Market Overview

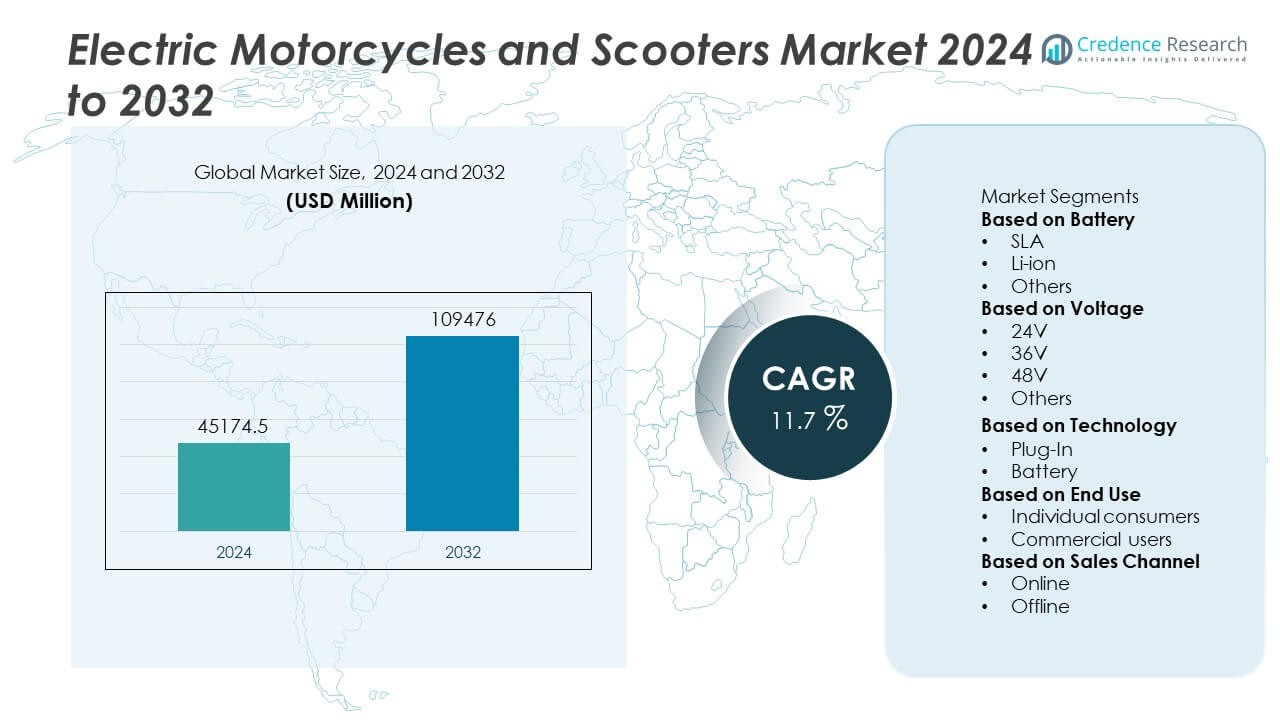

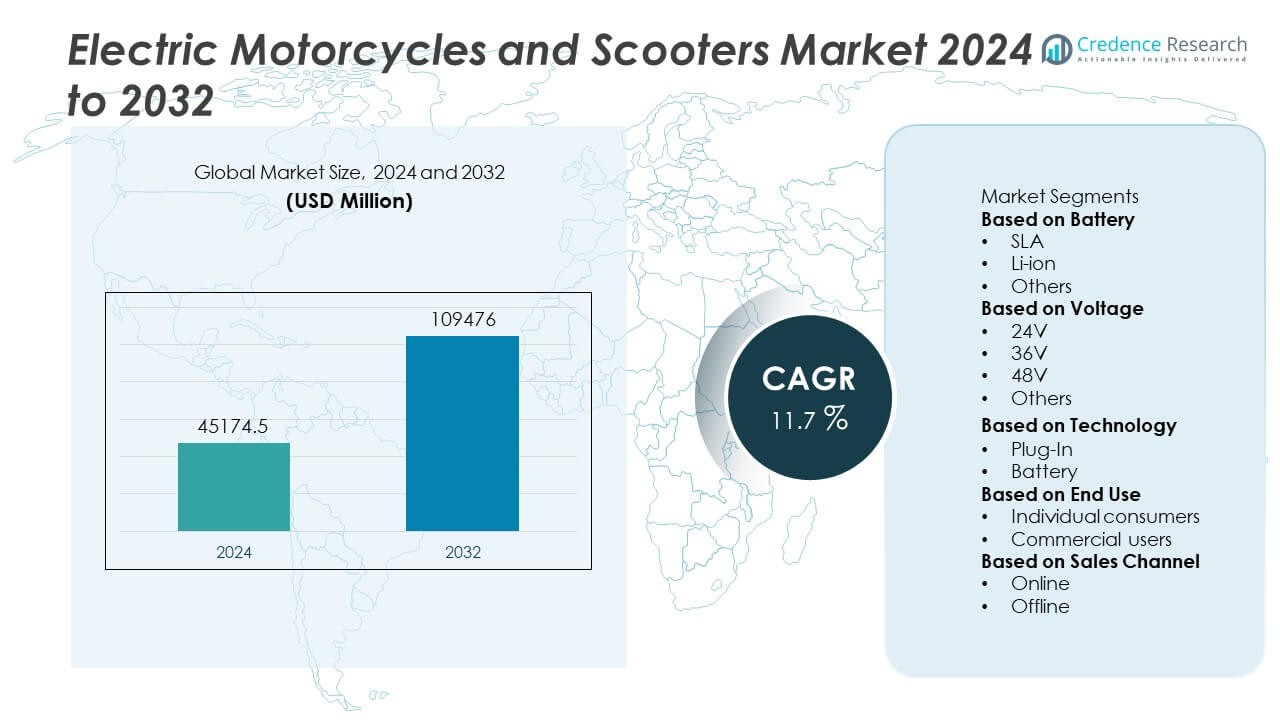

The Electric Motorcycles and Scooters Market was valued at USD 45,174.5 million in 2024 and is projected to reach USD 109,476 million by 2032, growing at a CAGR of 11.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Motorcycles and Scooters Market Size 2024 |

USD 45,174.5 Million |

| Electric Motorcycles and Scooters Market, CAGR |

11.7% |

| Electric Motorcycles and Scooters Market Size 2032 |

USD 109,476 Million |

The electric motorcycles and scooters market is led by major players including Ola Electric, Yamaha Motor, Hero Motor, Energica Motor, Harley-Davidson, Yadea, Kawasaki Motors, Triumph Motorcycles, Zero Motorcycles, and Honda Motor. These companies dominate through innovations in battery technology, energy efficiency, and connected mobility features. Asia-Pacific emerged as the leading region in 2024, holding a 39% share of the global market, driven by strong manufacturing capabilities and government incentives for electric mobility. Europe followed with a 29% share, supported by strict emission norms and urban electrification programs, while North America accounted for 25%, propelled by growing demand for premium, high-performance electric two-wheelers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electric motorcycles and scooters market was valued at USD 45,174.5 million in 2024 and is projected to reach USD 109,476 million by 2032, growing at a CAGR of 11.7% during the forecast period.

- Rising demand for sustainable transportation, government subsidies, and improvements in battery efficiency are driving the global adoption of electric two-wheelers.

- The market is witnessing trends such as the expansion of fast-charging networks, AI-based smart connectivity, and the integration of lightweight materials for better performance.

- Key players including Ola Electric, Yamaha Motor, Honda Motor, Harley-Davidson, and Yadea focus on technological advancements, new model launches, and regional expansion to strengthen competitiveness.

- Asia-Pacific leads with 39% share, followed by Europe with 29% and North America with 25%, while the lithium-ion battery segment dominates with 72% of demand and the 48V voltage range holds 45% market share globally.

Market Segmentation Analysis:

By Battery

The lithium-ion (Li-ion) segment dominated the electric motorcycles and scooters market in 2024, accounting for over 72% of the total share. Its leadership stems from higher energy density, faster charging, and longer lifespan compared to sealed lead acid (SLA) batteries. Li-ion technology also supports lighter vehicle designs and improved performance, making it the preferred choice among manufacturers and consumers. The SLA segment, holding 22% share, remains relevant for low-cost models in developing markets, while other battery types, with 6% share, include emerging chemistries like solid-state and nickel-metal hydride that are gaining research attention.

- For instance, Yamaha Motor’s E01 scooter uses a 4.9 kWh lithium-ion battery providing a range of 104 km. It supports 0–90% charging in 1 hour using a quick charger. The battery is integrated with a smart Battery Management System (BMS) that monitors temperature and voltage variations across individual cells to extend battery lifespan and ensure consistent performance under urban driving conditions.

By Voltage

The 48V segment led the market in 2024, capturing around 45% of the total share. This dominance is driven by its efficiency and ability to deliver optimal balance between performance and safety for mid-range electric motorcycles and scooters. The 36V category, accounting for 32% share, remains preferred for lightweight commuter scooters, while 24V and other voltage systems, together contributing 23%, serve entry-level and performance-specific models. The growing demand for vehicles offering better speed, range, and durability continues to boost the adoption of 48V systems across both premium and mass-market segments.

- For instance, Ola Electric’s S1 Pro Gen 2 operates on a higher voltage electrical system, utilizing a 4 kWh lithium-ion battery. It delivers a certified range of 195 km per charge. The scooter’s motor produces a peak output of 11 kW with a top speed of 120 km/h, while the system enables regenerative braking and thermal protection to enhance efficiency and battery safety during extended rides.

By Technology

The battery-based segment dominated the market in 2024 with a share of 67%, driven by its simplicity, cost-effectiveness, and wide compatibility with various electric two-wheeler models. These vehicles rely on stored energy, providing flexible and portable charging solutions. The plug-in segment, with 33% share, is growing rapidly due to the expansion of charging infrastructure and demand for higher-capacity batteries. Consumers in urban regions prefer plug-in models for their convenience and fast-charging capabilities. Continuous advancements in charging systems and hybrid integration are further enhancing the appeal and practicality of both technologies.

Key Growth Drivers

Rising Demand for Eco-Friendly Urban Mobility

The growing concern over air pollution and carbon emissions is driving the adoption of electric motorcycles and scooters worldwide. Consumers and governments alike are shifting toward sustainable transportation options to reduce environmental impact. Urban areas, in particular, are witnessing strong demand due to compact design and zero tailpipe emissions. Government subsidies, tax incentives, and low maintenance costs further strengthen market growth. As cities embrace cleaner mobility, electric two-wheelers are becoming integral to smart urban transportation systems.

- For instance, Yadea’s KS6 Pro electric scooter features a 500W rated motor with an 800W peak power output and a 36V 15.3Ah lithium-ion battery that delivers a top speed of 30 km/h with a range of up to 55 km on a single charge. The scooter emits zero tailpipe emissions and integrates an energy recovery system that converts braking energy back into stored power, supporting the brand’s sustainability-focused urban mobility initiatives.

Advancements in Battery and Charging Technology

Technological improvements in lithium-ion and solid-state batteries are enhancing performance, safety, and efficiency. Faster charging, higher energy density, and extended lifecycle are making electric motorcycles and scooters more reliable and convenient for daily use. Rapid expansion of fast-charging networks and battery-swapping infrastructure further improves accessibility. Manufacturers are also investing in smart battery management systems to optimize performance and ensure longevity. These advancements are accelerating the replacement of conventional two-wheelers with high-performance electric alternatives across global markets.

- For instance, Hero MotoCorp’s Vida V1 Pro electric scooter is powered by a 3.94 kWh lithium-ion battery that supports fast charging from 0–80% in 65 minutes and has a company-claimed range of 165 km, with real-world ranges generally found to be lower. The model integrates a dual removable battery setup and a smart thermal management system with a dedicated fan to manage battery heat.

Supportive Government Policies and Incentives

Government support through purchase subsidies, tax exemptions, and emission regulations continues to drive market expansion. Many countries have implemented EV mandates and incentive programs to promote electric two-wheeler adoption. Investment in charging infrastructure and renewable energy integration complements this growth. Additionally, regulations limiting fuel-based vehicle usage in urban zones are pushing consumers toward electric options. Such policy-driven initiatives, combined with local manufacturing incentives, are helping the industry achieve scalability and cost competitiveness, fostering long-term market sustainability.

Key Trends & Opportunities

Integration of Smart and Connected Technologies

The rise of connected mobility is transforming the electric motorcycles and scooters market. Integration of IoT, GPS, and AI-enabled systems enhances performance monitoring, route optimization, and theft prevention. Manufacturers are offering mobile app connectivity, over-the-air updates, and real-time diagnostics to improve user experience. Smart features such as regenerative braking and remote access are also gaining traction. These advancements appeal to tech-savvy consumers seeking convenience and digital control, creating opportunities for companies investing in intelligent and connected electric two-wheeler platforms.

- For instance, Zero Motorcycles equips its SR/F model with the Cypher III+ operating system that offers Bluetooth and cellular connectivity for real-time diagnostics and firmware updates. The platform allows users to access live ride data, GPS-based route tracking, and performance tuning through the Zero app, while the 17.3 kWh battery system supports smart energy monitoring for optimized range and charging control.

Growth of Shared Mobility and Fleet Electrification

The increasing popularity of shared mobility services is creating new opportunities for electric two-wheelers. Ride-sharing, delivery, and rental platforms are rapidly adopting electric motorcycles and scooters to reduce operational costs and meet sustainability goals. Fleet electrification initiatives from logistics and last-mile delivery companies are boosting bulk purchases. Governments supporting commercial EV fleets with incentives and infrastructure development are further driving this shift. This trend not only expands the market base but also strengthens long-term adoption through consistent fleet utilization and visibility.

- For instance, Honda Motor launched its EM1 e: electric moped for Europe, targeting a young demographic for easy, emission-free urban transport. The model uses a swappable 1.47 kWh Honda Mobile Power Pack e: battery, providing a usable travel range of over 41 km per charge. The moped’s compact 1.7 kW hub motor ensures low maintenance. A mobile app, part of the Honda e:Swap battery service, allows users to locate swapping stations and monitor battery status.

Key Challenges

High Initial Costs and Battery Replacement Expenses

Despite declining battery prices, electric motorcycles and scooters remain expensive compared to fuel-powered models. The cost of advanced batteries and electronic components contributes to higher upfront prices, limiting adoption among cost-sensitive buyers. Additionally, battery replacement after a few years adds to long-term ownership costs. This remains a key deterrent in emerging economies with limited purchasing power. Manufacturers are addressing this challenge through local production, modular batteries, and flexible financing models to improve affordability and accessibility.

Lack of Charging Infrastructure and Range Concerns

Insufficient charging infrastructure continues to hinder widespread adoption of electric two-wheelers, particularly in developing regions. Limited access to public charging stations and slow charging speeds affect user convenience and travel range. Range anxiety remains a major issue for commuters covering longer distances. Although governments and private players are expanding fast-charging and battery-swapping networks, progress remains uneven. Overcoming these infrastructure and range-related barriers will be essential to achieving mass adoption and sustaining growth in the global market.

Regional Analysis

North America

North America held a 25% share of the electric motorcycles and scooters market in 2024, driven by rising environmental awareness, favorable government incentives, and expanding EV infrastructure. The U.S. leads adoption due to strong consumer interest in premium electric models and active investments from major manufacturers. Federal and state-level programs offering rebates and tax credits are encouraging electric two-wheeler ownership. Growing urban congestion and fuel cost fluctuations further enhance demand. Increasing integration of smart charging networks and fleet electrification initiatives is expected to strengthen North America’s market growth through the forecast period.

Europe

Europe accounted for a 29% share of the global electric motorcycles and scooters market in 2024, supported by strict emission regulations and sustainability-driven policies. Countries such as Germany, France, the Netherlands, and the United Kingdom are leading adopters, encouraged by tax incentives and low-emission zone mandates. Consumers increasingly favor electric two-wheelers for short commutes and last-mile delivery operations. Advancements in lithium-ion batteries and fast-charging infrastructure are improving convenience and range. The region’s focus on green mobility, coupled with the rise of shared mobility platforms, continues to position Europe as a key market for electric two-wheelers.

Asia-Pacific

Asia-Pacific dominated the global electric motorcycles and scooters market with a 39% share in 2024, led by strong demand in China, India, and Japan. Government subsidies, tax benefits, and large-scale domestic manufacturing are key growth drivers. The region’s growing population and rising urbanization are increasing reliance on cost-effective, clean transportation. China remains the largest contributor, supported by its well-established EV ecosystem and widespread charging infrastructure. India’s expanding delivery and shared mobility sectors further boost adoption. Ongoing technological innovations and affordable product availability make Asia-Pacific the fastest-growing and most competitive regional market globally.

Latin America

Latin America captured a 4% share of the electric motorcycles and scooters market in 2024, driven by growing urbanization, government-led clean mobility initiatives, and rising fuel prices. Brazil and Mexico lead the region, supported by expanding infrastructure for electric vehicle charging and fleet electrification. The demand for affordable electric scooters is growing among middle-income consumers seeking cost-efficient mobility solutions. However, limited financing options and high import costs continue to challenge broader adoption. Increasing partnerships between local governments and private players are expected to improve accessibility and promote long-term regional growth.

Middle East & Africa

The Middle East and Africa accounted for a 3% share of the global electric motorcycles and scooters market in 2024, supported by emerging e-mobility initiatives and increasing awareness of sustainable transportation. The United Arab Emirates, Saudi Arabia, and South Africa are leading markets, driven by expanding charging networks and government incentives promoting electric adoption. Growing use of electric scooters for deliveries and urban commuting is gaining momentum. However, high initial costs and limited local production constrain growth. Continuous infrastructure development and renewable energy integration are expected to unlock new opportunities in this region over the forecast period.

Market Segmentations:

By Battery

By Voltage

By Technology

By End Use

- Individual consumers

- Commercial users

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electric motorcycles and scooters market includes key players such as Ola Electric, Yamaha Motor, Hero Motor, Energica Motor, Harley-Davidson, Yadea, Kawasaki Motors, Triumph Motorcycles, Zero Motorcycles, and Honda Motor. These companies compete through technological innovation, strategic expansion, and advanced battery integration to enhance performance and affordability. Leading manufacturers focus on improving range, charging efficiency, and smart connectivity features to attract a wider customer base. Collaborations with battery suppliers and infrastructure developers are strengthening supply chains and boosting scalability. Premium brands emphasize high-performance electric motorcycles, while regional players target mass-market scooters with cost-effective designs. Expanding e-commerce channels, rental platforms, and government incentives are further intensifying competition. Continuous R&D investment, sustainable manufacturing, and diversified product portfolios remain crucial strategies as companies strive to capture growing demand for clean and efficient two-wheeler mobility worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ola Electric

- Yamaha Motor

- Hero Motor

- Energica Motor

- Harley-Davidson

- Yadea

- Kawasaki Motors

- Triumph Motorcycles

- Zero Motorcycles

- Honda Motor

Recent Developments

- In September 2025, Honda unveiled its first electric motorcycle, the WN7, targeting the European market as part of its electrification strategy.

- In August 2025, Ola Electric introduced a rare-earth-free ferrite motor that received government certification, to be incorporated across its vehicle lineup.

- In May 2025, Yamaha Motor announced plans to launch a new affordable electric scooter, code-named RY01, derived from its River Indie platform.

- In 2025, Zero also showcased the 2025 Zero SR/S sportbike, emphasizing its blend of performance and daily usability.

Report Coverage

The research report offers an in-depth analysis based on Battery, Voltage, Technology, End Use, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric motorcycles and scooters market will continue expanding with strong global adoption of clean mobility.

- Advancements in lithium-ion and solid-state batteries will enhance range and efficiency.

- Fast-charging and battery-swapping infrastructure will significantly improve user convenience.

- Smart connectivity and IoT integration will drive innovation in performance and safety features.

- Governments will strengthen incentives and regulations supporting electric two-wheeler adoption.

- Asia-Pacific will remain the dominant region due to large-scale production and policy support.

- Europe and North America will see rapid growth in premium and high-performance electric models.

- Shared mobility and delivery fleets will increasingly shift toward electric two-wheelers.

- Manufacturers will focus on affordability through local production and modular battery designs.

- Expanding charging networks and technological standardization will accelerate mass-market adoption globally.