Market Overview

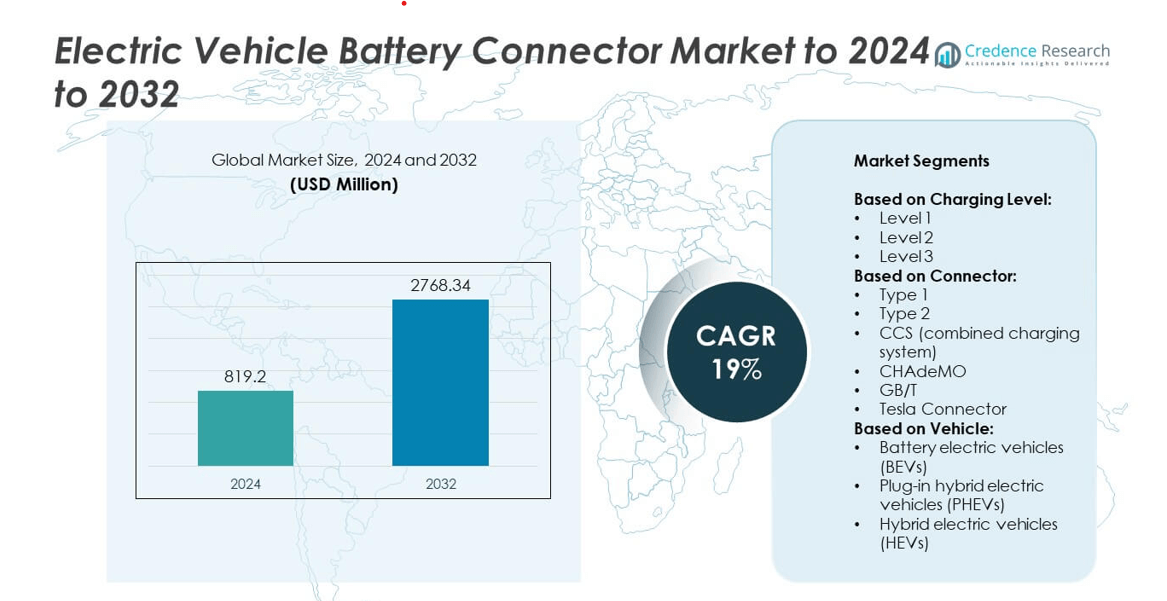

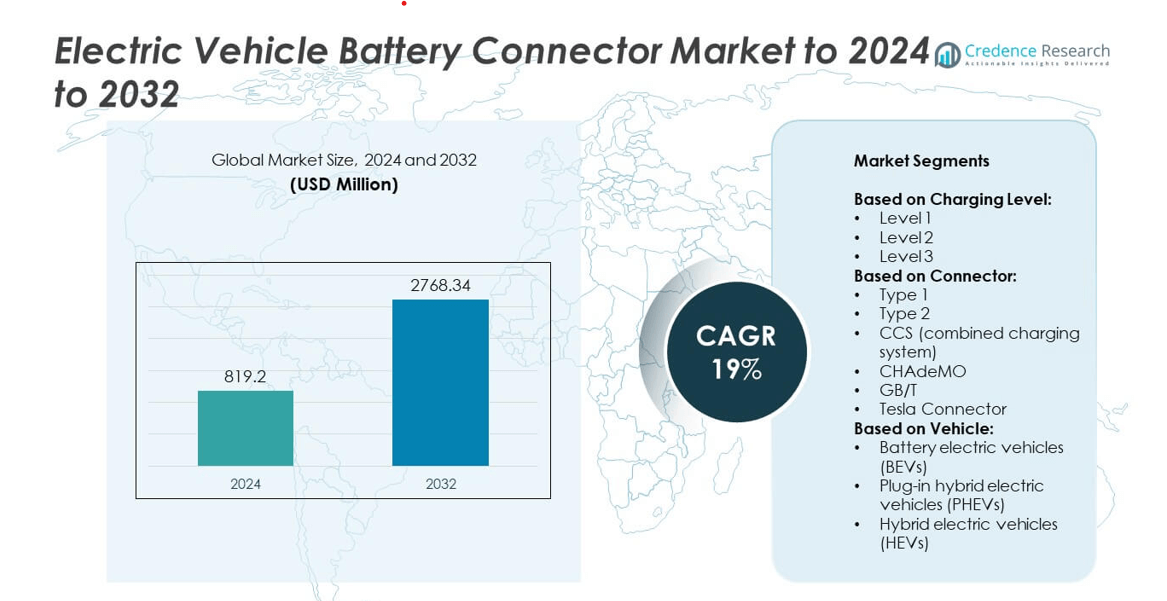

Electric Vehicle Battery Connector Market size was valued at USD 819.2 million in 2024 and is anticipated to reach USD 2,768.34 million by 2032, at a CAGR of 19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Battery Connector Market Size 2024 |

USD 819.2 million |

| Electric Vehicle Battery Connector Market, CAGR |

19% |

| Electric Vehicle Battery Connector Market Size 2032 |

USD 2,768.34 million |

The Electric Vehicle Battery Connector Market is led by major players such as Siemens AG, ABB, Tesla, Amphenol, HUBER+SUHNER, ChargePoint, Bosch, TE Connectivity Ltd., ITT Inc., Aptiv PLC, and Schneider Electric. These companies focus on developing advanced, high-voltage, and fast-charging connector solutions to meet the growing global EV demand. Strategic partnerships with automakers and charging infrastructure providers enhance their product reach and technical integration. North America emerged as the leading region in 2024, accounting for about 34% of the global share, driven by robust EV adoption, expanding fast-charging networks, and strong regulatory support promoting clean transportation initiatives.

Market Insights

- The Electric Vehicle Battery Connector Market was valued at USD 819.2 million in 2024 and is projected to reach USD 2,768.34 million by 2032, growing at a CAGR of 19%.

- Rising electric vehicle production and the expansion of ultra-fast charging networks are the key factors driving market growth worldwide.

- Increasing adoption of high-power Level 3 connectors and standardization of CCS systems are shaping market trends, supported by innovations in lightweight and heat-resistant materials.

- The market is moderately consolidated, with key players focusing on R&D, partnerships, and sustainable connector solutions to enhance performance and durability.

- North America led with a 34% share in 2024, followed by Europe at 30% and Asia Pacific at 28%, while Level 3 charging connectors accounted for over 58% of total market share, supported by rapid infrastructure growth and strong regulatory incentives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Charging Level

Level 3 connectors dominated the Electric Vehicle Battery Connector Market in 2024, accounting for over 58% of the total share. Their dominance stems from fast-charging capability, enabling vehicles to achieve 80% charge within 30 minutes. The growing network of DC fast chargers and rising adoption of long-range EVs have further accelerated demand for Level 3 systems. Automakers and charging providers are standardizing high-power connectors to improve efficiency and reduce downtime. Increasing installation of public fast-charging stations by companies such as ABB and Siemens continues to strengthen this segment’s leadership globally.

- For instance, ABB’s Terra 360 delivers up to 360 kW, can add 100 km of range in under 3 minutes (depending on the vehicle), and can be configured to charge up to four vehicles simultaneously with dynamic power distribution.

By Connector

The CCS (Combined Charging System) held the largest market share of around 42% in 2024. This dominance is driven by its dual AC/DC compatibility, enabling flexible charging across various power levels. Widespread adoption in Europe and North America, supported by major OEMs like Volkswagen, BMW, and Ford, reinforces its position. CCS’s backward compatibility with Level 2 infrastructure and enhanced safety features make it the preferred choice for modern EVs. Standardization efforts under global interoperability initiatives have further expanded CCS deployment in both passenger and commercial vehicle segments.

- For instance, Siemens SICHARGE D supports up to 400 kW, 1,000 V, and 2 DC outlets with dynamic power allocation.

By Vehicle

Battery electric vehicles (BEVs) led the market in 2024, capturing nearly 67% of the global share. BEVs’ dominance is fueled by strong government incentives, stricter emission norms, and technological advancements in high-capacity battery systems. The growing production of fully electric models by Tesla, BYD, and Hyundai has significantly increased connector demand. BEVs rely heavily on robust and thermally stable connectors for efficient power transfer during high-voltage charging. The expanding global charging infrastructure and declining battery costs continue to strengthen the BEV segment’s growth across major EV markets.

Key Growth Drivers

Expansion of High-Power Charging Infrastructure

The rapid development of ultra-fast charging networks is a major driver for the Electric Vehicle Battery Connector Market. Public and private investments are accelerating the deployment of DC fast chargers supporting 350 kW or higher capacities. These systems require durable, thermally stable connectors to handle high current loads. Governments in Europe, China, and the U.S. are funding highway charging corridors, boosting connector demand. As charging times shorten, automakers increasingly adopt advanced connector designs to ensure efficiency, reliability, and user safety across varying power levels.

- For instance, As of late 2025, Electrify America operates over 1,000 DC fast charging stations with over 5,000 chargers (or dispensers) across North America, many with high-power 350 kW capabilities

Rising Electric Vehicle Production

Global EV production growth significantly drives connector adoption. Leading OEMs such as Tesla, BYD, and Volkswagen are scaling EV output, demanding efficient, lightweight, and heat-resistant connectors. Growing consumer demand for emission-free vehicles and strict emission targets encourage large-scale manufacturing. Increased production of passenger and commercial EVs raises the need for reliable high-voltage interconnections. This expansion directly strengthens the supply chain for connectors, wiring harnesses, and related electronic components in EV architectures.

- For instance, Tesla produced 1,773,443 vehicles in 2024, driving high-voltage connector demand.

Technological Advancements in Connector Design

Ongoing innovations in materials and contact technology are propelling market growth. New designs feature enhanced conductivity, compact dimensions, and liquid-cooling capabilities to support ultra-fast charging. Manufacturers are integrating safety interlocks and smart monitoring to detect overheating or faults. These advancements improve energy transfer efficiency and prolong connector lifespan. The integration of lightweight aluminum alloys and composite housings further supports vehicle weight reduction and enhances performance, making modern EV connectors both safer and more efficient.

Key Trends & Opportunities

Integration of Smart and Digital Monitoring Systems

The adoption of IoT-enabled connectors is a growing trend in electric vehicles. Smart connectors allow real-time monitoring of temperature, current, and voltage, improving charging safety and diagnostics. Manufacturers are incorporating digital interfaces for predictive maintenance and remote analytics. This trend enhances reliability and user experience while supporting intelligent energy management systems. As EV infrastructure becomes more connected, the demand for data-driven connector systems is expected to expand rapidly across fleet and public charging applications.

- Fopr instance, Amphenol ePower-Lite supports up to 120 A, 1,000 V, and offers optional HVIL. This connector is used in vehicle systems that often employ CAN-based diagnostics to monitor electrical performance

Standardization and Global Interoperability Initiatives

The move toward universal connector standards presents a major opportunity for market expansion. Governments and industry alliances are promoting harmonized charging interfaces such as CCS and GB/T to simplify cross-border EV charging. Standardization reduces infrastructure complexity and improves consumer convenience. Collaborative projects among OEMs and charging providers are accelerating interoperability solutions. This harmonization not only cuts costs but also increases adoption rates in emerging EV markets by ensuring compatibility across multiple brands and charging systems.

- For instance, As of August 2025, China reports nearly 17.35 million charging piles nationwide, including 4.32 million public units, all adhering to the GB/T charging standard.

Key Challenges

High Manufacturing and Integration Costs

The production of high-performance connectors involves expensive materials, precision tooling, and testing standards. Advanced designs with cooling systems and smart sensors raise overall manufacturing costs. OEMs face challenges balancing connector durability with affordability, especially in mass-market EVs. Integration into compact vehicle architectures also increases design complexity. These factors limit cost competitiveness for low-priced electric models, slowing adoption in developing regions where affordability remains crucial.

Reliability and Thermal Management Issues

Connector reliability during high-voltage, fast-charging operations remains a technical challenge. Continuous exposure to high temperatures can degrade insulation, leading to performance failures. Effective thermal management is critical to prevent overheating and ensure safety. Manufacturers must design connectors with advanced materials and cooling systems to handle extreme conditions. Inadequate temperature control or poor contact integrity can cause system inefficiency, reducing charging performance and posing long-term maintenance risks for EV manufacturers and charging providers.

Regional Analysis

North America

North America held the largest share of about 34% in the Electric Vehicle Battery Connector Market in 2024. The region’s leadership stems from strong EV adoption across the U.S. and Canada, supported by federal incentives and expanding charging infrastructure. Automakers such as Tesla, Ford, and General Motors are integrating advanced high-power connectors in new EV models. The rise of public DC fast-charging networks and growing investments by companies like ABB and ChargePoint strengthen regional growth. Increasing consumer shift toward zero-emission vehicles continues to enhance market penetration across residential and commercial charging applications.

Europe

Europe accounted for nearly 30% of the global market share in 2024, driven by stringent carbon regulations and strong EV sales across Germany, Norway, and the U.K. The region’s focus on harmonized charging standards, particularly CCS, has promoted cross-country interoperability. Major automakers including Volkswagen, BMW, and Renault are adopting fast-charging connectors to support next-generation electric fleets. EU-backed initiatives such as the Fit for 55 policy are expanding public charging networks. Continuous R&D in lightweight and high-conductivity connectors positions Europe as a hub for technological advancements in EV infrastructure.

Asia Pacific

Asia Pacific captured around 28% of the total market share in 2024, led by rapid electrification in China, Japan, and South Korea. China remains the largest contributor due to strong government mandates, subsidies, and large-scale EV manufacturing by BYD, NIO, and SAIC. The region’s dominance in connector production and raw material availability supports cost-effective supply chains. Japan and South Korea focus on CHAdeMO and GB/T connector technologies, ensuring compatibility with domestic EV models. Growing infrastructure development and expanding local OEM partnerships continue to strengthen Asia Pacific’s role in global market expansion.

Latin America

Latin America held a modest share of around 5% in 2024, with growth led by Brazil, Mexico, and Chile. Government incentives for EV adoption and collaborations with global charging solution providers are driving gradual infrastructure expansion. The increasing presence of global automakers setting up EV assembly lines supports local connector demand. However, high equipment costs and limited charging stations hinder faster adoption. Investments in renewable power and public transportation electrification are expected to create future opportunities for high-performance connectors across regional urban mobility projects.

Middle East & Africa

The Middle East & Africa region accounted for approximately 3% of the global market share in 2024. Growth is driven by initial EV deployment programs in the UAE, Saudi Arabia, and South Africa. Governments are investing in pilot charging corridors and public charging stations, encouraging the use of advanced connector systems. The region’s hot climate increases the need for connectors with superior thermal durability. Partnerships between global charging solution providers and local energy firms are strengthening supply networks. Although adoption remains in early stages, supportive policies and rising EV imports are boosting long-term market prospects.

Market Segmentations:

By Charging Level:

By Connector:

- Type 1

- Type 2

- CCS (combined charging system)

- CHAdeMO

- GB/T

- Tesla Connector

By Vehicle:

- Battery electric vehicles (BEVs)

- Plug-in hybrid electric vehicles (PHEVs)

- Hybrid electric vehicles (HEVs)

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the Electric Vehicle Battery Connector Market features leading players such as Siemens AG, ABB, Tesla, Amphenol, HUBER+SUHNER, ChargePoint, Bosch, TE Connectivity Ltd., ITT Inc., Aptiv PLC, and Schneider Electric. These companies compete through continuous innovation, focusing on high-voltage, lightweight, and thermally stable connector designs. Market participants emphasize R&D investments to enhance safety, conductivity, and charging speed. Strategic collaborations with EV manufacturers and charging infrastructure providers are strengthening product compatibility across global platforms. Firms are also prioritizing sustainable manufacturing using recyclable materials and compact designs to meet evolving emission standards. Expansion in emerging markets and alignment with government EV policies remain central to growth strategies, while long-term competitiveness depends on technological leadership and reliability in fast-charging applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- ABB

- Tesla

- Amphenol

- HUBER+SUHNER

- ChargePoint

- Bosch

- TE Connectivity Ltd.

- ITT Inc.

- Aptiv PLC

- Schneider Electric

Recent Developments

- In 2024, HUBER+SUHNER Announced the expansion of its HPC portfolio to include a North American Charging System (NACS) solution. This enabled the company to cater to the growing demand for NACS-compatible charging solutions.

- In 2023, TE Connectivity launched its HIVONEX connector and charging solutions, including the PowerTube Connector Series for high electrical loads in commercial vehicles, trucks, and buses.

- In 2023, Amphenol released the DuraSwap™ Concentric Connectors, designed for swappable battery systems in electric vehicles

Report Coverage

The research report offers an in-depth analysis based on Charging Level, Connector, Vehicle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by expanding global EV production.

- Fast-charging connectors will dominate as automakers prioritize reduced charging times.

- Technological innovation will focus on lightweight, heat-resistant, and high-efficiency materials.

- Integration of smart and IoT-enabled connectors will enhance real-time monitoring and safety.

- Standardization of charging interfaces such as CCS and GB/T will improve global interoperability.

- Public and private investments in charging infrastructure will accelerate market penetration.

- Connector manufacturers will adopt modular and compact designs for next-generation EV architectures.

- Asia Pacific will emerge as the leading production hub due to large-scale manufacturing capacity.

- Collaborations between OEMs and energy providers will drive product innovation and reliability.

- Growing sustainability goals will push adoption of recyclable and eco-friendly connector materials.