Market Overview:

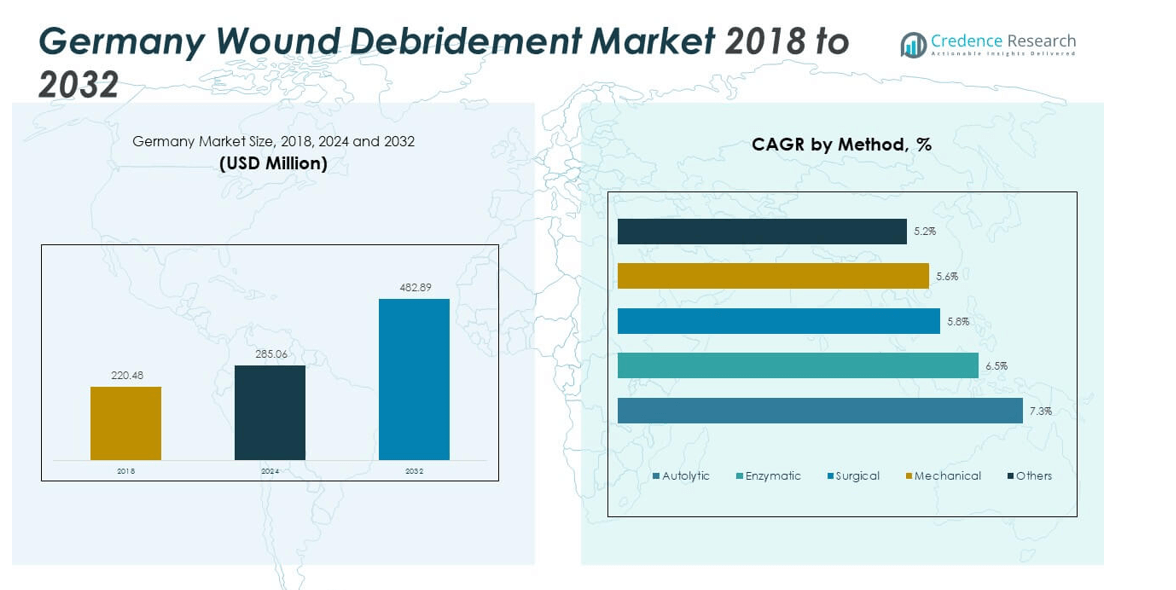

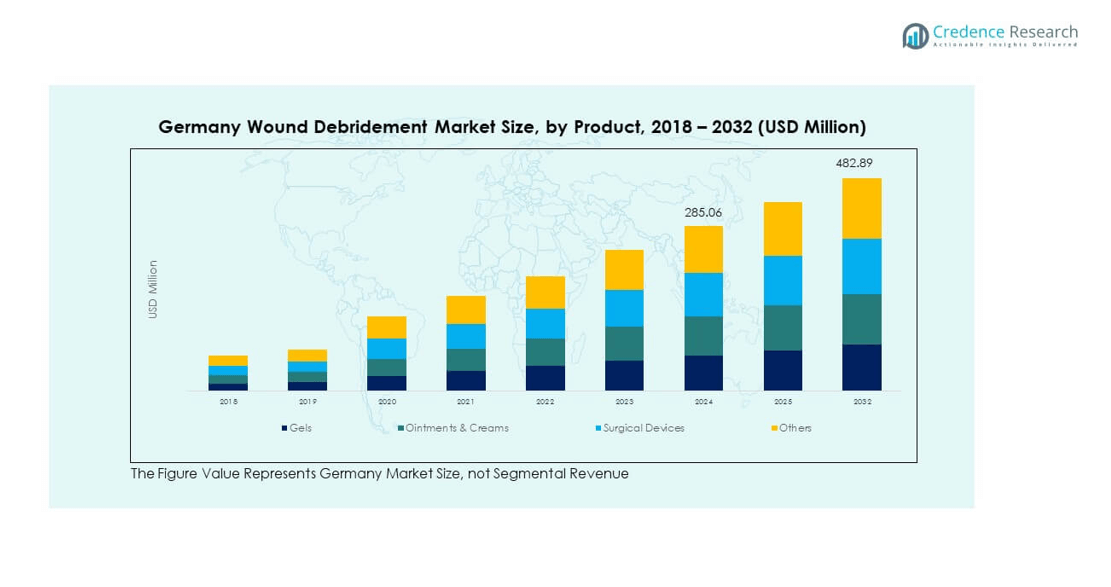

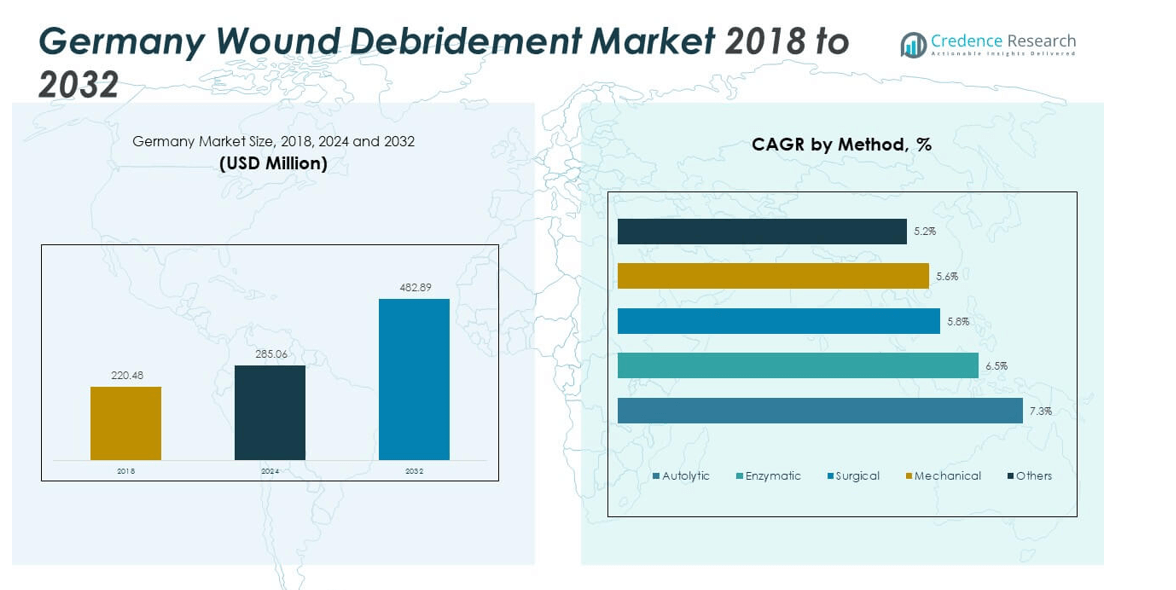

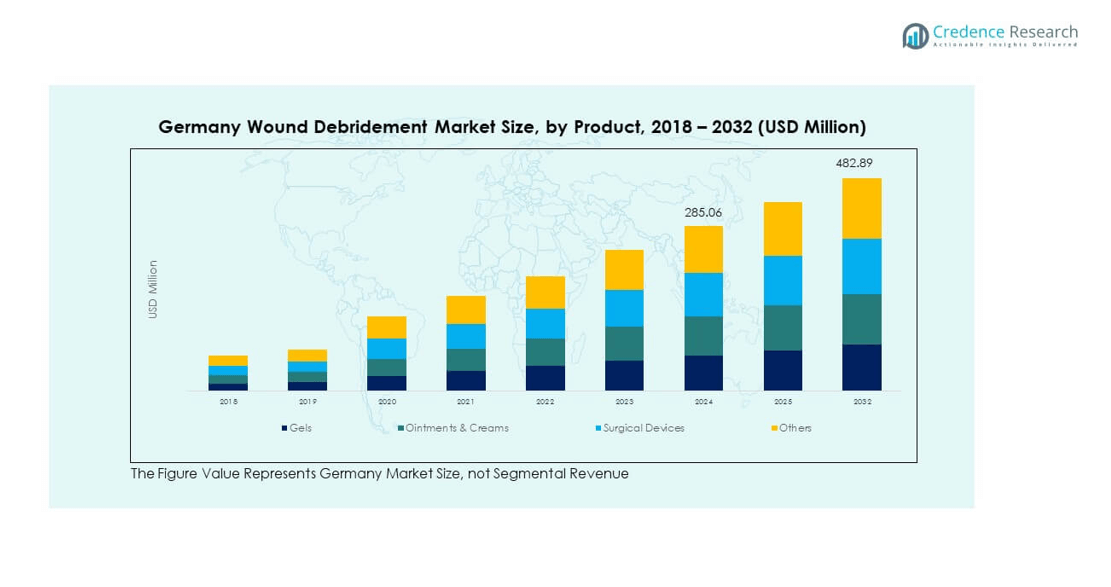

The Germany Wound Debridement Market size was valued at USD 220.48 million in 2018, increased to USD 285.06 million in 2024, and is anticipated to reach USD 482.89 million by 2032, at a CAGR of 6.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Wound Debridement Market Size 2024 |

USD 285.06 million |

| Germany Wound Debridement Market, CAGR |

6.81% |

| Germany Wound Debridement Market Size 2032 |

USD 482.89 million |

The market growth is driven by rising cases of chronic wounds, diabetic ulcers, and surgical infections. Increased awareness of advanced wound care solutions and strong healthcare infrastructure support adoption. Growing demand for minimally invasive procedures and innovations in enzymatic and mechanical debridement methods are also accelerating expansion across hospitals and specialty clinics in Germany.

Regionally, Western Germany dominates due to its large concentration of advanced healthcare facilities and higher healthcare expenditure. Urban centers such as Berlin, Munich, and Frankfurt are key markets supported by advanced wound management programs and research investments. Eastern regions are emerging, with government initiatives and growing hospital infrastructure improving access to wound care technologies.

Market Insights:

- The Germany Wound Debridement Market was valued at USD 220.48 million in 2018, reached USD 285.06 million in 2024, and is expected to attain USD 482.89 million by 2032, registering a CAGR of 6.81%.

- Western Germany leads the market with a 38% share, supported by advanced healthcare systems and widespread adoption of modern wound care solutions.

- Southern Germany holds a 27% share, driven by innovation, strong medical technology manufacturing, and research partnerships, while Northern and Eastern Germany together account for 35%, benefiting from healthcare expansion and government support.

- Gels dominate the product segment with an estimated 32% share due to high efficiency in moisture balance and healing promotion, followed by ointments and creams with 28% share for their convenience and versatility.

- Surgical devices contribute roughly 25% share, emerging as the fastest-growing category owing to advancements in ultrasonic and mechanical debridement systems used in complex wound cases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Chronic and Diabetic Wounds Driving Demand

The Germany Wound Debridement Market is expanding due to the rising incidence of chronic wounds, pressure ulcers, and diabetic foot ulcers. Germany’s aging population and increasing diabetes cases have created a strong need for effective wound care. Hospitals and clinics are adopting advanced debridement techniques to accelerate healing and reduce infection risks. The government’s focus on improving patient outcomes supports product innovation. High healthcare expenditure enables wider access to modern treatment devices. The growing demand for enzymatic and autolytic debridement is transforming traditional practices. It is also encouraging manufacturers to enhance precision and safety features in their offerings.

- For instance, Smith+Nephew launched its CENTRIO Platelet-Rich-Plasma (PRP) System, designed to aid the healing of chronic wounds such as diabetic foot ulcers and pressure ulcers, through maintaining a moist wound environment and tailoring treatment at point-of-care settings.

Technological Advancements Enhancing Treatment Efficiency and Outcomes

The integration of technology is reshaping the Germany Wound Debridement Market by improving accuracy and recovery rates. Companies are investing in advanced mechanical and ultrasonic debridement tools to enable faster tissue removal. These devices provide consistent results and minimize patient discomfort. The use of single-use and portable systems enhances convenience and infection control. Healthcare providers are adopting digital monitoring and imaging solutions for wound assessment. It is helping clinicians tailor treatment plans and track progress effectively. Continuous innovation is strengthening the market’s clinical value and reliability across hospitals and outpatient centers.

- For instance, Söring GmbH manufactures the SONOCA 300 ultrasonic dissector, offering three working frequencies in one device (25 kHz, 35 kHz, and 55 kHz); this unique capability is targeted for advanced surgical procedures, including wound debridement applications in Germany.

Government Healthcare Policies Promoting Advanced Wound Care Adoption

Germany’s robust healthcare policies and reimbursement structure are major growth drivers for wound debridement solutions. Public and private insurers are covering a wide range of wound management treatments, making care more affordable. Government initiatives supporting chronic disease management are boosting the demand for specialized wound products. Hospitals are encouraged to follow evidence-based care models that rely on modern debridement techniques. It is also fostering collaborations between research institutions and manufacturers. National standards for wound care have improved product quality and patient safety. Strong institutional support continues to expand the adoption of innovative debridement devices across the country.

Growing Awareness and Training Programs Among Healthcare Professionals

Increasing education and training initiatives among healthcare professionals are advancing wound debridement practices. Universities, hospitals, and medical associations are introducing programs that focus on best practices in wound management. These efforts help nurses and surgeons apply effective debridement techniques with greater confidence. It is improving consistency in clinical outcomes and patient recovery. The emphasis on continuing education also supports the adoption of newer devices and materials. Training workshops enhance practical knowledge, leading to better handling of complex wounds. Such programs are promoting professional development and fueling long-term market growth across Germany.

Market Trends:

Shift Toward Minimally Invasive and Patient-Centered Debridement Techniques

The Germany Wound Debridement Market is witnessing a shift toward minimally invasive and patient-focused treatment solutions. Healthcare professionals prefer enzymatic and autolytic methods for reduced pain and faster healing. These techniques lower hospital stays and healthcare costs. It is encouraging manufacturers to design user-friendly and portable products. The rising popularity of outpatient wound care centers reflects this trend. Patients are also becoming more aware of the comfort and safety advantages of advanced debridement. Growing clinical preference for non-surgical techniques is shaping future product development.

- For instance, Söring Ultrasonic-Assisted Wound Debridement (UAW) devices are cited in clinical experiences for providing relatively painless debridement and selective removal of devitalized tissue without damaging intact cells, supporting patient-centered wound care in chronic wound management pathways.

Integration of Digital and AI-Based Wound Monitoring Technologies

Digitalization is transforming wound care by enabling accurate diagnosis and progress tracking. AI-powered imaging systems help clinicians measure wound size and tissue conditions precisely. The Germany Wound Debridement Market is adopting these technologies to improve decision-making. Hospitals are integrating wound monitoring software with electronic health records for seamless management. It is enhancing treatment efficiency and reducing complications. Remote wound assessment tools are also gaining traction for home-based care. The trend supports better data collection and personalized treatment planning in clinical environments.

- For instance, in October 2023, Smith+Nephew opened a new surgical innovation and training center in Munich, Germany, that focuses on advancing digital and AI technologies across its portfolio, including advanced wound management, orthopedic surgery, and sports medicine. Another example of their innovation is the launch of the AI-powered personalized planning software for the CORI Surgical System, announced in May 2023.

Sustainable and Eco-Friendly Debridement Product Development

Environmental sustainability is becoming a key focus area for wound care manufacturers in Germany. Companies are developing biodegradable and reusable tools to reduce medical waste. The Germany Wound Debridement Market is adapting to this shift by encouraging green innovation. Hospitals are prioritizing suppliers that meet environmental standards and certifications. It is influencing procurement decisions and corporate strategies. The trend aligns with Germany’s national sustainability goals. The move toward eco-friendly practices is helping the market appeal to environmentally conscious healthcare institutions.

Rise of Outpatient and Home-Based Wound Management Solutions

Outpatient and home-based care models are gaining strong traction due to convenience and cost benefits. Patients prefer managing wounds at home under remote supervision. The Germany Wound Debridement Market is responding with compact, easy-to-use devices suitable for self-care. Telemedicine integration supports wound assessment and follow-up consultations. It is helping reduce hospital burden and improving access for rural populations. Manufacturers are focusing on ergonomic designs and safety features for non-professional use. This trend is reshaping product portfolios and widening patient engagement across care settings.

Market Challenges Analysis:

High Cost of Advanced Debridement Equipment and Limited Accessibility

The Germany Wound Debridement Market faces challenges related to the high cost of advanced devices and limited reimbursement in specific cases. While hospitals in major cities can afford modern technologies, smaller healthcare facilities face financial constraints. The expense of single-use tools and digital systems restricts widespread adoption. It is especially difficult for community clinics to maintain affordability. Limited awareness in rural regions adds to the disparity in wound care quality. Budget pressures on healthcare providers can slow technology upgrades. Addressing pricing barriers remains essential for broader market penetration across all regions.

Regulatory Complexity and Shortage of Skilled Professionals

Strict regulatory processes in Germany pose a challenge for the timely introduction of new wound debridement products. Manufacturers must comply with stringent standards for safety, efficacy, and environmental impact. It is extending approval timelines and increasing costs for product launches. Another major issue is the shortage of trained professionals skilled in advanced debridement methods. Many healthcare workers require specialized training to handle modern devices safely. These skill gaps can delay proper treatment and affect clinical results. Collaborative programs between industry and educational institutions are needed to resolve these barriers.

Market Opportunities:

Emergence of Advanced Biologic and Enzymatic Debridement Solutions

The Germany Wound Debridement Market offers opportunities through advancements in biologic and enzymatic formulations. These innovations accelerate healing by targeting necrotic tissue selectively. It supports better recovery for chronic and diabetic wounds. Companies investing in R&D are gaining competitive advantages through specialized products. Hospitals are increasingly integrating such solutions into standard treatment protocols. The growing preference for non-surgical debridement methods is expanding this segment’s potential. Continuous improvements in bioactive materials will further enhance treatment safety and outcomes.

Expansion of Telehealth and Home-Based Wound Care Programs

Germany’s digital healthcare expansion creates new opportunities for remote wound management. Telehealth platforms allow doctors to monitor healing progress and adjust treatments virtually. The Germany Wound Debridement Market benefits from this trend by offering compatible portable systems. It improves access to quality care in underserved regions. The growing focus on patient comfort and cost efficiency supports this shift. Partnerships between technology providers and healthcare institutions can accelerate adoption. The model aligns with the national vision for digital and patient-centered healthcare delivery.

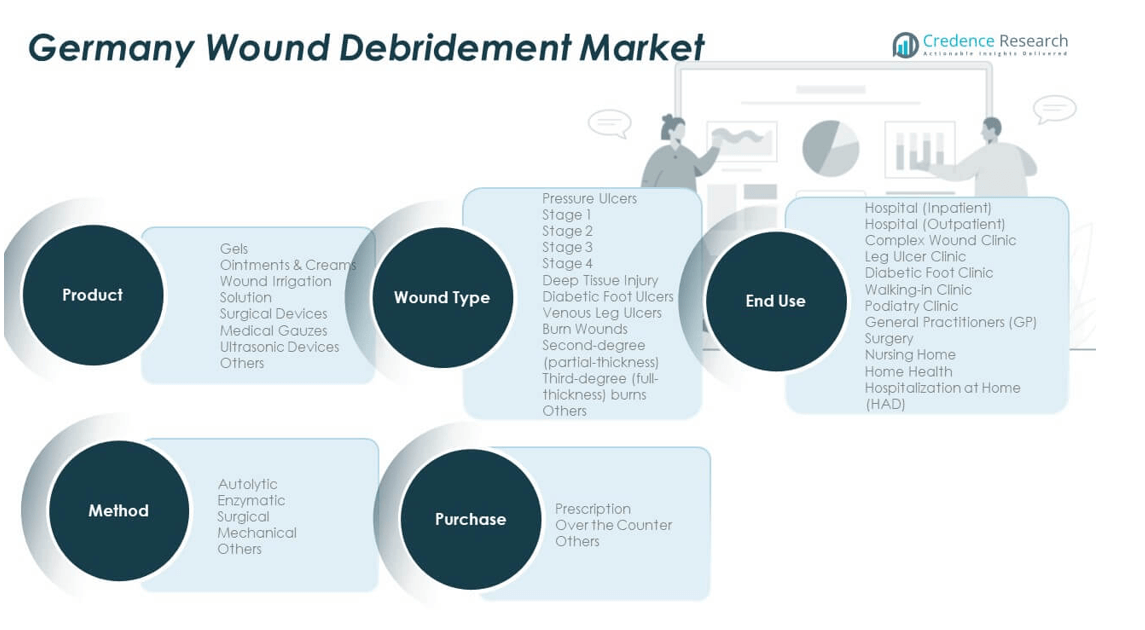

Market Segmentation Analysis:

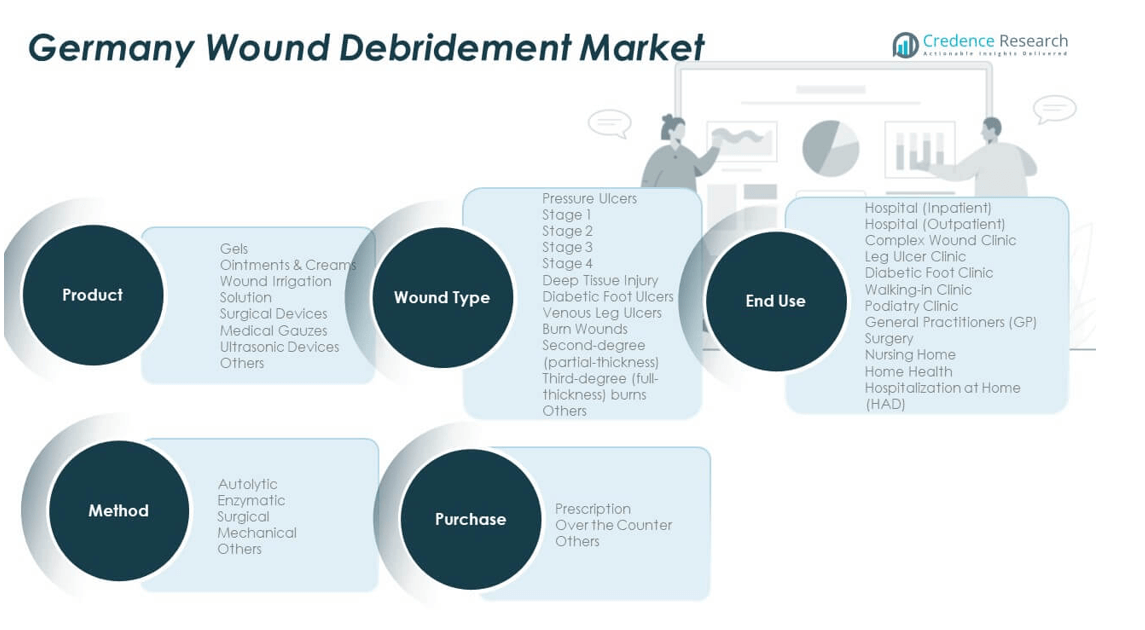

By Product Segment

The Germany Wound Debridement Market features diverse products such as gels, ointments and creams, wound irrigation solutions, surgical devices, medical gauzes, ultrasonic devices, and others. Gels and ointments hold strong adoption due to their ease of application and effectiveness in moisture control. Surgical and ultrasonic devices are gaining traction for their precision and ability to treat complex wounds. Wound irrigation solutions and gauzes continue to support hospitals and clinics in infection prevention and cleaning efficiency. It reflects a balanced mix of traditional and advanced solutions supporting comprehensive wound management.

- For instance, SONOCA 300 by Söring GmbH is highlighted for its innovative multi-frequency ultrasonic capabilities, supporting a broad product mix for wound debridement and surgical interventions in Germany.

By Method Segment

Autolytic and enzymatic methods dominate due to their non-invasive nature and reduced pain levels. Surgical and mechanical techniques remain vital for severe or chronic cases needing rapid tissue removal. The Germany Wound Debridement Market benefits from advancements that improve treatment outcomes and reduce healing time. Demand for enzymatic methods is increasing across hospitals and home care settings. It is supported by ongoing product innovation aimed at enhancing tissue selectivity and patient comfort.

- For instance, Söring UAW systems are used in clinical settings for gentle, selective removal of soft, non-viable tissue by low-frequency ultrasonic oscillations, supporting improved tissue selectivity and comfort for chronic wound care.

By Wound Type Segment

Pressure ulcers and diabetic foot ulcers represent the largest share of wound cases in Germany. Stage 2 and Stage 3 ulcers are more frequent due to aging and chronic conditions. Venous leg ulcers and burn wounds also drive consistent demand for advanced care tools. The market shows rising attention toward early-stage management to prevent complications. It highlights the growing integration of multi-method approaches across chronic wound types.

By End-Use and Purchase Segment

Hospitals, both inpatient and outpatient, lead demand due to high patient inflow and specialized wound units. Clinics, nursing homes, and home health services are expanding usage for chronic wound care. Hospitalization-at-home programs are growing due to patient convenience and digital monitoring. Prescription-based products dominate, while over-the-counter (OTC) options gain visibility in mild wound care. It reinforces the Germany Wound Debridement Market’s strong balance between institutional demand and patient-centric care.

Segmentation:

By Product Segment

- Gels

- Ointments & Creams

- Wound Irrigation Solutions

- Surgical Devices

- Medical Gauzes

- Ultrasonic Devices

- Others

By Method Segment

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

By Wound Type Segment

- Pressure Ulcers

- Stage 1

- Stage 2

- Stage 3

- Stage 4

- Deep Tissue Injury

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds

- Second-Degree (Partial-Thickness)

- Third-Degree (Full-Thickness) Burns

- Others

By End-Use Segment

- Hospital (Inpatient)

- Hospital (Outpatient)

- Complex Wound Clinic

- Leg Ulcer Clinic

- Diabetic Foot Clinic

- Walk-in Clinic

- Podiatry Clinic

- General Practitioners (GP) Surgery

- Nursing Home

- Home Health

- Hospitalization at Home (HAD)

By Purchase Segment

- Prescription

- Over the Counter (OTC)

- Others

Regional Analysis:

Western Germany – Leading the Market with 38% Share

Western Germany dominates the Germany Wound Debridement Market, accounting for nearly 38% of total revenue. The region’s leadership is driven by advanced healthcare infrastructure, high hospital density, and early adoption of innovative wound management technologies. Major cities like Cologne, Düsseldorf, and Frankfurt house specialized wound care centers and research facilities. Hospitals in this region actively integrate ultrasonic and enzymatic debridement methods to improve patient outcomes. It benefits from strong collaborations between universities, healthcare providers, and medical device companies. High awareness among patients and physicians further boosts the use of modern wound care solutions.

Southern Germany – Strong Growth Supported by Innovation and R&D

Southern Germany holds around 27% market share and shows strong growth driven by innovation and manufacturing strength. The region, home to cities such as Munich and Stuttgart, has a concentration of medical technology firms and research institutions. It emphasizes product development in biodegradable and precision-based debridement systems. The healthcare system’s focus on chronic wound care and early intervention supports expansion. It attracts investment from international wound care companies seeking advanced production capabilities. Hospitals and clinics in Southern Germany are key adopters of digital wound assessment tools, improving accuracy in treatment delivery.

Northern and Eastern Germany – Emerging Hubs with Expanding Healthcare Access

Northern and Eastern Germany collectively contribute about 35% to the Germany Wound Debridement Market. Both regions are witnessing steady improvements in healthcare access and hospital infrastructure. Government funding for regional hospitals and community clinics supports the adoption of wound care technologies. It is strengthening demand in underserved areas where chronic wound incidence is rising. Northern Germany benefits from proximity to North Sea trade routes, aiding imports of medical devices. Eastern Germany, driven by cities like Leipzig and Dresden, is emerging as a growth corridor due to healthcare modernization and rising diabetic populations. The overall expansion across these regions enhances the country’s wound care ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Braun SE

- Lohmann & Rauscher GmbH & Co. KG

- Schülke & Mayr GmbH

- curea medical GmbH

- Ausbüttel & Co. GmbH (Draco)

- Paul Hartmann AG

- Ottobock SE & Co. KGaA

- HARTMANN GROUP

Competitive Analysis:

The Germany Wound Debridement Market is moderately competitive, featuring a mix of established medical device manufacturers and specialized wound care firms. Companies such as B. Braun SE, Paul Hartmann AG, and Lohmann & Rauscher dominate through extensive product portfolios and strong hospital partnerships. It emphasizes technological innovation and cost efficiency to strengthen market position. Local firms like Schülke & Mayr GmbH and curea medical GmbH enhance competition by offering region-specific wound solutions. Continuous product upgrades and research collaborations sustain leadership and differentiation among top players.

Recent Developments:

- In September 2025, B. Braun SE announced the full acquisition of True Digital Surgery (TDS), a company specializing in robotic-assisted 3D surgical microscopy, aiming to accelerate innovation and integration of advanced digital technologies into B. Braun’s microsurgery and wound care portfolio in Germany.

- In September 2025, Lohmann & Rauscher GmbH & Co. KG successfully completed the acquisition of 49% of the shares of the ADA Group, a Portuguese supplier of gauze, nonwoven products, and bandages, thereby strengthening its European wound care position and secure raw material supply, with the strategic partnership effective retroactively from January 1, 2025.

- In April 2025, Lohmann & Rauscher Group also acquired Unisurge International Ltd., a UK-based manufacturer and supplier of surgical solutions, further broadening its wound management and surgical products business across Europe, including the German market.

Report Coverage:

The research report offers an in-depth analysis based on product, method, wound type, end-use, and purchase segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising prevalence of chronic wounds will sustain long-term demand growth.

- Innovation in enzymatic and ultrasonic debridement will enhance treatment precision.

- Expansion of home-based care will increase adoption of portable wound devices.

- Digital monitoring systems will strengthen clinical wound management practices.

- Strong government healthcare spending will support modern wound care adoption.

- Collaborations between manufacturers and hospitals will drive product validation.

- Growing awareness among healthcare professionals will improve patient outcomes.

- Sustainable and eco-friendly wound care products will gain regulatory support.

- Entry of new players will intensify competition and drive pricing optimization.

- Continuous R&D investments will secure Germany’s leadership in advanced wound treatment.