Market Overview:

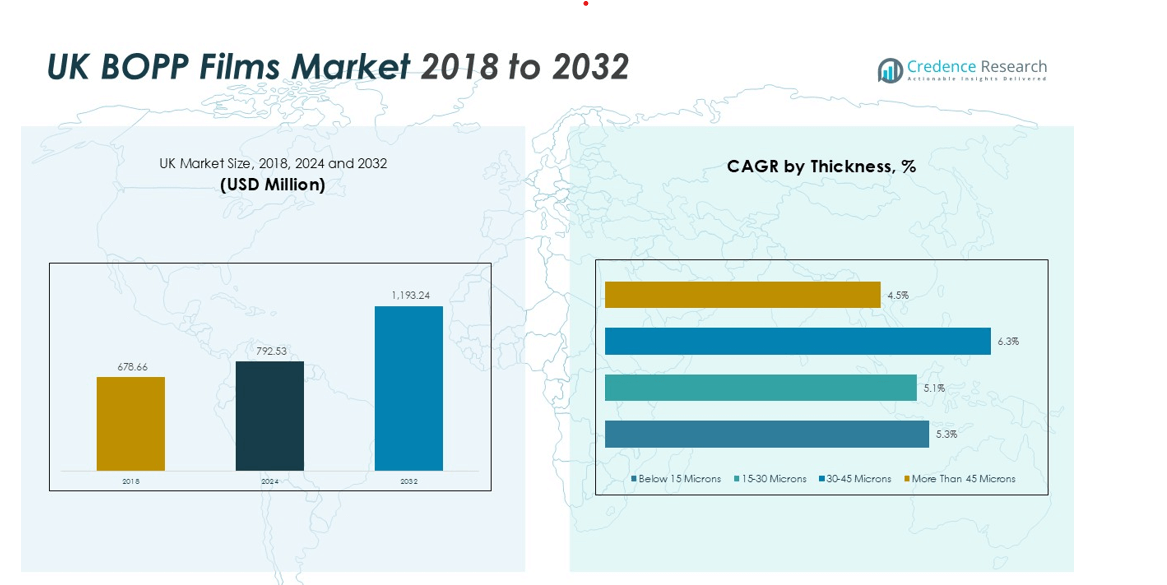

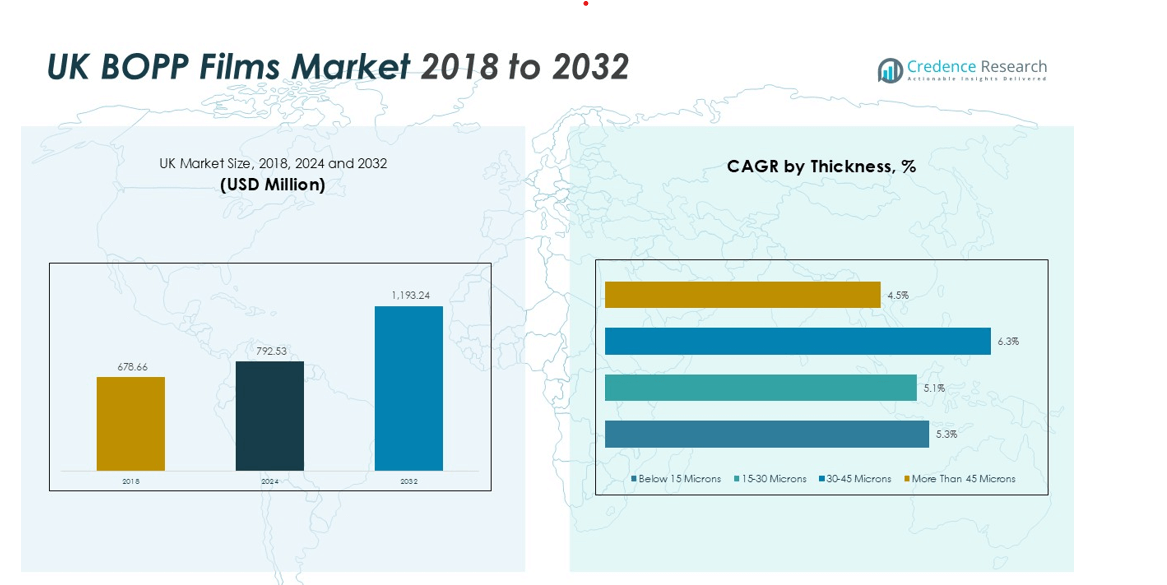

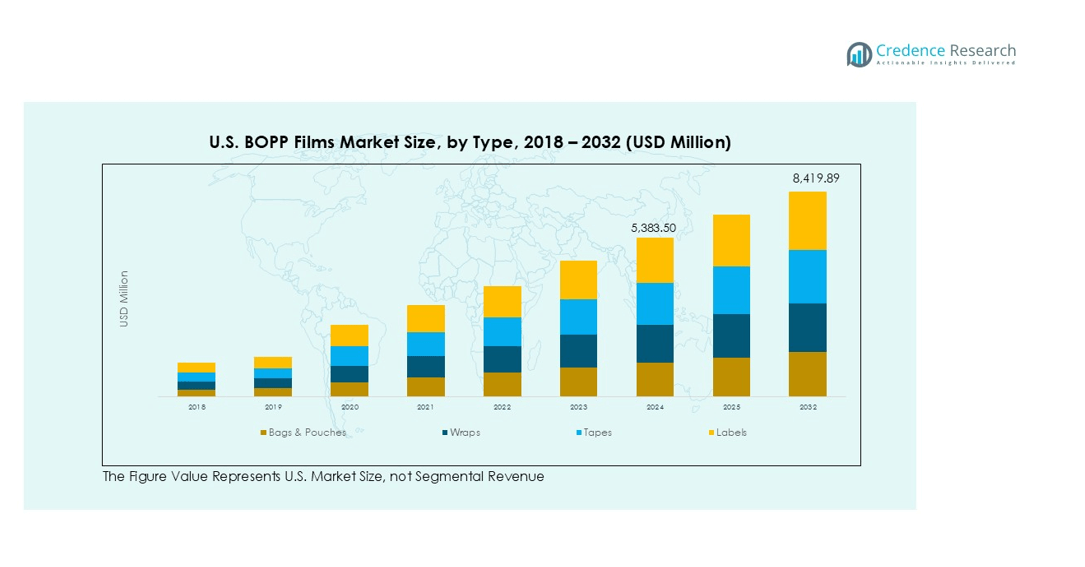

The UK BOPP Film Market size was valued at USD 678.66 million in 2018 to USD 792.53 million in 2024 and is anticipated to reach USD 1,193.24 million by 2032, at a CAGR of 5.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK BOPP Film Market Size 2024 |

USD 792.53 million |

| UK BOPP Film Market, CAGR |

5.25% |

| UK BOPP Film Market Size 2032 |

USD 1,193.24 million |

Rising consumption of packaged food and beverages, along with the expanding e-commerce industry, is driving the adoption of BOPP films in the United Kingdom. These films offer excellent moisture resistance, printability, and cost efficiency, making them ideal for flexible packaging. Additionally, ongoing technological advancements in film manufacturing—such as multi-layer extrusion and metallized coatings—enhance performance and recyclability, aligning with the UK’s stringent environmental packaging regulations.

Regionally, England dominates the UK BOPP Film Market due to its large food processing and consumer goods manufacturing base. The presence of established packaging converters and high investment in sustainable materials further support regional growth. Scotland and Wales are also experiencing growing adoption, driven by local manufacturing initiatives and the shift toward eco-friendly flexible packaging solutions.

Market Insights:

- The UK BOPP Film Market was valued at USD 792.53 million in 2024 and is projected to reach USD 1,193.24 million by 2032, registering a CAGR of 5.25%.

- Rising consumption of packaged food and beverages is driving strong demand for flexible and recyclable BOPP films in the United Kingdom.

- Continuous technological progress in multi-layer extrusion and metallized coatings enhances film durability, sealing performance, and recyclability standards.

- Expanding e-commerce and retail sectors are increasing the need for lightweight, transparent, and moisture-resistant packaging solutions.

- England leads with 68% market share due to its large manufacturing base and high concentration of packaging converters.

- Volatility in polypropylene resin prices and limited recycling infrastructure remain key operational challenges for film producers.

- Growing investments in bio-based and mono-material films are creating new opportunities aligned with the UK’s circular economy objectives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable and Recyclable Packaging Solutions

Growing environmental awareness and strict government regulations are driving the demand for sustainable packaging in the UK. The UK BOPP Film Market benefits from its recyclability and lightweight nature, which help reduce plastic waste. Manufacturers are adopting bio-based and recyclable BOPP films to meet the UK’s extended producer responsibility (EPR) policies. These materials offer durability and clarity while supporting circular economy goals. It continues to gain traction among food and beverage brands aiming to lower their carbon footprint.

- For instance, Mura Technology’s first Hydro-PRT site in Wilton, Teesside, achieves an annual carbon emissions saving of 40,000 tonnes.

Expansion of Food, Beverage, and Consumer Goods Industries

The rapid growth of the food processing and consumer goods industries boosts film consumption. BOPP films provide superior moisture, oxygen, and aroma barriers, essential for maintaining product quality. Rising demand for packaged snacks, ready-to-eat meals, and frozen foods in the UK drives consistent use of these films. It offers cost-effective protection, printability, and shelf appeal, enhancing brand visibility in retail environments. Increased investments in flexible packaging formats further accelerate market adoption.

- For instance, for every kilogram of Derprosa™ bioBLUE 30 films marketed by Taghleef Industries, 300 grams of fossil-based resins are replaced.

Technological Advancements in Film Manufacturing Processes

Manufacturers are implementing advanced production methods such as multi-layer extrusion, corona treatment, and metallization. These innovations improve the mechanical strength, gloss, and sealing properties of BOPP films. The UK BOPP Film Market experiences higher product efficiency and reduced material waste through these upgrades. It supports faster production cycles and improved film performance across varied packaging applications. Technological development also ensures compliance with evolving sustainability standards.

Growth of E-Commerce and Flexible Packaging Applications

The expansion of e-commerce platforms across the UK significantly increases demand for reliable and durable packaging materials. BOPP films are used in mailers, wrapping films, and protective laminates due to their tensile strength and transparency. It enables superior product protection and appealing presentation during logistics. Retailers favor BOPP-based solutions for their lightweight design and recyclability. Continuous online retail growth sustains long-term opportunities for flexible packaging manufacturers.

Market Trends:

Adoption of Bio-Based and High-Barrier Film Technologies

Sustainability is shaping the development of new materials in the UK BOPP Film Market. Manufacturers are investing in bio-based resins and recyclable polymers to comply with national sustainability goals and plastic reduction mandates. It supports the UK’s transition toward a circular economy by minimizing landfill waste and carbon emissions. High-barrier film technologies are also advancing, offering superior protection against moisture, oxygen, and light exposure for food and pharmaceutical packaging. Companies are deploying advanced coatings and metallization techniques to extend shelf life and maintain product integrity. Smart packaging features, including laser coding and transparent lamination, are being integrated to enhance traceability and branding. The growing preference for eco-friendly films across packaging sectors highlights a strategic move toward greener material innovation.

- For instance, Innovia Films has engineered ultra-high-barrier polypropylene films that provide an outstanding oxygen barrier of 0.1 g/m² over a 24-hour period, designed to replace foil in mono-material laminate structures.

Rising Preference for Flexible and Functional Packaging Formats

Changing consumer lifestyles and the surge in online retailing are driving a shift toward flexible packaging in the UK. BOPP films are preferred for their versatility, light weight, and superior aesthetic appeal. It offers excellent print quality, making it ideal for labeling, pouches, and wraps used across food and personal care products. Manufacturers are focusing on thinner gauges to reduce material consumption while maintaining mechanical performance. Digital printing compatibility and matte-surface finishes are also gaining momentum in premium packaging applications. The trend toward resealable, transparent, and tamper-evident designs further boosts market demand. Continuous product innovation and customization strengthen the competitive position of flexible packaging suppliers in the UK market.

- For instance, Accrued Plastic Ltd. contributes to material reduction efforts by offering clear BOPP films with a thickness as low as 15 microns for various flexible packaging needs.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Pressures

Volatile polypropylene resin prices continue to challenge manufacturers in the UK BOPP Film Market. It depends heavily on petrochemical feedstocks, which are influenced by global crude oil price fluctuations and geopolitical instability. Supply chain disruptions and high transportation costs affect production efficiency and profit margins. Manufacturers face difficulties maintaining stable pricing while meeting growing demand for sustainable packaging. Limited domestic polymer production further increases reliance on imports, exposing producers to exchange rate risks. Strategic sourcing partnerships and localized supply initiatives are becoming vital to ensure long-term material availability.

Stringent Environmental Regulations and Recycling Infrastructure Gaps

The UK’s evolving environmental legislation poses challenges for BOPP film producers. It requires compliance with extended producer responsibility (EPR) policies and stricter recycling mandates under the UK Plastics Pact. Insufficient recycling infrastructure limits the large-scale recovery of flexible packaging films. Manufacturers must redesign film structures to meet recyclability standards without compromising product performance. Developing mono-material solutions remains technically complex and costly. Increased regulatory pressure to transition toward circular packaging systems compels producers to invest in research and innovation.

Market Opportunities:

Growing Demand for Eco-Friendly and High-Performance Packaging Solutions

Sustainability commitments by brands and retailers are creating new growth avenues in the UK BOPP Film Market. It offers a strong opportunity for producers developing recyclable and bio-based film variants. The demand for compostable and mono-material packaging is increasing across food, beverage, and personal care sectors. Companies that integrate renewable feedstocks and solvent-free coating technologies can attract environmentally conscious consumers. Expanding applications in flexible pouches, wraps, and labels support broader adoption. Government incentives for green innovation further enhance the potential for sustainable packaging materials.

Expansion in E-Commerce and Advanced Printing Technologies

The rise of e-commerce continues to transform the country’s packaging landscape. It creates significant opportunities for durable, lightweight, and visually appealing films that can withstand logistics handling. BOPP films provide high clarity, printable surfaces, and moisture resistance suitable for online retail packaging. Investments in digital and 3D printing technologies enable greater customization and branding flexibility. The trend toward smart labeling and tamper-evident packaging designs enhances product authenticity and consumer trust. Growing collaboration between converters and retailers is fostering innovation in flexible and intelligent packaging formats.

Market Segmentation Analysis:

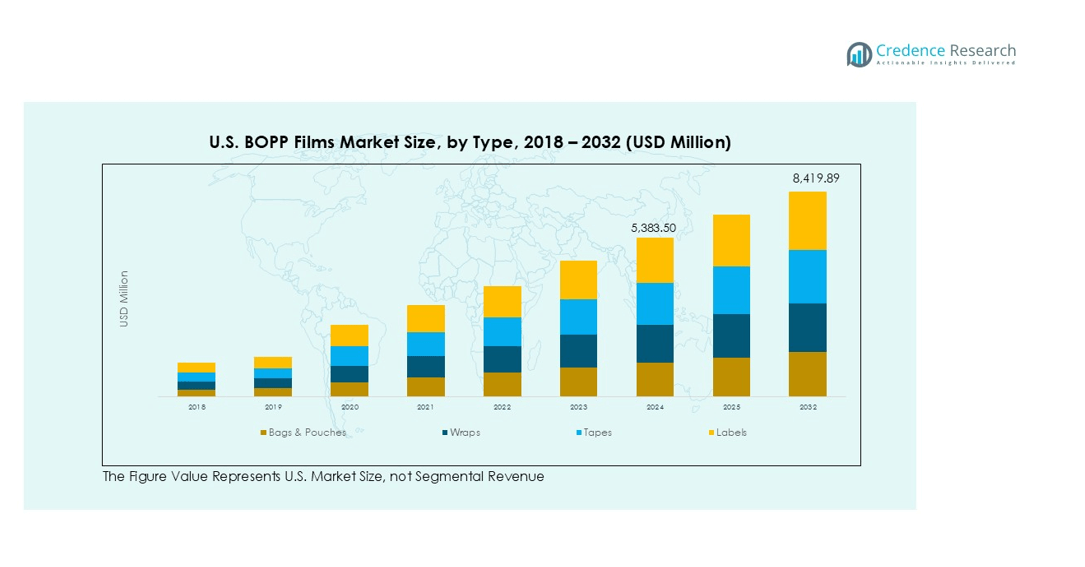

By Type

The UK BOPP Film Market is segmented into bags and pouches, wraps, tapes, and labels. Bags and pouches dominate due to their high usage in food and beverage packaging. It offers strong clarity, moisture protection, and superior printability suited for retail applications. Wraps are increasingly used in bakery and confectionery products because of their flexibility and lightweight design. Tapes and labels segments are growing with higher demand for durable, printable, and adhesive materials across industrial and consumer sectors.

- For instance, Innovia Films recently enhanced its production capabilities by commissioning a new 8.8-meter-wide multi-layer co-extrusion line, which is engineered to produce 35,000 tons of advanced BOPP films annually.

By Application

Food packaging holds the largest share driven by demand for ready-to-eat meals and frozen foods. It benefits from BOPP films’ barrier protection, transparency, and recyclability. Beverage and tobacco industries rely on these films for improved shelf appeal and aroma preservation. Personal care and pharmaceutical applications use BOPP films to maintain hygiene and product integrity. Electrical and electronics applications are expanding with the rising need for moisture-resistant and dielectric materials.

By Thickness

Films between 15–30 microns account for the largest market share due to balanced flexibility, strength, and cost efficiency. It is widely preferred for snack packaging, labeling, and wrapping applications. Films below 15 microns are used in lightweight pouches and lamination, offering cost benefits for high-volume use. Thicker variants above 30 microns are favored for heavy-duty packaging and industrial use. Growing innovation in multi-layer film manufacturing is enhancing performance across all thickness categories.

- For instance, manufacturing advancements for BOPP films have improved material efficiency, with a 60-gauge (15 micron) film now offering a yield of approximately 51,800 square inches per pound.

Segmentations:

By Type:

- Bags & Pouches

- Wraps

- Tapes

- Labels

By Application:

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical & Electronics

- Others

By Thickness:

- Below 15 Microns

- 15–30 Microns

- 30–45 Microns

- More Than 45 Microns

By Production Process:

Regional Analysis:

Strong Market Concentration Across England’s Industrial and Packaging Hubs

England holds 68% share of the UK BOPP Film Market in 2025, making it the leading regional contributor. It benefits from a robust manufacturing base, advanced logistics networks, and strong packaging industry presence. Major demand originates from food, beverage, and personal care sectors concentrated in the Midlands, Greater London, and the North West. Established converters and suppliers ensure efficient production and distribution. Continuous investment in sustainable packaging and recycling technologies strengthens England’s leadership in BOPP film innovation and output.

Steady Growth Supported by Scotland’s Food and Beverage Sector

Scotland accounts for 18% share of the UK BOPP Film Market, supported by its expanding food and beverage industries. It continues to attract packaging manufacturers focused on recyclable and high-barrier film applications. Government initiatives promoting sustainable production drive investments in advanced flexible packaging solutions. Export-oriented food producers increasingly prefer BOPP films for moisture and aroma protection. Local producers are aligning product design with Scotland’s circular economy objectives and packaging waste regulations.

Emerging Potential in Wales and Northern Ireland Through Local Manufacturing Expansion

Wales and Northern Ireland together hold 14% share of the UK BOPP Film Market, reflecting growing regional participation. It is driven by manufacturing diversification and government incentives for sustainable material innovation. Small and medium converters are expanding capabilities to meet demand from regional food and industrial sectors. Improved logistics and access to recycled polymers enhance local film production efficiency. Collaborative sustainability programs and recycling infrastructure upgrades are supporting long-term regional competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Innovia Films (CCL Industries)

- Treofan (via Jindal Poly Films)

- Taghleef Industries

- UFlex Ltd.

- Toray Films Europe

- Berry Global Inc.

- Elite Plastics Limited

- Klöckner Pentaplast (K-P)

- Cosmo Films Limited

Competitive Analysis:

The UK BOPP Film Market is characterized by strong competition among global and domestic producers focusing on sustainability, product quality, and technological efficiency. Leading companies such as Innovia Films, Taghleef Industries, UFlex Ltd., and Berry Global Inc. emphasize recyclable and bio-based film development to meet environmental standards. It continues to evolve with advancements in multi-layer extrusion, metallization, and high-barrier coatings that enhance performance and shelf life. Strategic collaborations, regional expansions, and acquisitions are common as companies strengthen market reach and production capacity. Firms are also investing in lightweight and high-clarity films to cater to demand from food, beverage, and personal care sectors. Competitive differentiation depends on cost optimization, product customization, and compliance with the UK’s circular economy goals.

Recent Developments:

- In September 2025, Innovia Films announced it would present mono-material polypropylene solutions at the Fachpack 2025 trade fair, including films for PET and foil replacement, to meet the upcoming European Packaging and Packaging Waste Regulation (PPWR).

- In September 2025, Taghleef Industries (Ti) launched an innovative detachable in-mold label film technology designed to to allow labels to separate cleanly during the mechanical recycling process.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Thickness and Production Process. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for recyclable and bio-based BOPP films will continue to rise with stricter sustainability regulations in the UK.

- Manufacturers will focus on developing mono-material structures to enhance recyclability and reduce environmental impact.

- Adoption of advanced coating and metallization technologies will strengthen barrier properties for food and pharmaceutical packaging.

- Growth in e-commerce packaging will drive the need for durable, lightweight, and printable film materials.

- Companies will expand local production capacities to minimize import dependency and improve supply chain resilience.

- Integration of digital and smart packaging solutions will improve traceability, branding, and consumer engagement.

- Collaboration between converters and brand owners will increase to develop circular packaging systems.

- Rising preference for flexible over rigid packaging will sustain strong demand across multiple industries.

- Technological innovation in film extrusion and thickness optimization will improve cost efficiency and performance.

- Sustainability-led policies and recycling infrastructure upgrades will shape long-term market competitiveness and innovation strategies.