Market Overview:

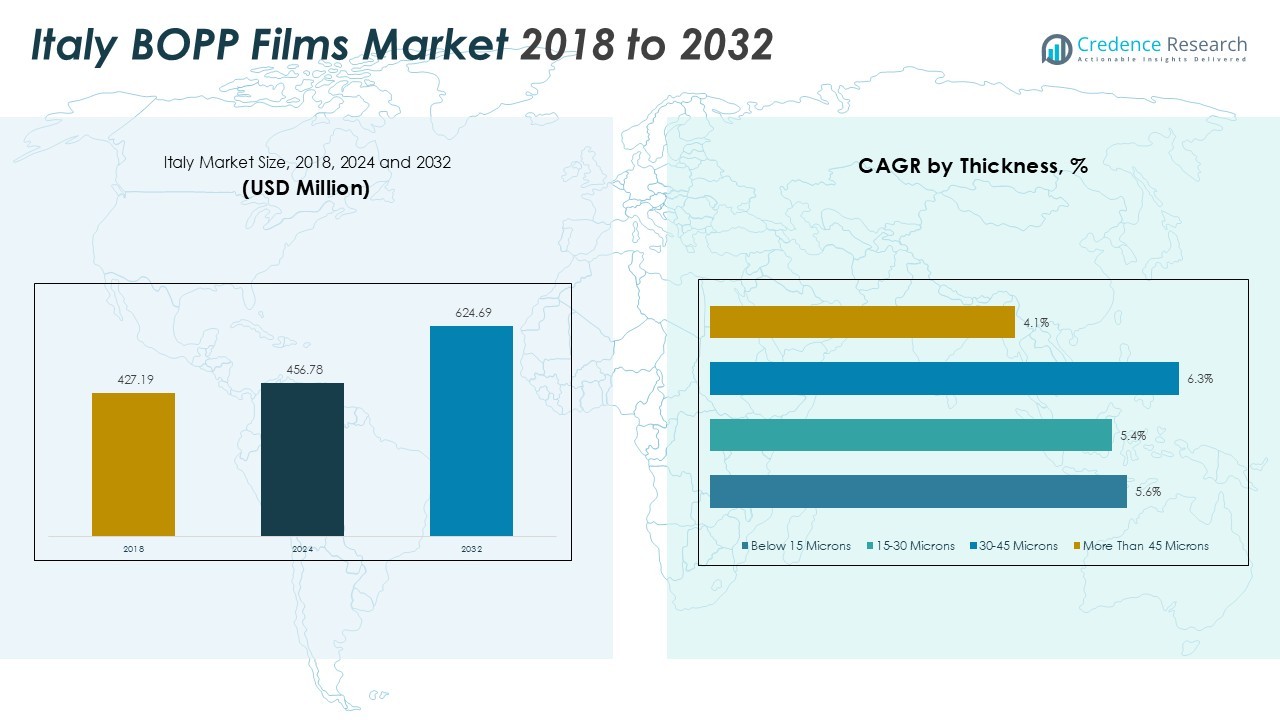

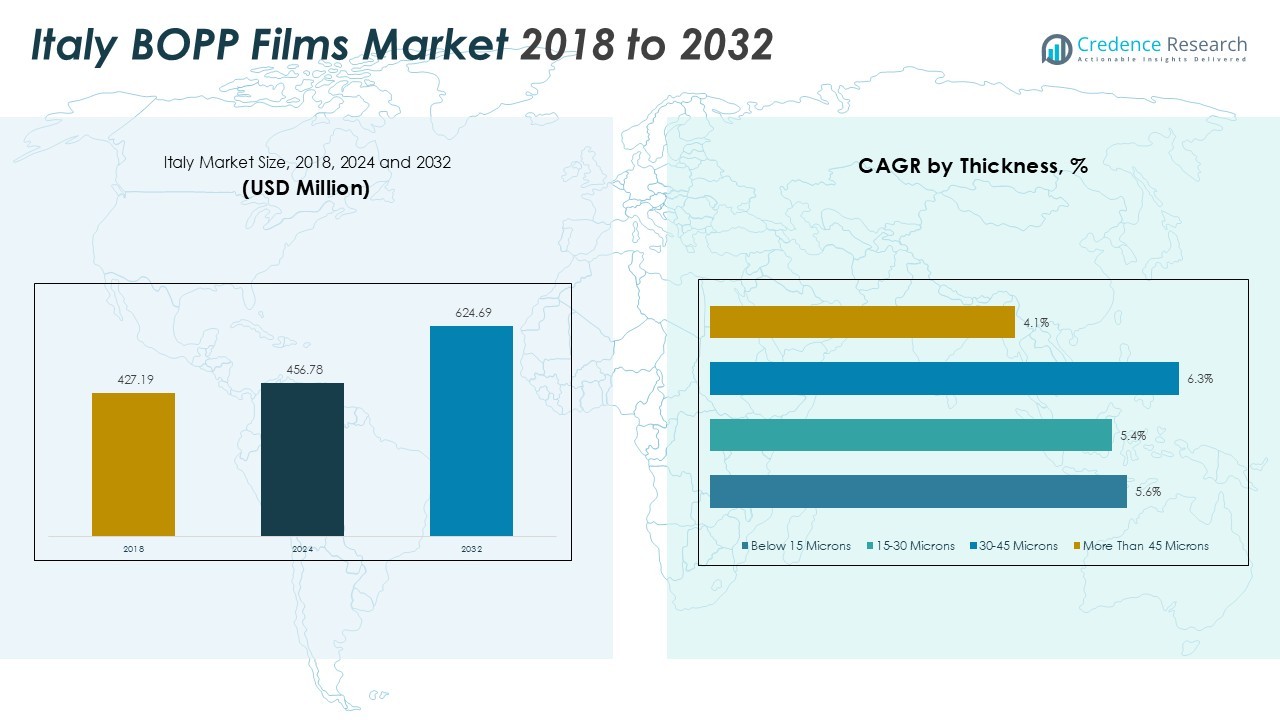

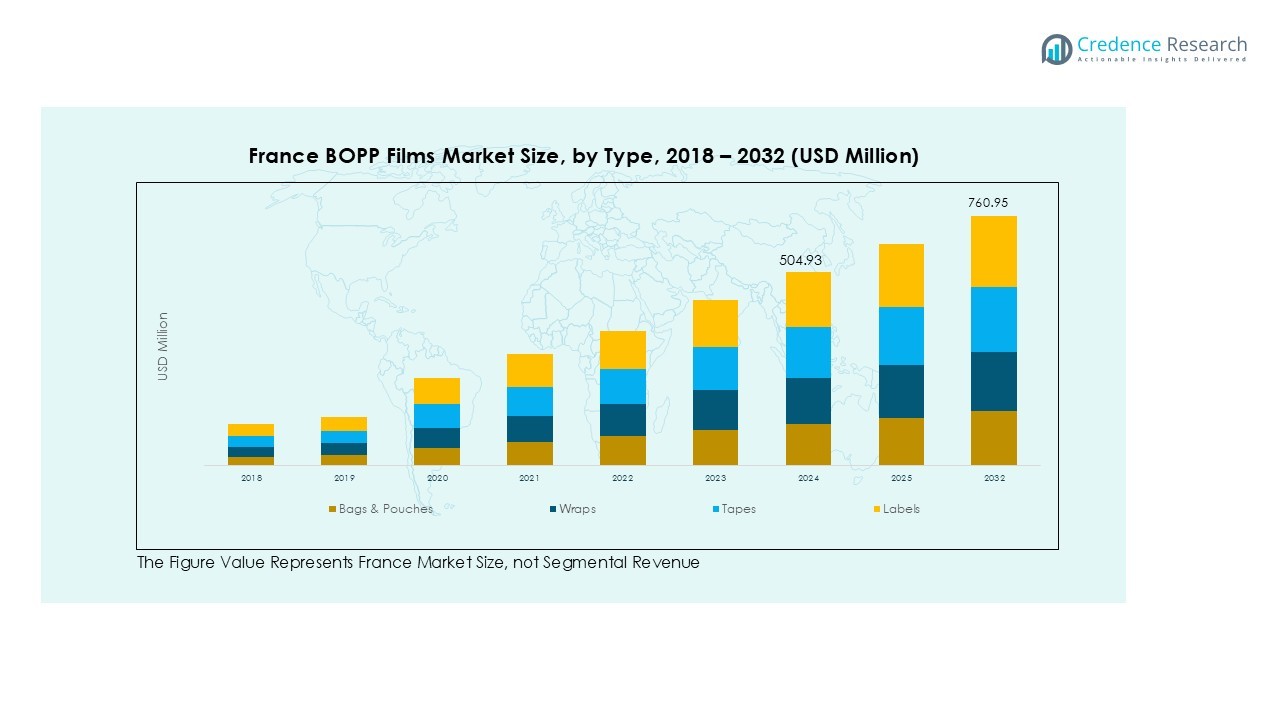

The Italy BOPP Films Market size was valued at USD 427.19 million in 2018 to USD 456.78 million in 2024 and is anticipated to reach USD 624.69 million by 2032, at a CAGR of 3.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy BOPP Films Market Size 2024 |

USD 456.78 Million |

| Italy BOPP Films Market, CAGR |

3.99% |

| Italy BOPP Films Market Size 2032 |

USD 624.69 Million |

Key factors fueling market expansion include rising awareness of eco-friendly and recyclable packaging materials and the regulatory focus on sustainability. Manufacturers are increasingly shifting toward bio-based and recyclable BOPP films to comply with stringent European Union directives and meet consumer expectations for environmentally responsible packaging solutions. Furthermore, ongoing innovation in film technology, including improved barrier coatings and heat-sealable grades, is broadening their application scope in industrial and consumer packaging.

Regionally, Northern Italy dominates the market due to its strong industrial base and advanced packaging manufacturing infrastructure. The presence of major food processing and pharmaceutical hubs, coupled with robust logistics networks, supports consistent demand for high-performance BOPP films across domestic and export-oriented industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market grew from USD 427.19 million in 2018 to USD 456.78 million in 2024 and is projected to reach USD 624.69 million by 2032 at a CAGR of 3.99%.

- Rising demand for eco-friendly and recyclable packaging drives adoption of bio-based BOPP films across multiple industries.

- The food and beverage sector fuels growth by requiring films that preserve freshness, extend shelf life, and enhance product appeal.

- Technological advancements in multi-layer extrusion, metallization, and barrier coatings improve film performance and expand applications.

- EU regulations and circular economy initiatives push manufacturers to develop recyclable and energy-efficient BOPP films.

- Market challenges include raw material cost fluctuations, energy-intensive processes, limited recycling capacity, and technical limits for high-temperature use.

- Northern Italy accounts for nearly 60% of production and consumption, while southern and central regions show growth potential due to urbanization and retail expansion.

Market Drivers:

Rising Demand for Sustainable and Recyclable Packaging Solutions

The Italy BOPP Films Market is strongly driven by growing environmental awareness and regulatory emphasis on sustainability. Consumers and brands are increasingly choosing packaging materials that can be recycled without compromising performance. BOPP films, known for their excellent clarity, moisture resistance, and cost-effectiveness, align with this trend by offering eco-friendly and mono-material packaging options. Italy’s packaging producers are adopting recyclable and bio-based BOPP film variants to comply with EU packaging waste directives and achieve circular economy goals. This shift toward sustainable solutions continues to strengthen market growth across multiple end-use industries.

- For instance, in 2023, Italian pasta maker Garofalo became the first company to launch a mono-material pasta package using certified circular polypropylene (PP) from post-consumer recycled plastic waste.

Expanding Food and Beverage Industry Supporting Market Growth

The expanding food and beverage sector in Italy significantly influences demand for BOPP films. Food manufacturers rely on these films for packaging products such as snacks, pasta, and frozen foods due to their superior sealing and barrier properties. It helps maintain product freshness, enhance shelf appeal, and extend product shelf life. Growing consumer demand for convenient and pre-packaged food items supports higher consumption of flexible packaging. The rise in modern retail formats and e-commerce food deliveries further reinforces BOPP film adoption in Italy’s food packaging applications.

Technological Advancements Enhancing Film Performance

Ongoing innovations in film production technologies are enhancing the performance and versatility of BOPP films in Italy. Advanced coating techniques, improved metallization, and multi-layer extrusion technologies are improving film strength, transparency, and heat resistance. It enables manufacturers to develop high-quality films tailored for demanding packaging needs in food, pharmaceutical, and consumer goods sectors. Technological improvements also contribute to cost efficiency and reduced material waste during production. Continuous innovation remains a crucial driver for maintaining Italy’s competitive position in the European packaging market.

- For instance, Vibac produces BOPP lamination films for food packaging with a total thickness starting at 14 microns, expanding their portfolio for diverse flexible packaging applications.

Regulatory Support and Shifting Industry Preferences Driving Adoption

Government policies promoting recyclable packaging materials are positively influencing BOPP film adoption in Italy. Regulations encouraging reduction of plastic waste and improved material recovery have accelerated investment in sustainable packaging solutions. It pushes manufacturers to redesign product lines using recyclable and energy-efficient BOPP films. Growing collaboration between packaging producers and recycling industries supports development of circular supply chains. Regulatory clarity and evolving consumer expectations are steering the market toward long-term growth and innovation in sustainable film solutions.

Market Trends:

Expansion of High-Barrier and Lightweight Film Structures Driving Market Differentiation

The Italy BOPP Films Market is witnessing growing demand for films that combine high barrier protection with reduced material usage. Manufacturers are developing advanced multi-layer and metallized films that provide strong resistance against moisture, oxygen, and UV exposure, ensuring product freshness and extended shelf life. It supports the replacement of traditional heavy packaging materials, enabling lower transportation costs and improved sustainability. Demand for thin-gauge films continues to rise, particularly in pouches, wraps, and flexible food packaging applications. Producers are focusing on enhancing mechanical strength, seal performance, and optical clarity to ensure thinner films deliver the same or higher performance. These advancements help packaging companies achieve cost efficiency while meeting evolving European sustainability and performance standards.

- For instance, Garofalo launched mono-material pasta bags in Italy using SABIC’s TRUCIRCLE BOPP film, with each bag incorporating post-consumer recycled content and released to stores in March 2023.

Shift Toward Sustainable, Mono-Material, and Bio-Based Film Innovations

Rising environmental concerns and regulatory initiatives are driving the shift toward recyclable and mono-material packaging across Italy. Companies are redesigning BOPP film structures to simplify recycling processes and reduce overall plastic waste. It promotes the development of bio-based films and incorporation of post-consumer recycled materials without compromising durability or appearance. Manufacturers are improving coatings and sealants to enhance recyclability while maintaining strong barrier performance and print quality. Major brands in food, beverages, and personal care sectors are prioritizing environmentally responsible packaging to align with consumer expectations and circular economy goals. Continuous investment in sustainable material innovation reinforces Italy’s role as a progressive market within Europe’s flexible packaging landscape.

- For instance, COIM offers Novacote® HS 8443, a solvent-based, PVC and STYRENE-FREE heat seal lacquer with a low softening point, enabling a sealing temperature from 70°C upwards.

Market Challenges Analysis:

Escalating Raw Material Costs and Volatility Hinder Manufacturer Margins

The Italy BOPP Films Market confronts significant challenges from unstable feedstock costs, especially polypropylene, which depend heavily on global crude oil price fluctuations. It forces producers to absorb higher input expenses or pass them to customers who often resist price increases. Fabrication of multi-layer or metallized films demands precise stretching, orientation, and coating steps. Those steps raise energy consumption and capital investment, particularly when cooling, heating, or tension-control equipment demands tight tolerances. Smaller firms with limited financial reserves struggle to invest in newer machinery or buffer inventory, which reduces scale economies and weakens competitive positioning.

Regulatory Pressure, Recycling Infrastructure Gaps, and Technical Limits Restrict Growth

Stringent environmental rules in the EU require higher recycled content, restrict certain additives, and enforce bans or limits on single-use plastics. It compels manufacturers to redesign film compositions and coatings to meet new standards while preserving barrier performance. Recycling systems in Italy still show inadequate capacity to recover multi-layer or metallized BOPP films; mixed or composite materials often lack efficient sorting or processing. High- temperature sealing or sterilization remains problematic for many BOPP grades. It leads to limitations in applications such as hot-fill packaging or retortable pouches, where performance reduces under heat exposure. Consumer expectations over sustainability increase scrutiny of packaging lifecycle, pressuring brands to ensure traceability, durability, and recyclability together—even when technical or cost trade-offs exist.

Market Opportunities:

Emerging Capacity Expansions and Specialty Film Development Open Growth Avenues

Producers in Italy invest substantial capital in expanding production capacity for BOPP films in major sites, particularly for specialty grades that meet higher barrier and aesthetic demands. It creates opportunities to serve food, personal care and luxury packaging sectors with metallized, AlOx-coated and sealable films. Firms scale up thin-gauge film lines to reduce raw material usage while maintaining performance, thereby responding to cost pressures and sustainability demands. It enables converters and brands to experiment with innovative applications like lidding films, multilayer pouch structures, and overwraps that preserve visual appeal. Collaboration between manufacturers and research institutions supports product innovation and process optimization.

Sustainability-Driven Innovation and Regulatory Alignment Fuel Product Differentiation

Italy BOPP Films Market finds opportunity in the shift toward recyclable mono-material structures and bio-based feedstocks. It encourages producers that develop chemically recycled or renewable resource-derived polypropylene films to capture value under evolving regulations. Certifications and compliance with EU and national packaging waste rules present advantages for brands seeking to demonstrate environmental responsibility. It pushes innovation in coatings, adhesives and film formulations that meet barrier and packaging safety criteria without compromising recyclability. Demand from retailers and consumers for sustainable credentials creates premium segments for such differentiated films. Integration of smart features—freshness indicators, anti-fog, or tamper evidence—in sustainable films enhances perceived value.

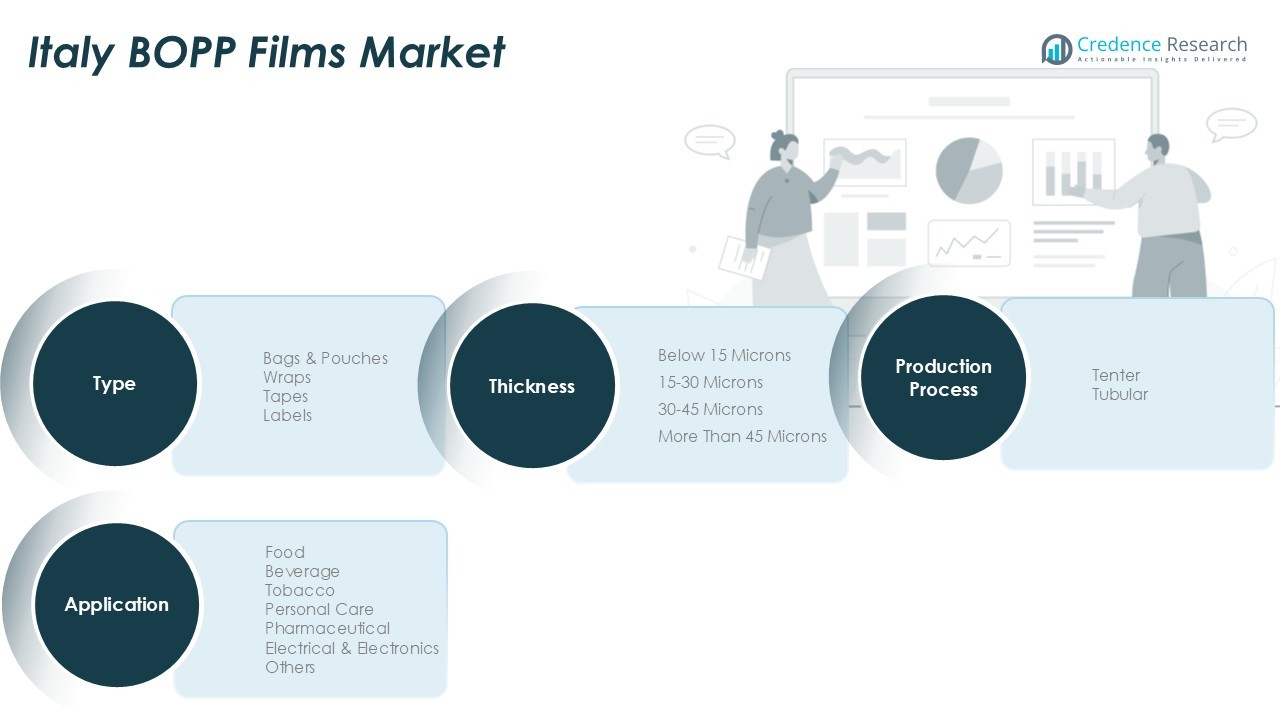

Market Segmentation Analysis:

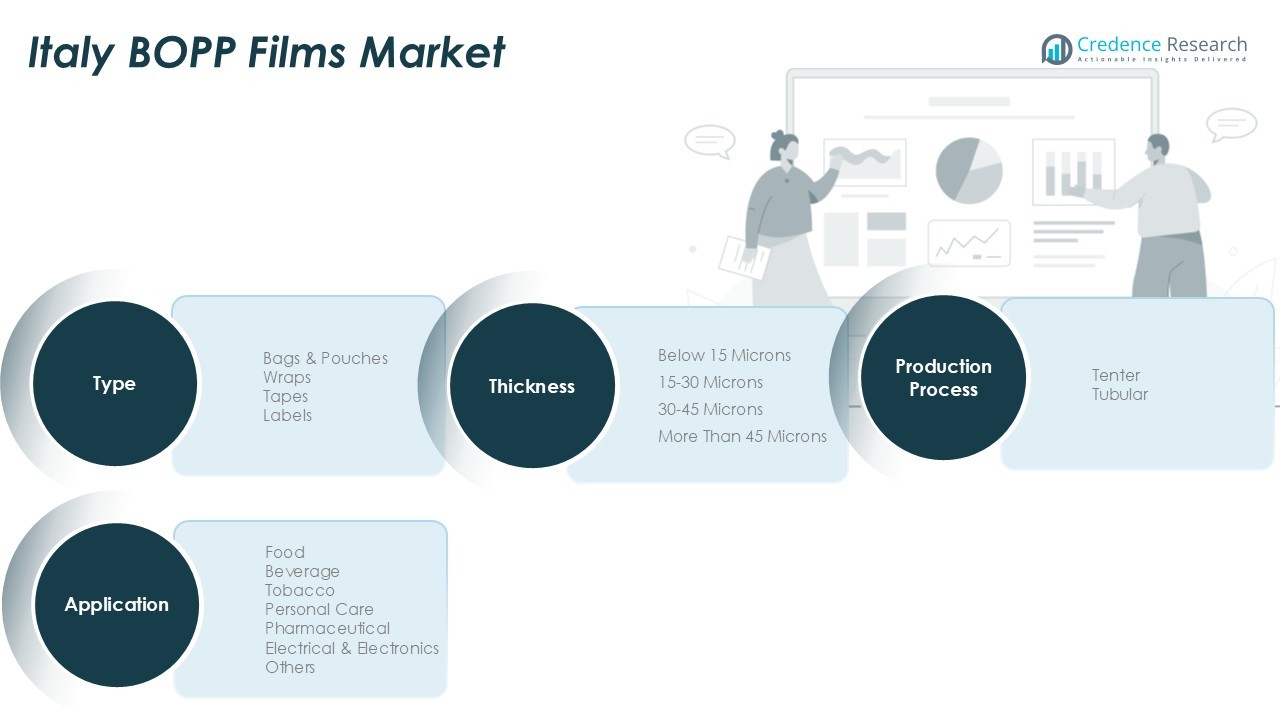

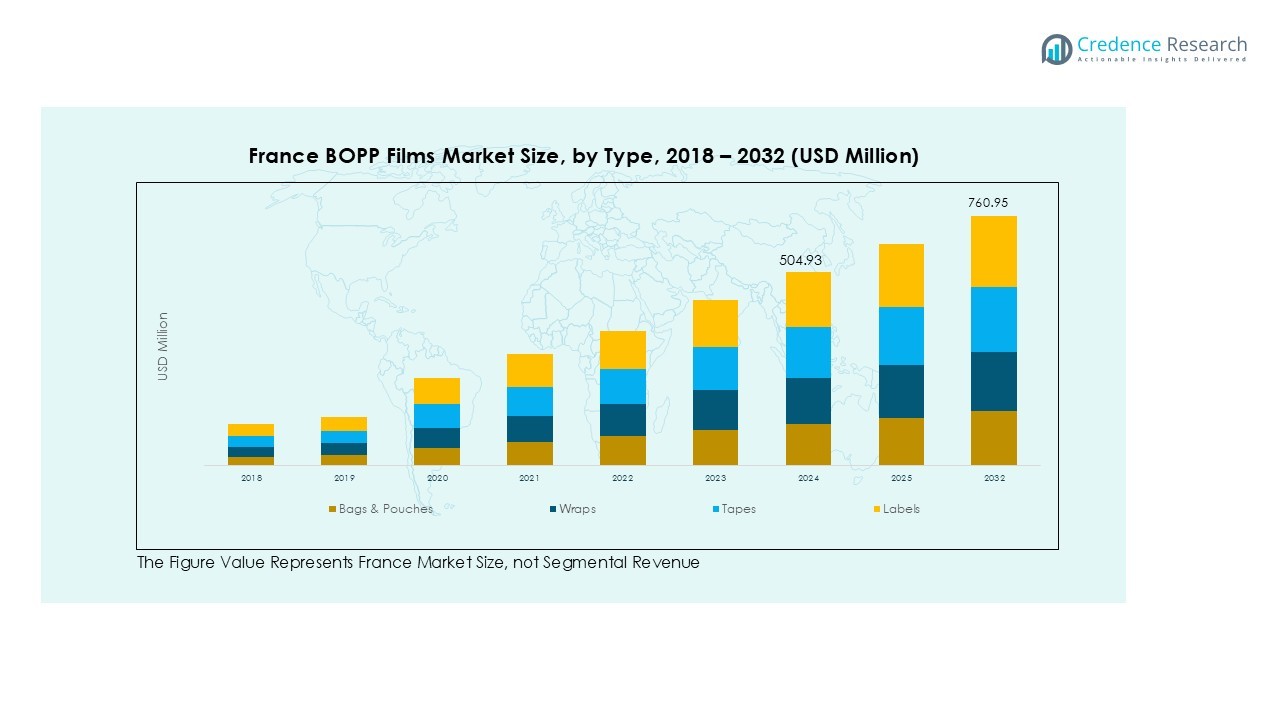

By Type

The Italy BOPP Films Market demonstrates strong demand for bags and pouches due to their widespread use in food packaging, providing excellent sealing, barrier properties, and convenience. Wraps and tapes maintain significant shares in industrial and retail applications, while labels benefit from high clarity and printability, supporting branding and product identification. It enables converters and brands to deliver functional performance along with visual appeal.

By Application

The food and beverage sector accounts for the largest consumption segment, driven by the need to preserve freshness, extend shelf life, and enhance product presentation. Pharmaceutical and personal care segments show steady growth due to strict packaging standards and demand for secure, tamper-evident solutions. Tobacco and electrical & electronics applications generate niche demand, requiring specialized films for barrier protection and durability. It allows manufacturers to meet industry-specific requirements while maintaining quality consistency.

- For instance, Klöckner Pentaplast developed its kp ReClose film for food applications, which allows a package to be securely resealed up to 20 times, improving consumer convenience and reducing food waste.

By Thickness

Films in the 15–30 microns range dominate the market, offering an optimal balance of flexibility, strength, and cost efficiency for most packaging needs. Below 15 microns films are increasingly adopted for lightweight, high-volume applications, while 30–45 microns and above are used where superior mechanical strength and barrier performance are required. It enables producers to cater to diverse packaging demands while optimizing material usage and operational efficiency.

- For instance, Taghleef Industries has expanded its Shape360 portfolio to include a 42-micron film, demonstrating its commitment to developing thinner, more material-efficient solutions for the packaging industry.

Segmentations:

By Type

- Bags & Pouches

- Wraps

- Tapes

- Labels

By Application

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical & Electronics

- Others

By Thickness

- Below 15 Microns

- 15-30 Microns

- 30-45 Microns

- More Than 45 Microns

By Production Process

Regional Analysis:

Northern Italy Industrial Concentration and Manufacturing Hubs Drive Packaging Demand

Northern Italy accounts for 60% of the total production and consumption within the Italy BOPP Films Market. The region hosts major packaging converters, food manufacturers, and pharmaceutical plants that depend on consistent film supply. It benefits from advanced extrusion and orientation technology installed in Lombardy, Emilia-Romagna, and Veneto. Localized manufacturing clusters ensure quick turnaround times, cost efficiency, and tailored product grades for high-barrier and decorative packaging. Strong logistics infrastructure and skilled labor availability strengthen the competitive edge of northern producers, supporting Italy’s leadership within the European flexible packaging sector.

Regional Logistics Networks and Cross-Border Trade Shape Supply Dynamics

Central and northern Italy contribute 70% of BOPP film exports to neighboring European countries. The extensive logistics network, including ports, rail corridors, and road systems, enables stable cross-border trade and raw material inflow. It allows producers to maintain a flexible production model and balance domestic and export market requirements. Partnerships with EU-based converters facilitate technology exchange and uniform quality standards across borders. Trade integration within the European single market promotes steady growth and supply chain resilience for Italian BOPP film manufacturers.

Urban Consumer Markets, Retail Modernization and Southern Growth Potential

Southern and central Italy collectively represent 40% of the country’s demand for flexible packaging films, driven by expanding retail and food distribution networks. Rapid growth in urban centers such as Rome, Naples, and Bari fuels demand for visually appealing and durable packaging. It encourages adoption of high-clarity and heat-sealable BOPP films in consumer goods and food packaging. Ongoing investments in regional recycling infrastructure and circular packaging systems enhance sustainability in film usage. Market participants focusing on localized production and eco-friendly solutions are positioned to capture growing opportunities in these emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Manucor S.p.A.

- Taghleef Industries Italy

- Jindal Films Europe

- Polinas

- Polibak

- UFlex Ltd.

- Innovia Films

Competitive Analysis:

The Italy BOPP Films Market exhibits a highly competitive landscape, dominated by several established players with strong production capacities and advanced technological capabilities. Leading companies focus on expanding their product portfolios through specialty films, including metallized, heat-sealable, and bio-based variants to meet evolving customer and regulatory demands. It benefits from strategic developments such as mergers, acquisitions, regional expansions, and collaborations with converters to strengthen market presence and distribution networks. Continuous investment in research and development enables manufacturers to enhance film performance, reduce production costs, and introduce innovative packaging solutions across food, beverage, pharmaceutical, and personal care sectors. Competition also drives companies to improve operational efficiency, optimize supply chains, and maintain high-quality standards. Firms that align sustainability initiatives with product differentiation, while responding to cost pressures and consumer preferences, secure a significant advantage in Italy’s dynamic BOPP films sector.

Recent Developments:

- In July 2025, UniCredit and SACE announced a structured financing agreement worth up to €45 million to support Manucor S.p.A.’s industrial growth in Southern Italy.

- In July 2025, Taghleef Industries announced it would unveil three new film innovations at Labelexpo Europe, including SHAPE360® TDSW, a newly announced white film for TD shrink sleeve labels specifically developed for light-sensitive products.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Thickness and Production Process. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for sustainable and recyclable packaging solutions will continue to drive adoption of bio-based BOPP films across multiple industries.

- Food and beverage sectors will increasingly rely on high-performance films that preserve freshness, extend shelf life, and enhance visual appeal.

- Technological innovations in multi-layer extrusion, metallization, and barrier coatings will expand application potential and improve film quality.

- Manufacturers will focus on developing mono-material and compostable films to comply with evolving European environmental regulations.

- Urbanization and retail modernization in southern and central regions will create new growth opportunities for premium and convenient packaging formats.

- Strategic collaborations between producers and converters will accelerate innovation and shorten product development cycles.

- Companies will invest in digital printing and surface treatments to provide high-quality aesthetics for luxury and branded packaging.

- Recycling infrastructure improvements and circular economy initiatives will drive adoption of eco-friendly BOPP films.

- Firms that optimize production efficiency and supply chains will strengthen their competitive advantage in the market.

- Future growth will favor manufacturers that integrate sustainability, performance, and design innovation to meet evolving consumer expectations and regulatory demands.