Market overview

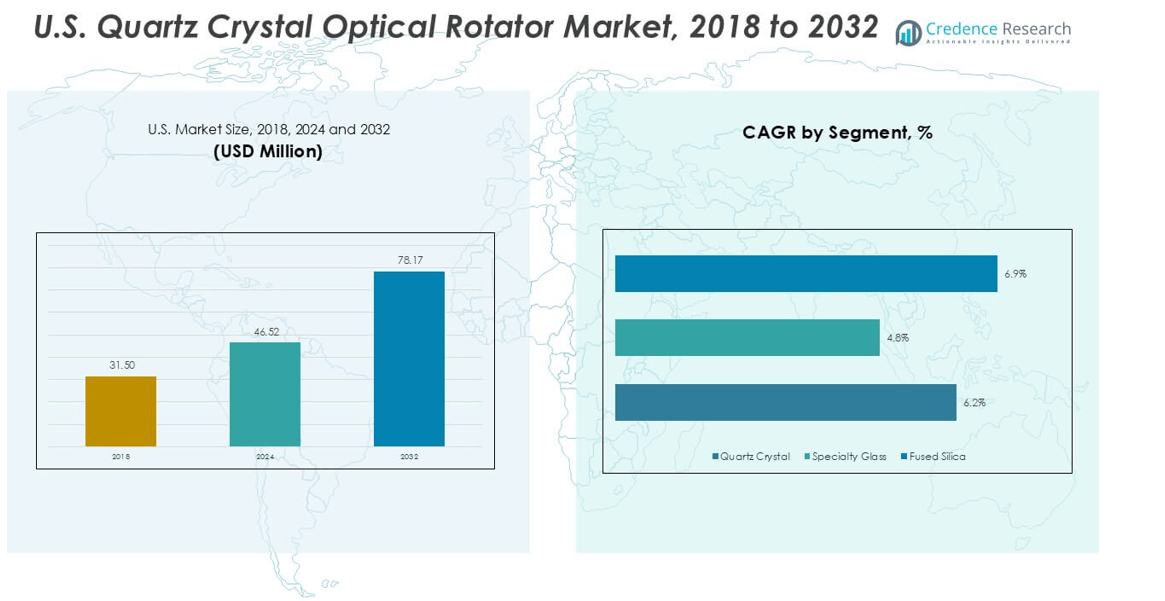

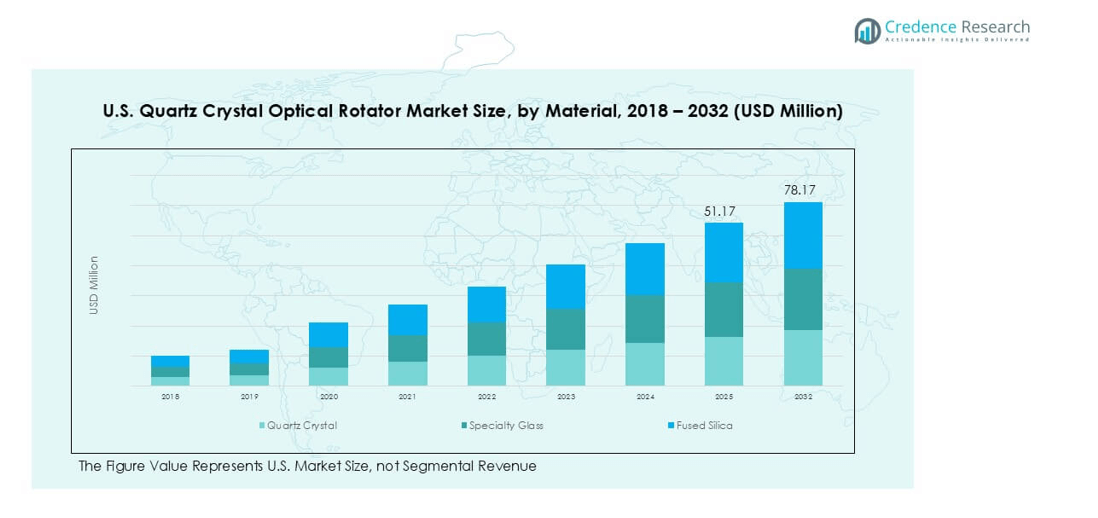

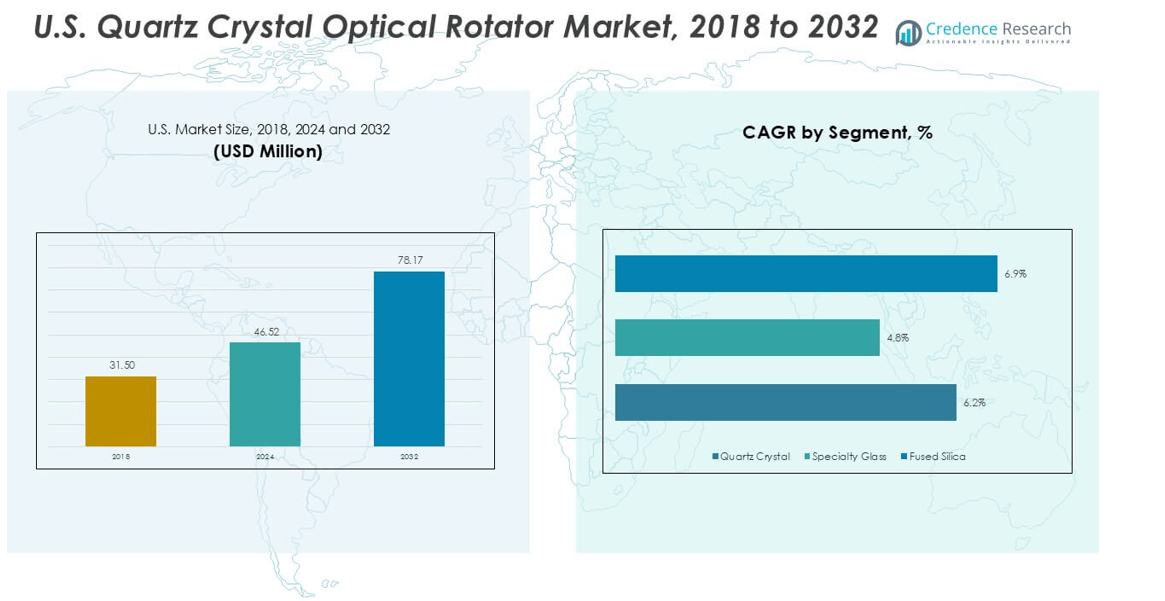

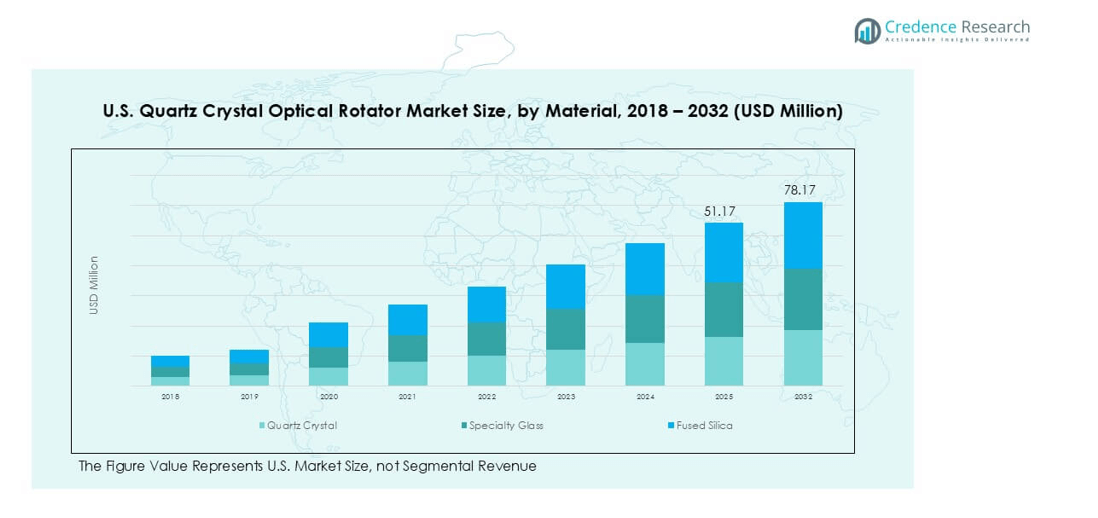

The U.S. Quartz Crystal Optical Rotator market size was valued at USD 31.50 million in 2018, reaching USD 46.52 million in 2024, and is anticipated to reach USD 78.17 million by 2032, at a CAGR of 6.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Crystal Optical Rotator Market Size 2024 |

USD 46.52 million |

| U.S. Quartz Crystal Optical Rotator Market, CAGR |

6.24% |

| U.S. Quartz Crystal Optical Rotator Market Size 2032 |

USD 78.17 million |

The U.S. Quartz Crystal Optical Rotator market is led by key players such as Advanced Photonics Corporation, Crystal Dynamics Inc., CrystalPro Technologies LLC, PolarTech Corporation, and LuminaOptics Inc. These companies dominate through advanced product portfolios, strategic R&D investments, and strong penetration in telecommunications and medical imaging applications. Emerging firms including CrystalClear Optics LLC, Crystaline Innovations Inc., InnoQuartz Solutions Inc., and Innovative Optics Inc. are gaining ground with specialized solutions for research and industrial automation. Regionally, the Northeast leads with 32% market share, supported by robust telecom infrastructure and strong research ecosystems. The South follows with 26%, driven by fiber-optic expansion and healthcare adoption, while the Midwest and West each hold 21%, benefiting from industrial automation and advanced photonics research respectively. This competitive and regionally diverse market highlights both innovation-driven leadership and strong opportunities for growth.

Market Insights

- The U.S. Quartz Crystal Optical Rotator market was valued at USD 31.50 million in 2018, reached USD 46.52 million in 2024, and is projected to hit USD 78.17 million by 2032, growing at a CAGR of 6.24%.

- Market growth is driven by expanding fiber-optic networks, increasing demand for high-speed data transfer, and rising adoption in advanced medical imaging technologies across hospitals and diagnostic centers.

- Key trends include integration of rotators with photonic devices for quantum communication, LiDAR, and semiconductor inspection, alongside higher adoption in industrial automation for precision engineering and machine vision.

- Competition is marked by established firms such as Advanced Photonics Corporation, Crystal Dynamics Inc., and PolarTech Corporation, while emerging players like InnoQuartz Solutions Inc. and CrystalClear Optics LLC expand niche offerings; however, high manufacturing costs and competition from liquid crystal-based alternatives remain restraints.

- Regionally, the Northeast leads with 32% share, followed by the South at 26%, while the Midwest and West hold 21% each; by material, quartz crystal dominates due to stability and precision performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Quartz crystal dominated the U.S. market in 2024, capturing the largest share due to its high optical activity, stability, and reliability in precision instruments. Its consistent performance across a wide temperature range makes it the preferred material in optical communication and industrial devices. Specialty glass follows as a growing segment, driven by demand for cost-effective solutions in mid-range optical systems. Fused silica, though niche, supports advanced scientific and medical research applications where low thermal expansion and high transparency are critical, fueling its gradual adoption in high-performance systems.

- For instance, a 45° crystalline quartz rotator from Edmund Optics has parallelism < 10 arcsec and rotational accuracy < 5 arcmin at 1064 nm.

By Rotation Type

Fixed rotation accounted for the dominant share of the U.S. quartz crystal optical rotator market in 2024. Its widespread use is attributed to durability, consistent angular accuracy, and integration in telecom networks requiring long-term stability. Fixed rotators are widely deployed in standardized industrial systems where minimal calibration is needed, ensuring cost efficiency and reliability. Variable rotation is expanding steadily, supported by rising demand in research laboratories and specialized imaging systems that require flexibility, tunable polarization, and dynamic adjustments for customized optical performance.

- For instance, Karl Lambrecht’s fixed rotators specify rotation tolerances of ±0.06° at 1064 nm and ±0.7° at 347 nm.

By Application

Telecommunications emerged as the leading application in 2024, holding the largest market share. The segment benefits from the rapid expansion of high-speed data transmission, fiber-optic networks, and 5G infrastructure across the U.S., all of which rely on efficient polarization control. Medical imaging is also experiencing significant growth, as advanced imaging technologies adopt optical rotators to improve resolution and diagnostic precision. Industrial automation applies these devices in machine vision and quality inspection systems, while scientific research continues to push innovation. Other applications include niche uses in aerospace and defense technologies.

Key Growth Drivers

Expansion of Fiber-Optic Communication Networks

The rapid expansion of fiber-optic communication networks is a key growth driver for the U.S. quartz crystal optical rotator market. Growing demand for high-speed internet, cloud computing, and 5G rollouts has increased the use of polarization control devices to enhance signal transmission quality. Quartz crystal optical rotators provide stability and precision, which are critical in minimizing losses during long-distance data transfer. With the U.S. government and private telecom players investing heavily in fiber deployments, the demand for advanced optical components is rising. The rotators’ ability to deliver reliable performance across wide frequency ranges ensures their adoption in telecom infrastructure, particularly in urban and rural broadband projects.

- For instance, OptiSource’s quartz polarization rotators deliver wavefront distortion of λ/10 at 632.8 nm and rotation tolerance of 0.5° across common telecom bands.

Rising Adoption in Medical Imaging Technologies

The use of advanced medical imaging technologies is expanding in the U.S., creating strong demand for quartz crystal optical rotators. Devices like optical coherence tomography (OCT) and other polarization-based imaging systems rely on precise polarization control to generate high-resolution images. Rotators enhance diagnostic accuracy in ophthalmology, cardiology, and oncology applications, driving clinical outcomes. The increasing prevalence of chronic diseases and the growing focus on early detection are further accelerating imaging adoption in hospitals and research labs. Moreover, advancements in minimally invasive imaging technologies are boosting rotator demand, as manufacturers integrate these devices into next-generation imaging platforms. This adoption supports market growth while aligning with healthcare modernization initiatives.

- For instance, SIMTRUM’s quartz polarization rotator offers surface parallelism < 10 arcsec and damage threshold > 5 J/cm² (20 ns pulse) at 1064 nm.

Industrial Automation and Precision Engineering Growth

The rise of industrial automation and precision engineering applications is significantly contributing to market growth. Optical rotators are being increasingly adopted in machine vision systems, quality inspection processes, and robotics, where polarization control ensures accuracy and consistency. U.S. manufacturers are embracing Industry 4.0 technologies, and the integration of optical devices in automation is enhancing system efficiency. Quartz crystal rotators, known for their durability and reliability, provide long-term stability in automated processes. Their role in laser-based manufacturing, semiconductor inspection, and metrology further strengthens adoption. As industries continue to modernize and deploy smart technologies, the rotators’ ability to support high-precision tasks makes them indispensable for automation-driven growth.

Key Trends & Opportunities

Integration with Advanced Photonic Devices

One major trend is the integration of quartz crystal optical rotators with advanced photonic devices. With the U.S. advancing in quantum communication, LiDAR, and photonic sensing technologies, demand for reliable polarization control is increasing. The rotators are being incorporated into hybrid photonic platforms to improve signal processing and optical coherence. This creates opportunities for manufacturers to supply solutions for cutting-edge applications, including autonomous vehicle navigation and quantum encryption systems.

- For instance, Simtrum’s quartz polarization rotator offers wavefront distortion < λ/4 at 633 nm and damage threshold > 5 J/cm² (20 ns, 20 Hz)

Growing Research Investments in Optical Science

Research institutions and universities across the U.S. are expanding projects in optical science, creating opportunities for quartz crystal rotator suppliers. Increasing federal funding for scientific innovation, particularly in defense, aerospace, and biomedical optics, supports adoption. Rotators are essential in experimental setups requiring precise control of polarized light. This trend not only drives academic adoption but also accelerates commercialization of new applications in emerging fields like biophotonics and nanophotonics.

Key Challenges

High Manufacturing Costs and Material Limitations

A major challenge for the U.S. quartz crystal optical rotator market is the high cost of manufacturing. The production process requires precision cutting, alignment, and polishing of crystals, which increases overall costs. Specialty quartz crystals are also limited in supply, raising concerns about scalability and price stability. These factors restrict adoption in cost-sensitive industries where lower-priced alternatives may be preferred, limiting market penetration beyond premium applications.

Competition from Alternative Polarization Technologies

The market faces strong competition from alternative polarization control technologies, such as liquid crystal-based rotators and electro-optic modulators. These alternatives are gaining traction due to their compact design, tunability, and compatibility with integrated optical systems. While quartz rotators remain dominant in precision-driven sectors, the increasing commercialization of cost-effective alternatives poses a challenge. This competitive pressure requires quartz crystal rotator manufacturers to focus on differentiation through superior durability, accuracy, and integration with next-generation optical platforms.

Regional Analysis

Northeast

The Northeast held the largest share of the U.S. quartz crystal optical rotator market in 2024, accounting for 32% of total revenue. This dominance is driven by the region’s strong presence of telecommunications hubs, research institutions, and healthcare facilities that widely adopt advanced optical technologies. High demand from universities and federal labs in states like Massachusetts and New York supports scientific research applications. The growing deployment of 5G networks and fiber-optic infrastructure also contributes to steady growth. Rising medical imaging use in urban hospitals strengthens the Northeast’s leadership in this market.

Midwest

The Midwest accounted for 21% of the U.S. market in 2024, supported by strong industrial automation and manufacturing activity. States such as Illinois, Ohio, and Michigan rely on quartz crystal optical rotators in robotics, precision engineering, and machine vision systems. The region’s expanding semiconductor and automotive industries are driving further adoption of polarization control technologies. While not leading in telecommunications, the Midwest’s strong emphasis on Industry 4.0 and industrial innovation positions it as a stable growth contributor. Research-focused universities in the region also add to demand for scientific and laboratory applications.

South

The South captured 26% of the U.S. market in 2024, emerging as a significant growth region. The expansion of fiber-optic networks and large-scale data centers in states like Texas, Virginia, and Georgia is a major driver. The healthcare sector also plays a strong role, as southern states are investing heavily in advanced imaging and diagnostic equipment. Aerospace and defense industries concentrated in this region further support adoption of quartz crystal rotators in specialized applications. The combination of telecom growth and diverse industrial uses positions the South as one of the fastest-growing regions.

West

The West represented 21% of the U.S. quartz crystal optical rotator market in 2024, led by technology-driven demand from California and Washington. The region benefits from its leadership in photonics, quantum research, and semiconductor innovation. Major universities and technology companies are accelerating adoption through investments in optical science and advanced communication platforms. Demand from medical imaging and research laboratories also contributes to steady growth. With California’s expanding technology ecosystem and defense-related applications, the West remains a key innovation hub, balancing its share through high-value, cutting-edge applications in telecommunications and scientific research.

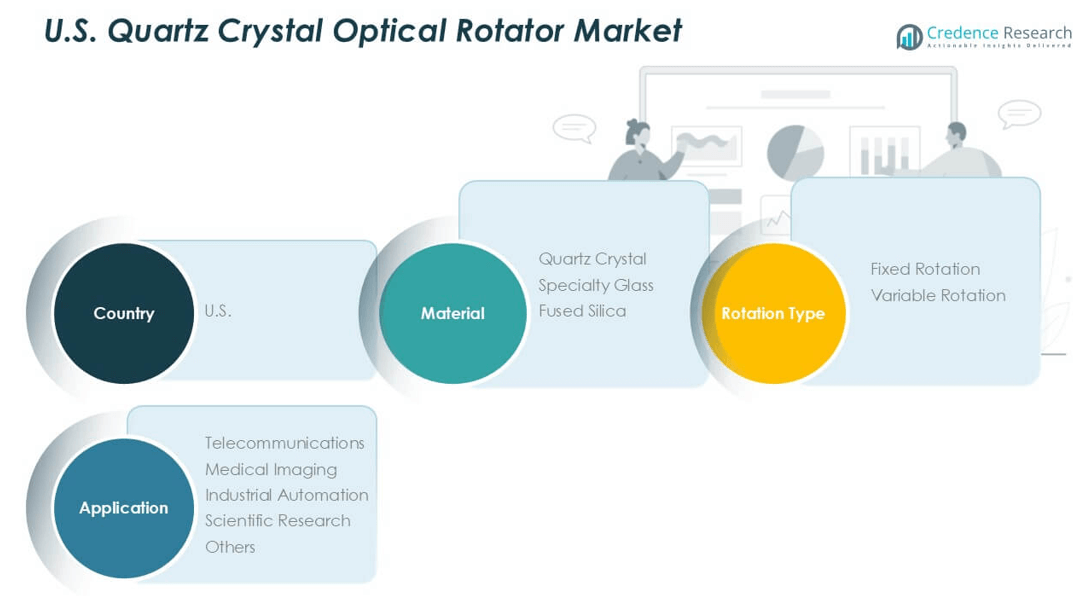

Market Segmentations:

By Material

- Quartz Crystal

- Specialty Glass

- Fused Silica

By Rotation Type

- Fixed Rotation

- Variable Rotation

By Application

- Telecommunications

- Medical Imaging

- Industrial Automation

- Scientific Research

- Others

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Quartz Crystal Optical Rotator market is moderately consolidated, with competition driven by both established optical component manufacturers and emerging specialized firms. Leading players such as Advanced Photonics Corporation, Crystal Dynamics Inc., CrystalPro Technologies LLC, PolarTech Corporation, and LuminaOptics Inc. hold significant market presence, leveraging strong product portfolios and strategic collaborations. These companies focus on serving diverse end-use sectors, including telecommunications, medical imaging, and industrial automation. Smaller firms like CrystalClear Optics LLC, Crystaline Innovations Inc., and InnoQuartz Solutions Inc. are gaining traction by offering niche, customizable solutions tailored for research and scientific applications. Competitive strategies include continuous R&D investment, product innovation, and expansion into high-growth applications such as 5G networks and precision medical imaging. Mergers, acquisitions, and partnerships with research institutions further shape the competitive environment, as companies aim to strengthen their technological expertise and expand market share in a rapidly advancing optical landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, major showcasing of advanced photonics and optical systems occurred at the Laser World of Photonics event, featuring innovations relevant to high-precision optical manipulation.

Report Coverage

The research report offers an in-depth analysis based on Material, Rotation Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily with strong demand from telecommunications.

- Expansion of 5G and fiber-optic networks will boost adoption of optical rotators.

- Medical imaging applications will drive usage in diagnostic and minimally invasive technologies.

- Industrial automation and machine vision will remain key contributors to demand growth.

- Research institutions will increase adoption for scientific experiments and optical innovations.

- Integration with advanced photonic and quantum communication devices will create new opportunities.

- Competition from alternative polarization technologies will pressure quartz rotator manufacturers.

- High manufacturing costs will challenge wider penetration in cost-sensitive industries.

- Regional growth will remain strong in the Northeast and South due to telecom and healthcare.

- Innovation-driven strategies and collaborations will define the long-term competitiveness of leading companies.