Market Overview

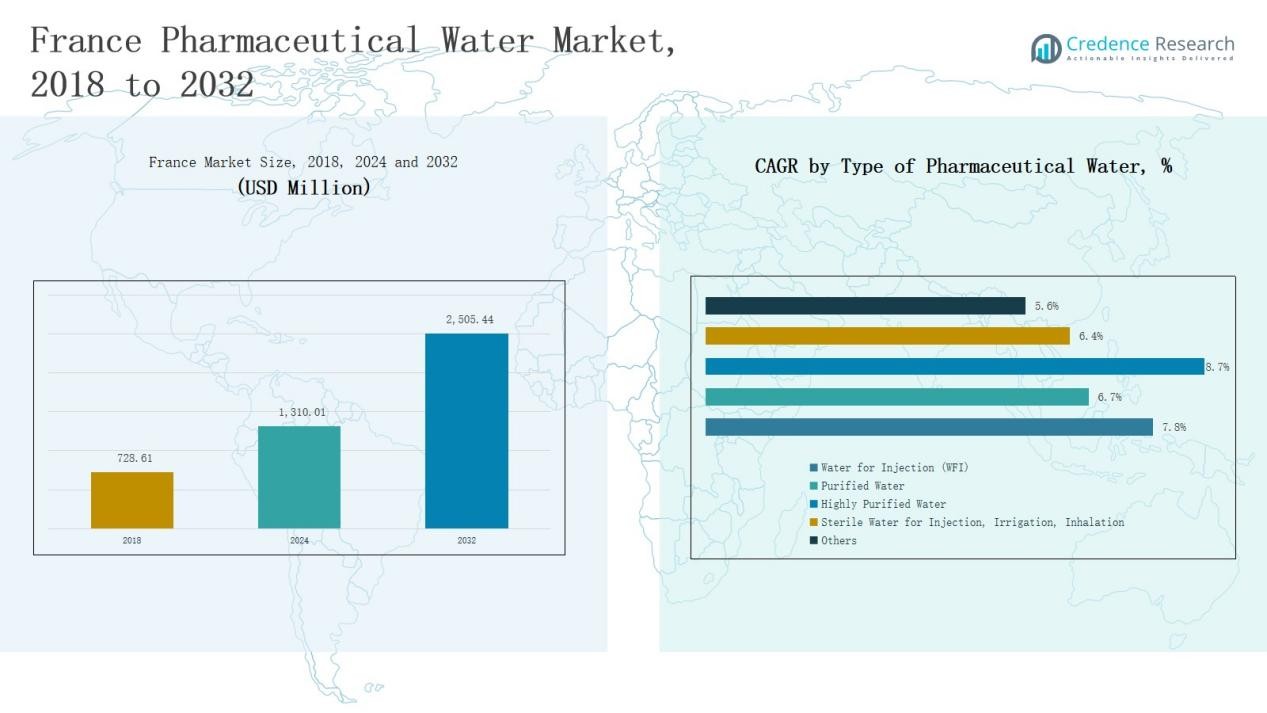

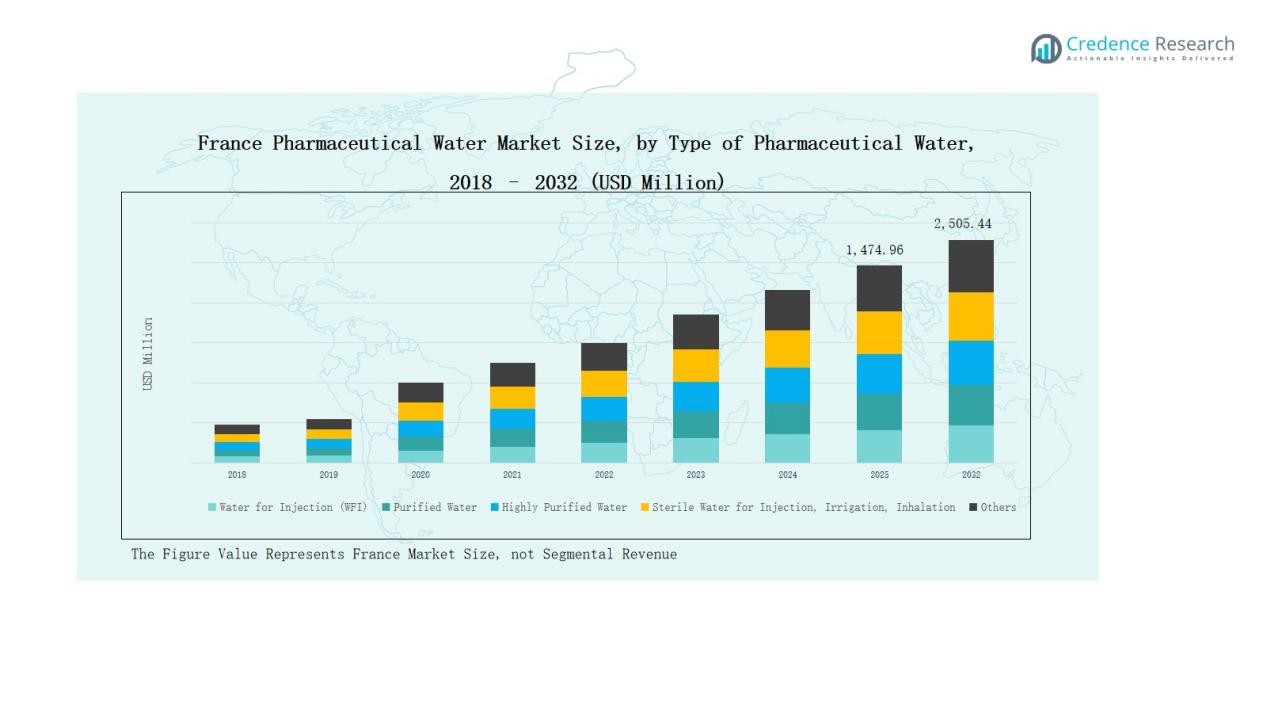

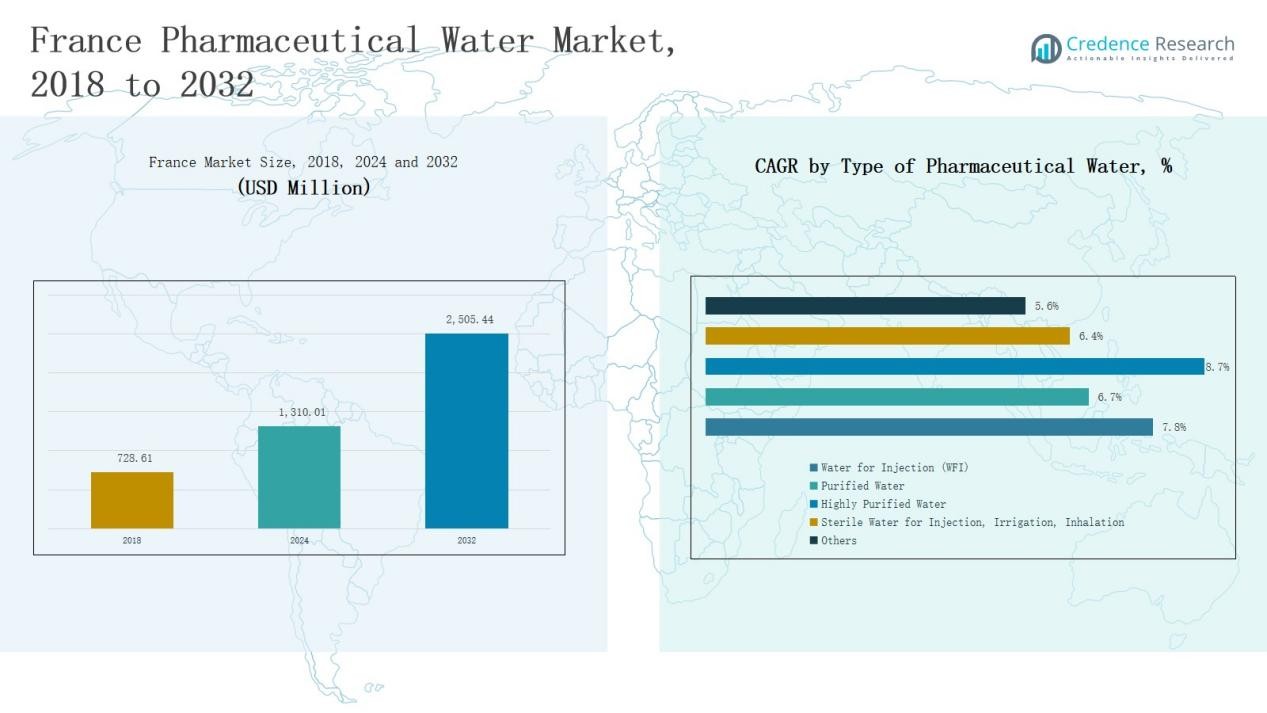

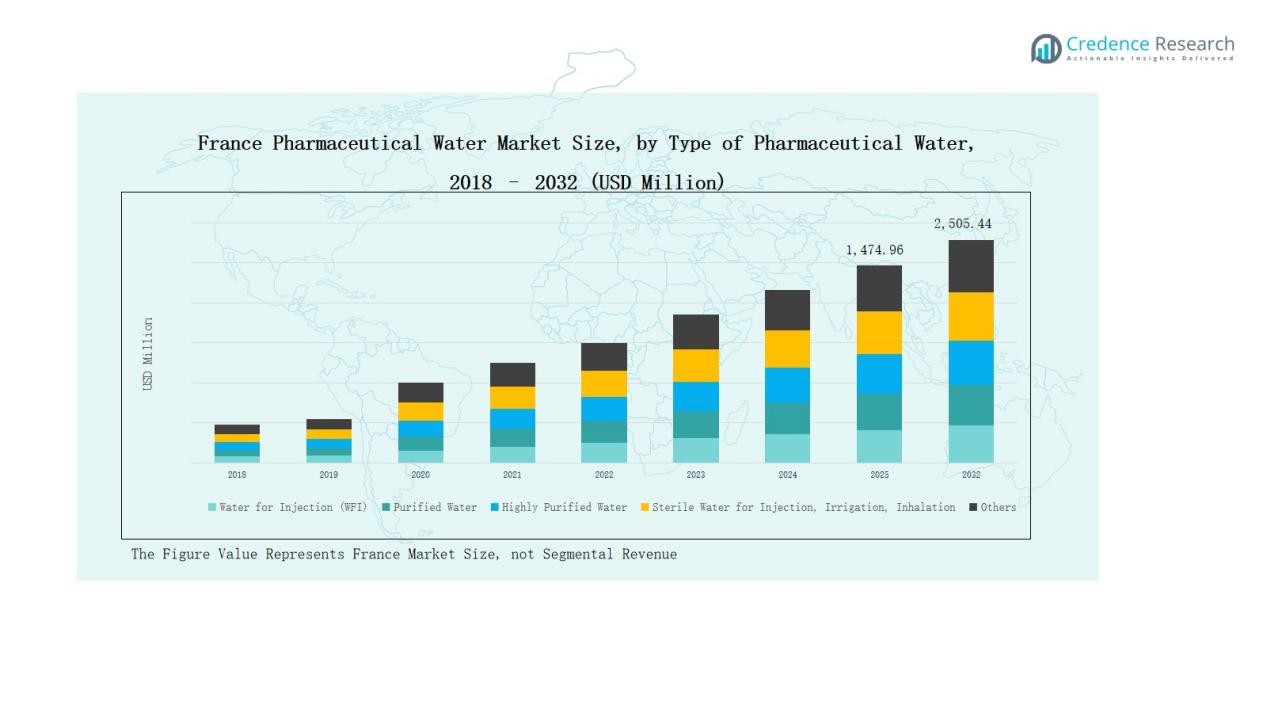

The France Pharmaceutical Water Market was valued at USD 728.61 million in 2018, grew to USD 1,310.01 million in 2024, and is projected to reach USD 2,505.44 million by 2032, expanding at a CAGR of 7.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Pharmaceutical Water Market Size 2024 |

USD 1,310.01 Million |

| France Pharmaceutical Water Market, CAGR |

7.86% |

| France Pharmaceutical Water Market Size 2032 |

USD 2,505.44 Million |

The France Pharmaceutical Water Market is led by major players such as Veolia Environnement S.A., Suez Water Technologies & Solutions, BWT Pharma France, Degremont Technologies (Suez Group), Danone Waters, Saipol, Metron, Eiffage Génie Civil, Sarp Industrie, and Nexelia Group. These companies dominate through advanced purification systems, digital monitoring solutions, and strong regulatory compliance with EMA and GMP standards. They focus on sustainable water management, automation, and energy-efficient treatment technologies tailored for pharmaceutical applications. South France emerged as the leading region in 2024, capturing 31% of the national market share, driven by its high concentration of biopharmaceutical manufacturers, R&D facilities, and sustainable production infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Pharmaceutical Water Market was valued at USD 728.61 million in 2018, reached USD 1,310.01 million in 2024, and is projected to hit USD 2,505.44 million by 2032, growing at 7.86%.

- South France led the market in 2024 with a 31% share, driven by biopharmaceutical hubs in Marseille, Montpellier, and Nice emphasizing sustainable and energy-efficient purification systems.

- The Water for Injection (WFI) segment dominated by type, holding 41.6% share due to its critical use in sterile formulations and biologics manufacturing.

- Reverse Osmosis (RO) led by technology with a 36.8% share, favored for its cost efficiency, high purification consistency, and regulatory compliance.

- Pharmaceutical & Biotechnology Manufacturing was the leading application segment in 2024 with a 52.3% share, supported by growing biologics and injectable drug production across France.

Market Segment Insights

By Type of Pharmaceutical Water:

The Water for Injection (WFI) segment dominated the France Pharmaceutical Water Market in 2024, accounting for 41.6% of the total share. This leadership is driven by its essential role in injectable drug manufacturing, sterile formulations, and biopharmaceutical processes. Stringent EMA and GMP standards promote the adoption of advanced distillation and membrane-based systems. Increasing biologics and vaccine production further accelerates demand for high-purity WFI, reinforcing its critical position in pharmaceutical water infrastructure across France.

- For instance, in 2024, Merck KGaA expanded its WFI production capabilities in Molsheim, France, by integrating advanced membrane-based purification modules to support biopharmaceutical clients.

By Treatment Technology:

The Reverse Osmosis (RO) segment held the largest share of 36.8% in 2024, supported by its efficiency in removing ions, bacteria, and organic contaminants. Pharmaceutical manufacturers in France favor RO systems for consistent water purity, cost efficiency, and compliance with pharmacopoeia standards. Integration of RO with ultraviolet disinfection and deionization units enhances system reliability. The growing trend toward modular and energy-efficient purification systems strengthens the adoption of RO technology across pharmaceutical facilities nationwide.

- For instance, MECO, a biopharmaceutical equipment provider, highlights its RO systems as critical for delivering pure water essential for optimal drug production.

By Application:

The Pharmaceutical & Biotechnology Manufacturing segment led the France Pharmaceutical Water Market in 2024, capturing 52.3% of the market share. Its dominance is attributed to the high consumption of purified and injectable-grade water in drug formulation, sterile processing, and cleaning operations. Expanding biologics, vaccines, and injectable drug pipelines drive continuous water demand. Growing investments in GMP-certified facilities and automation technologies further support the segment’s leadership in ensuring quality and regulatory compliance.

Key Growth Drivers

Rising Biopharmaceutical and Injectable Drug Production

The expanding biopharmaceutical and injectable drug sector drives the demand for high-purity pharmaceutical water in France. Manufacturers require Water for Injection (WFI) and Purified Water for formulation, cleaning, and sterilization processes. Continuous advancements in biologics, cell therapies, and vaccines have increased consumption of WFI systems. Investments in sterile manufacturing facilities and strict EMA guidelines further encourage pharmaceutical companies to modernize purification infrastructure, strengthening the growth of the France Pharmaceutical Water Market.

- For instance, Sanofi’s new sterile manufacturing facility in France increased its investment in advanced WFI purification technology to comply with EMA guidelines and enhance drug safety.

Stringent Regulatory Standards and GMP Compliance

France’s adherence to European Medicines Agency (EMA) and Good Manufacturing Practice (GMP) regulations ensures strict control over water quality used in pharmaceutical production. These standards require validated purification technologies, including reverse osmosis, distillation, and UV disinfection. Pharmaceutical companies increasingly invest in automated monitoring and validation systems to meet quality benchmarks. The emphasis on risk-based water management and process reliability enhances compliance and drives the adoption of advanced purification and distribution systems across French pharmaceutical facilities.

- For instance, Sanofi France deployed an automated water quality monitoring platform integrating UV disinfection sensors and data logging to ensure continuous GMP compliance in its Normandy site’s sterile production lines.

Growing Focus on Sustainable and Energy-Efficient Systems

Environmental sustainability has become a core driver in the France Pharmaceutical Water Market. Manufacturers prioritize systems that reduce energy consumption, minimize wastewater, and use recyclable materials. The adoption of closed-loop purification systems and low-energy distillation units aligns with national carbon reduction goals. Companies like Veolia and Suez focus on eco-efficient process water technologies. Rising emphasis on corporate sustainability reporting and government incentives for green manufacturing further accelerate the transition toward sustainable pharmaceutical water solutions.

Key Trends & Opportunities

Integration of Automation and Digital Monitoring Systems

Automation and real-time monitoring technologies are transforming pharmaceutical water management in France. Advanced control systems ensure continuous quality assurance, data integrity, and predictive maintenance. Digital integration supports compliance documentation and traceability, reducing manual intervention and operational errors. Smart sensors and IoT-enabled platforms provide real-time quality data, improving system efficiency. This digitalization trend presents opportunities for solution providers offering AI-driven analytics, remote diagnostics, and cloud-based water system validation platforms to pharmaceutical manufacturers.

- For instance, Evoqua’s Sophis digital services offers a comprehensive remote monitoring and analysis solution for pharmaceutical water management, using predictive analytics to detect process anomalies early and ensure consistent production of high-purity water.

Expansion of Modular and Compact Purification Units

The growing preference for modular water purification systems is reshaping the market landscape. Compact and scalable units reduce installation time, operational costs, and facility footprint. These systems suit small and mid-sized biopharmaceutical plants seeking flexible production capacities. Modular designs enable quick system upgrades and GMP validation, ensuring adaptability to new production requirements. This shift creates strong opportunities for manufacturers offering prefabricated, plug-and-play solutions tailored for diverse pharmaceutical applications in France.

- For instance, EnviroChemie introduced their EnviModul series in 2025, offering prefabricated plug-and-play water treatment modules that allow biopharmaceutical plants to scale production with minimal downtime.

Key Challenges

High Capital and Maintenance Costs

The installation and operation of pharmaceutical-grade water systems demand significant financial investment. Equipment such as distillation units, reverse osmosis membranes, and monitoring devices involves high initial and maintenance costs. Smaller pharmaceutical and research facilities face budget constraints in implementing fully validated systems. Frequent calibration, energy use, and membrane replacement further increase operational expenses, creating financial challenges that limit widespread adoption among emerging pharmaceutical enterprises in France.

Complex Validation and Documentation Requirements

Meeting EMA and GMP validation standards requires extensive documentation and qualification of water systems. Pharmaceutical companies must continuously validate system performance through Installation Qualification (IQ), Operational Qualification (OQ), and Performance Qualification (PQ). This process is resource-intensive and time-consuming, often delaying project execution. Failure to maintain proper documentation or validation compliance can result in regulatory penalties. These stringent procedures create operational bottlenecks, especially for firms lacking in-house technical expertise and regulatory support.

Risk of Microbial Contamination and System Downtime

Microbial contamination remains a major operational challenge in pharmaceutical water systems. Biofilm formation in storage tanks, pipelines, and distribution loops can compromise water purity. Even minor deviations in temperature or flow rates may lead to bacterial growth and system failures. Regular sanitization and real-time monitoring are essential but costly. Unplanned downtime due to contamination incidents disrupts production schedules, impacting overall efficiency and regulatory compliance within the France Pharmaceutical Water Market.

Regional Analysis

North France

North France accounted for 27% of the France Pharmaceutical Water Market in 2024. The region benefits from strong pharmaceutical manufacturing clusters, particularly around Lille and Amiens. It supports advanced biologics and sterile drug production facilities that demand high-purity Water for Injection and Purified Water systems. Favorable industrial infrastructure and skilled workforce contribute to growth. Continuous investment in GMP-certified production plants and automated purification systems enhances competitiveness. The presence of major water technology providers encourages consistent market expansion in this region.

South France

South France held 31% of the France Pharmaceutical Water Market share in 2024, emerging as the leading region. The area hosts several biotechnology hubs and life science companies operating across Marseille, Montpellier, and Nice. It demonstrates strong adoption of sustainable purification technologies and energy-efficient systems. The concentration of biopharmaceutical R&D facilities drives high usage of Reverse Osmosis and Distillation systems. Government incentives supporting green manufacturing further strengthen its position. It remains a strategic region for future capacity expansion in pharmaceutical water infrastructure.

East France

East France captured 18% of the France Pharmaceutical Water Market in 2024. The region’s pharmaceutical production base around Strasbourg and Nancy emphasizes compliance with EMA standards. Growing investments in advanced purification systems and digital water monitoring platforms support market growth. Rising focus on biologics, sterile injectables, and vaccine production stimulates demand for Water for Injection units. Infrastructure modernization in industrial parks and expansion of regional distribution networks enhance market performance. It continues to attract both local and international system integrators.

West France

West France represented 24% of the France Pharmaceutical Water Market in 2024. The region has a well-established presence of pharmaceutical manufacturers and contract research organizations in Nantes and Rennes. It focuses on upgrading existing purification plants to meet evolving GMP standards. Companies invest in hybrid treatment solutions combining Reverse Osmosis, UV Disinfection, and Deionization. Growing collaborations with water technology providers support operational efficiency. It shows promising potential for steady growth driven by regulatory alignment and technology-driven purification systems.

Market Segmentations:

By Type of Pharmaceutical Water:

- Water for Injection (WFI)

- Purified Water

- Highly Purified Water

- Sterile Water for Injection, Irrigation, and Inhalation

- Others

By Treatment Technology

- Reverse Osmosis (RO)

- Ultraviolet (UV) Disinfection

- Distillation

- Deionization

- Others

By Application:

- Pharmaceutical & Biotechnology Manufacturing

- Research Laboratories & Academic Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

By Region

- North France

- South France

- East France

- West France

Competitive Landscape

The France Pharmaceutical Water Market features a competitive landscape dominated by established players such as Veolia Environnement S.A., Suez Water Technologies & Solutions, and BWT Pharma France. These companies lead through extensive expertise in validated purification technologies, including Reverse Osmosis, Distillation, and Ultraviolet Disinfection systems. It is driven by continuous innovation in energy-efficient and sustainable purification solutions tailored to pharmaceutical applications. Local firms like Degremont Technologies, Saipol, and Metron strengthen competition through customized water treatment and monitoring systems. Strategic partnerships with pharmaceutical manufacturers and CMOs enhance market presence and compliance support. Leading companies prioritize digital integration, automation, and predictive maintenance to improve system reliability. Continuous R&D investment and strong regulatory alignment with EMA and GMP standards reinforce their market leadership. The increasing focus on green and modular water systems further intensifies competition, positioning technology-driven companies at the forefront of future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Veolia Environnement S.A.

- Suez Water Technologies & Solutions

- BWT Pharma France

- Degremont Technologies (Suez Group)

- Danone Waters

- Saipol (Biodiesel and Water Solutions)

- Metron

- Eiffage Génie Civil

- Sarp Industrie

- Nexelia Group

Recent Developments

- In May 2025, Veolia acquired the remaining 30% stake in its Water Technologies & Solutions (WT&S) unit, gaining full ownership of the division.

- In September 2025, LuminUltra acquired GL Biocontrol, a France-based microbial testing company, to strengthen its water diagnostics presence in Europe.

- In September 2025, CTECH Europe launched a strategic partnership with AA Environmental to establish PFAS Purification, a joint venture focused on next-gen purification of PFAS in industrial wastewater.

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmaceutical Water, Treatment Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity water systems will grow with expanding biopharmaceutical production.

- Automation and digital monitoring technologies will become standard in purification facilities.

- Modular and compact water treatment units will gain strong adoption among mid-sized manufacturers.

- Sustainability will drive investments in energy-efficient and low-waste purification systems.

- Integration of AI and IoT will enhance process control and predictive maintenance capabilities.

- Local manufacturing partnerships will strengthen supply chain resilience for water systems.

- Upgrades in GMP-certified facilities will create steady demand for system validation services.

- Government support for green pharmaceutical production will accelerate technology replacement cycles.

- Competition will intensify as domestic and global players expand product portfolios.

- Continuous R&D in membrane and distillation technologies will shape future product innovation.