Market Overview

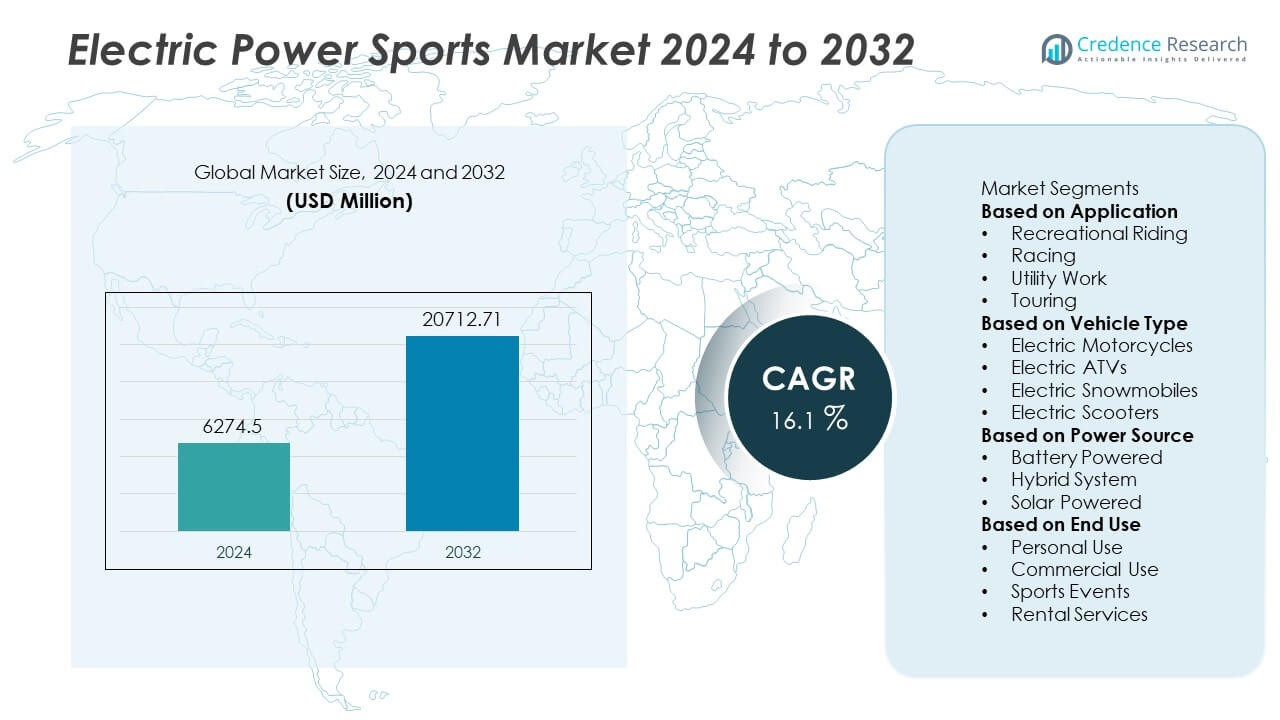

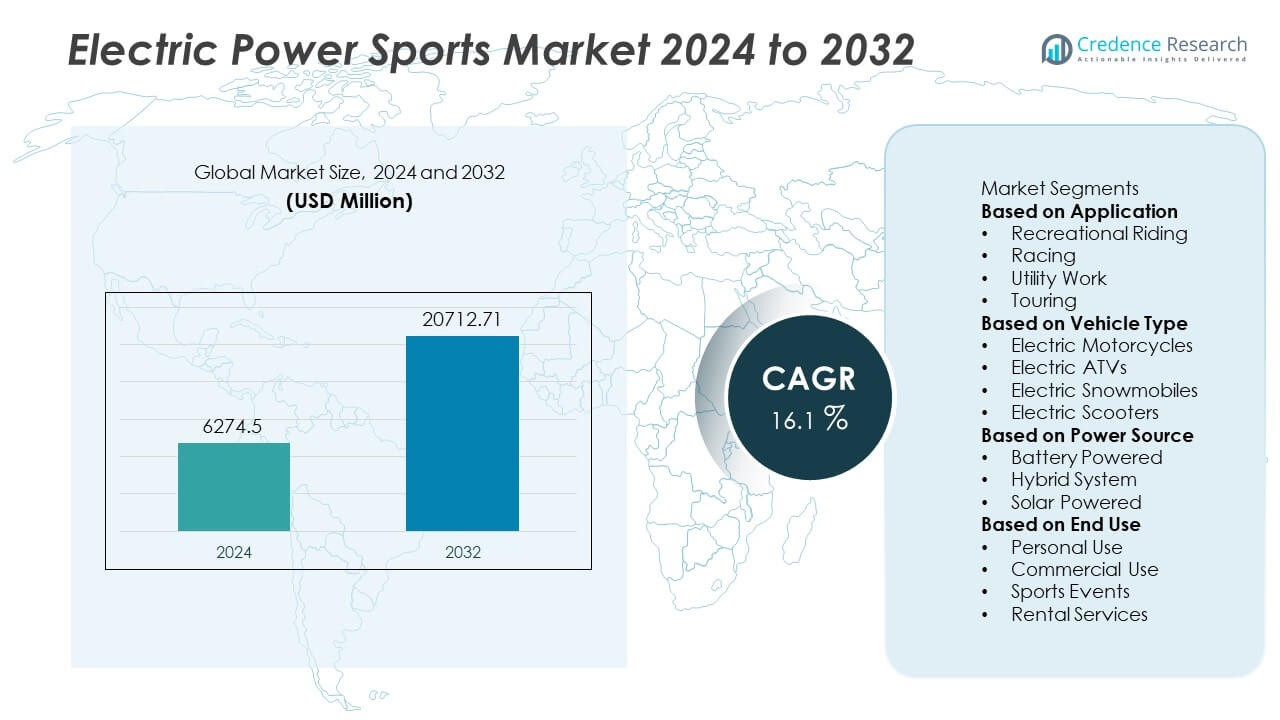

The Electric Power Sports market was valued at USD 6,274.5 million in 2024 and is projected to reach USD 20,712.71 million by 2032, registering a CAGR of 16.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Power Sports Market Size 2024 |

USD 6,274.5 Million |

| Electric Power Sports Market, CAGR |

16.1% |

| Electric Power Sports Market Size 2032 |

USD 20,712.71 Million |

The Electric Power Sports market is dominated by key players including Polaris Inc., Yamaha Motor Company Ltd., BRP Inc. (Bombardier Recreational Products), Zero Motorcycles Inc., KTM AG, Honda Motor Co. Ltd., Kawasaki Heavy Industries Ltd., Taiga Motors Corporation, Nikola Corporation, and Torrot Electric Europa S.A. These companies lead through innovation in high-performance electric drivetrains, battery efficiency, and connected mobility solutions. Europe emerged as the leading region with a 29% market share in 2024, driven by strong environmental policies and early adoption of electric recreational vehicles. North America followed with 36%, supported by high consumer spending on premium electric ATVs and motorcycles, while Asia-Pacific accounted for 25%, boosted by large-scale EV production and rising recreational demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Power Sports market was valued at USD 6,274.5 million in 2024 and is projected to reach USD 20,712.71 million by 2032, growing at a CAGR of 16.1%.

- Rising consumer demand for sustainable recreational vehicles and supportive government policies are driving market expansion across ATVs, motorcycles, and snowmobiles.

- Manufacturers are focusing on lightweight, battery-efficient, and connected electric power sports models to improve performance and range while appealing to eco-conscious users.

- Leading companies such as Polaris Inc., Yamaha Motor Company Ltd., and BRP Inc. are investing in advanced battery technologies and smart connectivity to strengthen their competitive edge.

- North America led the market with a 36% share in 2024, followed by Europe with 29% and Asia-Pacific with 25%, while the recreational riding segment dominated the market by application with over 50% share.

Market Segmentation Analysis:

By Application

The recreational riding segment dominated the Electric Power Sports market in 2024, accounting for over 50% of the total share. This dominance stems from the rising popularity of eco-friendly leisure activities and the growing appeal of electric vehicles for outdoor adventure sports. Consumers prefer electric models for their quiet operation, low maintenance, and smooth torque delivery, enhancing user experience in trails and parks. Manufacturers are expanding their product lines with high-performance recreational EVs to meet increasing demand for sustainable power sports alternatives.

- For instance, Polaris Inc. introduced the Ranger XP Kinetic UTV equipped with a 29.8 kWh lithium-ion battery delivering 110 HP and 140 lb-ft of torque. The Ultimate trim of this model has a manufacturer-estimated range of up to 130 km (80 miles), though real-world performance may vary.

By Vehicle Type

The electric motorcycles segment led the market with around 40% share in 2024, driven by growing consumer preference for high-speed, emission-free personal mobility. Advancements in lithium-ion battery efficiency and rapid charging technology are improving vehicle range and performance. Increasing availability of urban charging infrastructure and government incentives for electric two-wheelers further fuel market growth. Major brands are introducing innovative electric models with enhanced acceleration, digital connectivity, and lightweight design to capture both commuter and performance-focused riders.

- For instance, Zero Motorcycles launched the DSR/X adventure electric motorcycle featuring a Z-Force 17.3 kWh battery and a 75 kW (100 hp) motor generating 229 Nm (169 lb-ft) of torque. The model achieves a top speed of 180 km/h (112 mph) and a real-world city range of up to 288 km (179 miles).

By Power Source

The battery-powered segment held the largest market share of over 70% in 2024, supported by continuous battery cost reductions and infrastructure expansion. Lithium-ion technology offers superior energy density and durability, making it the preferred choice for electric power sports vehicles. Consumers favor battery-powered systems for their reliability and instant power delivery. Manufacturers are also investing in advanced battery management systems (BMS) and fast-charging solutions to extend range and reduce downtime, reinforcing the segment’s leadership across motorcycles, ATVs, and snowmobiles.

Key Growth Drivers

Rising Consumer Demand for Sustainable Recreational Vehicles

Growing environmental awareness and demand for zero-emission recreational vehicles are fueling the Electric Power Sports market. Consumers are shifting toward electric alternatives for cleaner, quieter, and low-maintenance performance in outdoor and sports activities. Manufacturers are introducing electric ATVs, motorcycles, and watercraft with enhanced range and power to appeal to eco-conscious buyers. The trend aligns with global sustainability goals, driving higher adoption across developed regions with strong recreational vehicle cultures.

- For instance, Taiga Motors introduced its Nomad snowmobile with a 23 kWh battery pack and a liquid-cooled electric motor that produces up to 120 HP. The model achieves a range of up to 100 km per charge and supports DC fast charging that can replenish 80% capacity in approximately 40 minutes.

Advancements in Battery and Charging Technologies

Continuous improvements in lithium-ion battery capacity and charging efficiency are accelerating Electric Power Sports adoption. Enhanced energy density enables longer range and better performance for electric motorcycles, snowmobiles, and ATVs. Rapid charging infrastructure expansion and battery management systems further improve convenience and safety. These technological advances are reducing consumer concerns related to charging time and range, strengthening market penetration in both on-road and off-road segments.

- For instance, BRP Inc. has developed its Rotax E-Power platform for use in vehicles like the Can-Am Outlander Electric ATV. This features an 8.9 kWh liquid-cooled lithium-ion battery pack and a 35 kW (47 hp) electric motor. The system supports Level 2 charging, enabling a recharge from 20% to 80% in as little as 50 minutes.

Supportive Government Policies and Incentives

Favorable policies promoting electrification and emission reduction are boosting market growth. Governments in North America, Europe, and Asia-Pacific are offering tax incentives, purchase subsidies, and charging network investments to encourage electric vehicle adoption. Regulations restricting internal combustion engines in sensitive recreational zones are further supporting electric alternatives. This policy framework is encouraging both established OEMs and startups to expand their electric power sports portfolios, driving global market expansion.

Key Trends and Opportunities

Integration of Smart Connectivity and Performance Analytics

Manufacturers are incorporating smart connectivity features and telematics into electric power sports vehicles. Real-time performance monitoring, GPS tracking, and smartphone integration enhance rider experience and safety. Connected technologies also allow predictive maintenance and energy optimization. This trend is opening opportunities for digital ecosystem partnerships, where manufacturers collaborate with software providers to deliver integrated electric power sports platforms.

- For instance, Yamaha Motor Company introduced its Y-Connect mobile telematics platform for electric motorcycles and ATVs, featuring Bluetooth-enabled real-time tracking and over 30 performance data points, including battery health, torque output, and ride analytics.

Growth of Lightweight and Modular Vehicle Design

The industry is witnessing a shift toward lightweight and modular chassis structures for improved efficiency. Advanced materials such as carbon fiber composites and aluminum alloys help reduce weight while maintaining strength. Modular vehicle designs allow flexibility for different battery configurations and drive systems, reducing manufacturing costs. This trend supports scalability and customization, meeting diverse customer needs across recreational and commercial use cases.

- For instance, KTM AG developed its Freeride E-XC electric off-road motorcycle with a lightweight composite frame combining steel and forged aluminum sections, and a removable 3.9 kWh PowerPack battery. The modular battery design allows for a quick swap and delivers a peak power of 18 kW.

Key Challenges

High Initial Costs and Limited Affordability

The high production cost of electric power sports vehicles remains a major barrier to mass adoption. Premium battery systems, specialized components, and advanced electronics increase overall pricing compared to fuel-based counterparts. Limited economies of scale and high R&D expenses further constrain cost reduction. This affordability gap slows market growth, particularly in developing regions with price-sensitive consumers.

Inadequate Charging and Service Infrastructure

Insufficient charging infrastructure for recreational and off-road zones presents a key challenge for electric power sports users. Riders often face difficulties accessing charging stations in remote areas, limiting travel range and convenience. The shortage of trained technicians and specialized parts for maintenance adds to operational hurdles. Addressing these issues requires coordinated investments in infrastructure and service networks to support long-term market expansion.

Regional Analysis

North America

North America held a market share of 36% in the Electric Power Sports market in 2024. The region leads due to strong consumer demand for high-performance recreational vehicles and growing environmental awareness. The United States dominates regional growth, supported by the rapid adoption of electric motorcycles, ATVs, and personal watercraft. Major manufacturers are investing in new electric models and expanding charging networks across popular adventure and sports destinations. Canada also contributes significantly, with increasing participation in off-road and snow-based electric recreational activities driving regional expansion.

Europe

Europe accounted for 29% of the Electric Power Sports market in 2024, driven by stringent emission regulations and a strong shift toward sustainable mobility. Countries such as Germany, France, and the Nordic nations are leading in electric motorcycle and snowmobile adoption. Government incentives promoting low-emission recreation and advancements in battery efficiency are further supporting regional growth. European manufacturers are developing lightweight and high-torque electric power sports models suited for both on-road and off-road applications, reinforcing the region’s position as a key innovation hub.

Asia-Pacific

Asia-Pacific captured 25% of the Electric Power Sports market in 2024, fueled by rapid urbanization, rising disposable income, and the growing popularity of recreational mobility. China, Japan, and India are major contributors, supported by expanding EV production capabilities and cost-effective manufacturing. Increasing awareness of eco-friendly outdoor sports and the presence of regional electric two-wheeler manufacturers enhance market penetration. Government subsidies and investment in charging infrastructure are further encouraging consumers to adopt electric ATVs, scooters, and motorcycles across diverse terrains.

Latin America

Latin America represented 6% of the Electric Power Sports market in 2024. Brazil and Mexico dominate regional adoption due to growing interest in sustainable outdoor recreation and increased import of electric ATVs and motorcycles. Local governments are promoting low-emission mobility through pilot electrification programs, particularly in tourism zones. While infrastructure remains limited, private investments in rental fleets and adventure parks using electric vehicles are increasing. Gradual economic recovery and rising consumer interest in eco-friendly power sports are expected to drive future regional growth.

Middle East and Africa

The Middle East and Africa held a market share of 4% in the Electric Power Sports market in 2024. Growth in the region is supported by increasing demand for luxury recreational vehicles and rising interest in desert and marine adventure sports. The United Arab Emirates and Saudi Arabia lead the market through premium imports and development of EV-compatible infrastructure. In Africa, recreational zones and government focus on green mobility are expected to boost long-term market potential.

Market Segmentations:

By Application

- Recreational Riding

- Racing

- Utility Work

- Touring

By Vehicle Type

- Electric Motorcycles

- Electric ATVs

- Electric Snowmobiles

- Electric Scooters

By Power Source

- Battery Powered

- Hybrid System

- Solar Powered

By End Use

- Personal Use

- Commercial Use

- Sports Events

- Rental Services

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Power Sports market includes major players such as Polaris Inc., Yamaha Motor Company Ltd., BRP Inc. (Bombardier Recreational Products), Zero Motorcycles Inc., KTM AG, Honda Motor Co. Ltd., Kawasaki Heavy Industries Ltd., Taiga Motors Corporation, Nikola Corporation, and Torrot Electric Europa S.A. These companies focus on expanding their electric product portfolios through advanced battery technologies, lightweight vehicle design, and digital connectivity features. Strategic collaborations with battery suppliers and charging infrastructure developers are enhancing product efficiency and range. Leading manufacturers are investing in research and development to improve torque output, energy density, and thermal management systems. Several companies are also targeting eco-conscious consumers by launching electric models for off-road, marine, and urban mobility segments. Continuous innovation, along with regional manufacturing expansion and government-supported electrification programs, is intensifying competition in this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Taiga Motors unveiled its next-generation Orca electric watercraft lineup, including a 3-seat crossover “Orca WX3” with DC fast charging and bidirectional vehicle-to-grid functionality.

- In May 2025, Taiga restarted production of its MY25 Orca watercraft and launched a new battery cooling system that supports double peak DC fast charging and reduces charge time to under 30 minutes.

- In 2025, Taiga rolled out a mobile app update with features like encrypted GPS tracking, LTE remote access, over-the-air updates, remote diagnostics, and remote charging control for pilot users.

- In June 2024, Polaris established the first off-road trail charging network in Michigan’s Ontonagon County (four stations), supporting its Ranger XP Kinetic and encouraging EV off-road adoption.

Report Coverage

The research report offers an in-depth analysis based on Application, Vehicle Type, Power Source, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electric Power Sports market will expand rapidly with the global shift toward clean mobility.

- Manufacturers will focus on improving battery range, efficiency, and durability for better performance.

- Integration of digital connectivity and smart controls will enhance user experience and vehicle safety.

- Electric ATVs, motorcycles, and snowmobiles will gain strong demand in both recreational and utility sectors.

- Government incentives and emission regulations will continue to accelerate electrification across all regions.

- Investments in charging infrastructure will improve convenience and encourage broader market adoption.

- Partnerships between OEMs and battery technology firms will strengthen innovation and product reliability.

- Lightweight vehicle designs using advanced materials will improve efficiency and driving dynamics.

- Hybrid and solar-assisted power systems will emerge as complementary technologies in specific applications.

- North America and Europe will remain key markets, while Asia-Pacific will experience the fastest growth driven by expanding EV production.