Market Overview

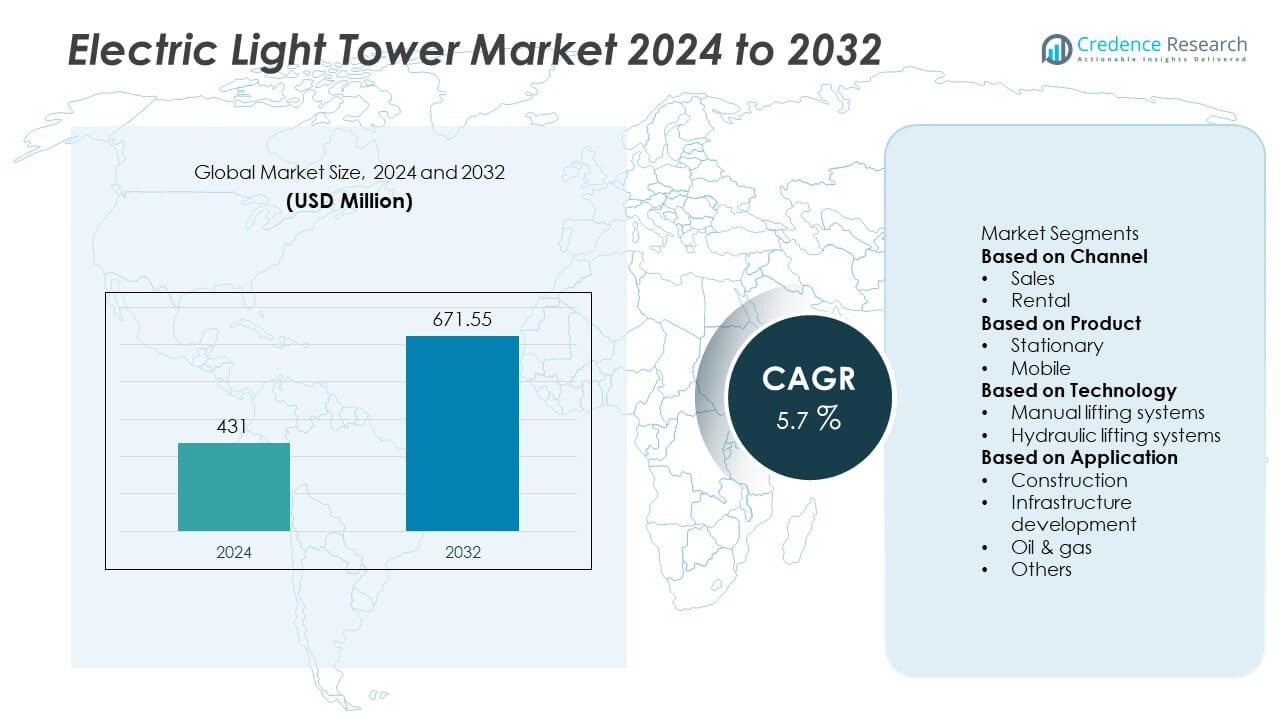

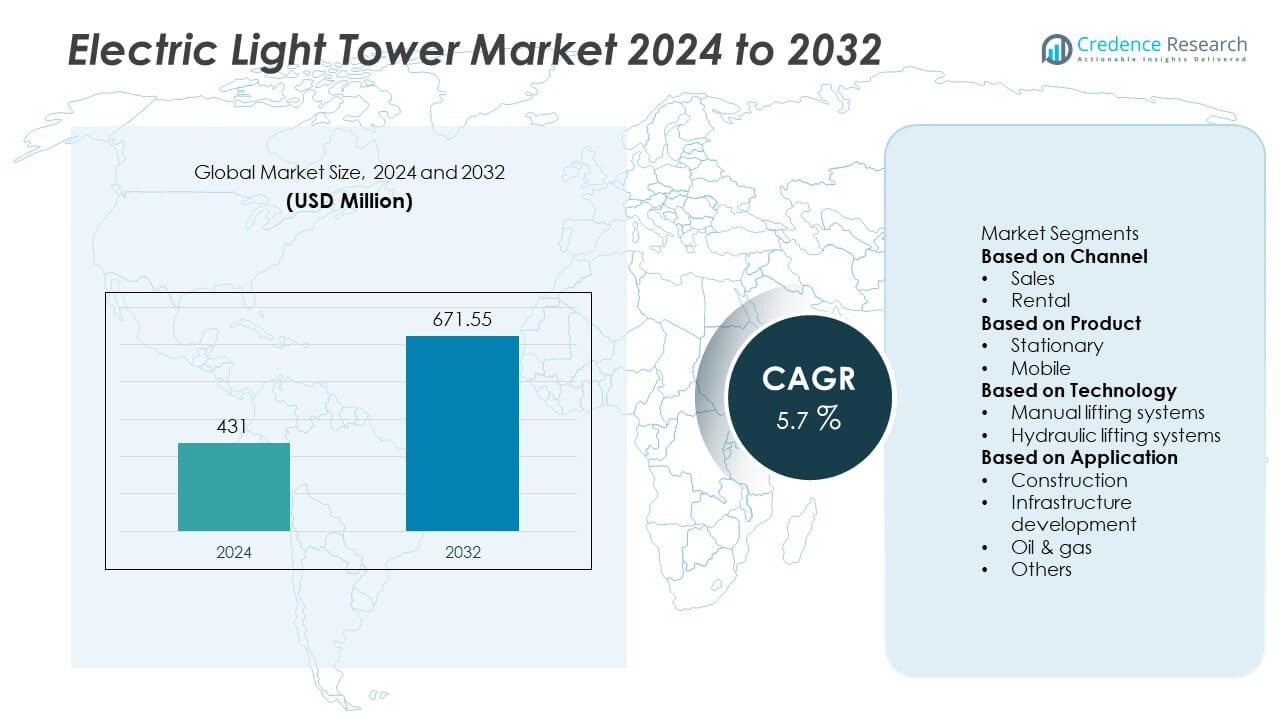

The global Electric Light Tower market was valued at USD 431 million in 2024 and is projected to reach USD 671.55 million by 2032, registering a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Light Tower Market Size 2024 |

USD 431 Million |

| Electric Light Tower Market, CAGR |

5.7% |

| Electric Light Tower Market Size 2032 |

USD 671.55 Million |

The Electric Light Tower market is led by key players including Generac Power Systems, Atlas Copco, Allmand Bros., Chicago Pneumatic, Hannaik, LARSON Electronics, Boss LTR, Herc Rentals, Axiom Equipment Group, and Italtower. These companies dominate through innovation in LED lighting, hybrid power integration, and portable design advancements that enhance performance and energy efficiency. North America emerged as the leading region in 2024, holding 34% of the global market share, driven by strong infrastructure development, oilfield operations, and the widespread adoption of rental-based light towers. Europe followed with 27%, supported by strict emission standards and rapid shift toward sustainable lighting systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Light Tower market was valued at USD 431 million in 2024 and is projected to reach USD 671.55 million by 2032, registering a CAGR of 5.7% during the forecast period.

- Expanding infrastructure development and increasing night-time construction activities are key drivers boosting demand for efficient and portable electric light towers across industries.

- Growing adoption of LED and hybrid-powered systems, along with smart monitoring features, defines a major trend shaping market innovation and sustainability.

- The market is moderately consolidated, with leading companies such as Generac Power Systems, Atlas Copco, Allmand Bros., and LARSON Electronics focusing on product efficiency, mobility, and reduced emissions.

- North America led the market with 34% share in 2024, followed by Europe at 27% and Asia-Pacific at 25%, while the mobile segment accounted for over 70% share, reflecting high preference for flexible and transportable lighting solutions.

Market Segmentation Analysis:

By Channel

The sales segment dominated the Electric Light Tower market in 2024, capturing nearly 65% of the total share. Its dominance is driven by strong demand from infrastructure and construction projects requiring permanent or long-term lighting solutions. Industrial operators prefer ownership for cost efficiency and reliability over repeated rentals. However, the rental segment continues to grow rapidly across mining, oil, and event industries due to flexibility and reduced maintenance needs. Increasing deployment in temporary projects and short-term operations is expected to sustain rental demand through 2032.

- For instance, Generac Power Systems expanded its lighting portfolio with the GLT Series, integrating 4 × 320 W LED modules capable of delivering up to 188,000 lumens and a continuous runtime of over 200 hours on a single refueling cycle, supporting continuous construction illumination in large-scale highway projects.

By Product

The mobile segment led the market in 2024, accounting for over 70% of the total share. These towers offer high flexibility and ease of transport across multiple job sites, making them ideal for construction, mining, and emergency response applications. Growing preference for compact, trailer-mounted units with efficient LED systems supports their dominance. Stationary towers maintain steady adoption in fixed industrial and municipal applications where mobility is less critical. The continued demand for portable lighting across outdoor operations reinforces the mobile segment’s leadership in global markets.

- For instance, Atlas Copco’s HiLight V5+ mobile LED tower features four 350 W floodlights and is powered by a 2-cylinder Kubota engine. Its runtime varies depending on the fuel tank size and market, but some models with a 28-gallon (105-liter) fuel tank can run for up to 150 hours.

By Technology

The hydraulic lifting systems segment held the largest share in 2024, representing around 60% of total installations. These systems provide quicker setup, enhanced safety, and better height adjustment compared to manual variants. Growing adoption in construction and oilfield sites, where time efficiency and stability are key, drives their widespread use. Manual lifting systems remain relevant for small-scale projects with limited budgets. The ongoing shift toward automation and labor-saving designs is expected to further strengthen the dominance of hydraulic technology in upcoming years.

Key Market Growth Drivers

Expansion of Construction and Infrastructure Projects

The steady rise in global construction and infrastructure development acts as a major growth catalyst for the Electric Light Tower market. Expanding urbanization, highway construction, and mining projects demand continuous lighting for safe, round-the-clock operations. Governments across Asia-Pacific, North America, and Europe are investing heavily in large-scale infrastructure and smart city projects. Electric light towers are preferred due to their reliability, mobility, and energy efficiency, supporting widespread adoption across public, industrial, and commercial sectors.

- For instance, Allmand Bros. deployed its Night-Lite GR-Series towers on large U.S. infrastructure projects, with a recent liquid-cooled 6kW model featuring four 350-W LED fixtures that produce over 228,000 total lumens and a 238-liter (63-gallon) fuel tank enabling up to 215 hours of continuous illumination per refueling cycle, ensuring uninterrupted lighting for 24-hour highway maintenance operations.

Shift Toward Energy-Efficient and LED-Based Systems

The growing move toward LED-based lighting systems is transforming the Electric Light Tower market. LED towers consume less power, offer higher illumination, and require minimal maintenance compared to metal halide systems. Manufacturers are incorporating intelligent features like remote monitoring, dimming control, and hybrid power setups. This trend aligns with global sustainability efforts and emission reduction goals. As industries adopt eco-friendly lighting, LED-based towers continue to replace conventional models, enhancing operational efficiency across construction, mining, and event sectors.

- For instance, Atlas Copco’s HiLight V5+ LED tower integrates four 350-W LED floodlights to illuminate an area of up to 5,000 m². The unit can run for up to 88 hours with an 80-liter fuel tank and a fuel consumption of 0.9 l/hr. This design results in significantly lower fuel consumption and emissions compared to traditional halide towers, making it a sustainable and cost-effective lighting option for remote worksites.

Rising Adoption in Emergency and Remote Operations

Electric light towers are increasingly essential for emergency response and remote operations. Their ability to deliver rapid, dependable lighting in off-grid or disaster-prone areas drives growing deployment. Governments, defense agencies, and humanitarian organizations use mobile light towers for field operations, disaster recovery, and emergency camps. Rising natural disasters and power outages highlight the need for portable lighting solutions. As reliability and quick setup become crucial, the market continues to expand in public safety and critical infrastructure sectors.

Key Market Trends and Opportunities

Integration of Smart and Hybrid Power Solutions

The Electric Light Tower market is seeing increased adoption of smart and hybrid energy systems. Manufacturers are integrating solar panels, batteries, and grid connections to reduce fuel consumption and emissions. IoT-based control panels allow operators to monitor performance, automate operation, and predict maintenance needs. These technologies enhance efficiency and minimize downtime. Hybrid-powered light towers are gaining popularity in large industrial and infrastructure projects focused on sustainability and operational cost optimization.

- For instance, Generac Power Systems introduced its MLT6SMD LED light tower, which features a Mitsubishi diesel engine with variable ECOSpeed technology. The engine adjusts its speed based on the load, offering an extended runtime of up to 205 hours on a single 40-gallon tank when powering the lights only.

Growth of Rental-Based Business Models

Rental-based business models are creating strong growth opportunities in the Electric Light Tower market. Contractors and event organizers increasingly prefer renting equipment to minimize capital costs and maintenance burdens. Rental providers are expanding their fleets with mobile, energy-efficient LED towers to meet diverse project needs. The growth of digital rental platforms and improved logistics further enhances accessibility and convenience. This flexible approach benefits users requiring short-term illumination while offering steady revenue potential for rental service providers.

- For instance, Herc Rentals expanded its rental portfolio with new Atlas Copco HiLight V5+ light towers, each equipped with four 350 W LED lamps. These units have a 105-liter fuel tank that supports an extended run time of up to 150 hours and offer significant fuel savings, optimizing performance for construction and event projects. Telematics for fleet tracking is also available as an optional feature.

Key Market Challenges

High Initial Investment and Maintenance Costs

High upfront investment remains a major obstacle in the Electric Light Tower market. Advanced LED and hybrid systems offer long-term savings but require substantial initial spending. Regular maintenance of electrical components, lighting units, and control systems adds to total ownership costs. These financial barriers often lead smaller operators to favor rental options. Manufacturers are addressing this challenge by developing cost-effective designs that deliver performance, durability, and lower lifecycle expenses without compromising quality.

Limited Power Supply in Remote Locations

Limited power access in remote or off-grid sites poses a consistent challenge for electric light tower deployment. Although hybrid and solar-powered units are emerging, their adoption is slowed by higher costs and limited energy storage capacity. In mining, oilfield, and rural construction sites, unstable power supply can disrupt lighting continuity. To overcome this, companies focus on enhancing battery efficiency and integrating renewable energy systems to ensure reliable, uninterrupted operation in isolated environments.

Regional Analysis

North America

North America held the largest share of the Electric Light Tower market in 2024, accounting for 34% of global revenue. Strong infrastructure expansion, oilfield exploration, and extensive road construction activities in the United States and Canada are the main growth contributors. The region benefits from a well-established rental network and a growing preference for energy-efficient LED-based towers. Rising investments in disaster management and public safety applications also enhance adoption. Continued focus on sustainable and automated lighting technologies will further drive North America’s market growth through 2032.

Europe

Europe captured 27% of the Electric Light Tower market in 2024, supported by strong environmental regulations and widespread demand for sustainable lighting systems. Countries including Germany, France, and the United Kingdom are leading in adopting LED and hybrid-powered towers for construction and event use. Stringent emission control policies accelerate the transition away from diesel-based units. Expansion in renewable energy and rail infrastructure projects also supports steady demand. The region’s mature rental market and emphasis on workplace safety ensure consistent growth across industrial and municipal applications.

Asia-Pacific

Asia-Pacific accounted for 25% of the Electric Light Tower market in 2024, fueled by rapid urbanization, industrialization, and public infrastructure development. China, India, and Japan remain leading contributors, driven by rising construction, mining, and oilfield operations. Governments are increasingly promoting energy-efficient and hybrid lighting systems to meet sustainability targets. Growing adoption of mobile towers for remote and large-scale projects supports regional expansion. Rising investments in highways, airports, and manufacturing facilities will continue to strengthen Asia-Pacific’s position as the fastest-growing regional market through the forecast period.

Latin America

Latin America represented 8% of the Electric Light Tower market in 2024, driven by increasing construction and mining activities. Brazil, Mexico, and Chile lead demand, supported by expanding energy and transportation projects. The growing use of rental-based solutions allows contractors to manage short-term needs cost-effectively. Government infrastructure programs and renewable energy initiatives are improving market conditions. Although the region’s growth pace remains moderate, greater access to energy-efficient and mobile lighting systems is expected to enhance adoption and strengthen the market outlook.

Middle East and Africa

The Middle East and Africa accounted for 6% of the Electric Light Tower market in 2024, supported by strong oilfield development and large-scale construction projects. Saudi Arabia, the United Arab Emirates, and South Africa are key markets driving regional demand. Increased use of electric and hybrid towers helps reduce emissions and maintenance costs across industrial operations. Government-backed infrastructure initiatives and industrial diversification programs further promote adoption. Continued investment in mining, energy, and public works projects ensures stable growth potential throughout the forecast period.

Market Segmentations:

By Channel

By Product

By Technology

- Manual lifting systems

- Hydraulic lifting systems

By Application

- Construction

- Infrastructure development

- Oil & gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Light Tower market includes major players such as Generac Power Systems, Hannaik, Chicago Pneumatic, Italtower, Allmand Bros., LARSON Electronics, Boss LTR, Atlas Copco, Herc Rentals, and Axiom Equipment Group. These companies compete through technological innovation, expanding product lines, and strategic partnerships with construction and rental service providers. Leading manufacturers focus on enhancing energy efficiency and sustainability by developing LED-based, solar-powered, and hybrid lighting solutions. Continuous product upgrades with remote monitoring and smart control systems help improve operational reliability and safety. Regional players emphasize cost-effective and mobile designs to meet local project requirements, while global companies leverage strong distribution networks and aftersales services to strengthen brand presence. The growing demand for efficient, low-emission lighting equipment encourages ongoing investments in research and development, ensuring continuous advancement and competitive differentiation in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Atlas Copco launched the second-generation solar light towers, the HiLight MS 4 and MS 5.

- In 2025, Atlas Copco also introduced an ultra-quiet diesel LED light tower for urban/residential use.

- In March 2024, Larson Electronics also introduced other new lighting and tower variants, including explosion-proof LED towers and metal halide towers.

- In January 2024, Generac Power Systems launched the GLT Series mobile lighting towers under a unified global platform strategy.

Report Coverage

The research report offers an in-depth analysis based on Channel, Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electric Light Tower market will witness steady growth driven by infrastructure and industrial expansion.

- LED-based and hybrid power systems will continue to replace traditional lighting units.

- Demand for mobile and energy-efficient towers will rise across construction and mining sectors.

- Rental-based business models will expand as contractors seek cost-effective solutions.

- Integration of smart controls and remote monitoring will enhance equipment efficiency.

- Manufacturers will invest more in solar-powered and battery-operated light tower designs.

- Sustainability goals and emission reduction policies will drive product innovation.

- Asia-Pacific will emerge as the fastest-growing region due to rapid urban development.

- North America will maintain leadership through advanced technology adoption and strong rental networks.

- Partnerships between manufacturers and service providers will strengthen distribution and aftersales capabilities globally.