Market Overview:

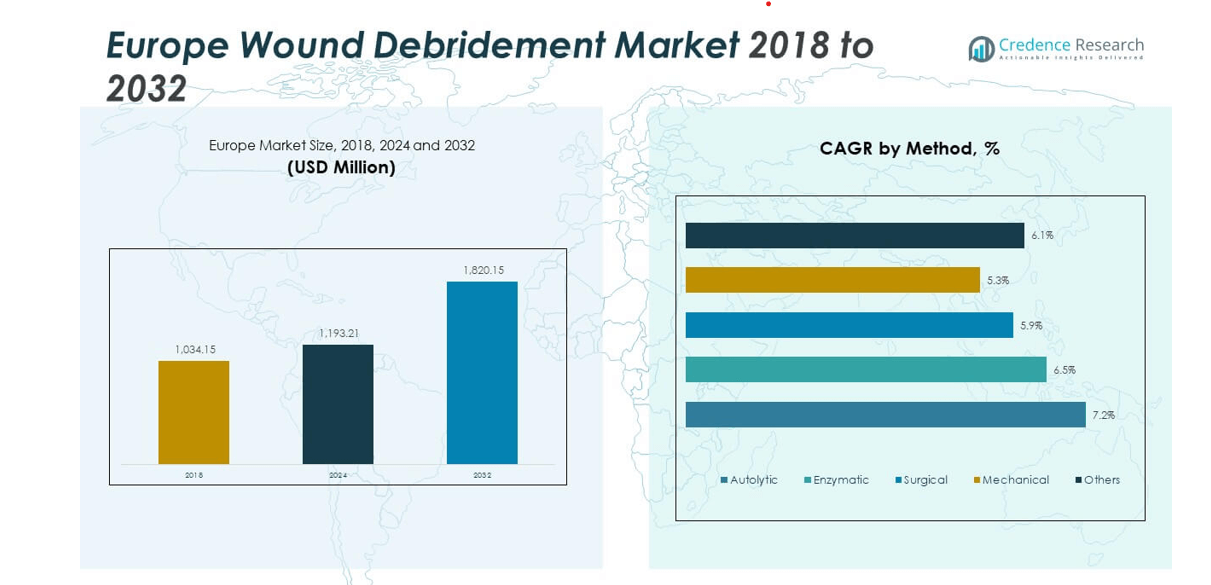

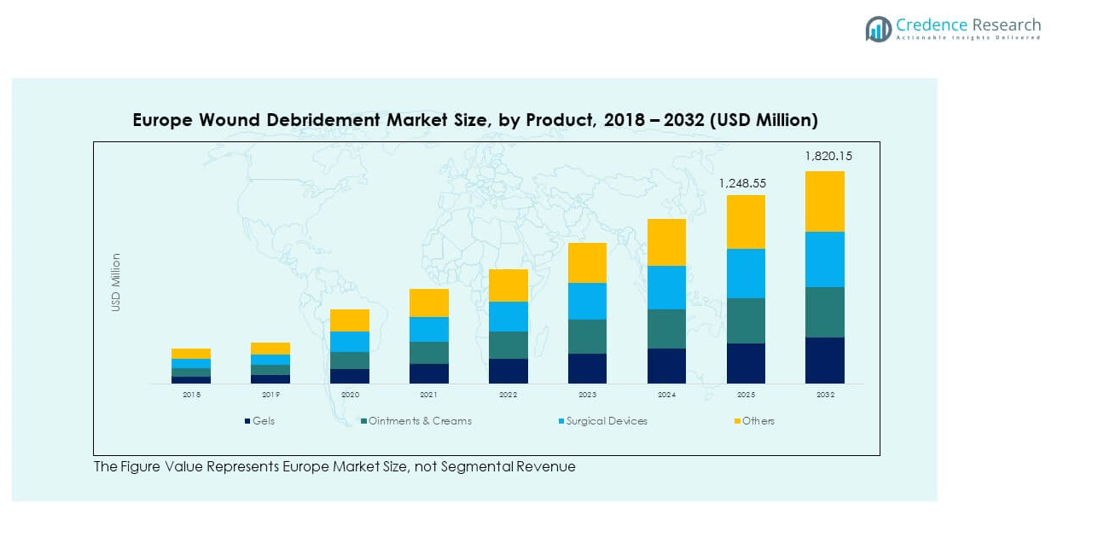

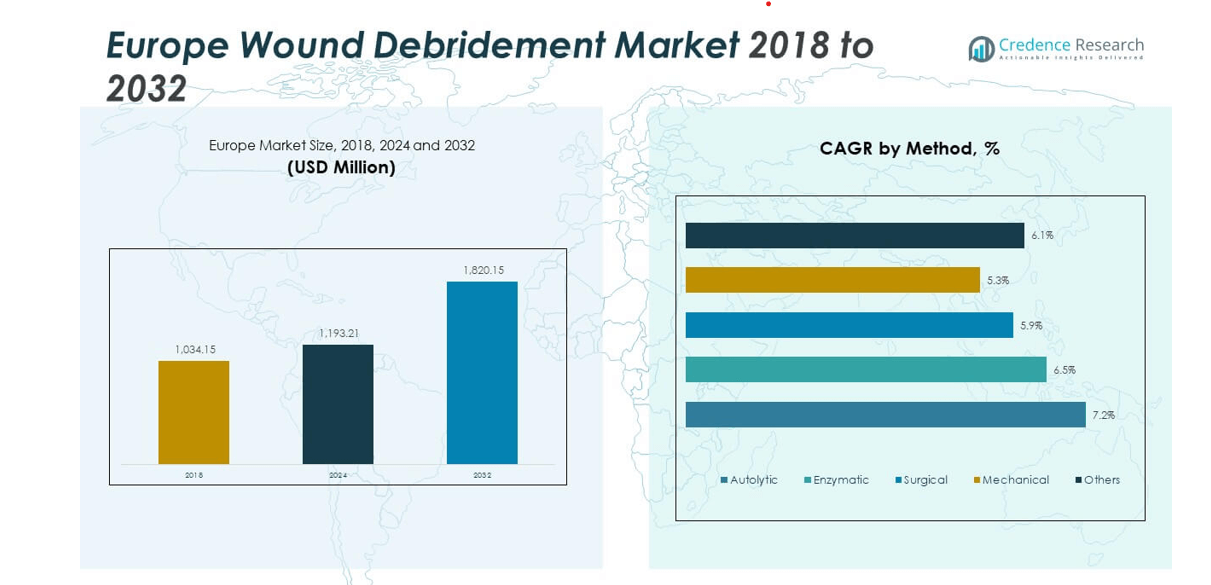

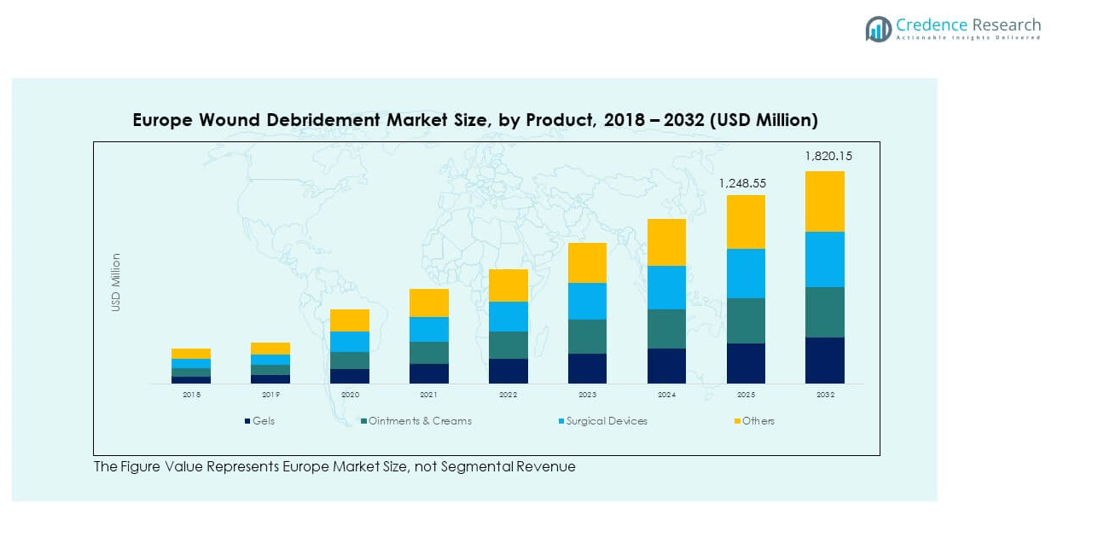

The Europe Wound Debridement Market size was valued at USD 1,034.15 million in 2018 to USD 1,193.21 million in 2024 and is anticipated to reach USD 1,820.15 million by 2032, at a CAGR of 5.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Wound Debridement Market Size 2024 |

USD 1,193.21 million |

| Europe Wound Debridement Market, CAGR |

5.42% |

| Europe Wound Debridement Market Size 2032 |

USD 1,820.15 million |

The market growth is driven by the rising prevalence of chronic and diabetic wounds across Europe. Increasing adoption of advanced wound care solutions and debridement devices supports faster healing and reduces infection risks. The growing elderly population, higher healthcare expenditure, and awareness programs promoting early treatment are also boosting demand for wound debridement procedures.

Western European countries, including Germany, France, and the U.K., lead the regional market due to strong healthcare infrastructure and advanced wound management technologies. Emerging markets in Eastern Europe are expected to grow rapidly, supported by improved healthcare access and government investments. The focus on home healthcare and outpatient wound management is also increasing across the region.

Market Insights:

- The Europe Wound Debridement Market was valued at USD 1,034.15 million in 2018, reached USD 1,193.21 million in 2024, and is projected to hit USD 1,820.15 million by 2032, expanding at a CAGR of 5.42%.

- Western Europe (58%), Southern Europe (22%), and Eastern & Northern Europe (20%) dominate the market, driven by strong healthcare infrastructure, higher awareness, and extensive use of advanced debridement technologies.

- Eastern and Northern Europe represent the fastest-growing region with rising healthcare investments, expanding access to wound care, and government-backed modernization programs.

- Among products, gels account for nearly 34% of market share in 2024, supported by high demand in chronic and diabetic wound care due to ease of application and proven effectiveness.

- Surgical devices hold about 27% share, driven by their efficiency in treating severe wounds and their increasing use in hospital and clinical settings across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Burden of Chronic Wounds and Diabetic Ulcers

The Europe Wound Debridement Market experiences strong growth due to the increasing incidence of chronic wounds and diabetic ulcers. The rise in obesity, diabetes, and vascular diseases drives the demand for effective wound care solutions. Hospitals and clinics are adopting advanced debridement devices to accelerate healing and minimize infection risk. The aging population, especially in Western Europe, contributes to the growing patient base requiring wound management. Governments are promoting preventive wound care programs, encouraging early treatment adoption. The market benefits from improved clinical guidelines supporting advanced debridement techniques. It continues to expand due to the rising focus on patient outcomes and recovery speed.

- For instance, Smith+Nephew’s PICO Single Use Negative Pressure Wound Therapy system has received positive recommendations in Europe for its role in treating complex diabetic foot ulcers and supporting faster wound closure, with endorsement from relevant clinical practice guidelines.

Growing Adoption of Advanced Debridement Technologies

The use of innovative techniques such as enzymatic, ultrasonic, and mechanical debridement drives the Europe Wound Debridement Market. These technologies offer precise and faster results, reducing healing time and hospital stays. Medical device manufacturers are investing in product innovation and user-friendly systems for clinicians. Hospitals and ambulatory care centers are integrating automated systems to improve procedural efficiency. Awareness among healthcare providers regarding cost-effective and minimally invasive options supports demand. Increased clinical research has led to new formulations for enzymatic agents and bioactive dressings. The market gains momentum from the shift toward modern, technology-based wound management solutions.

- For instance, Lohmann & Rauscher’s Debrisoft Lolly is acknowledged in European wound care settings for enabling effective and gentle mechanical wound bed cleaning within minutes, and is widely used as a safe alternative to some traditional debridement methods, especially for deep or hard-to-reach wounds.

Government Initiatives and Healthcare Reimbursement Policies

The Europe Wound Debridement Market benefits from supportive healthcare policies and reimbursement structures. Governments across the region are implementing programs to reduce wound-related complications and hospital readmissions. Reimbursement coverage for advanced wound care products encourages higher adoption among patients. Public healthcare systems in countries like Germany, France, and the U.K. play a vital role in promoting standard wound care practices. Medical associations provide training to improve clinician awareness of effective debridement methods. These initiatives have increased accessibility to quality care in both urban and rural areas. Strong policy support enhances the affordability and availability of wound debridement solutions.

Expanding Home Healthcare and Outpatient Care Services

The Europe Wound Debridement Market grows steadily with the expansion of home healthcare and outpatient wound management. Patients prefer at-home treatments due to convenience, cost savings, and reduced infection risk. Portable and easy-to-use debridement tools have encouraged self-care under medical supervision. Rising healthcare costs are driving hospitals to shift non-critical wound procedures to outpatient settings. Telemedicine services are enhancing follow-up and wound monitoring for remote patients. This trend benefits healthcare providers and patients by improving accessibility and efficiency. The shift toward decentralized wound care boosts the overall demand for modern debridement solutions.

Market Trends:

Increasing Integration of Digital and Smart Wound Care Technologies

The Europe Wound Debridement Market is witnessing rapid integration of digital tools and smart wound care systems. AI-driven wound assessment platforms enable accurate tracking of healing progress. Smart dressings embedded with sensors allow real-time data collection and patient monitoring. Healthcare providers are adopting connected wound care systems to improve decision-making and reduce treatment errors. These innovations enhance clinical efficiency and patient engagement. The demand for data-driven care models is strengthening across hospitals and clinics. This trend is shaping a new era of precision wound management across the region.

- For instance, peer-reviewed reviews confirm multiple wound care platforms in Europe have integrated AI-powered image analysis, supporting clinicians with high-quality wound segmentation and progress tracking capabilities in clinical environments.

Rising Preference for Minimally Invasive and Painless Debridement Procedures

The preference for minimally invasive wound care procedures is growing in the Europe Wound Debridement Market. Patients seek methods that minimize discomfort and recovery time. Enzymatic and autolytic debridement solutions are gaining popularity due to their gentle and selective action. Hospitals emphasize patient satisfaction, prompting wider use of less invasive options. Technological improvements have reduced procedural time while maintaining treatment quality. This approach lowers infection risk and hospital stay duration. It drives both healthcare efficiency and patient adherence to prescribed care routines.

- For instance, Hydrofera Blue Ready-Transfer dressings, manufactured by Hydrofera, LLC (an Essity company), are recognized in Europe for their supportive role in gentle wound management. They help reduce pain during dressing changes and improve moisture balance in healing environments by providing non-cytotoxic, antibacterial protection and effectively managing wound exudate.

Shift Toward Personalized and Patient-Centric Wound Care Solutions

The Europe Wound Debridement Market is moving toward personalized wound care models. Clinicians increasingly use patient data to customize treatment based on wound type and healing rate. Genetic profiling and advanced imaging aid in predicting wound recovery patterns. Manufacturers are introducing customizable debridement products tailored to specific wound needs. Hospitals and research institutions focus on developing personalized treatment pathways. This shift supports better clinical outcomes and improved cost-effectiveness. The growing trend of individualized care enhances overall patient satisfaction and treatment success.

Adoption of Sustainable and Biocompatible Debridement Products

Sustainability has become a central trend in the Europe Wound Debridement Market. Manufacturers are developing eco-friendly, biocompatible materials for wound care applications. The focus on reducing medical waste has led to innovative biodegradable dressings. Regulatory bodies encourage the use of non-toxic, safe materials in wound debridement products. Hospitals are increasingly adopting sustainable procurement policies to meet environmental goals. This trend aligns with Europe’s broader commitment to green healthcare initiatives. It strengthens the market’s reputation for responsible innovation and long-term growth potential.\

Market Challenges Analysis:

High Cost of Advanced Debridement Devices and Limited Reimbursement in Some Regions

The Europe Wound Debridement Market faces significant cost-related challenges that limit accessibility. Advanced mechanical and enzymatic systems often require high investment, making them less affordable for smaller clinics. Reimbursement coverage varies across European countries, creating inequalities in access. Eastern European nations, in particular, struggle with budget constraints in adopting advanced wound care technologies. Hospitals often depend on conventional treatments due to financial limitations. Limited reimbursement discourages adoption of innovative methods, especially among older patients. The uneven economic landscape hinders the consistent growth of modern debridement solutions across the region.

Shortage of Skilled Professionals and Limited Awareness in Rural Areas

A lack of specialized wound care professionals poses another challenge for the Europe Wound Debridement Market. Many healthcare centers in rural areas lack training programs focused on advanced debridement techniques. This gap results in delayed treatment and higher complication risks. Limited awareness among patients about the benefits of early wound care further restricts adoption. Hospitals struggle to meet growing demand for advanced care due to workforce shortages. The need for regular skill development remains critical. Addressing these issues requires collaboration between governments, medical institutions, and manufacturers to ensure consistent care delivery.

Market Opportunities:

Rising Demand for Point-of-Care and Home-Based Wound Management Solutions

The Europe Wound Debridement Market presents strong opportunities in point-of-care and home-based wound treatment. Portable and easy-to-operate debridement devices are meeting the needs of patients outside hospital settings. Growing home healthcare services support the trend of decentralized treatment. Manufacturers are focusing on developing compact, cost-effective solutions for home use. Patients prefer these methods for comfort and affordability. It opens new revenue streams for companies targeting aging populations and chronic wound cases. The market benefits from the push toward self-managed wound care and patient independence.

Increasing Investments in Research, Innovation, and Biologic Debridement Methods

Growing R&D investments are unlocking new possibilities in the Europe Wound Debridement Market. Biologic and enzymatic debridement methods are gaining traction for their precision and safety. Research institutions and industry leaders are collaborating to develop next-generation wound cleaning solutions. Governments are offering grants to accelerate innovation in regenerative and biologic wound care. These developments improve patient recovery and reduce infection rates. It strengthens Europe’s position as a leader in wound care innovation. The growing research pipeline ensures steady market expansion in the coming years.

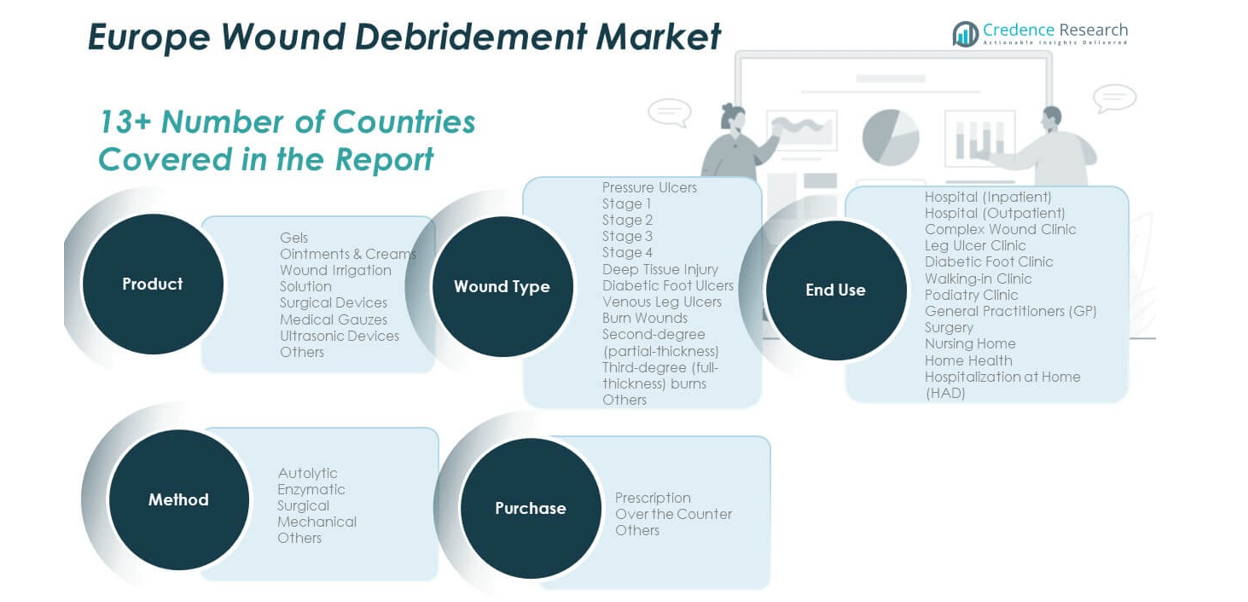

Market Segmentation Analysis:

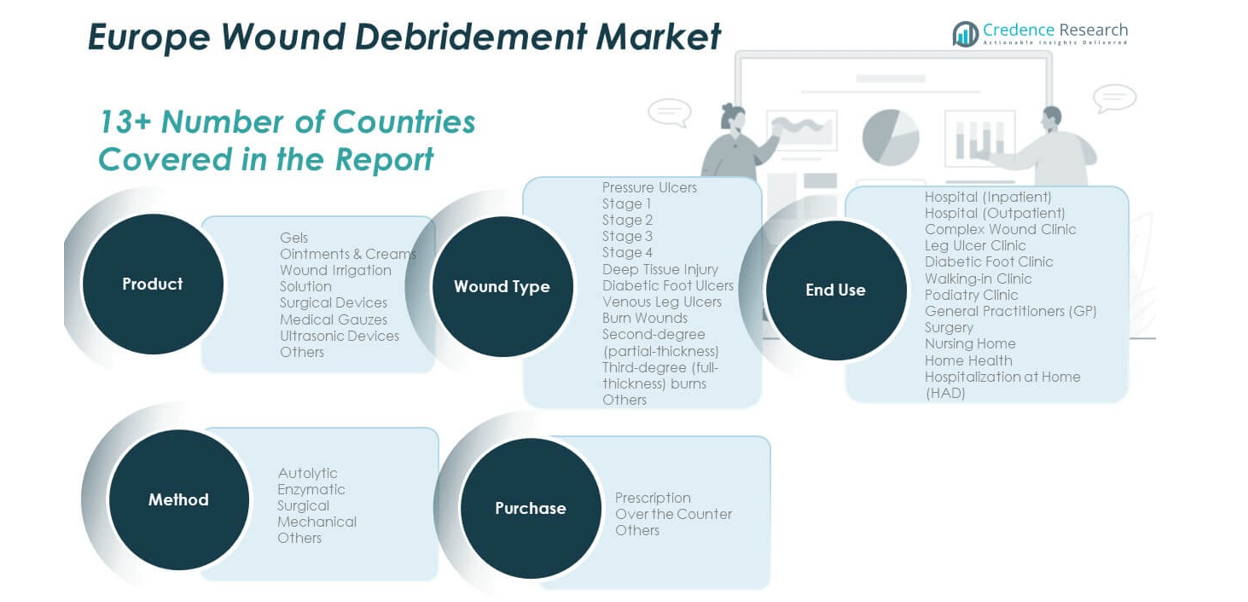

By Product

The Europe Wound Debridement Market includes products such as gels, ointments and creams, wound irrigation solutions, surgical devices, medical gauzes, ultrasonic devices, and others. Gels and ointments hold a major share due to their ease of use and effectiveness in chronic wound care. Surgical and ultrasonic devices are gaining traction for their precision and faster healing outcomes. Medical gauzes continue to be widely used in basic wound management, while irrigation solutions are preferred for infection control. Product innovation and improved biocompatibility drive steady growth across all categories.

- For instance, Advancis Medical’s Activon Tube—medical-grade Manuka honey gel—is utilized across European hospitals and clinics for its wound debridement and antibacterial efficacy, particularly in challenging chronic wounds.

By Method

The market is categorized into autolytic, enzymatic, surgical, mechanical, and other methods. Autolytic and enzymatic debridement dominate due to their gentle application and minimal tissue damage. Surgical methods remain critical for severe or complex wounds requiring rapid tissue removal. Mechanical techniques are used in cost-sensitive and acute care settings. Continuous improvements in enzymatic formulations and patient-focused care approaches are strengthening demand across this segment.

- For instance, the SonicOne ultrasonic debridement system, manufactured and originally marketed by Misonix, was acquired by Bioventus in 2021. The device, which is in clinical use in wound centers, supports effective chronic wound debridement and tissue removal. It is referenced by numerous manufacturer and clinician reports for its performance advantages in surgical settings.

By Wound Type

Key wound types include pressure ulcers, diabetic foot ulcers, venous leg ulcers, and burn wounds. Within pressure ulcers, advanced stages such as stage 3 and 4 require intensive debridement. Diabetic foot ulcers represent a major application due to increasing diabetes prevalence. Burn wounds, particularly second- and third-degree cases, require specialized care products and techniques.

By End-Use and Purchase Type

Hospitals, clinics, and home healthcare facilities are primary end-users. Inpatient and outpatient hospital settings dominate due to higher treatment volumes. Prescription-based products lead the purchase segment, while over-the-counter options gain popularity for minor wound care and home treatment convenience.

Segmentation:

By Product

- Gels

- Ointments & Creams

- Wound Irrigation Solution

- Surgical Devices

- Medical Gauzes

- Ultrasonic Devices

- Others

By Method

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

By Wound Type

- Pressure Ulcers

- Stage 1

- Stage 2

- Stage 3

- Stage 4

- Deep Tissue Injury

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds

- Second-degree (partial-thickness)

- Third-degree (full-thickness)

- Others

By End-Use

- Hospital (Inpatient)

- Hospital (Outpatient)

- Complex Wound Clinic

- Leg Ulcer Clinic

- Diabetic Foot Clinic

- Walk-in Clinic

- Podiatry Clinic

- General Practitioners (GP) Surgery

- Nursing Home

- Home Health

- Hospitalization at Home (HAD)

By Purchase Type

- Prescription

- Over the Counter (OTC)

- Others

By Country

- United Kingdom (UK)

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe – Established Market with Strong Healthcare Infrastructure

Western Europe dominates the Europe Wound Debridement Market with a market share of nearly 58%. The region benefits from advanced healthcare systems, high awareness of chronic wound management, and extensive adoption of modern wound care technologies. Countries such as Germany, France, and the United Kingdom lead due to strong hospital networks and the presence of key industry players. Growing investments in research and development, along with reimbursement support, strengthen market penetration. The elderly population and higher incidence of diabetes-related wounds sustain product demand. It continues to advance through innovation in debridement tools and the integration of digital wound monitoring solutions.

Southern Europe – Growing Adoption of Advanced Treatment Methods

Southern Europe holds about 22% of the regional market share, driven by rising healthcare modernization and improved access to wound management solutions. Countries like Italy and Spain are witnessing greater adoption of enzymatic and autolytic debridement methods due to increased patient awareness. Hospitals are expanding their use of cost-effective products such as gels and irrigation solutions to manage chronic wounds. Government health initiatives are improving treatment accessibility and promoting early diagnosis. The growing preference for outpatient and home healthcare services is boosting demand for portable and easy-to-use wound care devices. It demonstrates steady growth supported by ongoing clinical advancements and product affordability.

Eastern and Northern Europe – Emerging Markets with High Growth Potential

Eastern and Northern Europe collectively account for around 20% of the market share, with significant growth expected over the next decade. Countries like Poland, Russia, and the Nordic nations are investing in healthcare infrastructure to improve chronic wound care outcomes. The rise in diabetic and pressure ulcer cases is increasing the need for advanced debridement products. Local manufacturing and distribution expansion are helping bridge supply gaps in remote areas. Educational campaigns are enhancing awareness among clinicians and patients about modern wound management practices. It is anticipated that government support and private healthcare expansion will sustain market momentum in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Smith & Nephew

- ConvaTec Group PLC

- Braun SE

- Molnlycke Health Care AB

- Lohmann & Rauscher GmbH & Co. KG

- Schülke & Mayr GmbH

- URGO Medical

- Advanced Medical Solutions Limited

- Advancis Medical

- curea medical GmbH

- DEBx Medical

- Ausbüttel & Co. GmbH

Competitive Analysis:

The Europe Wound Debridement Market is highly competitive, with global and regional players focusing on innovation, product diversification, and partnerships. Key companies such as Smith & Nephew, ConvaTec Group PLC, B. Braun SE, and Mölnlycke Health Care AB dominate through advanced wound care portfolios and strong distribution networks. It is characterized by continuous product development targeting faster healing and reduced infection risk. Companies are expanding their presence in hospital and home care segments through cost-efficient technologies. Strategic mergers and R&D investments strengthen their market positioning across major European countries.

Recent Developments:

- In September 2025, Smith & Nephew launched the CENTRIO Platelet-Rich-Plasma (PRP) System in the US, a biodynamic hematogel derived from the patient’s own platelets and plasma designed to assist the natural healing process by maintaining a moist wound environment. The system is suited for managing chronic exuding wounds such as diabetic foot ulcers, venous leg ulcers, pressure ulcers, and tunnelling wounds, and is designed for point-of-care use in hospitals and physician offices.

- Molnlycke Health Care AB continues advancing wound care with products like Mepilex® Border Flex and Exufiber® for treating complex and exuding wounds, and their focus includes digital solutions and AI to transform wound care through better outcomes and cost reductions.

- Lohmann & Rauscher GmbH & Co. KG markets the Debrisoft® monofilament debridement pad recommended by NICE for improved wound debridement, offering faster and less painful outcomes for acute and chronic wounds.

- URGO Medical’s UrgoClean Ag, launched in 2025, is an advanced wound dressing with silver ions for continuous debridement, significantly reducing slough and necrotic tissue and promoting healing, particularly effective for venous leg ulcers and sloughy wounds.

- Advanced Medical Solutions Limited announced the acquisition of Peters Surgical in 2024 and has successfully launched LIQUIFIX™, an atraumatic fixation device marketed in the US for surgical and wound care applications.

Report Coverage:

The research report offers an in-depth analysis based on product, method, wound type, end-use, and purchase segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for non-invasive and painless wound debridement methods will accelerate innovation.

- AI-powered wound monitoring tools will enhance diagnosis and healing efficiency.

- Rising home healthcare adoption will boost portable and easy-to-use debridement products.

- Biologic and enzymatic formulations will gain stronger preference among chronic wound patients.

- Strategic partnerships will expand the availability of advanced wound management solutions.

- Sustainability will shape product design, focusing on biodegradable and eco-safe materials.

- Expansion into Eastern Europe will unlock new growth opportunities for manufacturers.

- Reimbursement support and clinical guideline updates will promote adoption of modern techniques.

- Continuous R&D investment will enhance precision and effectiveness in wound cleaning solutions.

- The market will evolve toward integrated care models combining technology and clinical expertise.