments in oil and gas pipelines, power generation, and HVAC installations fuel growth across the region. Expanding construction of residential and commercial buildings also boosts adoption of metallic tubing for durability and safety. Government initiatives supporting energy efficiency and infrastructure modernization further accelerate demand. Asia-Pacific’s vast population and strong economic growth position it as a key growth engine for the global market.

Latin America

Latin America held a 6% share of the flexible metallic tubing market in 2024, led by Brazil and Mexico. Expanding construction sectors, rising urban populations, and growing energy projects drive adoption across residential, commercial, and industrial segments. Demand in the oil and gas industry, particularly in offshore projects, supports market growth. However, economic challenges and fluctuating investment levels limit broader adoption in smaller markets. Increasing government focus on infrastructure and foreign investments in energy projects are expected to create new opportunities. Latin America’s gradual modernization supports steady but slower growth compared to other regions.

Middle East & Africa

The Middle East & Africa accounted for a 5% share of the flexible metallic tubing market in 2024, with demand concentrated in Saudi Arabia, the UAE, and South Africa. The region benefits from large-scale oil and gas projects, industrial expansions, and rapid urban development initiatives. Rising investments in power generation and construction, particularly smart city projects, further support demand. However, dependence on imports and high costs remain challenges in some areas. Government-backed infrastructure projects and growing industrial diversification initiatives provide opportunities, positioning the region for long-term but gradual growth in flexible metallic tubing applications.

Market Segmentations:

By Type

- Stainless Steel Tubing

- Aluminum Tubing

- Copper Tubing

- Others (Brass, Alloys, etc.)

By Application

- HVAC Systems

- Oil & Gas Pipelines

- Power Generation

- Others

By End-Use Industry

- Residential

- Commercial

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the flexible metallic tubing market is shaped by key players such as Parker Hannifin Corporation, OmegaFlex Inc., Metraflex Company, Smiths Group plc, Aerosun Corporation, Unisource Manufacturing Inc., Penflex Corporation, Witzenmann GmbH, Zotefoams plc, and Hose Master LLC. These companies focus on product innovation, material advancements, and compliance with stringent industry standards to maintain competitiveness. Many invest heavily in R&D to enhance tubing durability, corrosion resistance, and flexibility, ensuring suitability for critical applications in oil and gas, power generation, HVAC, and construction. Strategic partnerships and global expansions enable these players to strengthen supply chains and address rising demand across diverse regions. Sustainability also plays a central role, with manufacturers increasingly developing recyclable and energy-efficient tubing solutions. Intense competition fosters continuous technological improvements, positioning these players to capitalize on opportunities in infrastructure upgrades, industrial modernization, and energy projects while ensuring adherence to regulatory and safety requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Parker Hannifin Corporation

- OmegaFlex Inc.

- Metraflex Company

- Smiths Group plc

- Aerosun Corporation

- Unisource Manufacturing Inc.

- Penflex Corporation

- Witzenmann GmbH

- Zotefoams plc

- Hose Master LLC

Recent Developments

- In April 2024, Parker Hannifin’s hose division presented updates at NAHAD showing enhancements in hydraulic hose assemblies tied to their broader hose product lines (including stainless metal hoses).

- In January 2024, Witzenmann GmbH highlighted that its flexible metal hoses cover diameters from DN 6 to DN 300, with temperature resistance from –270 °C to +600 °C.

- In 2024, Witzenmann GmbH announced construction of a carbon-neutral headquarters in Pforzheim, Germany, designed to operate entirely without fossil fuels.

- In July 2023, OmegaFlex Inc. promoted its DoubleTrac® petroleum piping system, engineered for zero permeation and simplified installation in fueling applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for flexible metallic tubing will grow with expansion in oil and gas infrastructure.

- Stainless steel tubing will remain the dominant type due to durability and corrosion resistance.

- HVAC applications will see increased adoption as energy-efficient building systems expand.

- Power generation projects will drive usage of high-performance tubing in thermal and renewable plants.

- Industrial end users will sustain the largest share, supported by automation and safety requirements.

- North America will maintain leadership with strong adoption in energy and construction sectors.

- Asia-Pacific will emerge as the fastest-growing region driven by rapid urbanization and infrastructure growth.

- Manufacturers will invest in R&D for lightweight alloys and advanced tubing technologies.

- Regulatory standards on safety and environmental compliance will boost adoption of certified tubing solutions.

- Strategic partnerships and mergers will strengthen global supply chains and market competitiveness.